Step-by-step instruction

On November 1, the Organization received a loan from a counterparty in the amount of RUB 450,000. for a period of 18 months at 15% per annum. According to the terms of the agreement, the principal amount of the debt is paid in equal installments monthly, interest is accrued monthly on the balance of the debt. Payment of debt and interest is made according to the payment schedule.

On November 30 and December 31, interest was accrued and the principal and interest were paid according to schedule.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receiving a loan from a counterparty | |||||||

| November 01 | 51 | 67.03 | 450 000 | 450 000 | Receiving a loan from a counterparty | Receipt to the current account - Receiving a loan from a counterparty | |

| Reflection in the accounting of accrued interest on the loan for November | |||||||

| November 30th | 91.02 | 67.04 | 5 363,01 | 5 363,01 | 5 363,01 | Interest accrual | Manual entry - Operation |

| Payment of loan principal for November | |||||||

| November 30th | 67.03 | 51 | 25 000 | 25 000 | Payment of principal | Write-off from the current account - Repayment of the loan to the counterparty | |

| Payment of interest for November | |||||||

| November 30th | 67.04 | 51 | 5 363,01 | 5 363,01 | Payment of interest | Write-off from the current account - Repayment of the loan to the counterparty | |

| Reflection in accounting of accrued interest on a loan for December | |||||||

| 31th of December | 91.02 | 67.04 | 5 414,38 | 5 414,38 | 5 414,38 | Interest accrual | Manual entry - Operation |

| Payment of loan principal for December | |||||||

| 31th of December | 67.03 | 51 | 25 000 | 25 000 | Payment of principal | Write-off from the current account - Repayment of the loan to the counterparty | |

| Reflection in accounting of accrued interest on a loan for December | |||||||

| 31th of December | 67.04 | 51 | 5 414,38 | 5 414,38 | Payment of interest | Write-off from the current account - Repayment of the loan to the counterparty | |

Accounting for the lender

A mandatory condition of the loan agreement is the determination of the procedure and timing for payment by the borrower of the accrued amount. The frequency of accrual of such loan dividends is established in the initial loan agreement and can be made monthly, quarterly or in a certain reporting period. Below are the entries for calculating interest on loans received and issued. Let's figure it out sequentially.

The accrual of interest on the loan - postings will depend, first of all, on the type of activity (clause 34 of PBU 19/02) and the organizational and legal form of the creditor institution. In the case when the lender is a credit institution or microfinance organization, then, in accordance with Order of the Ministry of Finance No. 94n dated October 31, 2000 and PBU 9/99 (clause 12), interest on loans issued (entries) is reflected in account 90 of the chart of accounts.

If an organization that is not a credit organization accrues interest on the loan, the entry will be generated for the credit of account 91, in accordance with clause 16 of PBU 9/99.

By issuing a credit loan, the lender makes a certain financial investment; accordingly, accounting will be kept in account 58 “Financial investments”.

The accounting records for non-profit organizations would be:

- Dt 58.3 Kt 51 - a loan was issued to a third party;

- Dt 73.1 Kt 51 - to an employee of the organization.

The following records are generated by the accountant periodically - quarterly, monthly:

- Dt 58 Kt 91 - interest accrued on the loan issued, postings;

- Dt 51 Kt 58.3 - receipt of interest amounts to the current account. The return of funds by the borrower is also reflected in this accounting entry.

To maintain correct tax accounting by the lender, when interest is accrued under a loan agreement, entries are generated periodically, and the interest amounts themselves are recognized as income at the end of each reporting period in the case where the agreement is valid for more than one quarter (clause 6 of Article 271 of the Tax Code RF).

Receiving a loan from a counterparty

Regulatory regulation

Under a loan agreement, one party (the lender) transfers or undertakes to transfer into ownership the other party (borrower) money, things defined by generic characteristics, or securities, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of things received by him of the same type and quality or the same securities (clause 1 of Article 807 of the Civil Code of the Russian Federation).

Loan and credit are not the same thing! Under a loan agreement, a bank or other credit organization undertakes to provide funds to the borrower in the amount and on the terms stipulated by the agreement, and the borrower undertakes to return the amount of money received and pay interest for its use, as well as other payments provided for in the loan agreement, including those related to the provision loan (Clause 1, Article 819 of the Civil Code of the Russian Federation).

