Who and when is obliged to create a reserve for warranty repairs in accounting?

The company is obliged to recognize in its accounting a reserve for warranty repairs (WRR) if 3 conditions coincide at once (clause 5 of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”, approved by order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n):

- the company has the obligation to eliminate defects of the goods (products, works) discovered in the future during the warranty period, since it has issued a guarantee for them;

- there is a possibility of a decrease in economic benefits as a result of the fulfillment of warranty obligations;

- the amount of the provision can be reasonably determined.

The procedure for recognizing RGR in accounting:

- the liability is recognized at the reporting date;

- the amount of the RGR should allow you to pay off creditors or transfer the obligation to another person (clause 15 of PBU 8/2010);

- the estimated amount of costs for warranty repairs is assessed using actual data, based on practical experience or expert opinion (clause 16 of PBU 8/2010);

- significant amounts of RGR are disclosed in the accounting reports (clause 24 of PBU 8/2010).

The following materials will tell you about other types of estimated liabilities:

- “Provisions for doubtful debts in accounting”;

- “Reflection of the reserve for vacation pay in accounting”.

Is it necessary to form a reserve for warranty repairs and warranty service for income tax purposes, the Ministry of Finance clarified. Get free trial access to the ConsultantPlus system and find out the opinion of officials.

Amount of deductions

Calculate the maximum amount of deductions to the reserve of expenses for warranty repairs and warranty service using the formula:

| Limit amount of deductions to the reserve of expenses for warranty repairs and warranty service (%) | = | Actual costs for warranty repairs and warranty service for the previous 3 years | : | Revenue from sales of products subject to warranty repairs and warranty service for the previous 3 years (excluding VAT) | × | 100% |

This procedure is provided for in paragraph 3 of Article 267 of the Tax Code of the Russian Federation.

Advice : Sales volumes and costs for warranty repairs and warranty service change every year. Therefore, check annually whether the maximum amount of contributions to the reserve specified in the tax accounting policy is not overestimated. This will save the organization from possible errors in calculating income tax.

If the organization began to provide a guarantee for sold products less than three years ago, then when calculating the maximum amount of contributions to the reserve, take the proceeds and the amount of repair (maintenance) costs for the actual period of such sales (clause 3 of Article 267 of the Tax Code of the Russian Federation).

If previously the organization did not undertake warranty obligations at all, determine the maximum amount of contributions to the reserve as the amount of expected expenses. Calculate this indicator according to the warranty fulfillment plan, taking into account the warranty period and estimated repair costs. At the end of the year, specify the maximum amount of deductions based on actual expenses. Such rules are provided for in paragraph 4 of Article 267 of the Tax Code of the Russian Federation.

In tax accounting, reflect contributions to the reserve as part of other expenses associated with production and sales (subclause 9, clause 1, article 264 of the Tax Code of the Russian Federation). Include contributions to the reserve in the calculation of the tax base on the date of sale of products with warranty obligations (clause 3 of Article 267 of the Tax Code of the Russian Federation).

Determine the amount of contributions to the reserve for warranty repairs and warranty service using the formula:

| The amount of deductions to the reserve of expenses for warranty repairs and warranty service | = | Revenue from sales of products subject to warranty repair and maintenance (excluding VAT) | × | The maximum amount of deductions to the reserve of expenses for warranty repairs and warranty service |

Provision for warranty repairs and VAT

It is important for the company forming the RGR to remember that the following are not subject to VAT (subclause 13, clause 2, article 149 of the Tax Code of the Russian Federation):

- repair and maintenance services for goods during the warranty period of their operation, if they are provided without additional payment;

- cost of spare parts used during warranty repairs.

Explanation of the provisions of Art. 149 of the Tax Code of the Russian Federation, see the material “Art. 149 of the Tax Code of the Russian Federation: questions and answers.”

However, not everyone can take advantage of this VAT exemption.

For example, the issue of application of this exemption by third parties involved in relations with manufacturers of goods and repair companies, but not directly performing warranty repairs (the “manufacturer-distributor-dealer” chain), remains unregulated by law.

Examples of contradictory judicial positions are presented below:

- the distributor is not entitled to VAT exemption (Resolution of the 9th AAS dated October 26, 2011 No. 09AP-26094/11);

- whether the distributor has the opportunity to use the right to exemption from VAT (Resolution of the Federal Antimonopoly Service of the Moscow Region dated 02.02.2012 No. F05-13111/11).

