Assets listed on the balance sheet of an enterprise and used in production processes have a limited service life. Every year the functional condition gradually deteriorates, which is caused by natural depreciation. In addition, there is the concept of “obsolescence” - when inventory items are still suitable for use, but the feasibility of their use is reduced due to the emergence of alternative solutions with greater efficiency. Thus, for any organization, sooner or later there comes a time when it is necessary to issue an act of write-off of a fixed asset item. What grounds and orders are required for this, who determines the need for the procedure, and how exactly is it implemented from the point of view of document flow rules? Let's figure it out.

General overview

First, some basic terminology. The category under consideration includes inventory items that are on the company’s balance sheet and are involved in production and management processes for at least one year. Given the broadness of the formulation, not only complex technical equipment - machines and devices, but also transport, various types of mechanisms and devices, inventory, materials, buildings and premises, and even plantings and roads located on the territory owned by the organization can be defined in this capacity . The specifics influence the determination of its current state, therefore, before proceeding with the execution of the act of disposal of fixed assets and documentation in general, it is necessary to study in detail the features of the object in question.

Reasons for write-off

From an accounting point of view, the procedure for removing assets from the balance sheet of an enterprise seems to be very complex, since it requires the implementation of a number of standard activities. It is problematic to unify the process, at least due to the diversity of forms and types of property that formally belong to one category. The algorithm, defined by the provisions of clause 29 of PBU 6/01, as well as the content of methodological instructions published within the framework of the Decree of the Ministry of Finance of the Russian Federation No. 91n of 2003, provides for the following mandatory stages:

- Formation of a commission or working group that assesses the condition of inventory items and makes a decision on the advisability of restoration or refusal of further operation.

- Drawing up an act for write-off of fixed assets according to the OS 4 form.

- Reflection of the operation in the accounting program, in compliance with the transactions and data registration rules.

Physical wear and tear, like obsolescence, is a natural process caused by the regular use of goods and materials, as well as the development of technology. In most cases, expensive objects are subject to restoration, allowing them to preserve key functional properties. If investments in renovation turn out to be unjustified, a situation arises in which a more profitable solution from an economic point of view is refusal from further use.

Some operating systems are multi-component mechanisms, with different wear rates of individual components. Examples include motor vehicles, non-residential premises with several buildings, or large production lines. In this case, it is not necessary to abandon the entire object - it is enough to replace an obsolete part, or organize local repairs, that is, carry out partial liquidation.

Reasons sufficient for making a decision to withdraw from the balance sheet include:

- Inappropriateness of operation due to depreciation or obsolescence.

- Critical changes associated with an emergency or emergency situation.

- Identification of shortages during inventory, including as a result of theft.

- Unusable condition caused by intentional or accidental damage to property.

- Carrying out reconstruction, which involves removing part of the object.

The specified list is also regulated by regulations enshrined within the framework of methodological recommendations and accounting rules. An example of filling out an act of write-off of fixed assets can be freely downloaded from the Internet, however, before starting the procedure, it is necessary to study the key points, eliminating the possibility of registration and posting errors.

When should the OS-4b form be used?

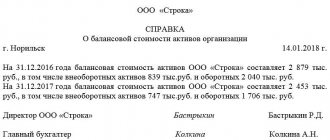

The unified form OS-4b is needed for the simultaneous write-off of several fixed assets.

The need for write-off arises either based on the results of an inventory, or when it is revealed that several identical objects that were once purchased at the same time have become worn out. In this case, either physical wear and tear (for example, for furniture) or moral wear and tear (for computers) can occur. Form OS-4b is not used to write off vehicles.

This form is drawn up in 2 copies:

- for accounting, where it serves as an accounting document justifying accounting entries for write-offs;

- for a financially responsible person who, in accordance with this document, delivers to the warehouse valuables received during the dismantling of liquidated objects.

Read about the features of writing off fixed assets when applying the simplified tax system in the article “How to correctly write off fixed assets using the simplified tax system?”