The main differences between a loan and a loan:

- The loan is issued only by the bank. The loan can be obtained from other legal entities, as well as individuals.

- The loan necessarily requires the payment of interest. The loan may be interest-free.

- The loan is issued exclusively in cash. The loan can be issued in kind or in securities.

- Loans are “subject to” the regulations of the Bank of Russia. For loans between persons other than credit institutions, these regulations may be considered as recommended.

The rules for accounting for loans are described in PBU 15/2008 “Accounting for expenses on loans and credits.” The amount received under the loan agreement is accounts payable and is accounted for depending on the loan term: if the term is up to a year inclusive - in account 66.03 “Short-term loans”, if the term is more than a year - in account 67.03 “Long-term loans” (1C chart of accounts).

The costs associated with the execution of the loan agreement and accounted for separately from the principal debt include (clause 3 of PBU 15/2008):

- interest on the loan;

- associated costs - payment for information and consulting services, contract review, etc.

Related expenses are taken into account evenly throughout the entire term of the loan agreement (clause 8 of PBU 15/2008).

From June 1, 2022, the legislative regulation of loan agreements has changed significantly. Details As of June 1, 2018, changes to credit and loan agreements came into force.

Accounting in 1C

Receipt of funds under a loan agreement is documented in the document Receipt to current account transaction type Receipt of a loan from a counterparty .

Please pay attention to filling out the fields:

- Amount - the amount received under the loan agreement, according to the bank statement.

- Agreement - loan agreement with Agreement Type - Other .

In our example, payments under the loan agreement are carried out in rubles, the term of the agreement is more than a year. PDF As a result of selecting such an agreement in the document Receipt to the current account, the following is automatically set:

- Settlement account - 67.03 “Long-term loans”.

Postings according to the document

The document generates the posting:

- Dt Kt 67.03 - receiving a loan from a counterparty.

Postings for obtaining a loan

The period for issuing short-term loans does not exceed 1 year. When an organization receives funds from a credit institution, founder, etc. they are accounted for in account 66. The loan can be received in cash, by transfer to an account, or in foreign currency. The following entries will be made accordingly:

- Debit 50 (, ) Credit 66 - entries for receiving a loan.

When repaying the debt, the posting is reversed:

- Debit 66 Credit 50 (,).

The payment amount and frequency are specified in the terms of the contract.

When a company incurs additional costs when obtaining a loan, they are recorded in 91 accounts:

- Debit 91.2 Credit 66.

Long-term loans are provided for a period of more than a year. Accounting account – 67. The loan can be accounted for in this account, or after the repayment period becomes less than 12 months, transfer it to account 66:

- Debit 67 Credit 66.

Example of loan receipt transactions:

The organization received two loans: one for 6 months in the amount of 150,000 rubles, and the second for 36 months in the amount of 680,000 rubles. When applying for a long-term loan, the lawyer’s services were paid - 5,000 rubles.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 66 | Short-term loan received | 150 000 | Bank statement | |

| 66 | 50 | Short-term loan repaid after 6 months | 150 000 | Payment order ref. |

| 67 | Long-term loan received | 680 000 | Bank statement | |

| 60 | Paid lawyer's services | 5 000 | Payment order ref. | |

| 91.2 | 67 | Legal services included as expenses | 5 000 | Certificate of completion |

| 67 | Long-term loan repaid | 680 000 | Payment order ref. |

Reflection in accounting of accrued interest for November and December

The amount of interest on the loan (or the condition of no interest) is specified in the agreement. If there is no such clause, then interest is paid at the key rate of the Bank of Russia in force during the settlement periods. Exceptions are loans between citizens (including individual entrepreneurs) in the amount of no more than 100 thousand rubles. and loans in kind, which are interest-free by default, unless the agreement provides for other conditions (clause 1, clause 4 of Article 809 of the Civil Code of the Russian Federation).

The accrued interest is reflected in the accounting system (clauses 6-7 PBU 15/2008, clause 5, clause 11, clause 18 PBU 10/99):

- as part of other expenses in the reporting period interest accrual;

- in the initial cost of the investment asset.