The use of VAT exemption by dealers is interpreted clearly in their favor (letter of the Ministry of Finance of Russia dated February 28, 2013 No. 03-07-07/5908).

Another controversial situation with VAT arises if a warranty is issued by the manufacturer, but the trading company carries out warranty repairs at its own expense. In this case, the trading company must pay VAT from its own funds, since in the absence of compensation from the manufacturer, such repairs are not considered warranty and are recognized as a free service.

When and how trading companies are formed in the accounting of RGR, we will tell you in the next section.

Industry specifics of the reserve for warranty repairs

The need to create a RGR may arise from different enterprises and organizations. Do industry specifics affect the algorithms for generating RGR?

To answer this question, we will focus on the scheme for the formation of RGR in 2 non-related industries: trade and construction.

RGR in trade

The need for the creation of RGR by trading companies is associated with the provision of guarantees to buyers for the goods sold. The most common type of warranty support that is beneficial for buyers is when selling household appliances.

Warranty repair costs in such a situation may only arise from one of the following entities:

- manufacturer of household appliances;

- trading company.

A trading company does not have the right to create a RGR if repairs under warranty are carried out:

- manufacturer;

- workshop of a trading company - if the manufacturer compensates for the costs incurred.

If a trading company provides customers with a company guarantee and repairs sold goods during the warranty period, it forms a RGR.

The purpose of creating a RGR in accounting is to uniformly include upcoming expenses for warranty repairs and warranty service in the costs of the reporting period of a trading company.

Regulatory grounds for the formation of the RGR:

- PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets” (approved by order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n);

- clause 72 of the Regulations on accounting and financial reporting (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

If a trading company creates a RGR for the first time, it needs to:

- enter into the working chart of accounts. 96 “Reserves for future expenses” (if this account was not previously provided) and supplement the accounting policy with a methodology for calculating the reserve;

- the amendments made to the accounting policy should be approved by order of the manager and the involved accounting specialists should be familiarized with them;

When developing a methodology for calculating RGR, a trading company can use statistical data (on breakdowns of specific goods, costs of repairing them, etc.), as well as the “tax” scheme for the formation of RGR (Article 267 of the Tax Code of the Russian Federation). The calculated annual amount of the planned RGR is approved by order of the head of the trading company before the start of the reporting year.

Example

Trading sells food processors and provides them with a 12-month company warranty (the manufacturer does not provide warranty repairs). The company’s accounting policy stipulates that the RGR is formed according to the “tax” method using data for the previous 3 years when calculating the amount of the reserve.

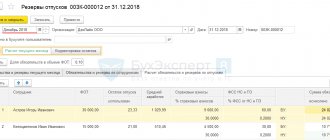

To form the RGR, the following data were used (for the previous 2 years):

- TC Vita's revenue for sold food processors is RUB 6,230,000. (excluding VAT);

- expenses for warranty repairs - 180,000 rubles.

Algorithm for calculating RGR:

- determination of the percentage of deductions to the Russian State Register: (180,000 / 6,230,000) × 100 = 2.889%;

- monthly deductions are made to the RGR, calculated on the basis of revenue from the sale of food processors and the percentage of deductions. For example, with revenue in January of 112,000 rubles. this is 3,235.68 rubles. (RUB 112,000 × 2.889%).

How to take into account the costs of warranty repairs, read in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Typical Situation. It's free.

RGR in construction

Construction companies, like trading companies, have to deal with warranty obligations - if the construction contract stipulates that the contractor, during the warranty period, is obliged to eliminate at his own expense defects that were not identified during the acceptance of the work performed.

For uniform recognition in accounting of expenses associated with the performance of these duties, the construction company creates a RGR.

However, a construction company has the opportunity not to fulfill warranty obligations if the shortcomings and defects that arise are not due to its fault, but in connection with (clause 2 of Article 755 of the Civil Code of the Russian Federation):

- normal wear and tear of the object (or its parts);

- improper use;

- incorrect application of operating instructions developed by the customer or third parties involved;

- improper maintenance and (or) repairs performed by the customer (general contractor or involved subcontractors).

