Sometimes paying wages in rubles is a currency violation.

Some companies (entrepreneurs) enter into employment contracts with foreigners. It is not prohibited. But it's risky. These risks are associated with Russian currency legislation (not only currency legislation, but this article is about currency risks).

Foreigners who are in Russia are considered non-residents

(Clause 7 of Article 1 of the Law “On Currency Regulation...”). The exception is foreigners who live in Russia with a residence permit. They are residents.

Residents are also citizens of Russia (IP) and legal entities registered in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

Payments between a resident and a non-resident are a foreign exchange transaction

(Clause 9, Article 1 of the law). Moreover, it does not matter what currency we are talking about: if a resident paid rubles to a non-resident, it is still a foreign exchange transaction.

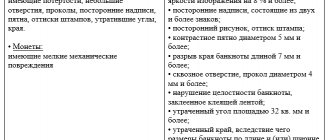

Foreign exchange transactions must be carried out through banks (Article 14 of the law). For a currency transaction in cash you can get a huge fine

, because this is a violation of currency legislation in accordance with Article 15.25 of the Code of Administrative Offences. Companies and entrepreneurs fall into this trap out of ignorance.

How does the tax office determine when there is one violation and when there are several?

For example, five foreigners are paid in cash once a month. Is it one violation or five?

We've seen both options. Sometimes the inspectorate combines the facts of payments by month, and then the payment to several non-residents per month is formalized as one administrative offense. It also happens differently: each payment to an individual non-resident is considered an independent offense, even if there are several non-residents working and they receive salaries in cash at the same time. Apparently, this depends on whether the inspectorate has a plan for administrative violations or not.

It doesn’t matter to entrepreneurs how many administrative violations there are - the fine is still the same. But for company directors this matters, because one thing is one thing - one fine of 20-30 thousand rubles for one violation, and another - 10 fines of 20-30 thousand rubles for ten violations.

The legislative framework

Salaries to foreign citizens are paid only by non-cash bank transfer. Those. funds can only be paid to an account or card, and cash withdrawal at the cash desk is prohibited. The reason is that a transfer to a foreign citizen is recognized as a foreign exchange transaction. In this regard, it must pass only through the bank (based on Federal Law No. 173 of 2003).

In case of cash payments, entrepreneurs and organizations, as well as officials, face a sanction in the form of a fine. In accordance with Article 15.25 of the Code of Administrative Offences, its size is:

- for organizations and entrepreneurs 75%-100% of the issued amount;

- for officials from 20 thousand to 30 thousand rubles. regardless of the amount issued.

Note! The period for prosecution is 2 years from the date of violation. Therefore, when conducting an inspection, even 1-2 years later, inspectors may draw up a protocol and demand payment of a fine.

How does the tax office even know that foreigners receive their salaries in cash?

Employers themselves tell her about this

. The employer, after all, performs the function of a tax agent and submits a 2-NDFL declaration (to be precise, this declaration has been canceled since 2021 and the information that was in this declaration is now included in the 6-NDFL declaration). The certificate contains a field “citizenship” of the individual in respect of whom the functions of a tax agent are performed.

The inspector asks:

— How do you pay your salaries?

The employer answers:

- According to the statement from the cash register.

OK it's all over Now. The rest is a matter of technique. The inspector may also request an employment contract, which specifies the procedure for paying wages.

Residents working abroad

Previous version of Art. 131 of the Labor Code allowed payment of labor only in rubles. Other legislative acts of the Russian Federation contained similar norms. In December last year, changes were made to Federal Law No. 173 “On Currency Regulation...”, according to which employees of diplomatic missions and other similar services were able to receive wages in foreign currency (from 01/01/2018), but only through accounts in authorized banks outside the territory of the Russian Federation.

To whom can wages be paid in foreign currency ?

Changes to the Labor Code of the Russian Federation have finally resolved the problem of contradictions in legislation: employees abroad can open accounts in Russian banks and receive payment for their work in foreign currency.

