How to use the calculator

Instructions for using the length of service calculator for sick leave

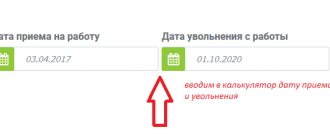

- If you know your length of service as of a certain date, then enter in the “Experience as of date” field the specific day and the number of years, months, days of experience as of that day. These fields are optional, but if you have this data, it will significantly reduce your calculations.

- In the “Date of hiring” and “Date of dismissal” fields, enter your dates, for example, according to your work book. You must fill out at least one line of this table.

- The “Additional periods” may include such periods as: being in the state or municipal service, the period of work as an individual entrepreneur, the period of receiving unemployment benefits, caring for a disabled person or an elderly relative, and others. The full list of such periods is described below, in the paragraph “What is included in the insurance period”.

- If you have served in the military, indicate its duration in the drop-down list.

- Click "CALCULATE". You can save the result as a doc file.

Please also take into account:

- Use the Today button (circle with a dot) to quickly insert the current date.

- Use the appropriate buttons to add, delete and clear required fields for faster and more convenient entry and change of information.

Insurance experience for pension insurance

From birth, an individual has an individual account opened in the Pension Fund. This account records all pension insurance payments made by the employer or other person, including the citizen himself. The period during which contributions to the Pension Fund were paid will constitute the main part of the insurance period when calculating the pension.

Important!

There is a limit on the amount of insurance coverage from which an individual has the right to receive an old-age insurance pension. Until 2015, the condition for receiving a pension was a five-year insurance period. By 2024, the length of service required to receive a pension will be 15 years (Article 8 of Federal Law No. 400-FZ dated December 28, 2013 “On Insurance Pensions”). The transition period to increase the minimum insurance period is currently ongoing:

| Year of pension assignment | Minimum insurance period |

| 2020 | 11 years |

| 2021 | 12 years |

| 2022 | 13 years |

| 2023 | 14 years |

| 2024 and later | 15 years |

The pension due to a citizen is calculated on the basis of the individual pension coefficient. Its value, in turn, depends on the insurance period.

The rules for calculating the insurance period for the purposes of pension insurance are established by Federal Law No. 400-FZ “On Insurance Pensions”, as well as the Decree of the Government of the Russian Federation dated October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions.” An employee’s insurance period includes not only work activity, but also other periods of life. The full list is specified in Article 12 of Federal Law No. 400-FZ. Let us give some examples of them:

- military service;

- periods of being on sick leave and receiving appropriate benefits;

- period of receiving unemployment benefits;

- the period of care of one of the parents for the child until he reaches one and a half years old (no more than six years in total);

- length of stay in custody or in places of detention of persons brought to criminal liability without justification, etc.

It is necessary to take into account that such periods cannot be included in the insurance period if before or after them no insurance contributions were paid to the Pension Fund for the individual.

An employee can work part-time. In this case, insurance premiums will be paid by each policyholder. However, only one of the periods can be included in the insurance period. The period for calculating the insurance period is taken based on the individual’s application.

If a citizen worked abroad, and this period was taken into account when determining a pension in another country, such a period is not included in the insurance period.

About the length of service calculator for sick leave

The calculator will help you quickly calculate the length of service required when filling out a sick leave certificate (certificate of incapacity for work).

Legislative basis for calculating length of service

The laws of the Russian Federation regulate the calculation of length of service for sick pay in the following documents:

- Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” No. 255 of December 29, 2006;

- Order of the Ministry of Health and Social Development of the Russian Federation “On approval of the Rules for calculating and confirming the insurance period to determine the amount of benefits for temporary disability, pregnancy and childbirth” No. 91 dated February 6, 2007 (edited September 11, 2009).

Sick leave length of service is the duration of periods of work and other activities during which a person was insured in case of temporary disability.

Why know the length of temporary disability?

Correctly calculating the time subject to payment for temporary disability is sometimes necessary not only for the citizen himself, but especially often for accountants and personnel employees. This is necessary for the correct calculation of sick leave benefits.

What is included in this type of internship?

