It is quite difficult to find an enterprise that does not have fixed assets on its balance sheet: without them it is impossible to organize the production process, they last more than 12 months and have an impressive valuation. Their acquisition is, as a rule, a significant investment that will pay off only during their operation and over time. How to take into account the costs of purchased expensive property in accounting and correctly calculate the profit? They are accounted for evenly by adding depreciation. You will learn how to calculate depreciation of fixed assets in 1C* from this article. Let's look at this process using the example of the 1C: Accounting program, edition 3.0.

*The main condition for this is that the OS has arrived at the organization, has been accepted for accounting and put into operation.

Receipt, acceptance and commissioning of the OS

1C software products for accounting automation allow you to register fixed assets in accounting using “Receipts of fixed assets,” which is accessible from the “Fixed assets and intangible assets” section of the main menu of the system.

Fig.1 Receipts of fixed assets

The document's header, table section and footer must be filled out.

The header of the document indicates:

- Number and date of the supplier's invoice;

- Name of the supplier counterparty;

- Agreement between the organization and the counterparty;

- Location of the OS, as a division of the organization;

- The financially responsible person, as an individual receiving a fixed asset;

- Asset accounting group – selected from the proposed predefined list.

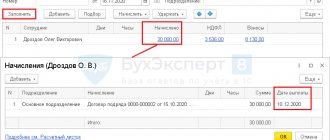

Fig.2 Document header

Particular attention should be paid to the detail “Method of reflecting depreciation expenses”. As you fill out the header details listed above, the mentioned details are gradually automatically filled in with the data of the current document. This is what the created method usually looks like:

Fig. 3 Method of reflecting depreciation expenses

The element belongs to a specific organization, in our case, Spetsavtomatika LLC. It shows the cost account. By default, the cost account is substituted from the organization's accounting policy, configured when the accounting configuration was launched. You can go to the accounting policy through the link in the organization card.

Fig.4 Transition to UE

Fig.5 Replace cost account

Here the cost account can be replaced with any necessary value - 20, 23, 25, 29, 44, 91.

After installing the desired cost account, you will need to fill out all the analytics elements:

- For accounts 20, 23, 29 – divisions, item groups, cost items;

- For accounts 25, 26 – divisions, cost items;

- For account 44 - cost items;

- For account 91.02 - items of other expenses.

The last attribute of the method, “Coefficient,” performs a very important function. Its use makes sense if the fixed asset is involved in several categories of accounting costs during the reporting period. For example, fixed assets are used for management purposes and for trading purposes, as a sales expense. To correctly set the depreciation method, you need to determine the shares attributable to each cost category. These shares must be reflected as coefficients.

Fig.6 Reflection of shares

In the example given, the values of the coefficients are equal to ones, they mean that depreciation will be divided equally/in half and accrued between cost accounts 26 and 44.

This way you can manage the ratios of the amounts of credited depreciation for an asset.

Let's fill out the receipt table.

Using the “Add” button, a new row is created in the table section.

Fig.7 Creating a new line

In this line you must fill in the object by selecting or creating it in the directory of the same name.

Fig.8 Filling the object

For correct accrual, you need to fill in the fixed assets accounting group, the code of the All-Russian Classifier of Fixed Assets (OKOF)* and the depreciation group in the card.

*OKOF must be pre-loaded into the system from an external file that comes with the configuration installation package.

The tabular part is completed by indicating the cost of the fixed asset, the VAT rate, and the useful life.

The document in question provides for the registration of receipt of a non-current asset, registration and putting the fixed asset into operation. After posting the document, the following transactions will be generated:

Fig.9 Wiring

Noteworthy is the fact that the document “Receipt of fixed assets” can be used to register a fixed asset, the depreciation of which will be credited using the straight-line method. To select other methods, it is recommended to use the sequential creation of documents “Receipt (act, invoice)” and “Acceptance for accounting of fixed assets”.

In the example under consideration, the OS is used for business purposes, so you can move on to the next step.

Posting errors for the reporting year and previous years

These errors differ not only in dates, but also in the methods of correction in reporting. Errors from previous years include those errors that were made in reports already submitted from previous years. For example, in 2022, an error from previous years will be an error made in 2022 after the statements were approved. And the date of approval of reporting is the day when the report data is approved in accordance with budget legislation. These rules are discussed in more detail in paragraphs 31-22 of the GHS “Accounting Policies, Estimates and Errors”.

And the errors of the reporting year include errors for the period of time when the reporting is either not generated or has not yet been approved. Thus, errors in 2022 will be errors in the reporting year. And even in 2022, until the report for the 202nd year is signed, all errors identified from it will be considered errors of the reporting year.

Calculation of depreciation of fixed assets in 1C

OS transfer their cost to the organization's expenses gradually, by calculating depreciation from the month following the month the OS was put into operation.

This is essentially a routine operation performed once a month. All such operations are performed in “1C Accounting” using the “Month Closing” tool. You can launch it from the “Operations” section of the main system menu.

Fig. 10 Closing the month

Closing the month is a workplace, a user assistant, which contains a list of all necessary routine operations. If any operation is not displayed in the assistant, it means that there is no need to perform it in the accounting system.

To calculate depreciation, use the operation “Depreciation and depreciation of fixed assets”.

