What about salary increases?

Increasing wages is a common procedure carried out by employers. Moreover, such an increase can be achieved using different methods:

- by indexing;

- salary increase.

Despite the fact that these methods are similar in their results, their nature is different in essence. Indexation is a guarantee provided at the state level (Articles 130, 134 of the Labor Code of the Russian Federation). The salary increase is voluntary.

The differences between these procedures are discussed in more detail below:

| Criterion | Indexing | Salary increase |

| Need for use | Mandatory | Voluntary |

| Circle of people | Applies to all employees | Does not apply to all employees |

| Causes | Impact of rising prices | Employer's decision |

| Increase size | Regulated at the state level | Set by the employer |

Salary increases in the form of indexation should be applied by all employers. Moreover, one of the conditions for using such an increase is the presence of a mention of this in the collective agreement or other local regulatory act of the enterprise (definition of the Constitutional Court of the Russian Federation dated November 19, 2015 No. 2618-O, letter of Rostrud dated April 19, 2010 No. 1073-6-1). In addition, it is within the competence of each employer to independently establish indexation rules, as well as determine the indexation coefficient itself.

The indexation coefficient (CI) is determined in the following way:

CI = Salary after indexation / Salary before indexation

NOTE! Since indexation is a government measure to bring the income received by citizens into line with the level of current market prices, the value of the CI provided by the employer is recommended to be correlated with the inflation rate for a specific region or country (determination of the St. Petersburg City Court dated March 21, 2011 No. 3866).

At the same time, it is also necessary to adjust the average earnings (AS). Note that the SZ should be adjusted if the wages themselves (salaries and tariff rates) change. If the size of other payments, for example compensation or incentives, has increased, this does not entail the need to adjust the SZ (clause 16 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, hereinafter referred to as the Regulations).

If you have access to ConsultantPlus, check whether you indexed your average earnings correctly when calculating vacation pay. If you don't have access, get a free trial of online legal access.

How to calculate the indexation size

Despite the strict regulations, the manager has the opportunity to prescribe the procedure and calculate the index based on his own needs and funding levels. The indexation coefficient, as well as the salary increase coefficient when calculating vacation pay, is determined by the formula:

CI = salary after I / salary before I,

Where:

- CI - coefficient;

- And - indexing.

The indicator of old and new salaries includes all amounts paid monthly to an employee in the form of remuneration for work - compensatory and incentive additional payments and allowances, bonuses and other payments. The index also applies when recalculating the average earnings, which is adjusted when salaries or tariffs change.

What is the procedure for wage indexation?

All changes in working conditions must be fixed in the employee’s employment contract. In this connection, when indexing earnings, the employer should certainly enter into an additional agreement with the employee to the employment contract indicating the updated amount of remuneration. In this case, it is important to make reference to the provision of the local act, in accordance with which the change in wages occurred (Article 134 of the Labor Code of the Russian Federation).

How to correctly index wages, see here.

Is it necessary to index vacation pay?

Due to the fact that the calculation of vacation pay depends on the size of the SZ, the indexation carried out in the organization affects the amount of vacation pay.

SZ for the purposes of the Labor Code of the Russian Federation is determined in accordance with Art. 139 Labor Code and Regulations.

According to clause 16 of the Regulations, an increase in the employee’s SZ is carried out with an increase in tariff rates, salaries (official salaries), and monetary remuneration in the organization (branch, structural unit). From the provisions of this norm it follows that the indexation of SZ is carried out if the increase affected all employees of the company. If such an increase is not carried out in relation to at least one employee, then the SZ is not indexed. The rationale for this conclusion can be found in letters from the Ministry of Health and Social Development of Russia dated January 30, 2009 No. 22-2-176 and Rostrud dated October 31, 2008 No. 5920-TZ. Thus, the indexation of vacation pay is influenced by the fact whether the SZ was increased or not.

Quite legal tricks

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

In some cases, an employee may be able to “save” vacation days or earn slightly more vacation pay by taking days off at the beginning and end of the vacation period.

For example, an employee goes on vacation for 3 weeks from July 4 to July 22, 2022. In fact, he rests from July 02 to July 24, since 02, 03, 23 and 24 are days off.

Attention: Holidays that fall during vacation are not included in the number of calendar days of vacation and are not paid. In such cases, the number of calendar days will be greater than the number of vacation days.