It is necessary to take into account that paragraphs. 2 and 4 tbsp. 724 of the Civil Code of the Russian Federation stipulate that the customer (general contractor) has the right to demand that the contractor eliminate deficiencies within 5 years from the moment the result of the work was accepted - the possibility of reducing this period is not provided for by law.

Thus, construction companies - unlike trade companies - have a legally established minimum period during which they are obliged to carry out warranty repairs and, in connection with this, may incur corresponding costs.

Otherwise, the approaches to the algorithms for generating RGR for a construction company are similar to those described above for trading companies.

Warranty repair reservation

Reserve accounting

Costs associated with warranty repairs or service are incurred during the year.

In order to evenly include these expenses in the production or distribution costs of the reporting period, manufacturing organizations can form appropriate reserves (clause 72 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n). The procedure for creating a reserve for warranty repairs and warranty service must be recorded in the organization’s accounting policies, as well as the method for calculating the deductions that form it. However, firms can determine the amount of these deductions in different ways. For example, based on the annual amount of the planned reserve for warranty repairs. This indicator is approved by the relevant administrative document of the head of the organization. The monthly contribution to the reserve in this case will be equal to 1/12 of the annual amount.

Example 1

The organization sells its products, which have a warranty period of 1 year. According to statistics, out of 100% of products sold, approximately 80% have no defects, 15% have minor defects that can be repaired, and 5% of the goods are replaced with a new one because they have serious defects that cannot be repaired.

Let's assume that the average cost of repairing 1 unit of goods is 1000 rubles, and the cost of replacing a product is 4200 rubles. During 2008, the organization plans to sell 20,000 units of goods.

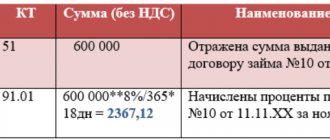

The amount of the reserve created for 2008 will be calculated as follows: 20,000 units. × 15% × 1000 rub. + 20,000 units × 5% × 4200 rub. = 7,200,000 rub.

Let's determine the amount of monthly contributions to the reserve: RUB 7,200,000. / 12 months = 600,000 rub.

In addition, the order on accounting policy can establish a methodology for creating a reserve in accounting, similar to that specified in Article 267 of the Tax Code. This option will help organizations bring accounting and tax accounting closer together.

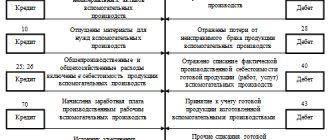

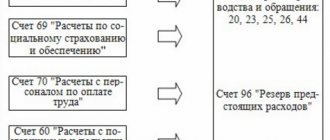

According to the Chart of Accounts for accounting financial and economic activities of organizations and the Instructions for its application (approved by Order of the Ministry of Finance on October 31, 2000 No. 94n), the reserve for warranty repairs and warranty service is taken into account in account 96 “Reserves for future expenses”, subaccount “Reserve for warranty repair and warranty service." On the credit of this account in correspondence with accounts 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses” or 44 “Sales expenses” the formation of a reserve is reflected. The write-off of expenses for warranty repairs from the amount of the created reserve is recorded in the debit of account 96 and the credit of accounts 10 “Materials”, 23 “Auxiliary production”, 69 “Calculations for social insurance and security”, 70 “Settlements with personnel for wages”, 76 “Settlements with various debtors and creditors”, etc.

Example 2

The organization carries out activities in the manufacture of household appliances (irons); a warranty period of 1 year is established for the products manufactured.

The order on accounting policy for 2008 provides for the creation of a reserve for warranty repairs. Contributions to the reserve are made every month.

We will determine the standard for monthly contributions to the reserve for warranty repairs and warranty service.

According to statistics, out of 1000 irons sold, 100 break during the year. At the same time, the average cost of repairing one broken iron is 30% of its cost.

Therefore, for warranty repairs of one iron, an amount of 3% (30% × 100 pcs. / 1000 pcs.) of its cost should be reserved.

Let's assume that the cost of one iron is 3,000 rubles.

The organization plans to produce 3,500 irons during the year; accordingly, the amount of monthly contributions to the reserve for 2008 will be 26,250 rubles. (RUB 3,000 × 3% × 3,500 units / 12 months).

Thus, every month the organization’s accountant must record:

Debit 20 Credit 96 - 26,250 rub. — the amount of the reserve for future expenses for warranty repairs and warranty service has been accrued.

