As always, we will try to answer the question “How to Account for a Printer in Accounting 2022.” You can also consult with lawyers for free online directly on the website without leaving your home.

In any case, it is important to take into account that fixed assets worth more than 40,000 rubles cannot be reflected in accounting as materials, even if this is provided for in the Accounting Policy. Therefore, fixed assets from 40,000 to 100,000 cannot be accounted for by the organization in account 10 “Materials”. At the same time, when we say “from 40,000,” we mean more than 40,000, since an object with an initial cost of exactly 40,000 rubles can still be taken into account as inventories.

Recognition of fixed assets as depreciable in accounting and tax accounting depends, among other things, on their cost. We will tell you about the features of accounting for fixed assets up to 100,000 rubles in 2022 for accounting and profit tax purposes in our consultation.

Fixed assets up to 100,000: tax accounting

In accordance with clause 5 of PBU 6/01, a cost criterion is established in accounting, which allows assets that meet the criteria of fixed assets (clause 4 of PBU 6/01) to be taken into account not as fixed assets, but as inventories. However, this cost limit is not 100,000 rubles, but 40,000 rubles. At the same time, this criterion may be lowered in the Accounting Policy for accounting purposes. And if desired, all objects that meet the conditions for recognizing them as fixed assets can be accounted for in account 01 “Fixed Assets”, regardless of their cost (Order of the Ministry of Finance dated October 31, 2022 No. 94n).

Presentation office equipment includes technical means, including a multimedia projector and projection apparatus, without the existence of which it is very difficult to present any report or advertising presentation.

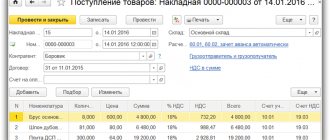

When purchasing a new office printing device, the question of how to place it on the balance sheet of the enterprise certainly arises. Confusion often arises regarding MFPs, since these devices simultaneously include a printing device, a fax machine, and a scanner.

Free maintenance

Laser printers and MFPs are classified as office equipment; their service life is 3-5 years. Timely write-off of depreciation cost allows the company to timely generate funds for the purchase of new equipment. The nature of the decrease in the value of fixed assets is described using the rules by which depreciation is carried out, where OKOF is the normative source.

An example of writing off as expenses fixed assets acquired during the period of application of the simplified tax system

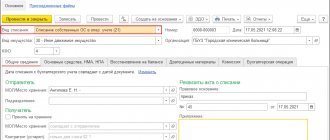

It is possible to issue an inventory card for a group of objects ( download form No. OS-6a ). Or create an inventory book using form No. OS-6b download (intended for small businesses). The inventory card (book) is filled out in one copy based on the data from the acceptance certificate and accompanying documents (for example, technical passports). Subsequently, information about all changes affecting the accounting of fixed assets (revaluation, modernization, internal movement, disposal) is entered into the card (book). The basis for this is the relevant documents. For example, download the act of acceptance and delivery of modernized fixed assets in form No. OS-3 , download the invoice for internal movement in form No. OS-2 .

What documents should I use to document the receipt of fixed assets?

Included in the initial cost of the object is the state duty for state registration of ownership of the object (if such expenses are incurred in the process of forming the initial cost of the object)

Due to the fact that the period of useful use for a computer component has been determined, it must be taken into account in the list of inventories, since the estimated parameter for classifying objects as OS is about 40 thousand rubles.

Next, depreciation, which is usual for every accountant, is calculated. 4, 5, 17 PBU 6/01; clause 1 art. 256, paragraph 1, art. 257, paragraph 1, art. 258 Tax Code of the Russian Federation; clause 1 of Government Decree No. 1 dated 01/01/2022 (hereinafter referred to as the Decree); Classification, approved.

