Payroll calculation is a labor-intensive and painstaking procedure. Despite the widespread automation of this process, an accountant is not immune from errors. Failures in the operation of computer equipment also occur, which can result in incorrect calculations and overpayment of wages to employees.

Having discovered an error, the accountant often makes an automatic deduction from the next month's accruals based on settlements with the employee, making the appropriate entries in accounting. Is such a “simple” way out of the situation legal? In what cases does an organization have no right to withhold excess wages paid? Is an accountant responsible for errors in payroll calculations? Let's find out in the article.

Is it possible to pay wages to a non-resident through a cash register ?

Returns are not always possible

It should be said right away that “automatic” deductions of amounts overpaid to an employee from the next month’s wages or failure to issue part of the wages in cash from the cash register under the same conditions are illegal.

Resolving an unpleasant situation for an accountant should begin with receiving a statement from the employee, in which he asks to withhold the excess amount of money received or undertakes to pay it in cash voluntarily.

It is possible to do without written consent only in some cases described in the Labor Code of the Russian Federation (Article 137):

- the presence of a counting error, i.e. such an error that can be attributed to arithmetic;

- the calculation was made on the basis of false information received from the employee (for example, false documents for personal income tax deduction);

- the calculation was made on the basis of false information from the primary documents for calculating wages (for example, according to the documents, the production output standard was met, but in fact it was not).

As a rule, such situations, in particular, the submission by an employee of false information that affects the calculation of “salary” amounts, are resolved in court (see the Labor Code of the Russian Federation, the same article).

If the employee has expressed in writing his consent to repay the overpayment, the employer can withhold it only for a month after the end of the period specified for the return of advances, debts, and incorrectly accrued amounts of payments.

How to arrange the release of deposited wages from the cash desk by proxy?

Procedure for deducting overpayment

First, you need to determine whether it is possible to withhold overpaid money from the employee. You can withhold money from an employee in the following situations (137 Labor Code of the Russian Federation):

- The employee did not work out the funds previously issued to the employee or did not return them. An example is failure to provide a report on a business trip or for accountable money. Or the employee was paid an advance, which he did not work off. In some cases, it is also possible to withhold vacation pay, for example, when the employee’s vacation was provided in advance and the employee resigns. It is important to remember that vacation pay cannot be withheld if an employee quits due to layoffs or conscription into the army;

- The employee was overpaid due to an accounting error. Or, due to an accounting error, the employee received a large amount of vacation pay or benefits.

Counting error and judicial practice

The presence of a counting (arithmetic) error is the most common argument of the employer when withholding overpaid amounts of wages. However, judicial practice in this area most often does not work in favor of organizations.

Example: The Moscow Regional Court, in its ruling No. 33-19764 dated 10/12/10, expressed the opinion that an overpayment cannot be a counting error, but is a consequence of the employer’s incorrect application of labor legislation. According to the judges, the overpayment cannot be attributed to the amounts of unjust enrichment (Civil Code of the Russian Federation, Art. 1109). The employee is not obliged to return the funds overpaid to him. In addition, not all courts recognize a malfunction in an accounting program as a counting error.

Example: The Sverdlovsk Regional Court, in its ruling in case No. 33-7642/2016 dated 04/21/16, did not recognize a technical counting error, but the Samara Regional Court in its ruling No. 33-302/2012 dated 01/18/12 did.

Judicial practice on the application of Art. 137 of the Labor Code clearly indicates that the following cannot be recognized as a counting error:

- payment for a longer vacation than the employee is entitled to by law;

- payment of a larger bonus;

- erroneous payment of double wages for the period.

This is evidenced by numerous decisions of courts of all levels, up to and including the Supreme Court (definition No. 59-B11-17 of 01/20/12).

On a note! Rostrud, in its letter No. 3044-6-0 dated 09-08-07, expresses the point of view according to which, even if there is an undeniable accounting error, the employee’s written consent is required to repay the difference at his expense.

What an employer may face

To begin with, it is necessary to indicate that a number of cases and errors can lead to overpayment of excess funds to an employee.

This may be the accountant's inattention when entering salary figures or when creating a statement for payment to a bank or cash desk. Or the chief accountant did not control the process enough. Applicable laws may also be misinterpreted and misapplied. Another common case of overpayment of wages is payments made for days not worked, in the case of untimely submission of a time sheet. According to Art. 137 of the Labor Code of the Russian Federation, overpaid wages can be recovered by the employer from the employee in certain cases:

- When the cause was a counting error (that is, an error made in arithmetic operations).

- When the employee’s fault was recognized (failure to comply with labor standards or downtime).

- When the court established the unlawful actions of an employee, which led to the receipt of “extra” amounts.

