The main document confirming an employee’s absence from work due to illness is a sick leave certificate. For the employer, this document is the basis for calculating benefits during the period of temporary incapacity for work of the employee. The legality of reimbursement of benefits from the Social Insurance Fund depends on the correctness of filling out the sick leave certificate.

If errors are detected in the document, the Social Insurance Fund may not accept the specified amounts of expenses for offset.

However, in practice, not every error on the certificate of incapacity for work leads to a refusal to offset expenses, and we’ll talk about this in more detail in the article.

Registration of sick leave

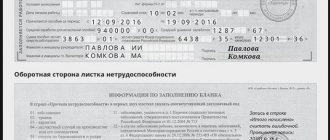

There are two parties involved in the procedure for issuing sick leave: the medical institution and the employer. Each party enters its own information into the document. Doctors indicate in the document the name of the medical organization and its address, the date of issue of the sick leave certificate, the full name of the sick employee, his gender and date of birth, the specialist’s place of work and the name of the company, also indicate the cause and duration of incapacity, and, finally, full name of the attending physician and his position.

Having received the document from the employee, the employer, on the certificate of incapacity for work, indicates the employee’s place of work and the name of the company, the employee’s INN and SNILS, insurance experience, the amount of average earnings for calculating benefits, the amount of accrued benefits, as well as the full names of the manager and chief accountant.

Do not forget that when applying for sick leave, you must check that the document is filled out correctly by the attending physician, as well as comply with the mandatory requirements.

For example, parties can fill out a document either using a printing device or manually. In the second option, information in the cells must be entered in specially designated fields in capital block letters using a black pen.

Pay attention to the pen, it can be gel or capillary, but using a ballpoint pen is prohibited! You cannot go beyond the cells allocated for recording. But it is not prohibited to extend beyond the designated area when placing a seal, but the seal should not fall on the cells of the information field of the sick leave form.

A certificate of incapacity for work is issued by a medical organization to citizens of Russia or foreign persons permanently or temporarily residing in the country and working on the basis of employment contracts. This category of persons is subject to compulsory social insurance (OSI) in case of temporary disability and in connection with maternity.

The employer receives the document from an employee who returned to work after illness. It is the employer who controls the correctness of the compilation of sick leave by the medical institution. This is necessary in order to pay benefits on the basis of the document, receive payment amounts as compensation from the Social Insurance Fund, or count it towards a reduction in payments for accrued contributions for disability insurance. The first three days of illness are paid at the expense of the employer, the remaining days - at the expense of the Social Insurance Fund.

But the opposite situations may also arise when, during an inspection, the Social Insurance Fund, discovering the fact of incorrect registration of sick leave, decides to refuse to offset amounts that are not insurance payments. In this case, the amounts of accrued payments to the employee, which are not insurance payments, are subject to insurance contributions in the generally established manner.

When issuing sick leave, both the employer and the medical institution can make mistakes. If doctors make a mistake, then the company most often cannot influence the situation and therefore is forced to defend its position regarding the legality of offset of benefits in court. But there is good news: the courts almost always side with the companies.

If the amount of sickness benefit is calculated incorrectly

When calculating benefits, it is necessary to take into account quite a lot of factors: the period of illness, the employee’s length of service, the average daily earnings, and the correctness of filling out the sick leave. And the rules for calculating sick leave are constantly changing. Therefore, no one is immune from mistakes.

First, let’s remember the general rules for paying for temporary disability.

Rule 1. Benefit for temporary disability due to illness or injury is paid:

- for the first three days - at the expense of the policyholder;

- for the remaining period, starting from the 4th day of temporary disability - at the expense of the budget of the Social Insurance Fund of the Russian Federation.

GOOD TO KNOW

Read more about the rules for calculating disability benefits in the material “How to calculate benefits in 2015?” (Ryabova K.N., “Simplified accounting”, No. 3, March 2015).

Rule 2. The benefit is paid for all calendar days falling during the period of release from work indicated on the sick leave, including weekends and non-working holidays (Part 1, Article 6 of Law No. 255-FZ).

The benefit is not accrued in cases where:

- the employee was on vacation at his own expense;

- the employee was on study leave;

- the employee was on parental leave and did not work part-time;

- the employee was on downtime, and the course of the illness began during downtime.

