Tax legislation obliges persons who own vehicles to annually accrue and pay tax. The frequency of this procedure increases if the region has provided for mandatory advance payments of transport tax based on the results of each quarter.

Each time, when calculating a tax liability in relation to a vehicle, an organization is faced with the need to reflect the results obtained in accounting using double entries on accounting registers. Postings are made upon the fact of the calculation (tax accrual), as well as upon the transfer of the accrued tax amount to the local budget (tax payment).

Since the responsibility for maintaining accounting falls only on organizations, the question of correctly reflecting the accrual and payment of transport tax in accounting arises only before legal entities. Individuals with the formation of an individual entrepreneur must pay tax on their vehicles, but they do not need to reflect this information using accounting entries.

Explanation of the concept of transport tax

Transport tax is regional.

Its rates are regulated by regional authorities, but they should not differ more than 10 times from the rate specified in the Tax Code (Article 28 of the Tax Code of the Russian Federation). This tax must be paid by all owners of transport (Article 357 of the Tax Code of the Russian Federation) - legal entities and individuals who have at their disposal (by right of ownership or ownership) transport registered in accordance with the laws of the Russian Federation.

Read about the nuances of vehicle registration and the tax consequences of its absence in the article “Lack of vehicle registration will not exempt you from transport tax .

Transport tax accounting

Account 68 “Calculations for taxes and fees”, provided for in the Chart of Accounts, is used, among other things, for reflecting and accounting for transport tax. You should create a subaccount to account 68 specifically for postings for calculating transport tax.

For each vehicle, the amount of transport tax payable to the budget at the end of the tax period, in accordance with clause 2 of Art. 362 of the Tax Code of the Russian Federation is calculated separately.

Therefore, it is advisable in accounting to reflect the accrued amounts in the accounts of the corresponding costs - either for production or as part of other expenses. The choice of a specific corresponding account will depend on where exactly the transport is used: in auxiliary or main production, in which particular division.

If transport is used in the main production, then the transport tax is classified as ordinary expenses and its accrual is reflected in correspondence with accounts for accounting for ordinary expenses 20 (23, 25, 26, 44 ...).

Let's look at the accounting entries for transport tax:

| Debit | Credit |

>Transport tax accounting

How is transport tax calculated?

The obligation to independently calculate tax is assigned to legal entities. Despite the fact that tax returns for 2022 for organizations have been cancelled, and the Federal Tax Service must send them messages with the amount already calculated (similar to how it now does it for individual entrepreneurs and individuals), the tax of a legal entity is still calculated they will do the same on their own. First, they must know the amount in order to make advance payments throughout the year (if they are established in the region). And secondly, the message from the tax office is more of an informational nature, so that the company can compare its accruals with those made according to the tax authorities. After all, she will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

The calculation of transport tax involves the application of a rate to the tax base, taking into account the time the transport is in the payer’s ownership. In some cases, an increasing coefficient is also applied (clause 2 of Article 362 of the Tax Code of the Russian Federation).

Please note that the tax must be paid not by the one who uses the vehicle, but by the one who owns it. Even if the owner has issued a power of attorney to drive the vehicle, the authorized person does not pay tax.

Tax is calculated for the full month during which the vehicle is owned by the payer. In this case, the month of registration is considered complete if the vehicle is registered before the 15th day inclusive. The month of deregistration is considered complete if the object is deregistered after the 15th day.

For example, if a car was purchased and registered on April 15, 2020, then the transport tax for 2022 was calculated for the buyer for the period of ownership of the car starting from April 2020, and for the seller - until March 2022 inclusive.

A sample payment order for transport tax for organizations and detailed instructions for filling it out can be found in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

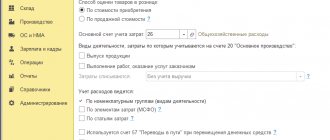

Calculation of transport tax in 1C

In 1C, transport tax calculation is carried out:

- quarterly—advance payments are set in the settings;

- at the end of the year - the settings do not set the payment of advances.

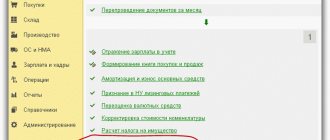

Tax calculation, including advance payments, is carried out through the Month Closing procedure - operation Calculation of transport tax.

During the reporting period

At the end of the year

Reconciliation with the Federal Tax Service for transport tax

From 2022, the tax return for transport tax has been canceled (Clause 9, Article 3 of Federal Law No. 63-FZ of April 15, 2019).

The tax authority sends a message to the organization about the calculated amount of transport tax for the tax period within 6 months. after the tax payment deadline, i.e. after March 1 of the year following the reporting year (clause 4 of Article 363 of the Tax Code of the Russian Federation).

