If the need arises, an order approving the regulations on business trips is signed. It is this document that gives the organization’s local regulatory act legal force, although there are alternative methods of approval.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

It is worth noting that the business travel clause is not mandatory for all companies. In a number of organizations, especially small ones and operating within one locality, such documentation will be unnecessary.

But if the organization’s employees visit other cities for work purposes, and even more so spend a significant amount of time on business trips, then the provision and its continuation in the form of an order will be vital for compliance with document flow standards and the normal functioning of the accounting department.

The main functionality of the Regulations is to document the expenses that naturally arise during travel processes, as well as to prevent possible controversial situations.

Why draw up a regulation on sending employees on business trips?

The regulation on business trips refers to the internal local acts of the employer, used along with other similar documents (regulations on remuneration, internal labor regulations, regulations on bonuses, wage indexation, etc.).

Read more about internal local acts on our website:

- “Internal labor regulations - sample 2021”;

- “Regulations on labor protection of workers - sample 2021.”

The form of this document is not approved by law and its content is not regulated. Each employer draws up such a provision taking into account its “travel” subtleties and features.

The regulations on business trips are intended to establish and consolidate many different factors: types of business trips (within Russia or outside its borders), the nature and amount of reimbursed travel expenses (only for travel and accommodation or another list), the transport used for trips and other features.

The development of such an internal document for tax accounting purposes allows you to fearlessly recognize various expenses as travel expenses and justify their amount in expenses when calculating income tax or simplified tax system.

There is no need to draw up a regulation on business trips if the employer does not send its employees on business trips and does not plan to do so.

ConsultantPlus experts explained how to develop and approve regulations on business trips. If you don't already have access to the system, get a free trial online.

Elements of an order

The document is generated in accordance with GOST R 7.0.97-2016 (which has already replaced GOST R 6.30-2003). At the top are indicated:

- If available, a trademark or emblem of the organization. They are usually available on company letterhead.

- The name of the organization whose employees are drafting the document.

- Full name of the order.

- Document Number.

- Date of.

- The place where the order was issued.

- Registration number of the paper.

The introductory part is usually followed by the main text of the order. It begins with stating words about the purpose of the publication. You can refer to the desire to create a certain procedure for sending on business trips, to optimize (document) expenses incurred during employee trips, etc. The second part of the main text of the order contains a list, which in most cases contains instructions regarding:

- Links to the Regulations on Business Travel, which must be attached to the order. The first paragraph indicates its registration number and date of compilation.

- Cancellation of the previous order approving the regulations on business trips. The second paragraph is contained in the document only if the organization previously had a Regulation and now a fresh, later version is being approved.

- The one who is tasked with bringing other employees up to date. These can be heads of departments, heads of structural divisions, as well as the entire team (if necessary and the reality of meeting the requirements). Full name and position are indicated.

- The one who is appointed responsible for carrying out the order.

- Who retains control over the implementation of all points of the official paper.

The order ends with a visa from the head of the organization. If there is such a possibility, then a stamp is placed. The order will look more impressive if it is printed on company letterhead. If this is not possible, then do not forget to indicate the details of the compiler’s organization.

What is considered a business trip and when the travel regulations do not apply

The 2022 regulation on business trips is based on the definition that is familiar to everyone and the basic conditions for recognizing an employee’s trip as a business trip.

IMPORTANT! Based on the definition given in Art. 166 of the Labor Code of the Russian Federation, a business trip is considered to be a trip by an employee to carry out an official assignment outside his workplace for a period established by the employer.

Since a person’s departure from the place of his permanent location is associated with additional expenses (for travel, accommodation, etc.), requiring special documentation and justification, and the recognition of travel expenses when calculating the tax base for profit or the simplified tax system depends on many factors (service focus, duration trips, etc.), the importance of the provisions on business trips can hardly be overestimated.

This document substantiates the amount of various expenses associated with the trip (from daily allowance to airfield taxes and baggage fees), and also describes the procedure for the actions of seconded employees (the scheme for obtaining funds for the trip, the composition of the required documents, working hours when traveling, etc.).

This provision may not be used in all cases. This document does not regulate the actions of company employees if their work is of a traveling nature, as well as when employees travel for their personal purposes.

Of particular importance when applying the travel regulations is the correct classification of the trip. You can recognize a departure as a business trip and legally use the position in the following cases:

- the trip is carried out for official purposes and by decision of management;

- the employee works for a certain period of time away from the locality in which his main workplace is located;

- An employment contract or a GPC agreement has been concluded with the traveling employee.

Is it possible to take into account travel expenses for income tax purposes for an employee with whom a GPC agreement has been concluded? Find out here.

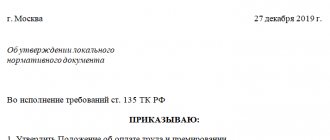

Form of order for approval of travel regulations

There is no unified form of order for approval of travel regulations. On our website there is a form and a sample order that you can use in your work.

At present, the use of letterhead to fill out an order is not mandatory (except for cases where this is stipulated in the office management instructions of a particular organization).

If you use a regular sheet of A4 paper, you will need to indicate the following organizational details in the header of the document:

- name of the organization or individual entrepreneur;

- legal address;

- INN/KPP.

The structure of the order is as follows:

- The title of the order, answering the question “about what”.