Rule 3. When calculating temporary disability benefits, it is necessary to take into account the length of service.

The amount of the benefit depends on the employee’s length of service:

- with 8 or more years of experience - in the amount of 100% of average earnings;

- with experience from 5 to 8 years - in the amount of 80% of average earnings;

- with up to 5 years of experience - in the amount of 60% of average earnings.

Experience is important for calculating benefits in connection with caring for a sick family member (Parts 3, 4, Article 7 of Law No. 255-FZ of December 29, 2006).

But if an accident occurs at work, payments are made in the amount of 100% of the average earnings.

Periods of work (service, activity) are calculated in calendar order on the basis of full months (30 days) and a full year (12 months). Moreover, every 30 days of these periods are converted into full months, and every 12 months of these periods are converted into full years (clause 21 of the order of the Ministry of Health and Social Development of the Russian Federation dated 02/06/2007 No. 91).

Rule 4. To calculate the average earnings of an employee, you need to take all payments for which insurance premiums were calculated in the two previous calendar years.

The amount of payments is limited by the limit for calculating contributions to the Social Insurance Fund in the corresponding year (Part 3.2 of Article 14 of Law No. 255-FZ).

| Year | Limit base, rub. |

| 2015 | 670 000 |

| 2014 | 624 000 |

| 2013 | 568 000 |

Rule 5. Average daily earnings for calculating temporary disability benefits are determined by dividing the amount of accrued earnings in the billing period by 730.

Rule 6. In some cases, the benefit will be minimal.

If the employee did not work, that is, the employer did not pay insurance premiums for him, or he cannot confirm his length of service and the accrual of insurance premiums with a certificate from his previous place of work, then in this case the minimum wage is taken as the basis for the calculation. In 2015, this amount was 5965 rubles. And the average daily earnings amounted to 196.11 rubles.

Rule 7. The maximum benefit amount is also limited.

The maximum benefit amount will be 1632.88 rubles. per day ((568,000 rub. + 624,000 rub.) : 730 days x 100%).

Rule 8. The basis for payment of disability benefits will be a correctly completed certificate of incapacity for work. The correctness of filling is regulated by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n. But there is no need to immediately panic if the sick leave is issued incorrectly. There is positive judicial practice: even if a certificate of incapacity for work is issued incorrectly (due to individual inaccuracies), it is subject to payment (resolution of the Federal Antimonopoly Service of the Far Eastern District dated November 12, 2008 No. F03-4850/2008 (left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated March 10, 2009 No. 2432/09 ), FAS Volga District dated October 24, 2006 No. A12-5505/06-C6, FAS Central District dated December 9, 2005 No. A14-4308/2005/170/23).

GOOD TO KNOW

For more information about errors in the certificate of incapacity for work, which do not interfere with the reimbursement of benefits, read the material “Some errors in sick leave are not a reason for refusal of compensation” (Svistunova O.N., “Simplified Accounting”, No. 5, May 2015).

Rule 9. Please note: a certificate of incapacity for work is not issued for care:

- for a sick family member over 15 years of age during inpatient treatment;

- for chronic patients during remission;

- during the period of annual paid leave and unpaid leave;

- during maternity leave;

- during the period of parental leave until the child reaches the age of 3 years, with the exception of cases of work performed during the specified period on a part-time basis or at home.

GOOD TO KNOW

If an insured event occurs after the start of downtime, temporary disability benefits during the downtime period are not paid.

Rule 10. The employer is obliged (Part 1, Article 15 of Law No. 255-FZ):

- assign temporary disability benefits within 10 calendar days from the date of presentation of the certificate of incapacity for work;

- pay benefits on the next day after the assignment of benefits, established for payment of wages.

If an error is found in the calculations

If an error occurs, you must first understand the reasons that led to it. Let's highlight the most common errors and their causes.

| Reason for error | Type of error that led to incorrect calculation of disability benefits |

| Abuses committed by an employee |

|

| Accountant's counting error |

|

GOOD TO KNOW

There is no legislative definition of the concept of “counting error”; in the legal literature such an error is defined as an error in arithmetic operations when calculating the amounts payable. An accounting error is also an overpayment of benefits to an employee as a result of an accountant's clerical error or misprint. If the accountant made a mistake in the calculation, it must, of course, be corrected.

