Creation of the document “Transfer of equipment for installation”

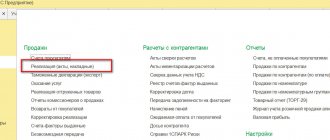

Creating a document – OS menu – Transferring equipment for installation – “Add” .

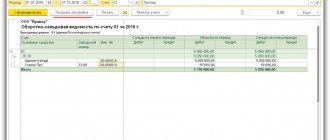

Filling out the header (Fig. 201):

- Line From – OS build date;

- Line Warehouse – warehouse from which fixed assets items are issued;

- The Construction object line is the OS object being collected; to do this, add a new element to the Construction objects ;

- Line Account – the account on which the cost of the collected fixed assets will be formed, as a rule, this is account 08.03 “Construction of fixed assets”;

- Term Cost item – cost item by which the cost of the assembled asset will be formed;

| STEP 2 |

Filling out the equipment table

Equipment tabular section (Fig. 201):

- In the tabular part - OS elements from the Nomenclature : Button "Selection" - elements of non-current assets from the Nomenclature - folder Equipment (OS objects) ;

- Column Quantity – number of elements transferred for assembly;

- Column Accounting account - accounting account, as a rule - 08.04 “Acquisition of fixed assets”;

- “Selection” button – materials used during assembly from the Nomenclature – Materials ;

- Column Quantity – number of elements transferred for assembly;

- Column Accounting account – accounting account, usually 10.01 “Raw materials and materials”.

Rice. 201

| STEP 3 |

Postings for transferring equipment for installation (1s 8.2)

- Postings can be seen by clicking the “Result of document posting” button.

Rice. 202

| Attention | |

|

| STEP 4 |

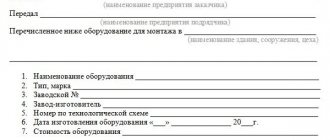

Act OS-15 (filling sample)

The form for the certificate of transfer of equipment for installation is filled out on both sides of the sheet. In the header of the document, general information is filled in, namely: name of the customer organization, structural unit, OKUD and OKPO form, basis for drawing up the document (name), its number and date of completion. Next, fill in the invoice, sub-account, analytical accounting code, date of delivery of the purchased equipment for installation, date of commissioning of the equipment - the actual date and the date determined by the contract. The document number and date of completion are indicated.

The main part contains general information about the acceptance and transfer of equipment for installation:

- Place of filling out the act, code according to OKPO;

- Name of the manufacturer, OKPO code;

- Name of the supplier company, OKPO code;

- Name of the company performing the installation, OKPO code.

The following contains detailed information about where the equipment was transferred for installation - the exact name of the building and the company's workshop. Information about the transferred equipment is presented in detail in a table consisting of eleven columns:

- Name of the equipment that was transferred for installation;

- Serial number assigned to the purchased equipment;

- Passport or marking number;

- Position number according to the technological diagram;

- Type, brand of equipment purchased;

- The date when the equipment arrived at the customer’s warehouse;

- Acceptance certificate number;

- Number of units of received equipment;

- Cost of one piece of equipment;

- The final (total) cost of the equipment that was purchased;

- Notes.

The reverse side of the OS-15 form contains detailed information about what was discovered during the installation of the equipment. In particular, it is necessary to record whether the equipment corresponds to the design specification or drawing. If the equipment does not comply with the declared parameters, then indicate the discrepancy. Note whether the equipment was received with technical documentation, describe in detail the composition of the kit in which the equipment was received.

Form OS-15 also includes information about equipment defects: if any were discovered, they must be listed. The detailed content and description of defects should be recorded in a separate act on identified defects (form OS-16).

In conclusion, the certificate of transfer of equipment for installation OS-15 contains information about the suitability of the equipment for installation. The act is signed by a representative of the customer company, which handed over the equipment for installation, and a representative of the company carrying out the installation, indicating the position held and a transcript of the signature. Also, the OS-15 act (a sample of the filling below) is signed by the financially responsible person, indicating the position and a transcript of the signature - this confirms the fact that the equipment has been accepted for safekeeping. One copy of the act must be given to the financially responsible person. The date the document was completed is indicated.