- The preamble of the order, which will need to indicate the regulations on the basis of and in pursuance of which the Regulations on Business Travel were developed, as well as the purpose of its development.

- The word "I command".

- The text of the order, which indicates the very fact of approval of the regulation and the date of entry into force of the regulation. As a rule, the provision itself usually acts as an annex to the order. In this case, it will be necessary to indicate this, for example, with the phrase “Approve from the date of publication of this order ____________ Regulations on business trips (Appendix No. 1 to the order).”

- List of responsible persons for bringing the order to the attention of interested employees and for executing the order.

- An indication of the person controlling the execution of the order.

- Position, signature and transcript of the manager who signed the order.

The number and date of the order are placed on the title page of the regulation or in another place designated for these details. From the date specified in the order, the provision comes into force.

An important condition of the provision is to secure the employee’s right to refuse a business trip

In the regulations on business trips, it would not be amiss to list all the cases when an employee has the right to refuse a business trip, and the situations when a ban on sending an employee on a business trip is imposed by law. This will allow employees to assert their legal rights and eliminate labor conflicts.

Thus, the Labor Code of the Russian Federation prohibits sending pregnant employees on business trips (Article 259), employees during the period of validity of the apprenticeship contract, if business trips are not related to apprenticeship (paragraph 3, Article 203), as well as minor employees of the company (Article 268). With regard to the last category of workers, the specified article of the Labor Code of the Russian Federation provides for nuances: business trips for minor creative workers are not prohibited according to the list approved by the Government of the Russian Federation (Resolution No. 252 dated April 28, 2007).

Another group of employees is allowed to refuse or agree to go on a work trip. In this case, they can express their will in writing. Among such employees (Article 259 of the Labor Code of the Russian Federation):

- women with children under 3 years of age;

- mothers and fathers raising children under 5 years of age alone;

- workers with disabled children;

- employees caring for sick members of their families in accordance with a medical report (Article 259 of the Labor Code of the Russian Federation).

The same choice is given to guardians and trustees of minors (Article 264 of the Labor Code of the Russian Federation).

For workers who do not fall into the above categories, refusal to go on a business trip means a high probability of receiving disciplinary punishment.

IMPORTANT! In accordance with Art. 192 of the Labor Code of the Russian Federation, an employee will commit a disciplinary act if he does not fulfill or performs his job duties poorly.

Thus, an employee’s refusal to go on a business trip is regarded as a violation of labor discipline, entailing disciplinary liability up to and including dismissal (Articles 192, 193 of the Labor Code of the Russian Federation). A clause in the employment contract stating that the employee cannot be sent on a business trip will help avoid this responsibility.

Read more about disciplinary offenses and their consequences in the material “Disciplinary offense under the Labor Code of the Russian Federation - concept and signs” .

Description in the position of the process of sending on a business trip

The Regulations on Business Travel for 2022 are based on the current version of the Regulation “On the Peculiarities of Sending Employees on Business Travel,” approved by Government Resolution No. 749 dated October 13, 2008.

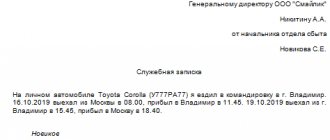

According to this document, the fact of being sent on a business trip is determined by issuing an order from the employer. The basis for issuing an order is most often a memo from the head of the department. A sample business trip memo may look like this:

If a memo is used to send an employee on a business trip, the procedure for its creation and movement should also be reflected in the regulations on business trips.

The rules for drawing up a memo for a business trip, sample 2021, are not regulated in any way. It is mandatory for her to have a resolution from the employer.

For information on how to draw up the main document for sending an employee on a business trip, read the article “Unified Form No. T-9 - business trip order .

The requirement to obtain a travel certificate has been abolished since 2015. However, the presence of this document to a certain extent disciplines the posted employee, and in the absence of travel documents, it allows you to confirm the dates of your stay on a business trip. For this reason, most employers did not abandon the use of a travel certificate and left it among the mandatory internal documents.

For information on how it is drawn up, read the material “Unified Form No. T-10 - Form and Sample” .

We are developing regulations for 2022

Almost all the nuances of sending an employee on a business trip are contained in government decree 749 on business trips, as amended in 2022, dated 10/13/2008. Fundamental changes in the direction of simplifying the registration of this working moment were made to the legislation in 2015, when the legislator abolished the obligation to issue travel certificates and official assignments. Although many organizations and enterprises to this day use these forms when sending an employee on a business trip, it is rather for the convenience of maintaining internal reporting, especially since the documents, along with the order to send on a business trip, are automatically generated from personnel accounting programs.

IMPORTANT!

Include a clause in the document about the possibility of canceling business trips due to emergencies. Due to the coronavirus epidemic, trips abroad are cancelled.

To develop an up-to-date local act, use the example of the business travel regulations 2022, but keep in mind that the sample internal document of another company contains individual characteristics, limited or expanded rights. When developing local acts, it is necessary to refer to the primary source - in our case, take government decree No. 749 as a basis.

Typically, the regulation consists of several sections and is a fairly lengthy document. In particular, take into account:

- general provisions;

- the procedure for sending employees on business trips;

- time limit for such a trip;

- rules for extension of time;

- cases of recall of a posted worker;

- guarantees when sent on a business trip;

- amounts and procedure for reimbursement of travel expenses.

