What is an advance invoice?

What are the specifics of such a document as an advance invoice, and how does it differ from other types of invoices, in particular, “shipping” invoices that are familiar to many payers?

Upon detailed consideration of the provisions of Art. 169 of the Tax Code of the Russian Federation, which introduces invoices as a legal category, it can be stated that the legislator distinguishes 3 types of invoices.

- A document that is issued upon the actual sale of goods (performance of work, provision of services) or transfer of rights from one entity to another. The requirements for its content are specified in clause 5 of Art. 169 of the Tax Code of the Russian Federation. Unofficially, such invoices are called “shipping” invoices.

- An invoice that the supplier must issue to the buyer upon receipt of advance payment for goods or work. The requirements for its structure are contained in clause 5.1 of Art. 169 of the Tax Code of the Russian Federation. Invoices of this type are advance invoices.

- Adjustment invoice - was introduced into the Tax Code of the Russian Federation as a legal category of Law No. 245 dated July 19, 2011. It is used if the supplier has reduced the price or volume of goods - in order to clarify the relevant data.

Read more about adjustment invoices in the article “What is an adjustment invoice and when is it needed?” .

It is interesting that in the provisions contained in paragraph 1 of Art. 169 of the Tax Code of the Russian Federation, the adjustment invoice is clearly allocated to an independent category. The classification of invoices into shipping and advance invoices is carried out in the Tax Code of the Russian Federation somewhat veiledly, but in fact it is present.

Thus, the legislator provides for the following classification of invoices:

- regular invoice;

- a document drawn up by the seller upon transfer by the client of an advance payment for the goods;

- adjustment invoice.

Let's take a closer look at the purposes for which an advance invoice can be used.

Purpose of advance invoices

An invoice is a source that serves as a legal basis for the company purchasing a product (work, service) to accept the amount of VAT included in the structure of the selling price as a deduction provided for by law. The legislator in paragraph 3 of Art. 168 of the Tax Code of the Russian Federation directly instructs the seller to send this document to the buyer upon receipt of advance payment for the delivered goods (work or service), as well as when the supplier actually fulfills its obligations.

Having an advance invoice in hand, the purchasing organization can, as if it had a shipping document, exercise the right to deduct VAT (clause 12 of Article 171 of the Tax Code of the Russian Federation).

Thus, advance and shipping documents have the same legal significance. The legislator has established the form in which they must be drawn up - its structure is given in Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Attention! From July 1, 2021, an updated invoice form is used (as amended by Decree of the Government of the Russian Federation dated April 2, 2021 No. 534). This is because, from July 2022, the product traceability system does not operate as an experiment. Read more about changes to the invoice here.

You can download the updated invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

In turn, a special form is also established for the adjustment invoice - in Appendix 2 to Resolution No. 1137.

You can download the updated form of the adjustment invoice by clicking on the image below:

There are 2 main criteria for distinguishing between advance and shipping invoices:

- moment of preparation (an advance document is drawn up upon receipt of an advance payment by the seller, a shipping document upon the fact of the sale of goods or completion of work);

- completeness of filling out (information in some of the points of the advance invoice cannot always be entered for objective reasons - and the legislator takes this into account).

Let us study the specifics of both of these criteria in more detail.

VAT on advance payment issued from the buyer

After transferring the prepayment, you will receive an “advance” invoice from the supplier. Based on it, you have the right to deduct tax. But follow the conditions from clause 12 of Art. 171 Tax Code of the Russian Federation:

- the invoice is issued in accordance with the requirements;

- there is a document confirming payment;

- There is a condition for prepayment in the contract.

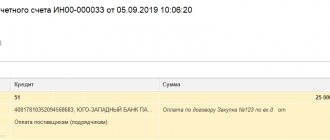

When transferring the advance payment, the buyer should have the following entries in his accounting:

Dt 60 Kt 51 - advance payment transferred to the supplier;

Dt 68 Kt 76 - VAT on the “issued” advance is accepted for deduction.

Record the received “advance” invoice in the purchase book. Indicate VAT on the advance payment in line 130 of section 3 of the tax return.

You can accept an “advance” invoice for deduction only in the quarter in which it was received. It cannot be transferred to the future. The rule on transferring deductions for a period of up to 3 years does not apply to advances (Letter of the Ministry of Finance of the Russian Federation No. 03-07-11/67480 dated October 17, 2017).

