What is included in travel expenses in 2022 and who sets the standards for reimbursement of travel expenses, we discuss in this article. We will also consider the reflection of travel expenses in accounting. And learn how to calculate travel expenses.

Also see:

- What is the daily allowance for a business trip abroad in 2020?

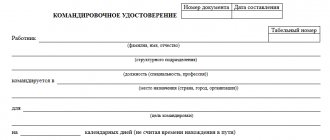

- Do I need a travel permit?

What is included in the list of travel expenses

The following employee expenses are subject to reimbursement of expenses related to business trips:

- daily expenses (you can read more about daily allowances in the article “The amount of daily allowances for business trips and their calculation”);

- fare;

- housing expenses;

- payment for a visa and fee for obtaining a foreign passport;

- consular fees;

- exit/entry fees;

- toll road fees;

- registration of compulsory insurance;

- mandatory fees and payments;

- other expenses incurred by an employee on a business trip with the consent of management.

This list was compiled taking into account the norms of labor legislation (Labor Code of the Russian Federation) and the Regulations on business trips approved by the Government of the Russian Federation.

Calculating and processing travel expenses abroad has its own characteristics, which you can familiarize yourself with in the article “How to calculate daily allowances when traveling abroad.”

Expenses for business trips of one’s own and “other people’s” employees

Based on clauses

12 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include expenses for business trips, in particular: for the employee’s travel to the place of business trip and back to the place of permanent work; for the rental of residential premises, while the employee’s expenses for paying for additional services provided in hotels are also subject to reimbursement (with the exception of expenses for service in bars and restaurants, in the room, expenses for the use of recreational and health facilities); daily allowance or field allowance; registration and issuance of visas, passports, vouchers, invitations and other similar documents; consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees.

We note that according to Art. 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Business trips of employees whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

According to Art. 16 of the Labor Code of the Russian Federation, labor relations arise between an employee and an employer on the basis of an employment contract concluded by them in accordance with the Labor Code of the Russian Federation.

Article 56 of the Labor Code of the Russian Federation establishes that an employment contract is an agreement between an employer and an employee, according to which the employer undertakes to provide the employee with work for a specified labor function, to provide working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement , agreements, local regulations and this agreement, pay the employee wages in a timely manner and in full, and the employee undertakes to personally perform the labor function determined by this agreement in the interests, under the management and control of the employer, to comply with the internal labor regulations in force for this employer.

Thus, only employees of an organization who have an employment relationship with it can go on a business trip. This is also confirmed by the norm of clause 2 of the Regulations on the specifics of sending workers on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

Consequently, an organization does not have the right to take into account the costs of paying compensation for travel and accommodation expenses of “foreign” employees as expenses when calculating corporate income tax as travel expenses. A similar conclusion is contained in the letter of the Ministry of Finance of Russia dated October 16, 2007 No. 03-03-06/1/723, which explains that in accordance with the provisions of Art. 166–168 Labor Code of the Russian Federation and Art. 255 of the Tax Code of the Russian Federation, a Russian organization has the right to reimburse business trip expenses only in relation to full-time employees with whom the organization has entered into employment contracts.

This conclusion is also supported by the Federal Tax Service of Russia for the city of Moscow in letter dated December 29, 2008 No. 19–12/121858, which also states that if the employees of the parent foreign organization are not employees of the Russian organization, and the costs of their business trips to the Russian The Federation is not directly related to the activities of a Russian organization aimed at generating income, then such expenses are not taken into account when forming taxable profit.

The fact that such costs cannot be taken into account as travel expenses is also indicated by the courts, in particular, in decisions of the Federal Antimonopoly Service of the Ural District dated January 19, 2009 No. Ф09-10311/08-С3, and the Federal Antimonopoly Service of the Northwestern District dated October 1. 07 No. A05-5368/2006–26, etc. The first of them notes that the taxpayer’s expenses associated with travel and accommodation of auditors - employees of the counterparty meet the criteria established in paragraphs. 17, 49 clause 1 art. 264 Tax Code of the Russian Federation. The second explains that if an agreement is concluded between organizations for the provision of consulting services on the customer’s territory, the agreement stipulates that the customer is obliged to compensate the counterparty for business trip expenses (travel, accommodation, daily allowance), and these expenses are actually incurred, documented and economically justified , then they are taken into account by the customer when determining the tax base for income tax on the basis of paragraphs. 15 and 49 clause 1 art. 264 Tax Code of the Russian Federation.

