Why is a liability provision necessary and what is it based on?

The Regulation on the Material Responsibility of Employees (PMR) is an internal local act that describes the relationship between the employer and employees in terms of the safety of the company’s property and touches on the nuances of compensation for damage.

Mandatory “material” provisions, like most internal developments (provisions on remuneration, bonuses, salary indexation, etc.), are not provided for by law. There are no special requirements for its composition, volume and content.

ConsultantPlus experts explained in detail what local regulations an employee should be familiarized with when applying for a job. Get trial demo access to the K+ system and go to the HR guide for free.

The presence of such a document provides for a unified approach to all employees regarding their responsibility for the company’s property, and also eliminates disagreements between the parties to the employment contract on issues of compensation for material losses.

IMPORTANT! The “materially responsible” issue to which the provision is devoted can also be described in other internal documents (collective agreement, internal labor regulations or agreements on financial responsibility). In this case, it is possible to do without developing a separate provision.

The creation of PMO is based on 13 articles of the Labor Code of the Russian Federation (238-250) and the resolution of the Ministry of Labor of Russia “On approval of lists of positions and works...” dated December 31, 2002 No. 85. The Labor Code of the Russian Federation regulates important aspects of determining the amount of damage caused to a company by employees, the procedure for its recovery , circumstances excluding the liability of the financially responsible person, as well as other important nuances.

Regulation No. 85 is of an additional regulatory and informational nature. In addition to a ready-made template for a liability agreement (LMA), it lists the positions and work performed by employees with whom it is possible to conclude a LMA.

How to conclude an agreement on full financial responsibility

Agreements are concluded in writing using the standard forms established in the list.

If a position or work is indicated in the list, there is a clause in the employment contract or a reference to the fact that the position is on the list, and the employee refuses to enter into an agreement on full financial responsibility, such refusal is considered as a failure to fulfill labor duties with the application of disciplinary measures. And what an employee’s financial responsibility is and that the fulfillment of job duties is accompanied by the conclusion of an agreement on full financial responsibility, he must be told at the stage of hiring.

There may be situations when such an agreement must be concluded with a working citizen. For example, the law changed, and the position or work of an employee was included in the list. In this situation, the employer offers the person to transfer to another job (Article 74 of the Labor Code of the Russian Federation). If there is no other job or the employee refuses the proposed option, the employment contract with him is terminated (clause 7, clause 1, article 77 of the Labor Code of the Russian Federation).

Material on the topic How to draw up a liability agreement

Resolution No. 85 and PMO

When developing a PMO, you should be sensitive to the content of Resolution No. 85. When providing for the responsibility of employees related to ensuring the safety of the company’s property, it is necessary to correlate the legality of the requirements of the PMO with the information reflected in this resolution. In addition, it is better to draw up contracts with employees taking into account the DMO template given in Resolution No. 85.

When concluding a DMO with your employees, you will have to not only check the list of positions from Resolution No. 85, but also take into account the types of work specified in it.

IMPORTANT! The more meticulously the employer carries out the preparatory procedures for completing all important papers, the easier it will be in the future to resolve situations related to material compensation for damage. In addition, the employer’s responsible approach to the system for ensuring the safety of his property and the initial detailed study of calculation algorithms for determining the amount of damage (at the stage of concluding an employment contract and DMO) show the employee the degree of his financial responsibility.

An employer may be tempted to play it safe and enter into a DMO with all employees without exception. In this case, he will arbitrarily expand the list of persons with whom, according to Resolution No. 85, it is possible to enter into DMO, and the rights of workers whose profession or work performed are not included in this list will be violated.

In order to avoid recognizing the DMO as illegally concluded and giving the PMO the status of a document that complies with the law, directly in the text or as an appendix to it, it is necessary to list all positions according to the company’s staffing table, the occupation of which by an employee requires the execution of a DMO.

“Unified Form No. T-3 - Staffing Schedule (form)” will help you draw up a staffing table without errors .

Special cases reflected in the PMO

To limit ourselves to listing positions in the PMO that comply with Resolution No. 85 means not to take into account an important nuance provided for by labor legislation. It concerns situations where full financial liability may arise for those employees with whom DMOs have not been concluded (and their registration is not required by law).

Non-contractual financial liability arises in the following cases (Article 243 of the Labor Code of the Russian Federation):

- Damage to the company's property was caused by the intentional actions of an employee;

- damage, loss and damage to assets occurred as a result of the actions or inaction of an employee who was intoxicated (alcohol, drugs or toxic);

- the company’s property was damaged as a result of the employee’s criminal actions (there is a court verdict) or an administrative offense committed by him, the fact of which was established by a government agency;

- the employee damaged the company's property by using it for personal purposes;

- the company suffered damage as a result of the disclosure by its employee of secret information constituting a secret protected by law.

