What to follow

The current procedure for filling out orders for transferring money to the treasury has been in effect since January 1, 2014 and was approved by order of the Ministry of Finance dated November 12, 2013 No. 107n. In fact, he introduced new rules for processing payment orders. Mostly firms, enterprises, merchants and individuals work with these documents. When making budget payments, they usually fill out field 22 with UIN - a unique accrual identifier.

Also see “UIN in payment orders: sample”.

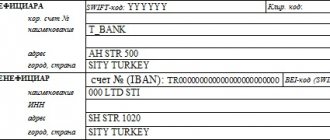

These changes forced the Ministry of Finance and the Treasury to prescribe a methodology for bringing the UIN in the application for cash expenses for the public sector. The form of this document is fixed in Appendix No. 1 to the Treasury Order No. 8n dated 10.10.2008. According to the FDC, this form has code 0531801:

Based on the letter of the Treasury of Russia dated December 19, 2013 No. 42-7.4-05/5.3-836, the format of the sample UIN in the application for cash expenses from March 31, 2014 must meet the following requirements:

- in the “Type” column – the letters “UIN”;

- in column 2 “Number” – UIN code;

- column 3 – not filled in;

- in column 4 “Subject” put a dash.

The second section of the application, entitled “Details of the basis document”, serves for this purpose:

Also see “What is UIN in a payment order.”

There is no special documentation or any reference tools in which you can find the UIN required to complete the application. The point is that this code must be unique. Otherwise, it will not be able to adequately pass through two different payments. It is assigned to a future payment automatically in the process of accruing funds by the administrator of the corresponding revenues to the treasury.

How to reflect adjustments to cash payments in accounting

The procedure for treasury servicing of budgets, revenues to the budgets of the budget system of the Russian Federation, operations with funds received at temporary disposal, funds of budgetary and autonomous institutions was approved by Order of the Federal Treasury dated May 14, 2020 No. 21n (hereinafter referred to as Procedure No. 21n).

To clarify transactions on treasury accounts and codes of the budget classification of the Russian Federation, as well as subsidy codes for which transactions were reflected in the personal account of a budgetary (autonomous) institution, the following is submitted to the territorial body of the Federal Treasury:

- Notification of clarification of the type and affiliation of payment in the form in accordance with Appendix No. 24 to Procedure No. 21n (form code according to KFD 0531809);

- or Notification of clarification of client transactions in the form in accordance with Appendix No. 25 to Procedure No. 21n (form code according to KFD 0531852).

Only transactions of the current year are subject to clarification (clauses 40, 66 of Order No. 21n). Clause 40 of Order No. 21n provides for the following cases of clarification of transactions on treasury payments:

- When changes on the basis of regulatory legal acts of the Ministry of Finance of Russia, financial bodies of constituent entities (municipalities) of the Russian Federation or management bodies of state extra-budgetary funds of the principles of assignment, the structure of codes of the budget classification of the Russian Federation;

- If you incorrectly indicate the code of the budget classification of the Russian Federation.

Let us remind you that an error is considered to be an omission and (or) distortion that arose during accounting and (or) preparation of reporting as a result of incorrect use or non-use of information about the facts of economic life of the reporting period, which was available on the date of signing the statements and should have been received and used in its preparation (clause 27 of the federal standard “Accounting policies, estimates and errors”, approved by order of the Ministry of Finance of Russia dated December 30, 2017 No. 274n, hereinafter referred to as the Standard “Accounting policies, estimates and errors”).

More on the topic: New procedure for reflecting application security in accounting from 10/01/2018

Errors are corrected in accounting by an additional accounting entry or an accounting entry using the “Red Reversal” method and an additional accounting entry (clause 28 of the Standard “Accounting Policies, Estimates and Errors”).

As a rule, the use of an incorrect budget classification code when making a payment is associated with an error. Consequently, cash payments can be clarified in accounting by adjusting the initial transactions using the “Red Reversal” method and recording the correct entries with an additional accounting entry. Payments associated with changes in the mechanism for applying budget classification codes can be adjusted in a similar way.

At the same time, the instructions for keeping records do not contain a procedure for clarifying cash payments. Therefore, operations to clarify payment should be agreed upon with the founder (GRBS).

Please note that in the treasury statement, clarifying transactions are reflected by the withdrawal/crediting of funds to account 0 307 12 000 “Calculations for budget transactions on the accounts of the body providing cash services” (clause 19 of the instructions for using the chart of accounts for treasury accounting, approved by order of the Ministry of Finance of Russia dated November 30, 2015 No. 184n). However, this does not mean that in budget (accounting) accounting, clarifying transactions should be reflected as cash receipts/disposals.

