Currency transactions in accounting in 2022

In accordance with the above PBU, in 2022, as in previous periods, currency transactions in accounting are reflected exclusively in rubles. This accounting provision does not apply to accounting for currency transactions related to:

- with the recalculation of financial reporting indicators, which are submitted in rubles, into foreign currency according to the requirements of foreign creditors;

- when compiling consolidated accounting, when the parent company processes the accounting of dependent institutions located abroad.

You can get more detailed information about currency transactions in our material “Currency transactions: concept, types, classifications” .

For conversion, the exchange rate of the Central Bank of Russia is used on the date that corresponds to the nature of the transaction. We will tell you more about the procedure for converting into rubles when accounting for foreign exchange transactions.

How to convert currency to rubles

To account for transactions in foreign currency, the date on which you should take the Central Bank exchange rate and convert the currency into rubles is very important. As already mentioned, in Russia, accounting for foreign exchange transactions is carried out exclusively in rubles, and since exchange rates are constantly changing, it is important to know the “correct” moment of converting currency indicators into rubles.

Thus, in order to be reflected in accounting and reporting, the cost values of liabilities and assets of a legal entity expressed in foreign currency, as well as the amount of reserves in foreign currency, must be converted into rubles.

In accounting for foreign exchange transactions, only the official exchange rate of the Central Bank of a given currency to the ruble is used to convert cost indicators into Russian rubles. The exception is cases when, in order to convert the value of a monetary obligation or a tangible asset into rubles, a special law or agreement establishes a different rate at which the amount payable must be recalculated.

The date of conversion of currency indicators into rubles is different for each operation. Most often, the date of conversion at the official exchange rate is the moment when the business operation is carried out. In the case where over the course of a month (or a shorter time period) an enterprise carries out a large number of similar transactions in foreign currency, and the official exchange rate has not undergone significant changes, it is possible to keep records of transactions in foreign currency of this type at the rate averaged over a given period of time.

PBU 3/2006 clearly defines all the moments when currency amounts should be converted into rubles:

- On the date of the business operation (when cash flows), as well as on the reporting date (balances at the cash desk/account), it is necessary to convert into rubles all cash/non-cash currency at the cash desk/on the foreign exchange account. Also, in a number of situations, the value of funds may be recalculated as the exchange rate changes.

- Cash/non-cash currency is recalculated at the rate existing at the reporting date in order to reflect the data in the financial statements.

- As of the date of the business transaction, the value of fixed assets, intangible and other non-current assets accepted for accounting, as well as the value of inventories and other assets, with the exception of cash, is recalculated.

- On the date of recognition of foreign currency income or expenses, they are recalculated into rubles. As for the date of recognition of travel expenses, it coincides with the moment of approval of the traveler’s advance report.

- On the date of recognition of costs that form the cost of fixed assets, intangible and other non-current assets, the amount of investments in foreign currency in these non-current assets is recalculated into Russian rubles.

- If an enterprise has received an advance payment in the form of a deposit or an advance payment, then these funds are accounted for in accounting in Russian rubles at the exchange rate at the time of receipt of the specified amounts.

- If the prepayment was paid by the company (in the form of transfer of a deposit or payment of an advance against the delivery of assets or for expected expenses), then this payment will be reflected in the accounting records in rubles at the rate prevailing on the date of payment.

After non-current assets, transferred or received advances have been reflected in accounting, their value is not recalculated when the exchange rate changes.

Read about what points you need to pay special attention to when organizing accounting for foreign economic activity in the article “Features of accounting for foreign economic activity .

How to determine the date?

Federal Law 402 (Article 12) states that all accounting and reporting objects must be expressed exclusively in rubles, and assets calculated in foreign currency must be recalculated into rubles. According to PBU, such recalculation is carried out at the rate of the Central Bank or by agreement of the parties to the transaction.

The exchange rate of any monetary unit constantly fluctuates, therefore, determining the correct date of conversion is one of the main tasks of an accountant.

PBU sets the date depending on the nature of the transaction:

- cash, banking volumes of currency - at the time of transactions and at the reporting date, as well as following changes in the exchange rate (if necessary);

- for reporting, all currencies: non-cash, cash, are recalculated on the reporting date;

- Intangible assets, fixed assets, inventories, other non-monetary assets - as of the date of the transaction and their registration;

- foreign currency income and expenses - as of the date of recognition (travel expenses in foreign currency are recalculated on the date of signing the advance report);

- costs for VNA - as of the date of recognition of costs that determine these assets, their value.

In addition, when receiving a foreign currency advance payment or deposit, the amount is taken into account at the exchange rate at the time of its receipt, and when paid - on the date when the payment was made.

According to PBU, paragraph 10, non-current and other assets, except cash, as well as advances and prepayments after being reflected in accounting, are not subject to recalculation due to exchange rate fluctuations.

Important! If the official exchange rate changes insignificantly and a large number of similar currency transactions take place, the average rate for a month or for a shorter period can be used for recalculation (clause 6 of PBU 3/2006).

What is exchange rate difference

The difference in rubles that arises when recalculating the currency value of assets and liabilities on different dates is called exchange rate. The exchange rate difference at the end of the reporting period relates to the financial result of the company, with the exception of the difference that is calculated on constituent deposits. In the latter case, the difference in rubles arises during the time interval between the founders’ decision to make a contribution in foreign currency and the very moment the founder pays the contribution. Such exchange rate differences do not affect the company’s financial results, but change the amount of additional capital.

Also included in the company’s additional capital is the exchange rate difference that arises when converting into rubles the tangible assets and monetary liabilities of a legal entity used to carry out business activities abroad. Exchange differences in this case can be attributed to the financial result in the form of adding part of the additional capital in the event of termination of activities abroad.

In all other cases, the exchange rate difference is credited to the financial result, reducing or increasing its total value.

Exchange differences arise on the following transactions:

- In case of partial or full repayment of debts by debtors or creditors in foreign currency. In this case, recalculation is carried out at the time of payment, if the debt was previously reflected in accounting at a different rate (the cost in rubles was calculated on the day of the transaction or recalculated on the last reporting date).

- When converting assets in the form of non-cash or cash into rubles.

The article “What is the responsibility for illegal currency transactions?” will introduce you to the types of currency violations and penalties for committing them.

Accounting for transactions in foreign currency in IFRS and RAS

To prepare financial statements, the value of assets and liabilities expressed in foreign currency, used by the organization to conduct foreign activities, is subject to conversion into rubles.Conversion of the value of monetary assets and liabilities expressed in foreign currency, used by the organization to conduct foreign activities, into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, effective on the reporting date.

Conversion of the value of non-monetary assets and liabilities expressed in foreign currency, used by an organization to conduct foreign activities, into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, on the date of the transaction in foreign currency, as a result of which these assets and liabilities were accepted for accounting purposes.

Conversion of income and expenses expressed in foreign currency, forming financial results from conducting foreign activities, into rubles can be carried out:

- using the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, in force on the corresponding date of the transaction in foreign currency;

- using the average exchange rate calculated as a result of dividing the sum of the products of the official exchange rates of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, and the days of their validity in the reporting period by the number of days in the reporting period.