Question: Is it possible to transfer wages to employees (citizens of the Russian Federation) sent to work in a foreign representative office in foreign currency to their accounts opened in banks outside the Russian Federation? How to calculate insurance premiums? View answer

The amendments apply to the following categories of resident citizens abroad collaborating with resident organizations:

- employees of diplomatic missions, consulates;

- employees of representative offices of international organizations abroad;

- employees of representative offices of the federal executive power of the Russian Federation abroad;

- representatives of the Russian Federation to international organizations or representatives of the federal executive power of the Russian Federation to international organizations;

- employees of government agencies abroad;

- military personnel and other workers performing their duties abroad, as directed by the federal authorities;

- NGO workers abroad;

- journalists abroad, etc.

On a note! According to the new rules, workers abroad can receive not only wages, but also monetary allowance (maintenance) and any other payments provided for in labor relations. Accruals are made in accordance with employment agreements (contracts) and additional agreements thereto.

Is it possible to reduce the fine under Art. 15.25 Administrative Code? What arguments will help reduce the fine?

Reducing the fine is difficult, but possible

. There is a condition - the fine for a legal entity must be more than 100 thousand rubles. If the fine is less, then it cannot be reduced.

In case No. A04-9503/2018, the company paid salaries from the cash register to the 141st non-resident employee for a total amount of 5.6 million rubles.

The inspectorate fined the company 4.2 million rubles. The court reduced the fine to 2.5 million rubles. The arguments were formulated vaguely:

- inadmissibility of unjustified suppression of economic initiative and company rights;

- absence of aggravating circumstances.

But the decision was upheld in 3 instances.

Another example: in case No. A45-12685/2019, an entrepreneur committed a currency violation in the amount of 140 thousand rubles. The inspectorate fined him 105 thousand rubles, but the court reduced the fine to 52.5 thousand rubles. The inspectorate objected: the entrepreneur has 37 million rubles in income per year, let him pay in full! But other arguments outweighed:

- the entrepreneur did not deny the violation;

- he has three children, loans and the status of a small business entity;

- the foreign buyer received a residence permit a short time after the transaction;

- money did not move across the Russian border;

- the transaction concerned a land plot that cannot be removed from Russian territory;

- the entrepreneur, albeit in violation, credited the money to his account.

The decision was upheld in 3 instances.

Paying wages to a foreigner: in cash or by card?

Foreigners are one of the biggest challenges for the payroll and HR accountant. Because there are countless peculiarities regarding personal income tax, insurance premiums, benefits, registration.

Moreover, there are also features in the payment of wages that should not be forgotten, especially if your company traditionally pays wages in cash. We will talk about this in the article.

Transfer of salary to a foreign currency non-resident

Payment of wages to a foreigner is based on the following regulatory documents:

- Part 3 of Article 136 of the Labor Code - it states the employer’s obligation to pay wages;

- Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” - this law defines the concepts of tax resident and tax non-resident that are important for us.

The employing organization is classified as a currency resident in accordance with clause “c”, clause 6, part 1, article 1 of Law No. 173-FZ.

A foreign citizen who temporarily resides in the Russian Federation and carries out labor activities at the same time is recognized as a foreign worker (paragraph 14, paragraph 1, article 2 of the law of July 25, 2002 No. 115-FZ).

Thus, a foreign worker does not belong to persons permanently residing in the Russian Federation on the basis of a residence permit, and therefore, for the purposes of currency legislation, he is recognized as a foreign currency non-resident (subclause “a”, clause 7, part 1, article 1 of Law No. 173-FZ ).

Please note: the concepts of “currency resident” and “tax resident” are not identical! Unlike tax residency, the concept of a currency resident is not related to the number of days a foreigner stays in the Russian Federation in a given year, but to the availability of a residence permit.

How is a foreigner's salary paid?

The transfer of wages to a non-resident - an individual who is not a permanent resident (who does not have a residence permit) is presented as a legal alienation of the currency of the Russian Federation by a resident in favor of a non-resident. This is a currency transaction (clause “b”, clause 9, part 1, article 1 of Law No. 173-FZ).

There is a rule for settlements on currency transactions: they are made by residents (in our situation, employers) only through bank accounts in authorized banks or by transfer of electronic funds (Part 2 of Article 14 of Law No. 173-FZ).

