List of expensive cars for 2022

Every year, no later than March 1, the Ministry of Industry and Trade publishes on the official website a list of passenger cars for which transport tax is paid at an increased rate. In 2022, another 87 cars were added to the list.

The document lists brands, models (versions), engine type and size, number of years since the year of manufacture. Cars are grouped by average cost, starting from 3 million rubles. The cost is calculated using formulas from the Procedure approved by Order of the Ministry of Industry and Trade No. 316 of February 28, 2014.

It doesn't matter how much you actually paid for the car when you bought it. If you find it in the List, to calculate the tax you need to apply a multiplying factor - from 1.1 to 3.

Why was it introduced?

Firstly , to replenish regional budgets with additional funds;

Secondly , since domestic passenger cars are not subject to the luxury tax, and the list of luxury cars, due to the rise in price of foreign technology, is slowly being replenished with cars that six years ago cost an order of magnitude cheaper and were available to a relatively wide segment of the population, the purpose of introducing an increasing coefficient is also can be considered import substitution;

Thirdly , the application of the above formula that the propertied must pay more money to the treasury

Procedure and formula for calculating transport tax

Starting with reporting for 2022, the transport tax declaration was cancelled. But organizations still have the obligation to independently calculate and pay it. Since 2022, tax inspectorates have been sending out letters with calculated transport tax. You can check your calculations with the Federal Tax Service and, if necessary, challenge the tax authorities’ information within 10 days from the date of receipt of the message.

Organizations must transfer advance payments, and at the end of the year - calculate and pay the difference between the amount of the annual tax and the advances paid on it. Local authorities in the regions can cancel advance payments, then only the annual tax needs to be paid.

The tax is calculated separately for each vehicle using the following formula.

You need to substitute the values for your cars into it:

- tax base - engine power in horsepower;

- tax rate - can be viewed on the Federal Tax Service website by selecting transport tax, year of manufacture of the car and your region. Rates may differ, since constituent entities of the Russian Federation have the right to change them;

- coefficient Kv - coefficient of vehicle ownership. Apply when a car is registered or deregistered in the quarter or calendar year for which the tax is calculated;

- coefficient Kp - increasing coefficient. Applicable to passenger cars costing over 3 million rubles. from the list of the Ministry of Industry and Trade;

- 1/4 - for calculating the advance (quarterly) payment. If there are no advance payments in the region, this coefficient does not need to be applied.

The Federal Tax Service imposed a luxury tax on owners of mid-segment cars

Thousands of motorists began to receive letters from the Federal Tax Service demanding to pay the increased transport tax for last year, Octagon reported, citing its sources. Increased transport tax in Russia is charged on cars no older than three years old, the cost of which starts from 3 million rubles and above. The publication emphasizes that the affected motorists bought their cars at a price much lower than 3 million rubles.

The problem is that in 2015-2019, a large number of models and their modifications cost less than 3 million rubles. However, at the time the tax was calculated in 2022, the price of some of these cars was already different. There are many reasons why the cost of cars is growing: improved equipment, an increase in the state's recycling fee and excise tax on powerful engines, the marketing policy of automakers,

but the most important thing is the weakening of the exchange rate

ruble

In October, the analytical agency Autostat published a study according to which the weighted average price of a new car in Russia over the past six years has jumped by 67% due to the depreciation of the national currency. And this process is still ongoing.

The experts’ words are illustrated by the example of the Mitsubishi Pajero Sport SUV. In 2016, its base price was 2 million rubles, and the maximum price was 2.35 million rubles. That is, the car could not be considered luxury in any way. And this year, when selling Pajero Sport, dealers will start talking at 2.6 million rubles, and starting with the third configuration (3.14 million rubles), the car moves into the category of luxury. This means that next year the transport tax for Pajero Sport will be calculated with a coefficient of 1.1.

The Ministry of Industry and Trade rules out the possibility of including cars that were previously sold below the 3 million ruble mark among luxury cars.

“If at the time of release of the vehicle its recommended retail price was below the threshold of 3 million rubles established by the Ministry of Finance of Russia, its inclusion in the list subject to application in the current and subsequent tax periods is excluded,” Gazeta.Ru was assured in press service of the ministry. —

At the same time, the Ministry of Industry and Trade of Russia does not set a goal to increase or decrease the number of items on the list, but only objectively reflects the information that is presented by the above organizations (auto).”