In case of detection of expenses for the payment of insurance coverage made by organizations in violation of the legislation on compulsory social insurance in case of temporary disability and in connection with maternity, not supported by documents, carried out on the basis of incorrectly executed documents or issued in violation of the established procedure, the territorial body of the Fund that carried out inspection, makes a decision not to accept such expenses as offset against the payment of insurance contributions to the Federal Social Insurance Fund of the Russian Federation (clause 4, article 4.7 of Federal Law No. 255-FZ). It should be borne in mind that a certificate of incapacity for work issued at the place of work on an external part-time basis must be drawn up in exactly the same way as a certificate of incapacity for work for the main place of work. There is only one difference in filling out: the name of the place of work and the need to underline the words “part-time” and in the corresponding line indicate the number of the certificate of incapacity for work issued at the main place of work.

GOOD TO KNOW

A serious mistake is to submit to the place of part-time work a copy of the certificate of incapacity for work issued for the main place of work, since payment of benefits is carried out only on the basis of the original document.

If the accountant has not paid additional disability benefits, then it needs to be recalculated. In addition, the employee has the right to compensation for late payment of benefits. Compensation is paid in an amount not lower than 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time from amounts not paid on time for each day of delay starting from the next day after the established payment deadline until the day of actual settlement inclusive (Article 236 of the Labor Code of the Russian Federation).

If the benefit was paid in a smaller amount, you should submit an application for additional payment and the necessary documents to the territorial body of the Fund at the place of registration of the enterprise. After recalculation, the missing amount will be transferred to the employee.

The corresponding entries must be made in accounting:

| Description | Amount (rub.) | Debit | Credit |

| Additional benefits for temporary disability were accrued at the expense of the Federal Social Insurance Fund of the Russian Federation | 1384 | 69 | 70 |

| Personal income tax accrued on the additional payment amount | 180 | 68 | 51 |

| Personal income tax was transferred from the amount of additional payment of benefits | 180 | 70 | 50 |

| The amount of additional accrued benefits minus personal income tax was paid from the cash register | 1204 | 91-2 | 73 |

| Compensation accrued for late payment of part of the benefit | 46,68 | 73 | 50 |

| The amount of interest for late payment of part of the benefit was paid from the cash register | 46,68 | 50 | 73 |

The opposite situation may occur when the employer accrues a larger benefit or the Social Insurance Fund refuses to pay benefits because the sick leave turned out to be false.

What to do in this case:

- if the overpayment occurred as a result of a calculation error, then it is possible to recover funds from the employee;

- If the overpayment occurred due to the fault of the company, then it is possible to write off these funds.

Example 1.

When calculating temporary disability benefits, the accountant mistakenly excluded 8 calendar days from the calculation period and divided the amount of earnings taken into account into 722 calendar days (730 calendar days - 8 calendar days) instead of 730.

The benefit was accrued on October 15, 2015.

The error was discovered on November 02, 2015.

The overpayment amounted to 4,200 rubles.

The overpayment was written off from the company’s own funds and recognized as the employee’s income on November 2, 2015.

Example 2.

The calculation and recording of overpayments is as follows:

| Description | Amount (rub.) | Debit | Credit |

| REVERSE The over-accrued benefit amount for the first 3 days of temporary disability was reversed | 1200 | 69 | 70 |

| STORNO Settlements with the Federal Social Insurance Fund of the Russian Federation for insurance premiums in case of temporary disability and in connection with maternity | 2800 | 69 | 70 |

| The amount of overpayment was written off from retained earnings of previous years. | 4000 | 91-2 | 70 |

It is important to remember that an employee can independently return the overpayment to the company’s cash desk, for example, if an incorrect calculation of benefits was associated with the provision of “fake” sick leave. If an error leads to an overestimation of the benefit amount, an overpayment is formed due to the fault of the policyholder; expenses incurred unnecessarily by the Fund in connection with the concealment or unreliability of the information provided are subject to compensation by the policyholder in accordance with the legislation of the Russian Federation.

GOOD TO KNOW

About the employer’s actions in a situation where an employee provides a “suspicious” sick leave, read the material “The employee brought a fake sick leave” (Skrigalovskaya E. A., “Simplified Accounting,” No. 6, June 2014).

Do I need to pay insurance premiums?

There are two opinions regarding the calculation of insurance premiums in case of incorrect calculation of sickness benefits.