Plotters, external storage devices and other exotics

It is necessary to determine what still belongs to fixed assets. The defining regulatory document is the accounting regulation “Accounting for fixed assets” PBU 6/01, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2022 No. 26n. Fixed assets are buildings and structures, machinery and equipment, instruments and devices, computer equipment, vehicles, tools, equipment, working, productive and breeding livestock, perennial plantings and other relevant objects. A fixed asset is an asset that simultaneously meets all four criteria:

The components of a computer are a monitor, a system unit, a keyboard, a mouse, etc. According to regulatory agencies, it is impossible to account for a computer in parts. This is explained by the fact that the components of a computer cannot perform their functions separately. Therefore, these items must be taken into account as part of a single fixed asset item. This point of view is reflected in the letter of the Ministry of Finance of Russia dated September 4, 2022 No. 03-03-06/1/639.

The printer is the main tool

It is necessary to determine what still belongs to fixed assets. The defining regulatory document is the accounting regulation “Accounting for fixed assets” PBU 6/01, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n.

Fixed assets are buildings and structures, machinery and equipment, instruments and devices, computer equipment, vehicles, tools, equipment, working, productive and breeding livestock, perennial plantings and other relevant objects.

A fixed asset is an asset that simultaneously meets all four criteria:

- it must be used by the organization in carrying out its activities, be it production of products, provision of services, performance of work, etc., or for management purposes;

- the period of use of the asset must be more than 12 months;

- the object was not purchased for resale;

- the use of the facility contributes to the organization's revenue generation.

Blinds in an organization can serve either as inventory or as another object.

Regarding the first criterion for classifying an object as a fixed asset, blinds can be used for management purposes if they are installed, for example, in the office of a management structure. Blinds can be installed in production workshops, in premises intended for the provision of services to the organization's clients.

The use of blinds is economically justified. What would the working conditions be like for workers in a manufacturing facility or office if there was too much sunlight coming through the windows? Excessive sunlight cannot create comfortable working conditions.

In other cases, the need to install blinds is justified by the fact that what is happening outside the premises does not distract workers from the work process or by the need to ensure comfortable working conditions. Even when creating a favorable image of an organization, the use of blinds has its useful meaning.

Thus, there is no doubt about the advisability of using this light-protective device in the production or management activities of an organization.

The blinds will definitely be used for more than 12 months. We meet two criteria for classifying blinds as fixed assets.

If an organization has installed blinds for their intended purpose, then their resale is not intended. This means that the conditions of the third criterion are met.

By creating favorable conditions, the installation of blinds increases labor productivity, thereby increasing the organization’s income.

The attractiveness of premises for serving clients and receiving visitors increases, thereby blinds help attract additional clients, which, in turn, affects profitability.

This means that the fourth criterion for classifying blinds as fixed assets is also met.

It follows from this that blinds can be taken into account as a fixed asset.

How to account for fixed assets, read the article “01 account in accounting (nuances).”

But there is one more point - the cost of this asset. In its accounting policy, the organization independently sets a limit on the cost of a unit of an object, above which the item will be accounted for as a fixed asset. The limit is set in the amount of 40,000 rubles.

An asset that meets all of the above criteria for classification as fixed assets, but with a cost not exceeding the approved limit, can be taken into account as an inventory. If the cost of our blinds was within the established limit, then they should be taken into account as a reserve.

It should be noted that the cost of installing blinds must be included in their actual cost.

Example

The organization purchased blinds from a supplier worth RUB 7,080. (including VAT 1,080 rubles 00 kopecks). The cost of installing blinds amounted to 354 rubles. (including VAT 54 rubles 00 kopecks). The limit for classifying inventories as inventories is set at RUB 40,000.

The actual cost of the blinds will be RUB 6,300.00. (6000.00 + 300.00). The organization accepted the blinds for registration as inventories and made the following entries:

- Dt 10 Kt 60 - 6300.00 rub. — blinds are registered;

- Dt 19 Kt 60 RUB 1,134.00 — VAT charged by the supplier is reflected

- Dt 20 (26, 44...) Kt 10 - 6,300.00 rub. — the cost of installed blinds is written off as expenses.

Learn more about accounting for materials in the article “Account 10 in accounting (nuances).”

