The procedure for issuing funds for reporting

Funds under the report are transferred either for business and operating expenses or for expenses associated with business trips.

The list of employees who have the right to receive funds on account is established by the Company Order.

Funds are transferred on account regardless of whether the accountable person is indebted for previous accountable amounts.

Individuals who have signed a civil contract with JSC Buttercup to perform work or provide services during the validity period of this agreement also have the right to receive funds on account from the cash desk of JSC Buttercup.

What documents will confirm expenses?

An accountant will not be able to take into account expenses when calculating income tax using the basic taxation system and reduce tax using the simplified system (with the object “income minus expenses”, tax rate 15%) if he does not have supporting documents. Although money on a corporate card can be considered accountable funds, this status is not enshrined in law. The fact is that the simplified procedure for conducting cash transactions for individual entrepreneurs and small businesses (approved by the instructions of the Bank of Russia dated March 11, 2014 No. 3210-U) applies only to accountable funds. Therefore, an entrepreneur or company manager should independently approve the rules by which corporate card holders must report.

For example, in an order on working with corporate cards, you can establish how employees should report in case of cash withdrawals. Since, due to the reflection of all movements on the account in the bank statement, it will not be possible to hide such facts, it is recommended to approve:

- a form of explanatory note in which the cardholder explains the reasons for receiving cash;

- a list of supporting documents if the money is spent;

- deadlines for submitting money not spent by the employee to the company’s cash desk;

- the procedure for filling out an advance report for such cases.

You can use an advance report form, which employees will fill out based on supporting documents. Accounting will always be able to reconcile the amounts in the report with the bank statement.

The set of supporting documents is determined by where and from whom the goods or services were purchased. If the seller is an organization or individual entrepreneur with an online cash register, you need

| Salesman | Documentation | ||||

| Organization or individual entrepreneur with an online cash register | Cash receipt, which indicates: names of goods and services; their price and value; name; Buyer’s TIN (Clause 6.1, Article 4.7 of Federal Law No. 54-FZ dated 22.05.2003) | Individual entrepreneur without an online cash register or self-employed | Sales receipt or certificate of work performed from the individual entrepreneur; check from the “My Tax” program from a self-employed person | Online services and online stores | Payment for services - a printed electronic cash receipt with the name of the service, its cost, name and TIN of the buyer; payment for goods upon receipt ─ cash receipt issued by the courier or at the pick-up point; prepayment for goods - a printed electronic receipt confirming payment, as well as an invoice as proof of receipt of the goods |

Problems with blocking a bank card

Recently, there have been legal proceedings related to the blocking of a bank card to which accountable money is transferred.

Blocking a card is a procedure of technical restriction on transactions using it, providing for the bank’s refusal to provide authorization (obtaining from the bank the permission necessary to use the card transaction, and obliging the bank to execute the order of its holder), that is, limiting the remote ability to manage the account.

This is due to the fact that the bank is obliged to document information obtained as a result of implementing internal control rules in order to combat the legalization (laundering) of proceeds from crime and the financing of terrorism in cases where unusual transactions are detected.

For this reason, the bank has the right to request, and clients are obliged to provide the bank with the necessary information (clause 14 of article 7 of the Law of 07.08.2011 No. 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism" , clause 4.1 of the Regulations on the requirements for the internal control rules of a credit organization in order to combat the legalization (laundering) of proceeds from crime and the financing of terrorism, approved by the Bank of the Russian Federation dated March 2, 2012 No. 375-P).

Important! At the same time, the current legislation in the field of combating the legalization (laundering) of proceeds from crime and the financing of terrorism does not limit credit institutions in terms of the volume of documents requested from clients.

In turn, clients are obliged to provide organizations carrying out transactions with funds or other property with the information necessary for these organizations to fulfill the requirements of this federal law, including information about their beneficiaries and beneficial owners (clause 14 of article 7 of Law No. 115-FZ ).

For example, in one of the court cases examined, in the period from November 2016 to January 2022, large sums of money were regularly credited to an individual’s bank card account. Transfers were made in equal amounts, with the purpose of payment “On account for business needs.” The total amount of funds transferred to the account was: 2 payments of 250 thousand rubles, 17 payments of 100 thousand rubles.

The bank requested clarification on the transactions for depositing funds, as well as documents confirming the economic meaning of the transactions performed.

In response to the Bank’s request, the client provided the following documents: an employment order for the position of chief accountant, an employment contract, receipts for cash receipts with the purpose of “return from an accountable person.” No other documents confirming the posting of funds to the organization's cash desk were presented. No explanations were provided about the reasons for the multiple returns to the company's cash desk of funds received on account.

From an analysis of the documents provided by the Bank, it was concluded that the client’s transactions did not have clear economic meaning. The information and documents provided did not allow us to exclude suspicions about the dubious nature of the transactions carried out by the client. Taking into account all the information available to the Bank, a decision was made to recognize the client’s transactions as suspicious.

