The procedure for providing borrowed funds from an organization

When drawing up a loan agreement, the following points should be taken into account:

- If the founder of the company is not the only one, the consent of the co-founders should be obtained. The consent is documented in the minutes of the board of founders. This document states that the council does not object to issuing an interest-free loan to the person and indicates the essential points of the agreement. These are items such as amount, repayment terms, lack of interest.

- After obtaining the consent of the remaining owners, an agreement is drawn up. Since one of the parties to the agreement is a legal entity, the document is drawn up in writing. The contract must indicate that the loan is interest-free. From September 1, 2018 Art. 208 of the Civil Code of the Russian Federation states that if the agreement does not indicate the interest-free nature of the loan, then the key rate of the Central Bank, which is valid during the relevant periods of the loan, is applied to the loan amount. The agreement is signed by the head of the enterprise and the borrower. If the manager and the borrower are the same person, the contract is additionally endorsed by another responsible person. As a rule, the chief accountant.

- Based on the agreement, money is issued through a cash desk or bank.

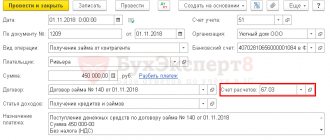

How to apply for an interest-bearing loan?

Features of issuance from the cash register

The issuance of a loan through the cash desk of an enterprise is regulated by the procedure for conducting cash transactions, which is established by the Central Bank of the Russian Federation. A significant limitation will be the limit on cash transactions within one agreement. Today it is 100,000 rubles. This means that the maximum loan amount under one agreement cannot exceed 100,000 rubles in cash.

When issuing a loan through the cash register, an expense cash order is issued indicating the basis for the disbursement of funds (loan agreement), and the order must be recorded in the cash book.

Cash register equipment is not used when issuing and returning a loan to the cash desk, since this operation is not a sale or provision of services.

The return is issued by a cash receipt order.

Accounting entries

Depending on the term, loans are divided into short-term (up to 1 year) and long-term (over one year).

Depending on the type of loan and the source of its issuance, the following entries will be made in accounting:

- Dt 66 Kt 50 – issuance of a short-term loan from the cash register.

- Dt 67 Kt 50 – issuance of long-term loans from the cash register.

- Dt 66 Kt 51 - issuing short-term loans through a bank.

- Dt 67 Kt 51 – issuance of long-term loans through a bank.

How to write off an issued loan?

A loan to the founder can be written off in two cases:

- In case of full repayment.

- In case of registration of a debt forgiveness procedure.

Refund

In accordance with the concluded agreement, the founder can repay the interest-free loan either in full or in part, on time or ahead of schedule, as well as on a deferred date by agreement of the parties.

Depending on the method of return, amounts are reflected in accounting entries:

- Dt 50 Kt 66, 67 – return in cash to the cash desk of a short-term or long-term loan.

- Dt 51 Kt 66, 67 – repayment of a short-term or long-term loan through a credit institution.

Debt forgiveness

Any person can forgive a debt to another person, either completely or partially. From a legal point of view, this is an ordinary transaction. Debt forgiveness is regulated by Art. 415 of the Civil Code of the Russian Federation. The law does not impose any special requirements for the loan forgiveness procedure on the founder.

As a general rule, a debt can be forgiven if this fact does not violate the rights of other persons in relation to the lender's property.

According to the Civil Code of the Russian Federation, the debt is considered forgiven from the moment the borrower receives notice of the debt being written off. The debtor may object to the forgiveness of the debt within a reasonable time.

The fact of forgiveness from the date of receipt of the notice is reflected in paragraph 2 of Art. 415 of the Civil Code of the Russian Federation, this clause was introduced relatively recently. Before the advent of this norm, the parties formalized the forgiveness procedure in other ways.

- Drawing up a gift agreement.

- Concluding a debt forgiveness agreement. Often, participants in borrowing relationships consider unilateral notification insufficient and enter into a bilateral agreement. This is not prohibited by law, but it would be redundant. In addition, on the basis of this agreement, in any case, it will be necessary to send the debtor a notice of debt forgiveness.

Regardless of the method of writing off the debt to the founder, the latter receives a material benefit, with which it is necessary to pay personal income tax at a rate of 13%.

The forgiven debt cannot be expensed and therefore reduce the taxable base. This type of cost is not reflected in Art. 346.16 Tax Code. The amount of forgiven debt is included in profit, that is, it is a direct loss for the enterprise.

In what cases can a loan agreement be written off by a company?

As a general rule, a company can write off the funds due to it under a loan agreement if the existing debt has become classified as bad.

When can a debt be considered bad?

As follows from paragraph 2 of Art. 266 of the Tax Code of the Russian Federation, this is possible when any of the following circumstances occur:

- The statute of limitations on the contract has expired. In this case, the company must remember that if, after 3 years (clause 1 of Article 196 of the Civil Code of the Russian Federation) from the moment the debt was formed, the loan has not been repaid, the company has the right to write it off. But only if the company has not sued the debtor over the past 3 years.

Attention! If the debtor company acknowledges by its actions that it must pay the amount of the debt under the contract, the statute of limitations will be interrupted and will have to be counted again.

For more information on writing off overdue debt, see the article “How to write off bad debt with an expired statute of limitations.”

- The company that borrowed the money was liquidated. At the same time, the company should understand that the legality of writing off the loan agreement is best confirmed by an extract from the Unified State Register of Legal Entities on the liquidation of the debtor. Tax authorities may refuse to consider a debt uncollectible until the company provides confirmation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

- The debt obligation was terminated under the Civil Code of the Russian Federation due to the fact that it is no longer possible to fulfill it (for example, if the debtor, an individual, died).