The insurance period for calculating sick leave includes the following periods:

- work under an employment contract;

- state and municipal service;

- period of activity as an individual entrepreneur;

- engaging in activities as notaries, private detectives, private security guards;

- periods of activity as a deputy (Federation Council, State Duma), as well as periods of filling these government positions;

- periods of activity as a clergyman;

- periods of engaging a person sentenced to imprisonment in paid work, provided that he fulfills the established work schedule;

- periods of work as a member of a collective farm or production cooperative, subject to personal labor participation in its activities.

What is not included in this type of internship

The periods when you were on maternity leave, as well as all other periods not mentioned in the legislation, are not included.

The amount of sick leave depends on the length of service

To calculate the amount of sick leave, information about average earnings for the last two years is required.

If in the two-year period preceding the disability the citizen had no official income, the minimum amount of benefit will be calculated based on the minimum wage that is current today.

The first three days of disability are compensated by the policyholder himself, and the rest of the time is financed from the budget of the Social Insurance Fund of the Russian Federation.

The share of disability compensation depends on the employee’s insurance coverage:

- those who have worked for less than 5 years will receive 60% of the salary for days of incapacity;

- having experience from 5 to 8 years – 80%;

- More than 8 years of experience entitles you to 100% compensation.

Counting Features

The length of sick leave is determined on the day of the onset of temporary disability.

The calculation procedure is calendar. In the calculator, only the “remaining” periods are converted according to the principle: every 30 days into 1 full month, every 12 months into 1 full year.

Overlapping periods are counted as one. The calculator contains this algorithm, so even if you enter “overlapping” periods, the “intersection days” will be counted once.

Periods spent on parental leave will not be counted towards this length of service.

The calculation of length of service for sick leave affects the amount of payments, and therefore our calculation (even with a difference of 1 day) may not coincide with the calculation of the accountant in your organization. Please take note.

How to calculate disability benefits

Russian legislation states: any employee has the right to receive benefits for temporary disability by providing the employer with evidence of such disability.

First of all, this is, of course, a correctly drawn up certificate of incapacity for work. The law requires an accountant to calculate sick leave in this way :

- Calculate the employee's average daily salary.

- Compare the amount received with the limits established by the Social Insurance Fund.

For details, see the material “Maximum amount of sick leave in 2022.”

- Determine the percentage of payment by calculating the employee’s length of service.

- Calculate benefits by multiplying average daily earnings by the number of sick days. In this case, the Social Insurance Fund will reimburse sick leave starting from the 4th day, the first 3 are paid by the employer.

An example of calculating benefits is in the article “Accrual of sick leave - an example.”

In addition, sick leave for caring for a sick relative or for pregnancy has its own calculation features. Accounting errors in this case are not uncommon. As a result, the calculation of sick leave by the Social Insurance Fund employee shows data that differs from the employer’s data, and the latter begins to have disputes with both employees and social insurance.

Regarding military service

According to paragraph 3 of Article 10 of the Federal Law of May 27, 1998 N 76-FZ “On the status of military personnel”:

The time spent by citizens in military service under a contract is counted in their total length of service, included in the length of service of a civil servant and in the work experience in their specialty at the rate of one day of military service for one day of work , and the time spent by citizens in military service by conscription (in including officers called up for military service in accordance with the decree of the President of the Russian Federation) - one day of military service for two days of work .

However, there is also such a thing as insurance experience. It replaced the length of service from January 1, 2007. Until January 1, 2007, 1 day of service under a contract was counted as 1 day in the insurance and work experience, and 1 day of conscription service was counted as 1 day in the insurance period, and as 2 days in the work experience. Also, if the length of service before January 1, 2007 is greater than the insurance period, it will be taken into account.

Our calculator asks you to select the most common periods of military service. However, in specific cases, the service may not last the even periods indicated in the list, but more precise ones, containing, in addition to years, also months and days. This is especially true for contract service. In this case, we recommend that you use the “Additional periods” block instead of selecting a value from the block regarding military service. In the “Additional periods” block, you can set the beginning and end of the period of military service under the contract, in which case the calculation will be as accurate as possible.

Calculator for calculating temporary disability benefits 2022

To calculate sick leave on the Social Insurance Fund website, click on the “Benefits” tab, then “Calculation of temporary disability benefits.”

To calculate sick leave on the Social Insurance Fund website in 2022, you must enter information about the period of illness, select the type of disability, treatment regimen and type of sick leave, the employee’s length of insurance, etc. on the “LN details, calculation conditions” tab.

