Depreciation of fixed assets 2020-2021 in BU and NU: similarities and differences

In both types of accounting (both BU and NU), the cost of fixed assets is transferred to costs by calculating depreciation. The methods of this calculation and the procedure for their application are established by:

- for BU - clauses 18, 19 of PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n;

- for NU - clause 1 of Art. 259, art. 259.1, 259.2 Tax Code of the Russian Federation.

There are similarities in the calculation of depreciation between BU and NU in the following points:

- inclusion of the cost of fixed assets in expenses begins with the month following the month of commissioning, and stops with the month following the month of repayment of all this cost or the month of disposal;

- write-offs over the useful life, as a rule, are not suspended;

- the rules for applying one of the cost write-off methods are the same - linear;

- changes in the cost of fixed assets occur during reconstruction (or other similar processes: modernization, completion, partial liquidation);

- it is possible to revise the useful life if the technical characteristics of the operating system are improved due to reconstruction (or other similar processes).

For all other positions, discrepancies either exist or are allowed:

- There are different lists of fixed assets that are not subject to depreciation;

- the limit for inclusion in the OS is set in different amounts;

- The initial cost of the OS can be estimated differently;

- different estimates of useful life are possible;

- neither the number of cost write-off methods available for use during the useful life, nor the algorithms for calculating the monthly write-off amount for these methods (except for linear);

- the possibilities of applying the same method to a group of fixed assets, changing the method and using coefficients for the depreciation rate are assessed differently;

- the approach to accounting for revaluation results differs;

- In NU it is possible to write off part of the cost of the operating system at a time.

For more information about the comparison of depreciation rules in force in accounting and financial accounting, read the material “Rules for calculating depreciation of non-current assets.”

It is this opportunity to write off part of the cost as expenses to NU at a time and received the unofficial name of the depreciation bonus. There is no such option at BU.

This award is distinguished by the following characteristics (clause 9 of Article 258 of the Tax Code of the Russian Federation):

- applicability both to the cost of the operating systems themselves and to the costs of their reconstruction (or other similar processes);

- impossibility of application to intangible assets and to assets received free of charge (including as a contribution to the management company);

- the need to recognize in the month the start of depreciation or changes in the cost of the reconstructed fixed assets (clause 3 of Article 272 of the Tax Code of the Russian Federation);

- limited write-off amount: no more than 10% - for OS 1–2 and 8–10 groups;

- no more than 30% - for OS groups 3–7;

We calculate the maximum value

Please note that the amount of depreciation bonus on fixed assets that you can count on has its own limit. It is established by law. The main factor in this case is the depreciation group of the fixed asset, for which the premium must be calculated. To successfully complete this stage, just look at our sign.

| Maximum bonus | Group for depreciation | Basis for calculation |

| 10 percent | 1 – 2, 8 – 10 | General: 1) initial cost of the OS (exception - if received for free); 2) costs for completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation. |

| 30 percent | 3 – 7 |

Establishing a depreciation premium in tax accounting

The use of a bonus such as depreciation is not necessary for the profit tax payer. Therefore, the decision on its application must be included in the accounting policy for NU (letter of the Ministry of Finance of Russia dated September 23, 2008 No. 03-03-06/1/539). But such a decision alone will not be enough, since it is also necessary to establish a number of parameters essential for calculating the bonus (letter of the Ministry of Finance of Russia dated 05/06/2009 No. 03-03-06/2/94). These options include:

- The size of a specific share of the cost of fixed assets or the cost of reconstruction (or other similar processes), established in a value not exceeding the maximum allowable premium limit for a certain group of fixed assets (letter of the Ministry of Finance of Russia dated October 30, 2014 No. 03-03-06/1/55106 ).

- The range of objects to which the bonus calculation procedure will be applied. These can be all fixed assets, or individual groups of them, or, for example, objects that have a certain value (letter from the Ministry of Finance of Russia dated November 17, 2006 No. 03-03-04/1/779 and the Federal Tax Service of Russia in Moscow dated August 13, 2012 No. 16 -15/ [email protected] ).

If the accrual of a depreciation bonus is not provided for by the accounting policy or the parameters influencing the procedure for its calculation are not established, then the application of the bonus may be considered unjustified by the tax authority.

On the basis of which documents and in which sections the accounting policy is developed, read the article “Drawing up a regulation on the accounting policy in the organization.”

Controversial issues

When transferring property on lease, the right to calculate the depreciation allowance is ambiguous, since the transferred asset is already taken into account by the organization as an asset transferred for temporary use.

The Ministry of Finance of Russia, in clarifications No. 03-03-06/1/543 (March 2008) and No. 03-03-06/1/192, is of the opinion that the assets that were transferred cannot be considered fixed assets, since they are not used in the production process.

