The vast majority of companies take out loans from time to time. Funds can be taken directly from the founder. This deal has certain nuances. The manager must correctly formalize the raising of funds, but an equally important stage is their return. Let's look at all the nuances of this stage in the article.

Question: How to record the receipt and repayment of an interest-free long-term loan from the founder (legal entity)? The organization received a loan from the founder in the amount of RUB 5,000,000. for a period of 24 months. According to the agreement, the loan is interest-free. The loan was repaid within the period established by the agreement. View answer

Key Features

Let's consider the basic rules for loan repayment:

- The money must be transferred within the time limits specified in the contract.

- If the loan agreement does not specify the terms, the lender may demand repayment of the funds at any time. The debtor is obliged to repay the debt within a month from the date the claim is sent by the lender.

- If the loan was issued in foreign currency, it must be repaid in rubles. The total amount is determined at the exchange rate valid at the time of the refund.

- The loan may be interest-free. However, this condition must be stated in the contract. If this is not done, interest will be charged.

Question: Is it necessary to issue a check with the attribute “expense” if an organization returns an interest-free loan to the founder - an individual by payment order through a current account to his bank card? View answer

IMPORTANT! The terms of the contract may be changed before the agreement is concluded. After the funds are transferred to the lender, the transaction is considered to have taken place. That is, its conditions cannot be changed.

Question: How to reflect in an organization’s accounting the repayment of an interest-free loan provided by the founder (LLC) by transfer of compensation (purchased goods)? The founder of a trade organization provided her with a short-term interest-free loan in the amount of 500,000 rubles. Subsequently, an agreement was signed to repay the obligation under the loan agreement by transferring compensation - purchased goods in the amount of 500,000 rubles. (including VAT), which corresponds to their market value. The actual cost of the transferred goods, equal to the cost of their acquisition for tax accounting purposes, is 450,000 rubles. (without VAT). View answer

Features of loan repayment with interest

If funds are provided at interest, this should be stated in the agreement. It also specifies the rate and payment procedure. If the document does not contain information about the rate, it is determined according to the Central Bank rate at the time of conclusion of the agreement. If the agreement does not specify how interest will be paid, it will be included in the monthly payment.

IMPORTANT! The interest received by the founder will be considered his income. Therefore they are taxed at 13%. Interest paid by the debtor will be considered his expenses. They reduce the tax base.

How to apply for loan coverage?

Refunds do not require additional paperwork. The entire procedure is carried out according to a previously drawn up agreement, in accordance with its provisions. The agreement continues until the last payment is made, after which the transaction is closed.

Question: How to reflect in the accounting of a borrower using the simplified tax system the receipt of an interest-free loan from the founder (legal entity), as well as its repayment? Under a loan agreement concluded on June 30 for a period of three months, funds in the amount of 400,000 rubles were received on the same day. View answer

On the date of the last payment, both the principal “body” of the debt and interest must be returned. If there is an unpaid amount, the creditor may apply various penalties specified in the agreement. Depending on the terms of the agreement, payments may be paid according to a schedule, in a lump sum. When covering a debt, the debtor must request paper that confirms the payment made. For example, this could be a check or bank statement.

Repayment of a loan to an individual from a legal entity

To correctly carry out the operation of returning borrowed funds, you must first familiarize yourself with the legislative framework.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

There are a number of regulatory documents according to which it is possible to correctly carry out the operation of repaying a loan to an individual from a legal entity.

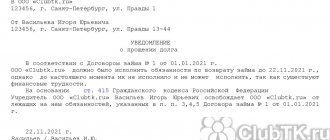

The main defining document of the relationship between the lender and the borrower is the agreement. According to paragraph 1, Article 808 of the Civil Code of the Russian Federation, it is subject to mandatory registration of a loan between individuals if the amount exceeds 1000 rubles, and with the participation of a legal entity - regardless of the amount.

Therefore, the loan repayment procedure must be described in detail in the relevant clauses of the agreement.

To perform this procedure, the use of cash registers is not required, and checks are not issued to reflect transactions in the cash book.

