List of expensive cars for 2022

Every year, no later than March 1, the Ministry of Industry and Trade publishes on the official website a list of passenger cars for which transport tax is paid at an increased rate. In 2022, another 87 cars were added to the list.

The document lists brands, models (versions), engine type and size, number of years since the year of manufacture. Cars are grouped by average cost, starting from 3 million rubles. The cost is calculated using formulas from the Procedure approved by Order of the Ministry of Industry and Trade No. 316 of February 28, 2014.

It doesn't matter how much you actually paid for the car when you bought it. If you find it in the List, to calculate the tax you need to apply a multiplying factor - from 1.1 to 3.

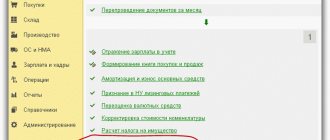

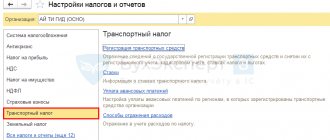

Procedure and formula for calculating transport tax

Starting with reporting for 2022, the transport tax declaration was cancelled. But organizations still have the obligation to independently calculate and pay it. Since 2022, tax inspectorates have been sending out letters with calculated transport tax. You can check your calculations with the Federal Tax Service and, if necessary, challenge the tax authorities’ information within 10 days from the date of receipt of the message.

Organizations must transfer advance payments, and at the end of the year - calculate and pay the difference between the amount of the annual tax and the advances paid on it. Local authorities in the regions can cancel advance payments, then only the annual tax needs to be paid.

The tax is calculated separately for each vehicle using the following formula.

You need to substitute the values for your cars into it:

- tax base - engine power in horsepower;

- tax rate - can be viewed on the Federal Tax Service website by selecting transport tax, year of manufacture of the car and your region. Rates may differ, since constituent entities of the Russian Federation have the right to change them;

- coefficient Kv - coefficient of vehicle ownership. Apply when a car is registered or deregistered in the quarter or calendar year for which the tax is calculated;

- coefficient Kp - increasing coefficient. Applicable to passenger cars costing over 3 million rubles. from the list of the Ministry of Industry and Trade;

- 1/4 - for calculating the advance (quarterly) payment. If there are no advance payments in the region, this coefficient does not need to be applied.

Examples of transport tax calculation

How to calculate the transport tax on a car in 2022 for an average budget model? There are two universal formulas that will help car owners determine the approximate amount of their tax liability.

Calculation example for owners who have owned a car for more than 1 year

For car owners who have owned the car for more than a year, the formula looks like this:

Tax amount = (tax rate) x (engine power).

For example, the owner of a car with an 80 hp engine, who has been the owner for more than a year, will pay:

200 rub. = 2.5 rub. (rate for engines of this category) X 80

The tax rate must be clarified with the tax authority at the place of registration of the vehicle, since the Tax Code specifies only basic rates. Their final size is determined by local authorities.

Calculation example for owners who have owned a car for less than 1 year

For drivers who have been using the vehicle for less than a year, the formula is slightly transformed. First, the amount of the liability for the month is found out, then it is multiplied by the number of months during which the car was owned by the car owner:

Tax amount = (tax rate) x (engine power) / 12 months x (number of months of actual ownership).

For a car owner who owns a car with an 80 hp engine, for example, for five months the tax amount will be:

83.33 = 2.5 rubles. (rate for engines of this category) x 80 / 12 months x 5 months (actual ownership period).

You can download tax rate options here

Example calculation for expensive cars

If everything is clear with budget transport, then how to calculate transport tax for owners of expensive cars? In this case, the basic formula remains the same, but an additional increasing factor is introduced. Its size directly depends on the cost and age of the vehicle. That is, the more expensive and older the car, the higher the indicator, and accordingly the car owner will contribute more tax to the treasury.

So, the universal formula for expensive cars:

Tax amount = (engine power) x (tax rate) x (coefficient).

For example, the owner of a powerful one-year-old SUV with an engine capacity of 306 hp. will pay the following tax:

5967 rub. = 15 rub. (tax rate for such cars) x 306 x 1.3 (coefficient for this car).

To calculate the 2022 transport tax for car owners of luxury cars that they have been using for less than a year, you need to slightly modify the formula. First, the average monthly amount is found out, which is subsequently multiplied by the number of months.

Tax amount = (tax rate) x (engine power) x (ratio) / 12 months x (number of months of actual ownership).

If the above-mentioned car is owned for less than a year, for example, seven months, then the amount of the car owner’s tax liability will be:

RUB 3,480.75 = 15 rub. (tax rate for such cars) x 306 x 1.3 (coefficient for this car) / 12 months x 7 months.

All tax ratio options are here

How to determine the multiplying factor for expensive cars

- Find your car in the list of the Ministry of Industry and Trade by model (version), type and engine size.

