To obtain additional income, individual entrepreneurs have the right to issue loans at interest (as opposed to the bank issuing loans). The other party to the agreement may be individuals, companies or other individual entrepreneurs. Contractual relations should be documented, and the income received should be reported to the Federal Tax Service. However, an individual entrepreneur’s loan for an individual entrepreneur can be interest-free.

What is special about a loan between an individual entrepreneur and an individual?

In some cases, individual entrepreneurs can provide loans to individuals. Moreover, this loan can be either in cash or in the form of transferring any property to an individual (equipment, vehicles, etc.). In these cases, it becomes necessary to obtain an interest-bearing or interest-free loan. The type of loan is chosen by the borrower and the lender independently, but taking into account regulatory requirements.

Important! If the agreement does not indicate that the loan is interest-free, then in this case it will be considered interest-bearing with monthly calculation and payment of interest established by the Central Bank of the Russian Federation.

If the loan amount does not exceed 1000 rubles, it is possible to reach an agreement orally without confirming it with a written loan agreement.

Can an individual entrepreneur give a loan to an individual entrepreneur?

An individual can borrow not only from credit institutions, but also from private companies. A similar procedure is also allowed for individual entrepreneurs. There can be many reasons for these actions: personal needs or business development. If you immediately want to make a profit from the loan, then such transactions will be taxed at the rate of 6%.

Contents of the loan agreement

For your information! In legislative acts, loans between private companies are considered interest-bearing by default. Therefore, the contract must specify the type of agreement.

Interest-free loan agreement

Interest-free loan between individual entrepreneurs and individuals

When providing a loan without paying interest to an individual, the lender assumes the role of a tax agent for personal income tax. According to Art. 226 of the Tax Code of the Russian Federation, an individual entrepreneur who has provided an interest-free loan to an individual is obliged to withhold and pay personal income tax on the income received by the individual as an interest-free loan.

The role of the tax agent obliges the lender:

- calculate material benefits every month;

- withhold personal income tax from this calculation;

- pay the calculated personal income tax to the budget;

- provide reporting documentation on personal income tax.

In accordance with paragraph 7, paragraph 1, art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of income is the last day of each month during the period for which borrowed (credit) funds were provided, when income is received in the form of material benefits obtained from savings on interest when receiving borrowed (credit) funds .

Example No. 1. Determining the period for calculating material benefits.

Individual Entrepreneur Ivanov provided an interest-free cash loan to an individual on July 28, 2022 for a period of 6 months, i.e. until January 29, 2022. According to Art. 223 of the Tax Code of the Russian Federation, material benefits will be calculated:

- 07.2022;

- 08.2022;

- 09.2022;

- 10.2022;

- 11.2022;

- 12.2022;

- 01/2022

Interest-bearing loan between individual entrepreneurs and individuals

When providing a loan to an individual with payment of interest less than 2/3 of the current rate of the Central Bank of the Russian Federation at the moment, there is a need to calculate and pay personal income tax on the material benefit, which in this case is the tax base. The occurrence of material benefit in this case is discussed in paragraphs. 1 clause 2 of article 212 of the Tax Code of the Russian Federation.

The lender assumes the role of a tax agent for personal income tax, obligated to monthly calculate and pay personal income tax on income received by an individual.

Calculation of the material benefits of an interest-free loan between an individual entrepreneur and an individual

In accordance with Art. 212 of the Tax Code of the Russian Federation, material benefits received from savings on interest for the use of borrowed (credit) funds are recognized as income of the taxpayer and are subject to personal income tax calculation.

Material benefit can be calculated using the following formula:

MV = SZ * 2/3 KSCB * KKD / 365(366)

MB - material benefit

SZ – amount of borrowed funds

KCSB is the key rate of the Central Bank of the Russian Federation

KKD - the number of calendar days of use of borrowed funds in the current month

365 (366) – number of calendar days in the current year

Important! Calculation of material benefits is made on the last day of the month.

Example No. 2. Determining the material benefits of an interest-free loan between an individual entrepreneur and an individual.