When applying bonus depreciation in the field of taxation and accounting, additional difficulties arise. Its advantages include the opportunity to get a significant quick profit tax benefit when purchasing expensive equipment. If the organization does not plan to sell assets in the near future, this opportunity should not be neglected.

The most significant indicator of business performance is profit from sales. But there are other indicators that help assess the success of an existing business: labor productivity and profitability. Read our materials on how to calculate these indicators.

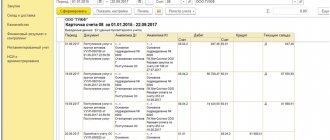

We reflect the application of the bonus in the 1C program

In the 1C program, the parameters necessary for calculating the premium are reflected immediately at the moment the OS is registered. This is done in the document “Acceptance for accounting of fixed assets” using the “Tax accounting” tab.

The following should be reflected here for the premium in comparison with the data usually indicated in the depreciation section:

- the amount of the premium percentage corresponding to the established accounting policy for the group to which the fixed asset is assigned;

- cost account and name of the cost item to which the bonus will be linked in the NU analytics.

The amount of the accrued premium will be included in the volume of indirect expenses of the reporting period in which depreciation began or the cost of fixed assets was changed after reconstruction (clause 9 of Article 258 and clause 3 of Article 272 of the Tax Code of the Russian Federation).

Bonus depreciation and accounting policies

We draw your attention to the fact that the use of bonus depreciation is a right and not an obligation of the taxpayer. Therefore, an Organization that has decided to take advantage of the depreciation bonus needs to consolidate its choice in its accounting policy for tax purposes (paragraph 5 of Article 313 of the Tax Code of the Russian Federation).

Otherwise, the tax authorities may exclude the amount of depreciation bonus from tax expenses (see Letter of the Ministry of Finance of Russia dated September 23, 2008 N 03-03-06/1/539).

In addition, we draw your attention to the fact that the legislation establishes only the maximum amount of the depreciation bonus - no more than 10 or 30% of the original cost of the fixed asset, depending on which depreciation group it belongs to. This means that the company has the right to charge a depreciation premium in smaller amounts within the limits provided for in paragraph 9 of Art. 258 Tax Code of the Russian Federation.

Therefore, the exact amount of the bonus should be fixed in the Accounting Policy for tax purposes.

At the same time, the Organization is not obliged to justify the chosen amount of the bonus.

Thus, the following conclusions can be drawn:

- Whether or not to take advantage of the depreciation bonus is the right of the taxpayer.

- If the Organization decides to use a depreciation bonus, then (in order to avoid disagreements with the tax authorities) the Organization should consolidate its choice and the exact amount of the depreciation bonus in its accounting policies for tax purposes.

A bonus was applied: how to calculate and how to write off its amount

The amount of the bonus is determined simply: as a share of the cost of the OS being put into operation or as a share of the costs of reconstruction (or other similar processes). It is calculated per month:

- the beginning of depreciation calculation - for the OS put into operation for the first time (i.e. in the first month following the month of commissioning);

- changes in the cost of fixed assets based on the results of reconstruction (or other similar processes), i.e. in the month of drawing up a document recording the fact of completion of reconstruction work (letter of the Ministry of Finance of Russia dated August 20, 2014 No. 03-03-06/1/41628).

At the same time, the OS itself:

- It is included in the depreciation group intended for it, but at the book value reduced by the amount of the depreciation bonus - in the 1st case.

- Remains in the same depreciation group (clause 1 of Article 258 of the Tax Code of the Russian Federation), but at a cost increased due to reconstruction costs, from which the amount of the depreciation bonus is subtracted - in the 2nd case. In this case, the service life can be revised, but only within the limits valid for the group to which the OS belongs. However, it is impossible to change the depreciation rate when revising the term (letter of the Ministry of Finance of Russia dated February 11, 2014 No. 03-03-06/1/5446).

Simultaneously with the accrual of the depreciation bonus, in the same month, ordinary planned depreciation is accrued according to the method and algorithm established for it by the accounting policy, calculating it from the cost of the fixed assets, reduced by the amount of the bonus.

To learn about the rules by which the cost of the same fixed assets will be written off in accounting, read the material “Methods of calculating depreciation in accounting.”

Thus, in BU and NU, when using bonus depreciation, temporary differences arise in the amount of accrued depreciation, due to:

- Overstatement of the total amount of depreciation charges in NU in comparison with the accounting book due to the use of premiums that are not included in the accounting book.

- A discrepancy in the amounts of planned monthly depreciation, which will arise not only when using different methods of calculating it, but even when using the same linear method, since the calculation of monthly amounts in this case will be based on different accounting values of the cost of the fixed assets. Since the accounting value in the accounting system will be less than in the accounting system, the amount of monthly planned depreciation accrued by the linear method in the accounting system will be less than in the accounting account.