Fig. 11 Depreciation and depreciation of fixed assets

To complete the operation, you need to click on the “Perform monthly closing” button and the system will first perform the procedure for re-posting documents, and then calculate depreciation. If depreciation is calculated without errors, then the accrual procedure line will change color to green.

Fig. 12 Correctly calculated depreciation

The result of the depreciation calculation procedure is accounting entries, which can be seen by opening the context-sensitive menu via the hyperlink and selecting the “Show entries” command.

Fig.13 Show wiring

This is what the wiring looks like for our fixed asset, the acquisition of which we are considering in this article.

Fig. 14 Postings for fixed assets

Let us remember that the method of reflecting depreciation expenses contained two expense accounts for our fixed assets - 26 and 44. Depreciation between the accounts should have been divided equally, because the method indicated the same coefficients for each of the two lines.

Taking into account that the initial cost of the OS was 110,959 rubles. (VAT is not included in the price), as well as a useful life of 61 months, with the linear depreciation method, its monthly amount will be 1,819 rubles, that is, each cost account accounts for 909 rubles. 50 kopecks

For the convenience of users, this operation is additionally separated in the “OS and intangible assets” section of the main menu of the system.

Fig. 15 OS and intangible assets

After clicking on the command, a list of routine accrual operations will open in the system.

Fig. 16 List of routine accrual operations

If recalculation is necessary as a result of making changes to primary documents, you can cancel depreciation in 1C using the “Cancel operation” function.

Fig.17 Cancel operation

A canceled operation is marked with a white sheet icon.

Accounts for correcting errors of previous years identified through control activities

| Year in which the error was made | Accounting accounts used to correct errors from previous years | ||

| Correcting an error does not affect the financial result | Income adjustment required | Cost adjustments required | |

| Last year | 0 304 66 000 “Other calculations of the year preceding the reporting year, identified through control activities” | 0 401 16 000 “Income of the financial year preceding the reporting year, identified through control measures” | 0 401 26 000 “Expenses of the financial year preceding the reporting year, identified through control activities” |

| Other past years | 0 304 76 000 “Other calculations of previous years identified through control measures” | 0 401 17 000 “Income of previous financial years identified through control measures” | 0 401 27 000 “Expenses of previous financial years identified through control measures” |

More on the topic: Change in contract price this year

Example. In the reporting period in March 2022, in the accounting of a budgetary institution, the internal financial control authorities discovered an error made in September 2022: expenses for routine repairs of the building in the amount of 1,200,000 rubles. erroneously attributed to an increase in the original (book value) of the building. Expenses for the current repairs of the building in 2022 were made using subsidies for the implementation of the state (municipal) task. In the current year, the date of discovery of the error in the institution’s accounting reflects the corrective entries:

Debit 4,401 26,271 Credit 4,104 12,411 – reflects the adjustment to the amount of depreciation from September to December 2022;

Debit 4,401 20,271 Credit 4,104 12,411 – reflects the adjustment to the amount of depreciation from January to February 2022;

Debit 4,106 11,310 Credit 4,304 66,732 – the “Red reversal” method reflects the increase in capital investments in 2022;

Debit 4,101 12,310 Credit 4,304 66,732,

Debit 4,304 66,832 Credit 4,106 11,310 – the “Red reversal” method reflects the increase in the value of the building by the amount of current repairs in 2022;

Debit 4,401 26,225 Credit 4,304 66,732 – expenses for current repairs are included in the financial result for 2022.

How to change depreciation in 1C 8.3

The capabilities of the accounting system "1C: Accounting 8.3" are not limited to just calculating depreciation. The system has a multifunctional journal “Asset Depreciation Parameters”, which is also available from the “Assets and Intangibles” section of the main menu of the system.

Fig.18 Change OS depreciation parameters

It has the ability to create specialized documents related to the features of these charges. At the same time, with their help you can figure out how to change the calculation of depreciation in 1C 8.3.

Fig. 19 How to change depreciation in 1C 8.3

When using these documents, you must take into account their essential feature - they affect the calculation of depreciation from the month following the month of their registration in the system. If you have any questions, contact our 1C support specialists, we will be happy to help you!

Postings for depreciation

How to fix errors?

To correct an error, you need to fill out a transaction log and a certificate in form 0504833. For corrections in accounting, only a certificate is used. Moreover, the certificate can correct mistakes of the current year and previous years.

The basis for correcting an error is a document that was reflected with errors or completely forgotten to post. For example, an additional agreement to the contract that was not reflected.

What needs to be reflected in the accounting statement in form 0504833?

- Reason for making corrections.

- Full name and number of the transaction log.

- The period for which the register was compiled.

- The period in which the error was found.

In the “Note on Acceptance of the Accounting Certificate for Accounting” there is a reference section. And there you need to indicate which of the registers the correction entries were sent to. Errors in electronic registers are corrected by the employee who is responsible for their formation. This is done on the basis of accounting statements.

Correcting last year's mistakes

There are several methods you can use to fix this error:

- Make changes using the “Red reversal” method;

- Make additional wiring;

- Make additional wiring along with the “Red reversal”.

This method is described in more detail in paragraph 28 of the GHS “Accounting policies, estimates and errors” and paragraph 18 of the Instructions for the Unified Chart of Accounts No. 157n.

Correcting mistakes from previous years

Let's look at how the mistakes of past years are corrected. First of all, their correction occurs through special accounts. And the type of account depends on the type of error and the year in which the error occurred.