Chart of accounts for public sector employees: features of legislative regulation

Since 2011, budget structures, which are established by the state or municipalities, are divided into 3 types:

- autonomous;

- budgetary;

- state-owned.

In order to optimize the regulation of accounting in the above structures, the legislator has developed special legal regulations. The main one is the order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, which approved, in particular, the Unified Plan for Accounting Accounts.

The jurisdiction of Order No. 157n of the Ministry of Finance of Russia applies to all types of institutions operating within the framework of the budget system of the Russian Federation. However, in order to increase the efficiency of accounting regulation in various types of relevant structures, the legislator issued additional legal acts:

- Order of the Ministry of Finance dated December 6, 2010 No. 162n, which regulates the accounting of financial and business transactions in institutions classified as state-owned, as well as in funds - the Pension Fund of the Russian Federation, the Social Insurance Fund, the Federal Compulsory Medical Insurance Fund and government authorities (below we will consider the limits of the jurisdiction of this regulatory legal act in more detail);

- Order of the Ministry of Finance dated December 16, 2010 No. 174n, which approved the rules governing the accounting of financial transactions in budgetary institutions;

- Order of the Ministry of Finance dated December 23, 2010 No. 183n, the provisions of which regulate accounting in institutions classified as autonomous.

When exploring the features of legislative regulation of accounting in the budgetary structures of the Russian Federation, great attention should be paid to the conceptual apparatus of the legislator.

Which institutions maintain a chart of accounts for budgetary accounting?

The fact is that the term “chart of accounts for budget accounting”, based on the norms of paragraph 21 of Order No. 157n, is applicable only to those structures in respect of which the exclusive jurisdiction of Order No. 162n applies, that is, to structures classified as government-owned, as well as the same, as we noted above, to government bodies and extra-budgetary funds.

In turn, in relation to accounting in organizations classified as autonomous or budgetary, it is legitimate to use another term - “chart of accounts”. And this is quite logical, since these institutions have a large amount of powers in terms of extracting income from business activities (clause 2, clause 3 of Article 298 of the Civil Code of the Russian Federation, clause 4 of Article 9.2 of the Federal Law of January 12, 1996 No. 7, concerning the activities of NPOs ).

It may be noted that the maintenance of economic accounting by those bodies that provide cash support for the activities of autonomous or budgetary organizations is regulated by Order No. 162n. And this is also quite logical, since the relevant government agencies, in particular the Federal Treasury, are not engaged in entrepreneurial activities, and there is no need for them to maintain accounting.

Order No. 162n - the main regulatory legal act for budget accounting

In connection with the above, it will be useful to study the limits of jurisdiction of Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n. It establishes rules governing the maintenance of budgetary accounting:

- government institutions;

- power structures - state, municipal;

- Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund, extra-budgetary funds related to territorial ones;

- legal entities that are accountable to the state in terms of spending budget funds;

- structures responsible for cash support of budget transactions;

- bodies of the Federal Treasury, municipalities, financial structures at the level of constituent entities of the Russian Federation, which accompany the maintenance of business accounts of budgetary and autonomous structures.

All noted types of structures must therefore maintain budgetary accounting.

Read about the basic principles of organizing accounting in budgetary institutions in the material “Rules for maintaining accounting in budgetary organizations.”

Planned changes to Instruction No. 162n

First of all, we would like to draw attention to the planned changes to Appendix No. 1 to Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n - Chart of Accounts for Budget Accounting. Appendix No. 1 reflects the numbers of budget accounting accounts indicating 24-26 digits of account numbers. The planned changes are intended to specify the information indicated in 24-26 digits, in accordance with the provisions of Order No. 209n * (3). That is, “legalized” account numbers will make it possible to less frequently refer to Order No. 209n in terms of determining the KOSGU code, reflected in 24-26 digits of budget accounting account numbers. This will significantly reduce labor costs when choosing KOSGU codes indicated in 24-26 digits of account numbers when it comes to articles 560, 660, 730 and 830 of KOSGU.

More on the topic: Inventory when changing materially responsible persons in public sector institutions

In addition, such clarifications of the information indicated in 24-26 digits of account numbers make it possible to resolve some controversial situations. For example, now you can clearly answer the question: what to indicate in 24-26 digits of account number 304 03 “Calculations for deductions from wage payments.” This is code 737/837. For example, in Appendix No. 1 it is planned to reflect the following account numbers:

- 0 205 61 560/660 “Increase/decrease in accounts receivable for capital receipts from other budgets of the budget system of the Russian Federation” is updated to 0 205 61 561/661 “Increase/decrease in accounts receivable for capital receipts from other budgets of the budget system of the Russian Federation” ;

- 0 206 11 560/660 “Increase/decrease in wages receivable” is specified to 0 206 11 567/667 “Increase/decrease in wages receivable”;

- 0 210 82 000 “Settlements with the financial authority to clarify outstanding budget revenues for the year preceding the reporting year” is updated to 0 210 82 181 “Settlements with the financial authority to clarify outstanding budget revenues for the year preceding the reporting year”;

- 0 304 03 730/830 “Increase/decrease in accounts payable for deductions from wage payments” is specified to 0 304 03 737/837 “Increase/decrease in accounts payable for deductions from wage payments.”

