Loans are a popular means of financing in a group of companies, both to cover short-term cash gaps and to implement long-term projects. In order not to face claims from tax authorities, a choice is often made in favor of interest-free loans. But are interest-free loans as harmless as it seems at first glance?

TaxCOACH experts analyzed claims from fiscal authorities that arise when issuing (receiving) exclusively interest-free loans. And not only in the group of companies, but in general, in relation to any possible options.

For analysis, we took all court cases on tax disputes that reached the cassation court from the beginning of 2022 to March 2020, in which the words “interest-free loan” were heard in any way.

The results turned out to be very interesting. Let's try to trace why and when business entities use interest-free loans, and in what manner the tax authorities react to them.

Cases in which relations involving gratuitous borrowing were considered can be divided into several categories.

Unjustified tax benefit cases

Almost half of the cases concern unjustified tax benefits associated with the illegal receipt of VAT deductions (refunds) for transactions with “one-day companies.”

Interest-free loans in such disputes are the basis for tax authorities to make conclusions about:

1. The transit nature of the movement of funds. That is, the person who performed the services is only a nominal person who organizes formal document flow with the taxpayer.

2. Withdrawal of funds from the business. This conclusion is related to the previous and subsequent ones. In most cases, tax authorities pay attention to the lack of return of funds as evidence of the withdrawal of funds to third parties or interdependent entities. In addition, the non-repayment of the loan is assessed as an integral attribute of a “fly-by-night” loan.

3. Interdependencies of the parties to the transaction. It is obvious that the transfer of funds free of charge (without interest) has no economic purpose for the creditor; accordingly, such relations are not typical for independent entities.

4. Bad faith of the counterparty. The presence of facts of issuing interest-free loans is, in the eyes of the tax authorities, one of the general characteristics of the bad faith of the counterparty.

In many ways, these findings are intertwined with each other and used together. And the very presence of interest-free loans, especially those not repaid at the time of the audit, is assessed by the tax authorities as a sign of suspicion of the counterparty, other transactions with which require attention.

Taxation of participants in a transaction

Every company accountant should know how to properly arrange an interest-free loan between legal entities. Taxes are paid exclusively by the party that has received material benefits from this process.

A company that lends money without interest makes no profit, so it has no tax consequences.

The borrower benefits from the absence of interest, so the benefit is calculated based on the refinance rate, after which it is added to the income tax base.

According to Art. 25 of the Tax Code of the Russian Federation, many companies try to prove through the courts that there is no need to pay taxes. To do this, they turn to the arbitration court. In judicial practice, there are indeed cases when the court satisfied the plaintiffs’ demands, due to which the borrowers were exempt from paying taxes, but in most cases, representatives of the Federal Tax Service proved that the company had a material benefit.

Gratuitous loans in cases of artificial division of business

Many of the above methods of using gratuitous loans are found in cases of artificial division of a business and are presented by the tax authority as evidence:

- interdependence of business entities operating as a single business. The MKD management company created an interdependent contractor to take advantage of the specialized VAT benefit. The tax authority established the identity of the companies’ activities, and interest-free financing did not raise any doubts in the court’s mind about the creation of a scheme for artificial fragmentation (Resolution of the Arbitration Court of the Volga-Vyatka District dated March 12, 2019 in case No. A43-47773/2017).

- lack of independence and control of the participants in the loan agreement (Resolution of the Arbitration Court of the Far Eastern District dated February 13, 2019 in case No. A59-5764/2017).

- the presence of a single financial center, which controls the entire group of companies. The proceeds of controlled legal entities were immediately transferred to the beneficiary (IP) in the form of interest-free loans that were not repaid. The courts equated these amounts to the revenue of the individual entrepreneur, and therefore the individual entrepreneur lost the right to apply the simplified tax system. (Decision of the Supreme Court of the Russian Federation dated November 13, 2022 in case No. A27-2411/2016).

In the well-known KFC case (Resolution of the Arbitration Court of the North Caucasus District dated 02/26/2020 in case No. A32-50460/2017; Resolution of the Arbitration Court of the North Caucasus District dated 02/05/2020 in case No. A32-53098/2017) interest-free loans were used as a way financing of interdependent persons, which was perceived by the tax authority as one of the proofs of the non-independent nature of business activities by business entities. In addition, funds received as gratuitous loans were issued with the purpose of “payment for semi-finished products” with subsequent receipts for “return of payment for semi-finished products.” Thus, the company tried to hide gratuitous financing of current activities in a group of companies without achieving a business goal of obtaining economic benefits on the part of the lending organization.