Below you can download the unified form of the OS-15 act and see an example of how to fill it out.

Form OS-15 (filling sample)

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.Creation of new equipment arrival in 1C 8.2

Creating a document – menu Purchase – Receipt of goods and services – button “Add” – transaction type Purchase, commission .

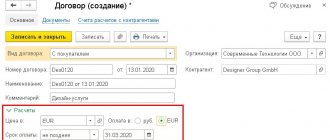

Services tab (Fig. 204):

| Attention | |

| All inventory items that have a tangible form, incl. and materials should be reflected on the Products . If services and works are required, they must be entered on the Services tab. If you have containers, you need to capitalize them on the Containers tab. |

- "Add" button ;

- In the tabular part - nomenclature items (service) and quantity, price, VAT rate, VAT amount ;

- The choice of service name is usually made from the Services . We recommend creating two subgroups in this group: Own and Third-Party; Line Cost account (AC) – account 08.03 “Construction of fixed assets”: Subconto 1 – fixed asset object to be assembled;

- Subconto 2 – cost item by which the cost of the collected OS will be formed;

- Subconto 3 “Construction methods” – Contract method;

Rice. 204

| STEP 5 |

Main features of accounting

Operating systems that cannot be used without pre-operational installation, assembly, and adjustment must be entered into a synthetic account by the accountant of a manufacturing company separately from other non-current assets. A special account is created for separate accounting. On it, the equipment to be installed is taken into account until it is put into operation. After completing all documentation for installation, commissioning and special wiring, the asset is transferred to fixed assets.

Separate accounting reflects the total amount of costs incurred for the acquisition of equipment, installation, programming, and commissioning. This volume includes:

- cost of equipment and components;

- the price of delivering the asset to the production facility;

- expenses for preparation for installation (construction and other work), installation, commissioning;

- the cost of storing an asset until it is launched.

If a company simultaneously purchases several non-current assets that are subject to installation, accounting allocates the total costs to the items.

If at the end of the reporting period the equipment has not been put into operation, it must be reflected in accounting in accordance with the rules discussed above. Also, accounting data is reflected in current reporting. If you are reporting at the end of the year, line 1190 should be filled out in the balance sheet. The cost of equipment that has not been put into operation is expressed in monetary units and must be summed up with the cost of other non-current assets.

Important:

An accountant can take into account equipment that is subject to installation and commissioning only if there is correct primary documentation, for example, a signed OS-14 act. When the equipment is sent for installation, an OS-15 certificate is drawn up. In accounting, the cost of the fixed asset is transferred to investments in non-current assets. Confirmation of installation costs are accounting certificates and certificates of completed work. The first ones are used if the installation is carried out on your own. Certificates of completed work are relevant when a production company cooperates with contractors.

Filling out settlement accounts

Filling out the “ Settlement accounts” :

- Line Settlement account – account 60.01 “Settlements with suppliers and contractors”;

- Line Advances account – account 60.02 “Settlements for advances issued.”

Filling out the " Advanced" :

- Line Input number and Input date – number and date of the supplier’s invoice;

- "Pass" button .

| STEP 6 |

Registration of incoming invoice

Registering a supplier invoice (Fig. 205)

- Enter via the link Enter an invoice at the bottom of the document Receipt of goods and services ; Reflect VAT deduction checkbox is not set by the organization applying the simplified tax system.

Rice. 205

| STEP 7 |

Receipt of equipment

For the received equipment, fill out the document Receipt (act, invoice, UPD) operation type Equipment in the Purchases .

In the document on the Equipment , indicate all components from the supplier document. In our example, the equipment is listed as one item despite the fact that it requires assembly.

The accounting account is entered automatically if the item type is Equipment for installation .