In Instruction No. 162n it is planned to clarify the account number for the capitalization of unaccounted for objects identified during the inventory - 0 401 10 199 “Income from other gratuitous non-cash receipts.”

Also, in Instruction No. 162n, when reflecting the accrual of amounts of income that require clarification by treasury authorities, administrators of uncleared revenues currently use account 0 210 02 189 “Settlements with the financial authority for other income received into the budget.” At the same time, it is planned to change it to account 0 210 02 181 “Settlements with the financial authority for unknown revenues received into the budget.”

Accounting in budgetary institutions based on the chart of accounts

So, we have become familiar with the main regulations governing the preparation of the budget accounting plan in 2022. Now we will consider the current provisions of the legislation regarding the formation and structuring of accounts used in accounting.

In accordance with the norms of paragraph 21 of Order No. 157n, Russian budgetary organizations, using the Unified Chart of Accounts or a special accounting plan, are required to create internal charts of accounts for business accounting, called working ones.

In both types of chart of accounts - in the document approved in order No. 162n or in the work plan that is formed in the institution, account numbers are used, the structure of which contains 26 digits.

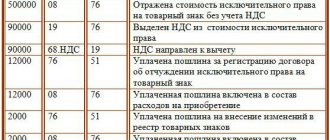

Let's consider their main features, which can be presented in table form:

| Rank | Features of the codes |

| 1–17 | In numbers 1–17, an analytical code is recorded that correlates with the classification code of budget expenditures, institutional income or other funding resources |

| 18 | The number 18 contains a code reflecting the type of cash security |

| 19–23 | In 19–23 digits of the business account used in the plan, the synthetic code present in the Unified Plan is recorded |

| 24–26 | State institutions must record transaction codes in 24–26 digits according to KOSGU |

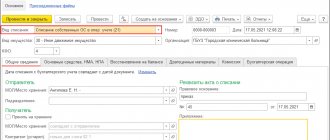

You can see a real working chart of accounts for budget accounting compiled by one of the Russian municipalities on our website:

Let us now study the invoicing algorithm, which can be included in the work plan, in more detail.

Instruction 174n as amended for 2022 - changes in the chart of accounts (account 0 114 00 000)

Let's consider which groups of accounts and analytical accounting accounts are used to generate, in monetary terms, information about accrued losses from impairment of fixed assets, intangible assets, non-produced assets and business transactions that reflect changes in impairment losses, in accordance with the objects of accounting and the content of the business transaction:

| Account group | Analytical accounts |

| 0 114 10 000 “Depreciation of the institution’s real estate” | 0 114 11 000 “Depreciation of residential premises - real estate of the institution” 0 114 12 000 “Depreciation of non-residential premises (buildings and structures) - real estate of institutions” 0 114 13 000 “Impairment of investment real estate - real estate of institutions” 0 114 15 000 “Depreciation of vehicles - real estate of institutions” |

| 0 114 20 000 “Depreciation of particularly valuable movable property of the institution” | 0 114 22 000 “Depreciation of non-residential premises (buildings and structures) - especially valuable movable property of institutions” 0 114 24 000 “Depreciation of machinery and equipment - especially valuable movable property of institutions” 0 114 25 000 “Depreciation of vehicles - especially valuable movable property of institutions” 0 114 26 000 “Depreciation of production and economic inventory - especially valuable movable property of institutions” 0 114 27 000 “Depreciation of biological resources - especially valuable movable property of institutions” 0 114 28 000 “Depreciation of other fixed assets – especially valuable movable property of institutions” 0 114 29 000 “Depreciation of intangible assets - especially valuable property of institutions” |

| 0 114 30 000 “Depreciation of other movable property of the institution” | 0 114 32 000 “Depreciation of non-residential premises (buildings and structures) - other movable property of institutions” 0 114 33 000 “Impairment of investment real estate – other movable property of institutions” 0 114 34 000 “Depreciation of machinery and equipment – other movable property of institutions” 0 114 35 000 “Depreciation of vehicles – other movable property of institutions” 0 114 36 000 “Depreciation of production and economic inventory - other movable property of institutions” 0 114 37 000 “Depreciation of biological resources - other movable property of institutions” 0 114 38 000 “Depreciation of other fixed assets – other movable property of institutions” 0 114 39 000 “Depreciation of intangible assets – other movable property of institutions” |

| 0 114 60 000 “Impairment of non-productive assets” | 0 114 61 000 “Depreciation of land - non-productive assets” 0 114 62 000 “Impairment of subsoil resources – non-productive assets” 0 114 63 000 “Impairment of other non-productive assets - non-productive assets” |