If the actual costs incurred for warranty repairs in any month during the reporting year turn out to be greater than the amount of the formed reserve, then the excess amount is taken into account in account 97 “Deferred expenses”, and then written off to the debit of account 96 “Reserves for future expenses”. This course of action allows you to evenly include the costs of warranty repairs and warranty service in the organization’s costs.

If the reserve at the end of the reporting year turns out to be greater than the expenses actually incurred for warranty repairs during the same period, then the excessively reserved amounts are reversed in the debit of accounts 20 “Main production”, 26 “General business expenses” or 44 “Sales expenses” and credit to account 96 “Reserves for future expenses”. The unused balance of the reserve may be carried forward to the next year.

However, management may decide not to create a reserve for warranty repairs for the next year. In this case, the excess reserve funds must be added to the financial result of the organization. This operation is reflected by an entry in the debit of account 96 “Reserves for future expenses” and the credit of account 91 “Other income and expenses. Moreover, the “released” amounts should be included in the financial results in January of the year following the reporting year.

The organization that has formed the reserve must periodically make an inventory of it, during which the correctness of the formation and expenditure of the corresponding amounts is checked, and, if necessary, the size of the created reserve is adjusted. This activity should be carried out taking into account the provisions of the Guidelines for inventory of property and financial obligations, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49. The assessment of the correctness of the formation and use of the reserve for warranty repairs and warranty service is carried out according to estimates, calculations and other documentation .

Tax expenses

The procedure for forming a reserve for future expenses for warranty repairs and warranty service for tax purposes is established by Article 267 of the Tax Code. According to paragraph 1 of this legislative norm, organizations that sell goods have the right to create such reserves, and deductions for their formation can be accepted as expenses that reduce the income tax base.

Similar to accounting, the decision to create reserves is the prerogative of organizations, requiring reflection in the accounting policy, where the maximum amount of deductions for profit tax purposes should be fixed. In this case, the reserve is created only in relation to those goods or works for which, in accordance with the terms of the contract concluded with the buyer, maintenance and repairs are provided during the warranty period (clause 2 of Article 267 of the Tax Code). In the letter of the Federal Tax Service of Moscow dated December 25, 2006 No. 20-12/115088, an explanation was given, according to which a company, including a trading one, sells products under warranty repair conditions and made a decision to form a reserve, recording in the accounting policy for the upcoming tax period, the limit of funds attributable to it may make deductions to the reserve (accepted for the purpose of calculating income tax as expenses) on the date of sale of the specified goods.

Monthly amounts of deductions for the formation of a reserve for warranty repairs and warranty service are included in other expenses associated with production and sales (subclause 9, clause 1, article 264 of the Tax Code). At the same time, as Ministry of Finance specialists reminded in letter dated January 19, 2007 No. 03-03-06/1/16, such costs can be written off as “profitable” expenses even in the case where the organization did not decide to create an appropriate reserve . In such cases, when a firm uses the accrual method, costs are recognized as such in the period to which they relate, regardless of the time of actual payment of funds (or other form of payment).

In a letter from the Federal Tax Service for Moscow dated February 20, 2007 No. 20-12/016797.1, the capital tax department indicated that customs duties may also be included in expenses that reduce the income tax base as costs associated with warranty repairs and maintenance. payments for the import of spare parts for the specified repairs, transportation costs and brokerage services. In addition, this may include the costs of business trips, wages and unified social tax for payments to service engineers of a trading company.

The reserve created by the organization cannot exceed the limit specified in paragraph 3 of Article 257 of the Tax Code. Namely, it turns out to be more than the share of expenses actually incurred by the company for warranty repairs and maintenance in the volume of revenue from the sale of these goods for the previous 3 years, multiplied by the amount of revenue from the sale of these products for the reporting (tax) period. The same legislative norm states that in cases where a company carries out activities in the sale of goods with the condition of warranty repairs and warranty service for less than 3 years, to calculate the maximum amount of the reserve formed, the volume of revenue from the sale of these goods (works) for the actual period of such implementation. Moreover, in letter dated February 22, 2008 No. 03-03-06/1/129, specialists from the Ministry of Finance noted that it is not necessary to record in the organization’s accounting policies the possibility of changing the established procedure for creating a reserve for upcoming expenses for warranty repairs and maintenance.