The resulting exchange rate differences are reflected in the accounting records of the reporting period for which the organization's financial statements are prepared, and are subject to credit to financial results as other income or other expenses.

The procedure for recalculating the reporting indicators of a subsidiary compiled in foreign currency is established by the Methodological Recommendations for the preparation and presentation of consolidated financial statements, approved by Order of the Ministry of Finance of Russia dated December 30, 1996 No. 112 and assumes:

- recalculation of assets and liabilities at the last quote of the corresponding exchange rate in the reporting period;

- recalculation of income and expenses of a subsidiary at the rates in effect on the relevant dates of transactions in foreign currency, or using the average rate;

- reflection of emerging differences in the composition of additional capital with separate disclosure in the Explanations.

Payments in foreign currency and reporting

The statements indicate exclusively the ruble equivalent of the value of the company's assets, existing liabilities and reserves (including those used/located abroad).

If in the country where a Russian company operates, it is required to prepare reports in the currency of that state, then the reports are also prepared in foreign currency.

The financial statements reflect those cost values that are indicated in the accounting. In most cases, the conversion of the currency value into rubles is carried out at the time of the transaction, but there are situations when it is necessary to make a conversion at the reporting date.

The accounting records reveal the amounts of exchange rate differences:

- formed when converting into rubles the currency value of assets and liabilities for which it is required to pay in foreign currency;

- when recalculating the currency value of assets and liabilities for which payment will be made in rubles;

- credited to accounting accounts, which do not take into account financial results.

The official exchange rate in rubles established by the Central Bank on the reporting date is also reflected in the financial statements. If a rate other than the official rate of the Central Bank of the Russian Federation is established (by agreement or law), then this information is also reflected in the reporting.

II. Conversion of the value of assets and liabilities expressed in foreign currency into rubles

4. The value of assets and liabilities (currency notes in the organization’s cash register, funds in bank accounts (bank deposits), cash and payment documents, financial investments, funds in settlements, including for borrowed obligations, with legal entities and individuals, investments in non-current assets ( fixed assets, intangible assets, etc.), inventories, as well as other assets and liabilities of the organization), expressed in foreign currency, are subject to conversion into rubles for reflection in accounting and financial statements.

5. Conversion of the value of an asset or liability expressed in foreign currency into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation. If, for the recalculation of the value of an asset or liability expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then the recalculation is made at such rate.

6. For accounting purposes, the specified conversion into rubles is made at the rate valid on the date of the transaction in foreign currency. The dates of individual transactions in foreign currency for accounting purposes are given in the appendix to these Regulations. If there is an insignificant change in the official exchange rate of a foreign currency to the ruble, established by the Central Bank of the Russian Federation, conversion into rubles associated with the performance of a large number of similar transactions in such foreign currency can be carried out at the average rate calculated for a month or a shorter period. (paragraph introduced by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 No. 147n)

7. Recalculation of the value of banknotes at the organization’s cash desk, funds in bank accounts (bank deposits), monetary and payment documents, securities (except for shares), funds in settlements, including for borrowed obligations with legal entities and individuals (except for funds received and issued advances and prepayments, deposits), expressed in foreign currency, in rubles must be made on the date of the transaction in foreign currency, as well as on the reporting date. Recalculation of the value of banknotes at the organization's cash desk and funds in bank accounts (bank deposits), expressed in foreign currency, can also be carried out as the exchange rate changes. (clause 7 as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 No. 147n)

8. To prepare financial statements, the value of the assets and liabilities listed in paragraph 7 of these Regulations is recalculated into rubles at the rate in effect on the reporting date.

9. For the preparation of financial statements, the value of investments in non-current assets (fixed assets, intangible assets, etc.), inventories and other assets not listed in paragraph 7 of these Regulations, as well as funds received and issued advances and prepayments, deposits are accepted in the assessment in rubles at the rate in effect on the date of the transaction in foreign currency, as a result of which the specified assets and liabilities are accepted for accounting. Assets and expenses that were paid by the organization in advance or for the payment of which the organization transferred an advance or deposit are recognized in the accounting records of this organization, assessed in rubles at the rate in effect on the date of conversion into rubles of the funds issued in advance, deposit, prepayment (in part attributable to the advance, deposit, prepayment). The income of an organization, subject to the receipt of an advance, deposit, prepayment, is recognized in the accounting records of this organization in rubles at the rate in effect on the date of conversion into rubles of the received advance, deposit, prepayment (in the part attributable to the advance, deposit, prepayment ). (clause 9 as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 No. 147n)

10. Recalculation of the value of investments in non-current assets, assets listed in paragraph 9 of these Regulations, as well as funds received and issued advances, prepayments, deposits after their acceptance for accounting due to changes in the exchange rate is not carried out. (clause 10 as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 No. 147n)

Currency transactions in case of conducting business abroad

If an enterprise operates abroad, then when preparing financial statements, all assets used and existing liabilities are recalculated into rubles. This also applies to funds held in accounts in foreign banks operating abroad.

Conversion into rubles to reflect foreign exchange transactions in accounting is carried out at the official rate established by the Central Bank for the currency in which assets, liabilities and inventories are recorded. The exception is when recalculation is made at the average rate.

Cash in foreign currency, including in settlements of borrowed obligations, which are used by the organization to conduct business abroad, are converted into rubles at the Central Bank exchange rate in effect on the reporting date. Foreign non-current assets of the company, as well as advances received and sent in connection with activities abroad are recalculated into rubles at the Central Bank exchange rate on the day of the transaction in foreign currency.

If a company has recalculated the value of its foreign assets and liabilities as required by foreign legislation, then this recalculated value is converted into rubles at the rate that was in effect on the date of recalculation.

The difference that arises when converting into rubles the value of assets and liabilities that are used to conduct the company’s foreign activities is reflected in account 83 as additional capital in the accounting of foreign exchange transactions.

The materials in this section will help you understand the intricacies of accounting.

PBU 3/2006 ACCOUNTING FOR ASSETS AND LIABILITIES, THE VALUE OF WHICH IS EXPRESSED IN CURRENCY

4. The value of assets and liabilities (currency notes in the organization’s cash register, funds in bank accounts (bank deposits), cash and payment documents, financial investments, funds in settlements, including for borrowed obligations, with legal entities and individuals, investments in non-current assets ( fixed assets, intangible assets, etc.), inventories, as well as other assets and liabilities of the organization), expressed in foreign currency, are subject to conversion into rubles for reflection in accounting and financial statements.

5. Conversion of the value of an asset or liability expressed in a foreign currency into rubles is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation, and in the absence of such a rate - at the cross rate of the corresponding currency, calculated based on foreign exchange rates currencies established by the Central Bank of the Russian Federation.

If, for the recalculation of the value of an asset or liability expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then the recalculation is made at such rate.