For the listed accounts, transactions will be reflected in the following entries:

| Operation | DEBIT | CREDIT |

| Accrual of losses from impairment of fixed assets, intangible assets and non-productive assets | 0 401 20 274 “Losses from impairment of assets” | Analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” |

| Taking into account amounts of losses from impairment of non-financial assets upon receipt of fixed assets, intangible assets, and non-productive assets | When transferring between the head office and separate divisions (branches): DEBIT of analytical accounting accounts account 0 304 04 000 “Internal departmental settlements” | CREDIT of analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” |

| If received free of charge: DEBIT account 0 401 10 189 “Other income” | CREDIT to analytical accounting accounts 0 114 00 000 “Impairment of non-financial assets” | |

| When internally moving accounting objects when they are classified (excluded) into (from) the category of especially valuable movable property: DEBIT account 0 401 10 172 “Income from transactions with assets” | CREDIT of analytical accounting accounts of account 0 114 00 000 “Impairment of non-financial assets” (with simultaneous reflection in DEBIT of the corresponding analytical accounting accounts of account 0 114 00 000 “Impairment of non-financial assets” and CREDIT of account 0 401 10 172 “Income from transactions with assets”). | |

| Write-off of accumulated losses from impairment of non-financial assets for caused fixed assets, intangible assets, non-productive assets | When transferring fixed assets, intangible assets, non-productive assets within the framework of settlements between the head office, separate divisions (branches), reflected on the basis of primary documents drawn up by the transferring and receiving parties, and notification in form 0504805: DEBIT of analytical accounting accounts 0 114 00 000 “Impairment non-financial assets" | CREDIT of analytical accounting accounts 0 304 04 000 “Internal departmental settlements” |

| When transferring accounting objects to a government body, state (municipal) institution, reflected on the basis of primary documents drawn up by the transferring and receiving parties, and notification in form 0504805: DEBIT of analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” | CREDIT account 0 401 20 241 “Expenses for gratuitous transfers to state and municipal organizations” | |

| When transferring fixed assets upon their sale on the basis of a decision of the permanent commission on receipt and disposal of assets, on the gratuitous transfer of fixed assets, intangible assets, adopted in accordance with the laws of the Russian Federation (in relation to organizations other than international financial organizations, supranational organizations and foreign governments , individuals), incl. when a budgetary institution creates other organizations, as well as the disposal of fixed assets, intangible assets in accordance with the decision made to write them off, when transferring fixed assets into non-operating (financial lease): DEBIT of analytical accounting accounts account 0 114 00 000 “Impairment of non-financial assets” | CREDIT of analytical accounting accounts account 0 101 00 000 “Fixed assets”, accounts 0 102 00 000 “Intangible assets” |

Algorithm for generating an account in 2022

The most problematic part of the account structure placed in the work plan is the codes related to analytical and recorded in numbers 1–17. This may include:

- KDB (income code established for the budget);

- KRB (expense code, also established for the budget by law);

- CIF (code corresponding to sources of financing).

Let's look at how the required value is determined in the counting digits from 1 to 17 using the example of KRB.

The structure of the KRB is as follows:

- in digits 1–3 the code of the manager is recorded - it can be viewed in Appendix No. 9 to Order No. 65n of the Ministry of Finance of Russia dated July 1, 2013;

- in 4–7 digits the codes of the section, as well as the subsection, are recorded - they can be found in Appendix No. 2 to Order No. 65n;

- in 8–17 digits it records the code of the target cost item - it can be selected from the list contained in Appendix No. 10 to Order No. 65n;

- in categories 15–17, a specific type of expense is recorded - it can be selected from the list in Appendix No. 3 to Order No. 65n.

At the same time, it should be noted that the legislator, having formed rather complex criteria for calculating categories 1–17, gives budgetary institutions the opportunity to simplify the task extremely by indicating zeros in the corresponding component of the account (Appendix No. 2 to the instructions approved by Order No. 162n). This opportunity, in particular, was used by the municipality, which drew up a work plan, which is available at the above link.

Therefore, if you indicate zeros in digits 1–17, then the main task in creating a business account for the work plan will be to determine the 18–26 digits of the account included in the work plan.

Account structure

Order 162n clarifies the procedure for generating an account number. In categories 1 to 17, the BCC is indicated. There are four options:

- Group account. Example: 0 101 00 000. For such accounts, zeros are indicated in the first 17 digits;

- Accounts with income classification. Example: 0 205 21 00. KDB is entered in the first 17 digits. The income code consists of 20 digits, included in the account from 4 to 20: the code of the type of income and the code of the subtype of income.

- Accounts with expense classification. Example 0 302 25 00. From 1 to 17 digits, the KRB is entered, from 4 to 20 digits: section, subsection, target item, type of expense.

- Accounts that take into account sources of financing. Example: 0 201 04 00. The first 17 digits are filled with 4–20 digits of the CIF: funding source group code, subgroup code, article code and source type code.

To determine the budget classification of accounts, Instruction 162 contains Appendix 2. In the 18th category, the activity type code is entered. 19 – 23 digits – analytical accounting account from the chart of accounts. For government institutions, the last three digits are KOSGU. For autonomous and budgetary ones - analytical code of receipt and disposal.

We create an account for the plan: categories 18–26

The figure indicated in digit 18 depends on the type of financing. Most likely, this will be the number 1 (the accounting operation is carried out at the expense of budget resources) or 3 (reflects the operation carried out at the expense of funds temporarily at the disposal of the budget structure). By the way, this category, based on the structure of Appendix No. 1 to the Instructions, approved by Order No. 162n, can also be indicated as zero. Many Russian government agencies do this - this can be seen in the example of the real work plan that we presented above.