- Calculate how many years have passed since the vehicle was produced. The age of the car is calculated in calendar years as of January 1 of the year for which the tax must be paid. The year of manufacture is not taken into account. The year for which the tax is paid is included in the calculation. For example, the age of a 2016 car when calculating tax for 2022 is 5 years.

- Check to see if the age of your vehicle is listed in the last column of the listing. If not, the transport tax must be calculated without a multiplying factor.

- If the description of the car matches, look in which section it is located. The coefficient by which the transport tax should be increased depends on the cost category.

Calculation example

Since 2022, an organization from the Yaroslavl region has owned a Lexus LX 450D 4.5 Standard passenger car:

- year of release - 2017;

- engine capacity - 4461 cubic meters. cm.

- maximum power - 272 hp. With.

- The fuel used is diesel.

When calculating tax for 2022, 4 years have passed since the year of issue, that is, no more than 5 years. Lexus is included in the List of Expensive Cars (line No. 347) and is in the section with an average cost of 5 to 10 million rubles.

Calculation of transport tax.

- In the Yaroslavl region for passenger cars with an engine power of 250 hp or more. With. The tax rate is set at 150 rubles. with every horsepower.

- Increasing factor - 2.

- The ownership coefficient will not be included in the calculation since the car was registered with the organization during the entire tax period.

- Transport tax for 2022 = 272 l. With. x 150 rub. x 2 = 81,600 rub.

- Advance payment for the 1st, 2nd or 3rd quarter of 2022 = RUB 81,600. : 4 = 20,400 rub.

Tax base and rates

To calculate the transport tax, you need to know what to “dance” from, i.e. the tax base. Here are the possible options:

- The most common is engine power in horsepower for all vehicles with such an engine.

- For aircraft with jet engines, the engine thrust in kilograms of force.

- For tugs - gross tonnage in registered tons.

- For everyone else - a unit of transport.

At the federal level there are general rates; regions can increase or decrease them, but no more than 10 times. For example, in the Tax Code the rate is for cars with an engine power of up to 100 hp. With. – 2.5 rub. Moscow set it at 12 rubles, and the Yaroslavl region - 15.8 rubles.

Differential rates can also be established, which depend on the year of manufacture of the car and the environmental class.

How to calculate transport tax for less than a month

In this case, to calculate the transport tax, you need to apply the ownership coefficient, which is calculated as the quotient of dividing the number of full months during which the vehicle was registered to the payer by 12 months. The resulting Kv value is rounded to four decimal places.

When calculating the ownership coefficient, the month of registration or de-registration is taken as a full month if the car:

- registered until the 15th inclusive;

- deregistered after the 15th.

Let's assume the car was sold and deregistered on March 12, 2021. The month of deregistration is not taken into account, since it occurred before the 15th.

Kv = 2: 12 = 0.1667.

Transport tax for 2022 = 272 l. With. x 150 rub. x 2 x 0.1667 = 13,603 rubles.

Transport tax on a new car

Question: The organization purchased a new passenger car with a maximum permitted weight of 2.5 tons in February 2021 and registered it with the traffic police. How to calculate the transport tax for 2022 and advance payments in relation to this car if the organization will not sell it until the end of 2022 and does not have other vehicles subject to tax?

Answer: The car is included in the calculation of advance payments for the 2nd and 3rd quarters. The amount of calculated tax for 2021 is determined for the period of ownership of the car, that is, for 10 months. To calculate the amount of tax payable, the amount of calculated tax should be reduced by the amount of calculated and paid advance payments.

Rationale: An organization, purchasing a vehicle and registering it with the State Traffic Inspectorate of the Ministry of Internal Affairs, becomes a payer of transport tax <*>. There is no need to pay transport tax for individual vehicles. For example, these include electric vehicles - vehicles of categories M1, M1G, driven exclusively by an electric motor, classified by the EAEU HS code 8703 80 000 2.

The tax period for transport tax is a calendar year. The annual tax amount for each car is calculated based on the annual rate established for organizations in paragraph 1 of Appendix 27 to the Tax Code <*>.

For payer organizations, there is an obligation to make advance payments for the 1st, 2nd and 3rd quarters of the calendar year. Advance payments are calculated and paid based on the availability of vehicles on January 1, April 1 and July 1, respectively. The amount of the advance payment is 1/4 of the tax amount calculated based on the annual tax rate <*>.

For a passenger car with a maximum permitted weight of 2.5 tons, the annual tax rate is RUB 255.00.

A passenger car purchased and registered in February 2022 is included in the calculation of the advance payment for the 2nd and 3rd quarters. The amount of the advance payment for each quarter will be 63.75 rubles. (1/4 x 255.00 rub.), for both quarters 127.50 rub. (RUB 63.75 x 2). Advance payments for the second and third quarters of the organization will need to be transferred to the budget no later than June 22 and September 22, respectively <*>.

