Concept and rates of income tax in 2022

Income tax (NDFL) is a tax paid on income received by all residents and non-residents of Russia. The tax agent, i.e., calculates, withholds and transfers income tax from wages. person paying the income.

Almost all income of a physicist is subject to taxation:

- wage;

- bonuses, allowances;

- remuneration received as part of the execution of civil contracts;

- winnings;

- income received in kind, etc.

Income tax rates depend on the status of an individual and the type of income:

| Tax rate | It applies to: |

| 13% |

|

| 15% | dividends paid to non-residents |

| 30% | income from securities of Russian companies |

| 35% |

|

Payment of personal income tax in case of late receipt of final payment

In practice, there are often situations in which a resigning employee cannot receive the required payments in a timely manner for various reasons. This usually happens when the employee is on vacation or sick leave.

According to the rules discussed above, the accounting department must make personal income tax transfers on the day when funds intended for the resigning employee are received from the bank. If he cannot receive these funds in a timely manner, then the accountant does not need to petition the tax service for a refund of the transferred tax, and then again, after issuing the calculation to the employee, make tax transfers. When an employee cannot come to the accounting department on time and receive the final payment, by law it is considered to have been received with a deferment. The dismissed employee will receive the required funds later, if possible, after deducting tax.

It’s another matter if the funds are transferred to the employee’s bank card. They are credited immediately to his bank account after the accountant receives funds to pay salaries and contributions to the tax service. That is, in any case, the date of personal income tax payment in the event of dismissal of an employee is the day the accountant receives the funds intended for payment from the bank.

What amounts are not subject to income tax?

The Tax Code of the Russian Federation does not contain certain benefits for personal income tax. But it provides for certain amounts:

- in the form of income that is not taxed at all;

- which are not taxed in the prescribed amount and are deducted from the income received (deductions). That is, the income received is reduced by the amount of the deduction and income tax is withheld from the balance.

There are deductions:

- standard (children's deductions);

- property (for the acquisition/sale of property);

- social (for treatment, training, pensions);

- professional (only for individuals performing work under GPC contracts, as well as individual entrepreneurs, self-employed persons, etc.);

- investment (for individuals who open investment accounts and also receive income from the sale (redemption) of securities traded on the Ordinary Securities Market).

How to reflect payments to a dismissed employee in 6-NDFL

Now let's talk about how to reflect the dismissal of an employee in 6-NDFL. At the same time, we will complicate the situation by allowing the employee to receive not only salary, but also other payments due upon dismissal, incl. severance pay and average earnings for the 2nd and 3rd months after dismissal, exceeding the non-taxable limit.

Note! Cases of payment of severance pay are strictly limited by the Labor Code of the Russian Federation. In our material, under the term “severance pay” we generalize any compensation upon dismissal, incl. upon dismissal by agreement of the parties.

There are no explanations about the differences in the principles of reflecting in form 6-NDFL the amounts due to an employee upon dismissal, attributable to wages, as well as other income.

If you follow the law literally, the date of actual receipt of income is:

- the last day of work, if we are talking about salary payments upon dismissal;

- day of payment of income - for other income received in cash upon dismissal.

For each type of payment, a separate block is filled in section 1.

We decided on this. Now let's look at non-taxable amounts.

Amounts of severance pay and cf. earnings for the 2nd and 3rd months after dismissal, not exceeding in general 3 times the average monthly earnings (6 times for workers in the northern regions), are not subject to income tax (paragraph 8, paragraph 3, art. 217 of the Tax Code of the Russian Federation). Since there are no deduction codes for these non-taxable amounts in Order No. ММВ-7-11/ [email protected] , only the amount in excess of the payment over the non-taxable part will be included in the calculation.

Thus, the calculation reflects:

- salary,

- compensation for unused vacation,

Read about its calculation in the article “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation.”

- severance pay and cf. earnings exceeding the limit.

Procedure for withholding income tax from wages

Income in the form of wages is accrued once a month, on the last day of the month (clause 2 of article 223 of the Tax Code of the Russian Federation). Accordingly, salary income tax must be calculated and withheld once a month. This provision is confirmed by letters of the Ministry of Finance of the Russian Federation dated September 12, 2017 No. 03-04-06/58501, dated April 10, 2015 No. 03-04-06/20406. An exception is the situation of dismissal of an employee, in which the calculation of his salary for the current month is made on the day of dismissal (last working day).

Deadlines for payment of income tax on accrued wages to the budget, in accordance with clause 6 of Art. 226 of the Tax Code of the Russian Federation are associated with the dates of actual payment of income. Personal income tax on wages is transferred no later than the next day after the day of its payment.

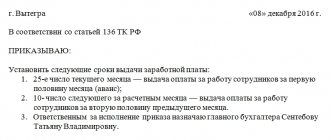

Due to the fact that Art. 136 of the Labor Code of the Russian Federation obliges organizations to pay wages at least 2 times a month (for the first and second halves), wages are actually paid twice:

- in the current month for its first half (advance);

- in the month following the billing month for its second half (final settlement).

From 10/03/2016 Art. 136 of the Labor Code of the Russian Federation limits the period during which the accrued salary must be paid: the payment date cannot be set later than the 15th calendar day occurring after the period for which the salary was accrued.