In numbers 19–23, as we noted above, the code specified in the Unified Plan and correlating with synthetic accounting is recorded. The KOSGU code is recorded in numbers 24–26. It can be found in Appendix No. 5.1 to Order No. 65n of the Ministry of Finance.

The provisions of the legal acts indicated at the beginning of the article, which regulate accounting in budgetary institutions of the Russian Federation, are adjusted quite often. Let's study in more detail the current innovations regarding the norms approved by the legislator in Order No. 157n, as well as Order No. 162n in 2020.

Important changes

The Ministry of Finance of Russia, by order No. 198n dated September 14, 2020, updated order 157n and the unified chart of accounts.

The order has been sent for registration to the Ministry of Justice and has not yet entered into force. It is planned that all changes will take effect from 01/01/2021 and will be applied when preparing annual financial statements. The updated instructions for maintaining budget accounting in budgetary institutions look like this:

- KOSGU codes for subarticles of articles 560, 660, 730 and 830 at the end of the year for accounts with balances are not reset.

- Deferred income is divided according to the date of recognition in accounting. In the financial result of the current year, the amounts are recorded in account 401 41. The remaining amounts are reflected in account 401 49 “Deferred income for recognition in subsequent years.”

- An object of fixed assets (FPE) newly accepted for accounting after decommissioning of the inventory group is marked with a new inventory number. Internal inventory numbers for objects within the group are not used in the future.

- On off-balance sheet account 27, fixed assets for the personal use of employees are subject to registration. This is the organization’s property that they use, including outside the institution and outside of working hours - laptops, smartphones and other gadgets.

New in the Unified Budget Chart of Accounts

So, the first regulatory legal act, the provisions of which we will consider for innovations, is Order No. 157n of the Ministry of Finance of Russia, through which the legislator approved the Unified Chart of Accounts in organizations included in the budget system of the Russian Federation.

In accordance with the changes made to the source of law in question by Order of the Ministry of Finance dated September 27, 2017 No. 148n, which entered into force on October 29, 2017, two accounts were excluded from the Chart of Accounts: 204 51 “Assets in management. Three accounts have had their names changed:

- 204 32 “Participation in state (municipal) enterprises”;

- 206 61 “Calculations for advance payments (transfers) for compulsory types of insurance”;

- 206 63 “Calculations for advances on benefits paid by organizations in the general government sector.”

The new edition of instruction No. 157n provides that when maintaining accounting, the principle of prudence must be observed, that is, priority is established for the recognition of expenses and liabilities over the recognition of possible income and assets. Also an important innovation is the requirement to reflect the correction of errors of previous years in accounting and reporting separately.

About innovations in budget accounting in 2020

Unified chart of accounts: how to use it

The Russian Ministry of Finance has developed separate charts of accounts and instructions for their use for each of the three types of state (municipal) institutions: budgetary, state-owned, autonomous. They are applied on the basis of the Unified Chart of Accounts for state (municipal) institutions.

The procedure for generating an account number has been adjusted

According to the order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n “On approval of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions and Instructions on its application", analytical codes in the account number of the working chart of accounts are reflected as follows: – in digits 1–17 – analytical code according to the classification criteria of receipts and disposals; – in the 18th digit – code of the type of financial support (activity); – in 24–26 digits – analytical code of the type of receipts, disposals of an accounting object. It should be noted that for state-owned and budgetary institutions, the KOSGU codes are reflected in 24–26 categories, for autonomous ones - the analytical code of receipts, disposals of accounting objects in the structure approved by the plan of financial and economic activities. The 19–23 digits of the account number of the Working Chart of Accounts reflect the synthetic account code of the Unified Chart of Accounts. Instead of the currently used four codes for the type of financial support (activity), nine will be used. 1. For state institutions (municipal), financial bodies of the corresponding budgets and bodies providing their cash services, the following codes are provided: – 1 – activities carried out at the expense of the corresponding budget of the budgetary system of the Russian Federation (budgetary activities); – 2 – income-generating activity (institution’s own income); – 3 – funds at temporary disposal; – 4 – subsidies for the implementation of state (municipal) tasks; – 5 – subsidies for other purposes; – 6 – budget investments; – 7 – funds for compulsory health insurance. 2. To reflect the Federal Treasury authorities and financial authorities of the constituent entities of the Russian Federation (municipalities) of operations carried out within the framework of cash services of non-profit organizations that are not participants in the budget process (including budgetary and autonomous institutions), the following codes are provided: – 8 – funds of non-profit organizations on personal accounts. This code is used in relation to transactions with the institution’s (organization’s) own funds, funds at temporary disposal and subsidies for the implementation of state (municipal) tasks, recorded on the institution’s (organization’s) personal account; – 9 – funds of non-profit organizations in separate personal accounts. This code is provided to reflect transactions with subsidies for other purposes and budget investments accounted for in a separate personal account.