One of the positions is based on Art. 9 of Law No. 212-FZ, which sets out a list of payments that are not subject to contributions to compulsory pension insurance. In particular, these include state benefits paid in accordance with the legislation of the Russian Federation (clause 1, part 1, article 9 of Law No. 212-FZ). At the same time, benefits paid, including in accordance with Federal Law dated December 29, 2006 No. 255-FZ, are recognized as state benefits. Maternity benefits are one of the types of insurance coverage for compulsory social insurance (Part 1, Article 1.4 of Law No. 255-FZ).

Officials believe that if the benefit is calculated incorrectly or the Social Insurance Fund refuses to pay, then insurance premiums must be charged. In particular, the Ministry of Health and Social Development in its letter dated August 30, 2011 No. 3035-19 indicated: “Expenditures on compulsory social insurance that are not accepted for offset are not considered non-taxable payments in accordance with clause 1, part 1, art. 9 of Law No. 212-FZ and are subject to taxation in the generally established manner. They classify such payments as income paid within the framework of labor relations, and recognize them as subject to insurance premiums on the basis of Part 1 of Art. 7 of Law No. 212-FZ."

If insurance premiums are not calculated, penalties are also possible.

In accordance with Part 1 of Art. 47 of Federal Law No. 212-FZ, non-payment or incomplete payment of insurance premiums as a result of understating the base for calculating insurance premiums, other incorrect calculation of insurance premiums or other unlawful actions (inaction) of insurance premium payers entails a fine in the amount of 20% of the unpaid amount of insurance premiums.

However, there is an opposite point of view expressed by the judges. According to this point of view, there is no need to charge insurance premiums. In the resolution of the Federal Antimonopoly Service of the Ural District dated April 25, 2014 No. F09-2274/2014, the court came to the conclusion that the Social Insurance Fund has no grounds to charge insurance premiums for the amount of hospital benefits that the Social Insurance Fund refused to accept for offset due to errors in the calculations. Mistakes made only entail refusal to accept expenses for offset. But the very essence of the social orientation of these payments is not lost from this. Moreover, the Foundation does not deny the fact of the onset of disability. Therefore, although “sick leave” is not accepted for credit, it is not another payment subject to contributions.

GOOD TO KNOW

Refusal to accept for offset the costs of paying insurance coverage, declared by the policyholder for reimbursement from the funds of the Social Insurance Fund, entails only the obligation of the policyholder to transfer to the fund's budget insurance premiums accrued in the prescribed manner and not repaid in a compensatory manner.

Can overpaid benefits be recovered from an employee?

As a general rule, amounts of benefits paid in excess to the insured person cannot be recovered from him, except in cases of accounting error and dishonesty on the part of the recipient (submission of documents with deliberately incorrect information, concealment of data affecting the receipt of benefits and its amount, other cases ). Withholding is made in the amount of no more than 20% of the amount due to the insured person for each subsequent payment of benefits or his salary. If the payment of benefits or wages is terminated, the remaining debt is collected in court. At the same time, companies often have to prove the legality of collecting benefits in the courts. Here are a few reasons:

- if an error in calculations occurred due to a software failure, then such an error is recognized as a counting error (Cassation ruling of the Novosibirsk Regional Court dated January 20, 2011 No. 33-126/2011);

- if the benefit was paid twice, then such a transfer is considered an arithmetic error (Determination of the St. Petersburg City Court dated April 1, 2014 No. 33-5114/2014);

- the company incorrectly summed up the number of days worked, which can be regarded as a counting error (Appeal ruling of the Sverdlovsk Regional Court dated March 14, 2014 No. 33-3221/2014).

GOOD TO KNOW

It is necessary to take into account that a counting error is an error made in arithmetic operations (actions related to counting: multiplication, addition of sums, etc.). But technical errors, including those made through the fault of the employer, are not considered countable.

Thus, before writing off funds from an employee’s salary, you must:

- establish that the incorrect calculation occurred as a result of a counting error or dishonesty on the part of the recipient;

- if the above criteria are not met, then it is possible to write off funds at the request of the employee; for this it is necessary to request a corresponding application;

- if the employee refuses to compensate for the employer’s losses, then you can try to recover the funds through the court or write it off from the company’s net profit.