In NU, accrued interest is reflected in non-operating expenses:

- for uncontrolled transactions - based on the actual interest rate (clause 2, clause 1, article 265 of the Tax Code of the Russian Federation, clause 1, article 269 of the Tax Code of the Russian Federation);

- for controlled transactions - within the maximum threshold of the key rate of the Central Bank of the Russian Federation or international rates EURIBOR, SHIBOR, LIBOR, depending on the currency of the loan (clause 1.1, clause 1.2 of Article 269 of the Tax Code of the Russian Federation).

As a rule, interest on loans is accrued by analogy with bank loans: from the next day after the amount is received until the day the loan is repaid inclusive - this procedure is provided for in clause 3.14 of the Regulations of the Central Bank of the Russian Federation dated August 4, 2003 N 236-P. However, for loans it is not mandatory, so the contract can provide for a different procedure: for example, establish a fixed amount of interest (clause 2 of Article 809 of the Civil Code of the Russian Federation).

In our example, interest, according to the loan agreement, is accrued on the balance of the debt monthly according to the following formula:

Let's calculate interest for November and December:

In the following months the calculation will be similar.

Accounting in 1C

The accrual of interest is reflected in the document Transaction entered manually, the transaction type Transaction in the section Operations – Accounting – Transactions entered manually:

- in accounting - on account 91.02 “Other expenses”;

- in NU - as part of non-operating expenses.

Interest accrual for November.

Interest accrual for December and subsequent months is processed in the same way.

For more convenient work, you can define a template for reflecting accrued interest in accounting. To do this, you need to create a Standard Operation document in the Operations – Accounting – Standard Operations section.

Article

Calculation of interest under a loan agreement: postings. What an accountant needs to know if a company has entered into a loan agreement, what entries to make.

The company as a lender

Let's start with typical transactions for a situation where your company provides a loan to a counterparty. In addition, consider the tax implications of this transaction.

Transferring money to the borrower

Calculation of interest under a loan agreement: postings. Let's start with the fact that there is no need to charge VAT on the amount that you transfer to the borrower (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation). Don’t include the transferred money in expenses for tax accounting purposes either (Clause 12, Article 270 of the Code).

In accounting, loans for which your company will receive income in the form of interest must be shown on account 58 (clauses 2, 3 of PBU 19/02). And you can account for interest-free loans in account 76. In this case, make the following entry:

DEBIT 58 subaccount “Granted loans” (73 subaccount “Settlements on loans granted”, 76) CREDIT 51 (50) - loan provided.

Calculation of interest under a loan agreement: postings

For the amount of interest, prepare invoices marked “Excluding VAT”. Otherwise, controllers may charge your company a fine of 10,000 rubles. Or 30,000 rubles, if your company has not issued invoices for two or more quarters. This sanction is established in Article 120 of the Tax Code of the Russian Federation.

When calculating income tax, include accrued interest in the company's non-operating income on a monthly basis. And also on the date when the counterparty repays the loan. Such rules are established in paragraph 6 of Article 250 and paragraph 6 of Article 271 of the Tax Code of the Russian Federation.

In accounting, recognize interest on a loan agreement evenly in income. That is, regardless of when your company actually receives these amounts from the counterparty. This is what officials from the Russian Ministry of Finance recommend to do in a letter dated January 24, 2011 No. 07-02-18/01. Calculation of interest under a loan agreement posting:

DEBIT 76 (73 subaccount “Settlements on loans provided”) CREDIT 91 subaccount “Other income” - interest on the loan has been accrued;

DEBIT 51 (50, 70) CREDIT 76 (73 subaccount “Settlements on loans provided”) - interest received from the borrower (deducted from the salary if the loan was issued to an employee).

If you issued a loan to an individual at a small interest rate, you will have to calculate personal income tax on material benefits at a rate of 35 percent.

What entry should be made in accounting if the lender is an employee? That is, you have the opportunity to withhold personal income tax:

DEBIT 70 CREDIT 68 subaccount “Calculations for personal income tax” - personal income tax is accrued on material benefits.

Loan repayment

When the counterparty returns the debt to you, your company does not generate income. This is stated in subparagraph 10 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

Make the following entries in your accounting:

DEBIT 51 (50, 70) CREDIT 58 subaccount “Provided loans” (73 subaccount “Settlements for granted loans”, 76) - the loan amount was returned by the counterparty.

