Principle of working with score 08

According to Order No. 94n, to form the initial cost of a non-current asset, it is necessary to use accounting account 08.

This account allows you to accumulate all the costs that were associated with the creation, acquisition and development of new property of the institution. Costs can be grouped into five main sections:

- Fixed assets of the organization. Such objects include not only fixed assets on which depreciation is charged (buildings, transport, equipment), but also non-depreciable assets. Which? For example, land plots, subsoil.

- Intangible assets of an enterprise (patents, rights, intellectual property, all types of assets that do not have a physical shell, but generate profit and are used in business for more than 12 months).

- R&D results (relevant for research activities).

- Increasing the number of livestock (for agricultural enterprises).

- Development of natural resources. For example, which ones? Non-current exploration assets, exploration and exploration activities of the mining industry).

The first two groups are used almost everywhere, since fixed assets and intangible property are objects without which an economic entity will not be able to conduct its activities or it will be significantly difficult. The other three groups are less common. They are relevant for narrow specializations and types of economic activity.

What is reflected in accounting on account 08

Account 08 is intended for object-by-object accounting of costs of investments in the property of an enterprise, which will serve it as means of production for a long time.

The costs of reconstruction and modernization of such property are also taken into account. Important! From 01/01/2022, accounting for capital investments will be regulated by the new FSBU 26/2020. You can start applying the standard early. Find out what needs to be changed in accounting and accounting policies from the Review from ConsultantPlus. Trial access to the system can be obtained for free.

These costs, based on the nature of further use of the property, can be divided into 5 groups:

- fixed assets, including those not subject to depreciation (for example, land);

- intangible assets;

- R&D;

- development of natural resources;

- increasing the herd in livestock farming.

If the last 3 groups are relatively rare, then almost every organization deals with the first 2.

According to the method of acquisition, property can be:

- purchased, and it does not require additional investments for commissioning;

- received free of charge or as a contribution to the management company;

- entirely created by the organization itself;

- created (built) over a long period of time by a third party;

- created in a mixed way: something was purchased or made by contractors, and something was done by the enterprise’s own resources.

For information on accounting for transactions related to the authorized capital, read the article “Maintaining accounting records of the authorized capital (nuances).”

Subaccounts 08 accounts

The current accounting regulations provide for the opening of additional sub-accounts, which will allow for more detailed systematization and structuring of information on investments in non-current assets of the enterprise.

You can open separate sub-accounts for account 08 “Investments in non-current assets”.

| Number and name of the subaccount to account 08 | What do we include in the calculation? |

| 08-01 “Purchase of land” | We reflect the costs of the enterprise associated with the acquisition of land plots. |

| 08-02 “Purchase of natural resources” | We generate information on the acquisition of environmental management facilities, with the exception of land plots. |

| 08-03 “Construction of fixed assets” | On account 08-03 we accumulate information about the costs of an economic entity for the construction of fixed assets. |

| 08-04 “Acquisition of fixed assets” | We summarize the costs and expenses of the enterprise aimed at purchasing buildings, structures, equipment, transport and other fixed assets. |

| 08-05 “Acquisition of intangible assets” | We record information about the company’s expenses on the purchase of intangible property. |

| 08-06 “Transfer of young animals to the main herd” | Declaration of costs for raising young productive and working livestock in the organization, transferred to the main herd. |

| 08-07 “Acquisition of adult animals” | We reflect the cost of adult and working livestock purchased for the main herd. We also include expenses for shipping animals. |

| 08-08 “Performing research, development and technological work”, etc. | We reflect information on the expenses of an economic entity for conducting R&D activities and other types of technological research, research and development. |

The organization independently decides whether to open additional subaccounts or not. This decision must be justified in accounting policies. But maintaining separate analytics in the context of fixed assets and intangible property is mandatory.