Collection in court

If the borrower does not repay the money under the loan agreement, the lender may go to court with a claim to recover money from the borrower under the loan agreement. When going to court, you need to remember that the law establishes a statute of limitations. Based on Art. 196 of the Civil Code, the general limitation period is 3 years . The agreement of the parties to revise the statute of limitations is invalid (under Article 198 of the Civil Code). But the statute of limitations is not automatically applied by the court.

In this case, the court will accept the statement of claim regardless of whether the statute of limitations has expired or not. One of the parties must apply for the expiration of the statute of limitations, and then the court rejects the claim (under Article 199 of the Civil Code).

The limitation period begins to count from the first day of delay in repaying the loan. Based on Art. 203 of the Civil Code, the limitation period is interrupted after the borrower acknowledges the debt. Such actions could be, for example, partial repayment of debt, the parties concluding an additional agreement to the loan agreement, etc.

If the statute of limitations is missed, the law allows them to be reinstated. The decision to restore the terms is made by the court, taking into account the valid reasons. This is, for example, serious illness, helplessness, illiteracy, etc. Such reasons can be taken into account if they have occurred over the past six months (based on Article 205 of the Civil Code).

If the borrower voluntarily repays the loan amount in full after the statute of limitations has expired, he does not have the right to demand that the loan be returned (based on Article 206 of the Civil Code).

Gratuitous transfer of funds covered by a gratuitous loan agreement

When transferring funds under a loan agreement, whether paid or gratuitous, it is important to understand that this operation must be repayable. Otherwise, it is difficult to disagree with the tax authorities that such a transaction is a gratuitous transfer of property, subject to income for the receiving party.

...The funds received under an interest-free loan agreement were recognized as gratuitously received property, since the taxpayer did not provide any documentary evidence of the existence of borrowed legal relations, and therefore these amounts were subject to inclusion in non-operating income. (Resolution of the Arbitration Court of the Ural District dated February 13, 2019 in case No. A07-30518/2017).

It should be noted that in cases where the tax authority believes that the relationship under the loan agreement is of a formal nature, and therefore the loan agreement covers a gratuitous transfer of property, the facts of the remuneration of the agreement and the return of funds by the time the dispute is considered may play a key role.

Thus, in case No. A76-24391/2018, the court agreed with the taxpayer about the illegality of additional income tax charges on the amount of funds received under the loan agreement. As the court pointed out, it followed from the terms of the agreement that the loan was interest-bearing, and therefore it cannot be recognized as a gratuitous transfer of property.

Is there any material benefit?

Each participant in the transaction must take into account the tax consequences of an interest-free loan between legal entities. The company, which receives money for its use without interest, derives some benefit from this process. Therefore, the company must take into account the profit received when calculating the taxable base for income tax.

An accountant must competently understand how this material benefit is calculated correctly. Since the interest rate is not specified in the agreement, the Central Bank refinancing rate is used in the calculation.

The material benefit is calculated using the formula: material benefit = refinancing rate * 2 / 3 * debt amount / 365 * loan term in days. The resulting value is included in the tax base necessary for calculating income tax. The settlement procedure will be carried out on the day the loan amount is fully repaid to the lender. This does not take into account the method of payment of the debt, so the amount can be paid in installments or in a single payment at the end of the period specified in the contract.

If the tax on the amount received is not paid, the tax inspector may hold the company liable. This risk of interest-free inter-entity lending must be considered by every organization.

Free loan as a way to pay dividends

The next case deserves special attention, since we admire both the resourcefulness of the entrepreneur and the creative approach of the tax authority in identifying the tax evasion scheme.

The court considered a controversial situation in which a member of a group of legal entities received both interest-bearing and interest-free loans from its legal entities. The funds received from loans were periodically partially spent on repaying previously incurred loans. But the total amount of debt gradually grew. A participant in a society would have a kind of pyramid of debts. Your own “MMM” for yourself.

The tax authority, having established that the funds were spent by the founder for his personal needs and were not used in business activities, came to the conclusion that, in fact, the funds received free of charge were his dividends from participation in the group companies.