6. For accounting purposes, the specified conversion into rubles is made at the rate valid on the date of the transaction in foreign currency. The dates of individual transactions in foreign currency for accounting purposes are given in the appendix to these Regulations.

If there is an insignificant change in the official exchange rate of a foreign currency to the ruble, established by the Central Bank of the Russian Federation, conversion into rubles associated with the performance of a large number of similar transactions in such foreign currency can be carried out at the average rate calculated for a month or a shorter period.

7. Recalculation of the value of banknotes at the organization’s cash desk, funds in bank accounts (bank deposits), monetary and payment documents, securities (except for shares), funds in settlements, including for borrowed obligations with legal entities and individuals (except for funds received and issued advances and prepayments, deposits), accrued revenue not presented for payment in excess of the amount of the advance received (prepayment), expressed in foreign currency, in rubles must be made on the date of the transaction in foreign currency, as well as on the reporting date.

Recalculation of the value of banknotes at the organization's cash desk and funds in bank accounts (bank deposits), expressed in foreign currency, can also be carried out as the exchange rate changes.

8. To prepare financial statements, the value of the assets and liabilities listed in paragraph of these Regulations is recalculated into rubles at the rate in effect on the reporting date.

9. For the preparation of financial statements, the value of investments in non-current assets (fixed assets, intangible assets, etc.), inventories and other assets not listed in paragraph of these Regulations, as well as funds received and issued advances and prepayments, deposits are accepted in the assessment in rubles at the rate in effect on the date of the transaction in foreign currency, as a result of which the specified assets and liabilities are accepted for accounting.

Assets and expenses that were paid by the organization in advance or for the payment of which the organization transferred an advance or deposit are recognized in the accounting records of this organization, assessed in rubles at the rate in effect on the date of conversion into rubles of the funds issued in advance, deposit, prepayment (in part attributable to the advance, deposit, prepayment).

The income of an organization, subject to the receipt of an advance, deposit, prepayment, is recognized in the accounting records of this organization in rubles at the rate in effect on the date of conversion into rubles of the received advance, deposit, prepayment (in the part attributable to the advance, deposit, prepayment ).

10. Recalculation of the value of investments in non-current assets, assets listed in paragraph of these Regulations, as well as funds received and issued advances, prepayments, deposits after they are accepted for accounting due to changes in the exchange rate is not carried out.

Is an invoice issued in foreign currency in 2022?

When issuing an invoice in foreign currency, the taxpayer should consider 2 factors:

- clause 7 art. 169 of the Tax Code of the Russian Federation allows that an organization has the right to indicate an amount in foreign currency in an invoice if it is the means of payment;

- clause 1 section Government Resolution II “On filling out documents for VAT calculations” dated December 26, 2011 No. 1137 contains a provision according to which, if payments in ruble equivalent are indicated in the contract with the total contract price in foreign currency, the invoice must be issued in rubles.

The resulting inconsistency is a source of trouble for organizations that take the rules of the Tax Code too literally. During audits, tax authorities quite often file complaints on this basis. However, judicial practice shows that in such disputes the taxpayer wins. The judges believe that the Tax Code of the Russian Federation has an advantage over the decision of the Government of the Russian Federation.

Read more about the rules for issuing foreign currency invoices in the material “Invoice in foreign currency - how to issue?” .

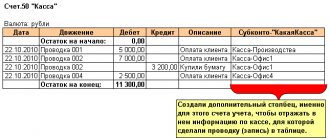

Entries in accounting registers

Accounting for currency transactions is carried out using special registers. Entries in such registers are made in rubles according to the accounting accounts of existing assets and liabilities in foreign currency. It does not matter where exactly the company operates - abroad or in Russia. Entries for accounting for settlements and funds are also made simultaneously in the currency in which settlements were made (accruals of liabilities) or payment was received.

In accounting for transactions with foreign currency, exchange rate differences are reflected separately from other income/expenses, including separately from the financial results obtained from conducting business operations in foreign currency.

Read about the role of currency payments in organizing accounting for export transactions in the material “How to take into account exports in accounting (nuances)?” .

V. The procedure for generating accounting and reporting information on transactions in foreign currency

20. Entries in accounting registers for accounts of assets and liabilities, the value of which is expressed in foreign currency, are made by an organization operating both on the territory of the Russian Federation and abroad, in rubles. The specified entries for assets and liabilities listed in paragraph 7 of these Regulations are simultaneously made in the currency of settlements and payments. Accounting statements are prepared in rubles. In cases where the legislation or rules of the country where the organization conducts its activities outside the Russian Federation require the preparation of financial statements in a different currency, then the financial statements are also prepared in this foreign currency.

21. Exchange differences are reflected in accounting separately from other types of income and expenses of the organization, including financial results from transactions with foreign currency.

22. The financial statements disclose:

- the amount of exchange rate differences arising from transactions of recalculation of the value of assets and liabilities expressed in foreign currency, subject to payment in foreign currency;

- the amount of exchange rate differences resulting from transactions of recalculation of the value of assets and liabilities expressed in foreign currency, payable in rubles;

- the amount of exchange rate differences credited to accounting accounts other than the account of the financial results of the organization; the official exchange rate of foreign currency to the ruble, established by the Central Bank of the Russian Federation, as of the reporting date. If, for the recalculation of the value of assets or liabilities expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then such rate is disclosed in the financial statements.

Appendix to the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006), approved by Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 No. 154n

Currency account: how to keep track of transactions

To keep records of foreign exchange transactions for foreign exchange settlements, there is a separate synthetic account 52 in the chart of accounts. The main basis for entering information into accounting for this account is bank statements. The credit of the account reflects transactions involving the transfer and debit of foreign currency funds from the account.

The debit of this active account reflects:

- at the beginning of the month - the balance of non-cash foreign currency;

- during the month - all foreign exchange earnings.

In accounting, currency balances on accounts are reflected in ruble revaluation. Make sure that you recalculate correctly and reflect the revaluation in accounting and tax accounting according to established rules using a Ready-made solution from ConsultantPlus. You can get demo access to the K+ system absolutely free.

If, when checking bank statements, the company discovers errors when posting or debiting money from a foreign currency account, then they are reflected in the “Claims” subaccount opened to account 76.

For account 52, for the convenience of maintaining analytical accounting, it is customary to open sub-accounts of the 1st and 2nd order. Sub-accounts of the 1st order: 52-1 “Accounts in foreign currency within the state” and 52-2 “Accounts in foreign currency abroad.” Subaccounts of the 2nd order help to maintain separate accounting for accounts opened in different currencies. But most often, 2nd order subaccounts are created to reflect transactions on current, transit and special transit accounts.

A transit account in foreign currency was previously used for the mandatory sale of foreign currency earnings that were transferred by non-residents as payment for services or products. After the sale of the required amount of foreign currency, the remaining amount in the transit account was transferred by the bank to the client’s current account opened in foreign currency. Now the transit account is used to record on it amounts for which information has not yet been submitted to the bank confirming that the foreign currency receipts belong to a specific agreement.