If you issued an interest-free loan to an employee, when returning it, withhold personal income tax from the material benefit:

DEBIT 70 CREDIT 68 subaccount “Calculations for personal income tax” - personal income tax is accrued on material benefits.

Company as a borrower

Calculation of interest under a loan agreement: entries if the company is a borrower. Now let's look at what accounting entries to make and how to calculate taxes if a company receives a loan from a lender.

Getting a loan

Do not include funds received in the form of a loan as income (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

In accounting for loans whose term does not exceed a year, use account 66. If your company received funds for a period of more than 12 months, record their amount in account 67. Thus, the posting will be as follows:

DEBIT 51 (50) CREDIT 66 (67) subaccount “Calculations for the principal amount of the loan” - a loan was received.

Calculation of interest under a loan agreement: postings

In tax accounting, credit interest on loans to non-operating expenses. But within the limit. Its size is equal to the refinancing rate increased by a factor of 1.8 (clause 1.1 of Article 269 of the Tax Code of the Russian Federation). By default, we take the most common case: you normalize interest on obligations, focusing on the Bank of Russia rate, and received the loan in rubles.

Interest must be taken into account in expenses on a monthly basis, as well as on the date when your company repays the loan to the counterparty. Such rules are established in paragraph 8 of Article 272 of the Code.

If you pay interest to the founder or another individual, withhold personal income tax at a rate of 13 percent.

For accounting purposes, reflect accrued interest as part of other expenses. This follows from paragraph 7 of PBU 15/2008. Calculation of interest under a loan agreement posting:

DEBIT 91 subaccount “Other expenses” CREDIT 66 (67) subaccount “Loan interest payments” - interest accrued under the loan agreement;

DEBIT 66 (67) subaccount “Calculations for interest on a loan” CREDIT 68 subaccount “Calculations for personal income tax” - personal income tax is withheld (if the company pays interest to an individual);

DEBIT 66 (67) subaccount “Loan interest payments” CREDIT 51 (50) - interest was paid under the loan agreement.

The exception is loans that your company obtains to purchase or construct an investment asset. Interest on them must be included in the cost of this property. However, small businesses have the right to include interest on any loans as other expenses.

Loan repayment

The loan amount that your company transferred to the counterparty does not need to be included in expenses. In accounting, reflect the refund as follows:

DEBIT 66 (67) subaccount “Calculations for the principal amount of the loan” CREDIT 51 (50) - the loan amount was returned to the counterparty.

More details: https://www.glavbukh.ru/art/21987-naglyadnaya-pamyatka-dlya-dogovora-zayma-provodki-i-raschety#ixzz4OI1eUomO

Payment of principal for November and December

Accounting in 1C

Payment of the principal debt is reflected in the document Write-off from the current account type of operation Loan repayment to the counterparty in the Bank and cash desk section - Bank - Bank statements - Write-off.

Please pay attention to filling out the fields:

- Amount - the amount of the principal debt to be paid, according to the bank statement.

- Agreement - loan agreement with Agreement Type - Other .

- Type of payment - Debt repayment .

In our example, payments under the loan agreement are carried out in rubles, the term of the agreement is more than a year. PDF As a result of selecting such an agreement and the type of payment Debt Repayment in the document Write-off from the current account, the following is automatically set:

- Settlement account - 67.03 “Long-term loans”.

Payment of the principal debt for December and subsequent months is processed in the same way.

Postings according to the document

The document generates the posting:

- Dt 67.03 Kt - payment of the principal debt.

Features of lending

A credit agreement or loan agreement is a bilateral agreement that stipulates the conditions for one party to provide a specific type of assets (money, property, intangible assets, etc.) that belong to this party for temporary use by the second party (organization, individual entrepreneur or employee).

Let us remind you that a loan can only be issued by a specialized organization that has the appropriate license. But borrowed funds can be obtained from a company, individual entrepreneur or individual. In addition, lending is carried out exclusively in money, that is, in cash. While loans can also be obtained in material form, for example, in the form of products, fixed assets, raw materials or any other property of the company.

Some companies can provide borrowed funds free of charge, that is, there is no need to pay additional fees for the use of borrowed assets (Clause 1, Article 809 of the Civil Code of the Russian Federation). However, most companies provide lending for a specific fee - they calculate interest on the loan, and the accrual entries reflect the occurrence of the borrower's debt to the lender.

The provision of borrowed funds in the accounting of the borrower and the lender differ significantly.

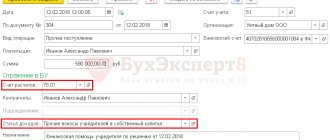

Payment of interest for November and December

Accounting in 1C

The payment of interest is reflected in the document Write-off from the current account transaction type Repayment of loan to the counterparty in the Bank and cash desk section - Bank - Bank statements - Write-off.

Please pay attention to filling out the fields:

- Amount - the amount of interest paid, according to the bank statement.

- Agreement - loan agreement with Agreement Type - Other .

- Type of payment - Payment of interest .

In our example, payments under the loan agreement are carried out in rubles, the term of the agreement is more than a year. As a result of selecting such an agreement and payment type, Payment of Interest in the document Write-off from the current account is automatically set:

- Settlement account - 67.04 “Interest on long-term loans.”

Payment of the principal debt for December and subsequent months is processed in the same way.

Postings according to the document

The document generates the posting:

- Dt 67.04 Kt - payment of interest.

Reporting

Long-term loans received are reflected in the balance sheet according to:

- line 1410 “Borrowed funds” - the balance of debt is reflected;

- line corresponding to the investment asset - in the amount of interest taken into account in the cost of acquisition of this asset.

If there is less than a year left until the loan is repaid, it can be transferred to short-term accounts payable. The possibility of transfer must be recorded in the accounting policies of the organization. If the loan is converted to short-term, it will be reflected according to:

- page 1510 “Borrowed funds”.

In the income tax return, the amounts of accrued interest are reflected as part of non-operating expenses: PDF

- Sheet 02 Appendix No. 2 page 201 “Expenses in the form of interest on debt obligations...”

In the income statement, accrued interest is reflected according to:

- page 2330 “Interest Payable.”

See also:

- Purchasing materials using loan funds

- Purchase of fixed assets using loan funds

- What is the difference between a founder's loan and financial assistance?

- Financial assistance from the founder: features of registration and taxation

- Loan forgiveness by the founder

- Changes regarding the conclusion of credit and loan agreements came into force on June 1, 2018

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Accounting for loans from the lender - entries for issuing loans

If a company issues a loan to another organization, then the transactions will be as follows:

- Debit 58 Credit (50, , …) – entry for the issued loan.

As can be seen from the posting, a loan can be provided not only in the form of a sum of money, but also in the form of property (materials, fixed assets, etc.). The amount that will be taken into account in this case is the value of goods/materials, etc.

When issuing an interest-free loan to a legal entity, the amount is taken into account in the debit of account 76 and the credit of the account for issuing funds or property (50, ,10, etc.).

Loan repayment is documented by posting:

- Debit (50, 40...) Credit 58 (76).

Regarding the taxation of loans with VAT, there are two opposing points of view. The first is based on the fact that there is a transfer of ownership, which is an implementation (Article 39 of the Tax Code of the Russian Federation). Sales are subject to VAT. The opposite point of view: when receiving and returning a loan in the form of goods, there is no object of VAT taxation.

Entries for VAT accounting on loans in kind:

- Debit 91.2 Credit 68 VAT – when issuing a loan

- Debit 19 Credit 58 (76) – accounting for input VAT when repaying the loan.

The issuance of a loan to an employee of an organization is documented by posting:

- Debit 73 Credit 50 ().

The return is processed by return posting.

Example:

The organization issued an interest-free loan to a legal entity in the amount of 320,000 rubles.

Postings for issuing a loan:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 76 | Issuing an interest-free loan | 320 000 | Payment order ref. | |

| 76 | Loan repayment | 320 000 | Bank statement |

Loan repayment

Repay the loan (depending on the type of property being transferred and the terms of the agreement) by writing:

Debit 51 (50, 41, 10...) Credit 58-3 – reflects the return of the interest-bearing loan;

Debit 51 (50, 41, 10...) Credit 76 – reflects the return of the interest-free loan.

When repaying a loan in kind, reflect the amount of “input” VAT on the cost of incoming property using the following posting:

Debit 19 Credit 58-3 – input VAT on property received from the borrower when repaying an interest-bearing loan is taken into account;

Debit 19 Credit 76 – input VAT on property received from the borrower when repaying an interest-free loan is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – accepted for deduction of input VAT (if the organization is a VAT payer).

An example of how a loan issued to an organization in kind is reflected in accounting. The terms of the agreement establish an interest rate; interest is paid in cash

On January 31, Alpha LLC provided an interest-bearing loan in kind to Proizvodstvennaya LLC.

"Alpha" and "Master" are VAT payers.

The subject of the contract is 12,000 sheets of galvanized iron in the amount of 600,000 rubles. (including VAT – RUB 91,525). The actual cost of the goods is 508,475 rubles. The loan repayment deadline is March 2. The interest rate under the terms of the agreement is 20 percent per annum. Interest is paid in cash.

The refinancing rate on the date of interest payment was conditionally 11 percent per annum, not a leap year.

In accordance with Alpha's accounting policy, for accounting purposes, the organization recognizes income from the provision of interest-bearing loans as part of other income.

The following entries were made in Alpha's accounting.

January 31:

Debit 58-3 Credit 10 – 508,475 rub. – the amount of the loan issued is reflected in the amount of the actual cost of the transferred goods;

Debit 58-3 Credit 68 subaccount “VAT calculations” – 91,525 rubles. – the amount of the loan issued is reflected in the amount of VAT accrued on the cost of materials transferred to the borrower.

28th of February:

Debit 76 Credit 91-1 – 9206 rub. (RUB 600,000 × 20%: 365 days × 28 days) – interest accrued on the loan for February.

2nd of March:

Debit 76 Credit 91-1 – 658 rub. (RUB 600,000 × 20%: 365 days × 2 days) – interest accrued on the loan for the period from March 1 to March 2.

The refinancing rate during the loan period was 11 percent per annum.

The amount of interest calculated based on the refinancing rate will be: RUB 600,000. × 31 days : 365 days × 11% = 5606 rub.

The accountant charged VAT on the amount of excess interest received over the amount of interest calculated based on the refinancing rate. The excess amount is RUB 4,258. (9206 rubles + 658 rubles – 5606 rubles).

VAT on the amount of excess interest received over the amount of interest calculated based on the refinancing rate amounted to 650 rubles. (RUB 4,258 × 18/118).

The following entries were made in accounting:

Debit 91-2 Credit 68 subaccount “VAT calculations” – 650 rubles. – VAT is charged on the amount of excess interest calculated based on the terms of the agreement over the amount of interest calculated based on the refinancing rate;

Debit 51 Credit 76 – 9864 rub. (9206 rubles + 658 rubles) – interest was received from the borrower for using the loan in kind;

Debit 10 Credit 58-3 – 508,475 rub. – materials received to pay off the loan debt were capitalized;

Debit 19 Credit 58-3 – 91,525 rub. – input VAT on the cost of returned materials is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 91,525 rubles. – accepted for deduction of input VAT.

An example of how a loan issued to an organization in kind is reflected in accounting. The terms of the agreement establish an interest rate; interest is paid in cash. The organization applies a special tax regime

On January 31, Alpha LLC provided an interest-bearing loan in kind to Proizvodstvennaya LLC.

Alpha uses a simplification.

The subject of the contract is 12,000 sheets of galvanized iron in the amount of 600,000 rubles. The actual cost of the goods is 600,000 rubles. The loan repayment deadline is March 2. The interest rate under the terms of the agreement is 20 percent per annum. Interest is paid in cash. It's not a leap year.

In accordance with Alpha's accounting policy, for accounting purposes, the organization recognizes income from the provision of interest-bearing loans as part of other income.

The following entries were made in Alpha's accounting.

January 31:

Debit 58-3 Credit 10 – 600,000 rub. – the amount of the loan issued is reflected in the amount of the actual cost of the transferred goods.

28th of February:

Debit 76 Credit 91-1 – 9206 rub. (RUB 600,000 × 20%: 365 days × 28 days) – interest accrued on the loan for February.

2nd of March:

Debit 76 Credit 91-1 – 658 rub. (RUB 600,000 × 20%: 365 days × 2 days) – interest accrued on the loan for the period from March 1 to March 2.

Debit 51 Credit 76 – 9864 rub. (9206 rubles + 658 rubles) – interest was received from the borrower for using the loan in kind;

Debit 10 Credit 58-3 – 600,000 rub. – materials received to pay off the loan debt were capitalized.