In each of these sections it is important to take into account all the nuances. For example, a provision for a budgetary institution may begin like this:

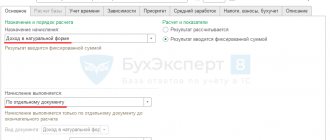

From this sample it is clear that the position is approved by the head of the organization: a field is provided for his personal signature and date of approval. One of the main sections of this local act is the section on the procedure for submitting reports related to assignments on a business trip. It is advisable to immediately write down the following rule:

The posted employee, within 3 working days after returning, is required to provide documents confirming the intended use of the allocated funds.

In addition, when drawing up the regulations, they must specify the items of travel expenses that the organization is ready to compensate to the employee. For example:

PPT.ru LLC reimburses business travelers for food costs in the amount of no more than 1 thousand (1000) rubles per day.

Returning from a trip. Business trip memo: sample 2021

Since 2015, one more document has ceased to be used - a business trip report. Although this does not mean that an employee returning from a business trip will not have to report for the work done on the business trip. You will still have to issue the document at the end of your business trip, just in a different form and under a different name.

IMPORTANT! In accordance with clause 7 of Regulation No. 749, confirmation of the length of stay on a business trip and other nuances of the business trip can be a memo issued by the employee about the business trip. The 2021 sample is not normatively established for it, and the employer can develop it independently. At the same time, he has the right either to provide for all seconded employees, without exception, the obligation to draw up such a memo, or to reflect in the regulations on business trips certain cases of its execution (for example, a business trip on personal transport or the absence of travel cards and other documents confirming the duration of the business trip).

In addition to the memo, the employee returning from a trip will have to draw up a document that is mandatory for everyone - an advance report. A company can develop its own form for such a report or use the unified form AO-1.

For rules for filling out Form AO-1, see here .

To prepare an advance report and final payment for the travel payment issued in advance, 3 working days are given after returning from a business trip (clause 26 of Regulation No. 749). The report is accompanied by documents confirming all expenses incurred during the trip (accommodation, travel and other travel expenses).

How to develop a business travel policy in an organization

There are no strict legal requirements for the content of this document. The employer has the right to include in it whatever he deems necessary. However, using the standard text of the Regulations as a source will greatly simplify the task (download a sample). Then, if desired, it can be supplemented with other sections arising from the specifics of a particular company.

When choosing a sample, it makes sense to give preference to the most recent options developed after 2015. The fact is that in 2015, when making further adjustments to the already mentioned Decree of the Government of the Russian Federation of October 13, 2008 No. 749. From the text in its latest edition, in particular, the requirements for mandatory execution of travel certificates, official assignments and reports on the work done were excluded business trip. For example, confirmation of the dates of departure on a business trip and return from it is now exclusively tickets and, for example, if an employee used official or personal transport for the trip, route sheets, and a travel certificate with notes on departure and arrival, which was previously mandatory, has become superfluous. However, if you continue to use this unnecessary bureaucracy as usual, there is no violation.

Structure of the regulation on business trips in the organization

Usually, when drawing up the Business Travel Regulations for an organization, they are guided by the following standard structure:

- General provisions. The main concepts and terms used in the document are explained here. In this section, it makes sense, guided by the provisions of the current legislation, to prescribe which trips are business trips and which are not, which categories of employees cannot be sent on business trips (the Labor Code prohibits sending pregnant women and minor employees), and which ones can only with their consent, etc.

- Procedure for registering a business trip. Typically, this paragraph prescribes the procedure for document flow in connection with business trips and delineates the areas of responsibility of the company’s structural divisions and/or specific officials - for example, what is the accounting department responsible for, and what is the personnel department responsible for, and in what sequence should business trip documents be transferred between departments . It is usually stipulated that the basis for a business trip is the corresponding order of the head of the organization; there may also be a reference to the established form of the order. Previously, business trips had to be recorded in a special internal journal. Now there is no such requirement in the law, but if the employer continues to use it, it is worth reflecting these circumstances in the text. The section may contain references to standard forms of orders and other local documents, but it is also possible to use your own options. In this case, the requirements for them are specified separately. In particular, such documents may contain:

- purpose of the trip;

- Expected Result;

- method of travel (type of transport (train, plane, bus, watercraft, the fact of using personal or business transport, if applicable, calculation of fuel costs when using personal or business transport);

- type of housing used during a business trip: hotel, rented apartment, premises provided free of charge by the employer or host, another option (for example, when traveling to a city where the employee has relatives, he stays with them);

- the duration of the business trip, here it makes sense to state that in a situation where it is difficult to predict the exact date of the employee’s return, an approximate date is indicated, and the daily allowance for issuing an advance is calculated on the basis of it;

- full or partial reimbursement of travel expenses at the expense of the receiving party, for example, the client.

- Travel dates. There is no room for creativity here, since this point is strictly regulated by Decree of the Government of the Russian Federation of October 13, 2008 No. 749: arrival and departure dates are determined by tickets or route sheets.

