Cause of disability codes on sick leave: decoding

The cause of disability code on the sick leave is indicated in a special field consisting of two cells. Their values range from 01 to 15. The form has three cells for specifying an additional code. It is intended to clarify the causes of injury or illness and some other details. Their values range from 017 to 021.

Let's look at the most common values, and the remaining codes for the reasons for disability on the new sick leave can be seen on the sample back of this form.

An employee can hide his disability, but because of code 45 on sick leave, the employer will find out everything

Code 45 on a sick leave certificate will help the employer understand that the employee is disabled. If this code is not present, the FSS may be indignant and signal the error to the employer. In this way, a person’s secret will be revealed and the secret will become clear.

When applying for a job, some disabled people hide their health problems from the employer and do not present a certificate.

The reasons may be different:

- someone is shy;

- someone is afraid of being refused admission;

- some already after registration are afraid that they might get rid of them;

- and some even get a job and a schedule that is prohibited for disabled people.

In the situation described by a participant in our forum, just such a story happened. The man hid his disability from his employer.

There were no complaints about the employee's work. But recently he fell ill with a cold and took out sick leave.

The accounting department refuses to pay for it until the employee brings a certificate of disability. Perhaps the accountant learned about the disability from the Social Insurance Fund, where he transferred the sick leave for payment, or saw code 45 on the sheet and realized that the employee was not telling something.

But this is far from a unique case when a sick leave makes a secret explicit and information about a disability that an employee kept secret becomes known to the employer.

Recently, Rostrud considered a similar situation - here and here. The Social Insurance Fund refused to pay for long-term sick leave, since disabled people have a limit on paid days.

For the employer, this information came as a complete surprise. Not only was the calculation of the sick leave incorrect, but also the disabled person of group 2 had an irregular day according to the contract. What should an employer do in such a situation?

Firstly, Rostrud explained, informing the employer about one’s disability is a right, not an employee’s responsibility . The employer does not have the right to demand from the employee documents confirming his disability.

Moreover, during the period of work, it is impossible , since information about disability relates to personal data and is protected by law , says Rostrud.

Meanwhile, this legally protected information still reaches employers.

Secondly, says Rostrud, if an employee never brings a disability certificate, he does not need to be granted extended leave and shortened working hours. That is, for the employer, this disabled person is an ordinary employee with a standard set of labor rights.

But as for irregular working hours, Rostrud’s explanations are something like this: it’s possible, but it’s not. And provided that the person brings a pink certificate.

The fact is that the Labor Code does not contain a direct ban on irregular working hours for people with disabilities, Rostrud explains. At the same time, a shortened working week (36 hours) is established for disabled people of group 2. This in itself excludes the possibility of working on irregular working hours.

But let's return to the topic of the forum. There the sick leave was due to ARVI, so it is unlikely that it exceeded 4 months. What went wrong?

Participants in the discussion assume that the issue is in the registration of sick leave. For people with disabilities, the code is 45 . The FSS discovered that the person has a disability, but there is no code on the sick leave. Or there was a code and the accountant drew attention to it.

By the way, although this code is set on sick leave by doctors, the employer may turn out to be extreme because he did not control it. We talked about this court decision earlier.

Incorrectly filled out sick leave backfires on the employer

However, as for the situation that is being discussed in our forum, the employer’s refusal to pay sick leave is unlawful.

Our readers note that blackmail “paying sick leave in exchange for a pink certificate” is illegal.

The discussion takes place in the forum topic “ Bukh does not pay sick leave without a disability certificate .”

By the way, from next year all sick leave will become electronic, and interaction between the Social Insurance Fund and employers will become closer. Information about each sick leave from the Social Insurance Fund will automatically be sent to the employer, even if the employee did not intend to claim payment for these days.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Taking turns caring for a sick child

If necessary, sick leave can be issued to different family members alternately (clause 36 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia No. 624n).

The insured event is the temporary disability of the insured person (family member) due to the need to care for a sick child (and not the illness of the child or another family member who needs care). Therefore, a certificate of incapacity for work for each family member must be issued as a primary one. Certificates of incapacity for work issued to each family member who cared for a sick child are subject to closure. Accordingly, benefits for temporary disability are calculated as for individual insured events. This is stated in the letter of the FSS of Russia dated July 28, 2016 No. 02-09-14/15-0.

When 44 is put on the certificate of incapacity for work

Many personnel officers have a question about whether it is necessary for foreign citizens. According to Article 66 of the Labor Code of the Russian Federation, everyone who works under an employment contract must have a work book, which means foreigners must have exactly the work book of the established form. Work books or other replacement documents from foreign countries are not accepted, with the exception of old work books of the USSR. If the insured event occurred during the period from the moment of conclusion of the employment contract until its complete termination, the date is set from which the employee would begin to perform his duties. The next line is intended to indicate the insurance period, in which you should write the number of full years and months. In the column intended to record the period of payment of the due benefit, you must indicate the start and end dates of the illness. Information on average earnings and average daily earnings is entered in the corresponding lines, in accordance with law number 255-FZ of December 29, 2006. Then the amount of benefit paid by the Social Insurance Fund is indicated. In the “Total accrued” line, you must enter the total amount of benefits intended to be paid to the employee, taking into account personal income tax.

