OKOF for computers and peripheral equipment

OKOF is a detailed code with a complex structure assigned to homogeneous elements of non-current property. A complete list of them is contained in the All-Russian Classifier of Fixed Assets (the abbreviation stands for this).

These sets of figures are needed to facilitate control over working capital, streamline the process of calculating depreciation on them, and record transactions occurring with fixed assets in primary documents and reporting.

Now there is a new edition of the list of ciphers established by the Order of the State Standard of Ukraine dated December 12, 2014. No. 2018-st. Until 2017, a different list was used; it was put into effect by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 359.

Important!

Equipment that was registered during the period when the “old” list of codes was in force is not required by law to be transferred to new codes before it is deregistered. However, such a need may still arise. And for this, there are so-called transitional keys, which show the correspondence between old and new codes.

By the way, sometimes reverse translation is necessary (new ciphers into old ones). This is due to the fact that preferential property is determined by the relevant Government Resolutions, in which the list of fixed assets has not been adjusted taking into account the changed OKOF. Accordingly, when identifying units of non-current assets with new codes that can be used to obtain a preference, you have to use transitional keys to find out what code they would have been assigned if the 1994 edition of the list was still in effect.

Problems often arise with determining the OKOF of a computer and peripheral equipment.

Typically, a computer consists of many components: screen, system unit, keyboard, mouse, printer, scanner. When purchasing this equipment necessary for the work of each organization, the question arises: to take it into account as a whole or in parts. Especially if the components are purchased at different times and their service life varies.

The explanatory letter of the Ministry of Finance dated 06/02/2010 No. 03-03-06/2/110 makes this point transparent. Recognized as depreciable in accordance with

Art. 256. According to the Tax Code of the Russian Federation, property (in this case, a personal computer) is taken into account as a single object of fixed assets if the components included in its composition cannot be used as independent means of labor.

As we understand, the keyboard, mouse, printer and other PC components do not work individually. It turns out that these computer elements must be taken into account all together, one OKOF at a time. For convenience in accounting, it is recommended to assign a single service life to these components - as a rule, this is 2-3 years. Another option is not prohibited (different service life for individual components), but it may raise unnecessary questions and claims from regulatory authorities and create other difficulties associated with accounting.

The new Classifier for computers (and peripheral equipment) provides the following code: 320.26.2.

MFP OKOF 2022 depreciation group

A multifunctional device is equipment that refers to copying and computing tools. In this case, an object should be understood as each unit equipped with all accessories and devices necessary to perform the assigned tasks. MFPs include duplicating and copying equipment, calculators, typewriters, etc. In other words, these are office equipment, without which the work of any company is impossible.

According to tax inspectorate specialists, for the purpose of calculating income tax, the multifunctional device “copier-printer-scanner” belongs to the third depreciation group, since according to OKOF (OK 013-94) it corresponds to code 143010210 “Blueprinting means”. The opinion of the judges on this issue coincides with the inspectors (Resolution of the Moscow District Court No. F05-12104/2022 dated 09/08/2022 in case No. A40-88095/14). When a fixed asset performs several independent functions at once, then in this case it is necessary to proceed from the maximum depreciation group and useful life. In the case under consideration, the judges took into account the Classification of fixed assets, which was in force until January 1, 2022 (as amended on July 6, 2022).

We recommend reading: What are the Salaries in the Pension Fund 2022

Subgroups 320.26.2 in OKOF

The code provided for designating computers has 4 subgroups. They detail the equipment intended for processing and outputting information according to various significant characteristics. These are the subciphers:

- 320.26.20.11 – intended for PCs whose weight does not exceed ten kilograms. This is computer equipment in the form of MacBooks, tablets, electronic diaries, etc.

- 320.26.20.13 – machines equipped with processors and components for receiving and outputting data.

- 320.26.20.14 – equipment, the purpose of creation and acquisition of which is automatic processing of entered information.

- 320.26.20.15 – computer equipment, the housing of which includes devices for storage and (or) input/output.

Every time an organization purchases new digital equipment, the accountant independently chooses which OKOF corresponds to it. It is under this code that accounting and control of incoming office equipment will be carried out.