Subsequently, at the court hearing, the employee confirmed that she used these funds in cash to pay contractors under business contracts. If the counterparty could not accept payment, she handed over the money to the cashier, but did this only for the bank, holding it for some time.

The court recognized the actions of Sberbank PJSC as legal (Decision of the Budennovsky City Court (Stavropol Territory) dated 06/07/2018 No. 2-563/2018).

But if you submit all documents to the bank in a timely manner and explain the essence of the transactions, then there will be no grounds for blocking the card. As noted in the Determination of the Moscow City Court dated 09/07/2016 No. 4g-10455/2016 “... an individual is not engaged in entrepreneurial activity and the transfer of funds to his personal card cannot be considered entrepreneurial activity, as well as arguments about the absence of a ban on the transfer organization of accountable amounts to the personal cards of employees, since they are based on an incorrect interpretation of substantive law and are not supported by evidence.”

How to get a corporate card

A corporate card is linked either to an existing company or individual account, or to a separate “card” account opened specifically. With its help, they pay for the same expenses for which they usually receive money on account. For example, they buy tickets for business trips, stationery and water for the office, gasoline for a company car. A corporate card is used in the same way as a regular one.

First of all, the head of the company determines the circle of people to whom the cards will be issued. After this, he turns to his manager at the bank with a statement listing future cardholders. You can set limits for all or only some open cards, beyond which you will not be able to spend money from your current account.

Business owners who operate without employees receive a card in their name. For personal expenses, such a card must be used carefully so as not to raise questions from the bank and the tax office. For example, it is not recommended to withdraw all the money deposited into your account every day.

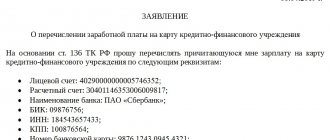

What should be written in a payment order for the transfer of accountable money?

In order to eliminate possible problems with the bank, when transferring accountable amounts to the employee’s card in the payment order, you must indicate in field 24 “Purpose of payment” “Transfer of funds against the report for payment of business expenses.”

This formulation will eliminate tax risks, because during tax audits, funds transferred as accountable to employees’ bank cards may be classified by the tax authorities as wages. Accordingly, personal income tax and insurance premiums may be charged on these amounts, in the opinion of the tax authorities.

How to take into account payment from a card in tax accounting

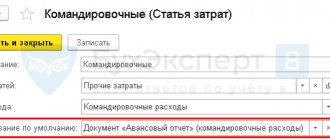

The money that the accountant transfers to employees’ subaccount cards or to a corporate card remains the company’s money. Upon receipt of supporting documentation confirming the legality of accounting for such expenses, the accountant takes into account the costs to reduce the tax base. In this case, personal income tax is not charged, since the employee does not receive economic benefits; such amounts, when credited to the employee’s card, are represented as the employee’s debt to the company. After submitting checks, forms, receipts confirming expenses in favor of the company, the expenses are distributed among the company's expenses by the accountant in accordance with the expense item. If the employee has not provided the necessary evidence that the money was spent in the interests of the company, the accountable amount is deducted by the accountant from the employee’s salary, subject to personal income tax of 13 percent. Since such amounts are accepted as the economic benefit of the employee. For example, with the company’s accepted practice of paying employees for mobile communications at the company’s expense, the employee topped up the connection from his bank card (accounting entries reflect expenses for the company’s needs and reimbursement of expenses to the employee). The accountant considers such payments as company expenses. If an employee tops up his personal phone account, and the company policy does not provide for compensation for mobile communications, then these expenses will not be taken into account as company expenses.

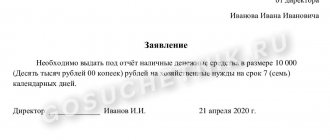

Reimbursement of business trip expenses

Situations also often arise when an employee goes on a business trip without issuing accountable amounts, and upon returning receives reimbursement for his expenses. In this case, we adhere to the same strategy, that is, we do not consider such an employee an accountable person, and he should report not according to the advance report, but according to the report on spent funds indicated in the previous part of the article. Thus, paragraph 26 of the regulations on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, refers to the advance report as a document confirming the use of money issued in advance before the trip. By the way, do not forget to include the daily allowance for each day of the business trip in the report. Reimbursement of daily allowances is guaranteed by Art. 168 Labor Code of the Russian Federation. An application for reimbursement of expenses is attached to the report on the funds spent, and then an order from the manager for reimbursement is issued.

Find out how to reimburse an employee for expenses in foreign currency on a business trip abroad by getting a free trial access to ConsultantPlus.

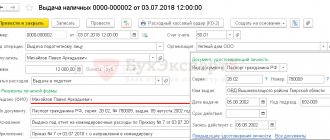

Currently, all unified forms are not mandatory (clause 4 of article 9 of law dated December 6, 2011 No. 402-FZ). To draw up a report form on the funds spent, you can modify the advance report form AO-1.

You can download the report form on our website - see. .