Calculation of sick leave in 2022

In 2022, the calculation period for benefits includes 2016 and 2022.

For 2016, you can take into account payments within the range of 718,000 rubles, for 2022 – within the range of 755,000 rubles.

Let's calculate the maximum average daily earnings for calculating sick leave in 2022:

The maximum average daily earnings for calculating sick leave in 2022 is: RUB 2,022.81.

From January 1, 2022, the minimum wage is 9,489 rubles. Average monthly earnings should be compared with 9,489 rubles.

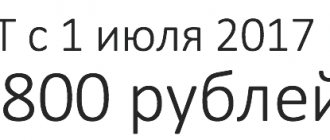

In 2022, the minimum wage was 7,800 rubles. Since the minimum wage has been increased, the minimum sick leave benefit in 2022 has become larger.

Let's calculate the average daily earnings:

The maximum average daily earnings for 2022 is: RUB 311.97.

Formulas

There is a formula that helps calculate the minimum sick leave in 2022. It looks like this: on the date of the employee’s illness in 2022, we take the current minimum wage, which we multiply by 24 months, and then divide it all by 730 days. The final result is the minimum average daily earnings. If, based on the results of the calculation, it turns out that it is less than calculated according to the minimum wage, then a larger amount is accepted for the calculation.

When sick leave is calculated on the basis of the minimum average daily earnings, it is necessary to calculate disability benefits for a period of 1 day. The following method is used for calculation: they take the amount of the minimum average daily earnings based on the minimum wage and multiply it by a percentage depending on the length of service that the employee has accumulated.

To determine the percentage depending on the length of service, the following rule is used:

- the calculated percentage is set as 100 if the employee’s insurance experience is more than 8 years;

- the calculated percentage for sick leave is set as 80 if the employee’s work experience is 5-8 years;

- 60% is used for calculation if the employee’s length of service is less than 5 years.

Keep in mind: when the length of service is less than six months, the amount of sick leave should not exceed the minimum wage per calendar month.

During the first 3 days of an employee’s illness, the provision of sick leave comes from the employer’s budget. After this, payment for the sheet occurs at the expense of funds allocated by the Social Insurance Fund - FSS of the Russian Federation. And in cases where sick leave was issued because the employee needed to care for a sick relative, the benefit is paid in full using Social Insurance Fund funds from the first day.

For cases where an employee works part-time, a general formula is used with the minimum wage indicator for sick leave in 2018. Then the resulting value is multiplied by a special coefficient. It represents the proportion of hours actually worked over the entire working period.

From January 1, 2022, the minimum wage is 9,489 rubles. This amount is enshrined in the Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation Regarding Increasing the Minimum Wage to the Subsistence Level of the Working-Age Population.”

Reference data for calculating sick leave in 2022. Table.

| Indicator for calculating sick leave in 2022 | Indicator value in 2022 |

| Billing period | 2016 and 2022 |

| Number of days in the billing period | 730 days |

| Minimum wage | 9489 rub. |

| Limit earnings for calculating sick leave | 2016 – 718,000 rubles. 2022 – RUB 755,000. Amount: 2016 + 2022 = RUB 1,473,000. |

| Maximum average daily earnings | 2017.81 rub. |

| Minimum average daily earnings | RUR 311.97 |

Calculation of average earnings

The benefit is calculated based on the average earnings of the insured person, calculated for 2 calendar years preceding the year of parental leave, i.e., when the benefit is assigned in 2022 - for 2016 and for 2022.

The average earnings, on the basis of which benefits are calculated, include all types of payments in favor of the insured person, for which insurance contributions to the Social Insurance Fund of the Russian Federation were calculated in accordance with the legislation of the Russian Federation on taxes and fees (starting from 01/01/2017).

Average earnings for calculating benefits are taken into account for each calendar year in an amount not exceeding the maximum base for calculating insurance premiums established in accordance with paragraph 6 of Article 421 of the Tax Code of the Russian Federation.

The maximum amount of annual earnings taken into account when calculating benefits is for:

- 2018 - RUB 815,000;

- 2017 - RUB 755,000;

- 2016 - 718,000 rubles;

- 2015 - 670,000 rubles;

- 2014 - 624,000 rubles;

- 2013 - 568,000 rubles;

- 2012 - 512,000 rubles;

- 2011 - 463,000 rubles;

- 2010 - 415,000 rubles;

- 2009 and earlier periods - 415,000 rubles.