As for those firms that have not previously sold goods on similar terms, they can take the expected costs of these costs as a guideline when limiting the reserve. These, in turn, mean the costs provided for in the plan for fulfilling warranty obligations, taking into account the warranty period (clause 4 of Article 267 of the Tax Code). At the same time, as noted by the Federal Tax Service for Moscow in a letter dated December 14, 2007 No. 20-12/119717, deductions to the reserve of costs for warranty repairs and warranty service with the subsequent inclusion of these amounts in “profitable” expenses can be made on the date of sale corresponding goods. In this case, compliance with the requirement to record in the accounting policy the decision to create a reserve for warranty repairs indicating the limit of deductions for the upcoming tax period is mandatory.

Example 3

Since 2008, the organization began to carry out activities in the production and sale of household appliances, for which it established a warranty period of 1 year.

In the order on accounting policies, the coefficient of deductions to the reserve, taking into account the estimated costs of repairing household appliances, is set at 0.5% of the amount of revenue from the sale of household appliances.

Revenue from the sale of household appliances amounted to: for the second quarter of 2008 - 500,000 rubles; for the third quarter of 2008 - 800,000 rubles.

Thus, deductions to the reserve for warranty repairs and warranty service, taken into account as part of other expenses, will amount to: for the second quarter of 2008 - 2,500 rubles. (RUB 500,000 × 0.5%);

for the third quarter of 2008 - 4000 rubles. (RUB 800,000 × 0.5%).

In the third quarter of 2008, an additional 1,500 rubles must be included in the expenses for creating the reserve. (4000 rub. - 2500 rub.)

Please note that upon expiration of the tax period, it will be necessary to adjust the amount of the created reserve based on the share of actually incurred expenses for warranty repairs and maintenance in the volume of revenue from the sale of these goods for the expired period.

VAT on spare parts

In accordance with subparagraph 13 of paragraph 2 of Article 149 of the Tax Code, services provided without charging additional fees for the repair and maintenance of goods and household appliances during the warranty period of their operation, including the cost of spare parts and parts for them, are not subject to VAT. At the same time, tax amounts charged to the buyer when purchasing goods used for transactions not subject to taxation or exempt from it are taken into account in the cost of these products (subclause 1, clause 2, article 170 of the Tax Code). Thus, VAT on purchased spare parts intended for use during warranty repairs and maintenance is not deductible, but is taken into account in the cost of purchased spare parts. If the VAT on spare parts was accepted by the organization for deduction, then during warranty repairs, in cases where they are used without charging an additional fee, the corresponding tax amounts should be restored and paid to the budget (clause 3 of Article 170).

As is known, companies carrying out both taxable and non-VAT activities must keep separate records (clause 4 of Article 149 of the Tax Code). Otherwise, organizations will not be able to either accept the corresponding amounts of VAT for deduction or take them into account as expenses when calculating income tax. The only exceptions are cases when the share of expenses for the production of goods and property rights, the sale of which is not subject to VAT, during the tax period did not exceed 5 percent of the total production expenses (clause 4 of Article 170 of the Tax Code). In such situations, the tax amounts presented by companies are subject to deduction in accordance with the procedure provided for in Article 172 of the Code.

Warranty repair services for goods provided by a company that has entered into contracts with both the manufacturing plant of such products and the trading organization are exempt from VAT. But, as Ministry of Finance specialists indicated in letter No. 03-11-04/2/26 dated February 5, 2008, such a tax exemption is possible only if such services are actually provided during the warranty period of the goods.

However, there is another point of view. In particular, in letter dated May 16, 2007 No. 19-11/045476 of the Federal Tax Service for the city of Moscow it is stated that only amounts received by the organization directly carrying out warranty repairs are exempt from VAT, within the limits of reimbursement of the cost of its implementation and used in the process. spare parts. The capital's tax authorities explained their position as follows. Since the right to warranty repair follows from the purchase of a product of inadequate quality, the obligation to eliminate defects free of charge (warranty repair) rests with the manufacturer (seller) or the organization performing its functions, regardless of who will directly provide the service or perform warranty repair work of this product. Consequently, the VAT tax base does not include only funds received from the manufacturer (seller) or companies performing its functions for the repair and maintenance of goods and household appliances during the warranty period of their operation. At the same time, remuneration amounts, as well as other funds received from manufacturers and remaining at the disposal of the organization and service centers, are subject to VAT in the generally established manner.