IMPORTANT! Starting from 2022, the operating system must be written off taking into account the rules of FAS 6/2020. PBU 6/01 will no longer be in force. If you want to apply the new standard in 2022, write about it in your accounting policy.

ConsultantPlus experts explained in detail how an organization can switch to accounting for fixed assets and capital investments in accordance with FAS 6/2020. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Order of conduct

In order to remove unusable assets from an organization’s balance sheet, it will first be necessary to determine whether their further exploitation has no real basis. This task is assigned to a special commission, approved in a special manner, which is tasked with confirming the presence of facts of wear, defects, or the absence of material assets due to shortages.

The verdict of a malfunction is the basis for drawing up an act for writing off the OS, a sample of which we will consider later. This document, properly executed, allows you to draw up an order, which contains an order from the management of the enterprise to remove assets from the general balance sheet. After this, the results of joint work are transferred to the accounting department, which carries out the procedure for reducing the value of fixed assets, and the object itself is disposed of, given away on a voluntary basis, or sold on the secondary market - if there is appropriate demand.

Download the act on write-off of fixed assets. Form OS-4

Download sample forms for accounting for fixed assets at an enterprise: Form OS-1. Filling out the act of acceptance and transfer of fixed assetsForm OS-1a. Filling out the building acceptance certificateForm OS-2. Invoice for internal movement of fixed assets Form OS-3. Certificate of acceptance and delivery of fixed assets after repair Form OS-4A. Vehicle write-off certificate Form OS-6. Inventory cardForm OS-6B. Inventory bookForm OS-14. Certificate of acceptance and transfer of equipmentForm OS-15. Certificate of acceptance and transfer of equipment for installationForm OS-16. Defective actOrder for write-off of fixed assetsRetirement of fixed assets (postings, examples)Accounting for the lease of fixed assets (entries, examples)Accounting for the receipt of fixed assets (documents, postings) Methods for calculating depreciation of fixed assets

Whose responsibilities include filling out the act?

Before starting the partial or complete liquidation procedure, it is necessary to determine the composition of the commission responsible for assessing the state of the OS.

In accordance with the regulations, the working group must consist of three or more people, which must include an employee of the enterprise who is the financially responsible person, as well as the organization’s accountant. The final list is determined by order of the manager. It is also possible to involve third-party specialists who have expert knowledge in the required area and have sufficient qualifications to certify the criticality of the identified failure. This practice is relevant when solving issues related to complex technical equipment.

Making a final decision on writing off fixed assets according to the form is possible only after the authorized commission has implemented all the planned activities. These include:

- Conducting a visual inspection (except for cases where the reason for removal from the balance sheet is the identified shortage or theft of inventory items).

- Assessment of the functional state, potential and feasibility of restoring the facility, as well as the economic aspects of further operation.

- Establishing the root cause of deterioration - depreciation, obsolescence, intentional or accidental damage.

- Identification of persons responsible for premature loss of performance characteristics - in situations where the standard service life has not yet expired.

- Determining the possibility of partial use of individual components, elements or materials, as well as the prospects for their implementation in order to generate income and compensate for losses of the enterprise.

The results of the overall assessment are recorded in the commission’s conclusion. The absence of a standard form allows you to choose a template yourself, subject to entering the mandatory details of the primary documentation and approval by order of the manager within the framework of the organization’s accounting policy. Responsibility for filling out lies with a full-time employee, usually representing the accounting department.

