Benefit amount and length of service

Why is sick leave not always paid at 100%? At what length of service will an employee’s disability be paid based on the minimum wage?

The relationship between the percentage of payment for disability and length of service is given in Part 1 of Article 7 No. 255-FZ of December 29, 2006. The payment percentage for continuous operation is:

- 8 years or more - 100%;

- more than 5 but less than 8 years - 80%;

- less than 5 years - 60%.

Also, Part 6 of Article 7 of Law No. 255-FZ stipulates sick leave payment depending on length of service, which is less than 6 months. It does not exceed the minimum wage for a calendar month. The current minimum wage is set at 11,280 rubles. From 01/01/2019 it will be 12,130 rubles.

A certificate of incapacity for work issued due to pregnancy and childbirth is always paid at 100%, regardless of the employee’s length of service.

Why is it needed?

Calculation of the insurance period (SS) is required in the following situations:

Free legal consultation

+8 800 100-61-94

- To establish the amount of payment for temporary disability or sick leave. Secretary Maria Petrovna fell ill and needed surgery. At the clinic they signed a sick leave certificate for her, and now she will receive disability benefits calculated by the company’s accountant.

- To calculate the volume of subsidies for BiR. This year, 2 teachers from school No. 11 in Novosibirsk are going on maternity leave - one in biology and one in history. A biology teacher has worked for 8 years and her benefit will be an order of magnitude higher than that of a newly arrived history teacher who has worked for only 4 months.

- To form a pension.

Reference! In each individual case, the calculation algorithm, period and other nuances may vary.

Calculation of experience

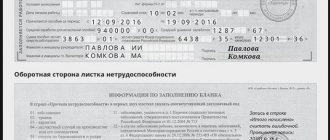

Let's take a closer look at how to calculate the length of service for sick leave in 2022. It is calculated according to the rules established by order of the Ministry of Health and Social Development No. 91 of 02/06/2007.

The insurance period for sick leave payment is determined by entries in the work book and on the basis of other supporting documents. To the question of what length of service is taken into account when calculating sick leave, the answer is clear: all periods of work or service of the employee are taken into account.

How are things going with your studies? Even if an entry about it is made in the work book, the time spent on study is not included in the calculation of length of service for sick leave.

Military service is included in the calculation. If there is no record of it, then the period of service will confirm the military ID.

The question often arises: is sick leave included in the length of service, and whether to include it in the calculation. Yes, when calculating the insurance period of work, you must remember that all periods are included in it. While a person is listed as an employee of the organization, the following should be included:

- time of illness;

- another vacation;

- maternity leave and parental leave;

- other absence from work.

To determine continuous work experience, use the following algorithm:

- Calculate complete calendar annual periods of work or service (January 1 to December 31).

- Count the complete calendar months (from the 1st to the last day of the month) that are not included in the complete calendar years.

- Determine the number of days not included in complete years and months.

- Convert days to months, based on the calculation 30 days equals 1 month.

- Convert every 12 months to years.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » A citizen was fired from one job on 12/31/2019, got a new job on 01/09/2020, is continuous work experience/insurance record lost in this case?

Question:

A citizen was fired from one place of work on December 31, 2019, and got a new job on January 9, 2020. Is continuous work experience/insurance record lost in this case?

Lawyer's answer

What is continuous work experience and where is it used?

Continuous work experience is the duration of work at one enterprise (institution, organization) without a break or at different enterprises, if during the transition from one enterprise to another the continuity of work experience was maintained in the prescribed manner.

Continuous work experience is taken into account, in particular, when determining the amount of temporary disability benefits due to an employee in the case provided for in Part 2 of Art. 17 of Federal Law No. 255-FZ of December 29, 2006 (hereinafter referred to as Law No. 255-FZ).

Also, continuous work experience is used in a number of cases, in particular when determining the right to receive various additional payments and wage supplements, and providing additional leave to certain categories of employees.

For example, a bonus is provided for the duration of continuous work for employees of healthcare institutions under the jurisdiction of the Federal Customs Service of Russia and health centers. The specified allowance is established and paid in accordance with the Procedure approved by Order of the Federal Customs Service of Russia dated November 13, 2008 N 1412.

Guide to HR issues. Procedure for calculating experience {ConsultantPlus}

The concepts of “continuous work” and “continuous work experience” are not disclosed in the Labor Code of the Russian Federation. In dictionaries, the word “continuous” is interpreted as continuous, lasting without a break, without intervals (breaks) <1>, etc.

———————————

<1> Explanatory dictionary of the Russian language S.I. Ozhegova.

It turns out that continuous work or continuous experience is work for a given employer without a break, i.e. when the employment relationship between the employer and employee is maintained without interruption. At the same time, within the meaning of Art. 121 of the Labor Code of the Russian Federation, it does not matter whether the employee actually works or whether his place of work or position is legally retained (for example, on non-working holidays or at military training camps). If the employment contract is terminated, the employee is fired, and continuity of service is lost, because a “gap” has formed—a break in labor relations.