When is an advance invoice issued and how is it recorded?

As we noted above, the legislator requires the supplier to generate an invoice for the buyer upon the sale of goods, performance of work, provision of services, or after receiving an advance payment for the relevant obligations.

There are exceptions to this rule. In accordance with paragraph 3–5 of paragraph 1 of Art. 154 of the Tax Code of the Russian Federation, clause 17 of the Rules for maintaining a sales book, advance invoices are not drawn up if:

- the period of production of goods is more than 6 months;

- goods (work, services) in accordance with clause 1 of Art. 164 of the Tax Code of the Russian Federation are taxed at a rate of 0%;

- goods, works, services are not subject to VAT or are exempt from taxation in accordance with Art. 149 Tax Code of the Russian Federation;

- The taxpayer received an exemption under Art. 145, 145.1 Tax Code of the Russian Federation.

An advance invoice must be issued no later than 5 calendar days from the date of receipt of the advance payment. This is what paragraph 3 of Art. 168 Tax Code of the Russian Federation. If the last day of the period is a weekend, holiday or non-working day, an invoice can be drawn up no later than the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

For example, for an advance payment received on June 30, 2021, an invoice can be issued either on June 30 or on any day from July 1 to July 5. The 5 day period expires on July 4th, but that is a Sunday. Therefore, the deadline is 07/05/2021.

ATTENTION! If the buyer transfers partly the debt for the previous delivery and partly the advance payment in one payment order within the framework of one contract, then an advance invoice is issued only for the advance part of the payment. For example, Smiley LLC purchased goods worth 50 thousand rubles from Leto LLC. 10/13/2021. On October 15, 2021, Leto LLC paid 300 thousand rubles with 1 payment order, of which 50 thousand rubles. - debt, and 250 thousand rubles. — advance payment for subsequent delivery. Smiley LLC will issue 1 advance invoice for 250 thousand rubles. (300 thousand rubles - 50 thousand rubles debt).

An invoice of any type must be issued in 2 copies - the first is given to the buyer, the second remains with the company and is subject to registration in the sales book (clause 2 of Appendix 5 to Resolution No. 1137).

Exactly how the seller registers advance invoices is described in detail in the Ready-made solution from ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Read about some of the nuances of maintaining a sales book in this article.

It may be noted that the legislator obliges sellers to provide buyers with invoices, but does not provide mechanisms for liability for failure to comply with the relevant instructions. However, the buyer has the right to request an invoice from an unscrupulous counterparty through the court.

Advance and tax accrual

According to the law, if the seller has received an advance from the buyer, he must remember to charge VAT on it.

So, on the basis of paragraph 2 of Art. 153 of the Tax Code of the Russian Federation, when determining the tax base for VAT, revenue from sales (sales) is determined based on all income of the payer associated with settlements for payment for goods (work, services) received by him in cash or in kind.

Moreover, as a general rule, the law considers the earliest of the following dates to be the moment of determining the tax base (clause 1 of Article 167 of the Tax Code of the Russian Federation):

- day of shipment or transfer of goods/works/services;

- the day of payment or partial payment for upcoming deliveries of goods/performance of work/provision of services.

Simply put, having received an advance payment for the supply of goods, performance of work or provision of services, the seller must charge VAT for payment to the budget. The calculated rate will be 20/120 or 10/110 (clause 4 of article 164 of the Tax Code of the Russian Federation).

The choice of tax rate (0%, 10% or 20%) depends on the rate at which the law (Article 164 of the Tax Code of the Russian Federation) applies to the sale of specific goods, performance of work or provision of services for which the seller (supplier) received an advance .

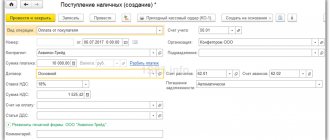

Features of filling out a sample invoice for an advance payment

The invoice for the advance payment must contain (based on the requirements of clause 5.1 of Article 169 of the Tax Code of the Russian Federation):

- date of document preparation, serial number (they must be included in line 1);

- information about the seller and the client - names of companies, their addresses, INN, KPP (in lines 2, 2a, 2b, 6, 6a, 6b);

- data on the payment document confirming the transfer of the advance - number and date (recorded in line 5);

- details of the document on which the invoice was drawn up (line 5a);

- the name of the settlement currency, as well as its code - in accordance with OKV (line 7);

- the name of the product/work for which the advance is paid - as it appears in the agreement between organizations (in column 1);

- the VAT rate established for a specific type of product - and it should be designated as calculated - 10/110 or 20/120, and not 10 and 20% (in column 7);

- the amount of calculated VAT - in rubles and kopecks without rounding (in column 8);

- the amount of the prepayment received, also in rubles and kopecks (in column 9).