If the error is countable, then you must proceed according to the following algorithm:

- it is necessary to draw up an accounting certificate or report from the commission that revealed the accounting error. It is better if the error is identified by the commission, since this will help mitigate the company’s risks in terms of challenging the counting error;

- the employer, on the basis of the act, issues a deduction order, which establishes the amount, terms and procedure for deduction from wages;

- The employee must be familiarized with the order and act. Some employers prepare a separate written notice, provide one copy to the employee, and keep the second as a basis for writing off funds from wages;

- from each amount paid to the employee in person, no more than 20% can be withheld until the overpaid benefit is fully repaid;

- the employee must be familiarized with the payslip so that the employee knows what amounts have been written off from his salary.

GOOD TO KNOW

If an error was made in determining the amount of the benefit, which led to an excessive payment of financial support, the benefit was paid in violation of the requirements of legislative or other regulations or on the basis of incorrectly executed or issued in violation of documents, the territorial body of the Social Insurance Fund will refuse to accept the amount of the benefit (its parts).

Due to the fault of the medical institution

The FSS is not always interested in who made a mistake on the sick leave. Therefore, in their judgments they are very unambiguous: if the certificate of incapacity for work is drawn up with violations, then the amount of expenses for temporary disability benefits cannot be accepted for offset.

But the judicial authorities note that if a mistake was made by a medical institution and it is impossible to prove dishonest actions on the part of the employer or his employee, then such an action is not a sufficient basis for not accepting benefits expenses for offset (Determination of the Armed Forces of the Russian Federation dated July 17, 2022 No. A03-8483 /2018, Resolution of the AS CO dated February 12, 2015 in case No. F10-4991/2014). This means that it is unlawful to hold employers responsible for mistakes made by a medical institution, since in such situations the relationship regarding the expenditure of funds on social insurance arises between the Social Insurance Fund and the organization, and not between the Fund and the medical institution. The principle voiced above can be called global; then let’s look at special cases from judicial practice.

Subscribe to the magazine “Calculation” or “Calculation. Premium" for the 1st half of 2022!

Consequences of mistakes in sick leave

Based on the sick leave information processed by the Social Insurance Fund in the prescribed manner with the participation of the employer, temporary disability benefits are paid.

In particular, sick leave indicates a valid reason for an employee’s absence from work - due to his illness or the need to care for immediate family members. Let us turn to the history of interaction between employers and the Social Insurance Fund on issues of sick pay. If we talk about the amount of benefits paid in 2022 by an employer in a non-pilot region (except for payment for the first 3 days of sick leave), then it was subsequently compensated to him from the federal budget at the expense of the Social Insurance Fund. Moreover, each case of payment of disability benefits to company employees was carefully studied by inspectors from the Social Insurance Fund when conducting an inspection of the employer. In 2022, policyholders also reimbursed benefits paid during the period until the end of 2022 as part of a non-pilot project. In 2022, the Social Insurance Fund itself will fully pay for sick leave starting from the 4th day of the employee’s incapacity for work.

There are nuances in determining the beginning of the sick leave payment period in the Social Insurance Fund.

One of the grounds for refusal to offset funds for payment to the Social Insurance Fund in the amount of temporary disability benefits paid may be the discovery of errors in the preparation of sick leave certificates (clause 18 of Government Resolution No. 101 of February 12, 1994). Therefore, employers must carefully ensure that sick leave is completed correctly.

In 2022, solving this problem in most cases will be significantly simplified thanks to the widespread introduction of electronic sick leave. Employers do not fill them out in principle and therefore cannot make mistakes on their part when filling out the forms.

Read more about the implementation of electronic sick leave in the special material.

At the same time, paper sick leave is issued for a number of categories of employees. Employers are fully involved in filling them out. We are talking about employees who (Part 28, Article 13 of Law No. 255-FZ dated December 29, 2006):

- have access to information constituting state and other secrets;

- subject to state protection.

If there are mistakes made by the employer on the paper sick leave that can be corrected, then appropriate corrections are made on the sheet.

As evidenced by judicial practice (applicable in relation to legal relations with the participation of employers and the Social Insurance Fund under current legislation by analogy), employers are increasingly able to overturn decisions of the Social Insurance Fund to refuse to offset the costs of paying sick leave to their employees on sick leave certificates with deficiencies in registration.