Accounting for non-financial assets

Changes in the accounting procedure for non-financial assets are dictated by the innovations introduced by Law No. 83-FZ to the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations”. Thus, if before the amendments were made, a budgetary institution did not have the right to dispose of the property assigned to it for operational management, then from January 1, 2011, such restrictions were established only with respect to the disposal of especially valuable movable property assigned to the budgetary institution by the owner, or at the expense of funds allocated him for the acquisition of such property, as well as real estate. In addition, taking into account the changes made by law to Article 665 of the Civil Code of the Russian Federation, a budgetary institution has the opportunity to enter into financial lease agreements. Objects of non-financial assets are recorded in the corresponding accounts according to the analytical groups of the synthetic account of the object of accounting for objects of property: – 10 “Real estate of the institution”; – 20 “Especially valuable movable property of the institution”; – 30 “Other movable property of the institution”; – 40 “Property – leased items”; – 50 “Non-financial assets that make up the treasury.” Thus, in accordance with the new standards, when forming, for example, an account number for accounting for an object belonging to the “Residential premises” group, it should be accounted for on account 101 11, and not on account 101 01, as was established earlier, that is, instead zero in the analytical account code indicates the code of the corresponding group of accounting objects. New analytical groups of accounts have been introduced to account for the costs of production of finished products, works,; – 70 “Overhead costs of production of finished products, work,; – 90 “Distribution costs”. Innovations have been introduced into Section I “Non-financial assets” of the Unified Chart of Accounts. I would like to draw your attention to the fact that the specifics of accounting for finished products, goods, and trade markups are specified. These categories were not previously mentioned in budget accounting instructions. The name of account 106 04 has been changed. It is now called “Investments in inventories” (the previous name was “Manufacture of inventories, finished products, works, services”). A new account 109 00 “Costs for the production of finished products, performance of work, services” was introduced. The norms of the new Instruction began to contain: – definitions of direct costs, overhead costs, general business expenses, distribution costs; – methods of distribution of overhead costs and general business expenses; – issues of organizing cost accounting in an institution. Thus, as you can see, budget accounting is increasingly approaching accounting in commercial organizations.

Depreciation of objects...

Particular attention should be paid to the procedure for calculating depreciation and changing the boundaries of the cost of an object for the purposes of calculating depreciation.

…fixed assets

For fixed assets, depreciation is calculated in the following order. 1. For an object of real estate when accepting it for registration upon state registration of rights: – worth up to 40,000 rubles. inclusive, depreciation is charged in the amount of 100 percent of the book value of the object upon acceptance for accounting; – costing over 40,000 rubles. depreciation is accrued in accordance with depreciation rates calculated in accordance with the established procedure. 2. For movable property: – for library collections worth up to 40,000 rubles. inclusive, depreciation is accrued in the amount of 100 percent of the book value when the facility is put into operation; – for fixed assets worth over 40,000 rubles. depreciation is accrued in accordance with depreciation rates calculated in accordance with the established procedure; – for assets worth up to RUB 3,000. inclusive, with the exception of library collection objects and intangible assets, depreciation is not accrued; – for other fixed assets worth from 3,000 to 40,000 rubles. inclusive, depreciation is accrued in the amount of 100 percent of the book value when the facility is put into operation.

…intangible assets

For intangible assets, depreciation is calculated as follows:

– for assets worth up to 40,000 rubles. inclusive, depreciation is charged in the amount of 100 percent of the book value when they are registered; – for objects costing over 40,000 rubles. depreciation is accrued in accordance with depreciation rates calculated in accordance with the established procedure. Changes related to the reflection of accrued depreciation in accounting are also associated with the separation from the property of the institution of real estate, especially valuable and other movable property, leased items and treasury property.

Accounting for financial assets

More detailed detailing of synthetic accounting is also provided for the accounts of Section III “Financial Assets” of the Chart of Accounts. Namely, the requirements of the legislation on the possibility of opening accounts for state (municipal) institutions in credit institutions, the Federal Treasury or in the financial authority of the corresponding budget are taken into account. The grouping of transactions under this section is provided in terms of codes 10, 20, 30, but the names of these codes are different than in the section “Non-financial assets”, namely: – 10 “Cash in the personal accounts of the institution with the treasury authority”; – 20 “Cash in the institution’s accounts with a credit institution”; – 30 “Cash in the institution’s cash desk.” The following analytical codes are provided: – 1 “Institutional funds in accounts”; – 2 “Institutional funds placed on deposits”; – 3 “Institutional funds in transit”; – 4 “Cash desk”; – 5 “Cash documents”; – 6 “Letters of Credit”; – 7 “Institutional funds in foreign currency.” As you can see, the names of groups of financial assets practically repeat the names of analytical accounts for account 201 00 000 “Institutional funds” of Instruction No. 148n, with the exception of the name of account 201 02 000 “Institutional funds received for temporary disposal”, instead of which the type of financial assets was introduced “Institutional funds placed on deposits.” The "Cash" account now has the number 201 34 instead of 201 04, the "Cash Documents" account - 201 35 instead of 201 05, the "Letters of Credit" account - 201 26 instead of 201 06, the "Institutional Cash in Foreign Currency" account - 201 27 instead of 201 07. The Instructions provide a more detailed description of account 204 00 “Financial Investments” than previously. Deposits are excluded from the analytical groups as part of financial investments (transferred to financial assets); other financial assets are described with a greater degree of detail. According to the requirements of paragraph 194 of the Instructions, financial investments are grouped by analytical groups of the synthetic account of the accounting object: – 20 “Securities, except shares”; – 30 “Shares and other forms of participation in capital”; – 50 “Other financial assets”. Financial investments are accounted for as follows: a) securities other than shares - on an account containing the analytical code of the synthetic account group 20 “Securities other than shares” and the corresponding analytical code of the type of synthetic account of financial assets: – 1 “Bonds”; – 2 “Bills”; – 3 “Other securities, except shares”; b) shares and other forms of participation in capital - on an account containing the analytical code of the synthetic account group 30 “Shares and other forms of participation in capital” and the corresponding analytical code of the type of synthetic account of financial assets: – 1 “Shares”; – 2 “Statutory fund of state (municipal) enterprises”; – 3 “Participation in state (municipal) institutions”; – 4 “Other forms of participation in capital”; c) other financial assets - on an account containing the corresponding analytical code of the synthetic account group 50 “Other financial assets” and the corresponding analytical code of the type of synthetic account of financial assets: – 1 “Assets in management; – 3 “Other financial assets”.