So what happens, it won’t be possible to pay from the cash register to an employee of a foreigner temporarily staying in the territory of the Russian Federation? Rosfinnadzor answered this question quite unequivocally in the Information as of 08/07/2014 “On the payment of wages to non-resident individuals”: the possibility of paying wages to foreign employees from the cash desk in cash is not provided for by currency legislation. The same point of view was expressed by the Ministry of Finance - Letter dated August 29, 2016 No. ZN-4-17/15799 and the Federal Tax Service - letter dated August 29, 2016 No. ZN-4-17/15799.

Thus, there are no options - the salary of a foreign currency non-resident is paid to the card . The employer is recommended to include in employment contracts with foreign workers a condition on the transfer of wages to a bank account, or to include this condition in the collective agreement (Part 3 of Article 136 of the Labor Code).

How will they be punished for paying wages to non-residents in cash?

What could threaten an organization that nevertheless paid a salary to a foreign worker from the cash register in cash? She faces serious fines - from three-quarters to one time the amount of the illegal currency transaction. The basis for an administrative fine is the implementation of currency transactions in violation of currency legislation (Part 1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

The fine for officials ranges from 20,000 to 30,000 rubles.

How can currency auditors find out about your “sins”? They do not come with checks and are not able to track your cash transactions. And at least from the representatives of the tax office who checked you, who, during the inspection, saw the payment of wages to foreigners in cash. Tax inspectors are authorized to draw up administrative protocols for these offenses.

However, the offense has a statute of limitations - 1 year from the moment of its commission (Part 1 of Article 4.5 of the Administrative Code; Clause 14 of the Resolution of the Plenum of the Supreme Court of March 24, 2005 No. 5).

In the past, the courts sided with organizations

In previous years there was a more favorable situation for employers. The courts, when considering such cases, mostly take their side (Determination of the Supreme Arbitration Court of the Russian Federation dated January 27, 2014 No. VAS-19914/13, Resolution of the Supreme Arbitration Court of the Russian Federation dated September 16, 2014 No. A69-3058/2013; 12 AAS dated February 9, 2015. No. 12AP-45/2015; 17 AAS dated 09/29/2014 No. 17AP-10867/2014-AKu; 20 AAS dated 01/20/2015 No. 20AP-7198/2014; 9 AAS dated 02/06/2015 No. 09AP-55300/2014 ).

Courts often generally refuse to recognize the payment of wages to foreigners in cash as an offense and have given the following arguments:

1. Foreign exchange transactions between non-residents and residents are carried out without restrictions , with the exception of certain transactions that do not include the payment of wages in cash. This means that this operation is permitted by currency legislation. Currency transactions are carried out without restrictions, for which a special procedure is not established (Part 2, Article 5, Article 6 of Law No. 173-FZ).

2. The rules of the Labor Code also apply to foreign citizens. And if we turn to him, we will read that the salary is paid to the employee in rubles in the place where he performs the work or is transferred to the bank account specified by him, if this is provided for in the labor or collective agreement (Articles 11, 131, 136 of the Labor Code).

Those. The employer does not have the right to independently decide to transfer money to foreign employees. And he cannot open an account for an employee if an application has not been received from him.

3. Whether to open a bank account or not is a decision made by a non-resident employee , because he has the right, but not the responsibilities (Part 1, Article 13 of Law No. 173-FZ).

4. If the employee has not expressed a desire to receive money into a bank account, he must somehow be given a salary, because the employer is responsible for the delay in payment of wages (Article 142 of the Labor Code).

5. All irremovable doubts, contradictions and ambiguities in acts of currency legislation are interpreted in favor of residents and non-residents (Part 6, Article 4 of Law No. 173-FZ).

There were also decisions in which judges agreed that by paying foreign workers wages from the cash register, the employer had violated the law. But at the same time, such a violation was recognized as insignificant (Resolution 14 of the AAS dated 02.02.2015 No. A52-2556/2014).

Payment of wages to foreigners - how is it now?

However, in 2015, the practice changed - the Supreme Court, in its resolution dated March 6, 2015 No. 307-AD15-678, declared it an administrative offense to pay wages to your employees (non-residents) from the cash register in cash.