The ministry explained that the list of luxury cars is compiled based on information about the recommended retail prices of automakers (and their representatives) for each make, model and basic version, taking into account the year of manufacture. The threshold of 3 million rubles established by the Russian Ministry of Finance as a criterion for classifying cars as luxury has not been revised since 2014.

The reason for charging higher taxes to Russians may be discounts from automakers and rapid price increases within one year, believes automobile expert Sergei Ifanov. According to him, the Ministry of Industry and Trade sets a one-year age limit for the lower limit of the luxury tax, which includes cars such as the Ford Explorer, Mazda CX-9, Honda Pilot, etc.

“Therefore, taxes can be charged on cars that have risen in price to the level of 3 million rubles only during the last tax period. Obviously, some cars were sold at discounts, while their official price tags were already subject to high taxes. That’s why there was a misunderstanding among drivers,” said Ifanov.

The Federal Tax Service reported that owners of such cars, even if they purchased the cars at a discount, will still have to pay luxury tax.

“It is worth noting that to calculate the tax, it is not the transaction price when selling a car (market value) that is used, but information on the average cost of the corresponding brand, posted in the list of passenger cars with an average cost of 3 million rubles, which is published on the official website of the Ministry of Industry and Trade,” they clarified. in the press service of the Federal Tax Service.

If by November the taxpayer has not received a notice for last year’s period of ownership of the car and does not have benefits, then “he can contact any tax office authorized by the MFC or send an application through the taxpayer’s personal account,” the tax office clarified. Fiscal officials also reminded that transport tax must be paid before December 1.

How to determine the multiplying factor for expensive cars

- Find your car in the list of the Ministry of Industry and Trade by model (version), type and engine size.

- Calculate how many years have passed since the vehicle was produced. The age of the car is calculated in calendar years as of January 1 of the year for which the tax must be paid. The year of manufacture is not taken into account. The year for which the tax is paid is included in the calculation. For example, the age of a 2016 car when calculating tax for 2022 is 5 years.

- Check to see if the age of your vehicle is listed in the last column of the listing. If not, the transport tax must be calculated without a multiplying factor.

- If the description of the car matches, look in which section it is located. The coefficient by which the transport tax should be increased depends on the cost category.

Calculation example

Since 2022, an organization from the Yaroslavl region has owned a Lexus LX 450D 4.5 Standard passenger car:

- year of release - 2017;

- engine capacity - 4461 cubic meters. cm.

- maximum power - 272 hp. With.

- The fuel used is diesel.

When calculating tax for 2022, 4 years have passed since the year of issue, that is, no more than 5 years. Lexus is included in the List of Expensive Cars (line No. 347) and is in the section with an average cost of 5 to 10 million rubles.

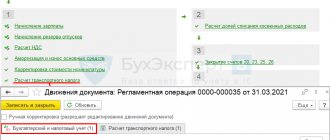

Calculation of transport tax.

- In the Yaroslavl region for passenger cars with an engine power of 250 hp or more. With. The tax rate is set at 150 rubles. with every horsepower.

- Increasing factor - 2.

- The ownership coefficient will not be included in the calculation since the car was registered with the organization during the entire tax period.

- Transport tax for 2022 = 272 l. With. x 150 rub. x 2 = 81,600 rub.

- Advance payment for the 1st, 2nd or 3rd quarter of 2022 = RUB 81,600. : 4 = 20,400 rub.

Manual tax calculations taking into account the increasing coefficient

Everything is very simple here.

It is enough to know what transport tax your car is subject to, excluding luxury tax. Next, remember the coefficients and multiply the amount of transport tax by the required one.

For example, we have a Jaguar F-Pace with a 2.0-liter Ingenium turbocharged gasoline engine with a capacity of 300 hp. With. The transport tax will correspond to about 45,000 rubles . We multiply this number by 1.1 and get 49,500 rubles including luxury tax.

The tax for cars of other categories is calculated in the same way, only you need to multiply the coefficient by 2 and 2, respectively. That is, the tax will be 2 or 3 times higher.

Note:

Let us remind you that taxation on cars under three years old in 2022 progressively decreased from the moment of purchase from 1.5 for the first year of operation to 1.1 for models aged from 2 to 3 years .

From 2022, the coefficient has been reduced to 1.1 for all models costing from 3 to 5 million rubles .