Depreciation groups of fixed assets 2022 according to OKOF: table

An organization acquiring a fixed asset is required to determine its useful life (SPI). This information is necessary for calculating depreciation in accounting and tax accounting. However, from 12 May 2022, accountants will apply the updated Classification of Property, Plant and Equipment. We will tell you in more detail what adjustments have been made to depreciation groups and how to take into account changes in work from 2022.

As a general rule, a company depreciates an asset over the useful life corresponding to a particular group. For example, the first group is property with a short useful life of 1 to 2 years, and the second is property with a useful life of 2 to 5 years, etc. See the table for the list of groups.

Shock absorption groups for code 320.26.2

In accordance with the annex supplementing the Decree of the Government of the Russian Federation dated January 1, 2002 N 1, which regulates the assignment of fixed assets to depreciation groups, the code in question is not included in any of the depreciation groups.

In accordance with

Art. 258 of the Tax Code of the Russian Federation , if the property is not included in the structure of any of the depreciation groups, then the organization can set their service life independently, based on the technical documentation accompanying the equipment.

Thus, for a computer (both as a whole and for its component parts), the service life is usually set in the range of two to three years. This corresponds to the second depreciation group.

What shock-absorbing group does the monoblock belong to?

Paper notices for personal taxes will begin mailing out in September. If a citizen does not live at his place of registration, such a notification may be lost. To prevent this from happening, it is better to inform the inspection office in advance of your current address for correspondence.

- Contributions to the formation of the management company.

- Property

purchased from third party companies and other manufacturers. - Property and equipment manufactured,

constructed, and constructed. - Exchanged, donated

for other types of fixed assets. - Receipt for free use

. The main basis and form of receipt are specified in the paragraphs of the donation agreement.

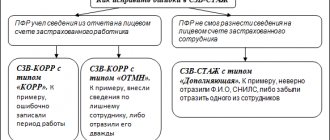

Transition keys

As mentioned above, transition keys are a table in which correspondences are established between OKOFs from the old and new editions of the list.

Translation of codes for equipment may be necessary in one direction or the other (not only from old to new, but also from new to old).

In particular, the transition key regarding office equipment looks like this.

As you can see, the “old” Classifier provides greater detail on computers and their components. In the “new” list, this group of equipment is united by one code.

Which shock-absorbing group does the monoblock belong to?

Consequently, since the new classifier does not provide separate codes for the named fixed asset, then, in our opinion, it can be assigned a conditional code 330.28.99.39.190 “Other special-purpose equipment, not included in other groups,” or it can also be recommended to consider it remotely suitable code 330.32.50.30 - Medical furniture, including surgical, dental or veterinary furniture; barber chairs and similar chairs and parts thereof.

For passenger cars of the highest - fifth class, engine size does not matter, and a passenger car even with a small engine size can belong to the highest class. It should be noted that there are no criteria for classifying cars as the highest class in regulatory documents. Moscow tax authorities propose to classify executive cars as the highest class [1]. True, the concept of a representative car is also subjective, because it is proposed to rely on such vague criteria as brand reputation, price, dimensions, engine power, production to special order, the presence of an armored body, speed, body shape (sedan, limousine), comfort, availability of additional equipment .

08 Feb 2022 juristsib 3077

Share this post

- Related Posts

- Personal Income Tax Reimbursement to a Foreign Worker Under a Patent 2022

- List of Magazine Recommended Vac 2022

- Accommodation in a Residence Zone with Preferential Socio-Economic Benefits

- Is there a benefit for Chernobyl victims for garbage removal in Vkursk region?

By what OKOF is a computer monitor taken into account?

A computer monitor is a component of a PC that cannot independently generate income for an enterprise, since it simply does not function separately from other computer components. And participation in the formation of profit is one of the main conditions for classifying equipment as depreciable property (along with a period of use exceeding a year and an initial cost of 40 thousand rubles in accounting and from 100 thousand rubles in tax accounting).

So, in accordance with the standards of PBU 6/01, the screen must be taken into account as part of the computer assembly. After all, the monitor is its integral part, one of the components that, together with others, ensures the functioning of the equipment. In this case, code 320.26.2 applies.