The court supported the tax authority. (Resolution of the Arbitration Court of the North-Western District dated January 31, 2019 in case No. A26-3394/2018).

Does an interest-free loan count as an economic benefit?

Many have not wondered whether a loan without interest will be considered an economic benefit and whether it is worth paying taxes?

Interest-free loan as an economic benefit: taxation nuances

When studying the specifics of the activities of microfinance companies and other credit structures, you may encounter the question of taxation of loans.

Let's consider how the Tax Code of the Russian Federation regulates this aspect of financial relations.

Profit as a basis for taxation

The main tax that individuals are required to pay is income tax (NDFL). This tax applies to all types of economic activity that bring profit to entities.

Article 41 of the Tax Code of the Russian Federation defines income as an economic benefit in monetary or in-kind form. The main criterion for determining a benefit is its assessment - this is reflected in the chapters of the Tax Code regulating the taxation of income of individuals and organizations.

Is a loan considered income?

The main conditions for granting a loan are repayment and urgency. At the end of the term, the user returns the loan amount to the lender - in most cases, with interest. Therefore, the receipt of borrowed funds cannot be considered a benefit, is not income in the legal sense, and is not subject to taxation.

However, there is a category of loans that are provided without interest. In this case, the fact of non-payment of interest for using a loan is an economic benefit that is taxed.

Moreover, if an individual received an interest-free loan from another individual, such savings are not taxed, in accordance with paragraph 1 of Article 212 of the Tax Code.

Thus, personal income tax is paid exclusively on interest-free loans received from legal entities - interest not paid on such loans, according to Russian law, is considered a type of income.

Procedural points

Credit structures most often offer interest-free loans to clients who first turn to them for financial assistance.

It is important to take into account that, according to Russian legislation, savings on interest is a type of income of an individual on which personal income tax is calculated.

A borrower who has received an interest-free loan is required to pay tax and file a return in the first quarter of the current year.

In order to determine the amount of tax, you need:

- determine the amount of interest saved (for this, 2/3 of the refinanced rate of the Central Bank, which is 6.61% per annum, must be compared with the interest rate specified in the agreement);

- summarize the total benefit - the resulting difference in interest should be multiplied by the term of the loan;

- calculate the amount of tax, which is 35% of the total income.

It is worth paying attention to the fact that for residents of the northern regions and rural areas, payment of personal income tax on income from material benefits received under an interest-free loan is not required.

What is the penalty for non-payment of tax?

Failure to pay tax on income received from an interest-free loan will result in penalties and may result in legal proceedings.

However, the amount of tax levied on interest on even the largest loan is insignificant. For example, when taking out a loan in the amount of 30 thousand rubles for a period of up to 30 days, the profit on saved interest will be 164 rubles 38 kopecks, and the tax amount will be 58 rubles.

The only correct solution would be to pay the tax, thus avoiding problems with the state fiscal system.

So, you only need to pay tax on an interest-free loan, non-payment of interest on which is considered a type of income. The amount of this tax is 35% of the profit received (interest payments saved).

Loans that are issued at interest are not those that bring profit to the entity, therefore they are not subject to personal income tax.

As an advertisement

Lack of business purpose when issuing an interest-free loan

We believe that the following incident, which occurred with a 17-year-old entrepreneur, should be highlighted separately. The tax authority (Resolution of the Arbitration Court of the West Siberian District dated January 18, 2019 in case No. A67-7866/2017) conducted an on-site tax audit of an entrepreneur who received multimillion-dollar loans from some and transferred to other companies. The tax authority assessed additional personal income tax on the funds received, indicating that the loan agreements do not reflect the actual economic meaning of the transaction, are not due to reasonable economic reasons (business purposes), were drawn up for the creation of formal document flow by interdependent persons in order to exclude funds from the taxable income of the individual engaged in making transit payments, including for the purpose of cashing out funds.

The practice of charging taxes on the entire turnover of transit companies as a way to combat cash-out may spread more widely, and may make their use an expensive and pointless pleasure.

Do I have to pay income tax on an interest-free loan?

Essence of the question

As a rule, companies pay interest for using other people's money. This is a company expense. If an interest-free loan is received, the company saves on interest. In this case, she receives free help. And, as you know, you have to pay taxes on everything that is free. If, for example, an interest-free loan is issued to a person, then he will have to pay income tax. It is believed that the citizen received material benefits. And you have to pay tax on it. This is written in the chapter of the Tax Code on personal income tax. But the chapter of the code on income tax says nothing about material benefits. So do you have to pay tax on it?