In such a situation, the employer can additionally insure itself by concluding a non-disclosure agreement with an employee who has access to classified information. It will emphasize the importance of non-disclosure of secret data and formally impose additional responsibility on the employee for its safety.

IMPORTANT! A non-disclosure agreement will not help to recover lost profits from an employee, since the obligation to compensate for damage arises within the framework of labor relations and the rules of Art. 139 of the Civil Code of the Russian Federation on compensation for losses in full for such cases do not apply.

How to draw up a liability agreement

For the document, you can use the forms proposed by the Ministry of Labor or develop your own template. The main thing is to adhere to the established rules when drawing up.

There have already been precedents when the court refused to recognize the legal force of a document due to the absence of certain points. To prevent this from happening, be sure to check the following conditions in the contract:

Carefully describe the conditions for the transfer, reception and storage of valuables. In particular, indicate the document regulating the process and the responsibilities of the parties. Also indicate what the employee must do to protect assets and what actions are prohibited.

Indicate how and when the safety of the valuables entrusted to the employee will be checked (audit, inventory).

Establish the level of responsibility of the employee. After all, not in every situation the employee is to blame for damage or loss of valuables. List the circumstances under which he is not financially liable for damage. For example, in the absence of proper storage conditions, during natural disasters.

Add a clause about the method of compensation for damages. The phrase “the procedure for determining and compensating for damage is determined by current legislation” is usually used.

The liability agreement is drawn up in two copies when the employee is hired. One remains in the custody of the personnel department, the second is transferred to the employee.

Age aspect of PMO

When describing in the PMO the principles of compensation for material damage by employees, it is necessary to take into account such an important factor as their age.

The conditions for the recovery of damages from minor employees in the PMO must be specifically stipulated. The category of workers “under 18 years of age” requires employers to take the most careful approach. For example, a DMO concluded with such an employee will not have legal force, and forcing a minor employee to fully compensate for damages is illegal.

IMPORTANT! Art. 244 of the Labor Code of the Russian Federation allows for the conclusion of DMO only with employees of the “18+” category, whose work is directly related to money and commodity values.

However, labor legislation, for example Art. 242 of the Labor Code of the Russian Federation, also protects the interests of the employer, limiting the degree of impunity for workers in the category “under 18 years of age” depending on the condition they were in at the time of damage to the employer’s property.

For example, if the company’s assets were damaged by the actions of a minor employee who was in an inadequate state (under the influence of drugs, alcohol or toxic substances), as well as as a result of his committing a crime or administrative offense, the damage is subject to compensation in full.

Other employees over 18 years of age are equal before the law and compensate the damage caused to the employer in accordance with the obligations assigned to them and the conditions of the concluded DME.

Description of the stages of collecting material damage from an employee

Separate from the organizational aspects in the PMO, it is necessary to pay attention to a detailed description of the process of recovering from employees the cost of lost or damaged company property.

The sequence of collection procedures is a chain of steps carried out step by step by the employer aimed at reducing its own material losses caused by the negligent actions of employees. Compliance with all legal requirements is of particular importance.

Initial stage: inventory

The preliminary stage of the damage recovery procedure is inventory. It is designed to identify the fact of damage to the company’s property and document it (clause 27 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

“Unified form No. INV-3 - form and sample” will help you process the inventory results quickly and efficiently .

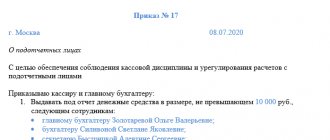

The inventory is carried out after the relevant order is issued.

To fill out an order for an inventory, you can use the sample posted on our website. See the article “Order for conducting an inventory - sample filling” .

Stage 1: internal investigation

The next link in the chain is an internal investigation, the purpose of which is to determine the causes of damage or loss of assets (Article 247 of the Labor Code of the Russian Federation). In this case, one cannot do without creating a commission, the composition of which is approved by order of the head of the company.

The employee who caused the damage will also have to work hard - he is obliged to explain in writing the reasons for the damage. His refusal to do this imposes on the employer the additional function of drawing up an act recording the fact of refusal (Article 247 of the Labor Code of the Russian Federation).

Written explanations of the offending employee are considered by the commission and taken into account when determining the degree of his guilt. If the damage was caused by several employees, the commission will have to find out the extent of responsibility of each of them.