Main entries for the account “Construction of fixed assets”

| Account debit | Account credit | Operation description |

| Reflection in accounting of contract construction | ||

| 08.03 | 60 (76) | The cost of contract work for the construction of fixed assets is taken into account |

| 19 | 60 (76) | VAT claimed by the contractor has been taken into account |

| Reflection in accounting of construction in an economic way | ||

| 08.03 | 10 (23; 25; 26; 60; 70; 76) | All costs of construction of a fixed asset facility suitable for use are taken into account |

| 19 | 60 (76) | VAT is taken into account on all costs of construction of a fixed asset facility suitable for use |

Methods of receiving property

The volume of non-current assets of an enterprise is characterized not only by the property status of the economic entity, but is also used to analyze production capacity, profitability and financial stability in general. Consequently, the organization is directly interested in strengthening and expanding its property base. Moreover, acquiring property yourself is not the only way to strengthen logistics.

The following methods of receiving property are distinguished:

- purchase or acquisition;

- free admission;

- creation in-house;

- creation by third parties;

- mixed method.

Depending on the method of receipt of the asset, the composition of costs included in the initial cost of the property is determined.

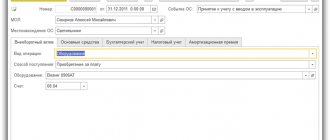

Formation of initial cost

The procedure for forming the initial cost of an asset is a list of costs, which is reflected in account 08 in accounting. The current PBU standards determine a specific list of institution costs that can be included in the initial cost of an asset. That is, they are reflected on account 08. The composition of such costs depends on the method of receipt of the asset into the ownership of the organization.

Here is a general list of the enterprise’s expenses for the receipt of property, which is taken into account in account 08 in accounting:

- The accounting value of an asset (property, fixed assets, intangible assets, R&D objects), that is, the price that was directly transferred to the seller. Including customs duties, commission fees, taxes owed and extra charges included in the price and paid to the seller. VAT and other non-refundable taxes are also included. The amounts of refundable deductions, tax bonuses and benefits should be deducted from the price when determining the initial cost.

- The fair value of the asset as of the date of its receipt in the event of a gratuitous transfer of property into the ownership of an economic entity. For example, receipt of fixed assets from the founder or investor.

- Other expenses associated with the acquisition, creation, development of a new facility (transportation, installation, consultations, etc.).

Including:

- expenses for remuneration of personnel involved in the creation of property;

- insurance premiums accrued for wages;

- the cost of work to create assets, paid under contracts to third-party organizations, individual entrepreneurs and individuals (for example, remuneration under a construction contract);

- state duties and other payments to the budget related to the creation, acquisition or production of a non-current asset (SAI);

- payment of intermediary services paid to third parties;

- costs of shipment, transportation, delivery, assembly, preparation, installation and other actions to bring the SAI into a condition suitable for operation;

- expenses for carrying out control activities to verify the readiness and proper functioning of the SAI;

- payment for materials, components and raw materials used to create or manufacture the VOA;

- payment of interest on installment payments to pay the cost of the asset;

- information, consulting and other support services;

- other types of services related to the creation or acquisition of objects, for example, payment for state construction supervision.

These costs of the enterprise, and along with them the accounting value, are reflected in the debit of the account. That is, debit turnover forms the initial cost. Credit turnover is formed immediately at the time the asset is accepted for accounting or at the time it is sold by a third-party company. In other words, the initial cost of the property is written off to a corresponding accounting account. For example, on the account. 01 “Fixed assets” when accepting fixed assets for accounting.

NMA

The developers of the Plan propose to maintain analytical accounting of the costs of intangible assets also for individual objects. Investments that go through subaccounts. 08.5, are recorded until the enterprise receives the exclusive right to intangible assets. It coincides with the date of state registration of the license agreement or right arising from the certificate or patent. Accounting account 08 records the actual expenses for the purchase of intangible assets and bringing them to a condition suitable for use. The cost is reflected in accordance with the invoices of suppliers accepted for payment after capitalization. In the case of the formation of certain types of intangible assets, the costs that the enterprise actually incurred are reflected.