And in recent years, there have been decisions not in favor of organizations, for example, Resolution of the Supreme Court of the Russian Federation of May 24, 2018 N F03-1521/2018 in case N A04-8136/2017.

Thus, at the moment, transferring salary to a non-resident in cash is very risky. If you go to court and the decision is not in your favor, the fines are very high. Therefore, if you do not want to allow even the very possibility of such claims being brought against you, payment of wages to a foreigner should be made through bank cards.

You might be interested in:

conclusions

You can't joke with currency legislation in Russia

. A step to the left, a step to the right - huge fines up to 100% of the amount of the violation.

You can pay salaries to non-residents (foreigners who do not have a residence permit in Russia) only by bank transfer through a bank

and nothing else. Otherwise, the business will work to pay fines.

You can reduce the fine for violating currency laws

, but not always - circumstances are needed that will convince the court that the fine is unreasonably high. To recognize holding a business liable as illegal due to the insignificance of the violation, all the stars must align.

Paying wages to a foreign worker from the cash register - judicial practice

As a rule, the courts take the side of employers in proceedings regarding the payment of wages to foreigners from the treasury.

It even happens that the court refuses to recognize such calculations as a violation. The courts justify their position as follows:

- The rules that govern the Labor Code apply to labor relations with foreigners, and the Labor Code of the Russian Federation provides for the payment of wages to employees in rubles at the place of work or by sending funds to the bank account specified by the employee, taking into account the provisions of a collective or labor agreement (Article 11 , 131, 136 Labor Code of the Russian Federation).

- All doubts, ambiguities and contradictions in acts of currency legislation that are irremovable must be interpreted in favor of residents and non-residents (Part 6, Article 3 of Law No. 173-FZ).

- A non-resident has the right to open a bank account in Russia, but is not obliged to do so (Part 1, Article 13 of Law No. 173-FZ).

- The law allows for currency transactions between residents and non-residents without any restrictions (except for individual transactions, but salary payments do not apply to these). Moreover, if the law does not establish a special procedure for conducting a currency transaction, it can be carried out without restrictions (Part 2 of Article 5, Article 6 of Law No. 173-FZ).

- If an employer delays wages to a foreign employee, he will be held liable as if the employee were a resident of the Russian Federation (Article 142 of the Labor Code of the Russian Federation).

Current legislation does not provide for the possibility and obligation of Russian employers to independently open bank accounts for the transfer of wages to non-residents of the Russian Federation, if they have not submitted the appropriate applications.

Read also the article ⇒ “Insurance premium rates for non-residents and foreign citizens in 2022“.

Is it possible for foreigners working under a patent to be paid in cash?

At the same time, this article directly indicates cases when resident legal entities have the right to make settlements with non-resident individuals in cash in the currency of the Russian Federation, the list of which is exhaustive and is not subject to broad interpretation. Info The specified list does not provide for the possibility of paying wages bypassing accounts in an authorized bank.

Control over compliance with the requirements of currency legislation is entrusted to the Federal Service for Financial and Budgetary Supervision, Rosfinnadzor. Law No. 173-FZ. In turn, payment by a resident to a non-resident of any ruble amounts, including wages, is considered a foreign exchange transaction, sub. “b” clause 9, part 1, art. 1 of Law No. 173-FZ, payments for which must be made in non-cash form - through bank accounts in authorized banks.

Exceptions to the rule

However, in some cases, the salary of foreign citizens can be issued in cash through the cash desk. If an employee has a residence permit, he has the right to receive money both on a card and in cash. As residents for the purposes of exchange control, having such a right, the state recognizes:

- all citizens of the Russian Federation (except for those who live abroad for a long time);

- foreigners who have a residence permit;

- stateless persons who have also obtained a residence permit in Russia.

All other persons are non-residents. Accordingly, their salary is issued exclusively through a transfer to a card or account.

Otherwise, wages for foreign citizens in 2019 are calculated according to the same rules as for Russian employees:

- at least 2 times a month;

- without violating payment terms;

- in equal or unequal parts (salary, advance payment).