Not every enterprise has in its documentation a Regulation on bonuses for employees, which relates to internal regulations. As a rule, it is mainly found in government and budgetary structures, as well as in large commercial companies with a large number of structural divisions and full-time employees. Small businesses do without it, which is quite acceptable, since the law does not oblige organizations to use such a document.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Why do you need a Bonus Regulation?

Each enterprise has the right to independently develop a bonus system for its employees. The only condition for this is that it fully complies with the framework of the current legislation of the Russian Federation.

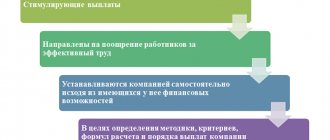

Generally speaking, the Regulations establish which employees, for what services and under what circumstances can receive financial incentives from the company’s management.

Thus, by developing the Regulations on bonuses, the enterprise administration usually achieves several goals at once:

- increased labor productivity and employee efficiency,

- the quality of products improves,

- labor discipline is strengthened,

- general prospects are expanding.

In some cases, in the future, the Regulations may become a legally significant document that has evidentiary force in court - for example, when resolving labor disputes and disagreements regarding the payment of wages and other material incentives to an employee. That is why its preparation should be treated with the utmost care, taking into account all the subtleties and nuances of the enterprise.

The main functions of the wage regulations and the scope of its legal regulation

To understand the meaning of the document, it is necessary to determine the areas of its legal regulation.

The provision contains rules governing a specific aspect of individual or collective labor relations, and therefore refers to local regulations. The main function of such acts is a source of information for employees of the organization about the procedure and rules for calculating and paying wages. Having a limited scope, such acts specify legal acts, taking into account the characteristics and working conditions at a particular enterprise. In other words, this document regulates relations within one enterprise.

Based on the provisions of Part 1 of Art. 135 and art. 372 of the Labor Code of the Russian Federation, the Regulations are drawn up taking into account the opinions of representative bodies, employees of the enterprise, as well as trade unions.

Who draws up the Regulations

The responsibility for developing this document on bonuses for employees usually falls within the competence of the company's lawyer, personnel officer, and less often - the secretary or the manager himself. In any case, this must be a person who has the necessary theoretical knowledge in the field of labor and civil legislation and the skills to write such documents. And regardless of who is directly involved in this work, the final version of the regulation must be submitted for approval to the director of the organization.

Is it necessary to familiarize employees with the Regulations?

Theoretically (and often practically) the Regulation applies to every employee of the enterprise, so all employees must be familiar with it. As a rule, the document is studied directly during employment or, if the document was developed during the period of active work of the organization, at any stage of its activities.

Typically, companies have special journals in which employees sign that they are familiar with the company’s internal regulations, including the Regulations on Bonuses.

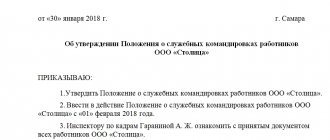

Issuance of an order approving the wage regulations

The developed layout of the Regulations is agreed upon with the heads of the personnel department and the financial department (chief accountant).

Provisions of Art. 162 of the Labor Code of the Russian Federation requires that this document be coordinated with a trade union if it has been created at the enterprise. After agreeing on the Regulations with the financial and personnel services, an order is issued to approve the regulations on remuneration, signed by the first head of the organization.

A completed example of this order can be downloaded below.

In accordance with the requirements of Art. 22 of the Labor Code of the Russian Federation, each employee must be familiar with the contents of the Regulations upon signature.

A ready-made sample of the salary clause can be found here.

Rules and example of drawing up Regulations on bonuses

There is no standard, unified, one-size-fits-all form of this document, so organizations can develop the Regulations in free form. The main condition is that it contains:

- name of company,

- creation date

- and the signature of the manager.

It is recommended to note a number of information that it is desirable to include in the document, these are:

- conditions for awarding the award,

- its size

- and payment terms.

It is also advisable to note that bonuses are solely the initiative of the employer - this, if anything happens, will help avoid unreasonable demands from subordinates.

Regulatory regulation of the provisions on remuneration and bonuses for employees - 2019-2020

The main purpose of creating the Regulations on remuneration and bonuses for employees is to reflect the mechanisms in accordance with which wages are calculated and paid at the enterprise.

The regulations are developed by the employer taking into account the specifics of business activities, financial capabilities and staff of the company. This document cannot contradict the Constitution of the Russian Federation, labor legislation and other regulations governing remuneration issues.