The notification about the calculated tax is sent to the location of the vehicles within the following time limits:

- at the end of the year - within 10 days after the message is generated, but no later than 6 months from the date of expiration of the tax payment period for the period;

- when clarifying data for calculating tax - no later than 2 months from the date of receipt of documents (information) for calculating (recalculating) tax;

- when liquidating an organization - no later than 1 month from the date the Federal Tax Service Inspectorate receives information about the start of the liquidation procedure.

If an organization does not agree with the amount of tax calculated by the Federal Tax Service, it sends a Message to it within 10 days from the date of receipt

- explanations in free form with the Appendix: Application for the destruction of a vehicle (form, approved by Letter of the Federal Tax Service of the Russian Federation dated March 18, 2020 N BS-4-21/4722) - upon liquidation of a taxable object;

- Applications for transport tax benefits (form, approved by Order of the Federal Tax Service of the Russian Federation dated July 25, 2019 N ММВ-7-21/ [email protected] ) - if benefits are available;

- Messages about the availability of vehicles (form, approved by Order of the Federal Tax Service of the Russian Federation dated February 25, 2020 N ED-7-21 / [email protected] ) - in the presence of vehicles not taken into account by the Federal Tax Service when calculating the tax.

- supporting documents (optional).

Even if the 10-day period is violated, the tax authorities will consider the explanations and, if there are grounds, recalculate the tax (Letter of the Federal Tax Service of the Russian Federation dated August 13, 2019 N AS-4-21 / [email protected] ).

If, despite the explanations and actually existing grounds for reducing the tax, the organization received from the tax authority a Request for payment of arrears of tax calculated according to the Federal Tax Service, it has the opportunity to resolve the issue by sending a complaint to a higher authority - the Federal Tax Service.

Calculation of transport tax: postings

According to PBU 10/99 (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n), transport tax is considered an expense for a normal type of activity. How exactly it will be shown in accounting depends on where the transport is used.

In general, transport tax is reflected in accounting by the following entries:

- Dt 20, 23, 25, 26, 44 Kt 68 - tax or advance payment has been accrued;

- Dt 68 Kt 51 - tax payment has been made.

If a unit of transport is used in an activity unrelated to the main one, the tax accrual on it is reflected in other expenses (clause 11 of PBU 10/99). In this case, in accounting it will look like this: Dt 91.2 Kt 68.

Do not forget to properly prepare the primary documents before making accounting entries. An accountant's certificate is a document that reflects the tax or the accrued advance payment for it.

The payer must indicate exactly how this tax will be reflected in the accounting policies in the accounting policy.

For the latest changes in the document regulating the main issues of formation of accounting policies, read the material “PBU 1/2008 “Accounting Policies of the Organization” (nuances).”

Postings for payment of transport tax

Within the period specified in the laws of the Moscow Region, you need to pay the accrued amount of transport tax shown on credit 68 of the account. In this case, the following double entry is shown in accounting:

- Deb.68 Tr.cash. Kr.51 – the accrued transport tax has been paid.

The date of reflection of the above transaction is the actual day of transfer of funds. Documentary justification is a payment order on the basis of which the bank withdraws funds from the client’s account in favor of another person.

Tax accounting of transport tax

To calculate income tax, transport tax is taken into account in other expenses that are associated with production and sales (clause 1 of Article 264 of the Tax Code of the Russian Federation).

When calculating the simplified tax system with the object “income”, the amount of transport tax is not taken into account, since expenses do not matter for its calculation (clause 1 of article 346.18 of the Tax Code of the Russian Federation). When simplified with the object “income minus expenses,” transport tax is included in expenses (Article 346.16 of the Tax Code of the Russian Federation). Unpaid transport tax cannot be taken into account when calculating the simplified tax system.

Read more about the tax under the simplified tax system in the article “Transport tax under the simplified tax system: calculation procedure, terms, etc.” .

Now let's move on to UTII. Let us immediately note that as of 01/01/2021, this tax regime is canceled, therefore the following provisions are relevant until 01/01/2021.

So, with UTII, the amount of imputed tax does not depend on the amount of transport tax, since its calculation is done without taking into account income received and expenses incurred.

If the payer uses OSNO and UTII together and transport is used in both taxation regimes, the tax amount must be divided. When using transport in only one of the modes, such separation is not necessary. If transport was used in activities related to OSNO, it can be taken into account to reduce income tax, if with UTII, the imputed tax cannot be reduced.

To correctly distribute the transport tax between the two regimes, you need to calculate what part is the income for each type of activity. To calculate the portion of income under OSNO, you must do the following: divide the amount of income under OSNO by income from all types of activities. The transport tax related to OSNO is determined by multiplying the amount of transport tax and the share of income received from OSNO. Transport tax related to activities on UTII is calculated in the same manner, using in this calculation the amount of income received on UTII. The sum of the results obtained from both calculations should give the total amount of accrued tax.

