When should salaries be paid?

The legislation clearly states that every employee must receive a salary at least twice a month, i.e. every two weeks. If the employer has the desire, he can pay his subordinates more often - even every day at the end of the shift.

It is impossible to issue salaries less than twice a month: violation of this rule threatens enterprises and organizations with serious sanctions from supervisory structures.

At the same time, exactly how the wages will be divided: equal shares or not – is at the discretion of the employer.

On October 3, 2016, legislators determined the exact day by which wages should be transferred to employees - this is the 15th of the current month. If the enterprise previously established deadlines that did not comply with this rule (for example, “finishing” for the previous month was paid on the 16th or later), it is necessary to issue an order to postpone the payment of wages.

This procedure should also include written notification to all employees of the enterprise about upcoming changes in the timing of salary payments at least two months before the event itself.

If the employee does not agree with the innovation, according to Art. 74, clause 7, part 1, art. 77, art. 178 of the Labor Code of the Russian Federation, the employer has the right to fire him.

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader.

Salary payment deadlines: establishment and change

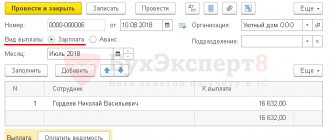

Salaries must be paid to the employee at least every half month (paragraph 6 of Article 136 of the Labor Code of the Russian Federation). Thus, the interval between the advance and payment for the month should not exceed 15 days. The employer chooses the specific dates for transferring funds to employees and prescribes them in one of three documents:

- internal labor regulations (ILR);

- collective agreement;

- employment contract.

Some courts and representatives of the State Labor Inspectorate insist on the need to indicate the exact dates of payment of wages in at least two documents: the PVTR and in one of the agreements (collective or labor agreements). Specifying salary payment intervals (rather than exact dates) in an employment or collective agreement may lead to disputes with controllers and penalties that will have to be contested in court. Therefore, we recommend that you specify the dates of salary payment both in the PVTR and in the contract.

The procedure for changing them depends on the document in which the deadlines for issuing wages are stated. Let's consider each of the options.

How to write an order correctly

Today there is no standard uniform template for all orders on the timing of payment of wages, so employers can write it in any form. In some cases, enterprises use internal document templates approved in the company's accounting policies. But, regardless of which path is chosen, the order must include a number of mandatory information. These include:

- Date of preparation,

- Name of the organization,

- the essence of the order, i.e. exact dates of payment of wages,

- the basis for its writing,

- persons responsible for its execution, indicating their positions and full names.

If any additional papers are attached to the document, they must be noted in a separate paragraph.

Certificates of arrears of wages and absence of arrears of wages

The purpose of a certificate of arrears of wages is to certify on the part of the employing organization the fact of the existence of arrears to the employee, as well as to prove a certain amount of such arrears.

This certificate may be required:

- An employee of a bankrupt company. In this case, the certificate is submitted to the arbitration manager to include the employee in the register of creditors.

- An employee of an office who is late or does not pay wages - to be presented to the tribunal, and then to the bailiffs in order to collect the accumulated debt. On this topic, our articles on the links Peculiarities of consideration of labor disputes regarding wages and What is the statute of limitations for wages?

- The organization itself submitting an application for recognition as zero. In this case, the certificate serves to take into account the total debt of the organization to creditors and is taken into account when assessing the volume of property created to satisfy the claims of creditors of such an organization (for example, the decision of the Vologda Region AS dated June 14, 2017 in case No. A13-4034/2017).

Thus, the mentioned certificates, properly executed, play in court the role of one of the proofs of the fact of debt, along with, for example, protocols, inspection reports, certificates of the labor dispute commission (read more about this document and the procedure for issuing it in our article at the link Certificate of the commission on labor disputes - standard), balance sheets, etc.

How to place an order correctly

The law does not impose any special requirements on both the information part of the document and its execution, so it is permissible to write an order both on a simple blank sheet of A4 or A5 format, and on the company’s letterhead, printed or handwritten. The only thing that must be strictly observed is the presence of an original signature of the head of the organization or a person authorized to endorse such papers.

In addition, the order is usually signed by the employees responsible for its implementation and those whom it directly concerns.

The signatures of the latter indicate that they are familiar with the order.

There is no strict need to stamp an order now: various types of cliches and stamps can only be used when this norm is established in the internal documents of the company.

In general, seals and stamps are no longer required for use (including by legal entities).

Usually the order is written in one original copy , but if necessary, additional copies can be made (for example, for presentation to the personnel department and accounting department).

Salary payment letter: how to issue?

A letter demanding payment of wages is written by the employee personally and can be sent to the employer by mail or delivered in person. The document is drawn up in 2 copies. On the copy that the employee keeps for himself, the manager is obliged to sign and date the text of the letter. In this way, not only employees who continue to work at the enterprise, but also dismissed employees who have not received the money due to them by law have the right to demand the return of arrears of wages.