IP Ivanov provided an interest-free cash loan to an individual on 07/02/2022 for a period of 20 days in the amount of 60,000 rubles. On July 31, 2022, it is necessary to calculate the material benefits:

SZ – 60,000 rubles

KSCB – 7.5%

KKD – 20 days

There are 365 calendar days in 2022

MV = 60000*5%*20 / 365 = 164.38 rubles.

The material benefit, namely a monetary amount of 164.38 rubles, will be the tax base for calculating personal income tax in July 2022.

How does the return work?

Repayment of a loan to an individual from an individual entrepreneur can be made in several ways. They should be divided into two options: cash and non-cash payments, monthly or lump sum at the end of the agreement. If the contract was drawn up taking into account all the rules, then this clause should be stated in it. The rights of the parties to the contract are protected at the legislative level.

Return options:

- The borrower borrows money for a year without interest. The total amount of debt is divided into 12 months and paid in equal installments. This could be a transfer to a personal account or transfer of cash against a receipt to a company employee;

- The borrower borrows money for a year, but with interest. The algorithm for distributing monthly installments is the same, but the amount of interest on the loan is added to the payments. There are two options for calculating interest: annual and monthly;

- if the lender provides money for a year, but does not require monthly payments, but waits, then by the end of the agreement, the borrower will repay the entire debt. In this case, if the loan was interest-free, then the amount of the refund does not change, and the debtor returns the loan amount. If the loan is interest-bearing, then interest for the entire period of use of the money is added to the amount of the principal debt.

Receipt

A social survey showed that taking loans from individual entrepreneurs is much more profitable for individual entrepreneurs, because entrepreneurs can agree among themselves and provide lending services on loyal terms. The main thing is to take into account that if an “investor” wants to make money from this, he is obliged to pay taxes.

*Prices are as of July 2022.

Calculation of the material benefits of an interest-bearing loan between an individual entrepreneur and an individual

Calculation of material benefits from a loan to an individual with payment of interest is carried out using the following formula:

MV = SZ * (2/3 KSCB – D) * KKD / 365(366)

MB - material benefit

SZ – amount of borrowed funds

KCSB is the key rate of the Central Bank of the Russian Federation

D – interest rate specified in the Loan Agreement

KKD - the number of calendar days of use of borrowed funds in the current month

365 (366) – number of calendar days in the current year

Example No. 3. Determination of the material benefits of an interest-bearing loan between an individual entrepreneur and an individual.

Individual Entrepreneur Ivanov provided a cash loan to an individual on 07/02/2022 for a period of 20 days in the amount of 60,000 rubles with an interest rate of 2%. On July 31, 2022, it is necessary to calculate the material benefits:

SZ – 60,000 rubles

KSCB – 7.5%

KKD – 20 days

D 2%

There are 365 calendar days in 2022

MV = 60000*(5%-2%)*20 / 365 = 98.63 rubles.

The material benefit, namely a monetary amount of 98.63 rubles, will be the tax base for calculating personal income tax in July 2022.

Differences between interest-bearing and interest-free loans

Individuals most often borrow money from credit institutions: banks or microcredit organizations. But it is possible to turn to private entrepreneurs for money. The main difference between a loan with and without interest is that in the first case, the principal amount is charged according to the rate specified in the contract, and in the second case, the loan amount does not change. The amount of money the applicant borrowed is the amount he will return upon expiration of the period specified in the agreement.

Note! By issuing loans without interest, the entrepreneur has no benefit. His actions can be justified by simple help.

Payment of interest

Loan agreement between an individual entrepreneur and an individual - sample

When drawing up a loan agreement between an individual entrepreneur and an individual, it is necessary to take into account the following points:

| Information | A comment |

| Date of the contract | HH.MM.YYYY |

| Contract number | Document serial number |

| Parties to the agreement | Full name of the individual entrepreneur and full name of the individual |

| Subject of the agreement |

|

| Rights and obligations of the parties | By agreement of the parties |

| Dispute Resolution |

|

| Details of the parties |

|

In some cases (by agreement of the parties), the following documents are attached to the loan agreement:

- additional agreement;

- repayment schedule;

- act of acceptance and transfer.