This provision is regulated by letter of the Ministry of Finance of Russia No. 03-11-05/40 dated February 21, 2008. This means that the use of trading proceeds to repay a loan is not recommended.

You can carry out the operation in the following way:

- deposit the required amount into the current account of a legal entity as revenue from the organization’s activities;

- use a checkbook to withdraw money and transfer it to an individual – the lender. The procedure is certified by a receipt, which can be notarized.

Regarding the maximum one-time amount of repayment of a loan obligation, there is an unambiguous instruction of the Central Bank No. 1843-U, the first paragraph of which limits cash payments when carrying out operations to repay credit (borrowed) obligations in the amount of 100,000 rubles. The same applies to both the principal body of the debt and the accrued interest.

If the total amount exceeds the established limit, then non-cash transactions must be performed. The procedure for performing them is fully consistent with that described above, with the exception of the last point.

If there are not sufficient funds in the current account for settlement, they are replenished by depositing proceeds. In the future, when drawing up a payment order to the bank, the number and date of signing the loan agreement are indicated in the “destination” column.

Funds must be transferred only to the account specified in the agreement. To do this, the bank must provide a copy of it.

A sample loan agreement between an individual and an individual entrepreneur can be downloaded in the article: loan agreement between an individual and an individual entrepreneur. How an individual can get a microloan for urgent needs is described here.

Refund methods

The method of repayment of the loan must be specified in the agreement between the parties. Let's look at the most common options.

Product

The possibility of repaying debt with goods is stipulated in Article 409 of the Civil Code of the Russian Federation. You can repay the loan using the following types of products:

- A product produced by the company.

- Products purchased by the company for further sale.

The goods, within the framework of the law, are the property of the legal entity. Therefore, when it is transferred, the transaction will be considered a sale and income tax will have to be paid on the proceeds.

IMPORTANT! How to determine the quantity of products to repay the loan? Typically, the purchase price is used in calculations.

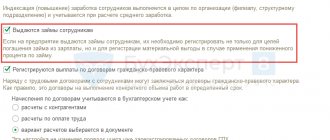

From current account to card

The required amount can be transferred to the lender directly to your bank card. The manager of the debtor company must draw up a document indicating the relevant transaction and its purpose (loan repayment). A transfer from a RS can be made not only to a card, but also to the lender’s RS. The choice of payment option depends on the convenience for both parties.

IMPORTANT! The translation must be supported by documents. This is required for accounting and tax purposes, as well as proof of transfer of funds.

Company property

Repaying a loan with the organization's property is subject to the same rules as covering a debt with goods. You will have to pay income tax on each payment, since the transaction will officially be considered a sale.

To make payments, you can use any fixed assets owned by the enterprise:

- Equipment, tools for manufacturing products.

- TS.

- Immovable objects.

The ratio of the loan amount to the fixed asset with which it is planned to repay the debt is determined jointly by both parties to the agreement. For example, the debtor can transfer to the founder a car, the cost of which, taking into account depreciation, is approximately equal to the amount of the debt.

IMPORTANT! You must remember to document the transaction. In particular, it is required to draw up a document on the write-off of fixed assets from the balance sheet of the enterprise to cover the loan. You will also have to pay tax, and therefore, after the payment has been made, a declaration of profit received is submitted.

Return of property

If for some reason the borrower cannot repay the loan debt, then an alternative option is possible.

According to Article 409 of the Civil Code of the Russian Federation, with the mutual consent of the parties, the borrower can provide any type of property - movable or immovable - as compensation for funds.

In this case, an additional agreement is drawn up, in which “compensation” will appear instead of the term “loan”.

However, in this case certain tax risks arise. They are associated with the problem of determining the current value of property.

To agree on an exact figure, it is recommended to invite independent experts who, by examining the condition of the property and comparing the current market value with a similar one, will determine the final price.

In practice, it is very difficult to come to a clear opinion when resolving this issue. Especially in cases where property is retained by force, after receiving a corresponding court decision.

The only exceptions are those cases when the contract was initially written as collateral, its primary value and possible depreciation during the term of the agreement were determined.