The foregoing allows us to conclude that travel and accommodation expenses for persons who are not employees of the organization are considered justified if such expenses are provided for in the contract and are related to activities aimed at generating income. In this case, it is necessary to take into account other criteria established in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation - economic feasibility and documentary evidence. In addition, these expenses should be considered not as business travel expenses, but as other expenses associated with production and (or) sales (clause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation), related to other expenses.

Payment of travel expenses

In order for an employee to travel to perform a job assignment, he must be paid an advance for travel expenses.

The deadline for paying travel expenses is before the start of the trip. It can be established in the organizational and administrative document of the company.

To receive an advance, an order is made for a business trip (you can read more about this topic in the material “How to properly arrange a business trip”).

Also, the employer can establish in the internal regulations the need to submit a preliminary calculation, memo, application for travel expenses or the development of an estimate of travel expenses, samples of which should preferably be fixed in a local act.

You can learn how to calculate travel allowances in the article “How to calculate travel allowances (expenses).”

In addition to daily allowance and payment of other travel expenses, the employee retains an average salary.

There are certain nuances when it comes to paying for business trip days that fall on weekends or holidays. You can find them in the article “Payment for business trips on weekends and holidays: features.”

Each company sets its own travel expense standards, taking into account its financial capabilities. At the same time, the daily allowance should cover the cost of food and household expenses during a business trip.

In what cases personal income tax is withheld from the amount of travel expenses, you can find out in the article “How to reflect daily allowances in tax accounting.”

Business trip concept

A business trip is understood as sending an employee, by order of his management, for a specific period of time to another location, in order for the employee to perform a professional task. Only trips of persons who have an officially registered labor relationship with the employer are recognized as business trips. All other legal relations regarding the performance of work have their own mechanism for regulating the movements and sending of employees to another area to perform work, and are not included in the concept of “business trip”.

The law contains a requirement that a business trip is mandatory for an employee; refusal to travel without good reason is recognized as a violation of labor discipline and entails liability.

However, some categories of employees are exempt from business trips or can be sent on business trips only by expressing their written consent. Such restrictions apply to employees during their pregnancy, raising children, or are related to the employee’s age.

Travel by employees whose work involves travel is not recognized as business trips and is paid according to other standards.

Accounting for travel expenses

Let's consider the reflection of travel expenses in accounting. To reflect them, account 71 “Settlements with accountables” is provided:

- by debit – take into account all funds issued for travel and entertainment expenses;

- on credit - reflect transactions when travel expenses are written off.

An advance for business trip expenses can be issued from the company's cash desk, transferred from a current account to an employee's bank card, or it can be transferred to a special corporate card.

Here are examples of wiring:

- Dt 71 – Kt 50: issued for travel expenses. If before this money was received at the cash desk for travel expenses, then the posting is as follows: Dt 50 - Kt 51 ;

- Dt 71 – Kt 51 : an advance was transferred against the report from the company’s current account;

- Dt 55 – Kt 51: transfer to a special account was made.

Subsequently - when the employee pays by card (for example, for a hotel) - the accountant will reflect the following transaction: Dt 71 - Kt 55 .

If an employee withdraws money from a corporate card (for example, for food), the posting is as follows: Dt 71 – Kt 55.

In accounting, travel expenses are charged to expense accounts (in most cases).

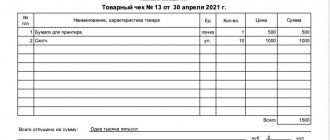

At the end of the business trip, the employee must submit to the accounting department a correctly completed advance report for travel expenses. In this case, the accountant will reflect the following entries in accounting: Dt 26 – Kt 71 (travel expenses written off).

You can read how to correctly draw up an advance report and report for an advance on travel expenses in the article “What should a business trip report be?”

Required documents

According to paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, a VAT deduction can be obtained if you have an invoice issued in the appropriate manner.