Stage 2: calculating the amount of damage

The company's financial service specialists will also have more work to do - they need to determine as reliably as possible the amount of damage caused by the employee.

Many factors need to be taken into account: the market price of lost or damaged property on the date of damage, information from accounting about the residual value of property, etc. (Article 246 of the Labor Code of the Russian Federation).

Final stage: paperwork and other final procedures

The materials of the internal investigation are not classified information for the employee in respect of whom it is being conducted and (or) his representative. The employer does not have the right to obstruct these persons in reviewing and appealing the papers drawn up and received during the investigation (Article 247 of the Labor Code of the Russian Federation).

The duration of the final stage depends on whether the employer will go to court to recover damages.

The employer has the right to recover the calculated amount of damage from the employee without resorting to judicial authorities, if its amount does not exceed the employee’s average monthly earnings. This procedure is preceded by the execution of an order from the head of the company. This must be done within a month from the date of calculation of the final amount of damage (Article 248 of the Labor Code of the Russian Federation).

In some cases, the employee and the employer may enter into an agreement providing for gradual compensation by the employee for material losses (installments). Simultaneously with the agreement, the employee must express in writing his obligation to pay the specified amount and specify the timing of payments.

If the employee has evaded his obligations to compensate for damage, the employer has the right to go to court (Article 248 of the Labor Code of the Russian Federation).

All of the above stages are enshrined in the provisions on the financial responsibility of employees, the content of which may differ from company to company. You can view one version of such a document for free by clicking on the picture below:

Material liability of the employee

In accordance with Art. 233 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), the employee’s financial liability arises for damage caused to the employer as a result of his guilty unlawful behavior (actions or inaction). Thus, any employee can be held financially liable if he unlawfully and culpably caused damage to the employer’s property.

Unlawfulness in relation to labor relations means that material damage arose as a result of the employee’s failure to perform or improper performance of his duties, which are assigned to the employee by law, an employment contract, or local regulations in force at the employer. The employee's financial liability is excluded in cases of damage due to force majeure, normal economic risk, extreme necessity or necessary defense, or the employer's failure to fulfill the obligation to provide adequate conditions for storing property entrusted to the employee (Article 239 of the Labor Code of the Russian Federation).

In addition, in order to talk about the occurrence of material liability for damage caused, a cause-and-effect relationship must be established between the employee’s action and the resulting material damage.

Thus, the employee’s financial liability occurs only if the following conditions are simultaneously present:

- unlawful behavior (actions or inaction) of an employee

- the employee’s guilt in committing an unlawful act (inaction)

- a causal connection between the employee’s unlawful action and material damage;

- absence of circumstances excluding the employee’s financial liability.

The employee is obliged to compensate the employer for direct actual damage caused to him. Lost income (lost profits) cannot be recovered from the employee. Direct actual damage is understood as a real decrease in the employer’s available property or deterioration in the condition of said property (including property of third parties located at the employer, if the employer is responsible for the safety of this property), as well as the need for the employer to make costs or excessive payments for the acquisition, restoration of property or compensation for damage caused by the employee to third parties (Article 238 of the Labor Code of the Russian Federation).

In this case, each party to the employment contract is obliged to prove the amount of damage caused to it. Basically, disputes arise over the amount of compensation for damage caused by the employee.

The amount of damage caused to the employer in the event of loss and damage to property is determined by actual losses, calculated on the basis of market prices prevailing in the area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of wear and tear of this property (Article 246 Labor Code of the Russian Federation).

Recovery of damages from the guilty employee for the amount of damage caused is carried out by order (instruction) of the manager. An order to recover damages from an employee must be issued no later than one month from the date of final determination of the amount of damage caused by the employee. Otherwise, the damage will have to be recovered through the court (Article 248 of the Labor Code of the Russian Federation).

The employer must require a written explanation from the employee to establish the cause of the damage. And if the employee refuses to provide an explanation, the employer draws up a corresponding act of refusal.

For example, an employer carries out an inventory after the dismissal of a financially responsible employee, which makes it impossible to hold a former employee who committed a shortage to financial liability (Determination of the RF Armed Forces dated May 7, 2018 No. 66-KG18-6).

The amount of material damage caused, which is recovered from the employee, directly depends on what kind of liability is provided for it: full or limited.

LIMITED LIABILITY

The limits of an employee’s financial liability are established by Article 241 of the Labor Code of the Russian Federation and are limited by the amount of his average monthly earnings, unless otherwise provided by the Labor Code of the Russian Federation or other federal laws.