Interaction with other accounting accounts

Account 08 is often used in the preparation of correspondence with separate accounting accounts. Let's consider controversial situations.

| Corresponding account | The essence of the operation |

| Account 07 “Equipment for installation” | Account 07 reflects information about the cost of equipment that cannot be operated without special installation or assembly work. To recognize such expenses as part of the initial cost of property, documentation is required. Form OS-15 or another format approved by the organization is used. Wiring:

|

| Account 20 "Main production" | Account 20 is used in correspondence with account 08 if the organization decided to use part of its independently produced products in its activities. Then the finished product at its actual cost is credited to account 08, from which the facility will be put into operation as a VOA produced in-house. Unfinished objects of the SAI for its own needs can be written off by reverse posting:

|

| Account 76 “Settlements with various debtors and creditors” | Used to reflect various types of costs that should be hidden in the original cost of the property. For example, make a wiring:

|

| Account 79 “Intra-economic settlements” | Use account. 79 to reflect calculations within the organization. For example, between structural divisions allocated to a separate independent balance sheet. Wiring:

Or:

|

| Account 94 “Shortages and losses from damage to valuables” | On the account 94 include losses and shortages in relation to property, regardless of the perpetrators. The postings are made in the following order:

|

Which accounts does it correspond with?

Account 08 can correspond with the following accounts.

From the debit of account 08 to the credit of accounts:

- Account 02 - when calculating depreciation of fixed assets that are used for modernization or creation of other operating systems;

- Account 05 - when calculating depreciation of intangible assets that were used to create other fixed assets or intangible assets;

- Account 07 - regarding the cost of equipment that was transferred for installation at the site;

- Account 10 - regarding the cost of materials that were used for the construction or modernization of the OS facility;

- Count 11 - when transferring young animals to the main herd;

- Account 16 - regarding the deviation in the price of inventories that were used in the creation of the fixed asset;

- Account 19 - when writing off VAT tax, which is not subject to reimbursement from the budget;

- Account 23 - when writing off the costs of auxiliary production to increase the cost of the capital investment object;

- Account 26 - when writing off general business expenses to increase the value of the capital investment object;

- Account 60 - when reflecting non-current assets received from suppliers, reflecting construction costs;

- Account 66 - when calculating interest on short-term loans and credits with the help of which the capital investment object was acquired (until it was accepted for operation);

- Account 67 - when calculating interest on long-term loans and credits with the help of which the capital investment object was acquired (until it was accepted for operation);

- Account 68 - when writing off amounts of non-refundable taxes on a capital investment object;

- Account 69 - when reflecting the accrual of social contributions on the salaries of workers who were involved in work with the object of capital investment;

- Account 70 - when calculating wages to employees who were involved in work with the investment object;

- Account 71 - when writing off expenses for accountable persons for a capital investment object;

- Account 75 - when one of the founders of the capital investment object makes a contribution to the authorized capital;

- Account 76 - when reflecting other services related to the commissioning of a capital investment facility;

- Account 79 - upon receipt or transfer of capital investment objects to the parent organization or branch;

- Account 80 - when transferring a capital investment object as a contribution under a joint activity agreement;

- Account 86 - upon receipt of a capital investment object in the form of investments or financing;

- Account 91 - when capitalizing MTs that were identified as a result of inventory and are intended for use when working with a capital investment object;

- Account 94 - the amounts of previously identified shortages and losses are written off to the capital investment object;

- Account 96 - when creating reserves at the expense of the investment object;

- Account 97 - deferred expenses are written off to the cost of the capital investment object;

- Account 98 - capital investment items received for free are taken into account.

You might be interested in:

Fixed assets in accounting and tax accounting, main changes in [year]

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 01 - when commissioning a capital investment as an OS object;

- Account 03 - when commissioning a capital investment that is supposed to be rented out;

- Account 04 - when commissioning a capital investment as an intangible asset;

- Account 76 - when writing off part of the cost of capital investment as insurance compensation, when making claims to contractors, etc.