An employee can write an application from July 2 to July 24 (including weekends), or from July 4 to July 22. The rest time will be the same, but in the first case, 16 days of vacation pay will be accrued and there will be another 12 days of vacation left, which can be used later. In the second case, the money will be credited in 12 days, but there will be another 16 days of vacation left.

Both options do not contradict the law. Please note that at least one part of the vacation per year must be at least 14 days (in accordance with Article 125 of the Labor Code of the Russian Federation).

How is vacation pay indexed?

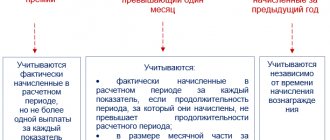

The indexation of vacation pay depends on the following factors:

- If the salary increase occurred during the period that is used to calculate vacation pay, then the SZ must be adjusted to the CI for the entire billing period.

- If the increase occurred during a period that is not included in the calculation of vacation pay, but precedes the vacation, then the SZ must be indexed for the calculation period.

- In cases where the salary increase occurred on vacation days, the SZ is adjusted from the date of the salary increase.

To index vacation pay, you must use the CI calculated using the above formula.

Note that the calculation period for determining the SZ for vacation pay is 12 months preceding the start date of the vacation.

For more information about the nuances of calculating vacation pay, see the article “What is the calculation period for vacation - vacation experience .

How to calculate the indexing coefficient for vacation pay

Vacation payments are indexed taking into account the indexation coefficient. It is important to take into account that the indexation coefficient involves taking into account both the increase in tariff rates and monthly additional payments to them.

This is due to the fact that in the process of calculating average earnings, it is necessary to calculate all payments provided for by the remuneration system . These are wages, various bonuses and additional payments for length of service, working conditions, and combinations.

In particular, we are also talking about supplements and allowances for work in harmful or dangerous conditions, for work on weekends and weekdays, night shifts, etc. These payments also increase proportionally after indexation.

The indexation coefficient is determined by a simple formula. It is necessary to divide the new amount of the employee’s salary and his current amount of monthly additional payments (allowances) in the month of increase by the previous amount of salary, tariff rate and additional payments (additions).

In practice, a situation may arise that it will not be necessary to apply the indexation coefficient, despite the fact that salaries have been increased. For example, the salary was increased by 15% and at the same time the monthly bonus was reduced by the amount of the salary increase. When dividing the new salary after indexation (taking into account the bonus) by the old one, a coefficient of 1 is obtained. Therefore, in fact, indexation of average earnings does not occur.

Companies that pay additional amounts to employees should remember that not all payments that are taken into account when determining average earnings are subject to adjustment by the increase factor . Thus, when recalculating average earnings, payments that are set not as a fixed value, but as a range of values (for example, as a percentage or a multiple of a certain value), as well as payments taken into account when determining average earnings in an absolute amount, are not adjusted.

Based on this rule, salary bonuses in a fixed value (in the form of a specific monetary amount) are not indexed, as are bonuses set as a percentage not of the salary, but of another value (for example, a bonus as a certain percentage of sales).

This position is contained in the recommendation letter of the Ministry of Health and Social Development of 2008 No. 2337-17.

The procedure for indexing vacation pay: examples

Let's look at examples of how vacation pay is indexed depending on the indexation period.

Example 1

From June 1, 2022, T.V. Markova was on vacation for 14 days. During the billing period, from June 1, 2022 to May 31, 2022, the employee’s salary was indexed from 20,000 to 25,000 rubles. The indexation date is November 2022. Markova's billing period was fully worked out. She did not receive bonuses or other payments.

To calculate the amount of vacation pay, it is necessary to determine the SZ. To do this, calculate the CI:

CI = 25,000 / 20,000 =1.25

To determine the size of the SZ, it is necessary to divide the billing period into 2 parts: the first part, preceding the increase, was 5 months, from June to October 2022; the second, from November 2020 to May 2022, is 7 months. Due to the fact that indexation took place in the billing period, the SZ for calculating vacation pay should be indexed from the beginning of the billing period. Thus, the formula should contain a reflection of indexation for 5 months (20,000 × 1.25 × 5) and the calculation of SZ taking into account the new salary (25,000 × 7).