Results

Items such as blinds, a flash card, a toilet, a printer, although they have signs of a fixed asset, are still more appropriate to be taken into account as part of inventories. This will simplify accounting, and there will be no distortion of the organization’s financial performance indicators.

Reply from 08/07/2013:

It is advisable to take laser printers and multifunctional devices (hereinafter referred to as MFP) into account as independent inventory items of fixed assets.

The criteria for classifying an object as fixed assets or inventories are given in paragraphs.

38, 39, 41, 98, 99 Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions (approved by order of the Ministry of Finance Russia dated December 1, 2010 No. 157n).

The main criteria for classifying an object as fixed assets are:

- the useful life of the object is more than 12 months;

- performance of certain independent functions by an object.

As a rule, the useful life of a printer and MFP is more than 12 months. As for the second condition, it is not fully satisfied, since the listed objects do not function independently. Most often, such devices are networked.

Because these items can be easily disconnected, moved, and reconnected, it is best to account for them as separate fixed assets for ease of accounting.

It should be noted that the assignment of material assets to the corresponding group of non-financial assets (fixed assets or inventories) is the competence of the institution. At the same time, it is recommended to define in the accounting policy a uniform procedure for accounting for all similar objects. This will avoid claims from regulatory authorities.

What is a server and how to take it into account?

Without going into technical details, a server is a powerful and reliable computer that can connect various electronic devices into a single network, which, in particular, allows:

- store and control information in one place;

- access the Internet from every workplace;

- use one program or one technical device (printer, fax, copier, etc.) simultaneously for several employees, and with the ability to do this remotely.

Of course, you have to pay for the pleasure, and finding a server for less than 40,000 rubles. not easy.

In addition, it cannot be worked with without special software, the costs of which are included in the cost of the device as the cost of bringing it to a state suitable for use.

4, 6, 8 PBU 5/01; clause 2 art. 254, paragraph 1, art. 256, paragraph 1, art. 257 Tax Code of the Russian Federation; Clause 1 of Federal Tax Service Letter No. KE-4-3/7756 dated May 13, 2011. After all, without software, a server is a lifeless box.

A single server, which usually looks like a computer system unit, does not cause any particular problems. If you suddenly managed to get a device for 40,000 rubles. or less (including the cost of the software), then in accounting and tax accounting it can be included in expenses immediately upon commissioning. 5 PBU 6/01; subp. 3 p. 1 art. 254 Tax Code of the Russian Federation.

If the server costs more, then it is the main tool for both accounting and tax purposes. Its useful life (USL) for tax purposes is from 25 to 36 months. Usually the same amount is measured in accounting.

Next, depreciation, which is usual for every accountant, is calculated. 4, 5, 17 PBU 6/01; clause 1 art. 256, paragraph 1, art. 257, paragraph 1, art. 258 Tax Code of the Russian Federation; clause 1 of Government Decree No. 1 of 01.01.2002 (hereinafter referred to as the Decree); Classification, approved.

Resolution (hereinafter referred to as Classification).

Server platforms

Given the diversity and large volume of tasks to be solved, servers often work in groups. To do this, individual blocks, called server platforms, are inserted into special racks and combined into a single powerful server.

To understand the rack accounting options and see their pros and cons, take a look at the table.

As you can see, accounting for all servers and racks as a single object is a safer option, but not always profitable.

Costs for updating system software for the server and purchasing additional programs

Replacing or radically updating the server system software, which is accounted for as a fixed asset, is considered a device upgrade in accounting and tax accounting. Accordingly, the costs for this increase the initial cost of the server and are subsequently depreciated along with the capital. 27 PBU 6/01; clause 2 art. 257 Tax Code of the Russian Federation.

Source: https://iiotconf.ru/printer-eto-osnovnoe-sredstvo/

Accounting

The initial cost of fixed assets acquired for a fee consists of the organization’s costs for their acquisition, construction and production, bringing them into a condition suitable for use. Expenses for the acquisition of computer programs, without which computer technology cannot perform its functions, should be considered as expenses for bringing an object of fixed assets into a state suitable for use. Therefore, include the programs necessary for the computer to operate in its initial cost.

