Loan from the LLC founder

If an organization has financial problems and there are not enough own funds to purchase working capital, transfer salaries, rent premises and other purposes, the founder has the right to help his business by issuing a loan from his own funds on more favorable terms compared to market ones.

The loan agreement between the founder and the LLC must be drawn up in writing. Here is an example of such a contract:

The agreement usually contains the following significant terms:

- date and place of its preparation;

- sides of the footprint;

- subject of the agreement (amount of money, amount of material assets);

- return periods;

- interest payment terms;

- fines for violation of contract terms;

- details and signatures.

A debt repayment and interest payment schedule is attached to the document.

If the founder is also a director of the company, he signs the document twice: both for the borrower and for the lender.

Loan agreement between the founder and LLC

Studying § 1 ch. 42 of the Civil Code of the Russian Federation, regulating relations related to the provision of loans, and the norms of the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ and comparing them with the loan agreement between the founder and the organization, the following conclusions can be drawn:

- the law does not prohibit the execution of such agreements;

- the law does not limit the terms of the loan and the amount of transferred amounts;

- The law does not prohibit concluding a gratuitous contract.

Thus, in relation to this type of loan agreement, the principle “what is not prohibited is permitted” applies. Its participants have the right to regulate all conditions themselves.

You can learn about the latest changes in the regulation of loan agreements by reading our article Changes in the loan agreement.

Interest-free loan agreement from the founder

An interest-free loan agreement between the founder and the organization does not imply the occurrence of additional fiscal obligations for the organization. It is not reflected either as income or as expenses when calculating income tax.

The only exception is if the business owner forgives the debt to a controlled structure, then the funds received will be included in non-operating income.

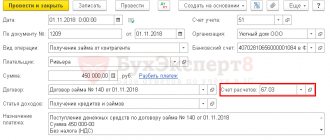

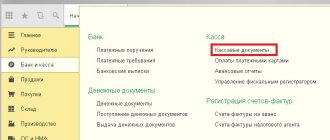

To help the company financially, the founder must come to the bank with a signed agreement and deposit funds into the organization’s current account. You can replenish the cash register with cash, in this case the fact of issuing money is confirmed by the cash receipt order.

The provisions of the Civil Code of the Russian Federation do not limit the maximum and minimum amount of borrowing, nor do they establish requirements for the targeted nature of the expenditure of funds. As a rule, money is issued for a long period of time and is returned when the company emerges from a crisis situation.

Preamble

Interest-free loan agreement

Tyumen

October 21, 2023

Kalugin Evgeniy Alfredovich, registered at the address: Tyumen region, Tyumen city, Ostankina street, building 354, apartment 767, passport: number 0000 series 000000, issued by the Ministry of Internal Affairs of Russia for the Tyumen region in the city of Tyumen on November 11, 2000, hereinafter referred to as the “Lender”, on the one hand, and Trans Service LLC, represented by the chief accountant of the organization, Anatoly Igorevich Lavrov, acting in accordance with the Charter of the company, hereinafter referred to as the “Borrower”, on the other hand, have entered into this agreement as follows:

The preamble of the agreement contains information related to the personal data of the Contractors. Thus, the preamble contains the following provisions:

- Firstly, the type of transaction being concluded (in our case it is an Interest-Free Loan Agreement from the Founder).

- Secondly, the place, that is, the city in which the agreement is drawn up;

- Thirdly, the date of conclusion of the contract;

- Fourthly, full name, passport details of the individual and name of the organization, full name of the organization’s representative;

- Fifthly, the roles of the participants in the transaction.

All of the above positions in the compartment form the content of the preamble.

Further, the agreement contains sections containing essential (without which the agreement does not enter into legal force) and additional (at the discretion of the parties) conditions. Below we will present a sample of each section separately.

Loan agreement to the founder from LLC

Borrowing from the company to the founders is a common way of lending to your own business. With the help of this mechanism, the owner (co-owner) of the organization can improve their own financial situation, receive funds for making major purchases or developing new commercial projects.