IMPORTANT! From 01/01/2021, all regions of the Russian Federation switched to direct payments of Social Security benefits. In 2022, this practice, along with the introduction of electronic sick leave, was transformed into a permanent mechanism. The employer pays only the first 3 days of sick leave, the rest of the money is transferred to the employee by the Social Insurance Fund. The offset mechanism for payment of benefits was cancelled.

The procedure for paying for electronic sick leave is described in detail in the Ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Invalid address

An error in the address of a medical organization cannot prevent benefits from being counted (for example, indicating the wrong building block). This argument is confirmed by the Resolution of the AS SZO dated September 5, 2019 No. A13-7645/2018.

If the address of the medical organization is indicated in the wrong sequence, then the sick leave certificate will not be considered damaged. In this case, the FSS identifies the medical institution by registration number, the Foundation itself announced this in a letter dated October 28, 2011 No. 14-03-18/15-12956.

Common questions and answers

Despite the apparent simplicity of filling out the sick leave form, many may have questions. You will find answers to the most common ones further in the article.

Do I need to indicate the exact period of work?

Previously, in certificates of incapacity for work with work experience exceeding 8 years, it was possible to indicate only the phrase “more than 8 years.” Now, in accordance with Chapter 9, Clause 51 of Order of the Ministry of Health No. 624n, it is necessary to indicate the exact actual length of service of an employee of the organization. Despite the fact that longer work experience does not in any way affect the amount of benefits received, sick leave certificates are required to indicate the length of service that the employee actually has . For example, if it is 10 years and 7 months, this is recorded in the appropriate field.

How to write single-digit years/months - 5 or 05 / 4 or 04?

In accordance with paragraph 66 of Order of the Ministry of Health No. 624n, records of single-digit months and years in the length of service of an employee of an organization are recorded as follows:

- if the experience is 5 years, then “5_” years are indicated;

- if 5 years and 4 months, then it is written in the format “5_” years and “4_” months, respectively.

What to do if a person has worked completely for years, without months?

If an employee of an organization has only a full 4 years of experience, information about this on the sick leave certificate is recorded in the format “4_ years 00 months”. This requirement is regulated by clause 13 of the letter of the FSS of Russia dated October 28, 2011 No. 14-03-18/15-12956.

If the insurance period is zero, should I leave the cells empty or indicate 00 00?

Letter No. 14-03-18/15-12956 of the Federal Insurance Service of Russia dated October 29, 2011, namely paragraph 13, establishes that if a company employee does not have insurance experience, data on this on the sick leave is recorded in the form “00 years 00 months” .

What date should I aim for?

In accordance with paragraph 60 of Order of the Ministry of Health No. 624n, when filling out a sick leave certificate, the employer records the insurance period immediately at the time of the occurrence of an insured event for an employee of the organization, that is, filling out the sections “insurance period” and “date of employment” are in no way interconnected.

Attention! Indicating the date of employment may be advisable only if the insured event with the employee occurred at the time of the already canceled contract with him, that is, when he was fired.

Read about what length of service is taken into account when calculating sick leave and whether military service and study are included in the calculation procedure.

What are the benefits for former employees?

In accordance with Article 5 No. 255-FZ, not only current employees of the organization, but also former ones can count on payment of benefits and receipt of sick leave. However, the employer will not have to pay sick leave if the former employee has already joined the staff of another company.

In the calculation conditions, code 47 is recorded (the case in which the employee is unable to work occurred within 30 calendar days from the date of termination of his work), and his insurance record is also recorded.

Incorrect date of birth

From the Resolution of the AS SZO dated May 12, 2022 No. A45-38305/2019, it can be found out that the error in the employee’s date of birth, due to which the Social Insurance Fund refused to pay, was made by the medical institution, while the Fund did not deny the presence of the disease. The courts also noted that the employee attempted to issue a duplicate document, but the medical organization, citing the Fund’s position, refused to do so. Accordingly, we can come to the conclusion that such inaccuracies in the document cannot be grounds for refusal to pay benefits.

Another company name

It is believed that the abbreviated or inaccurate name of the organization is a technical feature of filling out sick leave, therefore such data does not affect the amount of the benefit paid. There is no need to replace the sick leave with a duplicate. If there are such errors, the company can be identified by its registration number in the FSS (Resolution of the AS VSO dated May 24, 2022 No. A19-23241/2017).