BASIC: income tax

The initial cost of a computer includes pre-installed software, which is necessary for the full operation of this property (paragraph 2, paragraph 1, article 257 of the Tax Code of the Russian Federation). An organization should not list such software separately.

Since 2022, officials have abolished the rule that the tax classification of fixed assets can be used for accounting (decree of the Government of the Russian Federation dated July 7, 2022 No. 640). In accounting, the company independently determines how much it plans to use the facility (clause 20 of PBU 6/01). You can focus on tax classification. OKOF code for a laser printer (from January 1, 2022) is 320.26.2, the category “Computers and peripheral equipment” includes personal computers, various peripheral devices, including printers.

How to account for a printer in accounting

not easy. In addition, it cannot be worked with without special software, the costs of which are included in the cost of the device as the cost of bringing it to a state suitable for use.

4, 6, 8 PBU 5/01; clause 2 art. 254, paragraph 1, art. 256, paragraph 1, art. 257 Tax Code of the Russian Federation; P.

5 PBU 6/01; subp. 3 p. 1 art. 254 Tax Code of the Russian Federation. If the server costs more, then it is the main tool for both accounting and tax purposes. Its useful life (USL) for tax purposes is from 25 to 36 months.

How to properly keep track of expenses for cartridges?

If the acquired assets are used for production purposes, then their cost is included in expenses for ordinary activities (p.p.

- Write-off of cartridges in a budget organization

- Cost accounting for cartridges

- Accounting for components and consumables

- Printer and components in accounting

- Interesting publications:

- How to properly write off cartridges

Write-off of cartridges in a budgetary organization 5, 7 PBU 10/99 “Expenses of the organization”) and is taken into account in cost accounts (20, 23, 25, 26, 44).

In accounting, the write-off of inventories as expenses is carried out using one of the methods provided for in clause 16 of PBU 5/01: at the cost of each unit, at the average cost, at the cost of the first acquisition of inventories (FIFO method). The choice of the method used is reflected in the accounting policy.

How to record the purchase of a computer

Expenses for the acquisition of computer programs, without which computer technology cannot perform its functions, should be considered as expenses for bringing an object of fixed assets into a state suitable for use. Therefore, include the programs necessary for the computer to operate in its initial cost.

This procedure follows from paragraph 8 of PBU 6/01. Situation: how to reflect write-offs in accounting and monitor the safety of a computer put into operation.

Is the cost of the computer completely written off as an expense? Since the law does not regulate the procedure for accounting for a computer written off as an expense as part of materials, the organization must develop it independently.

In practice, to control the safety of a computer for each department (materially responsible person), you can maintain:

- record sheet of computers in operation;

Which account should I credit the printer to?

And confirmation of this will be the write-off act.

The form of such an act is approved by Resolution No. 71a.

Important However, it is too bulky and inconvenient for writing off low-value property.

Therefore, it is better to develop your own sample act and approve it in the accounting policy for accounting purposes.

An example of such a document is presented below. Method two: get a “low value” accounting card.

The chart of accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by order of the Ministry of Finance of Russia dated October 31.

2000 N 94н (hereinafter referred to as the Chart of Accounts and the Instructions, respectively), a separate balance sheet account 03 “Income-generating investments in material assets” is provided, designed to summarize information on the availability and movement of the organization’s investments in part of the property, buildings, premises, equipment and other assets that have a material form provided by an organization for a fee for temporary use (temporary possession and use) for the purpose of generating income.

Question: An organization purchased a printer costing less than RUB 10,000.

In accounting, it was taken into account as part of the inventory and written off at a time. In tax accounting, the cost of the printer was also completely written off at the time of its commissioning. Can an organization account for the cost of repairing a printer?

(“Russian Tax Courier”, 2007, n 4)

on account 10 as part of the inventory and wrote off its cost in full at the time of transfer to operation, it must maintain off-balance sheet accounting for this object. Data about the printer is recorded in the corresponding registration cards.