Act on write-off of fixed assets (except for vehicles)

Approved by order of the Ministry of Natural Resources dated 04.10.2011 N 413-OD

______________________________ (name of organization) ______________________________ (structural unit) Date written off from accounting Basis for drawing up the act ————————— ______________________________ ¦ Number ¦ ¦ (order, instruction) + —————-+——-+ Financially responsible person ¦ Date ¦ ¦ ______________________________ ——————+——-+ (last name, initials) Personnel number ¦ ¦ ——— I APPROVED Head of the organization ____________________ _____________________ (position, signature) (signature transcript) M.P. “__” _____________ 20__ ———————————- ACT ¦ Number ¦ Date of preparation ¦ on write-off of fixed assets +——-+————————+ (except for vehicles) ¦ ¦ ¦ ———+————————- Reason for write-off _______________________________________________________________ ___________________________________________________________________________ 1. Information about the condition of the fixed asset item as of the date of write-off ——————————————————— ————————————————————- ¦Name¦ Number ¦ Date ¦ Actual ¦ Initial ¦ Amount ¦ Residual¦ ¦ object +———————+——— ——————+ term ¦ cost at ¦accrued ¦cost,¦ ¦main ¦inventory¦factory release¦ acceptance for ¦operation¦moment of acceptance for ¦depreciation,¦ rub. ¦ ¦ funds ¦ ¦ ¦ (buildings) ¦ accounting ¦ ¦ accounting ¦ rub. ¦ ¦ ¦ ¦ ¦ ¦ ¦ accounting ¦ ¦ accounting or ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦recovery¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ cost, rub. ¦ ¦ ¦ +————+————+———+————+—————+————+——————+————+———- + ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ +————+————+———+————+—————+———— +——————+————+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————-+————+———+————+—— ———+————+——————+————+———— ————————————————————————— —— ¦ Main object ¦ Content of precious materials (metals, ¦ ¦ means, ¦ stones, etc.) ¦ ¦ fixtures, ¦ ¦ ¦ accessories ¦ ¦ +————————+—————— ————————————+ ¦name¦quantity¦name¦nomenclature¦ unit ¦quantity¦mass¦ ¦ ¦ ¦precious ¦number ¦measurement¦ ¦ ¦ ¦ ¦ ¦ materials ¦ ¦ ¦ ¦ ¦ +— ———+———-+————+—————+———+———-+——+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ +—— ——+———-+————+—————+———+———-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————-+———-+ ————+—————+———+———-+—— Conclusion of the commission. As a result of the inspection of the fixed asset object specified in this act with the complete set, it was established: _________________________________________ _____________________________________________________________________________ List of attached documents: __________________________________________ Chairman of the commission _______________ ___________ _______________________ (position) (signature) (deciphering the signature) Members of the commission: _______________ ___________ _______________________ (position) (signature) (decoding signatures) _______________ ___________ _______________________ 3. Information on the costs associated with writing off fixed assets from accounting, and on the receipt of material assets from their write-off: ———————————————————— ———————————————————————- ¦ Dismantling costs ¦ Received from write-off ¦ +—————————————+—— ———————————————————————————-+ ¦ type ¦document,¦amount,¦correspondence¦document,¦material assets ¦correspondence¦ ¦work ¦ date, ¦ rub. ¦ accounts ¦ date, ¦ ¦ accounts ¦ ¦ ¦ number ¦ +—————+ number +—————————————————————+—————+ ¦ ¦ ¦ ¦debit ¦ credit ¦ ¦name¦nomenclature¦ unit ¦quantity¦ value, ¦debit ¦credit ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ number ¦measurement¦ ¦ rub. ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦units¦total¦ ¦ ¦ +——+———+——+ ——+———+———+————+—————+———+———-+——-+——+——+———+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ 12 ¦ ]3 ¦ 14 ¦ +——+———+——+——+———+———+——— —+—————+———+———-+——-+——+——+———+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ——-+ ———+——+——+———+———+————+—————+———+———-+——-+——+——+—— — TOTAL ¦ ¦ ——— Results of the write-off _______________________________________________________ The write-off is noted in the inventory card (book) for accounting for fixed assets. Chief Accountant ___________ _____________________ (signature) (signature transcript)

How to draw up an act correctly

Completion of the first stage, in which the newly created working group is involved, allows us to move on to the next stage. The document flow regulations allow the use of various types of forms for writing off fixed assets, the choice between which is determined by the specifics of a particular situation. Current forms include:

- OS-4 is a standard template used when deregistering one object, with the exception of situations when it comes to road transport.