SZ = (20,000 × 1.25 × 5 + 25,000 × 7) / (29.3 × 12) = 853.25 rubles.

The amount of vacation pay will be: 853.25 × 14 = 11,945.50 rubles.

Example 2

Pushkov A.A. was on vacation from May 17 to May 26, 2022. During the period from May 17, 2022 to May 16, 2022, the employee was not on vacation. The employee’s salary during this period was 759 rubles. On May 22, the organization indexed wages by 5%.

The amount of vacation pay due to indexation must be recalculated starting from May 22.

To calculate the amount of vacation pay, we determine how many days were on vacation before indexation and after indexation: from May 17 to May 21 inclusive - 5 days, from May 22 to May 26 - 5 days. In this case, to calculate vacation pay for the first 5 days, the indexation coefficient will not be applied; for the remainder of the vacation, a coefficient of 1.05 must be used.

Thus, the amount of vacation pay for the entire vacation period will be:

5 × 759 + 5 × 759 × 1.05 = 7779.75 rubles.

That is, the employee’s vacation pay will be recalculated from the moment of indexation.

Using the above examples, you can once again be convinced that the rules that should be followed when indexing vacation pay depend primarily on the moment when the salary indexation was made: before the date of accrual of the corresponding payments or after.

Should average earnings be indexed if the salaries of not all employees of the department were increased? The answer to this question is in ConsultantPlus. And learn the material by getting trial access to the system for free.

Accrual of vacation pay: calculation for salary increases and tax accounting for “rolling” vacation

Memo

Before we get into the specifics and difficult aspects, let us briefly recall how vacation pay is calculated.

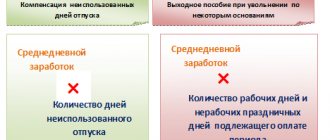

First, the accountant determines the average daily amount of earnings for the billing period, that is, for the last 12 calendar months preceding the month of the vacation. It is calculated by dividing the amount of accrued wages by 12 and 29.3 (average monthly number of calendar days). The resulting amount of average daily earnings is multiplied by the number of vacation days, this will be the amount of vacation pay. If an employee has worked in an organization for less than 12 months, then the salary accrued for the period of work is taken to calculate vacation pay. Calculate salary and vacation pay taking into account all current indicators

Salary increase for all employees

If the salary is increased as a whole for the organization, branch, structural unit (for example, department or section), vacation pay must be calculated taking into account this increase, using conversion factors. Moreover, the specifics of the calculation depend on the moment at which the increase occurred. There are three options. (Please note: the rules below do not apply if only one holidaymaker's salary has been increased).

The first option is that the salary increase occurred during the billing period, that is, during the 12 months preceding the month of vacation. In this case, payments taken into account when determining average earnings and accrued in the billing period for the period of time preceding the increase must be increased by a conversion factor. This coefficient is calculated by dividing the salary established in the month of the last increase by the salary established in each month of the billing period. This is stated in paragraph 16 of the Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922).

For example, an employee goes on vacation from June 17, 2022 for 24 calendar days. He has fully worked out the billing period from June 2022 to May 2022. His salary was 20,000 rubles, but from April 1, 2022 it was increased to 24,000 rubles. The conversion factor will be 1.2 (RUB 24,000: RUB 20,000). It must be applied to the salary for those months of the billing period that preceded the month of the salary increase. Accordingly, the amount of payments taken into account when calculating the average daily earnings for 12 months will be 288,000 rubles. (RUB 20,000 x 1.2 x 10 months + 24,000 x 2 months). The amount of vacation pay will be 19,659 rubles. (RUB 288,000: 12 months: 29.3 x 24 days).

The second option is that the salary increase occurred after the pay period, but before the onset of vacation. For example, an employee goes on vacation from June 17, 2022, and the salary increases from June 1, 2022. In this case, the entire average earnings calculated for the billing period are increased by the conversion factor. If we take the conditions of the previous example, in which only one condition changes (the salary is increased from 20 to 24 thousand rubles from June 1, 2022), then the average earnings calculated for the billing period should be 288,000 rubles. (RUB 20,000 x 12 months x 1.2). The amount of vacation pay will be 19,659 rubles. (RUB 288,000: 12 months: 29.3 x 24 days). As you can see, the end result is the same as in the first version.