Many organizations reflect the cost of objects, written off at a time from accounting accounts, in off-balance sheet accounting.

3 p. 1 art. 254 of the Tax Code of the Russian Federation). Complete write-off of the cost of objects in accounting and tax accounting does not mean that they are not available.

Printer repair cost accounting

At the same time, Order of the Ministry of Finance of Russia N 52n introduced an additional primary document - a receipt order for the acceptance of material assets (non-financial assets) (f. 0504207), which is drawn up by the institution upon receipt of material assets (including fixed assets, inventories), including including from third party organizations (institutions).

Info Such a receipt order serves as the basis for accepting the object for accounting and reflecting it on the balance sheet of the institution. Starting from the first day of the month following the month of acceptance for accounting, depreciation is accrued monthly on office equipment until the cost of these objects is fully repaid or they are disposed of (clause

86 Instructions No. 157n). Attention If a fixed asset was transported from an office to a repair shop, and then back, you should draw up reports on the movement of office equipment.

After completion of the repair, information about the actions taken is entered into the inventory card of the fixed asset (form OS-6).

Should a printer be considered a primary tool?

This option is beneficial not only from the point of view of profit taxation, but also allows you to save on property tax - there will be no taxable object for this tax (clause

1 tbsp. 374 Tax Code of the Russian Federation). Well, the cartridge, especially, is written off at a time.

It’s very easy to get personal advice from Elizaveta Seitbekova on accounting and taxation online - you just need to fill out.

Every day, three to five of the most interesting questions will be selected, the answers to which you can read in specialist consultations. Everything for an accountant. 3 jobs from 20,000 rubles per day!!!

How to correctly accept these objects for accounting?

According to clause

4PBU 6/01 “Accounting for fixed assets” (hereinafter referred to as PBU 6/01), an asset is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met:

- a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

- c) the organization does not intend the subsequent resale of this object;

- b) the object is intended to be used for a long time, that is, a period of more than 12 months or a normal operating cycle if it exceeds 12 months;

- d) the object is capable of bringing economic benefits (income) to the organization in the future.

At the same time, clause 6PBU 6/01 provides that the accounting unit of fixed assets is an inventory item.

From server to MFP: how to take into account unusual office equipment

not easy.

In addition, it cannot be worked with without special software, the costs of which are included in the cost of the device as the cost of bringing it to a state suitable for use; , , ; .

After all, without software, a server is a lifeless box. A single server, which usually looks like a computer system unit, does not cause any particular problems.

If you suddenly managed to get a device for 40,000 rubles.

or less (including the cost of the software), then in accounting and tax accounting it can be included in expenses immediately upon commissioning; . If the server costs more, then it is the main tool for both accounting and tax purposes. Its useful life (USL) for tax purposes is from 25 to 36 months.

Usually the same amount is measured in accounting.

Source: https://advokatn.ru/kak-uchest-printer-v-buhuchete-78720/

Meaning of the OKOF code for the printer

An item of fixed assets acquired by a company is reflected in tax accounting with the definition of a specific depreciation group. The period during which the cost of fixed assets will be taken into account in income tax expenses depends on it.

Okof code for printer in 2022

Classifier of fixed assets 2022 Classifier of fixed assets 2022 allows you to determine the useful life of an asset. If the object is not in the classifier, use the manufacturer's recommendations or technical specifications. A server is convenient not only because all computers work on a single network, but also because the information available on the server is usually available 24/7. Both plotters and drives for serious tasks cost more than 40,000 rubles.

It is impossible to imagine it without modern technology, which allows us to easily solve all kinds of problems. Progress leads to the fact that new types of technology appear much faster than rule-makers responsible for accounting and taxes have time to react to it. Which might give an accountant pause.

In tax accounting, a rack is not depreciable property, since its cost does not exceed 100,000 rubles. Therefore, the accountant wrote off the cost of the rack as material expenses on January 14 as a lump sum.