V. Semenikhin

simplified tax system nuances of the guarantee reserve

A simplified registration register in accounting must be created in relation to those goods (works) for which, in accordance with the terms of the contract concluded with the buyer, maintenance and repair are provided for during the warranty period.

It is necessary to take into account that:

- The RGR must be formed in the accounting of a simplified person if he does not apply the simplified accounting and reporting rules provided for small enterprises (we will talk about the creation of the RGR by representatives of small businesses in the next section);

- To form a RGR, a simplifier has the right to use what is described in Art. 267 of the Tax Code of the Russian Federation by an algorithm, but in tax accounting the simplifier does not have the right to create this reserve - when calculating the single simplified tax, only paid expenses can be taken into account (clause 2 of Article 346. 17 of the Tax Code of the Russian Federation), and the accrued RGR does not apply to them;

- The simplifier enshrines the scheme for the formation of the RGR in the accounting policy for accounting purposes.

Study the algorithms for creating accounting policies by simplifiers using the materials posted on our website:

- “Accounting policy under the simplified tax system “income minus expenses” (2021)”;

- “Formation of accounting policies for individual entrepreneurs using the simplified tax system “income” - sample”.

Overexpenditure of reserve

If at the end of the year there is an overspending of the reserve, include the difference between the actual costs of repairs (maintenance) and the amount of the created reserve as part of other expenses. This follows from paragraph 2 of paragraph 5 of Article 267 of the Tax Code.

Situation: at what point can the amount of overspending of the reserve for warranty repairs and warranty service be included as an expense when calculating income tax? The organization uses the accrual method.

The period for writing off the amount of overexpenditure of the reserve is not established by law.

Article 267 of the Tax Code only states that the positive difference between the amount of actual expenses for warranty repairs and the amount of the created reserve is included in other expenses (paragraph 2, paragraph 5, article 267 of the Tax Code of the Russian Federation).

Representatives of the tax service believe that the excess of actual expenses for warranty repairs over the amount of the created reserve can be included in the calculation of the tax base only at the end of the year. This point of view was reflected in section 5.5.2 of the Methodological Recommendations, approved by order of the Ministry of Taxes of Russia of December 20, 2002 No. BG-3-02/729. Despite the fact that this document is currently not applied (order of the Federal Tax Service of Russia dated April 21, 2005 No. SAE-3-02/173), in practice, tax inspectorates take the same position.

Reserve for warranty repairs and small business

Representatives of small businesses are given the opportunity not to form RGR in accounting if they have chosen to use simplified methods of accounting and reporting as an accounting scheme (Clause 4, Article 6 of the Accounting Law of December 6, 2011 No. 402-FZ).

Who can consider themselves a small business and what a simplified method of accounting is, find out from the material “Features of accounting in small enterprises.”

In this case, the following documents may serve as the basis for a lawful refusal to create a RGR:

- clause 3 PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”, approved. by order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n;

- clause 20 of the Information of the Ministry of Finance of Russia “On the simplified system of accounting and financial reporting” dated June 29, 2016 No. PZ-3/2016.

When refusing to form a RGR, a small business representative using simplified accounting methods must take into account that the reporting he prepares must give a reliable representation of:

- on the financial position as of the reporting date;

- financial result for the reporting period;

- cash flows over the same period of time.

Based on such reporting, adequate and (or) effective management decisions are made, therefore, in order to increase the reliability of reporting information and uniform recognition of expenses, a small business entity may decide to voluntarily form a RGR in accounting.

IFRS-specific features of the formation of a guarantee reserve

The definition of a reserve from the perspective of international accounting and reporting is given in paragraph 10 of IFRS 37 “Reserves, contingent liabilities and contingent assets”. It means an obligation:

- with an indefinite period of execution; or

- of uncertain magnitude.

The standard defines the criteria for recognizing a provision in paragraph 14 of IFRS 37 - it is reflected in accounting if:

- a liability exists as a result of a past event that will require an outflow of resources embodying economic benefits to be settled;

- the amount of this liability can be reliably calculated.

IFRS 37 assumes that the firm will be able to calculate the liability. For example, to calculate warranty repair liability, you can multiply:

- number of goods sold;

- cost of repairs;

- the probability of a warranty case occurring, for the calculation of which you can use, for example, the percentage of breakdowns depending on the period of use of the product.