In all other cases, the employer will not be able to recover overpaid wages from the employee.

For example, if the law or regulatory documents were incorrectly interpreted and applied. If there was a failure in the calculation program, calculation indicators or forms of accrual of salary amounts were entered incorrectly (this kind of error is called technical). If the accrual amounts were calculated for an incorrect billing period or repeated payments of salaries, bonuses or other one-time accruals were made. The current labor legislation does not have a clear definition of a counting error. Due to this, the question often arises about what error is considered countable and by what criteria it is determined. In Letter No. 1286-6-1 dated October 1, 2012, Rostrud explained that a counting error is one made during arithmetic calculations (for example, an error when adding the components of wages, an incorrect comma or an added extra digit). Whether a counting error occurred or not is determined only by going to court, where the employer will have to prove that the error was in arithmetic operations.

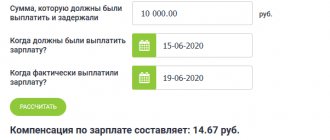

From all of the above it follows that if you mistakenly overpaid wages and the reason for the overpayment does not fall under the exceptions listed above, then until an agreement is reached with the employee on the voluntary return of the overpayment, such an amount cannot but be recovered, not withheld for wages or any other payments. Moreover, if the employee does not want to voluntarily repay the debt, it is also unlikely to be able to collect the amount voluntarily.

Documentation of the return of excess payments

Having discovered an error, the accountant is obliged to report it to the management of the company. Next, an act is drawn up, which records the fact of overpayment, amount, accrual period and other essential information. Members of the commission signing the act may be: accountant, chief accountant, cashier, etc.

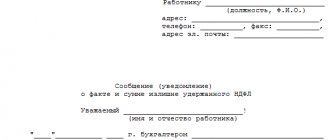

The second copy of the document or its copy is sent to the employee in relation to whom the error occurred. An official letter of notification about the need to repay the overpaid amount within a certain period is attached to the act.

If the employee does not object, then, based on his application, the amount is paid in cash or by non-cash deduction from wages on other terms agreed with the administration. Often such repayment occurs in installments. According to Art. 138 of the Labor Code of the Russian Federation, as a general rule, deduction is possible in the amount of no more than 20% of each salary. It should be taken into account that the employee, in addition to the specified amount to be repaid, may have other deductions.

If an employee agrees in writing to repay the debt in cash at the cash desk or voluntarily deposit it into the company’s account, but this period has expired and the debt has not been repaid, then within the next month the manager issues an order to deduct the amount of the debt from the employee’s salary. If the employee ignores the notice or refuses to repay the overpayment, the employer may go to court.

The issue with an employee who, upon dismissal, received more than what was required by law, is resolved in the same manner as indicated above. It is advisable to immediately indicate in the notice the possibility of going to court if the debt is not repaid. Dismissed employees in most cases refuse to voluntarily repay overpayments.

How to formalize and reflect in accounting the return to the cash desk of wages overpaid to an employee?

Accountant's responsibility

An accountant may be held financially liable under the law if it was not possible to repay the overpayment at the expense of the employee. The basis for holding the accountant accountable can be an act recording (Labor Code of the Russian Federation, Article 247):

- the amount of material damage;

- the reason for the loss.

The amount of loss can be repaid by an accountant in two ways:

- if there is a liability agreement with him, repayment occurs in full;

- if there is no contract of liability, repayment occurs in the amount of average monthly labor payments (Labor Code of the Russian Federation, Articles 244, 248).

If the accountant does not agree to repay the amount of the error voluntarily or the month period discussed above has expired, the issue of collection is decided exclusively by the court.

On a note! The full financial responsibility of an accountant can be fixed in an employment contract with him.

Postings

If you discover an overcharged and overpaid amount, you should remember that part of this amount is income tax. Thus, the excess payment is “split” into two independent amounts and reflected in different entries.

First, the overpayment as a whole is reversed, using the same entries by which it was accrued: Dt20, 23, 26 Kt70 - reversal for the amount of the overpayment (payments to the Funds for overpayment are similarly reversed).

Then personal income tax is reversed: Dt70 Kt68/NDFL – reversal from the overpayment amount (13%).

The remaining amount overpaid to the employee is reflected in account 73 with the opening of the corresponding sub-account: Dt 73 Kt 70.

The employee voluntarily pays off the debt by depositing funds into the cash register or by deducting from the salary. It is also possible to deposit funds into the company's current account: Dt50,51,70 Kt73.

If for some reason the debt cannot be collected, then the following entries are made:

- Dt76 Kt 73;

- Dt 91/2 Kt 76.