Due to the depreciation bonus, the total amount of depreciation determined in the accounting book for the month in which the cost of fixed assets began to be written off will be greater than the similar amount calculated in the accounting system, i.e., a deferred tax liability (DTL) will arise, which will be reflected in the accounting system by posting (clauses 12, 15 PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n):

Dt 68 Kt 77.

ATTENTION! Since 2022, PBU 18/02 has been applied in a new edition. Read about the application of the new rules here.

In subsequent months, this difference will be leveled by taking into account in expenses different amounts of depreciation accrued in accounting and accounting records. Accordingly, there will be a decrease in the amount of IT recorded in the first month:

Dt 77 Kt 68.

Check whether you have correctly calculated the depreciation bonus and taken it into account in accounting and accounting records, taking into account the innovations in PBU 18/02, with the help of advice from ConsultantPlus experts. Get free trial access to K+ and proceed to the calculation example.

Prize amount

The amount of depreciation charges with the bonus indicator will differ depending on the depreciation method used by the enterprise.

How to correctly calculate the depreciation bonus? In what period should it be reflected in expenses? How to calculate the residual value when selling a fixed asset to which a premium was applied? In what cases is a taxpayer obliged to restore bonus depreciation? View answer

Linear method

The mechanism for calculating indicators using the linear method will be considered using an example with the condition of using a tool for one-time attribution of depreciation-type premiums to expenses. Initial data:

- in January 2022, the company purchased new equipment at an initial cost of 525,500 rubles (excluding VAT);

- the equipment was launched immediately after purchase;

- the asset is classified in the fifth depreciation group;

- service life is limited to 108 months;

- According to accounting policies, 30% of the premium is allowed to be written off at a time.

The depreciation bonus is equal to 157,650 rubles (525,500*30%).

The monthly rate of accrued depreciation is 0.0093% (1/108*100%).

Every month depreciation will be charged in the amount of 3,421 rubles ((525,500-157,650)*0.0093).

Accrued depreciation for equipment began to be included in expenses monthly from February 2022. In the February period, costs included an amount equal to the sum of the premium and monthly depreciation (161,071 rubles).

Nonlinear method

With a nonlinear method with similar initial data, calculations will be reduced to determining the following indicators:

- The depreciation bonus is calculated in the amount of 157,650 rubles (525,500*30%).

- The monthly depreciation rate is applied at a rate of 2.7%. This value is established for the entire 5th group of fixed assets in Art. 259.2 clause 5 of the Tax Code of the Russian Federation.

Each month the depreciation amount will be different:

- in February it is equal to 9,932 rubles ((525,500-157,650)*2.7%);

- in March it is equal to 9,664 rubles ((525,500-157,650-9,932)*2.7%);

- in April it is equal to 9,403 rubles ((525,500-157,650-9,932-9,664)*2.7%).

In February, accounting may include in expense items an amount equal to 167,582 rubles (157,650+9,932).

Restoring the premium when selling OS: postings

Restoration of a premium associated with the fact of the sale of an asset before the expiration of 5 years from its commissioning to a person identified as an interdependent person requires reflection of its full amount as part of non-operating income for tax purposes in the period in which the sale was made (clause 9 of article 258 of the Tax Code RF). The fact that at the time of sale the tax value of the fixed assets may already be completely transferred to expenses will not matter.

At the same time, the residual value of the fixed assets involved in the formation of the financial result from the sale will need to be increased by the amount of the restored premium (subclause 1, clause 1, article 268 of the Tax Code of the Russian Federation).

Thus, when selling fixed assets under conditions obliging the restoration of the premium, the result from its sale in the NU will be determined not by the usual formula for such a situation (as the difference between the income from the sale and the residual value of the fixed assets), but by summing up the income from the sale with the amount of the restored premium and a subsequent reduction of this amount by the residual value of the fixed asset, increased by the amount of the restored premium.

If the financial result from the sale, calculated using this formula, turns out to be negative (i.e. a loss is incurred), it will have to be taken into account in the usual manner for such a result: writing off in equal parts over the remaining useful life (clause 3 of Article 268 of the Tax Code RF).

In BU there will be no such additional income, nor an increase in the residual value of the fixed assets. Therefore, again there will be differences in the BU. This time constants, which will be reflected by transactions of the opposite direction on the same accounts for the same amount:

Dt 99 Kt 68 - for income equal to the amount of the restored premium;

Dt 68 Kt 99 - according to the amount of increase in the residual value of fixed assets.

In order for the restoration of the premium to be reflected in the 1C program, when entering data into the document “Transfer of OS” in it, on the “Additional” tab, you must make a note about the need to restore the premium.