An example of an agreement under which a company issues a loan to its founder:

As a rule, loans to founders are issued on more favorable terms than bank loans. They imply a reduced interest rate, a convenient repayment schedule, and long terms. A loan from your own business can be denominated in rubles, foreign currency or material assets.

In order to avoid problems with the tax authorities, when documenting a loan to the founder, the company must take into account the following nuances:

- It is preferable to choose rubles as the borrowing currency. Fluctuations in the exchange rate of the dollar or euro will lead to the formation of material benefits and, as a result, questions from regulatory authorities;

- when concluding an interest-free loan agreement with the founder, the 0% rate must be specified as a separate clause in the agreement, otherwise the agreement will automatically be considered interest-bearing at the refinancing rate of the Central Bank of the Russian Federation;

- if the founder of the company simultaneously holds the post of general director, the borrowing agreement must be signed by another person, for example, the chief accountant. If the borrower endorses the contract himself, tax authorities may invalidate the document.

The subtleties of the relationship between the parties are regulated by Art. 807 Civil Code of the Russian Federation. The legislation does not limit the loan amount and gives the borrower the right to use the funds and property received at his own discretion.

How to draw up an interest-free loan agreement from the founder of an organization: sample

An interest-free loan agreement from the founder is drawn up in a classic way. It states:

- time and place of drawing up the contract;

- sides;

- loan amount;

- deadlines for its provision;

- non-interest clause;

- rights and obligations of the parties, other agreed terms;

- details, signatures, seals of the parties.

For the lender, the full name and passport details of the founder are indicated, and in the “Borrower” field - the full name of the LLC and the full name of the director as his representative.

At the end of the agreement, the full name, passport details, residential address of the founder-lender and details of the borrower organization are indicated.

How to document a loan to the founder

The transaction concluded between the company and its owner is formalized by a loan agreement from the organization to the founder. The document must be in writing, otherwise the legality of the loan will have to be proven in court.

The contract must include the following significant terms of cooperation:

- item (money or property);

- sum;

- deadlines;

- repayment procedure (small tranches or one amount at the end of the term);

- interest payment procedure.

Additionally, the agreement can specify the purposes for providing funds. A separate clause prescribes penalties for late payment of the loan amount or interest on it. You can specify requirements for the availability of collateral.

The legislation provides that the decision to issue a loan to the founder must be approved by the meeting of the Company's participants.

Personal income tax to the state or LLC interest

If you receive an interest-free loan or at an interest rate below 2/3 of the refinancing rate of the Central Bank of the Russian Federation (for example, at the beginning of 2022 - from 8.5%), then you have a material benefit. It is calculated on the last day of each month while you are using the loan. On material benefits you need to pay personal income tax at a rate of 35%.

Let's calculate the material benefits of an interest-free loan.

You take out an interest-free loan of 100,000 rubles from your LLC for the period from March 15 to April 30, 2022. You are going to return the entire amount at once. On the last day of each month of using the loan, you need to calculate the material benefit using the formula:

Loan amount × ⅔ rate of the Central Bank of the Russian Federation / 365 (366) days a year × number of days of using the loan this month.

Substitute numbers into the formula:

Material benefit as of March 31 = 100,000 × 8.5% * 0.66 / 365 days × 17 days of using the loan in March = 395.89 rubles. Personal income tax for material benefits - 130.64 × 35% = 138.56 rubles.

Material benefit as of April 30 = 100,000 × 8.5% * 0.66 / 365 days × 30 days of using the loan in April = 461.09 rubles. Personal income tax for material benefits - 250.55 rubles × 35% = 161.38 rubles.

So, for one and a half months of using the loan you will have to pay the state 299.94 rubles in personal income tax.

Interest-free loan agreement with an employee: contents

According to Part 1 of Art. 808 of the Civil Code of the Russian Federation, a loan agreement with an employee must be concluded in writing. First of all, the document indicates the date of signing, the position and full name of the company representative and employee. and usually introduces himself in the person of the director. The employee is referred to as the “Borrower”. The following are the provisions:

- Subject of the agreement. It records the loan amount in numbers and words, the disbursement period and the method of repayment. The amount is usually repaid through salary deduction.