If the amount of damage exceeds the employee’s average monthly earnings, the employee is obliged to compensate only that part of it that is equal to his average monthly earnings. If the concluded employment contract does not provide for full financial liability for damage caused to the employer, then the employee will bear financial responsibility for the damage caused within the limits of his average monthly earnings on the basis of Article 241 of the Labor Code of the Russian Federation.

At the same time, the rule on limited financial liability of an employee within the limits of his average monthly earnings is applied in all cases, except for those in respect of which the Labor Code of the Russian Federation or other federal law directly establishes a higher financial liability of the employee, in particular full financial liability.

FULL MATERIAL RESPONSIBILITY

In accordance with the provisions of Art. 243 of the Labor Code of the Russian Federation, financial liability in the full amount of damage caused is assigned to the employee in the case (clause 4 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated November 16, 2006 No. 52, letter of Rostrud dated October 19, 2006 No. 1746-6-1):

1) when, in accordance with the law, the employee is charged with financial responsibility in full for damage caused to the employer during the performance of the employee’s job duties. In this case, we are talking about those situations where the law directly provides for the employee’s obligation to compensate for damage in full. For example, the head of an organization, regardless of whether the employment contract with him contains a condition on full financial liability, bears full financial responsibility for direct actual damage caused to the organization (Article 277 of the Labor Code of the Russian Federation, paragraph 9 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 16 .2006 No. 52);

2) shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document. We are talking about the most common situation when an employee enters into an agreement with the employer on full financial responsibility;

3) intentional infliction of damage. Since the Labor Code of the Russian Federation does not disclose the concept of intentionality of causing damage, one can use by analogy the norms of the Criminal Code of the Russian Federation (Article 25), according to which intent can be direct (if the person was aware of the danger of his actions (inaction), foresaw the possibility or inevitability of the consequences and desired them offensive) and indirect (if the person was aware of the danger of his actions (inaction), foresaw the possibility of consequences, did not want, but consciously allowed these consequences or was indifferent to them);

4) causing damage while under the influence of alcohol, drugs or other toxic substances. The state of intoxication can be confirmed both by a medical report and by other types of evidence (for example, witness testimony), which will be assessed by the court. For full financial liability to arise on this basis, it is necessary not only to establish the fact of intoxication of the employee, but also the existence of a cause-and-effect relationship between the damage and the behavior of the intoxicated employee, that is, the fact of intoxication and the fact of damage themselves do not cause full financial liability;

5) damage caused as a result of the employee’s criminal actions established by a court verdict. The presence of a court conviction is a prerequisite for bringing an employee to full financial liability on this basis, therefore, termination of a criminal case at the stage of preliminary investigation or in court, including on non-rehabilitative grounds (in particular, due to the expiration of the statute of limitations for criminal prosecution, as a result of the amnesty act), or an acquittal by the court cannot serve as a basis for bringing a person to full financial responsibility;

6) damage caused as a result of an administrative violation, if such is established by the relevant government body and a decision is made to impose an administrative penalty. If an employee has been released from administrative liability for committing an administrative offense due to its insignificance, he can still be held financially liable in full, since if the administrative offense is insignificant, the fact of its commission is established. The expiration of the statute of limitations for bringing to administrative responsibility or the issuance of an amnesty act eliminating the application of administrative punishment excludes the employer from the possibility of bringing the employee to full financial liability on this basis;

7) disclosure of information constituting a secret protected by law (state, official, commercial or other), in cases provided for by the relevant federal laws;

causing damage not while the employee was performing his job duties. On this basis, bringing full financial liability to full liability does not matter when the damage occurred - outside or directly during working hours (for example, an employee damaged the employer’s equipment while attending to his personal affairs during working hours).

EVGENIYA TAYANOVA

, SENIOR PROSECUTOR OF THE DEPARTMENT FOR SUPERVISION, OVER THE EXECUTION OF LAWS IN THE SOCIAL SPHERE AND ON MINORS, OFFICE OF THE PROSECUTOR OF THE KHABAROVSK REGION

Source of publication: information monthly “The Right Decision” issue No. 10 (204) release date of 10/21/2019.

The article was posted on the basis of an agreement dated October 20, 2016, concluded with the founder and publisher of the information monthly “Vernoe Reshenie” LLC “.

Results

Material losses of the company caused by the fault of its employees are subject to compensation.

To recover damages, the employer will have to work hard: take an inventory, create a commission, calculate damages, etc. All stages of this process, as well as general issues of interaction between the employer and employees regarding the safety of property are reflected in the provision on financial liability. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.