To continue calculating sick leave in 2022 on the Social Insurance Portal, you must fill out information about earnings based on data from the employee’s personal account, as well as certificates issued by previous employers.

In addition, it is necessary to calculate and enter into the calculator the days excluded from the calculation. Next, to calculate sick leave online, click the “Calculate” button. The Social Insurance Fund system will calculate sick leave automatically and issue the amount of benefits payable by the employer and reimbursement from the Social Insurance Fund.

Minimum sick leave payment

If the employee had no earnings in the previous two years or the average earnings are below the minimum wage, the benefit must be calculated based on the minimum wage. Since 2015 it is 5,965 rubles/month.

Example

Elena Malysheva was ill from February 10 to February 20, 2015 (11 days). Insurance experience – 7 years. The calculation period is 2013 and 2014, when E. Malysheva did not have a job. The employee was also not on maternity or child care leave during these years. Therefore, there is no reason to replace the calculation period with other years.

The calculation will look like this:

- The average daily earnings will be 196 rubles. 10 kopecks

- 5,965 × 24 (months of the billing period) = 143,160 / 730 = 196 rubles. 10 kopecks

But this is not the final result for calculating benefits, since in accordance with the insurance period, E. Malysheva has the right to 80% of daily earnings - 156.88 rubles.

As a result, sick leave must be paid in the amount of: 156.88 × 11 = 1,725 rubles. 76 kop.

Calculator for calculating salaries, contributions and sick leave 2020-2021

How the amount of benefits is affected by the employee’s insurance experience

Currently, the benefit is issued in the amount of:

– 100 percent of earnings – to employees with a total insurance experience of eight or more years;

– 80 percent of earnings – to people with five to eight years of experience;

– 60 percent of earnings – to citizens with less than five years of experience.

Employees, regardless of their length of service, who are fired from the company and fall ill within 30 days of dismissal will also receive no more than 60 percent of their earnings. At the same time, we recall that if the employee’s work experience is less than six months, then the amount of the benefit cannot exceed one minimum wage per month.

You need to adjust by percentage as the amount of the benefit, which is calculated based on the employee’s actual earnings. So is the amount of benefits calculated based on the minimum wage.

Calculation of employee's insurance length

The amount of insurance coverage is important for calculating two benefits - for temporary disability and for pregnancy and childbirth.

So, sick leave is issued in the amount of:

– 100 percent of average earnings – for employees with a total insurance experience of eight or more years;

– 80 percent of average earnings – to employees with five to eight years of experience;

– 60 percent of average earnings – to citizens with less than five years of experience or in case of illness within 30 calendar days from the date of dismissal.

These percentages must be used, among other things, to calculate benefits for employees working and living in the Far North and equivalent areas. But only for those of them who began their working career in the North after January 1, 2007.

What periods are included in the insurance period?

Continuity of service is not important for calculating benefits. Only the so-called general insurance experience plays a role. That is, breaks in work can be of any duration.

The insurance period includes the following periods:

– work under an employment contract;

– state civil or municipal service;

— periods of military and other service in accordance with the Law of the Russian Federation of February 12, 1993 No. 4468-1;

– other activities during which the citizen was subject to compulsory social insurance.

Other activities that can be included in the insurance period

Specific rules for calculating and confirming insurance experience are established by order of the Ministry of Health and Social Development of Russia dated February 6, 2007 No. 91. The rules clarify what exactly is meant by “other activities”. First of all, this is the period of work as an individual entrepreneur, as well as a notary, private detective or security guard. However, this list is open. The main condition is that the employee at this time must be insured in case of illness and in connection with maternity. That is, the Social Insurance Fund of the Russian Federation must receive social insurance payments for it. And by them they mean:

– for the period before January 1, 1991 – contributions to state social insurance;

– for the period from January 1, 1991 to December 31, 2000 – insurance contributions to the Federal Social Insurance Fund of the Russian Federation;

– for the period from January 1, 2001 to December 31, 2009 – taxes credited to the Federal Tax Service of the Russian Federation (UST, “simplified” tax, UTII and Unified Agricultural Tax);

– for the period from January 1, 2010 – insurance contributions to the Federal Social Insurance Fund of the Russian Federation.