The materials on our website will tell you how the probability indicator is used in international accounting and reporting:

- “IFRS No. 15 Revenue from contracts with customers (nuances)”;

- “IFRS No. 36 Impairment of assets - application features”.

Based on the content of the standard, the situation of non-recognition of a reserve can arise only in exceptional cases:

- if it is not possible to calculate the amount of the reserve due to the impossibility of obtaining the data necessary for the calculation; or

- the calculated provisions are not material.

Even then, disclosure of the contingent liability is required in the notes to the financial statements. Eg:

- reflect the amount of expenses for warranty repairs in recent years; or

- Provide data on warranty periods for product groups.

When determining the value of the RGR, one should not forget about one fundamental IFRS rule: the costs of preparing source data and implementing calculation procedures should not be greater than the benefits received by users.

Results

The obligation to create a reserve for warranty repairs in accounting arises from those companies that provide a guarantee for goods (work, services) and during the warranty period are obliged to eliminate at their own expense defects and deficiencies identified by consumers.

The methodology for calculating the amount of the reserve is fixed in the accounting policy. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Provision for repairs of fixed assets

A little about the taxation of expenses for the repair of fixed assets.

Above in the channel I talked about when buildings, structures, machines, equipment and other similar objects are considered fixed assets. The Tax Code adds one more criterion: the cost must exceed 100 thousand rubles, otherwise it is immediately written off as a tax reduction. It is clear that expensive assets with a long service life sometimes need to be repaired. Generally, renovation costs reduce taxable income in the quarter in which the renovations are made. The reserve provided for in Article 324 of the Tax Code of the Russian Federation allows you to recognize repair costs before the fixed asset begins to be repaired. Thanks to this, you reduce income tax starting from the first quarter. Even if no repairs have yet been made. Even if they are never produced. In the latter case, at the end of the year you will have to increase taxable profit by the amount of the unused reserve, but during the year the unpaid money will have time to generate income. This is the main thing you need to know - technical details will follow. How it works?

At the beginning of the year, you estimate how much money will be spent during the year on repairs of fixed assets and draw up a cost estimate. The result of the estimate is the so-called maximum amount of contributions to the reserve. There is a limitation: the maximum amount cannot exceed the average annual actual repair costs calculated for the last 3 years. Then you determine the total cost of fixed assets - the sum of the initial costs of all fixed assets of the company (at these values the fixed assets were taken into account at the beginning of their careers).

Divide the first amount by the second - you get the standard for contributions to the reserve. ¼ of the product of the total cost of fixed assets by the standard will reduce taxable profit on a quarterly basis.

Example 1:

In 2022, you plan to spend 700 thousand rubles on repairs of fixed assets. In 2022, 600 thousand rubles were spent for this purpose, in 2017 - 500 thousand rubles, in 2016 - 400 thousand rubles. At the beginning of 2019, the initial cost of your company’s fixed assets was 10 million rubles.

Average annual actual costs for repairs amounted to 500 thousand rubles. (600 thousand rubles + 500 thousand rubles + 400 thousand rubles) / 3). Therefore, the maximum amount of contributions to the reserve will not be 700 thousand rubles, but only 500 thousand rubles.

The standard for contributions to the reserve = 500 thousand rubles. / 10 million rub. * 100% = 5%.

Starting from March 31, 125 thousand rubles will be transferred to the reserve quarterly. (1/4 * 5% * 10 million rubles).

What will happen to the tax later?

When repairs are actually made, they are financed only from the reserve. This means that there will be no expenses for repairs of fixed assets in this quarter - they were already recognized earlier. At the end of the year, an inventory of the reserve is carried out. If it is greater than the actual repair costs, the excess is included in income. If less, it’s an expense.

Example 2:

You have been greedy all year (or you have been lucky all year) and fixed assets have not been repaired. During the year, 500 thousand rubles were allocated to the reserve. On December 31, this amount is included in income and increases taxable income.

What is needed to create a reserve?

The reserve is voluntary. You just need to make a decision and consolidate it in your accounting policies.

A reserve for the repair of fixed assets can be created in a larger amount than the maximum amount of deductions. This is permitted for particularly complex and expensive types of major repairs that last more than a year. In this case, calculating contributions to the reserve will be more difficult, but the amount of savings will be greater. Tell us in more detail or go to the last reserve - for warranty repairs and warranty service?