- The procedure for remuneration of employees during a business trip, compensation for travel expenses, guarantees for employees in connection with business trips. Here, as in the case of the previous paragraph, it is necessary to focus on the requirements of the Labor Code of the Russian Federation and the mentioned government resolution. In the same section, it makes sense to specify which expenses are considered travel expenses and are subject to reimbursement, in which cases primary accounting documents (tickets, invoices, receipts, etc.) are required to reimburse them, and in which cases you can do without them. The list of travel expenses is determined at the legislative level and includes:

- travel costs;

- rental housing;

- daily allowance. At this point it makes sense to indicate their size. Legally, it is not limited by either an upper or a lower limit, but it must be taken into account that personal income tax and contributions to extra-budgetary funds are collected from their portion exceeding 700 rubles per day for trips around Russia and 2.5 thousand rubles for business trips abroad.

- Procedure for submitting business trip reports. The deadline for submitting reports is regulated by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 and is three days after returning from a business trip. But the forms of reporting documents, which can be either standard or the employer’s own, can be specified in this section. It also sets out the requirements for documents confirming expenses of each type (tickets, invoices, checks, strict reporting forms, etc.). If it is customary for an organization to require a written statement from an employee to compensate for overexpenditures, in the section of the Regulations on reporting, there is an opportunity to consolidate this at the regulatory level. In the event that an employee did not use the entire advance payment issued during a business trip, the procedure for returning the balance is spelled out. It can, for example, be deposited in cash at the cash desk or deducted from the next salary. In practice, both options are most often provided.

One of the options for a reporting document at the end of a business trip could be a memo

- Additional sections at the employer's discretion. They may stipulate, for example, the employee’s responsibilities during a business trip, additional guarantees provided to him by the employer, if applicable, sanctions for late submission of reports and lack of supporting documents, etc.

- Final provisions. They may contain the procedure for the entry into force of the Regulations on Business Travel (for example, from the moment of approval by the first person of the company and the issuance of the corresponding order), references to other local acts and the current legislation of the Russian Federation on certain issues, etc.

The Regulations on Business Travel may also be accompanied by forms of various documents accepted in the organization: a form of an order to send an employee on a business trip, an advance report, a travel certificate, a business trip log, applications for reimbursement of overruns or an option for accepting the unused balance of the advance, etc. Each such form is a separate application with a unique number: application 1, 2, 3, etc.

The possibility of sending individuals on business trips who are not employees of the company, but are in civil legal relations with it, is useless to include in the Business Travel Regulations. This option is excluded by the Decree of the Government of the Russian Federation of October 13, 2008 No. 749, the text of which clearly states that only an employee with whom an employment contract has been concluded can be sent on a business trip. If a company needs to send on a business trip a person who has a civil legal relationship with it and reimburse him for the expenses of such a trip, the problem is resolved at the level of a civil contract or additional agreements to it.

Requirements for registration of travel regulations

There are no specific requirements for the graphic design of this local regulatory act. It is enough to adhere to general office work standards. If a specific corporate standard is practiced in a particular company, it applies to this document to the same extent as to all other local documents.

When graphically designing the Business Travel Regulations, it is enough to adhere to general office work standards

Arranging business trips for organizations (video)

Where is the memo for the business trip in 2022?

As noted above, in some cases, confirmation of the length of stay on a business trip is a memo drawn up by the employee.

A sample memo for a business trip in 2022 can be downloaded here:

Please note that even with a memo in some cases (in the absence of travel documents, documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip), it is impossible to confirm the duration of the business trip (paragraph 3, paragraph 7 of Resolution No. 749 ). Additionally, you need to put on a memo or other document confirmation from the receiving party about the actual length of the employee’s stay on the business trip. In this regard, the execution of a travel certificate becomes important and it is still advisable to provide for the execution of such a document in the regulations on business trips.

How to arrange a business trip: necessary documents

First of all, companies that send their employees on business trips must have a developed business travel policy. This local regulation specifies the amount of daily allowance, the amount of compensation for expenses and other important details.

Previously, the set of mandatory travel documents included official assignments and travel certificates. But since January 8, 2015, these documents have been abolished. Now, sending an employee on a business trip is carried out on the basis of a legal act (order, instruction) of the employer.

Algorithm of actions

Issuing an order to send an employee on a business trip

An employee is sent on a business trip for a certain period of time based on a written decision of the employer. Therefore, an order must be issued (you can use the T-9 form), which indicates all the information that was previously included in the travel certificate and official assignment.

The employee gets acquainted with the order against signature.

Advance payment for travel expenses

The issuance of accountable funds is carried out on the basis of an administrative document of the manager - an order, instruction, decision. This can also be a written statement from a seconded employee, which contains the manager’s inscription about the amount of cash and the period for which they are issued, his signature and date. Read more about this procedure in the article “How to prevent mistakes in settlements with accountable persons.”

In addition to issuing an advance for travel expenses, the corresponding o or “06”) are entered in the time sheet.

If an employee has worked a day, and in the evening of that day he goes on a business trip, then the code “I” is entered in the time sheet and the salary is paid for that day, since the employee was actually at the workplace that day.

If the business trip lasted from Tuesday to Monday, then code “K” is entered for Saturday and Sunday. If an employee does not come to work on Tuesday and is on the road by agreement with the employer, then the code “K” is also indicated on the timesheet.

Filling out an advance report

Upon returning from a business trip, the employee submits to the employer an advance report (Form N AO-1) on the amounts spent, on the basis of which the final payment is made (the advance report is accompanied by actual travel expenses, living expenses and documents on other expenses related to the business trip). A report on work performed on a business trip is not submitted.

From this date, the actual duration of the employee’s stay on a business trip is determined by the travel tickets presented to him upon his return.

Subscribe to our Telegram channel to stay informed about the most important changes for business.

We list in the regulations documents confirming expenses

Fare

An employee's travel within the territory of our country or abroad, associated with the performance of official assignments, is always associated with additional costs. If you are planning a business trip around Russia, the initial costs of the employer when sending an employee on a business trip will be the cost of travel to the destination (for business trips abroad, costs begin with issuing visas, international passports, etc. - we’ll talk about this separately).

Modern methods of moving in space are quite diverse: trains, planes, buses, taxis. In addition, an employee’s personal car or a rented vehicle can serve as a business trip vehicle.

With the usual travel documents, everything is extremely simple: their originals are attached to the advance report, and the cost of travel is easily included in tax expenses. However, modern realities make adjustments to this understandable and familiar procedure for accounting for travel expenses.

The rapid introduction of electronic documents into our lives gives rise to disagreements between taxpayers and tax inspectors regarding the recognition on their basis of expenses for the movement of employees on business trips.

Explanations from officials can help with this. For example, the letter of the Ministry of Finance dated December 4, 2019 No. 03-03-07/94225 states that to document travel expenses when purchasing an air ticket in book-entry form (electronic ticket), a boarding pass and a printed baggage receipt (itinerary receipt) are sufficient. The coupon will confirm the travel of the business traveler on the route specified in the electronic ticket, and the cost of the flight will be justified by the route receipt. But a bank statement for the card that paid for the ticket is not required (see letter from the Ministry of Finance dated August 17, 2018 No. 03-03-07/58432).

In letters dated 09.24.2019 No. 03-03-07/73187, dated 09.23.2019 No. 03-03-06/1/72906, the Ministry of Finance notes that in the absence of a boarding pass with an inspection stamp, expenses can be confirmed by a carrier’s certificate or other documents , including indirectly confirming the fact of use of purchased air tickets.

See also: “Can the penalty for returning a ticket be taken into account?”

Living expenses

The algorithm for reimbursement of living expenses should also be reflected in the regulations on business trips (Article 168 of the Labor Code of the Russian Federation, paragraphs 11, 13, 14, 21 of Regulation No. 749). This is of no small importance for the recognition of tax expenses taken into account when calculating income tax or the simplified tax system: this possibility arises only if supporting documents are available (clause 1 of Article 252, subclause 12 of clause 1 of Article 264 of the Tax Code of the Russian Federation, letter from the Ministry of Finance Russia dated 03.03.2015 No. 03-03-07/11015).

For the employee himself, the issue of compensation for living expenses during a business trip is also not indifferent: the compensation he receives for unconfirmed expenses in amounts exceeding the established norms is subject to personal income tax (paragraph 10, paragraph 3, article 217, article 210 of the Tax Code of the Russian Federation).

Options for an employee’s accommodation at the place where work assignments are carried out are no less varied than the types of transport used for business trips. The easiest way to document expenses is to stay in a hotel.

In this case, it is enough to submit to the employer’s accounting department a strict reporting form from the hotel (it must comply with the requirements of the legislation on cash register systems) or a cash register receipt.

Are “unfortunate” contributions subject to compensation for paying a hotel for washing and ironing services for an employee’s personal belongings? The answer to this question is in ConsultantPlus. Study the material by getting free trial access to the system.

If an employer rents housing for a business trip employee and incurs expenses to pay the rent, such expenses can only be recognized for the days the employee actually resides there (letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/178, Federal Tax Service of Russia for the city of Moscow dated April 16, 2010 No. 16-15/ [email protected] ).

To learn about accounting for rental travel expenses, read the article “How to recognize apartment rental expenses for business travelers in tax accounting?” .

Resolution 749 Regulations on the specifics of sending employees on business trips / 749

Decree of the Government of the Russian Federation of October 13, 2008 No. 749

“On the peculiarities of sending employees on business trips”

(as amended as of August 8, 2015, with amendments and additions made to the text in accordance with decrees of the Government of the Russian Federation: dated March 25, 2013 No. 257, dated May 14, 2013 No. 411, dated October 16, 2014 No. 1060, dated December 29, 2014, No. 1595, dated July 29, 2015, No. 771)

In accordance with Article 166 of the Labor Code of the Russian Federation, the Government of the Russian Federation decides:

1. Approve the attached Regulations on the specifics of sending employees on business trips.

2. The Ministry of Labor and Social Protection of the Russian Federation must provide clarifications on issues related to the application of the Regulations approved by this resolution.

| Chairman of the Government of the Russian Federation | V. Putin |

| Moscow | |

| October 13, 2008 | |

| № 749 |

Regulations on the specifics of sending employees on business trips

(approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749)

1. These Regulations determine the specifics of the procedure for sending employees on business trips (hereinafter referred to as business trips) both on the territory of the Russian Federation and on the territory of foreign states.

2. Employees who have an employment relationship with the employer are sent on business trips.

3. For the purposes of these Regulations, the place of permanent work should be considered the location of the organization (a separate structural unit of the organization), the work in which is stipulated by the employment contract (hereinafter referred to as the sending organization).