Income calculations

As for account 205 00 “Income calculations”, the analytics for the account have changed slightly. At the same time, the wording of the names of the analytical groups was slightly changed and the content of the income groups was more detailed. Namely, the grouping of calculations is carried out in the context of types of budget revenues administered by the institution within the framework of the exercise of the powers of the administrator of budget revenues, and (or) types of revenues provided for by the approved estimate (financial and economic activity plan) of the institution according to the analytical groups of the synthetic account of accounting objects:

– 10 “Calculations for tax revenues”; – 20 “Calculations for income from property”; – 30 “Calculations of income from the provision of paid work; – 50 “Calculations based on budget revenues”; – 60 “Calculations for insurance contributions for compulsory social insurance”; – 70 “Calculations for income from operations with assets”; – 80 “Calculations for other income.” >|For more information about the procedure for accounting for income calculations, read “Extrabudgetary activities of government institutions under the new rules.” |<

Calculations for advances issued

The changes also affected account 206 00 “Settlements for advances issued.” Now the grouping of settlements for advances issued will be carried out in the context of the types of payments approved by the estimate (financial and economic activity plan) of the institution according to the analytical groups of the synthetic account of the accounting object: – 10 “Calculations for advances on wages and accruals on wage payments”; – 20 “Calculations for advances for work; – 40 “Calculations for advance gratuitous transfers to organizations”; – 50 “Calculations for advance gratuitous transfers to budgets”; – 60 “Calculations for social security advances”; – 90 “Calculations for advances for other expenses.” Settlements on advances issued (let me remind you that this does not include settlements with accountable persons accounted for in account 208) are accounted for as follows: a) advances on wages and accruals for wage payments - on the account containing the analytical code of the synthetic account group 10 and the corresponding analytical code for the type of synthetic account of financial assets: – 2 “Calculations for advances for other payments”; – 3 “Calculations for advances on accruals for wage payments”; b) advances for work, services - on an account containing the analytical code of synthetic account group 20 “Settlements for advances for work, services” and the corresponding analytical code for the type of synthetic account of financial assets: – 1 “Settlements for advances for communication services”; – 2 “Calculations for advances on transport; – 4 “Calculations for advance payments for rent for the use of property”; – 5 “Calculations for advances for work, services for property maintenance”; – 6 “Calculations for advances for other work and services”; c) advances on receipt of non-financial assets - on an account containing the analytical code of synthetic account group 30 “Calculations for advances on receipt of non-financial assets” and the corresponding analytical code for the type of synthetic account of financial assets: – 1 “Calculations for advances for the acquisition of fixed assets”; – 2 “Calculations for advances for the acquisition of intangible assets”; – 3 “Calculations for advances for the acquisition of non-produced assets”; – 4 “Calculations for advances for the acquisition of inventories”; d) advance gratuitous transfers to organizations - on an account containing the analytical code of synthetic account group 40 “Calculations for advance gratuitous transfers to organizations” and the corresponding analytical code: – 1 “Calculations for advance gratuitous transfers to state and municipal organizations”; – 2 “Calculations for advance gratuitous transfers to organizations, with the exception of state and municipal organizations”; e) advances transferred free of charge to budgets - on an account containing the analytical code of synthetic account group 50 “Calculations for advance gratuitous transfers to budgets” and the corresponding analytical code: – 1 “Calculations for advance transfers to other budgets of the budget system of the Russian Federation”; – 2 “Calculations for advance transfers to supranational organizations and foreign governments”; – 3 “Calculations for advance transfers to international organizations”; f) advances for social security - in an account containing the analytical code of synthetic account group 60 “Calculations for advances for social security” and the corresponding analytical code for the type of synthetic account of financial assets: – 1 “Calculations for advances for pensions, benefits and pension payments, social and medical insurance of the population"; – 2 “Calculations for advance payments for social assistance benefits to the population”; – 3 “Calculations for advances on pensions and benefits paid by organizations in the public administration sector”; g) advances for other expenses - on an account containing the analytical code of the synthetic account group 90 “Calculations for advances for other expenses” and the corresponding analytical code for the type of synthetic account of financial assets: – 1 “Calculations for advances for payment of other expenses”. Please note: as part of the development of accounting policies, the institution has the right, taking into account the requirements of the current legislation of the Russian Federation, to establish as part of the Working Chart of Accounts an additional grouping of calculations for advance transfers by type of expenses (disposals).