- Account 79 - upon receipt or transfer of capital investment objects to the parent organization or branch;

- Account 80 - upon return of the investment object upon termination of the joint activity agreement;

- Account 91 - when writing off losses, selling part of the capital investment, disposal, etc.

- Account 94 - identified shortfalls or losses in investments in assets are written off;

- Account 99 - writing off part of the cost of the investment object as a loss (as a result of an emergency, natural disaster, etc.)

Depreciation of investments in SAI

The question of whether depreciation is calculated from the 08th account remains relevant to this day. Until the object is accepted for accounting, depreciation is not accrued. Why? In accordance with Instruction No. 94n, depreciation on fixed assets and intangible assets is accrued only from the month following the month in which the organization accepted the property for accounting. Consequently, depreciation cannot be charged on objects that are at the stage of investment in SAI.

After accepting the property for accounting, depreciation should be calculated using the method that was enshrined in the accounting policy of the institution.

Features of record generation

When purchasing an OS, logically, the following wiring is assumed:

Db 01 (03, 04) Kd 60 (76, etc.)

However, the funds spent on the purchase must be transferred in transit through the 08 accounting account. In this case, it will have no balance, and it will become a screen article. The specificity of the account is also due to the fact that capital investments extend over time. In particular, this occurs during the construction process. In this case, accounting account 08 becomes material. In this case, unfinished construction can either be sold or given away free of charge. The new Plan has significantly expanded the functions of this article. Currently, it is used not only to summarize information about the company's actual investments, but also to reflect the amount of property received as an investment in capital and free of charge.

Where is account 08 reflected in the balance sheet?

If at the end of the reporting period there is a debit balance on account 08, then this indicator should be included in the active part of the balance sheet. Account 08 in the balance sheet: which line we reflect on depends on the type of property. Table:

| Line | What should be done |

| Balance line 1110 | Reflect in the balance sheet field the debit balance of account 08 in relation to investments in intangible assets. |

| Line 1120 | Include information in the balance sheet on investments in R&D, listed in account 08 as a debit at the end of the reporting period. |

| Line 1130 | We reflect investments in the development of deposits, subsoil and other types of intangible exploration assets. |

| Line 1140 | We disclose information about investments in the development of deposits of a material nature (material exploration assets). |

| Line 1150 | Account balance 08 regarding investments in fixed assets. Include the debit balance in the appropriate line of the balance sheet. |

| Line 1190 | Include information about investments in assets not disclosed in the SAI grouping of the balance sheet. |

For example, if the debit balance is on OS, then reflect the amount of investments in SAI on line 1150 of the balance sheet. If the organization’s accounting records a debit balance for R&D objects, fill out line 1120 of the balance sheet. For investments in intangible property, enter the value of the debit balance in line 1110 of the balance sheet.

Composition of non-current assets

Section 1 of the balance sheet reflects information about the organization's possible assets available.

Reflection of non-current assets in reporting

| Name of non-current assets | Check | Content |

| Intangible assets | 04 | Programs, cultural works, models, intellectual achievements, trademarks, business reputation |

| Results of developments and other research | 04 | Information on expenses for R&D and other types of work with a scientific focus |

| Intangible exploration assets | 04 | Work carried out by organizations when developing sites and assessing natural minerals |

| Material exploration assets | 04 | Property used for the development of natural mineral deposits |

| Fixed assets | 01 | Expensive property of organizations |

| Profitable investments in financial assets | 03 | Property used for rent or leasing for a certain fee |

| Financial investments | 58 | Securities, deposits, loans |

| Deferred tax assets | 09 | Temporary difference arising when calculating income tax |

| Other noncurrent assets | Other non-current assets that are not listed in other items |

The presented detailed list of non-current assets is used by organizations that prepare financial statements on a general basis. In a simplified reporting form, non-current assets are considered only according to two criteria: tangible and intangible. Their estimated value is reflected in the balance sheet at the end of the reporting period.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |