What is wage indexation

Wage indexation is a periodic increase in wages caused by rising consumer prices for goods and services. By its legal nature, this is a state guarantee of wages for workers (Determination of the Constitutional Court of the Russian Federation dated May 29, 2019 No. 1269-O).

Government agencies, municipalities, state and municipal institutions produce it in accordance with regulatory legal acts (Article 134 of the Labor Code of the Russian Federation).

Thus, from 10/01/2020, the salaries of public sector employees were indexed by 3% (Order of the Government of the Russian Federation dated 09/04/2020 No. 2250-r, clause 1 of the Government of the Russian Federation dated 01/08/2020 No. 1153). The federal budget for 2022 provides funds in the form of subsidies in order to partially compensate for additional costs of increasing wages for public sector workers to the budgets of constituent entities of the Russian Federation (Table 158 of Appendix 33 to the Law “On the Federal Budget for 2022 and for the planning period of 2022 and 2023” " dated December 8, 2020 No. 385-FZ).

Indexation of wages can also be carried out at the expense of the regional budget.

Thus, from 01/01/2021, employees of state government, budgetary and autonomous institutions of the city of Moscow, who are not subject to the provisions of the decrees of the President of the Russian Federation regarding the implementation of measures to bring wages to the appropriate level, have increased their salaries by 3.7% due to budgetary allocations capital (clauses 1, 2.2 of the Decree of the Moscow City Government dated December 25, 2020 No. 2378-PP).

The indexation procedure may also be regulated by industry agreements. In this case, it applies to employees of those institutions to which industry agreements apply (Articles 45, 48 of the Labor Code of the Russian Federation).

For employees not employed in the public sector, wages are indexed in the manner established by the collective, labor agreement, or local regulations of the organization.

The employer, depending on the specific circumstances, the specifics of its activities and the level of solvency, has the right to determine the frequency of indexation, the procedure for calculating its value, and the list of payments subject to indexation.

The provisions on wage indexation established in the organization are mandatory for the employer and apply to all employees.

Indexation: rights and responsibilities

Article 130 of the Labor Code of the Russian Federation declares state guarantees for employees not only in terms of the minimum wage, but also measures to increase the real level of wages. Inflation, which negatively affects the real content of wages, must be taken into account and leveled out by these measures. How to index wages in a commercial organization is stated in Art. 134 Labor Code of the Russian Federation. The Labor Code gives grounds for the conclusion: indexation of labor payments in commercial firms should increase the income of workers at the inflation level of the previous year. The procedure for indexing employee income is an obligation, not a right of management.

Question: Is it a violation if there is no clause on wage indexation in the local regulations of a commercial organization? View answer

Some employers-businessmen, relying on the norms of Art. 134 of the Labor Code of the Russian Federation, they refuse to index wages. This is justified by the fact that the article does not prescribe a clear order. At the same time, it states that the indexation procedure must be specified in the company’s LNA. The manager, when asked about indexation, can answer that there is no such provision in the LNA, therefore, he is not obliged to increase the amount of payment. The Constitutional Court has repeatedly pointed out the fallacy of this interpretation (for example, in Determination No. 2618-O of 11/19/15 and a number of others). Both the Ministry of Finance and the Ministry of Labor take the same positions.

The management of a commercial company must find funds for the annual indexation of wages following price increases, otherwise the company faces penalties (letter of the Ministry of Labor No. 14-3/B-1135 dated 12/26/17).

Annual indexation applies only to employees who have entered into an employment contract. Citizens working under a GPC agreement will not be affected by the mandatory indexation procedure this year. Indexation applies to all organizations and firms, both budgetary and commercial, but what the size will be is decided by the employer in the latter case.

Question: What regulatory document establishes the frequency of wage indexation in a commercial organization? In the absence of a direct legislative norm, is it possible to set the frequency to once every 3 years? When it is stated in the employment contract with the employee, “The salary is indexed in accordance with the Indexation Regulations, is it enough to issue an order for indexation without signing an additional agreement with the employee? View answer

It is impossible not to say about the position of the Supreme Court of the Russian Federation (Review of judicial practice No. 4, paragraph 10, 2022, approved by the Presidium of the Supreme Court on November 15, 2017): since the term “indexation” is absent in the Labor Code of the Russian Federation, the level of wages and its real content can also be increased through direct one-time payments, salary increases, i.e. The Supreme Court does not consider indexation through a percentage indicator to be the only possible way to comply with the requirements of the law.