As can be seen from the above, repayment of a loan to an individual can be carried out in several ways. The main thing is to decide on what is optimally convenient for both parties before signing the agreement and entering into force. In this case, you can avoid many ambiguities and possible problems in the future.

Is it possible for an 18-year-old unemployed person to get a cash loan? Find out from the article: loans from 18 years of age. How to correctly draw up a loan receipt between individuals, see the example.

The procedure for obtaining an interest-free loan between individuals is described on the page.

Forbidden ways

It should be taken into account that not all funds can be used when repaying a loan. The prohibitions are stipulated in various instructions of the Central Bank and the government.

By checkout

There is a list specified by the Central Bank Directive dated October 7, 2013, where funds from the enterprise’s cash desk can be spent. Loan repayment is not included in this list. It is possible to cover the debt using funds from the cash register only according to the following scheme:

- Funds are taken from the cash register and transferred to the PC at the bank.

- From the enterprise’s RS, the money is transferred to the lender with the indication “loan repayment.”

It is an offense to take funds directly from a treasury to cover a debt.

Cash

Repayment of debt in cash is prohibited. All transfers must be exclusively non-cash in order to track them. If the company has only cash, they need to be transferred to your PC, and then to the founder’s PC.

FOR YOUR INFORMATION! Some executives repay the loan directly from their salaries. Doing this is not prohibited, but it is not recommended, since the operations performed cannot be confirmed in any way.

ATTENTION! Using proceeds to pay off a debt is an administrative offense that is punishable by a fine.

Cash

In many cases, it is much more convenient for the lender to receive all or part of the debt (with phased repayment) in cash. This situation can have an unpleasant effect on the correctness of cash accounting of a legal entity.

In this case, it is recommended to follow the scheme of depositing money into a current account and then withdrawing it using a checkbook.

These restrictions came into force on June 1, 2014 and are associated with the new instruction of the Central Bank of Russia No. 3073-U on the procedure for conducting cash payments.

According to this resolution, withdrawal of money from the cash register is possible only in the following cases:

- payment of wages and social benefits;

- consumer needs of a legal entity not related to its activities. The loan agreement does not fall under this clause, since it was concluded as part of the business activities of the individual entrepreneur;

- for issuance to employees of the organization for reporting.

In addition to the correct withdrawal of funds, it is necessary to correctly display their movement in the financial statements. This also applies to loan repayment to an individual.

The wiring in this case should be made according to the following scheme:

- partial or full repayment of the loan, according to a previously signed agreement - Debit 50 (51), Credit 76;

- return of borrowed funds – Debit 50 (51), Credit 78 (sub-account for loans provided).

Currently, there are no regulatory documents describing the procedure for repaying loan obligations between individuals. Therefore, the main document confirming the receipt of cash in this case may be a receipt or a separate appendix to the agreement (if it was drawn up).

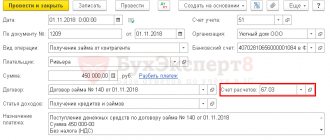

Accounting entries

Let's consider the transactions when covering the debt to the founder with goods:

- DT76 KT91 . Reflection of revenue from the sale of goods.

- DT90.3 KT68.02. VAT accrual.

- DT66 KT76 . Debt offset.

It is also required to indicate the amount of payments and the primary documents on the basis of which each of the transactions is performed.

Let's consider the transactions when issuing a loan from the founder:

- DT51 KT66 . Getting a loan.

- DT91.1 KT66 . Reflection of interest.

- DT66 KT51 . Return of funds to the founder.

- DT66 KT51. Transfer of interest on the loan.

The loan can also be interest-free. In this case, percentages may not be displayed.

Taxation

Taxation on repayment of a loan to an executive is no different from taxation on payments to any other creditor. If the debt is repaid by the company's operating assets or its products, income tax is paid, since it is considered that an act of sale of the company's property is being carried out. After the transaction is completed, you will have to file a tax return. All transactions related to loan repayment must be supported by primary documentation for tax purposes. Due to the impossibility of full control, it is prohibited to pay the debt in cash.