Article: How to calculate length of service for vacation: complex issues (Slesarev S.) (“HR service and personnel management of an enterprise,” 2022, N 5) {ConsultantPlus}

How to determine the insurance period for paying sick leave

The amount of benefits for temporary disability, as before, depends on the length of service, only not on continuous, but on insurance. The insurance period is determined on the day of the occurrence of the insured event, i.e. temporary disability (clause 7 of the Rules). In this case, the first day of illness is not taken into account in the calculation. The insurance period must be determined before the day of the insured event, i.e. the day of the onset of temporary disability is not included in the length of service. The FSS of the Russian Federation holds a similar opinion (Letter dated December 9, 2016 N 02-09-14/15-02-24113). When calculating the insurance period, breaks in work do not matter. Periods of labor and other activities are summed up. This follows from paragraph. 7 tbsp. 3 of the Law on the Basics of Compulsory Social Insurance. Calculation of periods of work (service, activity) is carried out in calendar order based on full months (30 days) and a full year (12 months). Every 30 days of these periods are converted into full months, and every 12 months of these periods - into full years (clause 21 of the Rules). Such a conversion of days into months and months into years is provided only for incomplete calendar months and incomplete calendar years. If the employee has worked a calendar month or a calendar year in full, there is no need to divide the number of days worked by 30 days and, accordingly, by 12 months (Letter of the Federal Social Insurance Fund of the Russian Federation dated October 30, 2012 N 15-03-09/12-3065P).

Guide to HR issues. Procedure for calculating experience {ConsultantPlus}

Taking into account insurance and (or) continuous work experience when determining the amount of temporary disability benefits

When determining the amount of temporary disability benefits, as a general rule, the insurance period is taken into account.

At the same time, from the provisions of Part 2 of Art. 17 of Law N 255-FZ it follows that if the duration of the insurance period, calculated in accordance with the said Law for the period before 01/01/2007, turns out to be less than the duration of the employee’s continuous work experience, used when assigning benefits in accordance with previously valid regulatory legal acts, for that same period, then the duration of the employee’s insurance period is taken to be the duration of his continuous work experience.

In some cases, the insurance period may be less than continuous, for example, for workers who found employment after leaving military service.

The time spent by citizens in military service under a contract is counted towards continuous work experience at the rate of one day of military service for one day of work, and while in military service by conscription - one day of military service for two days of work, if there is a break between the day of dismissal from military service and the day of hiring (entry into an educational organization) did not exceed one year, and for veterans of military operations on the territory of other states, veterans who performed military service duties in a state of emergency and during armed conflicts, and citizens whose total duration of military service is in preferential terms is 25 years or more, regardless of the duration of the break. This follows from paragraph. 1 clause 3 art. 10, para. 4 p. 5 art. 23 of the Federal Law of May 27, 1998 N 76-FZ “On the status of military personnel.”

Guide to HR issues. Procedure for calculating experience {ConsultantPlus}

Thus, if the employment contract with the employee was terminated, then the continuity of service was also lost, because a “gap” has formed—a break in labor relations. When calculating the length of insurance, for example, to pay for sick leave, breaks in work do not matter, since the periods of work and other activities are summed up.

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, January 2020.

When preparing the answer, SPS ConsultantPlus was used

Procedure for calculating temporary disability benefits

To calculate benefits, use the formula:

Payment for the employee's sick leave is made for all days of illness. The maximum duration of the disease is 12 months. Calendar days are paid, including weekends and holidays.

At the same time, how much sick leave is paid for care for a calendar year depends on the patient’s age:

- for an adult or a child over 15 years old - no more than 30 days and no more than 7 days in one case;

- for a child from 7 to 15 - no more than 45 days and no more than 15 days in one case;

- if the child is under 7 years old - no more than 60 days (in exceptional cases - 90);

- for a disabled child - no more than 120 calendar days.

Difference from labor and non-insurance length of service

In the Pension Fund, Social Insurance Fund, and accounting department, you can hear the concepts of labor, insurance and non-insurance experience. All these terms are closely related to each other, but have significant differences.

Length of service implies the entire period of a person’s work, regardless of transfers. The term can also be correlated with pension terminology, since until January 2002 it was used when calculating the pension provision of citizens.

Attention! The insurance period includes periods of work during which contributions were made to the relevant organizations on behalf of the employer.

Non-insurance service is represented by periods of time for which no deductions were made to the Social Insurance Fund (employee illness, caring for a child or sick relative, military service).

Useful to read: Sick leave for care

How to determine average daily earnings

Determine the average earnings to pay for disability using the formula:

The calculation period for temporary disability benefits is two calendar years preceding the year in which the employee fell ill. That is, if an employee fell ill on January 15, 2019, then earnings received in 2022 and 2022 should be included in the calculation.

The calculation includes all payments to the employee from which insurance premiums for compulsory insurance in case of temporary disability and in connection with maternity were calculated. Payments from the previous place of work are also taken into account if the employee has recently started work. Earnings data is taken into account on the basis of a certificate issued by the previous employer and issued in accordance with Order of the Ministry of Labor No. 182n dated April 30, 2013.