- Purposes for using funds if the loan is targeted. For example, for the purchase of household appliances.

- Rights and obligations of the parties. It is the company's responsibility to transfer the agreed amount to the employee's account. The employee undertakes to repay the debt in accordance with the established schedule.

- Responsibilities of the parties. The circumstances under which liability arises are indicated. For example, the borrower undertakes to conscientiously perform work duties and maintain discipline. If an employee is absent or appears drunk, the lender may demand that the debt be repaid ahead of schedule.

- Force majeure circumstances. In this paragraph, it should be noted that liability under an interest-free loan agreement with an employee does not arise if the obligations cannot be fulfilled due to force majeure.

- Contract time. Typically, the contract comes into force from the moment it is signed, and ends when the entire debt is paid.

Rights and obligations of the parties

Further, the document specifies provisions on the rights and obligations of Counterparties. This section specifies the obligations that the parties undertake to properly perform under this agreement. Based on the principle of freedom of contract, which is currently enshrined in the Russian Federation, Counterparties can specify various obligations by mutual agreement. We will try to highlight the main provisions. It looks like this:

The Lender undertakes to transfer the amount specified in the agreement to the Borrower’s bank account within 2 (Two) calendar days from the date of signing this agreement. The Borrower undertakes to repay the specified amount during the term of this agreement no later than February 22, 2024. The borrower has the right to repay the specified amount either partially or in full in a one-time payment. The parties have the right, by mutual agreement, to change the terms and conditions regarding the procedure and period for the return of funds by concluding an additional agreement. The parties undertake to fulfill their obligations properly in strict accordance with this agreement.

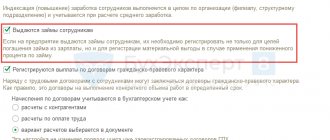

Interest-free loan agreement with an employee: features

When drawing up an agreement, it is better to discuss with the employee significant details that may affect the terms of the loan and its repayment, namely: what amount to issue and for how long, so that the employee can return it without damage to the company and himself. For example, before drawing up an interest-free loan agreement with an employee, they often pay attention to their marital status. After all, a person living alone will be able to repay the debt faster than someone who provides for a large family. It is also worth finding out whether the employee has outstanding bank loans or other cash payment obligations.

What is an interest-free loan agreement between the LLC and the founder?

At the stage of creating an organization, the founders invest funds into its authorized capital, which become the assets of the LLC. During the course of the company's activities, the funds invested in the authorized capital may not be enough. To ensure the normal functioning of the company, its participant can enter into a loan agreement with the LLC, transferring the amount of funds specified in the agreement for temporary use free of charge, i.e. no interest.

In order for a loan to be considered interest-free, an appropriate condition must be specified in it. If you ignore this rule, the LLC will be obligated to pay interest to its participant who lent the money, due to the requirements of clause 1 of Art. 809 of the Civil Code of the Russian Federation. The interest rate will be equal to the refinancing rate (determined by the location of the LLC).

When concluding a loan agreement, the question arises: is it required to pay tax on the funds attracted by the LLC? Based on clauses 10 p. 1 art. 251 of the Tax Code of the Russian Federation, when receiving borrowed funds, the organization does not have income; accordingly, such funds are not included in the tax base. Thus, an LLC is exempt from paying income tax when receiving a loan.

How to fill out an interest-free loan agreement between an organization and the founder?

The interest-free loan agreement must contain:

- Full name of the organization or enterprise;

- Details of both parties;

- Clauses that will describe the duties and responsibilities of the two parties;

- The name of the subject of the courts, for example, an inventory of property or funds;

- The final loan amount is indicated in words;

- The specific conditions under which the money will be returned are described;

- It is stated that a truly interest-free loan has been taken out;

- The agreement is accompanied by an agreement, an act of transfer of money, an agreement on the return of loan funds, so that there are no problems with the tax authorities;

- The agreement is drawn up in two identical copies, each of which has legal force.

If the terms of the agreement are not observed during the process of returning funds, then company representatives will bear legal liability in accordance with the legislation of the Russian Federation. Below you can download an interest-free loan agreement between the organization and the founder.