But if the corresponding cell contains information from a completely different organization, then such a certificate of incapacity for work is considered spoiled and cannot be accepted for calculation, this is stated in the letter of the State Administration - MRO FSS of the Russian Federation dated July 14, 2022 No. 14-15/7710-1110- LNK.

Incorrect dates

The incorrect start or end date of the period of incapacity for work became the subject of litigation in court, as a result of which the arbitrators of the court of the East Siberian District indicated that an error of this kind does not prevent the occurrence of an insured event and does not affect the payment of benefits in any way (the arbitrators also noted that the unreliability of the document presented to the authorities FSS did not confirm). In this regard, the company legally paid benefits to the employee (Resolution of the AS VSO dated February 20, 2019 No. A19-11796/2018).

Filling extra lines

The form contains several lines that do not need to be filled out in the general case of temporary disability, but the specialist fills them out by mistake:

- "Work start date." Indicated if the employee sought medical help in the period between the date of conclusion of the employment contract and the date of its cancellation. This line implies entering the day from which the employee begins work upon cancellation of the employment relationship.

- “Including non-insurance periods.” To reflect periods of military or other service according to Law No. 4468-1. The line incorrectly indicates periods that are not included in the calculation of average earnings (temporary disability, parental leave, etc.). In general, this line should not be filled in.

You need to correct erroneously filled lines like this (FSS Letter No. 15-03-14/05-12954 dated 10/18/2012):

- Cross out the incorrect entry with a neat line.

- On the back of the form, indicate the phrase: “The line ... is considered blank.”

- Add the entry “Believe the corrected one”, put the signature of the responsible employee and the seal of the institution (clause 65 of Order No. 624n).

Correcting entries

According to the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of June 29, 2011 No. 624n, if a document is lost or contains errors, a duplicate must be issued. But what happens is that companies and health care providers instead make corrections to the document, such as outlining an entry in black ink or changing data by crossing out previous entries, including with a correction agent.

The FSS authorities recognize such a sheet as damaged, it does not meet the requirements of the established Procedure, and there are no grounds for paying sick leave. But the courts considered that the corrected information does not refute the fact that the employee had an insured event and, despite the corrections, the information on the sick leave remains readable, and the document itself is not damaged; such conclusions follow, for example, from the Resolution of the Nineteenth Arbitration Court of Appeal dated February 7, 2022 of the year No. A14-18229/2018 and the Tenth Arbitration Court of Appeal dated April 4, 2022 No. 10AP-3439/2018.

Instructions: how to correct an error on a sick leave certificate

Clause 85 of the Conditions details how an employer can correct a paper sick leave certificate. For this you will need:

- carefully cross out the erroneous entry;

- make the correct entry on the back of the document;

- in the same place where the correct entry is made, an o is made, which is certified by the seal and signature of the responsible person of the employer who originally filled out this sick leave.

You cannot make a correction in any other way, including using a corrector that paints over an incorrect entry in order to put the correct one over it.

A ready-made solution from ConsultantPlus will help you organize your work with electronic sick leave. Get trial access to the system for free and proceed to the material.

The regulations do not establish a clear deadline for making corrections to sick leave. But, based on established judicial practice, employers should take care of correcting erroneous entries before the end of the on-site inspection initiated by the FSS, and, accordingly, before making a decision on its results (FAS Resolution ZSO dated November 27, 2009 No. A45-11770/2009).

True, there are many court decisions in which the employer defended its right to make corrections to the sick leave even after the completion of the on-site inspection (Resolution of the Federal Antimonopoly Service ZSO dated 04/11/2013 No. A27-15335/2012).

You can familiarize yourself with the judicial practice on penalties related to sick pay in the thematic article posted in the ConsultantPlus system. Get a free trial access to it.

Other errors

The Supreme Court (Decision of the Supreme Court of the Russian Federation of February 13, 2022 No. 306-KG17-22369) during the consideration of the case came to the conclusion that they do not interfere with the offset of the amount of benefits for certificates of incapacity for work, which contain the following inaccuracies:

- extension and issuance of sick leave for a period of more than 15 days, without the permission of the medical commission;

- the date of issue of sick leave does not correspond to the date of release from work;

- the certificate was issued over the past period, and not on the day the employee applied. However, the signature of the chairman of the medical commission was missing.