What the tax authorities say

The position of the tax department is not difficult to guess. Tax officials believe that if a company received an interest-free loan, it saved on interest. Such savings constitute her income. And if there is income, then you have to pay income tax on it. The position of the tax department on this issue was recently voiced by the head of the income tax department of the Ministry of Taxes and Taxes, Karen Ohanyan. He believes that a company that has been issued an interest-free loan receives a property right to use the money. Since she does not pay anything, this means that the right was received free of charge. According to paragraph 8 of Article 250 of the Tax Code, property rights received free of charge relate to non-operating income of the company. You must estimate such income based on market prices. Moreover, information on prices must be documented. Where can you get such data? And what documents can confirm them? The head of the department admits that these issues have not yet been resolved. Perhaps some solution will be proposed in the new Methodological Recommendations on Income Tax. According to our data, these recommendations will appear this year. In the meantime, Karen Iosifovich proposed using the Central Bank refinancing rate when assessing income from interest-free loans.

What independent experts say

But the opinions of independent experts are not so clear. Alexander Potapov, General Director of Consulting LLC (VPK), does not agree with Mr. Oganyan’s opinion: “When a company receives an interest-free loan, it is wrong to talk about material benefits. The concept of “material benefit” is contained only in Article 212 of Chapter 23 “Tax on Personal Income” of the Tax Code. And the provisions of this article cannot be applied when calculating corporate income tax. Tax authorities may argue that in the case of issuing an interest-free loan, a gratuitous provision of a service takes place. In this case, the income of the company that received the loan is assessed according to the rules of Article 40 of the Tax Code, namely: based on market prices for similar services. This is indicated in paragraph 8 of Article 250 of the Tax Code. However, in our opinion, providing a loan is not a service. According to Article 38 of the Tax Code, a service is an activity whose results do not have material expression and are sold and consumed in the process of its implementation. The loan agreement does not provide for the performance of activities as an ongoing process. This agreement implies the commission of a separate action - the transfer of money by the lender into the ownership of the borrower on a repayable basis. This is indicated in Article 807 of the Civil Code. In addition, if the issuance of a loan were considered by the Tax Code as the provision (sale) of a service, then income under the loan agreement (interest) would be classified as income from the sale. However, according to paragraph 6 of Article 250 of the Tax Code, interest on a loan agreement is non-operating income. As you can see, the very name of the income indicates that it is not related to the sale of any services. Thus, issuing a loan is not a service, and interest under such an agreement cannot be considered payment for it. Therefore, Article 40 of the Code cannot be applied to relations under a loan agreement. And therefore, there is no need to pay income tax on interest savings.” He is supported by Sergei Rodchenkov, general director of the audit company: “Yes, indeed, the whole question is whether the loan is a service. Previously, a similar question arose in relation to rent. Perhaps the tax office will be able to prove that issuing an interest-free loan is a service. After all, one of the parties to the agreement (the borrower) receives a benefit from this, while the other (the lender) bears the business risk. In this case, according to Article 250 of the Tax Code, the borrower has non-operating income. Now let's try to calculate this income. Income must be assessed based on market prices, which are determined taking into account the provisions of Article 40 of the Tax Code. In addition, the company must use official sources of information on market prices for goods, works or services and stock quotes. This is indicated in paragraph 11 of Article 40 of the Code. I doubt that such sources of information can be found, given that loans are not bank loans. Different chapters of the Civil Code are devoted to these types of transactions. Therefore, credit data cannot be used for loans. If there are no official sources of information, Article 40 of the Tax Code recommends using the subsequent sales price method and the cost method. But for interest-free loans, these methods are not applicable, since the price of the service is zero, and the costs cannot be determined. Thus, we were unable to calculate income. Perhaps this is why representatives of the Ministry of Taxes and Taxes in their oral presentations, although they recommend determining income on interest-free loans received based on the refinancing rate of the Bank of Russia, do not dare to declare this officially. We believe that until the tax authorities clarify this issue, there is no need to pay income tax when receiving interest-free loans.” But Maxim Maslennikov, an audit lawyer, does not agree with this position: “Property received free of charge (work, services) or property rights is one of the types of non-operating income of a company. This is indicated in paragraph 8 of Article 250 of the Tax Code. The concept of service is contained in paragraph 5 of Article 38 of the Code. According to it, a service for tax purposes is an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity. In our opinion, the provision of a loan fits this definition well, and therefore receiving an interest-free loan in cash should be considered as receiving financial services free of charge. Obviously, when receiving gratuitous services, including an interest-free loan, the company receives economic benefits (income). This follows from Article 41 of the Tax Code. But just because a company has received income does not mean that it must pay tax. First you need to evaluate the economic benefit of the organization. And this is where the main difficulties arise. From the meaning of paragraph 8 of Article 250 and Article 40 of the Tax Code, we can conclude that the economic benefits of an interest-free loan must be assessed based on the current interest rates for similar loans. That is, they must be issued for a similar period, have the same security, etc. This data must be documented. Moreover, you need to use official sources of information. But where to find such information is unclear. Firms that do not want to argue with tax authorities can be advised to use the Central Bank refinancing rate. Although this rate cannot be used to determine the market price of loan services, it is the only official indicator that all firms can use. Other companies may be advised to set minimum interest rates in the loan agreement. In this case, the tax authorities will have to prove the deviation of these percentages from the market ones. And it will be extremely difficult for them to do this.”