For example, when a remuneration system is established in municipal and state institutions, one of the regulatory documents is the Unified Recommendations. They are approved by the Russian Tripartite Commission in the form of a decision, documented in a protocol and signed by representatives of the parties - the Government of the Russian Federation, the All-Russian Association of Trade Unions and the All-Russian Association of Employers (in 2022, the recommendations adopted by the decision of December 25, 2018, Protocol No. 12 are in effect).

This document often serves as a guideline for drawing up regulations at enterprises of various organizational and legal forms.

Learn how to create perfect HR documents. Workshop on protection from labor inspectors online. The main source of legal regulation of the Regulations in the organization is Art. 135 Labor Code of the Russian Federation. However, in order to prescribe the optimal conditions establishing this type of relationship, it is necessary to take into account and take into account other regulatory documents, namely:

- unified tariff and qualification reference books for jobs and professions;

- regulations on remuneration approved by the ministry to which the employing organization is subordinate (for example, for cultural institutions such a regulation was approved by order of the Ministry of Culture of the Russian Federation dated March 28, 2019 No. 349);

- Law “On the Minimum Wage” dated June 19, 2000 No. 82-FZ, etc.

Rules for document execution

The document can be drawn up on a simple blank A4 sheet or the organization’s letterhead - this does not matter, just like whether it is written by hand or printed on a computer. The only rule is that it must have the signature of the head of the company or another person responsible for the approval of such employee documents. It is not necessary to certify the document with a seal, since since 2016, legal entities, as previously and individual entrepreneurs, have the right not to use seals and stamps to endorse their documentation.

The regulation is usually drawn up in a single copy , registered in the company's accounting policies, and then contained together with other internal regulations in a certain order. After losing its relevance, it is transferred for storage to the archive of the enterprise, where it remains exactly as much as is established by law. After the expiration of this period, the Regulation can be disposed of.

Structure and content of the document

They draw up a document motivating employees in free form, since there are no uniform requirements for the provision on incentive payments in the law. But there are main sections that need to be reflected in it:

- general provisions (information about the objectives of the document, grounds for calculating additional payments, sources of financing);

- conditions, criteria and amounts of allowances;

- procedure and terms of payment of premiums;

- conditions for reducing the amount of remuneration;

- the final part, the procedure for changing the document.

We recommend that you pay attention to who develops regulations on incentive remuneration - this is usually the responsibility of an accountant and a personnel officer. And then the document is approved by the manager.

The text must be formulated clearly and concisely. The criteria that influence the payment of the bonus should be listed in detail. When preparing a document motivating teachers, doctors, theater workers and other public sector employees, it is necessary to focus on the recommendations of government agencies (Ministry of Education, Ministry of Labor, Ministry of Culture). The regulations stipulate clear sources of funding.

ConsultantPlus experts looked at what additional considerations need to be taken into account when drawing up regulations on bonuses for employees. Use these instructions for free.

to read.

Sample

We invite you to familiarize yourself with the example of the provisions on bonuses and incentive payments and modify it taking into account the characteristics of your company. Here's how to fill out a section on the conditions and amounts of incentives in the LNA.

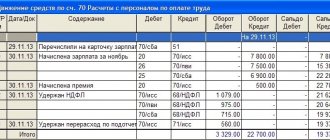

| 2. Bonus indicators and bonus amounts 2.1. For all employees for whom this Regulation is intended, the main condition for bonuses is the fulfillment of the plan for the financial performance of ___________. 2.2. Additional conditions for allowances and bonuses based on the results of the year, quarter and month are given in the table below. Allowances, additional payments, bonuses and other payments | ||

| For working at night | 400% per hour at the tariff rate | For work from 22.00 to 06.00 |

| For overtime work | For the first 2 hours - 150% per hour of work; for the subsequent time - 200% | |

| For working on weekends and holidays | 200% per hour of work | |

| For temporary replacement of an employee | 50% of the salary for the main job | |

| Allowances | ||

| For experience in this organization |

| If the experience is continuous in this organization |

| For labor intensity | 15% of salary | Approved by order of the head |

| Awards | ||

| Based on the results of work for the month | From 5% to 20% of salary | The percentage is set by order of the manager |

| Quarterly bonuses | From 10% to 50% of salary | Depends on performance indicators |

| Annual bonuses | 100% of salary | Paid to everyone who fulfilled the quota |

| Material aid | ||

| In connection with marriage, the birth of a child, or the death of a close relative | 7000 rubles | Must be supported by documents |

| Due to emergencies | The amount is determined by the decision of the director together with the trade union organization | Provide documents |

Please note what an approximate provision on incentive payments for an educational institution looks like. This template is designed for educators based on performance criteria.