The company's regular (current) account, opened in foreign currency, is credited with its foreign currency earnings, bank interest for the use of available funds and other foreign currency earnings related to business activities. Foreign currency accounts abroad, in accordance with federal legislation, can be opened for transactions related to the movement of capital investments.

A transit special account in foreign currency is opened by an authorized bank independently without the participation of the client. Such an account is needed to record foreign exchange transactions related to the purchase/sale of currency.

Companies usually store all available funds in foreign currency in foreign currency accounts of those banks that have appropriate licenses for the right to conduct foreign exchange transactions issued by the Central Bank. To open a foreign currency account abroad, you will need to obtain appropriate permission from the Central Bank of Russia.

Each bank foreign currency account is usually maintained in the currency that the bank client indicated when opening it. If another currency is received into this account, the bank will independently convert it under the conditions specified in the account servicing agreement. The currency is converted according to the international foreign exchange market exchange rate valid on the day of transfer.

To record currency transactions, active account 55 can also be used. It summarizes information on the availability/movement of money in Russia and abroad, both in Russian rubles and in foreign currency: in check books, letters of credit, on deposits and in other payment forms (except for bills of exchange). For each of the payment forms, 1st order subaccounts are opened for account 55. Analytical accounting is maintained for each letter of credit, deposit, checkbook, etc.

Also, to record foreign exchange transactions (when purchasing currency), organizations can use account 57, called “Transfers in transit.” For account 57, 1st order subaccounts can be opened:

- Currency listed for sale.

- Currency for sale deposited with a banking institution.

- Money in rubles transferred for the purchase of currency (funds before the day of purchase are taken into account here).

Subaccount 52-2 reflects monetary transactions in foreign currency carried out on the company's foreign accounts. The debit of this subaccount reflects:

- operations to receive funds transferred from the company’s current accounts opened with authorized Russian banks;

- unused currency;

- interest accrued by the bank for using the account balance;

- previously erroneously written off and then returned funds.

The account credit reflects:

- transactions for payment for the maintenance of a foreign representative office of the company;

- funds withdrawn for payment of salaries and compensation for travel expenses, as well as for payment of other expenses approved by the estimate;

- account servicing costs;

- transfers to the company's current account opened with a Russian authorized bank.

Bank clients can withdraw currency from their accounts to pay for travel expenses of their employees and with special permission from the Bank of Russia. Also, the enterprise can operate a cash register in foreign currency; transactions in it are reflected in subaccount 50-4 (in the case of foreign economic transactions and business trips abroad). All currency movements at the cash register are reflected in the enterprise's unified cash book. Naturally, all entries are made in rubles.

Exchange differences associated with changes in the ruble exchange rate on different days of valuation of foreign currency assets and liabilities that arise on accounts 52 and 57 are reflected using account 91. Positive exchange differences are visible in the subaccount “Other income” (on a loan), and negative ones - on subaccount “Other expenses” (by debit). The basis for reflecting exchange rate differences is an accounting certificate. Analytical accounting of exchange rate differences is carried out separately from other non-operating income/expenses of the enterprise. For this purpose, a separate accounting register is created.

Find out about codes for types of currency transactions from the material “Directory of codes for types of currency transactions (2022)” .

We apply PBU 3/2006 when receiving or issuing advances

When preparing financial statements in 2008, it is necessary to take into account the numerous changes that appeared in accounting this year. Among them is the new edition of PBU 3/2006. What should you pay attention to when applying the provisions of this accounting standard since 2008?

Changes to PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency”, which came into force in 2008, were made by Order of the Ministry of Finance of Russia dated December 25, 2007 No. 147n (hereinafter referred to as Order No. 147n).

One of the key amendments to this accounting standard concerns the revaluation of the amounts of advances, prepayments and deposits received (issued) under contracts, the value of which is expressed in foreign currency (in conventional monetary units). Since 2008, a new procedure has been in force: - accounting for advances (prepayments, deposits) transferred (received) under contracts in foreign currency (conventional monetary units); — determining the value of assets and expenses paid by the purchasing organization as an advance payment or in the form of an advance payment (deposit);

— calculation of the amount of income from the seller organization, which received an advance payment from the buyer (advance payment, deposit).

In addition, from this year, PBU 3/2006 introduced rules on the possibility of recalculating the value of long-term securities (except for shares), as well as the use of the average foreign currency exchange rate when calculating the value of assets and liabilities expressed in foreign currency. But we will not consider these changes within the scope of this article.

Note that the innovations that appeared in PBU 3/2006 affected transactions carried out not only under contracts drawn up in foreign currency (conventional monetary units), settlements for which are made in rubles. These amendments equally apply to contracts concluded with foreign partners, payments for which are made in foreign currency. This follows from paragraph 1 of PBU 3/2006. It states that the rules of this accounting standard apply to both types of contracts.

Let's analyze the new norms of PBU 3/2006 related to the accounting of transactions in foreign currency, under the terms of which the buyer gives the seller an advance (prepayment, deposit).

Accounting for advances received and issued

Based on the terminology of PBU 3/2006, the amounts of advances, preliminary payments and deposits are included in the funds in the calculations. Until 2008, these amounts were taken into account according to the rules of paragraph 7 of PBU 3/2006. Their value was subject to conversion into rubles at the foreign exchange rate established by the Bank of Russia or the provisions of the agreement in conventional monetary units on the date of the transaction, as well as on the reporting date.

Since 2008, the amounts of advances, prepayments and deposits are not subject to paragraph 7 of PBU 3/2006. They must now be accounted for in accordance with paragraphs 9 and 10 of this accounting standard.

The new edition of paragraph 9 of PBU 3/2006 provides that funds received and issued advances and prepayments, deposits are accepted in the assessment in rubles at the rate in effect on the date of the transaction in foreign currency, as a result of which the specified assets and liabilities are accepted for accounting .

Changes have also been made to paragraph 10 of PBU 3/2006. The new version of the said paragraph says: “Recalculation of the cost... of funds received and issued in advances, prepayments, deposits after they have been accepted for accounting due to changes in the exchange rate is not carried out.”

Consequently, the organization, having calculated the ruble value of the advance, prepayment or deposit on the date of receipt (transfer) of these funds, will no longer recalculate these amounts in the future (including on the reporting date).

EXAMPLE 1

Kometa LLC (buyer) in May 2008 transferred 100% prepayment to Luna CJSC (seller) under a contract for the supply of goods drawn up in conventional monetary units. According to the terms of the agreement 1. e. equal to 1 US dollar (at the Bank of Russia exchange rate on the day of payment plus 2%). The total cost of the transaction is 5000 USD. e. (in this and subsequent examples, amounts are given without VAT).When transferring funds, the accountant of Kometa LLC calculated the amount of the prepayment based on the current exchange rate of the Bank of Russia. On the date of payment, the official US dollar exchange rate was 24 rubles/dollar. USA. Thus, the prepayment amount is 122,400 rubles. ($5000#24 RUR/USD#102%).