Please note => At the birth of twins, is maternity capital required?

Filling out our part of the sick leave

How an employer can complete sick leave is described in detail in paragraphs 64 and 65 of the Procedure. The document should be completed:

- in Russian;

- gel, fountain or capillary pen with black ink or using printing devices. You cannot write with a ballpoint pen while on sick leave;

- in printed capital letters;

- without going beyond the boundaries of the cells and always starting from the first;

- separating words with empty cells (there is no need to put dashes in them).

The fields that the employer must fill out are listed in the table.

Section of the certificate of incapacity for work “To be completed by the employer”

| Field name | What to enter in the field |

| (place of work – name of organization) | or full or abbreviated name of the insured - organization (separate division); or surname, name, patronymic (patronymic is indicated if available) of the insured - an individual; |

| Basics | |

| At the same time | In one of the cells, check the box depending on what the employee’s place of work is: or the main one; or external part-time work - if the employee has an employment contract with another employer (Article 60.1, 282 of the Labor Code of the Russian Federation). |

| Registration | registration number specified in the notice (notification) of the policyholder (hereinafter referred to as the Notice), which is issued upon registration with the territorial body of the Federal Social Insurance Fund of the Russian Federation |

| subordination code | code in accordance with the Notice, consisting of five digits, indicating the territorial body of the Federal Social Insurance Fund of the Russian Federation in which the policyholder is currently registered |

| TIN of the disabled person (if available) | taxpayer identification number of the benefit recipient. If the employee does not have a TIN, do not fill out this field |

| SNILS | SNILS of the benefit recipient in accordance with the insurance certificate of state pension insurance |

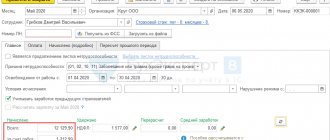

| Accrual conditions | two-digit code (several codes if necessary). In particular: 44 - if the employee started working in the Far North and equivalent areas before 2007 and continues to work in these areas; 45 - if the employee has a disability; 46 - if an employment contract is concluded with an employee for a period of less than 6 months. This code is not entered if code “11” is indicated in the line “Cause of disability”; 47 - if the illness occurred within 30 calendar days from the date of termination of work under the employment contract; 48 - for a valid reason for violating the regime (if the corresponding code is entered in the line “Notes about violation of the regime”), etc. |

| Act form | remains blank (the field is filled in only if temporary disability is caused by an accident at work) |

| Start date | to be completed in case of cancellation of the employment contract. It is necessary to indicate the date, month and year from which the employee was supposed to start working; |

| Insurance experience | the number of full years and months of an employee’s activity taken into account in the insurance period in accordance with the legislation of the Russian Federation |

| incl. non-insurance periods | the number of full years and months of the employee’s: military service; other service provided for by the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and criminal authorities executive system, and their families" from 01/01/2007 |

| Benefit due for the period | the start and end dates of the period for which the employee is assigned and paid temporary disability benefits |

| Average earnings for calculating benefits | the amount of payments that are taken into account when calculating benefits. If the employee has no earnings in the billing period or his earnings are less than the minimum wage, indicate 24 times the minimum wage established on the day of the onset of incapacity. In 2016 it is 148,896 rubles. |

| average daily earnings | average daily earnings, that is, the value indicated in the “Average earnings for calculating benefits” field, divided by 730 |

| Benefit amount: at the expense of the Social Insurance Fund of the Russian Federation at the expense of the employer | benefit amounts paid at the expense of: employer funds; budget funds of the Federal Social Insurance Fund of the Russian Federation, taking into account personal income tax (clause 1, part 2, article 3 of Law No. 255-FZ) |

| TOTAL accrued | total amount of benefits accrued to the employee, taking into account personal income tax |

| Last name and initials of the manager | FULL NAME. persons who signed the certificate of incapacity for work, including by power of attorney (full last name, then a space, then initials without a space) |

| Last name and initials accountant | |

The employer's seal may extend beyond the specially designated space, but should not fall into the cells of the information field of the sick leave form (clause 65 of the Procedure).

Sick leave for caring for a child aged 7 to 15 years

The maximum number of days to care for a sick child from 7 to 15 years old, which must be paid during the year, is 45 calendar days (Part 5, Article 6 of Law No. 255-FZ). At the same time, the number of paid days for each case of illness is limited to 15 calendar days.

The employee must be paid benefits in the same amount as when caring for a child under 7 years of age (clause 1, 2, part 3, article 7 of Law No. 255-FZ):

- when treating a child on an outpatient basis in the amount of:

— 60, 80 or 100 percent of average earnings, depending on the employee’s insurance coverage, for the first 10 calendar days of sick leave;

— 50 percent of average earnings for the following days;

- when treating a child in an inpatient setting - in the amount of 60, 80 or 100 percent of average earnings, depending on the employee’s insurance length for all days subject to payment.