The third option is that the salary increase occurred during the vacation period. For example, an employee goes on vacation from June 17 to July 10, 2022, and the salary increases from July 1, 2022. In this case, part of the average earnings increases from the date of the salary increase until the end of the specified period. Using an example, it will look like this: for part of the vacation from June 17 to June 30, 2022 (14 days), the amount of vacation pay will be 9,556 rubles. (20,000 rubles x 12 months: 12 months: 29.3 x 14 days), and for the “July” part (10 days) - 8,191 rubles. (20,000 x 12 months: 12 months: 29.3 x 1.2 x 10 days). The total amount of vacation pay will be 17,747 rubles. (9 556 + 8 191).

Compose HR documents using ready-made templates for free

Companies paying additional amounts (for example, bonuses) should be aware that not all payments taken into account when calculating average earnings will need to be adjusted by the calculated increase factor. Paragraphs 6 and 7 of clause 16 of the Regulations on calculating average earnings say the following:

“When increasing average earnings, tariff rates, salaries (official salaries), monetary remuneration and payments established to tariff rates, salaries (official salaries), monetary remuneration in a fixed amount (interest, multiple), with the exception of payments established to tariff rates , salaries (official salaries), monetary remuneration in a range of values (percentage, multiple). When average earnings increase, payments taken into account when determining average earnings, established in absolute amounts, do not increase.”

Thus, not all payments that are taken into account when calculating average earnings must be adjusted. The following are not subject to adjustment when recalculating average earnings: - payments established in relation to tariff rates, salaries (official salaries), monetary remuneration in a range of values (interest, multiple); - payments taken into account when determining average earnings, set in absolute amounts. Therefore, if, for example, along with the salary, permanent bonuses are paid, which are set in absolute amounts and do not depend on the amount of the salary, then when calculating vacation pay, a conversion factor should not be applied to such bonuses.

Rolling leave: expenses

Vacation pay amounts are taken into account when calculating income tax as part of labor costs (Clause 7, Article 255 of the Tax Code of the Russian Federation). With vacations falling within one reporting period, issues with recording expenses usually do not arise. And if a vacation begins in one reporting period and ends in another reporting period (for example, from June 17 to July 10), in what order should vacation expenses be taken into account for tax purposes?

In our opinion, the costs of paying for such leave should be taken into account in full in the first half of the year. We made this conclusion on the basis of paragraph 4 of Article 272 of the Tax Code, from which it follows that labor costs are recognized as an expense on a monthly basis based on the amount of labor costs accrued in accordance with Article 255 of the Tax Code. Vacation pay is accrued and paid by the employer before the vacation begins. This means that in the reporting period in which vacation expenses were accrued and paid, they should be written off.

But the Russian Ministry of Finance has its own view on this situation: when determining the tax base for income tax, the amount of accrued vacation pay for annual paid leave is included in expenses in proportion to the vacation days falling on each reporting period. That is, according to officials, the cost of vacation pay for “rolling” vacation should be distributed over reporting periods (letter of the Ministry of Finance of Russia dated October 25, 2016 No. 03-03-06/2/62147; see “The Ministry of Finance recalled how under the accrual method taken into account in vacation expenses in the case where the vacation fell within two reporting periods for income tax"). As we see, the situation is controversial and the organization must take into account tax risks when deciding what to do. As for judicial practice, it contains mostly positive examples for taxpayers (see, for example, the resolution of the Federal Antimonopoly Service of the West Siberian District dated November 7, 2012 No. A27-14271/2011).

Calculate wages and vacation pay, keep records and submit reports according to OSNO

Rolling leave: salary taxes

Questions arise not only regarding income tax, but also regarding “salary” taxes. The object of taxation of insurance premiums for companies and individual entrepreneurs making payments to individuals are payments and other remunerations accrued in favor of individuals subject to compulsory social insurance (clause 1 of Article 420 of the Tax Code of the Russian Federation). The date of payments and other remunerations is the day the payments and other remunerations are accrued in favor of the employee (Article 424 of the Tax Code of the Russian Federation). Since vacation pay is accrued before the vacation, then contributions are calculated at the time vacation pay is accrued.