The following entry was made in the accounting records of Kometa LLC:

DEBIT 60 subaccount “Advances issued” CREDIT 51

— 122,400 rub. — prepayment was transferred to the seller ZAO Luna under an agreement concluded in conventional monetary units.

In the accounting records of Luna CJSC, this operation is reflected as follows:

DEBIT 51 CREDIT 62 subaccount “Advances received”

— 122,400 rub. — an advance payment was received from Kometa LLC under an agreement drawn up in conventional monetary units.

At the end of the reporting period (June 30, 2008), the goods had not yet been shipped by the seller.

When preparing the financial statements, neither the buyer nor the seller recalculated the amount of the prepayment.

In the financial statements of organizations for the first half of 2008, the counterparty's debt was reflected in the same estimate at which it was accepted for accounting.

EXAMPLE 2

LLC Planeta (buyer) in May 2008 transferred a 100% advance payment under the contract for the supply of goods to the foreign supplier Crocus Ltd. According to the terms of the contract, payment is made in US dollars. The total cost of the transaction is $5,000.

When transferring funds, the accountant of Planeta LLC calculated the amount of the prepayment based on the current exchange rate of the Bank of Russia, which on the date of payment was 24 rubles/dollar. USA. The prepayment amount was 120,000 rubles. ($5000# #24 RUR/USD).

The following entry was made in the accounting records of Planeta LLC:

DEBIT 60 subaccount “Advances issued” CREDIT 52

— 120,000 rub. — an advance payment of $5,000 was transferred to Crocus Ltd.

At the end of the reporting period (June 30, 2008), the goods had not yet been shipped by the foreign supplier. When preparing financial statements, Planeta LLC did not recalculate the amount of the prepayment.

In the organization's financial statements for the first half of 2008, the supplier's debt is reflected in the same estimate at which it was accepted for accounting.

Is it necessary to recalculate old advances

After making changes to paragraphs 9 and 10 of PBU 3/2006, many accountants had a question: is it necessary to recalculate the amount of advances received before 2008 and recalculated at the current foreign currency exchange rate as of December 31, 2007 (at the reporting date)?

In principle, this issue concerns only the amounts of advances and prepayments transferred (received) under foreign contracts, settlements for which are carried out directly in foreign currency. In contracts, the value of which is expressed in conventional monetary units, in the vast majority of cases it is established that payments are made in rubles at the foreign currency exchange rate on the date of payment. For these transactions, there are no problems with reverse recalculation of the amounts of advances and prepayments received (issued) before 2008. After all, the amounts of advances and prepayments under such contract conditions in conventional monetary units are not recalculated at the reporting date. Their assessment is always made taking into account the provisions of the contract - at the exchange rate on the date of payment. The basis is paragraph 2 of paragraph 6 of PBU 3/2006.

To answer the question whether a reverse recalculation of the amounts of advances and prepayments received or issued under foreign trade contracts is necessary, let us turn to PBU 1/98 “accounting policies of the organization.” Paragraph 20 of this accounting standard states the following. If a change in accounting policy is caused by a change in the legislation of the Russian Federation or accounting regulations, then the consequences of the change are reflected in accounting and reporting in the manner prescribed by the relevant legislation or regulation. If such a procedure is not established in the above documents, the organization independently assesses and reflects in its financial statements the consequences of changes in accounting policies, relying on the provisions of paragraph 21 of PBU 1/98.

Paragraph 3 of Order No. 147n establishes the rules for the transition period. They need to be guided by them. They relate only to the recalculation of the value of long-term securities (with the exception of shares), which are listed in the organization’s records as of January 1, 2008, at the current foreign exchange rate.

The need for a reverse recalculation of the amounts of received (issued) advances and prepayments in connection with the introduction of new rules is not mentioned in the mentioned paragraph.

So, we can conclude that there is no need to recalculate advances and prepayments received or issued under foreign trade contracts and recalculated at the current foreign exchange rate as of December 31, 2007. This means that in accounting, these amounts in the future (from 2008) will be included in the estimate determined at the end of 2007.

Refund of received (issued) advances

Sometimes the parties to a transaction terminate the contract for one reason or another. If the buyer has transferred an advance payment (prepayment) to the supplier by this time, the seller is obliged to return it.

Is it necessary in this case to recalculate the amount of the previously received (issued) advance?

This issue is not separately covered in PBU 3/2006. Therefore, you should be guided by the general rules of this accounting standard.

According to the author, the return of the advance payment to the buyer upon termination of the contract or change in its terms must be considered as an independent operation. It is not subject to the rules of paragraphs 9 and 10 of PBU 3/2006, which relate only to the receipt (transfer) of advances and further accounting of the debt arising in connection with this.

When returning an advance payment (prepayment, deposit), it will have to be re-evaluated if required by the terms of the contract concluded in foreign currency. In this case, you must be guided by the norms of paragraph 5 of PBU 3/2006 and determine the amount of funds to be returned at the rate of the Bank of Russia or another foreign exchange rate that can be established according to an agreement concluded in conventional units.

Let us consider in more detail the operation of returning the advance (prepayment) upon termination of a foreign trade contract and an agreement in conventional monetary units.

Refund of advance payment under a foreign trade contract. Upon termination of such a contract, the Russian buyer will return to the foreign supplier the amount of the advance (prepayment) in the corresponding foreign currency. The buyer will one way or another have to determine the ruble valuation of the refunded funds on the date of transfer of money. Naturally, such an assessment is carried out at the current foreign exchange rate. The difference that has arisen in the account for accounting for settlements with a foreign supplier is nothing more than the exchange rate difference in the funds in settlements.

EXAMPLE 3

Let's use the condition of example 2. Suppose that the foreign supplier Crocus Ltd did not fulfill its obligations to supply goods to the Russian buyer Planet LLC in a timely manner. In August 2008, the parties entered into an agreement to terminate the contract. At this time, the accounts receivable of Crocus Ltd were listed in the records of Planet LLC, the ruble valuation of which was determined at the foreign currency exchange rate on the date of the prepayment in May 2008 (at the rate of 24 rubles/US dollars). The amount of this debt is 120,000 rubles.At the end of August, the foreign supplier returned $5,000 to Planet LLC. At the time of receiving foreign currency, the official US dollar exchange rate set by the Bank of Russia was 23 rubles/dollar. USA.

In the accounting records of Planeta LLC, when money was received in a foreign currency account, the accountant recorded the following entries:

DEBIT 52 CREDIT 60 “Advances issued”

— 115,000 rub. ($5,000#23 RUR/USD) - due to termination of the contract, the supplier Crocus Ltd returned the advance payment transferred to it in May 2008.

After the transaction to return the funds (at the rate of 23 rubles/US dollars) was reflected in the accounting records of Planet LLC, an exchange rate difference was formed in the account of settlements with this supplier. It must be reflected in the other income and expenses account.

DEBIT 91 CREDIT 60 “Advances issued”

— 5000 rub. (120,000 rubles - 115,000 rubles) - the exchange rate difference that arose when the supplier returned the prepayment was taken into account.

Repayment of advance payment under the agreement in conventional monetary units.