EXAMPLE OF CALCULATION OF SICK AWAY FOR CARE OF A CHILD FROM 7 TO 15 YEARS OLD DURING INPATIENT TREATMENTThe employee’s insurance period is 7.5 years.

Her average daily earnings for the purpose of calculating temporary disability benefits is 1,400 rubles. The employee’s child is 8 years old. She was on sick leave to care for this child from May 5 to May 21 (17 days). The child was in the hospital. Before this, during 2016, the employee was not on sick leave to care for a child. By the day the sick leave began (May 5), the total number of days of benefit payment since the beginning of the year is the maximum amount - 45 days. However, only 15 days are payable. sick leave. The benefit amount will be 16,800 rubles. (RUB 1,400 × 80% × 15 days). It happens that on sick leave to care for a child, only a portion of the days are spent on inpatient treatment. You need to keep track of days spent on different treatments separately.

EXAMPLE OF CALCULATION OF SICK AWAY FOR CARE OF A CHILD FROM 7 TO 15 YEARS OLD DURING OUTPATIENT AND INPATIENT TREATMENT The employee’s insurance experience is more than 7.5 years. The limit of paid days on sick leave for child care for the year has not been exceeded. The employee’s child is 8 years old. She was given sick leave to care for this child from May 5 to 21 (17 days): - for 3 calendar days from May 5 to 7 - for outpatient treatment; - for 8 calendar days from May 8 to 15 - for inpatient treatment; - for 5 calendar days from February 20 to February 25 - for outpatient treatment. All sick days are subject to payment in the amount of 80 percent of the employee’s average earnings, since the 10-day limit of days paid based on length of service for outpatient treatment has not been exceeded.

Sick leave codes and their interpretation

- 43 – if the employee was exposed to radioactive radiation;

- 44 – work is performed in the Far North;

- 45 – the employee has an established disability group;

- 46 – the employment contract was concluded for a period of up to six months;

- 47 – the insured event occurred within 30 days from the date of dismissal;

- 48 – the employee violated the treatment regimen for a valid reason;

- 49 – if the disease lasts more than 16 weeks;

- 50 – if the disease lasts more than 20 weeks;

- 51 – the employee did not have time to earn enough to pay for the insurance premium or the amount of earnings is less than the minimum wage.

Code 01 is the most common. It denotes any disease with the exception of diseases included in the special lists of the Ministry of Health. Domestic injuries and accidents not related to the patient’s work are coded 02. All types of quarantine for infectious diseases are coded 03. Industrial injuries include not only injuries received directly at the workplace, but also those received on the way to or from work.

Dispatch

To check and send a document, you need to open the document viewing page and select “ Check and send” :

After checking:

- If violations are found, correct them. To do this, close the window with the scan results, correct the violations (they are highlighted in red) and check again:

- If there are no violations, you must sign the file with a valid electronic signature certificate and click “Send the document to the FSS":

The file will be sent to the regional office of the FSS. The status of the electronic certificate of incapacity for work can be tracked on the document flow page.

Sending multiple emails

Sick leave can be sent en masse. To do this, on the page with a list of documents, you need to go to the “ Details and settings” , then click “ Enable bulk sending mode” . It will be enabled for the organization as a whole, meaning it will apply to all users.

In the same section, if necessary, you can disable the bulk sending mode.

First, the service shows documents for the last 4 days for which they are available. If necessary, you need to select a different date and also enable the No Errors . A send button will appear - in the image it is “ Send 2 documents to the FSS” . After clicking it, the system will transfer the user to the electronic signature selection window.

Requirements for filling out a sick leave certificate

According to paragraphs. 56, 65 of the appendix to order No. 624n, the data on the certificate of incapacity for work is entered as follows:

- print on a printer or manually enter information into cells in specially designated fields in capital block letters using a black pen;

- fields are filled from the first cell and do not go beyond them;

- The seal is placed in the places designated for this purpose, but the cells for displaying information must not be overlapped.

At the same time, the FSS of the Russian Federation in letters dated October 28, 2011 No. 14-03-18/15-12956, dated September 30, 2011 No. 14-03-11/15-11575, t 08/05/2011 No. 14-03-11/05-8545 explains that a number of shortcomings in filling out sick leave do not need to be corrected. These include:

- using capital letters rather than block letters;

- entry of records onto the boundaries of cells, and stamps onto cells to reflect information;

- the presence in the description of a doctor’s position of the words “doctor” and “attending physician”;

- spaces between the doctor's initials;

- shortening the name of the medical institution, position and surname of the doctor to the number of cells available in the form and excluding initials;

- use of quotation marks, periods, dashes and commas;

- inaccurate name of the place of work included in the document according to the employee;

- other blots that do not affect the reading of the information.

All other errors can lead to the fact that, from the point of view of the Social Insurance Fund, the sick leave will be filled out incorrectly.