And finally. The List published for 2022 now includes 1,298 models plus just over 100 cars. The full list, which includes most foreign automakers, can be found here: minpromtorg.gov.ru.

How to calculate transport tax for less than a month

In this case, to calculate the transport tax, you need to apply the ownership coefficient, which is calculated as the quotient of dividing the number of full months during which the vehicle was registered to the payer by 12 months. The resulting Kv value is rounded to four decimal places.

When calculating the ownership coefficient, the month of registration or de-registration is taken as a full month if the car:

- registered until the 15th inclusive;

- deregistered after the 15th.

Let's assume the car was sold and deregistered on March 12, 2021. The month of deregistration is not taken into account, since it occurred before the 15th.

Kv = 2: 12 = 0.1667.

Transport tax for 2022 = 272 l. With. x 150 rub. x 2 x 0.1667 = 13,603 rubles.

When and how to pay transport tax

Transport tax and advance payments for it are transferred to the Federal Tax Service at the place of registration of the car. Since 2022, payment terms have become the same in all regions. Organizations transfer advance payments no later than the last day of the month following the 1st, 2nd and 3rd quarters. Taking into account postponements due to weekends, these are 04/30/2021, 08/02/2021 and 11/01/2021. Tax for 2022 - no later than 03/01/2022.

Budget classification code (BCC) for payment of transport tax from organizations is 182 1 0600 110.

Individuals pay transport tax by December 1 of the following year.

Increasing transport tax coefficient - what is it?

An increasing coefficient of transport tax (TN) was introduced into the Tax Code of the Russian Federation in 2014.

It applies to certain categories of vehicles (VVs) and depends on the average cost of the car and its age. So, paragraph 2 of Art. 362 of the Tax Code of the Russian Federation provides for the following coefficients (for 2021-2022):

- 1.1 - for passenger cars with an average cost of 3 to 5 million rubles. inclusive, from the year of manufacture of which no more than 3 years have passed;

- 2 - for passenger cars with an average cost of 5 to 10 million rubles. inclusive, from the year of manufacture of which no more than 5 years have passed;

- 3 - for passenger cars with an average cost of 10 to 15 million rubles. inclusive, from the year of manufacture of which no more than 10 years have passed, as well as passenger cars with an average cost of more than 15 million rubles, from the year of manufacture of which no more than 20 years have passed.

The procedure for calculating the average cost is determined by the Ministry of Industry and Trade of Russia. He also posts on his website on the Internet a list of passenger cars with an average cost of 3 million rubles, the tax on which must be calculated with an increasing coefficient. You can track updates to the list of the Ministry of Industry and Trade on the department’s website.

The current list of the Ministry of Industry and Trade can be downloaded here.

See also “Land Rovers included in the list of expensive cars of the Ministry of Industry and Trade.”

The age of the car is determined taking into account the year of its manufacture (letter of the Ministry of Finance of Russia dated January 23, 2015 No. 03-05-05-04/1817).

Note that it is important to know the size of the increasing coefficient only for tax payers - organizations, since they pay the tax themselves (clause 1 of Article 362 of the Tax Code of the Russian Federation). For “physics” the coefficient will be applied by the inspectorate.

Read about how to fill out the declaration in this material .

Currently, there is no need to submit a transport tax return. At the same time, the organization remains responsible for calculating transport tax and advance payments for it. Please note that the deadlines for paying taxes and advance payments for tax payments have recently changed. Get trial access to the ConsultantPlus system and study the current rules for free.

How to reflect transport tax in accounting

The accrual of transport tax is reflected in the credit of account 68 “Calculations for taxes and fees”. To do this, a separate sub-account “Calculations for transport tax” is opened for account 68.

The debit account depends on where and how the car is used:

- in main production - Dt 20 “Main production”;

- in auxiliary production - Dt 23 “Auxiliary production”;

- for general production purposes - Dt 25 “General production expenses”;

- for management purposes - Dt 26 “General expenses”;

- in trading activities - Dt 44 “Sales expenses”;

- does not participate in the main activities of the organization - Dt 91.2 “Other expenses”.

For example, for a car that an organization leased, if this is not its main type of activity, you need to make the following entry:

Dt 91.2 “Other expenses” Kt 68 subaccount “Calculations for transport tax” - transport tax is accrued (advance payment of tax).