When terminating a transaction that is drawn up in conventional monetary units (foreign currency) and for which settlements are made in rubles, the assessment of the refundable amount of the advance (prepayment) depends on the terms of the contract. Namely, it depends on whether the foreign exchange rate is established in the contract, at which the amount of debt to be repaid will be determined or not. Let’s say that the contract concluded in conventional units does not define the specifics in the event of a refund of the advance (prepayment). If, upon termination of such a transaction, the buyer demands the repayment of the debt, the seller will return to him the amount of ruble funds that he actually received. There can be no talk of recalculating the debt at the new foreign exchange rate. This is not provided for in the contract.

EXAMPLE 4

Let's use the condition of example 1. Suppose that due to the failure of the seller ZAO Luna to fulfill its obligations to supply goods, the buyer LLC Kometa in August 2008 demanded to terminate the transaction and return the advance payment. The official US dollar exchange rate on the date of debt repayment decreased and amounted to 23 rubles/dollar. USA.The agreement concluded between the named organizations in conventional monetary units does not provide for any conditions in the event of termination of the transaction and return of the debt amount. Therefore, the seller did not recalculate and returned to the buyer the amount of money that he received from him in May 2008 - 122,400 rubles.

In the accounting records of Luna CJSC in August 2008, the following entry was reflected:

DEBIT 62 “Advances received” CREDIT 51

— 122,400 rub. — due to termination of the contract, the advance payment was returned to the buyer, Kometa LLC.

A similar entry was made in the accounting records of Kometa LLC:

DEBIT 51 CREDIT 60 “Advances issued”

— 122,400 rub. — the prepayment transferred in May 2008 to the supplier ZAO Luna was returned.

As a result of such entries, both organizations completely closed the debt of the counterparty. There was no exchange rate difference, since in August 2008 the debt was repaid in rubles at the same foreign exchange rate that was applied in May on the date of receipt (transfer) of the advance payment.

Another situation is also possible: in an agreement drawn up in conventional units, or in an additional agreement on termination of the agreement, the parties stipulated that calculations when returning the prepayment amount are carried out at a different foreign exchange rate, for example, in effect on the date of return. Then the supplier will be obliged to transfer to the buyer not the amount of money that he actually received from him in the form of an advance payment, but the amount calculated based on the foreign exchange rate established on the date of return of the money. In this case, in the accounting records of both organizations, an exchange rate difference will arise in the account of settlements with the counterparty.

EXAMPLE 5

Let's use the condition of example 1. The agreement, drawn up in conventional units between the buyer LLC Kometa and the seller ZAO Luna, stipulates that upon termination of the transaction, the supplier must return to the buyer the amount of the advance payment in rubles, calculated taking into account the US dollar exchange rate established by the Bank of Russia at the time of refund and increased by 10%.

In August 2008, the parties terminated the agreement. At this moment, the seller’s accounting records showed a debt to the buyer in the amount of 122,400 rubles. (advance payment calculated taking into account the US dollar exchange rate of 24 rubles/US dollars, increased by 2%).

At the end of August, Luna CJSC transferred the amount of debt to Kometa LLC. The seller calculated the amount of debt to be returned based on the US dollar exchange rate in effect on the date of payment, increased by 10% - 25.3 rubles/dollar. USA (RUB 23/USD#110%). According to the accountant's calculations, the refunded amount was 126,500 rubles. ($5000#25.3 RUR/USD).

In the accounting records of Luna CJSC in August 2008, the following entry was made:

DEBIT 62 “Advances received” CREDIT 51

— 126,500 rub. — due to termination of the contract, the amount of debt was returned to the buyer, Kometa LLC.

After the debt repayment operation was reflected (in the amount of the prepayment according to the agreement) in the seller’s accounting, an exchange rate difference arose in the account for accounting settlements with the buyer. It was charged to the account of other income and expenses:

DEBIT 91 CREDIT 62 “Advances received”

— 4100 rub. (RUB 126,500 - RUB 122,400) - the exchange rate difference that arose when the prepayment was returned to the buyer was taken into account.

Upon termination of the contract, the buyer LLC "Kometa" made the following entries in the accounting records in conventional units:

DEBIT 51 CREDIT 60 “Advances issued”

— 126,500 rub. — due to termination of the contract, the prepayment amount was returned by the supplier ZAO Luna;

DEBIT 60 “Advances issued” CREDIT 91

— 4100 rub. — reflects the exchange rate difference that arose when returning the advance payment previously transferred to the seller.

Sometimes the seller returns to the buyer part of the advance (prepayment), which remains as a surplus after the sale of goods (work, services).

This can happen, for example, if the seller has shipped fewer goods than expected, or the volume of planned work has decreased. In such a situation, the refundable balance of the advance (prepayment) must be assessed in the same manner as when terminating the contract. How to evaluate the value of assets acquired by the buyer after prepayment

Paragraph 2 of clause 9 of PBU 3/2006 establishes the rules for determining the value of acquired assets (expenses) if the buyer has already transferred an advance payment (prepayment) to the seller to pay for them. The new edition of this paragraph says: “Assets and expenses that were paid by the organization in advance or for payment of which the organization transferred an advance or deposit are recognized in the accounting records of this organization, valued in rubles at the rate in effect on the date of conversion of the funds issued into rubles advance, deposit, prepayment (in the part attributable to the advance, deposit, prepayment).”

In the future, the value of non-current assets accepted for accounting (fixed assets, intangible assets, etc.), inventories and expenses is not subject to recalculation. This is defined in paragraph 10 of PBU 3/2006.

Please note: since 2008, when assessing those acquisitions, the cost of which was paid in advance by the buyer in the form of an advance payment (prepayment, deposit), it is not necessary to apply the norms of paragraph 9 of PBU 3/2006. These rules apply only when determining the value of those assets and expenses that are paid after acquisition.

Based on the new norms of paragraph 9 of PBU 3/2006, with a 100% prepayment, the buyer must evaluate the value of the acquired assets (results of work performed, services provided) in the same amount as the prepayment amount was taken into account.

EXAMPLE 6

Let's use the condition of example 1. Let's say that the buyer of Kometa LLC received goods from the seller of Luna CJSC in July 2008. This delivery was already fully paid for by the buyer in May. The amount of the prepayment transferred was 122,400 rubles. It was calculated based on the exchange rate of 24 rubles/dollar. USA, increased by 2% (according to the terms of the agreement in conventional units).On the date of shipment of goods, the US dollar exchange rate decreased to 23.5 rubles/dollar. USA. But this does not give Kometa LLC grounds to evaluate the cost of purchased goods at the current foreign exchange rate. It is necessary to be guided by the new norms of paragraph 9 of PBU 3/2006 and determine the value of the received values in the same ruble valuation according to which the amount of the prepayment transferred to the supplier is reflected in the accounting records.

The following entries were made in the accounting records of Kometa LLC in July 2008:

DEBIT 41 CREDIT 60

— 122,400 rub. — reflects the cost of purchased goods;

DEBIT 60 CREDIT 60 subaccount “Advances issued”

— 122,400 rub. — the amount of the advance payment transferred to the seller CJSC Luna in May 2008 is credited.