At the bottom of the document, register the invoice or select the UTD radio button if the supplier provided one. VAT will be deducted in the document Formation of purchase ledger entries.

Clarified when to deduct VAT on equipment requiring installation

If the components arrived in several batches, arrange each one in the same way.

Postings

Checking the initial cost of equipment

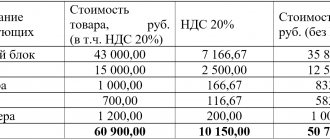

In our example, the initial cost of the OS is formed from the cost of elements and materials used for assembly and the cost of assembly services.

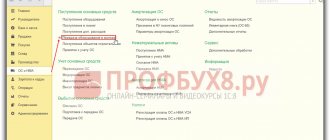

Checking the correct formation of the value of the assembled fixed asset - menu Reports - Balance sheet for account 08.03 “Construction of fixed assets” (Fig. 207):

- Line Period – indicate the period;

- Line Account – in the example – 08.03;

- Button “Generate report ”.

Rice. 207

Checking the calculation of the initial cost of the fixed asset Server No. 1 :

- The cost of assembled OS elements and materials is 62,180 rubles. (see postings in the document Transfer of equipment for installation) ;

- The cost of assembly services is RUB 3,540. (see transactions under the document Receipt of goods and services) ;

- Initial cost of the assembled OS Server No. 1 :

- 62,180 + 3,540 = 65,720 rubles

Exactly the amount is 65,720 rubles. reflected in the debit of account 08.03 “Construction of fixed assets” OS Server No. 1 .

The cost of the OS was calculated correctly.

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Account 07 Equipment for installation

Account 07 “Equipment for installation” is intended to summarize information on the availability and movement of technological, energy and production equipment (including equipment for workshops, pilot plants and laboratories) that require installation and are intended for installation in facilities under construction (reconstruction). This account is used by property developers.

Equipment that requires installation also includes equipment that is put into operation only after its parts have been assembled and attached to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment. This equipment includes control and measuring equipment or other devices intended for installation as part of the installed equipment.

Account 07 “Equipment for installation” does not take into account equipment that does not require installation: vehicles, free-standing machines, construction mechanisms, agricultural machines, production tools, measuring and other instruments, production equipment, etc.

Costs for the purchase of equipment that does not require installation are reflected directly in account 08 “Investments in non-current assets” as they are received at the warehouse or other storage location.

Equipment for installation is accepted for accounting as a debit to account 07 “Equipment for installation” at the actual cost of acquisition, which consists of the cost at acquisition prices and expenses for the acquisition and delivery of these assets to the organization’s warehouses.

The purchase of equipment for a fee from other organizations and persons is reflected in the debit of account 07 “Equipment for installation” in correspondence with account 60 “Settlements with suppliers and contractors” or others.

Acceptance for accounting of equipment contributed by the founders on account of their contributions to the authorized (share) capital of the organization is reflected in the debit of account 07 “Equipment for installation” and the credit of account 75 “Settlements with founders”.

The receipt of equipment for installation can be reflected using account 15 “Procurement and acquisition of material assets” or without using it in a manner similar to the procedure for accounting for relevant operations with materials.

The cost of equipment handed over for installation is written off from account 07 “Equipment for installation” to the debit of account 08 “Investments in non-current assets”. At the same time, the contractor accepts equipment delivered to the construction site that requires installation for off-balance sheet accounting under account 005 “Equipment accepted for installation.” The contractor removes the cost of this equipment or its parts handed over for installation from off-balance sheet accounting in account 005 “Equipment accepted for installation.” The cost of equipment transferred to a contractor, the installation and installation of which at a permanent place of operation has not actually begun, is not deregistered from the developer’s register.

When selling, writing off, transferring free of charge or other equipment for installation, its cost is written off to the debit of account 91 “Other income and expenses.”

Analytical accounting for account 07 “Equipment for installation” is carried out by equipment storage locations and individual items (types, brands, etc.).