You can download a sample of a completed advance invoice from ConsultantPlus, receiving a free trial demo access to the legal reference system. And in this ready-made solution you will find step-by-step instructions for filling out an advance invoice.

The requirement to indicate the amounts of VAT and prepayments in rubles and kopecks without rounding is given in clause 3 of the Rules for filling out invoices, letter of the Ministry of Finance of the Russian Federation dated April 22, 2014 No. 03-07-07/18585. This rule also applies to shipping invoices.

In all likelihood, the supplier will not have information for the remaining columns of the advance invoice at the time of drawing up the document. Actually, indicating such is not required if you follow the provisions contained in clause 5.1. Art. 169 of the Tax Code of the Russian Federation. In turn, when filling out a shipping invoice, they may well be available - as information about the shipper and consignee, recorded in the 3rd and 4th lines. They must be indicated in the relevant document in the same way as other information required in accordance with paragraph 5 of Art. 169 of the Tax Code of the Russian Federation.

So, the fundamental differences between an advance invoice and a shipping invoice are:

- in less stringent requirements of the legislator for filling out (which can be explained by the fact that the taxpayer may not have some information provided for in the structure of the form, which is approved by Resolution No. 1137);

- the need to indicate the VAT rate in the document as an estimated rate - in the format 20/120 or 10/110.

At the same time, both types of invoices have the same legal force in terms of the buyer of goods exercising the right to deduct VAT.

Typical mistakes when drafting a document

Any violations related to the preparation of financial statements may expose legal entities and officials to fines and other administrative penalties. An invoice for an advance payment is no exception. To avoid this, it is better to follow these rules:

VAT calculation

- Enter the details correctly. After all, it is the invoice that will be used by the buyer to receive a deduction. If the document is incorrectly drawn up, the company will be refused to return the funds, and this will have a detrimental effect on the reputation of the seller. It’s better not to take risks and check all the details, address, tax identification number and checkpoint several times.

- Write the payment document number correctly. Line No. 5 usually indicates the number and date of the payment order for which the advance was received.

- Fill out the sales book after preparing the invoice. The document number must be reflected in the book with code 22. You also need to record the offset of the payment using code 02. And if you need to restore VAT previously accepted for deduction, then it must be reflected using code 21.

- Do not record the advance in the sales ledger. After receiving the advance payment, the seller must record the payment in the above document, and after shipping the order - in the purchase book. When filling out the sales book, you should put a dash in columns 5a and 6a. And in the purchase book you don’t need to touch the 8th and 9th lines.

Note! The VAT amount is deductible only after the goods or services are sold. Thus, recording in the books of sales and purchases is necessary to determine how much tax the seller can supply from the budget.

Advance invoicing is part of the accounting code of ethics. This is a document that is drawn up after the buyer makes an advance payment. The advance serves as a step of trust on the part of the client, and the invoice indicates the responsibility of the seller. Since it is on this document that the VAT deduction is drawn up, it is important not to make mistakes in it and send it within the specified time.

Filling out an advance invoice: nuances

There are a number of nuances that are useful to pay attention to when generating an invoice according to the specified scheme.

The Ministry of Finance of the Russian Federation, in letter No. 03-07-11/427, issued on October 16, 2012, expresses the opinion that the serial numbers of advance invoices should be included in a single list with those established for shipping invoices. This is quite logical, based on the point of view that these types of invoices are intended to carry out the same legal actions in terms of the buyer’s exercise of the right to deduct VAT.

Read about numbering invoices out of order here.

In some cases, an advance payment from the buyer is received even before the names of goods, works, and services to be included in column 1 of the advance-type invoice become known. Letter No. 03-07-09/22 of the Ministry of Finance, issued on July 26, 2011, contains the opinion that in such cases, the invoice should reflect the general name of the product (for example, “confectionery”).

Read the article “Is it legal to refuse to deduct VAT if the name of the goods (works, services) is given in a generalized form in the invoice?”