The violations identified by the fund do not affect the materiality of the document data; they are minor and remediable. At the same time, the negative consequences of non-compliance with the procedure for issuing sick leave are assigned to the medical institution.

Error during correction

The employer must always ensure that corrections are made correctly, otherwise he may lose compensation. But there is a situation when the responsible specialist made the corrections incorrectly. Is it possible to correct the certificate of incapacity for work again?

For example, the accountant entered the correct data directly above the crossed out line, and not on the back of the document. This is considered a serious drawback; it will be difficult for the Social Insurance Fund to compensate the employer for expenses, since the information from the cells simply cannot be displayed when read.

Such filling out is not critical and there is no need to contact a medical institution for a duplicate of the form, because the original data can be recognized by the reading device (FSS Letter No. 14-03-11/15-11575 dated September 30, 2011).

That is, if, when filled out in handwriting, all the information on the temporary disability certificate is readable and does not interfere with the identification of the register, then you just need to make the corrections correctly: indicate the correct information on the back of the sheet and certify it with a signature and seal.

IMPORTANT!

If an organization does not agree with the decision of the territorial social insurance body, it has the right to challenge it in court.

On the employer's side

If an error on the sick leave was made by the employer, then, as a rule, the likelihood of disputes with the Social Insurance Fund is minimized. If the error is not significant, it can be corrected. To do this, you need to cross out the incorrect entry and add the correct one to the back of the form. New information must be confirmed with the entry “corrected to believe”, the signature and seal of the employer, as required by paragraph 65 of the Procedure for issuing certificates of incapacity for work. Examples of such violations are:

- incorrect employee TIN;

- any clerical error in the data (for example, incorrectly indicated insurance period);

- filling in a line that did not need to be filled in;

- incorrect amount of average employee earnings.

Also, the legality of payment of benefits will not be affected by the situation associated with filing a certificate of incapacity for work in the archive: when the information from the column was entered in the document (namely, the dates in the “exemption from work” field in the line “from what date”). The Arbitration Court of the Volga-Vyatka District did not consider the violation committed to be significant, since it does not affect the existence of an insured event in any way (Resolution of June 26, 2022 No. F01-10655/2020).

But if, through the fault of the employer, the certificate of incapacity for work was damaged and the information became unreadable because of this, then the document must be given to the employee for the medical institution to issue a duplicate. However, in judicial practice there are cases when the fact of the presence of a disease can be confirmed in another way.

For example, this may be receiving a written response from a medical institution, which contains information about sick leave issued with series and numbers, full names of sick employees (Determination of the Armed Forces of the Russian Federation dated September 27, 2022 No. 307-KG18-14530).

What to do if the place of work is not indicated

From January 1, 2022, certificates of incapacity for work are issued electronically, and all necessary information is taken by both the medical institution and the policyholder from a special information system. Situations where the place of work is not indicated on the sick leave (in the ELN) are actually excluded.

ConsultantPlus experts discussed how to check whether a sick leave form has been filled out correctly. Use these instructions for free.

But in special cases, medical institutions and health centers will issue paper certificates of incapacity for work in 2022 (Part 28 of Article 13 255-FZ of December 29, 2006). Paper sick leave is issued to patients whose information constitutes a state or other protected secret and is under state protection.

A separate procedure for registering a BC has been established for them (Section X of Order No. 1089n). And if the name of the organization is not indicated on the sick leave, then it must be filled in. Entries on paper certificates of incapacity for work can be combined - filled out both on a computer (in a specialized program) and by hand (FSS letter No. 17-03-09/06-3841P dated 10.23.2014).

And if the health worker does not enter the patient’s place of work, then the employer has the right to enter it himself. This is not a violation. The fact is that on paper sheets information about the employer-insurer is entered from the words of the employee. And employees often do not know the exact name of the company. As a result, doctors also make mistakes. To avoid gross errors and issuance of duplicates, representatives of a medical organization simply do not fill out the “Place of work” column.

IMPORTANT!

If the paper certificate of incapacity does not indicate the name of the organization in the part that is filled out by the medical institution, then the policyholder accepts such sick leave and enters the correct name independently. The FSS does not consider combined entries in the BL a violation and accrues benefits for such documents in the generally established manner.

ConsultantPlus experts discussed how to organize work with electronic sick leave. Use these instructions for free.