On a note! In 2015, a bill on the minimum amount of indexation of wages by region of the Russian Federation was submitted to the State Duma for consideration. The document was rejected by legislators.

What is the difference between indexation and salary increases?

1. The wages of all employees of the enterprise are indexed (clause 2 of the Determination of the Constitutional Court of the Russian Federation dated November 19, 2015 No. 2618-O). And salary increases, as a rule, occur in relation to individual employees. It may be due, for example, to the fact that the employee has proven himself well, improved his skills, and increased his productivity.

2. Indexation means an increase in wages by a certain percentage established in a regulatory or local act, in a collective agreement and due to inflation. The decision on how much to increase an employee's salary is made by the company's CEO.

Indexation coefficient

How exactly to index and how much to raise wages depends on the indicator chosen by the employer and fixed in the documents specified by law. It is permissible to use it as:

- consumer price index, which is established in a specific region or throughout the country (according to official data from Rosstat);

- inflation rate included in the federal or regional budget;

- the cost of living for the population;

- any objective indicator of rising prices for goods and services.

Is the employer obliged to index wages?

The employer is obliged to ensure an increase in the level of real wages in connection with rising prices. Indexing is one way, but far from the only one. Instead, the employer has the right to periodically increase wages by raising salaries, paying bonuses, and so on (clause 10 of the Review of Judicial Practice No. 4, approved by the Presidium of the Supreme Court of the Russian Federation on November 15, 2017).

If the company’s internal documents stipulate the obligation to index salaries by a certain coefficient, then it must be observed. And the fulfillment of this responsibility will not be affected by the fact that the general director, by a single decision, increased the salaries of all employees.

For failure to carry out indexation, the company faces administrative liability under Art. 5.27 of the Administrative Code (letter of the Ministry of Labor of the Russian Federation dated December 26, 2017 No. 14-3/B-1135). In accordance with it, violation of labor legislation and other regulatory legal acts containing labor law norms entails a warning or the imposition of an administrative fine:

- for officials and individual entrepreneurs - from 1 to 5 thousand rubles;

- legal entities - from 30 to 50 thousand rubles.

Article 5.31 of the Code of Administrative Offenses provides that violation or failure by an employer to fulfill obligations under a collective agreement or agreement entails a warning or the imposition of an administrative fine in the amount of 3 to 5 thousand rubles.

What is indexing and how often can it be done?

Salary indexation is an increase in employee pay, which should be carried out with a certain frequency by all employers without exception, regardless of whether they belong to the state budgetary sector or are independent commercial structures.

The main goal of this event is to bring wages into line with prices for basic food products and the consumer minimum. Indexation almost always depends on the level of inflation, the minimum wage and other external factors.

It is important to distinguish between indexation and salary increases. The difference is that indexation is carried out for all employees by the same coefficient at the same time, and the salary can be increased for individual employees at different times or by different amounts.

The frequency of indexation can be established by the employer in a collective agreement with employees, labor agreements or other regulations, but it must be carried out at least once a year. Otherwise, if it is discovered that this rule of law is being ignored, the employer may be punished by regulatory authorities through the imposition of an administrative penalty, accompanied by large fines.

How to register wage indexation

Employers not related to the public sector must establish the indexation procedure in a local regulatory act or in a collective agreement.

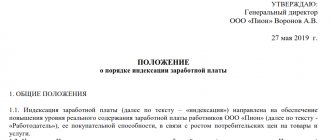

The act that sets out the indexation procedure can be either a separate document (for example, a regulation on wage indexation) or an appendix to a collective agreement or a local act (for example, an appendix “The procedure for indexing wages” to a wage regulation).