If in 2 calendar years immediately preceding the year of the insured event, or in one of the specified years, the insured person was on maternity leave and (or) child care leave, the corresponding calendar years (calendar year) upon application female workers may be replaced for the purpose of calculating average earnings by previous calendar years (calendar year), provided that this will lead to an increase in the amount of the benefit.

In the average earnings for calculating benefits, not only the earnings received from a given policyholder are taken into account, but also, in the general case, earnings during work (service, other activities) for another policyholder (other policyholders).

To confirm earnings received from another policyholder, the employee must provide a certificate of the amount of earnings from which the benefit should be calculated from the place of work (service, other activity) with the other policyholder (or a copy of the certificate certified in the prescribed manner), and the number calendar days falling in the specified period during periods of temporary disability, maternity leave, parental leave, the period of release of the employee from work with full or partial retention of wages.

If the insured person does not have a certificate (certificates) of the amount of earnings on the day of applying for benefits, the benefit is assigned and paid on the basis of the information and documents submitted by the insured person and available to the policyholder. After the insured person submits a certificate (certificates), the assigned benefit is recalculated for the entire past period, but not more than 3 years preceding the day the certificate (certificates) was submitted.

If at the time of the insured event the employee is employed by several employers, then child care benefits are assigned and paid to him at one of the last places of work of his choice (unlike benefits for temporary disability, pregnancy and childbirth, which in certain cases may paid for all jobs).

Average daily earnings are determined by dividing the amount of earnings of the insured person for the 2 previous calendar years of the start of the vacation (taking into account the limitation of its maximum annual amount) by the number of calendar days in the billing period, with the exception of calendar days falling on the following periods:

- periods of temporary disability, maternity leave, parental leave;

- periods of release from work with full or partial retention of wages in accordance with the legislation of the Russian Federation, if insurance premiums are not charged on the retained wages.

When calculating child care benefits, the average daily earnings cannot exceed the value determined by dividing by 730 the sum of the maximum values of the base for calculating insurance premiums for the 2 calendar years preceding the year of parental leave.

In 2022, the maximum average daily earnings for temporary disability benefits is (Article 14 of Law No. 255-FZ):

(RUB 718,000 + RUB 755,000) / 730 = RUB 2,017.81

In this regard, the maximum amount of benefits for child care up to 1.5 years in 2022 is equal to (Article 11.2, 14 of Law No. 255-FZ):

RUB 2,017.81 x 30.4 x 40% = 24,536.57 rubles.

An insured person with an insurance period of less than 6 months is paid child care benefits up to 1.5 years in an amount not exceeding the minimum wage established by federal law for a full calendar month, and in districts and localities in which district coefficients are duly applied to wages, in an amount not exceeding the minimum wage, taking into account these coefficients.

If the insured person did not have earnings for 2 calendar years preceding the year of the occurrence of the insured event, and also if the average earnings calculated for these periods, calculated for a full calendar month, are lower than the minimum wage established by federal law on the day the insured event occurred, the average earnings , on the basis of which the benefit is calculated, is taken to be equal to the minimum wage established by federal law on the day the insured event occurred.

If the insured person, at the time of the occurrence of the insured event, works part-time - part-time, part-time - the average earnings, on the basis of which benefits are calculated in these cases, are determined in proportion to the duration of the insured person's working hours. Moreover, in all cases, the calculated monthly child care benefit cannot be less than the minimum monthly child care benefit.

From January 1, 2018, the minimum wage is RUB 9,489. (Federal Law No. 421-FZ dated December 28, 2017). From May 1, 2018, the minimum wage is RUB 11,163. (Federal Law No. 41-FZ dated 03/07/2018).

In 1C:Enterprise 8 solutions, the minimum wage is kept up to date. For deadlines, see “Monitoring Legislative Changes.”

How to calculate sick leave benefits in 2022

After returning to work after illness, the employee presents a sick leave certificate. The organization is obliged to assign him a benefit within 10 calendar days from the date of application and pay it on the next day established for payment of wages. According to Article 15 of Law No. 255-FZ.

The benefit is accrued and paid if the employee applies for it no later than six months from the date of starting work. According to Article 12 of Law No. 255-FZ.