Sample contract

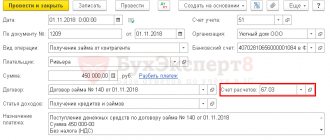

To obtain a money back guarantee, you need to draw up a contract. People who are not savvy in legal matters can face a lot of problems. The money is transferred to the borrower by issuing a cash receipt order or payment order so that the accounting department has the opportunity to correctly carry out this operation in the program. Based on any of these papers, the applicant will be able to come to the bank and receive the funds he borrowed. This is a general rule for all borrowers, whether an individual or an organization.

Loan for the self-employed - special conditions where you can get a loan

For a private individual, it is enough to provide only a passport and a completed application. This can be a free form questionnaire indicating contact information and other information. List of documents required for obtaining an individual entrepreneur loan from an individual entrepreneur and for drawing up an agreement in addition to a passport:

- company registration certificate;

- TIN;

- extract from the Unified State Register of Legal Entities.

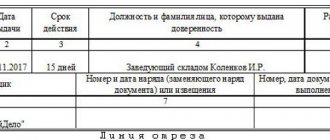

Important! If the borrower is a representative and not the owner of the company, then he is required to provide a notarized power of attorney.

Example contract

Taxation when applying for a loan between an individual entrepreneur and an individual

Taxation when applying for a loan between an individual entrepreneur and an individual depends on the status of the individual:

| Status of an individual | A comment |

| Resident of the Russian Federation | In accordance with paragraph 2 of Art. 224 of the Tax Code of the Russian Federation, in the case of providing a tax loan to an individual whose interest rate under the Agreement does not exceed 2/3 of the rate of the Central Bank of the Russian Federation, the tax rate on personal income is set at 35%. |

| Non-resident of the Russian Federation | According to paragraph 3 of Art. 224 of the Tax Code of the Russian Federation, in the case of providing a tax loan to an individual who is not a resident of the Russian Federation, the tax rate on personal income is set at 30%. |

| Employee | When providing a loan to an employee and calculating material benefits with subsequent calculation of personal income tax, it is necessary to take into account the purpose of the loan. If an individual entrepreneur provides an employee with a cash loan intended for: · new construction; · acquisition of an apartment, room, house (or share in them); · acquisition of land intended for individual residential construction; · acquisition of a land plot on which a residential building or a share in it is located, the acquisition of which is subsequently confirmed by the tax authorities, namely the emergence of the right to a property deduction in connection with the acquisition of real estate, the material benefit from this loan is not subject to personal income tax calculation (Article 212 of the Tax Code of the Russian Federation ). When performing the role of a tax agent, the lender is obliged to provide personal income tax reporting on the material benefits received by the borrower when using borrowed (credit) funds. |

Questions and answers

Question No. 1. I received an interest-free loan from my employer to build a house, but this is not noted in the contract - it simply contains information about the provision of the loan, but without a purpose. Can I somehow prove the fact that the funds were received specifically for the construction of a house in order to avoid paying personal income tax?

You need to enter into an additional agreement to the Loan Agreement, which will indicate the purpose of obtaining and providing the loan. In addition to the additional agreement, it is necessary to receive a notification from the Federal Tax Service about the emergence of the right of property deduction in connection with the construction of a new house.

Question No. 2. Our organization provided its employee with an interest-free loan, which was later forgiven. How to calculate personal income tax in this case?

When forgiving a loan, there is no question of saving on interest, in connection with which it is necessary to be guided by the Letter of the Ministry of Finance of the Russian Federation dated July 15, 2014 No. 03-04-06/34520, which explains that if the parties enter into a monetary donation agreement loan, the taxpayer does not need to repay the loan; therefore, there is no income in the form of material benefits for using an interest-free loan. In this case, income is subject to personal income tax at the rate of 13%.

Taxation

Employment contract between individual entrepreneurs and individual entrepreneurs - sample completed document

This transaction is subject to taxation. A loan that does not carry any profit, that is, an installment plan, is not subject to taxation by the lender, but the borrower will be required to pay tax on the funds received. Its size is also 6%. To avoid this, the contract must indicate the loan amount of no more than 1000 rubles*. Such tricks can help avoid paying taxes, but involve a certain risk for the lender.

For your information! If there is no material benefit, then taxation is excluded.