- OS-4a is a modification developed specifically for the above exceptions.

- OS-4b is a type of standard document filled out when disposing of several inventory items at once.

The regulation approving the procedure for preparing these forms is Goskomstat Resolution No. 7, published in 2003.

The generated documentation confirming the decision to write off implies the need to promptly reflect the operation in inventory books and cards, as well as accounting programs used to control the storage and movement of fixed assets. This recommendation is mentioned in paragraph 80 of the Methodological Instructions of the Ministry of Finance, which determines the significance of the procedure. As a rule, when maintaining document flow, standard documents are filled out in the following format:

- Inventory cards No. OS-6 for separate accounting of inventory and property assets.

- Forms corresponding to sample No. OS-6a are relevant in cases where assets belong to group categories.

- Inventory books of small enterprises - No. OS-6b.

The specified accounting documentation is also regulated by the already mentioned resolution of the State Statistics Committee.

Example of filling out OS 4 form for write-off

The procedure for completing the standard form provides for sequential entry of data, eliminating possible errors and discrepancies with basic recommendations. On the front side of the document, at the top, the following information is indicated:

- name of the enterprise;

- TIN and checkpoint;

- structural subdivision.

The last point is determined by the need to clarify the department or branch on whose balance sheet the fixed asset to be withdrawn is listed.

Next, information is entered on the grounds that served as a factor for making the decision on partial or complete liquidation. As a rule, a link is provided to one of the related acts or orders of the management team, supplemented by the data of the full-time employee who is financially responsible for the goods and materials in question (only the last name, first name and patronymic are indicated).

On the right side of the standard form, fill out the following sections:

- Code according to the All-Russian Classifier of Enterprises and Organizations.

- The date of drawing up the act on writing off the asset from accounting.

- Details of the document that served as the basis for the implementation of the procedure.

- Personnel number of the employee assigned to be responsible for the property.

Below is information about the serial numeric code assigned to the form, the actual reasons for the disposal of the fixed asset, as well as standard details. A separate free space is allocated for the approval and signature of the head of the organization.

After this, you need to move on to the next tabular part of the form, the content of which is directly related to the material assets to be written off. The procedure for specifying information looks like this.

| Column no. | Content |

| 1 | Nomenclature name of the object |

| 2-3 | Inventory and factory registration number, respectively |

| 4-5 | Dates of actual issue and crediting to the balance sheet of the enterprise |

| 6 | The actual duration of operation, that is, all periods during which inventories were actually used in production and management processes |

| 7 | Monetary value determined at the time of registration |

| 8 | Amount of depreciation charges during use |

| 9 | Residual value, defined as the difference between the values from points 7 and 8 |

Features of drawing up the OS-4 form

The act of writing off a fixed asset is drawn up by the employee responsible for accounting for fixed assets in the organization, based on the manager’s order to write off (liquidate) the fixed asset and the commission’s report on the impossibility of its further operation.

Form OS-4 is drawn up in 2 copies:

- the first is transferred to the accounting department (on its basis, accounting reflects the disposal of the fixed asset and its write-off from account 01);

- the second remains with the person responsible for the safety of fixed assets, and is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of dismantling the object.

The act is signed by members of the commission appointed by the head of the organization and approved by the head or his authorized person. The write-off results are reflected in the asset inventory card.

Sample of filling out the reverse side

When printing forms, it is important to take into account that the template form of the act of write-off of fixed assets is two-sided. The second part is characterized by the presence of two tables, the first of which contains information about individual object characteristics, including the presence of elements belonging to groups of precious metals.

The space below is reserved for recording the conclusion of the commission responsible for making the decision on deregistration, and is filled in in accordance with the verdict made based on the results of the expert analysis. If necessary, a list of related documentation is also provided, serving as an annex to the act. The signatures of the commission members are placed opposite the lines indicating their positions and full names.