The fact is that the legislation does not require compliance between treasury and budget (accounting) accounting. In addition, if clarifying transactions are reflected through cash receipts/disposals, additional turnover arises in the Information on the institution’s receivables and payables (f.f. 0503169, 0503769), as well as in section 3 of the Report on the institution’s implementation of the plan for its financial and economic activities (f. . 0503737), which in reality do not exist. Therefore, in our opinion, this option for reflecting clarifying operations seems less preferable.

Order

Regarding the indication of UIN in an application for cash expenses in 2022, the following rule applies: when transferring money to the budget system of the Russian Federation, in columns 1 and 2, indicate, respectively, the letters “UIN” and the value of the unique accrual identifier. They do this only if available.

When it is not possible to enter a specific UIN code, enter one digit “0” (zero) in the appropriate fields of the application.

According to the principles of operation of the Automated System of the Federal Treasury software, it automatically generates details 22 “Code” of the payment order from the UIN indicator, which is given in the section “Details of the basis document” of the application for cash expenses (including abbreviated ones).

Also see “Procedure for generating UIN for payment orders”.

What is the procedure for filling out the Application for cash expenses, incl. abbreviated

In accordance with the order of the Federal Treasury dated October 10, 2008 No. 8n, which approved the Procedure for cash services for the execution of the federal budget, budgets of the constituent entities of the Russian Federation and local budgets and the procedure for the implementation by territorial bodies of the Federal Treasury of certain functions of the financial bodies of the constituent entities of the Russian Federation and municipalities for the execution of the relevant budgets ( hereinafter referred to as Procedure No. 8n), in order to make cash payments, recipients of federal budget funds and administrators of sources of financing the federal budget deficit submit the following payment documents to the Federal Treasury authorities at the place of service in electronic form or on paper:

- Application for cash expenses (form code according to KFD 0531801);

- Application for cash expense (abbreviated) (form code according to KFD 0531851).

The procedure for filling out the Application for Cash Expenses is established by the provisions of clause 9.2 of Procedure No. 8n, the abbreviated Application for Cash Expenses - clause 9.31 of Procedure No. 8n.

A request for cash expenses is generated to pay monetary obligations within the framework of one budget obligation.

The abbreviated Application for cash expenses is used in cases where payment of a monetary obligation is carried out according to one budget obligation in the currency of the Russian Federation, according to one code of the budget classification of the Russian Federation and the occurrence of a monetary obligation is confirmed by no more than one basis document. At the same time, the abbreviated Application for cash expenses is not used for non-bank transactions.

Let's consider the most pressing issues that government institutions have when filling out Applications for cash expenses.

Question 1: how to fill out an Application for cash expenses when transferring funds to pay taxes and other payments to the budgets of the budget system of the Russian Federation?

In accordance with the Procedure for accounting by the Federal Treasury of revenues to the budget system of the Russian Federation and their distribution between the budgets of the budget system of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated September 5, 2008 No. 92n, the absence of the personal account number of the income administrator in the settlement document received from the bank for the account statement , an open body of the Federal Treasury on balance sheet account No. 40101*, is not a basis for classifying this receipt as unclear, and, therefore, indicating it in section 3 of the Application for cash expenses is not necessary.

In addition, when transferring funds for tax and other payments to the budgets of the budget system of the Russian Federation to account No. 40101, the details of tax payments, including the budget classification code by which these payments are taken into account, are filled out in section 4 “Tax payment details” of the Application for cash expenses. Accordingly, fill out column 4 “Personal account” of section 3 “Counterparty details” and column 4 “Recipient’s BC code” of section 5 “Deciphering an application for cash expenses” when transferring funds for tax and other payments to the budgets of the budget system of the Russian Federation to account No. 40101 not required.

* Account No. 40101 “Revenue distributed by the bodies of the Federal Treasury between the budgets of the budget system of the Russian Federation.”

2. Question 2: what to indicate in column 2 “TIN” of section 3 “Counterparty details” of the Cash Expense Application if the counterparty is an individual who does not have a TIN?

In accordance with clause 9.2 of Procedure No. 8n, in section 3 of the Application for cash expenses, the details of the counterparty to whom the funds are transferred in accordance with this Application are indicated, while in column 2 of section 3 the TIN of the counterparty is indicated.

According to the requirements for text file formats used in information interaction between Federal Treasury bodies and participants in the budget process, if the counterparty - an individual does not have a TIN - 0 is indicated in column 2 of Section 3.

The Federal Treasury authority, on the basis of Applications for cash expenses received from recipients of federal budget funds (administrators of sources of financing the federal budget deficit), generates payment orders for the transfer of funds, issued in accordance with the requirements of the Bank of Russia (clause 2.4.1 of Procedure No. 8n).