How to be

If you received an interest-free loan, your company will save some money. And therefore, you receive economic benefits. Such benefit, according to Article 41 of the Tax Code, is the income of the company. However, you must pay tax on this income only if it can be assessed. And to do this, you need to determine the amount of interest that firms take on similar loans. The company must confirm information about interest with documents. It remains unclear where to get such data. Conduct a survey in other companies? Contact Goskomstat? Most likely, you will not get such information anywhere. You can take the advice of tax officials and apply the Central Bank refinancing rate. However, can it be considered the market price for the use of borrowed money? In our opinion, no. It turns out that there seems to be income, but no one knows how to evaluate it. Therefore, it cannot be taken into account. But if you don't pay the tax, you may have disagreements with the tax office. If you do not want to argue with the tax authorities, then set a minimum interest rate in the loan agreement, for example 1 percent per year. In this case, the tax inspector will have to prove that this is not the market price of the loan. He most likely will not be able to do this.

Material provided by the magazine “Practical Accounting”

Free loan as a way to hide payment for goods

Another category of cases related to the use of interest-free loans is the substitution of payments for goods with loans (Resolution of the Arbitration Court of the North Caucasus District dated October 28, 2019 in case No. A32-35646/2018; Resolution of the Arbitration Court of the North Caucasus District dated April 8. 2019 in case No. A53-34226/2017).

In some cases, taxpayers try to retain the right to use the simplified tax system in this way. When selling a product, “cunning” entrepreneurs do not receive payment for it, thereby reducing revenue. However, the trick quickly turns into stupidity when, instead of paying for the goods, the buyer receives a loan, and an interest-free one at that (even worse if the loan is equal to the cost of the goods delivered). The situation is not helped even by the fact that the loan is issued not by the buyer, but by another company (Decision of the Supreme Court of the Russian Federation dated April 3, 2019 in case No. A03-384/2018).

Obviously, in such a situation, it will not be difficult for the tax authority to prove that the sole purpose of such a loan was the taxpayer’s desire to retain the right to apply a special tax regime (Resolution of the Volga District Arbitration Court dated January 29, 2020 in case No. A12-9362/2018).

In other cases, replacing payment for goods with interest-free loans is used as a way to hide the fact of payment for goods in order to avoid paying VAT. Thus, in case No. A04-9919/2017, the tax authority indicated that transactions between the company and its related parties to provide loans without paying interest were used by the taxpayer in order to hide the actual sale of goods to related parties, to understate revenue and, accordingly, the taxable base for VAT, since the issuance of gratuitous loans is not typical for relationships that would take place between counterparties independent of each other, acting independently and on a strictly entrepreneurial basis (Decision of the Supreme Court of the Russian Federation dated April 12, 2019 in case No. A04-9919/2017).

Another special case is an interest-free loan as a way of concealing the fact of purchasing property from an interdependent person in order to avoid paying property taxes. In one of the cases, a situation was considered when, with the help of a loan, they tried to hide the purchase and sale of cars, for which, instead of payment, the buyer was issued a loan for the same amount (Decision of the Supreme Court of the Russian Federation dated May 27, 2019 in case No. A64-929/2017).