Recovery

According to the law, the depreciation bonus will have to be restored if it was applied to property that is sold to interdependent parties to the transaction. The criterion for identifying objects for which this norm is mandatory is the length of time these assets are on the enterprise’s balance sheet. It cannot be more than 5 years old.

When the premium is restored, the tax base for calculating the income tax payment increases. The increase occurs in the month in which, according to accounting, the sale of a fixed asset was carried out. The restored amount must be included in non-operating income.

NOTE! An exception that does not allow the restoration of the premium to be initiated concerns situations where an asset is removed from the list of fixed assets not due to sale, but due to a fire or flood.

Certain situations arising from bonus depreciation

Questions regarding bonus depreciation may arise in the following cases, for example:

- Application by the tenant to inseparable improvements to the leased operating system. The Tax Code of the Russian Federation does not contain any restrictions that apply to this type of property. Although the tax authority may have a different opinion. If these improvements, together with the leased asset, are transferred free of charge to the lessor, then no sale occurs, and there is no need to restore the premium.

- Purchase of a used asset, to which the previous owner applied a depreciation bonus. Nothing prevents the new owner from applying a similar bonus (letter of the Ministry of Finance of Russia dated August 15, 2016 No. 03-03-06/1/47688).

- Carrying out reconstruction (or other similar processes) for a fully depreciated OS. The write-off of the cost (which has ceased to be zero) will resume according to the norms that were in effect when the original cost of the fixed assets was written off. At the same time, it becomes possible to apply a depreciation bonus to reconstruction costs.

ConsultantPlus experts talk in detail about the nuances of using depreciation bonuses in construction. Get trial access to the system and study the material for free.

See also:

- “Depreciation bonus when switching from the simplified tax system to the general regime”;

- “Can the “forgotten” depreciation bonus be added to the account now without clarification?”

Who should be deprived of bonuses?

What fixed assets are not subject to bonus depreciation? There are categories of fixed assets for which the application of a premium would be unlawful. Such objects include: fixed assets received free of charge or in payment for a share in the capital company, identified as a result of inventory (clause 9 of Article 258 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 8, 2012 No. 03-03-06/1/295 (clause 2), dated December 29, 2009 No. 03-03-06/1/829), as well as fixed assets that are not subject to depreciation. For example, fixed assets for which an investment deduction was applied (subclause 9, clause 2, article 256, clause 9, article 258, clause 7, article 286.1 of the Tax Code of the Russian Federation).

Results

The rules for calculating depreciation of fixed assets in accounting and financial accounting are such that they can lead to differences in the results of this process. One of the points that determines these differences is the possibility of using in the accounting system a one-time write-off of part of the cost of fixed assets (depreciation bonus), which is absent in the accounting system. The Tax Code of the Russian Federation establishes a number of mandatory rules for the use of bonus depreciation, allowing the taxpayer to detail some of them independently. The use of premiums in NU leads to differences between BU and NU. Under certain conditions, the premium amount is subject to restoration.

Sources:

- Tax Code of the Russian Federation

- PBU 6/01, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 N 26n

- PBU 18/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 N 114n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection in accounting

The concept of bonus depreciation is applicable only when accounting for taxes. In accounting, such write-off of costs is not provided.

This means that the difference that arose when applying the Accounting Appendix 18/02 will need to be correctly taken into account and displayed.

PBU 6/01 requires registration at the original cost of all assets of the enterprise, if we consider paragraphs 7 and 8. From the month following the month of registration of the object, depreciation is charged on it, depending on the useful life. Depreciation expenses include deductions for depreciation and the depreciation bonus itself.

They cause discrepancies between the amounts in accounting and tax documents. And this difference also requires careful consideration.

The resulting discrepancy consists of a temporary difference subject to taxation and a deferred tax liability. In the process of depreciation, these amounts will decrease, since the monthly deductions calculated by the accounting department are greater than the same write-offs in tax accounting.

To reflect the operations of registering an object, applying benefits and subsequent depreciation charges, the following accounting entries will be used:

- Dt 01–Kt 08 – registration of property at original cost;

- Dt 20–Kt 02 – monthly deductions for depreciation according to accounting documents;

- Dt 68 – Kt 77 – deferred tax liability, calculated as the difference between tax and accounting depreciation expenses, taking into account 20 percent income tax.

When the entire cost of an object put on record is paid, the resulting temporary difference will be equal to the depreciation bonus taken into account initially.

The Ministry of Finance of the Russian Federation warns that depreciation benefits should not be accrued on contributions to the authorized capital received by the company in property form.

Such assets are classified as acquired free of charge, without the cost of its purchase.

This is justified by letters No. 03-03-06/1/295, No. 03-03-06/2/122, No. 03-03-06/1/452 and No. 03-03-04/1/349 dated June 2012 and 2009, May and April 2006, respectively. The arbitration court is of the same opinion.