About the division of expenses when simultaneously applying the simplified tax system and UTII, read the material “The procedure for separate accounting for the simplified tax system and UTII.”

How to reflect transport tax in accounting and tax accounting

Accounting

In accounting, transport tax calculations are reflected in account 68 “Calculations for taxes and fees”. To do this, open a subaccount for account 68 “Calculations for transport tax” (Instructions for the chart of accounts).

As a rule, transport tax relates to expenses for ordinary activities (clause 5 of PBU 10/99).

The procedure for its reflection in accounting depends on the production or division of the organization in which the vehicle on which the tax is calculated is used. Also read how to calculate property taxes in accounting.

When calculating and paying transport tax, make the following entries:

Debit 20 (23, 25, 26, 44...) Credit 68 subaccount “Calculations for transport tax” – transport tax has been accrued (advance tax payment);

Debit 68 subaccount “Calculations for transport tax” Credit 51 – transport tax has been paid (advance tax payment).

If the vehicle is not used in the main activity of the organization, for example, transferred under a lease agreement (provided that this type of activity is not the main one), consider transport tax as part of other expenses (clause 11 of PBU 10/99):

Debit 91-2 Credit 68 subaccount “Calculations for transport tax” – transport tax has been accrued.

Calculate the amount of transport tax (advance payments for transport tax) in the accounting statement. This document is the basis for including transport tax (advance payments) as expenses (Article 9 of the Law of December 6, 2011 No. 402-FZ).

The tax accounting procedure for transport tax depends on the taxation system that the organization uses.

BASIC

When calculating income tax, include the amount of transport tax (advance payments for transport tax) among other expenses associated with production and sales (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). This must be done in the same period for which the advance payments are calculated. This should be done despite the fact that since 2011, organizations have been exempt from calculating advance payments for transport tax. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated June 7, 2011 No. 03-03-06/1/333 and dated April 20, 2011 No. 03-03-06/1/254.

You can confirm costs in the form of accrued amounts of advance payments for transport tax with primary documents drawn up in accordance with current legislation and containing all the necessary details. Such documents, for example, could be:

- certificate from an accountant;

— calculation of the amount of advance payment for transport tax;

— tax accounting registers, etc.

The title of the document in this case does not matter. Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated June 9, 2011 No. ED-4-3/9163.

If the organization uses the accrual method, include the amount of transport tax (advance payments) as expenses at the time of accrual - on the last day of the reporting (tax) period (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation). That is, on the date of drawing up the accounting certificate with the calculation of tax (advance payment). If the organization uses the cash method, include the amount of transport tax (advance payments) as expenses on the date of transfer to the budget (subclause 3, clause 3, article 273 of the Tax Code of the Russian Federation).

Situation: when calculating income tax, is it possible to take into account the amount of transport tax on a car that is not used in the production process (idled, leased, etc.)?

Answer: yes, it is possible, provided that the car is used in activities aimed at generating income.

When taxing profits, taxes accrued in accordance with current legislation (except for taxes mentioned in Article 270 of the Tax Code of the Russian Federation) are considered as other expenses associated with production and sales. The organization has the right to recognize such expenses on the basis of subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

However, when writing off certain expenses as a reduction in taxable profit, you need to take into account that all of them must be economically justified, documented and related to activities aimed at generating income. Such restrictions are established by paragraph 1 of Article 252 of the Tax Code of the Russian Federation. These restrictions also apply to taxes paid by the organization.

The economic basis for paying transport tax is the requirement of Chapter 28 of the Tax Code of the Russian Federation.

Documentary evidence of expenses can be a transport tax declaration and payment documents for the transfer of tax to the budget.

As for the connection between expenses and activities aimed at generating income, in relation to the transport tax on a car that is not used in the production process, such a connection is not obvious. The obligation to pay transport tax, provided for in Article 357 of the Tax Code of the Russian Federation, in itself does not confirm this connection.

Using a car for income-generating activities does not imply its daily operation. It is enough that the organization’s activities imply the presence of situations in which a car is necessary (transportation of goods, passengers, business trips of employees, etc.). Therefore, if for some time the car is idle, expenses in the form of transport tax on this car can be considered related to activities aimed at generating income.

The existence of such a connection can also be recognized if the car is leased. The rent received by the organization is income, therefore, paying transport tax for a rented car can be considered as one of the conditions for receiving this income.

Another thing is the transfer of a car for free use under a loan agreement (Article 689 of the Civil Code of the Russian Federation). Since in this case the vehicle is not used in activities aimed at generating income, during the audit the tax office may exclude transport tax from expenses for those periods when the car was used by the borrower.