Employees are sent on business trips based on a written decision of the employer for a certain period of time to fulfill an official assignment outside their place of permanent work. A trip by an employee sent on a business trip based on a written decision of the employer to a separate unit of the sending organization (representative office, branch) located outside the place of permanent work is also recognized as a business trip.

Business trips of employees whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

4. The duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment.

The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler, and the day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work. When a vehicle is sent before 24 hours inclusive, the day of departure for a business trip is considered the current day, and from 00 hours and later - the next day.

If a station, pier or airport is located outside a populated area, the time required to travel to the station, pier or airport is taken into account.

The day the employee arrives at his place of permanent work is determined similarly.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer.

5. Payment for an employee if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation.

6. The clause has lost force in accordance with Decree of the Government of the Russian Federation dated December 29, 2014 No. 1595.

7. The actual length of stay of an employee on a business trip is determined by travel documents presented by the employee upon returning from a business trip.

If an employee travels on the basis of a written decision of the employer to the place of business trip and (or) back to the place of work on official transport, on transport owned by the employee or owned by third parties (by power of attorney), the actual period of stay at the place of business trip is indicated in the official document. a note that is submitted by the employee upon returning from a business trip to the employer with the attachment of documents confirming the use of the specified transport for travel to the place of business and back (waybill, route sheet, invoices, receipts, cash receipts and other documents confirming the transport route).

In the absence of travel documents, the employee confirms the actual length of stay of the employee on a business trip with documents for renting residential premises at the place of business trip. When staying in a hotel, the specified period of stay is confirmed by a receipt (coupon) or other document confirming the conclusion of an agreement for the provision of hotel services at the place of business trip, containing information provided for by the Rules for the provision of hotel services in the Russian Federation, approved by the Decree of the Government of the Russian Federation of April 25, 1997. No. 490 “On approval of the Rules for the provision of hotel services in the Russian Federation.”

In the absence of travel documents, documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip, in order to confirm the actual period of stay at the place of business trip, the employee must submit a memo and (or) another document about the actual period of stay of the employee in business trip, containing confirmation of the party receiving the employee (organization or official) about the date of arrival (departure) of the employee to the place of business trip (from the place of business trip).

8. The clause has lost force in accordance with Decree of the Government of the Russian Federation dated July 29, 2015 No. 771.

9. Average earnings for the period the employee is on a business trip, as well as for days on the road, including during a forced stopover, are retained for all days of work according to the schedule established by the sending organization.

During a business trip, an employee working part-time retains the average salary from the employer who sent him on a business trip. If such an employee is sent on a business trip simultaneously for his main job and work performed on a part-time basis, the average earnings are retained by both employers, and reimbursable expenses for the business trip are distributed between the sending employers by agreement between them.

10. When an employee is sent on a business trip, he is given a cash advance to pay for travel expenses and rental of living quarters and additional expenses associated with living outside his place of permanent residence (daily allowance).

11. Employees are reimbursed for travel and rental expenses, additional expenses associated with living outside their permanent place of residence (daily allowance), as well as other expenses incurred by the employee with the permission of the head of the organization.

The procedure and amount of reimbursement of expenses related to business trips are determined in accordance with the provisions of Article 168 of the Labor Code of the Russian Federation.

Additional expenses associated with living outside the place of residence (per diems) are reimbursed to the employee for each day of a business trip, including weekends and non-working holidays, as well as for days en route, including during a forced stopover, taking into account the provisions provided for in paragraph of these Regulations.

When traveling on business to an area from where the employee, based on transport conditions and the nature of the work performed on a business trip, has the opportunity to return daily to his place of permanent residence, daily allowances are not paid.

The question of the advisability of the daily return of an employee from a business trip to a place of permanent residence in each specific case is decided by the head of the organization, taking into account the distance, transport conditions, the nature of the task being performed, as well as the need to create conditions for the employee to rest.

If the employee, at the end of the working day, in agreement with the head of the organization, remains at the place of business trip, then the costs of renting accommodation, upon provision of the relevant documents, are reimbursed to the employee in the manner and amount provided for in paragraph two of this paragraph.

In the case of sending wages to an employee on a business trip, at his request, the costs of sending them are borne by the employer.

12. Expenses for travel to the place of business trip on the territory of the Russian Federation and back to the place of permanent work and for travel from one locality to another, if the employee is sent to several organizations located in different localities, include expenses for travel by public transport, respectively. station, pier, airport and from the station, pier, airport, if they are located outside the populated area, in the presence of documents (tickets) confirming these expenses, as well as payment for services for issuing travel documents and providing bedding on trains.

13. In the event of a forced stop along the way, the employee is reimbursed for the costs of renting living quarters, confirmed by relevant documents, in the manner and amount provided for in paragraph two of this Regulation.

14. Expenses for booking and hiring residential premises on the territory of the Russian Federation are reimbursed to employees (except for those cases when they are provided with free residential premises) in the manner and in the amount provided for in paragraph two of this Regulation.

15. The clause has lost force in accordance with Decree of the Government of the Russian Federation dated December 29, 2014 No. 1595.

16. Payment and (or) reimbursement of employee expenses in foreign currency associated with a business trip outside the territory of the Russian Federation, including payment of an advance in foreign currency, as well as repayment of unspent advance in foreign currency issued to an employee in connection with a business trip, are carried out in accordance with Federal Law “On Currency Regulation and Currency Control”.