In case of partial prepayment (advance payment), the buyer is obliged to determine the cost of the acquired assets (work, services) as follows:

- the part of the cost for which the partial prepayment (advance payment) was transferred is accepted equal to the amount of ruble payment (paragraph 2, clause 9 of PBU 3 /2006);

— the unpaid part of the cost of acquired valuables is determined at the official foreign exchange rate in effect on the day of their receipt, or at another rate established in the agreement (clause 5 and paragraph 1 of clause 9 of PBU 3/2006).

The result of adding these amounts is the cost of the acquired assets at which the buyer must accept them for accounting. In the future, the cost of acquisitions is not recalculated (clause 10 of PBU 3/2006).

At the same time, the remaining part of the buyer's accounts payable is subject to revaluation. This requirement is contained in paragraph 7 of PBU 3/2006.

Revaluation is carried out on the date of the transaction (for example, to repay the balance of debt) and on the reporting date. In this case, the buyer will experience exchange rate differences. In accounting they are reflected as part of other income or other expenses. The basis is clause 13 of PBU 3/2006.

EXAMPLE 7

Granit LLC (buyer) and Izumrud OJSC (supplier) entered into an agreement for the supply of goods. The cost of delivery under the terms of the contract is 10,000 USD. e. At the same time 1 y. e. equal to 1 euro (at the Bank of Russia exchange rate on the date of transfer plus 1%).In May 2008, the buyer transferred an advance in the amount of 6,000 USD to the seller. e. On the date of payment, the official euro exchange rate was 36 rubles/euro. The advance amount was 218,160 rubles. (6000 euros#36 rubles/euro#101%).

The supplier shipped the goods in June 2008. On the date of shipment, the euro exchange rate set by the Bank of Russia was 36.5 rubles/euro. The buyer of Granit LLC calculated the cost of purchased goods as follows:

RUB 218,160 + 4000 euro#36.5 rub./euro#101% = = 365,620 rub.

The amount of debt of Granit LLC to the supplier after the receipt of purchased goods amounted to 4,000 USD. e. (10,000 c.u. – 6,000 c.u.). In ruble equivalent, this amount on the date of shipment was 147,460 rubles. (RUB 365,620 – RUB 218,160).

At the end of the reporting period (half of 2008), Granit LLC recalculated the amount of debt to the supplier. The euro exchange rate as of June 30, 2008 was 36.7 rubles/euro. Accounts payable to

OJSC Izumrud as of the reporting date, when converted into rubles, amounted to 148,268 rubles. (4000 euros#36.7 rubles/euros#101%). There was an exchange rate difference of 808 rubles. (RUB 148,268 – RUB 147,460).

The buyer transferred the remaining amount of the debt to the seller in August. The euro exchange rate on the date of payment was 37 rubles/euro. Payment amount: RUB 149,480. (4000 euros#37 rubles/euro#101%). On the final settlement date, the buyer determined the exchange rate difference for the transaction for the last time. Its value was 1212 rubles. (RUB 149,480 – – RUB 148,268).

The following entries were made in the accounting records of Granit LLC:

in May 2008

DEBIT 60 subaccount “Advances issued” CREDIT 51

— 218,160 rub. — prepayment was transferred to the seller OJSC Izumrud under the contract in conventional units;

in June 2008

DEBIT 41 CREDIT 60

— 365,620 rub. — reflects the cost of purchased goods;

DEBIT 60 CREDIT 60 subaccount “Advances issued”

— 218,160 rub. — the amount of the prepayment transferred to the supplier OJSC Izumrud in May 2008 is offset;

DEBIT 91 CREDIT 60

— 808 rub. — reflects the exchange rate difference that arose when recalculating the amount of accounts payable as of the reporting date (June 30, 2008);

in August 2008

DEBIT 60 CREDIT 51

— 149,480 rub. — the remaining amount of the debt was transferred to the supplier JSC Izumrud;

DEBIT 91 CREDIT 60

— 1212 rub. — reflects the exchange rate difference that arose when recalculating the amount of accounts payable on the date of payment.

The cost of valuables purchased from a foreign supplier, with whom payments are made in foreign currency, is determined in a similar manner.

The only difference is that when applying the norms of PBU 3/2006 for operations carried out within the framework of foreign trade contracts, the official foreign exchange rate established by the Bank of Russia is always used. How does a seller who has received an advance payment (advance payment, deposit) determine the amount of revenue?

Since 2008, for a supplier who has received an advance payment (advance payment, deposit) from the buyer in payment for an upcoming shipment, PBU 3/2006 provides for rules for determining the amount of revenue from the sale of goods (work, services). They are set out in paragraph 3 of clause 9 of this accounting standard: “The income of an organization, subject to the receipt of an advance, deposit, prepayment, is recognized in the accounting records of this organization, assessed in rubles at the rate in effect on the date of conversion of the received advance, deposit, prepayment into rubles (in the part attributable to the advance, deposit, prepayment).”

Consequently, the seller calculates the amount of sales proceeds in the same manner in which the buyer calculates the cost of purchased goods.

With a 100% prepayment, the supplier reflects in accounting the amount of income in an amount equal to the amount of the prepayment.

EXAMPLE 8

Let's use the conditions of examples 1 and 6. The seller ZAO Luna, having shipped goods to the buyer LLC Kometa in August 2008, reflected in its accounting proceeds from sales in the ruble amount in which the amount of the 100% prepayment received from the buyer was calculated in May - 122,400 rubles. The changed foreign currency exchange rate was not taken into account.The following entries were made in the accounting records of Luna CJSC in August:

DEBIT 62 CREDIT 90

— 122,400 rub. — revenue from the sale of goods to the buyer Kometa LLC is reflected;

DEBIT 62 subaccount “Advances received” CREDIT 62

— 122,400 rub. — the amount of advance payment received from the buyer for goods sold is credited.

In the case of partial prepayment, the seller calculates the amount of revenue as the sum of two components:

- part of the revenue equal to the amount of the advance received;

— the unpaid portion of the income equal to the amount of the buyer’s debt, calculated in rubles at the official foreign exchange rate established by the Bank of Russia on the date of sale, or at another rate determined in the contract.

In the future, the amount of calculated revenue is not recalculated.

At the same time, the amount of the buyer's receivables must be revalued at the date of the transaction (for example, to pay off debt) and at the reporting date. Exchange differences that arise are reflected in accounting as other income or other expenses.