The second table of the standard OS-4 form should contain the following data:

- The amount of associated costs arising as a result of partial or complete liquidation of fixed assets of the enterprise.

- List of surviving inventory items, the condition of which is recognized as meeting operational requirements.

- The amount of revenue received from the sale of disposed objects or their individual parts.

The final stage is the signing of the document by the chief accountant of the enterprise.

Sample act of write-off of fixed assets OS-4

The need to write off an asset arises when an object becomes unusable due to its physical or moral properties. In this case, the head of the enterprise issues a corresponding order for write-off and a commission is created that controls this process and signs the completed act. The head of the enterprise also signs the document. Data on the disposal of an object are entered into the inventory card.

The OS-4 form consists of three tables: (click to expand)

- The first table is filled out on the basis of the existing acceptance certificate of the object, which was drawn up when the fixed assets arrived at the enterprise; this table contains general information about the object, service life and accrued depreciation.

- The second table reflects the features of the object, the content of precious metals in it, this information can also be gleaned from the acceptance and transfer certificate OS-1, OS-1a, OS-1b.

- The third table lists the costs incurred in connection with the write-off of a fixed asset and its dismantling, while materials suitable for further use often remain, which are included as inventory items; the cost of these inventory items is also reflected in the third table along with the corresponding accounting entries.

How to correctly draw up a write-off act in form OS-4

The current document flow procedure allows filling out the form both manually and electronically, so here the decision is made directly by the responsible employee. The main condition is the presence of original personal signatures of the head of the organization, as well as each member of the evaluation commission. But certification using a seal is not a mandatory requirement, since since 2016 the legislation has left the use of stamps and cliches as an optional right of legal entities.

The document is drawn up in two copies: the first of them is transferred for further work to the accounting department of the enterprise, serving as the basis for reflecting entries in the accounting program, the second is retained by the employee financially responsible for the property being written off, until the moment of transfer to the warehouse and subsequent disposal or sale. If necessary, it is also possible to increase the number of copies, each of which must be properly executed and certified.

How to fill out form OS-4b

The unified form OS-4b, approved by the State Statistics Committee of the Russian Federation (Resolution No. 7 of January 21, 2003), is not mandatory for use. You can develop a similar document yourself or supplement the Goskomstat form with the necessary details.

The logic for filling out the OS-4b form is quite obvious and follows from the purpose of its sections and the names of the columns and lines of the form.

On the front side of the OS-4b form the following is reflected:

- information about the owner of the property and persons responsible for its safety;

- details (number and date) of the act, visa of the manager;

- information about the condition of objects at the time of write-off.

The reverse side contains:

- conclusion of the commission, certified by the signatures of its members;

- data on the posting to the warehouse and further sale (if it took place immediately after posting) of valuables obtained during the disassembly of objects.

For more information on how to take into account scrap metal generated during dismantling of a fixed asset, read the material “How to capitalize scrap metal from write-off of fixed assets”.

How and for how long to store the document

The storage procedure involves placing the forms first in the general catalog of current documentation, using a separate identifying folder, and then in the archive - after the expiration date. The duration, determined by regulations as well as internal rules of the organization, may vary, but must be at least three years, after which destruction is permitted.

So, now you know what to write in the OS 4 form, and what results of write-off of fixed assets are recorded in the reporting.

It's time to simplify the accounting of enterprise property by taking advantage of practical mobile automation solutions from. Number of impressions: 3421

Unified form OS-4 (form)

The unified form OS-4 is an act of write-off of fixed assets (OS). The form (you can download it on our website) and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7.

Let us remind you that at present the use of unified forms is optional. If you wish, you can independently develop and approve the form of the act for writing off the fixed assets.

More details about this can be found in the material “Primary document: requirements for the form and the consequences of its violation” .

ConsultantPlus experts explained how to correctly account for real estate:

If you do not have access to the K+ system, get a trial online access for free.