However, the law does not prohibit the accounting of some components of non-current property as separate items of fixed assets if their useful life periods differ (for example, clarifications on this point are contained in Letter of the Ministry of Finance of Russia dated July 14, 2017 N 02-05-10/44839).

It turns out that the monitor can be taken into account under OKOF 330.28.23.23 “Other office machines”. This is the second depreciation subgroup, which assumes a service life of two to three years.

Which depreciation group does the laptop belong to?

The names “laptop” or “netbook” are not found in Classification <1>, on the basis of which the useful life of fixed assets is determined for profit tax purposes <2>. Is it possible to determine the period of use of a laptop independently in tax accounting?

We recommend reading: Guardian report on the use of funds for 2022 sample

There really are no such objects as “laptop” and “netbook” in the Classification. But we must take into account that the Classification includes such a type of fixed assets as electronic computer equipment (code 14 3020000). And such equipment belongs to the second depreciation group, its useful life is over 2 years to 3 years inclusive. Computer technology, along with personal computers, also includes laptops.

Computer shock-absorbing group assembly

Depreciation groups are determined depending on the service life of the property - that is, the period during which it can be used in the organization and participate in the creation of profit.

There are 10 such subgroups in total; they are listed in the above-mentioned Government Resolution No. 1 of 01.01.2002. If any type of equipment is not listed in any of these groups, then its service life is established in accordance with the technical documentation attached to it.

The computer assembly is part of the second depreciation subgroup. The service life of the objects included in it is from two to three years.

Systematization of accounting

In accounting, information about the components of a computer is systematized in the context of the following OKOFs:

- 330.28.23.21 – for copiers;

- 330.28.23.23 – for screens;

- 320.26.20.15 (or 330.28.23.23) – for the system unit.

Code OKOF-2

OKOF-2 (as amended on 10/13/2020, taking into account changes came into force on 12/01/2020) All-Russian classifier of fixed assets OK 013-2014 (SNA 2008) came into force on January 1, 2020 to replace OKOF OK 013-94 For To convert the OKOF code to the OKOF2 code, use the OKOF to OKOF2 code converter.

special tool kits for telecommunications equipment and line-cable works; devices and equipment for operational work in communications - first group

(all short-lived property with a useful life from 1 year to 2 years inclusive)

OKOF table for office equipment

In this paragraph of the article, we will consider a table in which, for the convenience of accountants, codes for the most popular types of office equipment (in the old and new editions) are presented.

| Name of equipment | Old code | New code |

| Printer | 143020360 | 320.26.2 |

| Scanner | 143020000 | 330.28.23.23 |

| MFP | 143020360 | 320.26.2 |

| PC | 143020229 | 320.26.20.14 |

| Laptop | 143020224 | 320.26.20.11.110 |

| Tablet | 143020224 | 320.26.20.11.110 |

| Computer speakers | 143221125 | 320.26.30.11.150 |

| Server | 143020100 | 320.26.20.14 |

| Router (modem) | 143313450 | 320.26.30.11.190 320.26.30.23 |

| Landline telephone | 143222134 | 320.26.30.23 |

| Energy charging devices | 143440142 | 330.26.51.66 |

| Projector | 143322030 | 330.26.70.16 |

| Power supply | 143020000 | 330.28.23.23 |

| Mobile telephone | Absent | 320.26.30.22 |

We're not looking

Before looking for a code in the list of groupings (sections - subclasses) of OKOF (hereinafter referred to as the List of Groupings), you need to make sure that the object should be classified as a fixed asset, that is, it:

- is not a permanent part, fixture or accessory to another object;

- can be used repeatedly or permanently;

- can be used longer than 12 months;

- does not apply to objects classified by Instruction No. 157n as inventories, regardless of their useful life;

- does not apply to items classified as inventories in accordance with the accounting policies of the institution or department itself.

Otherwise, you should not look for the code in OKOF, even if it is there. For example, in the list of groupings there is a code for a “motorized tool” for forestry use. But since clause 99 of the Accounting Instruction N 157n indicates that gas-powered saws belong to inventory, there is no need to look for this code.