The letter of claim is drawn up in free form; the applicant must adhere to the official style. When writing an application, you must follow the outline below:

- At the top of the document is the name of the company where the employee works (or full name of the individual entrepreneur), the last name/first name/patronymic name of the employee responsible for paying wages, the personal data and position of the employee sending the letter of claim.

- Below, in the center, is written “Statement” or “Claim”.

- Next, you need to explain the essence of the dispute; you must definitely mention:

- Full name and position held by the employee who wrote the letter;

- date of conclusion and number of the employment contract;

- salary amount (according to the contract);

- when wages were last paid;

- how much the employer owes in total.

- Then you should outline the employee’s requirements arising from the above, supported by references to current laws and clauses of the employment contract.

- You should indicate the time and method of responding to the letter, put the date and your signature.

- Applications (if available).

Responsibility for delayed wages

By transferring money for work inappropriately to his employees, the manager bears responsibility under the Labor, Criminal and Administrative Codes:

- Art. 236 of the Labor Code establishes that each day of delay must be compensated with interest in the amount of not less than 1/300 of the rate of the Central Bank of the Russian Federation on the remaining amount of debt, starting from the first day of delay and ending with the specific date of transfer of funds.

- Art. 5.27 of the Code of Administrative Offenses of the Russian Federation provides for more stringent measures in the form of warnings or fines: for officials and individual entrepreneurs - up to 5,000 rubles, for legal entities - up to 50,000 rubles.

- Art. 145.1 of the Criminal Code of the Russian Federation is valid in case of partial non-payment of wages for longer than a quarter, or complete disregard for payments for more than 2 months.

For the employer, such violations can also threaten the fact that his subordinate has every right not to go to work if he has not received funds for more than half a month, but for this he must provide notice in writing (Article 146 of the Labor Code of the Russian Federation).

Before receiving a written notification from the manager in person about the readiness to pay the funds, the employee may not be at the place of work, but must continue working no later than the day following the date of issue of this document.

In what exceptional cases is an employee prohibited from suspending his work activity:

- If it is on the state. service or works in ambulance, electricity, gas, water, heat supply or in PT communications).

- In wartime or during the introduction of a state of emergency in the area of the subject.

- During contract service in the Armed Forces, employment in search and rescue units, the Ministry of Emergency Situations, the Ministry of Internal Affairs.

- If the organization services unsafe production facilities.

Sample certificate of lack of wages

Such a document confirming the fact of lack of income in the presence of official employment may be required, for example, by a citizen applying for a subsidy, or for submission to the tribunal for calculating the amount of alimony or deferment of debt payment, deferment or installment plan for payment of state duty and other purposes.

The form of such a certificate is not regulated at the legislative level, therefore it can be drawn up in free form indicating the mandatory attributes. With all this, it can either simply indicate the period during which the employee does not have wages (for example, due to being on leave without pay), or provide a monthly breakdown. In particular, such information can be presented in form 2-NDFL (see order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. ММВ-7-11 / [email protected] ) with zeros entered in the columns for the appropriate months.

A standard certificate in free form can be downloaded from the link: Certificate of lack of salary - standard.

When should a manager transfer money?

In accordance with Art. 136 of the Labor Code of the Russian Federation, the procedure, place and timing of salary payments in 2015 are determined by an internal collective or labor contract, but the gap between payments cannot exceed 15 days. For example: every month on the 20th - advance payment, on the 5th - salary. Clear dates are established by the regulatory documents of the organization itself. The standard order for the timing of salary payment (download in attachment N1) is not established by any legislative act, and the director fills it out without the help of others, but it must contain a reference to Art. 136 TC and certain numbers by which funds will be transferred. The employer can also set payments at other times, but taking into account the provisions of Art. 136 Labor Code of the Russian Federation.

If the accrual date falls on a calendar holiday or weekend, then the money must be transferred or issued in cash before this day. When going on regular or extraordinary vacation, an employee must receive vacation pay no later than 3 days before its official start.

An employee can be given money either in cash directly at the enterprise’s accounting department or through a credit company (bank). To do this, the company must have a service contract, and employees are issued plastic cards.

To design a contract with the bank, you will need a certificate about the timing of salary payments. (download file No. 2) Its standard is compiled by the organization itself in printed form, and must contain the signature of the chief accountant and the manager himself, as well as a seal.

Guided by paragraphs 1-4 of Art. 136 of the Labor Code of the Russian Federation, when transferring funds for his own work, the employee has the right to familiarize himself with the receipt, which contains the following information:

- About the components (salary, monthly bonus).

- About other amounts (one-time bonus, vacation pay, compensation from the employer for late payment, etc.).

- On deductions for payment of income tax to the Federal Tax Service and contributions to the Pension Fund, indicating all amounts.

- About the total amount to be transferred.