In some cases, it is possible to expense the transport tax on a car that the organization does not own, but which has not been deregistered with the traffic police. For example, if the former owner contributed a car to the authorized capital of another organization and entered into an agreement with the new owner to lease this vehicle. Since the car was used in the production activities of the tenant, the FAS of the North-Western District recognized that the transport tax paid by him may reduce taxable profit, since in this case the criteria of paragraph 1 of Article 252 of the Tax Code of the Russian Federation are met (resolution of the FAS of the North-Western District of December 15, 2011 No. A66-5535/2011).

A stable arbitration practice on the issue under consideration has not developed. Thus, in each specific situation when the car is not used in the production process, the organization must independently decide whether to include transport tax as an expense. Moreover, if the tax inspectorate does not agree with the decision made, the organization will have to defend its position in court.

simplified tax system

If an organization applies a simplified tax system and pays a single tax on income, then when calculating the tax base, do not take into account the amount of transport tax (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, include transport tax in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). These payments will reduce the tax base on the day they are transferred to the budget (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Do not take into account unpaid transport tax when calculating the single tax.

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, expenses in the form of transport tax do not affect the formation of the tax base for UTII.

OSNO and UTII

If an organization combines a general taxation system and UTII, then the vehicle can be used in both types of activities simultaneously. In this case, the amount of transport tax must be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation).

If the vehicle is used in one of the types of activities, then the transport tax does not need to be distributed.

The amount of transport tax related to the activities of the organization on the general taxation system can be taken into account when calculating income tax. The amount of transport tax related to the activities of the organization on UTII cannot be taken into account for tax purposes.

An example of the distribution of transport tax expenses. The organization applies a general taxation system and pays UTII

LLC "Trading Company Hermes" (Elektrostal, Moscow region) sells goods wholesale and retail. For wholesale transactions, the organization applies a general taxation system. Retail trade has been transferred to UTII.

Hermes accrues income tax on a monthly basis. The accounting policy of the organization states that general business expenses are distributed in proportion to income for each month of the reporting (tax) period.

In March, the income received by Hermes from various activities amounted to:

— for wholesale trade (excluding VAT) – 12,000,000 rubles; — for retail trade – 4,000,000 rubles.

The organization uses several trucks to deliver goods to wholesale and retail customers. In March, an advance payment of transport tax for the first quarter in the amount of 10,300 rubles was charged from these vehicles.

Transport tax expenses relate to both types of activities of the organization. To distribute them, the Hermes accountant compared the income from wholesale trade with the total income.

The share of income from wholesale trade in total income for March is: RUB 12,000,000. : (RUB 12,000,000 + RUB 4,000,000) = 0.75.

The amount of the advance payment for transport tax, which can be taken into account when calculating income tax, is equal to: 10,300 rubles. × 0.75 = 7725 rub.

The amount of the advance payment for transport tax, which relates to the organization’s activities on UTII, is equal to: 10,300 rubles. – 7725 rub. = 2575 rub.

This amount (RUB 2,575) is not taken into account for tax purposes.

Results

Independent calculation of transport tax is a thing of the past for legal entities. But they will continue to keep records of tax accrual and payment, reflecting it in accounting entries. In accounting, tax usually forms expenses for activities performed. In tax accounting, it is included in costs that reduce the base for income tax or simplified tax system with the object “income minus expenses.” When combining taxation regimes, the tax may be distributed.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Characteristics of transport tax

Note 1

Transport tax is a regional tax. This type of tax is regulated both by the Tax Code of the Russian Federation and by the laws of the constituent entities of the Russian Federation.

Transport tax is calculated and paid:

- legal entities (organizations of all forms of ownership);

- individual entrepreneurs;

- individuals.

These persons are payers of this tax, subject to the presence of registered vehicles.

Enterprises that are under a simplified taxation regime also charge and pay transport tax.

Note 2

Regardless of whether an organization is the owner of a vehicle, if such a vehicle is registered with an enterprise, then this enterprise is recognized as a transport tax payer.

Tax rates are determined by the laws of the constituent entities of the Russian Federation. Rates depend on such characteristics of the vehicle as:

- engine power;

- jet engine thrust or vehicle gross capacity per vehicle engine horsepower;

- 1 kilogram of jet engine thrust;

- 1 registered ton of vehicle;

- 1 unit of vehicle.

Can not understand anything?

Try asking your teachers for help

Taking into account the different characteristics of vehicles for establishing tax rates, the tax base is also determined based on the specified parameters.

The Tax Code of the Russian Federation does not provide for transport tax benefits. However, such benefits may be in the legislation of the constituent entities of the Russian Federation. Each individual region may have a different system of benefits.

The benefits system may include:

- types of activities of organizations or individual entrepreneurs;

- characteristics of the vehicle;

- etc.

The Tax Code contains a list of objects of taxation with transport tax, as well as a list of vehicles that are not recognized as such objects (Fig. 1):

Figure 1. Criteria for recognizing vehicles as objects of taxation