An important point: in 2001–2002, entrepreneurs did not pay unified social tax for themselves in the part credited to the Social Insurance Fund of the Russian Federation. And only from January 1, 2003 they had the opportunity to transfer insurance premiums voluntarily. Therefore, the period from January 1, 2001 to December 31, 2002, when calculating the insurance period of entrepreneurs, “falls out,” which was confirmed by the Constitutional Court of the Russian Federation in its ruling dated February 7, 2003 No. 65-O. And since 2003, the length of service is counted only for those entrepreneurs who transferred contributions.

Documents on the basis of which the insurance period is calculated

The main document confirming the employee’s insurance experience is the work book. If for some reason there are no entries in the work book or there is no book at all, employment contracts will help confirm the length of service.

In addition, you can also use extracts from orders, certificates, personal accounts and even payroll statements. The employee must present these documents to the employer (at the place where benefits are paid). Otherwise, the accountant will calculate the benefit based on the data indicated in the employee’s work book.

An employee who, before being employed by a company, was engaged in entrepreneurial activity, in order to confirm his insurance experience, can submit:

– certificates from archival institutions or documents from financial departments (if the employee was engaged in business before January 1, 1991);

– certificates from the territorial offices of the Federal Social Insurance Fund of the Russian Federation on payment of contributions (if the employee worked as an individual entrepreneur from January 1, 1991 to December 31, 2000 and after January 1, 2003).

How to calculate sick leave if your work experience is less than 6 months

This applies to people whose work experience is just beginning. If a person has officially worked less than six months in total throughout his life and up to the moment of illness, then there is a special limitation for his sick leave. This amount for a calendar month cannot be more than the minimum wage (minimum wage), taking into account regional coefficients.

Currently, the minimum wage is 7,500 rubles. However, if the region has established increasing regional coefficients for wage calculations, the minimum benefit amount must be increased by them.

Please note: payments based on the minimum wage also need to be adjusted depending on the employee’s insurance coverage.

Example 1. At Sokol LLC, Vorontsov S.D. got a job in November 2014. At the same time, this person did not work at other enterprises in 2014. From January 14 to January 21, 2015, Vorontsov was on sick leave.

The employee's total insurance period is 5 years and 4 months, which is significantly more than six months. Consequently, the accountant of Sokol LLC must calculate his allowance based on average earnings.

Example 2. Skorotov P.S. joined Polesie LLC on January 11, 2015. This is his first job. And on February 14 of the same year, Skorotov fell ill and was ill for five calendar days. It turns out that the employee’s total insurance experience is less than six months. Therefore, his benefit cannot exceed one minimum wage for a full calendar month. But it cannot be less than this value (taking into account the coefficient of 60 percent, since the insurance period is less than five years).

More reasons to count according to the minimum wage

A benefit calculated on the basis of the minimum wage must be paid not only if the length of service is less than six months. For example, if a sick employee, without good reason, did not follow the doctor’s instructions or did not show up for an appointment. The benefit based on the minimum will be calculated from the day the violation was committed. In this case, the amount of the benefit must be calculated separately for the days on which the employee violated the doctors’ instructions, and separately for the days when there were no violations. Finally, the results must be added up.

In addition, the minimum, and for the entire period of illness, is received by an employee who falls ill or is injured due to alcohol, drug or toxic intoxication.

During the last two calendar years, was the employee on parental leave for up to three years or maternity leave?

If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones. Of course, if it’s more profitable for the employee. To do this, she must write a special application. But keep in mind: real payments are taken into account and are not indexed in any way.

Example: V.S. Mikhailova, an employee of Vector CJSC. I got sick in April 2015. In June 2014, she returned from maternity leave, which she had been on since March 2011. The employee has been working for this company since March 2008. Thus, 2013 is “empty” for her, and 2014 is “half empty”.

In this case, the benefit can be calculated based on earnings for the two years preceding the maternity leave. These are 2009 and 2010. And if it is more profitable for the employee, she can leave 2014 and add 2010 to it. The main thing here is that the amount of benefits in the end be the largest.

Note that this is the only exception to the general rule. In all other cases, benefits must be calculated based on earnings for the last two calendar years.

The calculation includes all payments for all places of work for the last two calendar years for which insurance contributions to the Social Insurance Fund were calculated. But in practice, it is quite possible that the employee had no income during the estimated two years. In this case, the benefit must be calculated based on the minimum wage. This rule applies even if the employee had earnings in the year in which he fell ill.