Do I need to pay personal income tax when paying an advance? If it is paid before the end of the month with which it is contacted, then it is not necessary. An advance is not yet a salary, but a payment towards the amount that will be calculated only on the last day of the month. The point of view that there is no need to transfer personal income tax on an advance payment is confirmed by letters from the Ministry of Finance of the Russian Federation dated December 15, 2017 No. 03-04-06/84250, Federal Tax Service dated April 29, 2016 No. BS-4-11/7893, dated May 26, 2014 No. BS -4-11/ [email protected]

The situation is special with an advance payment, the payment date of which coincides with the last day of the month (i.e., the day of accrual of income for this month). The tax authorities believe that personal income tax must be paid on such an advance. The courts can also support them (see the decision of the Supreme Court dated May 11, 2016 No. 309-KG16-1804).

The rules for calculating advance payments are not strictly established. The amount of the advance payment is not calculated in accounting. The company itself has the right to decide how much it will be paid. This may be the full amount of wages accrued for the first half of the month, without deducting income tax from it, or the amount of wages reduced by the amount of personal income tax. The second option is preferable for the organization due to the likely possibility of the employee leaving work in the second half of the month. In this case, there will simply be no way to collect income tax not withheld from the income paid.

Dismissal: final settlement

On the last working day (day of dismissal), it is necessary to make a final payment and pay all amounts due to the employee.

Typically this is:

- Wages (salary, bonuses, allowances, additional payments for part-time work, etc.) accrued for time worked.

- Leave compensation upon dismissal (subject to personal income tax).

- Compensation payments based on dismissal.

Compensation payments based on dismissal include:

- Severance pay for redundancy.

- Severance pay upon dismissal for disability pension.

- Redundancy benefits while looking for a new job.

- Compensation to the manager, his deputies, and the chief accountant upon termination of the employment contract.

On the day of dismissal, it is necessary to transfer the entire accrued amount minus income tax (calculated according to the Tax Code of the Russian Federation) to the employee’s personal account or issue it at the company’s cash desk.

The employer has no right to delay payment (even if the bypass sheet is not signed).

Algorithm for calculating income tax from wages in 2022 using an example

Let's consider the procedure for calculating and withholding income tax from wages.

Example.

Samokhina L.A. works as a salesperson at Alternativa LLC. Her salary is 30 thousand rubles. per month. Samokhina has 3 dependent children and she wrote an application for a standard deduction.

Tax-free deduction amounts will be:

1,400 rub. - for 1 child;

1,400 rub. - for the 2nd child;

3,000 rub. - for the 3rd child.

The amount of tax to be withheld for January 2022 is: RUB 3,146. ((30,000 - 1,400 - 1,400 - 3,000) *13%)

Having paid the salary, Alternative LLC is obliged to transfer the tax withheld from the salary.

Let's consider the procedure for transferring income tax from wages to the budget.

Employee tax calculation

The income of the company's employees includes:

- monthly salary;

- payment of vacation and sick leave benefits;

- cash allowances, bonus payments;

- other payments provided for in the employment contract.

When calculating the tax amount, the entire monthly income paid to the employee must be taken into account. This amount is the taxable base, from which tax is withheld at the rate of 13%. That is, the tax is calculated using the formula:

NB*13%, where NB is the sum of all monthly income of the employee (salary).

Important! The letter of the Ministry of Finance No. 03-03-06/1/610 dated September 24, 2009 states that the tax not transferred from the advance payment must be calculated during the final calculation.

Transfer of income tax in 2020-2021

Currently, there is a single deadline for paying personal income tax on all forms of wage payment. The organization is obliged to transfer personal income tax to the budget no later than the day following the day of actual payment of wages, taking into account the postponement due to weekends and holidays (clause 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation).

A special deadline for transferring personal income tax is established for sick leave and vacation pay. The withheld tax must be transferred to the budget no later than the last day of the month in which such payments were made.

In the payment order for the transfer of personal income tax from wages, in field 101 “Payer status”, indicate the number 02, corresponding to the status of the tax agent.

When processing payment orders, it should be taken into account that by order of the Ministry of Finance of the Russian Federation dated October 30, 2014 No. 126n, the requirement to fill out field 110 “Payment Type” was canceled.

Important! Violation of the deadline for transferring income tax (even for one day) is punishable not only by penalties, but also by a fine in the amount of 20% of the late paid amount (Article 123 of the Tax Code of the Russian Federation).

What is personal income tax and who is the tax agent?

Any enterprises, organizations, firms or private entrepreneurs carrying out labor activities on the territory of the Russian Federation and registered with the tax authority are required to pay income tax (NDFL) to the state.

They are tax agents for the payment of personal income tax on the income of their employees. Even if an organization hires external employees to work at another enterprise, but they receive salaries from this organization, then this organization will also be a tax agent, since the hired employees receive income from it. Expert commentary

Kamensky Yuri

Lawyer

Tax to the state budget must be paid on all income of employees officially employed by the enterprise. The accounting department of the enterprise is responsible for calculating and withholding personal income tax. In this regard, the chief accountant is the responsible person for personal income tax transfers to the state budget. He represents the company as a tax agent. The tax is calculated into the state budget on a monthly basis. Data to the tax authority on the amount of required deductions is provided on an accrual basis. That is, personal income tax paid in the current month is added to the previously listed tax amounts.