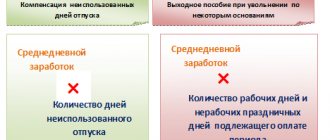

You must pay for the entire period of the employee’s incapacity, including weekends and non-working holidays.

In case of illness or domestic injury, benefits for the first three days of incapacity are paid to the employee at the expense of the company, and from the fourth day - at the expense of the Federal Social Insurance Fund of the Russian Federation (Clause 2, Article 3 of the Federal Law of December 29, 2006 No. 255-FZ).

Maximum sick leave period

Speaking about the maximum sick leave payment in 2022, one cannot help but recall the 2nd part of the final calculation formula - the duration of the period of illness in calendar days. Sick leave is issued according to strictly regulated rules for a period established by law.

The most common maximum terms are:

- For outpatient treatment - 15 days inclusive.

- Inpatient treatment - the period of stay in a hospital plus up to 10 days inclusive after hospitalization on an outpatient basis.

- Continuation of treatment in sanatorium-type institutions - 24 days inclusive.

NOTE! If the illness (injury) is related to the professional activity of the sick person, the travel time to the medical institution and back is included in the sanatorium sick leave.

- For pregnancy and childbirth - 140–196 days (depending on the situation).

- Caring for a sick child:

- up to 7 years - for the entire period of illness;

- from 7 to 15 years - for 15 days inclusive;

- over 15 years of age for outpatient treatment - for 3 days.

IMPORTANT! Standard treatment periods can be extended, but only by decision of a special medical commission.

Read about the rules for filling out sick leave brought by an employee in the material “An example of filling out a sick leave by an employer .

General procedure for calculating sick leave in 2022

First you need to calculate your average daily earnings. The calculation formula is given in paragraph 1 of Article 14 of Law No. 255-FZ.

To calculate sick leave, the number of days in a year is always 730. It doesn’t matter whether we count it in a leap year or not. Only for calculating maternity benefits, the number of days may be different.

Let's calculate the maximum base for calculating contributions. To calculate, we take the base values for 2016 and 2022: this is 718,000 rubles. and 755,000 rub. respectively. In total this will be: RUB 1,473,000.

Now you need to compare the employee’s average daily earnings with the minimum. The minimum average daily earnings is 311.97 rubles. If the employee’s earnings are below the minimum of 311.97 rubles, for further calculations you need to take this figure. If it’s more, we calculate it based on the employee’s average earnings. That is, we calculate sick leave benefits from the amount that is greater.

Then, you need to calculate the amount of benefits for the employee per day. To do this, we multiply the average daily earnings by a percentage depending on the employee’s length of service:

- 8 years or more – 100%;

- from 5 to 8 years – 80%;

- less than 5 years – 60%.

We have come to directly calculating the amount of the benefit. You need to multiply the amount of benefits for 1 day by the number of days the employee is sick.

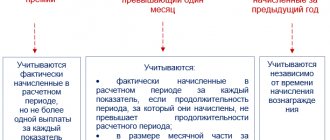

Indicators for calculating benefits have changed for 2018

The procedure for calculating VNIM benefits states that they must be calculated based on the employee’s average earnings, calculated for the two calendar years preceding the occurrence of the insured event (Article 14 of Law No. 255-FZ).

The calculation period for benefits assigned this year will be 2016-2017. To calculate benefits, a larger amount of earnings is taken, since the limit of payments taken into account has increased: RUB 1,473,000. (RUB 755,000 + RUB 718,000).

Maximum daily earnings: the amount of payments taken into account in the calculation is limited by the maximum base for calculating contributions to VNiM in the corresponding year:

The data in the table shows that with the change in the billing period, the maximum amount of earnings for benefits increased, since the calculation takes into account the maximum values for 2016-2017: RUB 2,017.81. (RUB 1,473,000 / 730 days). For an insured event that began in 2022, this figure when calculating benefits will be 1,901.37 rubles. ((RUB 670,000 + RUB 718,000) / 730 days).

Average daily earnings: for 2018 benefits, the billing period includes the leap year 2016, which includes 366 calendar days, so the number of days in the billing period is 731 days (366 days + 365 days). This means that when calculating child and maternity benefits, the marginal income must be divided by 731 to calculate the actual average daily earnings (similar to the calculation of benefits assigned in 2022).