According to Appendix 1 “List and description of details of a payment order, collection order, payment request” to the Regulations on the rules for making funds transfers, approved by the Bank of Russia on June 19, 2012 No. 383-P, in field 61 “TIN” of the payment order the recipient’s TIN is indicated (if it is assigned).

Thus, if an individual does not have a TIN, zeros (“0”) are entered in field 61 of the payment order.

Question 3: when is it possible not to fill out section 2 “Details of the foundation document”?

This is possible in the following cases:

- when filling out an Application for cash expenses by divisions of the Bailiff Service. In this case, the details of the enforcement proceedings under which the debt is collected from a legal entity or individual are not indicated;

- when the recipient of budget funds forms an Application for cash expenses to make cash payments using funds received at temporary disposal. At the same time, in addition to section 2, section 4 “Tax payment details” is also not completed.

Question 4: what to indicate in section 2 “Details of the basis document” for payment of obligations for services rendered?

In this case, an act of completed work (services) may be indicated.

Question 5: What should the recipient of budget funds indicate in section 2 “Details of the basis document” to pay the debt under the executive document?

Only the number and date of the writ of execution should be indicated, without indicating the reason for the debt.

Question 6: If in section 1 “Document details” in column 8 “Purpose of payment (note)” several documents are indicated, and in section 2 “Details of the basis document” - only one, is it necessary to authorize the payment of monetary obligations to the Federal Treasury submit all supporting documents?

It is necessary to submit all the supporting documents specified in the Application for cash expenses, and if the Federal Treasury has an electronic copy of them, re-submission of the supporting documents is not required.

Now let's look at how to fill out the Application for Cash Expenses (abbreviated).

In accordance with the provisions of clause 9.31 of Procedure No. 8n, in the “Basis of payment” field of section 1 “Document details” the following is indicated:

- in the line “agreement (government contract)” - the corresponding government contract (agreement) for the supply of goods, performance of work, provision of services for public needs or other basis document, for example, a municipal contract;

- on the line “name of the basis document” - the name of the document confirming the occurrence of a monetary obligation, for example, an invoice or act of work performed, etc.

In accordance with the provisions of paragraph 2.1.1 of Procedure No. 8n, an Application for cash expenses (reduced) is issued upon payment of a monetary obligation confirmed by no more than one basis document.

If two or more supporting documents are submitted to the Federal Treasury, payment of the monetary obligation is carried out on the basis of an Application for Cash Expenses (form code according to KFD 0531801), which provides for the possibility of indicating in Section 2 “Details of the supporting document” several supporting documents. According to the provisions of clause 9.31 of Procedure No. 8n in the field “Name of legal entity, Last name, I.O. individual” of section 2 “Counterparty details” of the Application for cash expenses (abbreviated) the name of the counterparty is indicated. If the counterparty has opened a corresponding personal account with the Federal Treasury, then its full or abbreviated name is indicated, in brackets - the full or abbreviated name of the counterparty, as well as the number of the personal account opened for him with the Federal Treasury.

Column 1 “BK Code” of Section 3 “Tax Payment Details” indicates the budget classification code (BCC) by which funds transferred in accordance with this application should be credited to the income of the corresponding budget of the budget system of the Russian Federation, as well as the KOSGU code, if the recipient of the payment is the counterparty whose corresponding personal account is opened by the Federal Treasury or financial authority.

In accordance with the provisions of clause 2.1.2 of Procedure No. 8n, the Federal Treasury authority checks the correctness of the formation of the Application for cash expenses (abbreviated) for the presence of details and indicators required for completion.

If a counterparty has opened a corresponding personal account with the Federal Treasury, the absence of indicators such as the counterparty's personal account number (with the exception of a personal account intended to reflect operations for the administration of budget revenues) and BCC (KOSGU) in the fields and columns of sections 2 and 3 is the basis for the refusal by the Federal Treasury to accept such a payment document for execution.

The question was answered by Yu.V. Kamardina , Deputy Head of the Department of Methodological Support of Budgetary Powers of the Federal Treasury for the Execution of the Federal Budget

Published in the journal “Budget Accounting and Reporting in Questions and Answers” No. 10, October 2012.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

In a shortened application

Shortened requests for cash expenses are also in use. The form of this document is approved by Appendix No. 30 to the mentioned Treasury Order No. 8n dated October 10, 2008 (according to the KFD, the form has code 0531851). The UIN in the application for cash expenses on this form is indicated differently.

The unique accrual identifier in shortened applications is indicated in the first section “Document Details”. The order is as follows:

- in the “name of the basis document” detail – the abbreviation “UIN”;

- in the “Number” detail – the UIN indicator.