If an advance is received for goods that are sold at rates of 10 and 20%, in the advance invoice you need to highlight groups of goods and for each group enter the appropriate tax rate - 20/120 or 10/110 (clause 1 of the Ministry of Finance letter No. 03 -07-15/39 from 03/06/2009).

What problems the seller and the buyer will have if this is not done, we have described here.

It may be noted that employees of the organization responsible for document flow, for the convenience of storing and using advance invoices, have the right to indicate additional information in additional lines and columns that do not change the form of the invoice (clause 9 of the Rules for filling out invoices, letters of the Ministry of Finance of the Russian Federation dated 04/08/2016 No. 03-07-09/20121, dated 02/26/2016 No. 03-07-09/10933, dated 11/24/2015 No. 03-07-09/68169, dated 04/08/2016 No. 03-07-09/20121 ).

The advance invoice must be signed by the head of the company and the chief accountant (or the employees who replace them). If the business is owned by an individual entrepreneur, then he or his authorized person must sign the document, but in any case, the details of the state registration certificate of this individual entrepreneur must be indicated in the invoice. The same rules apply to shipping and adjustment invoices.

Results

When prepayment is received, the supplier must issue an advance invoice on the form used for shipping invoices.

This document serves to calculate tax from the seller and deduct VAT from the buyer. The peculiarity of issuing an advance invoice is that it indicates the estimated tax rate, and some indicators inherent in a shipment invoice may be missing. Increased attention is required when preparing invoices when receiving advances for goods, works, and services taxed at different tax rates. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

After the advance is closed by sale

Let’s imagine that in October 2022, “Kind World” received threads from the supplier according to UPD No. 11 dated 10/09/2021 in the amount of 150,000 rubles. Toys were shipped to wholesale buyers for the entire amount of the advance received, 100,000 rubles. Retail buyers purchased toys worth RUB 5,000 by presenting previously purchased gift certificates.

In accounting for the Good World, you will need to do the following operations.

Upon receipt of prepaid goods

| date | Operation | D-t | Kit | Amount, rub. |

| 09.10.2021 | Materials were received and capitalized from the supplier according to UPD No. 11 dated 10/09/2021 | 10.1 | 60.1 | 125 000 |

| 09.10.2021 | VAT is reflected on the cost of materials received | 19 | 60.1 | 25 000 |

| 09.10.2021 | VAT accepted for refund | 68.02 | 19 | 25 000 |

| 09.10.2021 | VAT on advance payment has been restored to the budget | 60.1 | 68.02 | 20 000 |

Please note: when receiving prepaid valuables, it is necessary to recover VAT from the advance payment to the budget.

It would also be a good idea to check with the supplier.

The Astral Report 5.0 service will help you check the data in the sales and purchase books with the data of your counterparties before sending a VAT return.

In the VAT return for the 4th quarter of 2022, the Good World organization will fill out:

- Section 8, indicating the details of the invoice received from the supplier upon receipt of the materials;

- section 3 line 120;

- section 9, indicating the details of the invoice received from the supplier when transferring the advance;

- lines 080 and 090 of section 3.

When shipping goods on account of previously received advances

| date | Operation | D-t | Kit | Amount, rub. |

| 15.10.2021 | The sale of toys to a wholesale buyer was reflected and an invoice was issued for the sale | 62.1 | 90 | 100 000 |

| 15.10.2021 | VAT payable to the budget calculated on sales is reflected | 90.03 | 68.02 | 9 090,91 |

| 15.10.2021 | VAT on the advance previously reflected for payment to the budget has been accepted for reimbursement | 68.02 | 76.AB | 9 090,91 |

| 18.10.2021 | Reflects retail sales of toys to customers who presented gift certificates | 62.1 | 90 | 5 000 |

| 31.10.2021 | An invoice was issued for toys sold to individuals, reflecting VAT payable to the budget calculated from sales | 90.3 | 68.02 | 454,55 |

| 31.10.2021 | VAT on advance payments on gift certificates sold to individuals, previously reflected for payment to the budget, has been accepted for reimbursement | 68.02 | 76.AB | 454,55 |

In the VAT return for the 4th quarter of 2022, the Good World organization will fill out:

- section 9, indicating details of invoices for sales;

- line 020 of section 3;

- section 8, indicating details of invoices issued upon receipt of advances;

- line 170 of section 3.