The organization's accrued contributions are fully expensed for tax purposes, that is, there is no need to split it between reporting periods. And officials confirm this conclusion (Letter of the Ministry of Finance dated 06/09/14 No. 03-03-РЗ/27643; see “The Ministry of Finance again spoke about taking into account vacation pay in expenses in the case where the vacation fell within two reporting periods for income tax”). The reasoning is as follows: an expense in the form of a tax is recognized as such at the time of accrual, as expressly stated in subparagraph 1 of paragraph 7 of Article 272 of the Tax Code.

As for personal income tax, it must be withheld when issuing vacation pay, and transferred to the budget no later than the last day of the month in which such payments were made. The Ministry of Finance recalled this in letter dated 03.28.18 No. 03-04-06/19804 (see “Personal income tax on vacation pay: The Ministry of Finance recalled the procedure for withholding and paying tax”).

Is it possible to hold an employer liable if indexation was not carried out?

Some employers, in order not to increase the organization's costs, do not want to index salaries. However, such savings may entail administrative liability for the employer:

- If a local document contains information about wage indexation, but the actual absence of such a procedure, a fine in the amount of 3,000 to 5,000 rubles is imposed on the employer. (Article 5.31 of the Code of Administrative Offenses of the Russian Federation).

- If there is a simultaneous absence of information about indexation in local documents and the indexation itself, a fine for the legal entity employer is from 30,000 to 50,000 rubles, for officials and individual entrepreneurs - from 1,000 to 5,000 rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

These are not the only costs that an employer may incur due to the lack of indexation. If an employee, whose interests are infringed by its failure to carry out the work, goes to court, then the employer, in the event of a positive outcome, will have to pay the lost salary for all periods of violation of the law. And the amount of such payment will be obtained by calculating the difference between the indexed salary and the one actually paid (determination of the Primorsky Regional Court dated August 20, 2015 in case No. 33-7280/2015).

Let us note that some arbitrators take the employer’s side and believe that salary indexation is not his responsibility (appeal ruling of the Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Mordovia dated April 30, 2015 in case No. 33-918/2015).

However, there are a number of valid reasons for not indexing. These include:

- the difficult financial situation of the employer (appeal ruling of the Kostroma Regional Court dated May 26, 2014 No. 33-797/2014);

- a good level of employee salaries that does not require an increase (appeal ruling of the Omsk Regional Court dated November 25, 2015 No. 33-8541/2015).

Results

Not every employer is ready to index wages, despite the fact that this is required by law. However, if the enterprise nevertheless decides on such indexation, it is important to follow all the necessary procedures for the correct calculation of payments that are affected by such a change in wages.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

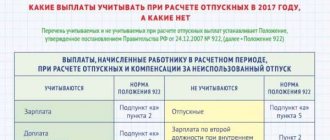

Base for calculating vacation pay

The basic rules for vacation pay are contained in Chapter 19 of the Labor Code (hereinafter referred to as the Code). Instructions for calculating average earnings can be found in Decree No. 922 dated December 24, 2007. Based on the listed documents, we will summarize the information necessary for further calculations. The following indicators influence the amount of vacation pay:

- average earnings per day,

- duration of vacation,

- billing period.

Let's look at each of them in more detail. Let's start with average earnings. The basis for it is the payments provided for a specific employee. Among them:

- actual salary accrued for hours worked,

- remuneration (including royalties),

- premiums to tariff rates and additional payments (including coefficients for special working conditions or the nature of the work),

- awards.

When forming average earnings, the amount of salary for a certain period of time is used. The Code specifies a year as the calculation period, but it is adjusted depending on the circumstances (if the employee has worked for less than a year, it is calculated based on the actual time worked using a special formula). When determining the amount of vacation pay, it is necessary to exclude from the reporting period those periods for which any payments were made. These could be, for example:

- periods of maintaining average earnings,

- receiving FSS benefits (for temporary disability, etc.),

- downtime due to the fault of the employer or for reasons beyond the control of the employer’s employee,

- paid days off to care for disabled children or those disabled since childhood,

- provision of financial assistance that has already been paid previously.

The duration of leave is set individually for each employee. The minimum for most is 28 days. When calculating the required leave, it is necessary to take into account the type of activity, working conditions and place of performance of duties by the employee. For certain categories of employees, the duration and specifics of the provision are specified in Articles 114, 116, 255 - 256 and 173 - 176 of the Code.