Interest-free loan to an individual

The very concept of “interest-free loan” implies the condition for its provision. That is, the creditor does not receive any benefit and provides funds and property free of charge. In the case of a financial transaction, the borrower must return exactly the amount of money that was provided to him by the lender without additional encumbrance.

Even if the agreement does not include interest rates, the loan was provided free of charge, therefore, no income was received from it - it is necessary to take into account the relationship with the tax authorities. This is especially true for legal entities in the case of a decrease in their own expenses when indicated in declarations.

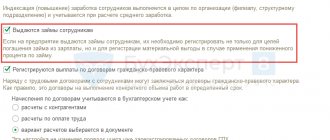

When is an interest-free loan issued?

Let's look at the most common practices:

- provision of an interest-free loan by the founder as assistance to the company;

- providing financial support to company employees;

- sponsoring the initial stages of a business project;

- mutual assistance between organizations on friendly terms;

- providing financial and other assistance to friends and relatives.

In any case, if the amount of funds provided or the value of the property exceeds one thousand rubles, an agreement must be concluded in writing. This insures the lender and leaves him the opportunity to appeal to the courts in the event of a bad situation or non-repayment of funds provided as an interest-free loan.

Since the person providing funds under an interest-free loan does not receive any benefit, the funds can be repaid ahead of schedule, unlike the same loan, where interest is beneficial to the lender.

Next, we will consider tax relations when borrowing, including interest-free loans.

Errors when accounting for amounts under gratuitous loan agreements

There are many cases in which there was a simple mistake by the taxpayer, which led to non-payment of tax. There are many such errors when issuing interest-free loans to individuals by organizations that must withhold personal income tax as a tax agent on material benefits on interest for the use of borrowed funds (Resolution of the Arbitration Court of the Far Eastern District dated October 9, 2019 in case No. A04-3940/2018; Resolution of the Arbitration Court Volga District dated February 28, 2020 in case No. A65-10597/2019).

However, there are also isolated cases with exceptional errors, when it is not entirely clear whether the taxpayer made a mistake or whether he was counting on the inattention of the inspectors.

For example, in case No. A57-4930/2019, the courts came to the conclusion that it was unjustified for the company to reduce the income portion by the amount of returned advances, believing that the advance payments returned by the company are not a return under a supply agreement, but are a return of an interest-free loan under another agreement, which is confirmed letters with the counterparty, interrogation protocol, coincidence of the amounts returned under the supply agreement and under the loan agreement.

Simply put, the taxpayer formalized the return of funds under the loan agreement as a return of the advance payment under the supply agreement, reducing the amount of taxable income. The tax authority noticed the error.

Whether the taxpayer intended to avoid paying taxes, or whether a simple mistake was made, history is silent.

As another case of a tax accounting error, we can cite case No. A63-2828/2018, in which the taxpayer did not write off accounts payable under an interest-free loan agreement issued by a person that was liquidated at the time of the audit.

During the audit, the tax authority came to the conclusion that in this case the taxpayer has non-operating income on which it is necessary to pay income tax.

Accounting entries for interest-free loans

To reflect the entries in accounting, it is necessary to pay attention to the second party to whom the interest-free loan is provided. And so let’s look at which accounts to conduct:

- account 73 – if the borrower is an employee of the enterprise;

- account 76 – if the borrower is a third-party individual;

- account 76 – used when providing an interest-free loan between legal entities;

- account 58 - cannot be used when providing an interest-free loan to another legal entity, since the interest rate is zero and the transaction is not a financial investment.

In the table we put a number of wires that can be used when processing interest-free loan transactions:

| Operation description | Debit | Credit |

| Accounting for transactions with the lender | ||

| Issuing an interest-free loan | 73.1; 76 | 51; 50 |

| Repaying an interest-free loan | 51; 50 | 73.1; 76 |

| Withholding personal income tax from an employee’s material benefit | 70 | 68 subaccount “NDFL” |

| PNO accrued if the transaction is recognized as controlled | 99 | 68 subaccount “Income tax” |

| Accounting for transactions with the borrower | ||

| Getting an interest-free loan | 51; 50 | 66; 67 |

| Repaying an interest-free loan | 66; 67 | 51; 50 |