Payment of daily allowances to an employee in foreign currency when the employee is sent on a business trip outside the territory of the Russian Federation is carried out in the manner and in the amounts provided for in the second paragraph of paragraph of these Regulations, taking into account the features provided for in paragraph of these Regulations.

17. During the travel time of an employee sent on a business trip outside the territory of the Russian Federation, daily allowances are paid:

a) when traveling through the territory of the Russian Federation - in the manner and amounts provided for in paragraph two of paragraph of these Regulations for business trips within the territory of the Russian Federation;

b) when traveling through the territory of a foreign state - in the manner and amounts that are provided for in the second paragraph of paragraph of these Regulations for business trips on the territory of foreign states.

18. When an employee travels from the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in foreign currency, and when traveling to the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in rubles .

The dates of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation are determined by the marks of the border authorities in the passport.

When an employee is sent on a business trip to the territory of 2 or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency according to the standards established for the state to which the employee is sent.

19. When sending an employee on a business trip to the territory of member states of the Commonwealth of Independent States, with which intergovernmental agreements have been concluded, on the basis of which border authorities do not make notes on crossing the state border in entry and exit documents, the date of crossing the state border of the Russian Federation is determined by travel cards documents (tickets).

In case of a forced delay in transit, daily allowances for the delay are paid according to the decision of the head of the organization upon presentation of documents confirming the fact of the forced delay.

20. An employee who went on a business trip to the territory of a foreign state and returned to the territory of the Russian Federation on the same day is paid daily allowances in foreign currency in the amount of 50 percent of the rate of expenses for the payment of daily allowances, determined in the manner provided for in paragraph two of this Regulation, for business trips on the territory of foreign states.

21. Expenses for renting living quarters when sending employees on business trips to foreign countries, confirmed by relevant documents, are reimbursed in the manner and amount provided for in paragraph two of this Regulation.

22. Travel expenses when sending an employee on a business trip to the territory of foreign states are reimbursed to him in the manner prescribed by paragraph of these Regulations when sending on a business trip within the territory of the Russian Federation.

23. An employee who is sent on a business trip to the territory of a foreign state is additionally compensated for:

a) costs for obtaining a foreign passport, visa and other travel documents;

b) mandatory consular and airfield fees;

c) fees for the right of entry or transit of motor transport;

d) expenses for obtaining compulsory medical insurance;

e) other obligatory payments and fees.

24. Reimbursement of other expenses related to business trips is carried out upon presentation of documents confirming these expenses, in the manner and amount provided for in paragraph two of this Regulation.

25. An employee, in the event of his temporary incapacity for work, certified in the prescribed manner, is reimbursed for the costs of renting a living quarters (except for cases when the posted worker is undergoing hospital treatment) and is paid daily allowances for the entire time until he is unable to begin work due to health reasons. fulfill the official assignment assigned to him or return to his place of permanent residence.

During the period of temporary disability, the employee is paid temporary disability benefits in accordance with the legislation of the Russian Federation.

26. Upon returning from a business trip, the employee is obliged to submit to the employer within 3 working days:

an advance report on the amounts spent in connection with the business trip and make a final payment for the cash advance for travel expenses issued to him before leaving for the business trip. Attached to the advance report are documents on the rental of accommodation, actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses associated with the business trip;

paragraph three of paragraph 26 has become invalid in accordance with Decree of the Government of the Russian Federation of December 29, 2014 No. 1595.

Regulations on business trips regarding payment of daily allowances

The amount of daily allowance is not regulated by law, therefore, expenses that reduce the tax base for profit or the simplified tax system are accepted in any amount independently established by the employer. This size is fixed in the regulations on business trips.

However, for the purposes of taxation of daily personal income tax and insurance premiums regulated by the Tax Code of the Russian Federation, there is a restriction obliging to withhold income tax and charge insurance premiums on amounts exceeding:

- 700 rub. — for business trips throughout Russia;

- 2,500 rub. - for foreign trips.

In this regard, most often the daily allowance is set within these limits.

Read more about calculating insurance premiums for daily allowances in this material.

Order storage period

The order approving the regulations on business trips relates to documentation on the main activities. He puts the Regulation into effect. It is logical that it has a permanent shelf life.

This document should not be confused with papers that are stored for 75 and 5 years. The latter include, for example, orders for short-term business trips. Each organization determines the method and system of document flow independently.

The main thing is compliance with the standards described in the List of standard management documents. The latter was approved by Order of the Ministry of Culture No. 558 of August 25, 2010 and regulates the storage periods for most types of documentation. And his 19th paragraph is devoted to orders that are stored permanently.

Features of foreign business trips in the regulations on business trips

The nuances of foreign business trips are reflected in the regulations on business trips in the event that the employer sends its employees on trips abroad to carry out official assignments.

Despite the fact that cost accounting and the process of organizing foreign and domestic business trips are based on general algorithms, the organization of an employee’s departure outside the country is associated with some peculiarities.

For example, reimbursement of travel and accommodation expenses for business travelers abroad occurs in the same way as when traveling within our country, but the list of reimbursed expenses has been expanded. These may include payment for registration of a foreign passport, visas and other travel documents, mandatory consular and airport fees, and other mandatory payments and fees.

At the same time, both the employer and the employee will have to take into account the requirements of the Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ, since without foreign currency it is impossible to stay abroad.