What does it include

According to Article 3 of Federal Law No. 165 of July 16, 1999 “On the Basics of Compulsory Social Insurance,” insurance experience should be understood as the sum of the length of time for paying insurance premiums. That is, the period of time for which the employer made contributions to the Social Insurance Fund and the Pension Fund of the Russian Federation.

On September 9, 2022, Order No. 585n of the Ministry of Labor approved the Rules for calculating the insurance period. In accordance with clause 2 of the Rules, the length of service includes:

- contract labor time;

- length of time in state or municipal service;

- time of activity of an individual entrepreneur as a lawyer. A member of a collective farm or production cooperative, a clergyman;

- performance of military duty;

- in case of illness;

- period of pregnancy and childbirth;

- when caring for a child under 1.5 years old, as well as for an elderly relative.

Payment of sick leave in 2022: changes, latest news

The minimum base for calculating the amount of payment for a certificate of incapacity for work is 24 times the minimum wage. Based on the minimum established wage, sick leave should be calculated even if the employee had no earnings in the previous 24 months.

Since from 01/01/2019 the minimum wage will be 12,130 rubles, the minimum base is equal to: 12,130 × 24 = 291,120 rubles.

The maximum size of the base is limited by the maximum base for calculating the amount of social insurance contributions in the billing period, which cannot be less than 12 times the average salary in the country, multiplied by the increasing coefficient (the coefficient also increases annually, and in 2022 it will be 2.2 ). In 2022, the limit is 912,000 rubles. Therefore, when calculating in 2022, take into account 1,680,000 rubles. (865,000 + 815,000), and in 2022 - 1,777,000 rubles. (912,000 + 865,000).

Legislative framework

Issues related to the insurance period for sick leave are regulated by the listed legal acts:

- Federal Law No. 255 of December 29, 2006 in Chapter 2 establishes an algorithm for generating benefits due to a temporary illness. Includes requirements and duration of transfer of benefits, factors for reducing the amount of payment, cases of a negative decision regarding the appointment of a support measure.

- Federal Law No. 165 of July 2, 1999 contains the principles of social insurance, includes a conceptual apparatus, establishes preferences and obligations of the parties to emerging legal relations.

- Order of the Ministry of Labor No. 585n dated September 9, 2020 establishes updated regulations for calculating the insurance period.

The latest document also approved the list of documents proving the existence of experience.

Insurance performance periods

Art. 5 Federal Law No. 255 established cases of payment of sick leave benefits:

- Loss of ability to work due to injury or termination of pregnancy/IVF procedure.

- Caring for a sick relative.

- When an insured individual, a child under 7 years of age, or a disabled adult family member is in quarantine.

- Prosthetics according to medical indications in a hospital.

- Recovery in a sanatorium after inpatient rehabilitation.

Payments will not be made if:

- the employee was released from work with full or partial pay;

- the employee was suspended from service;

- an arrest has been made;

- the enterprise is in idle mode.

You have the right to refuse to grant benefits if it is revealed that you have intentionally caused damage to your own health or if you have committed a deliberate criminal act.

Useful reading: Sick leave during probation period

What is insurance experience?

The insurance period is the periods of work and other activities during which insurance contributions were paid to the Pension Fund of the Russian Federation and the Social Insurance Fund for a citizen.

It is necessary to distinguish insurance length of service from work experience, since this concept unites not only those periods of a citizen’s life when he worked under an employment contract, but also military service, child care, and other types of activities.

The length of the insurance period influences the amount of temporary disability benefits when the employee falls ill, is injured, undergoes follow-up treatment in a sanatorium, or is on maternity leave.

Supporting documents

In accordance with Chapter II of the Rules for calculating SS, supporting documents of labor activity and deductions made are considered:

- Employment history.

- Work contract.

- Employment information in the electronic database.

Reference! If the work book or information about work in the register contains inaccuracies, then confirmation is provided by extracts from orders, personal accounts to which remuneration for labor was transferred, and salary payment statements.

For a private entrepreneur, it is possible to confirm deductions with the following documentation :

- an extract from a financial institution, a certificate from the archive;

- document from the FSS.

An extract from the Social Insurance Fund is used to confirm deductions from private attorneys, notaries, security guards, and detectives.

The period of military duty is confirmed by a military ID or an extract from the commissariat.

Documentation is provided by the recipient of payments at the destination and payment of benefits. Information is submitted to management or directly to the Social Insurance Fund.

How to confirm the insurance period for sick leave?

To confirm insurance experience, supporting documents must be submitted.

The list includes:

- employment history;

- employment contracts;

- extracts from the order;

- personal accounts;

- payroll statements;

- documents from the territorial Social Insurance Fund on payment of social insurance payments;

- certificate from a religious organization.

The specific list is determined by Section II of Order of the Ministry of Labor of Russia dated September 09, 2020 No. 585n.”