EXAMPLE 9

Let us use the condition of example 7. For the seller OJSC Izumrud, the accounting transaction under the contract in conventional units concluded with the buyer LLC Granit is reflected as follows:in May 2008

DEBIT 51 CREDIT 62 subaccount “Advances received”

— 218,160 rub. (6000 euros # 36 rubles / euros # 101%) - partial advance payment was received from the buyer Granit LLC under the contract in conventional units;

in June 2008

DEBIT 62 CREDIT 90

— 365,620 rub. (RUB 218,160 + EUR 4,000#RUB 36.5/EUR#101%)—reflects the cost of goods sold;

DEBIT 62 subaccount “Advances received” CREDIT 62

— 218,160 rub. — the amount of advance payment received from the buyer in May 2008 is taken into account;

DEBIT 62 CREDIT 91

— 808 rub. [4000 euros#(36.7 rubles/euro – 36.5 rubles/euro)# #101%] - reflects the exchange rate difference that arose when recalculating the amount of the buyer’s receivables as of the reporting date (June 30, 2008);

in August 2008

DEBIT 51 CREDIT 62

— 149,480 rub. (4000 euros # 37 rubles / euros # 101%) - the remaining amount of debt was received from the buyer Granit LLC;

DEBIT 62 CREDIT 91

— 1212 rub. [4000 euros#(37 rubles/euro – 36.7 rubles/euro)# #101%] - reflects the exchange rate difference that arose when recalculating the buyer’s debt on the payment date.

The amount of revenue of Russian suppliers conducting transactions with foreign buyers and receiving payment from them in foreign currency is formed in a similar way.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Purchase, sale of foreign currency and other operations: transactions

When maintaining accounting records, transactions on currency transactions are reflected in accordance with the chart of accounts and provisions on accounting. According to this document, account 52 “Currency accounts” can correspond with accounts 50, 51, 55, 57, 58, 60, 62, 66–69, 71, 73, 75, 76, 79, 80 - by debit and with accounts 04, 50, 51, 52, 55, 57, 58, 60, 62, 66, 67–71, 73, 75, 76 - on loan.

The most common postings for foreign exchange transactions are:

- upon receipt of currency:

- Dt 52 Kt 62 - receipt of foreign currency earnings to a bank account;

- Dt 52 Kt 66, 67 - receipt of borrowed funds in foreign currency;

- Dt 52 Kt 75, 76, 79 - receipts in foreign currency from the founders, other counterparties, separate divisions;

- Dt 57 Kt 52 - currency transfer for sale;

- Dt 51 Kt 57 - crediting proceeds from the sale of foreign currency in ruble equivalent;

- Dt 91 Kt 57 or Dt 57 Kt 91 - reflection of the financial result from the sale of currency;

- buying currency:

- Dt 57 Kt 51 - transfer of ruble equivalent for the purchase of foreign currency;

- Dt 52 Kt 57 - reflection of the amount of acquired foreign currency;

- Dt 91 Kt 57 or Dt 57 Kt 91 - reflection of the financial result from the purchase of currency;

- payment in currency:

- Dt 60 Kt 52 - write-off of foreign currency funds to pay for supplies;

- Dt 66, 67 Kt 52 - return of borrowed funds, payment of interest in foreign currency;

- Dt 75, 76, 79 Kt 52 - transfer of foreign currency funds to the founders, other counterparties, separate divisions;

- actions with cash currency:

- Dt 50 Kt 52 - receiving currency from the bank to the cash desk;

- Dt 71 Kt 50 - issuance of currency to an accountable person traveling on a business trip abroad;

- Dt 50 Kt 71 - return of unused currency by the accountable person to the cash desk;

- Dt 52 Kt 50 - return of currency from the cash desk to the bank.

Exchange rate differences in accounting are reflected in the correspondence of account 91 “Other income and expenses” and accounts that reflect property or liabilities in foreign currency.

To reflect the positive exchange rate difference in accounting, the following entries are made in 2022: Dt 50, 52, 55, 57, 60, 62, 66, 67, 76 Kt 91 (subaccount “Other income”).

To reflect the negative exchange rate difference, the postings will be as follows: Dt 91 (subaccount “Other expenses”) Kt 50, 52, 55, 57, 60, 62, 66, 67, 76.

When accounting for exchange rate differences, entries for securities denominated in foreign currency (except for shares) are recorded in accounts 58 and 91. Moreover, such entries are made only in accounting, and in tax accounting, securities denominated in foreign currency are not revalued.

ConsultantPlus experts explained in detail how to reflect currency transactions in tax accounting. To do everything correctly, get trial access to the system and go to the Guide. It's free.

Exchange differences in accounting and tax accounting in 2022

In recent years (starting from 2015), the recalculation of assets and liabilities is carried out at the rate of the Central Bank, unless otherwise specified in another law or agreement between the parties. In another case - at a different rate. Recalculation of liabilities must be carried out on the last date of the month. Before this year, there were 2 types of exchange rate differences: exchange rate differences, which arise during the revaluation of assets and liabilities under contracts with payment in foreign currency, and amount differences, which arise when payment is made in rubles at the rate agreed upon by the parties to the transaction.

In practice, accounting for exchange rate differences is not an easy task, raising many questions among accountants. Resolve them with the help of ConsultantPlus experts. Get a free trial access and go to the Ready Solution.

Salary in foreign currency: nuances

According to Art. 131 of the Labor Code of the Russian Federation, wages at domestic enterprises must be paid in rubles.

Find out from this publication whether an improperly executed employment contract can lead to an unscheduled labor inspection.

The issuance of earned money in the form of foreign currency is regarded as a violation for the following reasons:

- A change in the exchange rate of the ruble to a given currency may lead to the fact that the real salary will be less than it is established in the staffing table. That is, there will be a deterioration in wage conditions, which is considered a punishable act. Sanctions for such violations are determined by Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

- Salaries can be paid through a cash desk, and foreign currency can be issued in cash only for business travel purposes. Tax authorities may regard such an operation as a violation of currency laws.

Moreover, citing the fact that such payments are a violation of labor laws, tax authorities during audits may generally exclude such payments from expenses.

It is allowed to pay wages in the following currency:

- resident employees, if they actually perform their labor duties outside the territory of the Russian Federation (clause 26, part 1, article 9 and part 2, article 14 of law No. 173-FZ, letter of the Federal Tax Service dated 04.04.2018 No. OA-4-17 / [email protected] );

- non-resident employees (Part 2 of Article 14 of Law No. 173-FZ, letter of the Federal Tax Service dated January 12, 2018 No. OA-4-17 / [email protected] ).

Find out more about who can receive a salary in foreign currency from this article.

Will an employer be fined if he evades wage indexation, the publication “Fine for non-indexation of wages - under what article and by how much?” will tell you..

Results

To account for currency transactions, accounting accounts 52, 55, 57 and subaccount 50-4 are used. These accounts correspond with active-passive account 91 when taking into account emerging exchange rate differences from transactions.

The procedure for converting currency into rubles, calculating exchange rate differences, features of maintaining accounting registers and reporting are described in detail in PBU 3/2006. In addition, to organize the accounting of currency transactions, one must adhere to the norms of the currency and tax legislation of the Russian Federation, and in some cases, the legislation of those countries where foreign representative offices of Russian companies operate.

Sources:

- Order of the Ministry of Finance of Russia dated November 27, 2006 N 154n

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

- Tax Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

- Federal Law of December 10, 2003 N 173-FZ “On Currency Regulation and Currency Control”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.