This rule is easily followed when applying for a deduction for living expenses. The basis for the deduction is an invoice issued by the hotel (hotel, other organization providing accommodation services). In this case, the invoice can be issued both to the organization and to the employee. In the first case, based on the invoice, the organization makes a cashless payment to the hotel, after which it accepts VAT for deduction. In the second case, the employee pays the bill in cash, after which he receives reimbursement from the organization. The organization, in turn, accepts VAT for deduction based on the invoice and advance report of the employee.

If there is no invoice

However, often there is no invoice issued by the hotel reflecting the expenses for an employee’s accommodation on a business trip. The employee pays the cost of accommodation in cash and receives a receipt without an invoice or any additional documents.

Also, do not forget about travel documents, the receipt of which does not require the issuance of an invoice. Is it possible to deduct VAT in this case? The answer to this question is highly controversial.

On the one hand, representatives of the tax service categorically refer to paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, according to which the basis for deducting VAT can only be an invoice. On the other hand, there are a number of court decisions made in favor of taxpayers:

- – FAS Central District No. A62-1547/03 dated June 21, 2004;

- – FAS of the East Siberian District No. A19-1855/04-5-51-F02-3411/04-S1 dated 09.09.2004;

- – Federal Antimonopoly Service of the Ural District No. F09-554/04-AK dated 03/02/2004.

According to judicial arbitrators, organizations can deduct VAT on the basis of travel documents (railway, air, bus tickets, etc.) and receipts for payment of the cost of living, provided that the payment of these expenses was made by the employee in cash. The rationale for this position of the judicial authorities is clause 7 of Art. 168 of the Tax Code of the Russian Federation, according to which the sale of goods (work, services) to the population for cash payment does not provide for the issuance of an invoice. Such operations are accompanied by the issuance to the citizen of another document on a strict reporting form - a travel ticket or cash receipt.

- Thus, based on current judicial practice, an organization can accept VAT on travel expenses for deduction without an invoice if the following conditions are simultaneously met: travel/accommodation expenses were paid by the employee in cash;

- there is a supporting document (ticket, receipt) drawn up on a strict reporting form

.

If VAT is not allocated

Another popular question regarding the deduction of VAT on travel expenses is whether a company has the right to a deduction if VAT is not highlighted in the documents?

For example, an employee paid for accommodation services on a business trip and received a receipt for the total amount, excluding VAT. Can an organization receive a deduction?

In such cases, taxpayers should also turn to judicial practice. In accordance with the position of the arbitrators, in case of cash payments to the population, the issuance of documents with the allocation of VAT is not mandatory. Thus, an organization can reduce the VAT taxable base through a deduction if an employee paid for tickets or rental housing on his own in cash.

As a conclusion, we note that in order to avoid disputes with the tax authorities, the taxpayer should choose one of the following formats for preparing travel documents:

- The organization pays travel and accommodation expenses in non-cash form on the basis of an invoice with an allocated VAT amount.

- The employee purchases tickets (pays the cost of accommodation) independently in cash . Based on judicial practice, an organization can issue a deduction without an invoice, on the basis of a strict reporting form (travel document, receipt), in which the VAT amount is not allocated.

Other expenses of an employee on a business trip with the consent of management

An employee has the right to claim compensation for additional travel expenses if they are provided for in company regulations or labor legislation.

Additionally, in addition to daily allowance and accommodation, an employee may have expenses for a taxi on a business trip.

How to arrange this payment of travel expenses can be found in detail in the article “Payment for a taxi on a business trip: taxes and supporting documents.”

The company may also include other expenses in travel expenses. So, if an employee goes on a long trip, then packing luggage may be included in travel expenses.

Service fees and fines for returning/exchanging tickets (if the traveler is not at fault) are also included in travel expenses.

Payment of travel expenses on a business trip may take into account the standards established for categories of employees. For example, in a local act, an employer can stipulate that the company’s management, including deputy directors, have the right to travel in first class in a railway carriage and fly in business class. For all other employees - reserved seat and economy class, respectively. And this will not be a violation of paying expenses for business trips.

When auditing travel expenses, it is necessary to check first of all the existence of an internal regulation on business trips, which should specify all the norms for additional reimbursement. expenses.

Basic provisions

In many cases, the reimbursable expenses that the contractor insists on are expenses associated with the travel of its employees.