- The bailiff announced the end of enforcement proceedings due to the fact that either the debtor could not be found, or he did not have property that could be recovered to pay off the debt under the loan agreement.

EXPLANATIONS from ConsultantPlus: How to reflect in the accounting of an organization that is on the general taxation system and uses the accrual method, the write-off of the borrower's debt under an interest-free loan agreement in connection with the recognition of this debt as bad (the bailiff issued a decision to complete the enforcement proceedings and return the writ of execution to the creditor due to the impossibility of debt collection)? Read the detailed answer to this question in the material from K+, get a trial demo access for free.

Tax consequences

Since 2016, the legislator has considered receiving an interest-free loan an economic benefit. This benefit is determined in the amount of the Central Bank key rate in force during the settlement period. This period is considered to be a month.

In practice, this means that the borrower must pay monthly personal income tax in the amount of 35% of the loan amount, indexed by 2/3 of the Central Bank key rate.

Taxation example

For example, the founder took out an interest-free loan in the amount of 100,000 rubles on 1.01. 2022.

In January 2022, 7.75%.

100,000*7.75%*2/3*35%= 1,806 rubles. The borrower will have to pay this amount of personal income tax.

If the borrower is not a resident of the Russian Federation, the tax rate will be 30%.

Personal income tax is not levied if the loan was received for the purpose of purchasing or constructing housing, purchasing a room, a house, a plot of land for building a house, etc. In this case, the borrower must retain the right to a tax deduction. If the debtor has already exercised this right, the tax preference does not apply.

Thus, to apply this benefit, the tax agent should rely on a document confirming property rights to the above-mentioned objects and official confirmation of the right to a tax deduction from the Federal Tax Service.

In this case, the creditor company is a tax agent and is obliged to withhold personal income tax from the founder’s salary (if he is on the company’s staff) or from dividends.

What is considered material benefit?

Since 2022, changes have come into force regarding the recognition of interest-free use of a loan as a material benefit. They are enshrined in Federal Law No. 333-FZ of November 27, 2017, and fix two defining features of material benefit.

If at least one of them is present, then interest-free use of the loan is recognized as a material benefit:

- If the borrower is an employee of a business entity or is in another interdependent relationship (founder);

- If the borrower's failure to pay interest is financial assistance or satisfaction of the lender's obligations to the borrower (including for goods supplied, work performed or services rendered).

These rules also apply to loan agreements concluded before 1-1/2018 (letter of the Ministry of Finance dated 06/26/2018 No. 03-04-07/43786).

How to minimize tax expenses?

The monthly obligation of the borrower to pay tax on material benefits when using an interest-free loan is clearly stated in the law.

It is possible to minimize tax expenses by taking out a loan at minimal interest - slightly above 2/3 of the Central Bank key rate.

In this case, the company pays tax as for non-operating income. These incomes are subject to income tax, the base rate of which is lower - 20% versus 35 personal income tax. In addition, the interest-bearing loan agreement can be extended, making it indefinite.

Taking out an interest-free loan has very conditional benefits, which are offset by the tax burden or even lead to a minus.

Reporting when paying personal income tax on material benefits

Information about the material benefit received and the tax on it should be reflected in the declarations:

- 2NDFL (this type of material benefit is indicated under code 2610)

- Calculated according to form 6-NDFL.

Sometimes the tax agent does not have the ability to withhold money to pay taxes. This can happen if the borrower does not have an employment relationship with the company and does not receive dividends.

In this case, in addition to standard reporting for 2NDFL, it is necessary to inform the Federal Tax Service before March 1 of the year following the reporting year about the inability to pay the calculated tax.

This can be done by providing 2NDFL with sign “2”, and be sure to send this certificate to the debtor himself.

Nuances of writing off loan debt in tax accounting

For tax purposes, regulatory authorities may impose some additional requirements:

- In particular, the company needs to be prepared for the fact that the very right to write off the loan will need to be defended in court. In sub. 2 p. 2 art. 265 of the Tax Code of the Russian Federation, the legislator established that a company can include in tax expenses bad debts that could not be covered by the previously created reserve for doubtful debts. At the same time, as stated in paragraph 1 of Art. 266 of the Tax Code of the Russian Federation, such a reserve can be formed in relation to overdue payments under contracts for the sale of goods, works, and services. And the issuance of a loan by a company (not a bank) is neither the sale of goods nor the provision of services (letter of the Ministry of Finance of Russia dated May 10, 2011 No. 03-01-15/3-51). Consequently, regulatory authorities may consider that the right to write off overdue debts under sub. 2 p. 2 art. 265 of the Tax Code of the Russian Federation applies only to late payments for goods and services and does not apply to the issuance of loans. That is, taking into account a written-off loan when calculating income tax may lead to a dispute with the tax authorities.

- In addition, it often happens that organizations have mutual obligations to each other. And the regulatory authorities believe that it is unlawful to write off a loan if there is a counter debt that can be offset against the debt (letter of the Ministry of Finance of Russia dated October 4, 2011 No. 03-03-06/1/620). At the same time, as the Supreme Arbitration Court of the Russian Federation indicated in the Presidium Resolution No. 13598/12 dated March 19, 2013, offset is a right, not an obligation. In this regard, it seems that even if there is a counter-debt, the amount of the loan being written off can be attributed to expenses, but again with the risk of a dispute with the inspectors.

In order to justify an increase in tax expenses by the amount of the loan written off, the following actions must be performed:

- carry out an inventory of the debt under the loan agreement, based on the results of which draw up a corresponding act;

- write off the loan agreement by order of the manager.

In addition, a situation may arise that it will be necessary to write off a loan that was not returned to the lender by the company itself.

For the nuances of such a write-off, see the article “Writing off accounts payable with an expired statute of limitations.”