The procedure for calculating the amount of tax is enshrined in Art. 307-7 Tax Code, tax return (calculation) for transport tax from organizations (hereinafter referred to as calculation) <*>. First, the organization calculates the amount of tax (indicator of column 10 of the calculation) for the period of ownership of the vehicle in the tax period. In the situation under consideration, the organization registered the car in February 2021. The tax will be calculated starting from the 1st day of the month following the month in which the vehicle was registered, that is, from March 1, 2022 <*>. The car ownership period will be 10 months (from March to December).

The tax amount is determined by multiplying the annual tax rate by the coefficient for the period of ownership of the vehicle. The coefficient is determined by dividing the number of months of ownership by 12 (indicators in groups 6, 9, 10 of the calculation). It is calculated with an accuracy of four decimal places <*>.

Let's calculate the coefficient and tax amount for 10 months of 2022. The coefficient is 0.8333 (10 months / 12). The tax amount for 10 months will be: RUB 255.00. x 0.8333 = 212.49 rub.

Then the organization determines the amount of tax to be paid (indicator of column 14 of the calculation). It is defined as the difference between the amount of tax for the period of ownership (indicator of group 10 of the calculation) and the amount of the tax benefit (indicator of group 13 of the calculation). Please note that paying organizations have the right to apply benefits in relation to <*>:

— vehicles with a valid permit to participate in road traffic, for the issuance of which a state fee has been paid. This benefit is valid for vehicles with licenses valid in 2022 - 2022. permits, for the issuance of which in 2019 - 2022. state duty was paid <*>. When obtaining a permit in 2022, no state fee will be charged;

— vehicles deregistered before July 1, 2022.

In our situation, the organization has no grounds for applying these benefits. Based on the above, the amount of transport tax payable in relation to a passenger car will be 212.49 rubles.

Next, the organization should calculate the amount of transport tax to be paid (indicator column 18 of the calculation). It is defined as the amount of tax payable (indicator group 14 of the calculation) minus the amount of advance payments for the first, second and third quarters (indicators of group 15, 16 and 17 of the calculation). As noted earlier, the purchased car is included in the calculation of the advance payment for the 2nd and 3rd quarters. The amount of advance payments for both quarters is 127.50 rubles. (RUB 63.75 x 2). The amount of transport tax payable for a passenger car will be 84.99 rubles. (RUB 212.49 - RUB 127.50). The organization will have to pay this amount to the budget no later than February 22, 2022.

When and how to pay transport tax

Transport tax and advance payments for it are transferred to the Federal Tax Service at the place of registration of the car. Since 2022, payment terms have become the same in all regions. Organizations transfer advance payments no later than the last day of the month following the 1st, 2nd and 3rd quarters. Taking into account postponements due to weekends, these are 04/30/2021, 08/02/2021 and 11/01/2021. Tax for 2022 - no later than 03/01/2022.

Budget classification code (BCC) for payment of transport tax from organizations is 182 1 0600 110.

Individuals pay transport tax by December 1 of the following year.

How to reflect transport tax in accounting

The accrual of transport tax is reflected in the credit of account 68 “Calculations for taxes and fees”. To do this, a separate sub-account “Calculations for transport tax” is opened for account 68.

The debit account depends on where and how the car is used:

- in main production - Dt 20 “Main production”;

- in auxiliary production - Dt 23 “Auxiliary production”;

- for general production purposes - Dt 25 “General production expenses”;

- for management purposes - Dt 26 “General expenses”;

- in trading activities - Dt 44 “Sales expenses”;

- does not participate in the main activities of the organization - Dt 91.2 “Other expenses”.

For example, for a car that an organization leased, if this is not its main type of activity, you need to make the following entry:

Dt 91.2 “Other expenses” Kt 68 subaccount “Calculations for transport tax” - transport tax is accrued (advance payment of tax).

Using transport tax benefits

Tax benefit

- an advantage provided by the state or regional self-government to certain categories of taxpayers, putting them in a more advantageous position in comparison with others.

Types of transport tax benefits:

- full tax exemption;

- reduced rate;

- deduction.

In 2019

transport tax benefits are provided only by regional laws.

nalog.ru

– Services –

Main – Taxes and reports – Transport tax – Vehicle registration

The KIA Soul EV electric car is registered to the Organization in the Moscow region. The organization enjoys an exemption from transport tax for this vehicle. The conditions for the benefit have been met (Article 26.19 of the Law of the Moscow Region dated November 24, 2004 N 151/2004-OZ).

A SCANIA P360 truck is registered to the Organization in Yekaterinburg, engaged in international transportation. The organization has the right to pay 40% of the calculated transport tax (clause 3, clause 2, article 4 of the Law of the Sverdlovsk Region dated November 29, 2002 N 43-OZ).