Calculations with accountable persons

According to paragraph 217 of the new Instructions, the grouping of settlements with accountable persons is carried out in the context of the types of payments approved by the institution’s estimate (financial and economic activity plan) according to the analytical groups of synthetic accounting of the accounting object: – 10 “Settlements with accountable persons for wages and charges for payments for wages"; – 20 “Settlements with accountable persons for work; – 60 “Settlements with accountable persons for social security”; – 90 “Settlements with accountable persons for other expenses.” In Instruction No. 148n, the analytical codes provided for accounts 206 and 208 are numbered consecutively; in the new Instruction we will notice some differences (in the 208th account there are no groups 40 and 50).

Calculations for property damage

The name of account 209 00 “Calculations for shortfalls” has been changed to “Calculations for property damage”. Otherwise, the accounting requirements remained the same, with the exception of detailed accounting by groups. Grouping of settlements for property damage is carried out by groups of revenues reimbursed for damage to property according to the analytical groups of the synthetic account of the accounting object: – 70 “Calculations for damage to non-financial assets”; – 80 “Calculations for other damage.” Calculations for damage to property are accounted for as follows: a) calculations for damage to non-financial assets - on an account containing the analytical code of synthetic account group 70 “Calculations for damage to non-financial assets” and the corresponding analytical code for the type of synthetic account: – 1 “Calculations for damage to fixed assets” ; – 2 “Calculations for damage to intangible assets”; – 3 “Calculations for damage to non-produced assets”; – 4 “Calculations for damage to inventories”; b) settlements for other damage - on an account containing the analytical code of the synthetic account group 80 “Settlements for other damage” and the corresponding analytical code for the type of synthetic account of financial assets: – 1 “Calculations for cash shortages”; – 2 “Calculations for shortages of other financial assets.” Please note: along with other accounts on which settlements with debtors are recorded, two more new accounts have been introduced: – 210 05 “Settlements with other debtors” for accounting for settlements with debtors for transactions arising in the course of the institution’s activities and not intended for recording on other accounting accounts of the Unified Chart of Accounts; – 210 06 “Settlements with the founder” to account for settlements with the government body performing the functions and powers of the founder in relation to the state (municipal) budgetary institution, autonomous institution.

Calculations for accepted obligations

The grouping of settlements for accepted obligations of account 302 practically repeats the grouping of settlements for advances issued in account 206, with the exception of group 70 “Settlements for the acquisition of securities and other financial investments” and the code of the type of synthetic account 1 “Payroll calculations”, which are not included in the account 206. Clarifications have been added to the description of account 302 regarding the accounting of settlements for currency transactions.

Calculations for payments to budgets

The description of account 303 00 is supplemented by the requirement to keep separate records of the amounts of overpayments made to the budgets of the budget system of the Russian Federation, as well as a more detailed description of the purpose of the account. Namely, two additional codes, which reflect the institution’s settlements with the budget for the relevant taxes, supplemented the analytical codes of the type of synthetic account: – 12 “Calculations for corporate property tax”; – 13 “Calculations for land tax.”

Other settlements with creditors

Analytical codes for the type of synthetic account are supplemented with code 6 “Settlements with other creditors”. That is, settlements with other creditors should be reflected in the new account 304 06. This account is intended for the institution to record settlements with creditors for transactions that arise in the course of the institution’s activities and are not intended to be reflected in other accounts of the Unified Chart of Accounts.

Accounting for financial results

An analysis of Section IV “Financial result” of the Unified Chart of Accounts shows that the number of accounts for recording income, expenses and financial results has been significantly reduced. Account 401 00 was called “Financial result of a business entity” (previously called “Financial result”). The description of this account notes that the account is intended to reflect the result of the financial activities of institutions, as well as the financial result of a public legal entity based on the results of the execution of the corresponding budget of the budget system of the Russian Federation, the estimate (financial and economic activity plan) of a budget institution, an autonomous institution for the current financial year and for past financial periods. Please note: along with deferred income, it is also possible to keep records of deferred expenses. For these purposes, account 401 50 “Deferred expenses” was introduced.

The article was published in the journal “Accounting in Budgetary Institutions” No. 2, February 2011.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Budget accounting in government organizations, state funds and authorities

By order No. 172n dated October 31, 2017, which entered into force on December 8, 2017, the Ministry of Finance of the Russian Federation updated instructions on budget accounting No. 162n.

The new edition of Instruction No. 162n provides a recommendation for registering the internal movement of fixed assets using the debit and credit of the corresponding analytical accounts of account 010100000 “Fixed Assets” when transferring property for rent, free use, trust management, or storage.

Also, instruction No. 162n has been added:

- Regulations on the procedure for separating obligations under executive documents in accounts 040120000 “Expenditures of the current financial year” and 040160000 “Reserves for future expenses” in a situation where the source of the debt, the BCC, and the amount of the obligation are unknown. In such cases, the instructions require that in categories 15–17 indicate the account numbers KVR830, and in categories 24–26 - KOSGU 290, and after clarifying the missing data and clarifying the analytical account, reflect the internal movement of the accounts.