IMPORTANT! The right to use foreign currency for settlements with employees sent on business trips abroad is provided for in sub-clause. 9 clause 1 art. 9 of Law No. 173-FZ.

Foreign exchange costs associated with foreign business trips require special attention when reflecting them as part of tax expenses. For example, in the absence of a certificate of purchase of foreign currency, travel allowances can be converted into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of issuance of accountable amounts (letter of the Ministry of Finance of Russia dated September 3, 2015 No. 03-03-07/50836).

If the employer does not send his employees for official purposes outside the country, he no longer has to reflect the specifics of foreign business trips in his internal local acts.

You can download a sample regulation on business trips on our website using the link below.

Would you like to see an alternative version of the Business Travel Regulations? ConsultantPlus experts developed it specifically for the “Business Trips” Guide. Get free trial access to K+ and Regulations.

Find out how to confirm travel allowances paid by card using the link.

If changes are needed

The regulations on business trips are initially drawn up in order to avoid controversial and conflict situations between management and employees and contractors, primarily in financial and economic matters. It discusses fundamentally important points that allow you to regulate and optimize the algorithm for sending on a business trip. This is especially important if the company sends its employees there frequently.

If the Regulations no longer meet the requirements over time, or a situation has arisen that needs to be reflected there, then changes must be made to the document. Moreover, this change begins with the job description of one of the employees taking part in the travel process (its financing).

Then, based on the note, an order is issued from the manager about the need to make changes. Based on this order, a new, more appropriate Regulation is being developed. Then it is approved by a new order approving the regulations on business trips.

Thus, one organization may simultaneously have several approval orders, dated different dates and having different registration numbers. In order not to get confused in the signed documentation and to comply with document flow standards, all orders are entered into the journal of orders for the main activity in chronological order. In practice, they are guided by the latest version of the order approving the regulations on business trips.

Results

The regulation on business trips is an internal local act of the employer. This document does not have a strictly mandatory form and may not be issued if the employer does not send employees on business trips.

The provision makes it possible to justify the inclusion of travel expenses in tax expenses and eliminates disputes about the amount of compensation to business travelers for expenses incurred by them.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation of October 13, 2008 N 749

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of May 6, 2008 N 359

- Federal Law of December 10, 2003 N 173-FZ “On Currency Regulation and Currency Control”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Regulations on business trips: is it mandatory and what is it used for?

It must be said right away that this document is not mandatory for enterprises and organizations. In the event of a visit to the company’s office by inspectors from the labor inspectorate, tax inspectorate or other regulatory organizations, they do not have the right to demand that you show them this very Regulation, and certainly do not have the right to apply any sanctions to you in the absence of it.

Before sending employees on business trips, the company must adopt a local regulation regulating this process

Even when the subject of verification is the correctness of registration of travel expenses and their accounting, the absence of a provision on business trips as a local document is not yet a problem. After all, the legislation only requires employers to establish at the level of local regulations the procedure for sending employees on business trips, reimbursing them for expenses in connection with such trips, paying them for their work while on business trips, the amount of daily allowance, etc. But at the same time, no one insists on ensuring that all of the above points are spelled out in the Business Travel Regulations.

In everyday life, the regulation on business trips is also often referred to as Resolution of the Government of the Russian Federation of October 13, 2008 No. 749 “On the specifics of sending employees on business trips” with a number of changes and additions, the most recent of which as of 2022 date back to 2015. However, this is a departmental regulatory legal act. The regulations on business trips in a particular organization, as a rule, duplicate the key provisions of the mentioned Resolution, since it contains a number of legal requirements for the procedure for processing business trips and reimbursement of expenses. But it can never be equivalent to it.

The employer has the right to use alternative options to regulate business trips and everything connected with them: separate orders, for example, on approving the amount of daily allowance or regulations for sending an employee on a business trip and reporting upon return from it, the provisions of a collective agreement or employment contracts concluded with employees , where these points may be devoted to a special section or separate provisions, say, a section on the employer’s obligations to the employee within the framework of labor relations. Other options are also possible.

As for the state, in relation to local acts on business trips, it is only interested in two things: that these very local acts in any specific and convenient form for the employer are generally in principle and do not, by their content, worsen the position of posted workers in comparison with the current legislation, in particular , mentioned by the Decree of the Government of the Russian Federation and the Labor Code.

It is usually advisable to give preference to the development of a separate Regulation in a large organization with a large number of employees, since it will be easier. However, small companies often give it preference. They, in turn, often find it easier to prepare one document once based on a standard template than to develop a new one every time, for example, an order as one or another nuance arises.

In the first few months of the existence of a city newspaper in one of the Russian regional centers, there was no talk about business trips for journalists, since the editors were only interested in topics from the life of the city. However, then, during one of the actions carried out by the newspaper, the need arose to send an employee to Moscow. To reimburse him for his expenses, the editorial management, based on a standard document, developed a Regulation on Business Travel. Since there was no time, the standard text of the document was simply copied and lightly edited in some places, and entire sections, including, for example, those devoted to business trips abroad, migrated to the local Regulations from the sample untouched, causing only a smile from all involved. However, less than a year had passed before the editors had the opportunity to send one of the journalists for training in Sweden, and it was then that the section of the Regulations regarding foreign business trips came in handy.