In this regard, the question arises: can the customer compensate for the travel expenses of the contractor organization without prejudice to himself? Let us answer right away that the obligation for such compensation in accordance with the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) does not arise, since labor legislation provides for compensation for travel and accommodation expenses only for “our” employees sent on a business trip (Articles 166, 168 Labor Code of the Russian Federation). Therefore, if an organization, as the receiving party, compensates for travel and accommodation of “foreign” employees, including foreign organizations, then this compensation is the right of this organization, and not an obligation.

According to Art. 247 of the Tax Code of the Russian Federation, the object of taxation for corporate income tax is the profit received by the taxpayer. At the same time, for the purposes of applying Chapter 25 of the Tax Code of the Russian Federation, income received, reduced by the amount of expenses incurred, is recognized as profit for Russian organizations that are not members of a consolidated group of taxpayers.

In accordance with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented costs are those supported by documents:

issued in accordance with the legislation of the Russian Federation; executed in accordance with business customs applied in the foreign country in whose territory the relevant expenses were incurred; indirectly confirming the expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Thus, when including certain costs as expenses in order to determine the tax base for corporate income tax, their economic justification, direct relationship with activities aimed at generating profit, and their documentary evidence are of decisive importance.

Payment of travel expenses according to the agreement

The contractor very often wants to be reimbursed for additional costs under the contract. In the general case (clause 2 of Article 709 of the Civil Code of the Russian Federation), the price of the contract already includes compensation for all costs of the contractor and his remuneration. However, the parties may include a provision for reimbursement of travel expenses in the contract. How to pay travel expenses to the contractor in this case?

The provision for compensation for travel expenses makes sense when the contractor does not know in advance how many visits he will make to the site. However, you can:

- in the contract , limit the amount of reimbursement of travel expenses by the customer and set a limit;

- include the amount for travel expenses in the summary estimate.

It also makes sense to indicate in the contract what applies to travel expenses, as well as the deadline for reporting them. These clauses of the agreement will help justify the amount of travel expenses in tax accounting.

How to pay travel expenses under an audit agreement? Similarly: include in the contract a provision for compensation of travel expenses by the customer.

If the contractor is a foreign organization

If an organization cooperates with a foreign contractor, then it makes sense to pay attention to the letter of the Ministry of Finance of Russia dated May 2, 2012 No. 03-07-08/125, which states that in accordance with the provisions of Art. 161 of the Tax Code of the Russian Federation, when a foreign person who is not registered with the Russian tax authorities sells work, the place of sale of which is the territory of the Russian Federation, VAT is calculated and paid to the Russian budget by the tax agent purchasing these works from the foreign person. In this case, the tax base for value added tax is determined by the tax agent as the amount of income from the sale of work, taking into account value added tax.

Taking into account the fact that a Russian organization pays a foreign organization the cost of work, taking into account the costs associated with travel and accommodation of employees of a foreign organization, the Russian organization - tax agent should include in the VAT tax base all amounts of money transferred to the foreign organization.

In other words, the Russian organization as the customer must withhold VAT from the amount of compensation to the foreign organization - contractor.

If the contract contains a condition that the customer compensates the contractor for the costs of sending workers in excess of the contract price, then this is associated with increased risks for both parties, because according to Art. 41 of the Tax Code of the Russian Federation, this amount cannot be considered the contractor’s income; therefore, only the amount of remuneration under the contract will be taken into account as part of his revenue.

In addition, Chapter 21 of the Tax Code of the Russian Federation does not answer the question of whether the contractor should charge VAT on the amount of compensation received.

At the same time, according to the regulatory authorities, the funds received by the contractor as compensation for their travel expenses, on the basis of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation are subject to VAT, and the tax is calculated based on its calculated rate (letters of the Ministry of Finance of Russia dated 08/15/12 No. 03-07-11/300, dated 04/22/15 No. 03-07-11/22989).

If the contractor calculates VAT on the amount of compensation received, then he has the right to take advantage of a deduction for travel expenses.

Despite the fact that the customer can take into account the entire amount paid under the contract as part of the expenses, he “loses” VAT on the transferred amount of compensation, since upon receipt of this amount the contractor issues an invoice in one copy. Consequently, the customer has no basis for receiving a deduction.