- The procedure for reflecting in the accounting accounts changes in financial investments in the authorized capital during the transformation of a state unitary enterprise (MUP). A decrease in financial liabilities is reflected in the debit of account 040110172 “Income from transactions with assets” and a credit in account 120432630 “Decrease in participation in state (municipal) enterprises”, and an increase in financial liabilities is reflected in the debit of account 020433560 “Increase in the cost of participation in state (municipal) institutions” and credit account 040110172 “Income from operations with assets.”

- Changes made to instruction No. 157n.

Read about the formation of entries in budget accounting when calculating wages in the article “Wage entries in budget accounting.”

Read about the features of budget accounting of fixed assets in the article “Budget accounting of fixed assets in 2022 (nuances).”

And the material “Write-off of fixed assets in budgetary institutions” will introduce you to the write-off of fixed assets in budget accounting.

On December 27, 2022, the Ministry of Finance of the Russian Federation prepared a draft amendment to instruction No. 162n. Some of the changes are caused by the entry into force on January 1, 2020 of certain federal accounting standards for public sector organizations.

See: “New standard for fixed assets for public sector employees.”

In particular, it is expected that a number of accounts will be deleted, new ones will be introduced, and the names of some accounts will be changed. For example, in the section “Non-financial assets” it is assumed that the accounts “Other fixed assets - real estate of the institution”, “Residential premises - other movable property of the institution”, “Fixed assets - leased items” and others are excluded; adding an account to reflect the property in the concession. Changes are expected in other sections of the Chart of Accounts.

Unified PSB

Unified PAS is the basis of accounting for budgetary organizations. Instruction No. 157n indicates which chart of accounts is applicable in government institutions: for each type of government organization there is a separate instruction:

- for autonomous ones - instruction No. 183n (Order of the Ministry of Finance No. 183n dated December 23, 2010);

- for budget funds - instruction No. 174n (Order of the Ministry of Finance No. 174n dated December 16, 2010);

- for state-owned funds - instruction No. 162n (Order of the Ministry of Finance No. 162n dated December 6, 2010).

The unified chart of accounts for budget accounting consists of systematized sections. There are five of them in total:

- Non-financial assets - fixed assets, intangible and non-productive assets, materials, goods and finished products, depreciation, markup, investments in non-financial assets, non-material assets in transit, non-financial assets of treasury property, expenses.

- Financial assets - cash, financial investments, accounts receivable, investments in financial assets.

- Liabilities - accounts payable, settlements of accepted obligations, payments to the budget.

- Financial result is the financial result of an economic entity, calculations for cash transactions.

- Authorization of expenses - limits on budgetary obligations, obligations and appropriations, estimated assignments, rights to accepted obligations, approved amount of financial support, received financial support.

The unified plan of the SBU also includes off-balance sheet registers. Their numbering consists of two digits and reflects various transactions that are not taken into account on the balance sheet. The following is recorded on the balance sheet:

- property received for use and valuables in storage;

- strict reporting forms, awards, prizes and cups, unpaid vouchers;

- state and municipal guarantees;

- fixed assets in operation;

- periodicals for use and others.

The registers of the unified PAS are constructed as follows:

| Balance account name | Synthetic account of an accounting object | Group name | Type name | ||

| account codes | |||||

| synthetic | analytical | ||||

| group | view | ||||

| 1 | 2 | 3 | 4 | 5 | 6 |

| Section 1. Non-financial assets | |||||

| Non-financial assets | 100 | 0 | 0 | ||

| Fixed assets | 101 | 0 | 0 | ||

| 101 | 1 | 0 | Fixed assets - real estate of the institution | ||

| 101 | 2 | 0 | Fixed assets - especially valuable movable property of an institution | ||

| 101 | 3 | 0 | Fixed assets - other movable property of the institution | ||

| 101 | 9 | 0 | Fixed assets - property in concession | ||

| 101 | 0 | 1 | Living spaces | ||

| 101 | 0 | 2 | Non-residential premises (buildings and structures) | ||

| 101 | 0 | 3 | Investment property | ||

| 101 | 0 | 4 | cars and equipment | ||

| 101 | 0 | 5 | Vehicles | ||

| 101 | 0 | 6 | Industrial and household equipment | ||

| 101 | 0 | 7 | Biological resources | ||

| 101 | 0 | 8 | Other fixed assets | ||

ConsultantPlus experts discussed how government agencies and authorities can keep budgetary records of authorizing budget expenditures (account 0,500,00,000. Use these instructions for free.

Results

Structures required to maintain budget accounting must develop a working chart of accounts based on those approved by law. At the beginning of 2022, changes must be made to the working chart of accounts and the coding of accounts to take into account the requirements of new regulatory documents on budget accounting, and, if necessary, balances must be transferred from excluded accounting accounts.

For what form do budgetary organizations submit financial statements, read the article “The procedure for submitting budget statements to the tax authorities for 2019-2020.”

Sources:

- Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n

- Order of the Ministry of Finance dated December 6, 2010 No. 162n

- Order of the Ministry of Finance dated December 23, 2010 No. 183n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.