When describing the indexing procedure in the document, it is necessary to fix:

1. Indexation frequency (every two years, once a year, once a quarter, and so on).

2. The procedure for determining the indexation value. The indexation coefficient can be calculated (review November 15, 2017, Appeal ruling of the Moscow City Court dated July 16, 2020 in case No. 33-12366/2020) based on:

- from the projected inflation rate in the country. This indicator can be found in the federal budget law for the next three years. For example, for 2022, inflation is planned at 3.7 percent (Clause 1, Article 1 of Law No. 385-FZ);

- the cost of living, determined for Russia as a whole or in a specific constituent entity of the Russian Federation;

Starting from 2022, the cost of living in the Russian Federation as a whole is set for the next year until July 1 of the current year. For the working-age population, the cost of living in 2022 is 12,702 rubles, in 2022 its size will increase to 13,026 rubles (Resolution of the Government of the Russian Federation of June 30, 2021 No. 1070). The cost of living per capita in a constituent entity of the Russian Federation for the next year is established by September 15 of the current year by the constituent entity of the Russian Federation, taking into account the coefficient of regional differentiation. For example, in the Moscow region, the cost of living for the working population in 2022 is 14,987 rubles, in 2022 - 15,394 rubles (Resolution of the Moscow Region Government dated August 24, 2021 No. 706/29);

- growth in consumer prices for goods and services. The consumer price index is officially established both for the country as a whole and for a specific region. It is published monthly by Rosstat and its territorial bodies.

In this case, the starting indicator (consumer price index, inflation) is not a mandatory value. The employer can choose another arbitrary value. The main thing is to take into account the rising cost of living.

3. List of payments subject to indexation (for example, only the salary can be indexed, while the amount of the bonus will remain unchanged or only a part of the salary equal to the regional minimum wage or other threshold will be indexed).

In no case should the document state that it does not apply to some employees. For example, the salaries of homeworkers or people working remotely are not indexed. This will be considered discrimination, for which the company will be held accountable.

An institution can carry out indexation depending on its economic indicators. To do this, you need to record in the document:

- the relationship between indexation and the financial performance of the company. For example, a local regulatory act should provide that the employer, depending on its solvency, carries out indexation by a coefficient that can change annually or quarterly by order of the manager;

- indexation coefficient in an amount not lower than the inflation rate.

For the absence of a document regulating the indexation procedure, the employer may be held administratively liable under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The law obliges the employer to index wages

IMPORTANT! A sample of the Regulations on the procedure for indexing wages from ConsultantPlus is available at the link

The law affirms the absolute obligation of the employer to promote the welfare of its employees and the adequacy of the real content of wages. Art. 134 of the Labor Code of the Russian Federation calls indexation a direct duty of any employer, no matter in what area it operates - budgetary or commercial.

Thus, there can be no discrepancies here - the employer is imperatively required to carry out indexing. However, the provisions of this article do not allow for its unambiguous interpretation. So, from them it is impossible to draw an exact conclusion about:

- timing of indexation;

- its frequency;

- salary indexation procedure.

Since the indexation procedure is not prescribed in basic laws, it must be regulated by employers in internal regulations:

- when concluding employment contracts (individual and collective);

- when drawing up any agreements, including amendments to contracts;

- in a separate local regulatory act;

- in the industry agreement.

ATTENTION! If the enterprise does not have a document with indexation regulations or its mechanism is not mentioned in the text of the employment contract or collective agreement, this does not relieve the employer of obligations before the law. The document must be developed or changes and additions must be made to existing acts. The absence of such provisions is a direct violation of the requirements of the Labor Code.

Since modern labor legislation in terms of regulating indexation is imperfect, bills are being introduced calling for changes to a number of ambiguous formulations aimed at creating a more precise concept of the wage indexation procedure and its imperativeness.

How to apply for wage indexation

Indexation is processed in the following order.

1. We fix the procedure for indexing. It can be formulated as follows:

- salaries, hourly tariff rates and piece rates are subject to indexation;

- Additional payments, allowances and bonuses set in a fixed amount are not subject to indexation;

- the payments indicated above are indexed once a year by the indexation factor;

- the value of the indexation coefficient is calculated from the projected level of inflation in Russia for the current year.

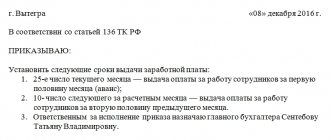

2. We issue an order to index wages. It must indicate the specific coefficient by which the salary will increase, as well as the date from which wages must be calculated in a new way. You should indicate the threshold amount for indexation if a local act provides for the establishment of such an amount by the head of the company. The order must be familiarized to employees against signature.

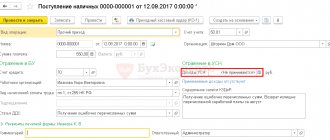

3. We make changes to employees’ employment contracts, since information on remuneration is an essential condition of the employment contract.

4. We make changes to the staffing table.