Refund of wages erroneously transferred to an employee

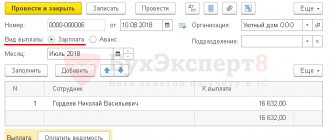

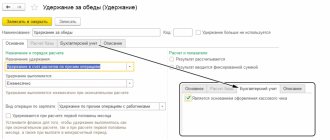

When you deposit money into the cash register, a cash receipt order is drawn up with the document Cash Receipt , available from the Bank and Cash Desk - Cash Desk - Cash Documents section:

- Type of operation - Other income ;

- Credit account – ;

- Reflection in the simplified tax system - Not accepted (delete amount).

Movement of the document Cash Receipt according to the register The book of income and expenses (section I ) shows: the amount was reflected in the Total Income and was not included in the accepted Income.

Results

- Excess accruals and wage payments can be returned to the organization without any problems only with the written consent of the employee in respect of whom the overpayment was made, and only if the one-month period is observed after the one set for the employee to voluntarily repay.

- In other cases, the return may be contested, including in court, despite the legally established possibility of debt repayment. A detected error in payments must be recorded in an act signed by the organization’s internal commission. The employee must be familiarized with the act.

- An accountant who makes a mistake bears financial responsibility for it in accordance with the law.

- Correspondence accounts used to account for overpayments of wages are reversal entries of previously made entries. The excess amount paid in hand is reflected in Dt 73 account. Its repayment by the employee is reflected in the Dt of the corresponding accounts, depending on the method of repayment. If the loss cannot be recovered, it is transferred to Dt 76 and then recorded according to Dt 91/2.

We ask the employee to voluntarily repay the debt

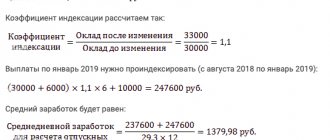

If the advance payment is returned, there will be no need to make adjustments to insurance premiums, since insurance premiums are not charged from the advance amounts. The same applies to personal income tax, if the employer does not withhold tax from advances paid.

If it is withheld, then the transferred tax will have to be returned to the current account or counted against future payments to the budget, and an updated 2-NDFL certificate will be issued for the employee if the tax period in which the overpayment occurred has expired.

If you voluntarily return the overpayment, there is no need to make any mutual settlements with the personal income tax officer, since he returns the money from which personal income tax has already been withheld, that is, minus tax.

When returning vacation pay, the accountant must reverse the accrual entry and cancel expenses in the form of accrued vacation pay in tax accounting.

There is an overpayment of insurance premiums. For the current period, it is necessary to take into account the adjustments for their accrual, and the overpayment should be adjusted with further payments.

If, in connection with the deletion of accrual of vacation pay, negative values are formed in the personalized accounting in the Pension Fund of the Russian Federation for an employee, the company’s report will not be accepted. Therefore, you will have to adjust not the current period, but the previous period. An overpayment of personal income tax is formed, withheld from the amount of vacation pay and transferred to the budget.

If the 2-NDFL certificate for the corresponding year has been submitted, you need to make an updated certificate - the current date with the old number.

The posting for accrual of personal income tax on vacation pay is reversed. The resulting tax overpayment can be returned to your current account or offset against future payments to the budget. EXAMPLE 1. HOW TO REFLECT OVEREXPENDITURE OF HOLIDAY PAY AND THEIR VOLUNTARY REFUND

At the beginning of the reporting year, employee Belov was granted early leave for the unworked period.

The amount of accrued vacation pay is 20,000 rubles, personal income tax in the amount of 2,600 rubles. (RUB 10,000 × 13%) was withheld and transferred to the budget. Belov received 17,400 rubles. (20,000 rubles - 2600 rubles). The accountant made the following entries: Debit 20 Credit 70

- 20,000 rubles.

– vacation pay was accrued to Belov; Debit 70 Credit 68

- 2600 rub.

– personal income tax accrued; Debit 68 Credit 51

- 2600 rub.

– personal income tax is transferred; Debit 70 Credit 50

- 7,400 rub.

- vacation pay was issued to Belov. Returning from vacation, Belov resigned. The vacation pay was returned to the cash register. The accountant made the following entries: Debit 20 Credit 70

- 20,000 rubles.

– Belov’s vacation pay was reversed; Debit 70 Credit 68

- 2600 rub.

– personal income tax accrual was reversed; Debit 50 Credit 70

- 17,400 rub. - Belov returned overpaid vacation pay. In tax accounting, wage expenses in the amount of 20,000 rubles. cancelled. Overpayment of personal income tax in the amount of 2600 rubles. will be counted against upcoming payments to the budget after the tax inspectorate makes an appropriate decision based on an application from the tax agent.