TABLE: “Base for calculating insurance premiums for VNiM”

| Year | Maximum base (in rubles) |

| 2017 | 755 000 |

| 2016 | 718 000 |

| 2015 | 670 000 |

Let's look at the nuances of calculating benefits using examples.

Example 1 (calculation of sick leave benefits)

The employee was sick for 5 days in February 2022, his insurance coverage is 10 years.

Earnings in 2016 – 740,000 rubles, in 2022 – 750,000 rubles.

There are no periods excluded when calculating average daily earnings.

To calculate average earnings, the employee’s income for 2016 is taken into account in the amount of RUB 718,000. (within the base) and for 2022 in the amount of 750,000 rubles. (in fact).

Average daily earnings - 2,010.96 rubles. (RUB 718,000 + RUB 750,000) / 730 days.

Let’s compare the amount received with the minimum daily earnings, calculated based on the minimum wage in effect at the time of the insured event (RUB 9,489).

The minimum earnings are 311.97 rubles. (RUB 9,489 x 24 months / 730 days). It is less than the actual one, so for the calculation you need to take the actual one (with 10 years of experience, 100% is taken).

The benefit amounted to 10,054.80 rubles. (RUB 2,010.96 x 5 days x 100%).

Example 2 (calculation of maternity benefits)

The employee goes on maternity leave for 140 calendar days from January 23, 2018.

Accounted payments: in 2016 - 690,000 rubles, in 2022 - 720,000 rubles.

There are no periods excluded when calculating average daily earnings.

Let's determine the actual average daily earnings: 1,928.86 rubles. (690,000 rub. +720,000 rub.) / 731 days. It does not exceed the maximum earnings (2,017.81 rubles) and more than the minimum (311.97 rubles).

Therefore, for the calculation we take the actual daily earnings.

The benefit will be 270,040.40 rubles. (RUB 1928.86 x 140 days x 100%).

Example 3 (calculation of maternity benefits for additional leave)

The woman went on maternity leave on December 13, 2017. The maternity benefit for 140 days is calculated from the average daily earnings for 2015 - 2016 - 1,530 rubles. In May 2022, the employee received additional sick leave for pregnancy and childbirth for 16 days (from 05/02/2018 to 05/17/2018).

The amount of maternity benefit for additional leave is 24,480 rubles. (RUB 1,530 x 16 days).

Example 4 (calculation of maternity benefits in the presence of periods excluded from average earnings)

The employee goes on maternity leave in February 2018. In 2016, she was paid a salary of 620,000 rubles. and temporary disability benefits – 28,000 rubles. (11 calendar days). In 2017, her salary was 680,000 rubles.

Payments will amount to RUB 252,777.78. (620,000 rub. + 680,000 rub.) / (731 days – 11 days) x 140 days.

Example 1. Calculation of sick leave in 2022

In January 2022, the sales manager brought sick leave to the company’s accounting department. The number of days of her illness = 9 calendar days. Insurance experience = 6 years. Actual earnings of the manager: In 2016 = 400,000 rubles In 2022 = 480,000 rubles. Earnings for 2016 and 2022, that is, for the billing period will be: 880,000 rubles. We compare this amount with the maximum earnings for calculating benefits - 1,473,000 rubles. The manager's earnings of 880,000 rubles do not exceed the maximum limit of 1,473,000 rubles. Let's calculate the amount of daily allowance for a manager: (400,000 rubles + 480,000 rubles): 730 days. × 80% = 964.38 rub. We multiplied by 80%, since the manager’s experience is from 5 to 8 years. This is the case when sick pay should be 80% of total earnings. The manager was sick for 9 days. Let's calculate the amount of benefits for 9 days of illness. To do this, we multiply the manager’s actual daily allowance by the number of sick days: 964.38 rubles. × 9 days = 8,679.42 rub.

How to calculate sick leave if the limit is exceeded

The calculation period for calculating sick leave benefits in 2018 includes 2016 and 2022.

The maximum base for calculating contributions: 2016 - 718,000 rubles, in 2022 - 755,000 rubles. The total is: 1,473,000 rubles.

To calculate sick leave benefits in 2022, you cannot take an amount that will be greater than the maximum base for calculation, that is, more than 1,473,000 rubles.

If an employee had a high salary and his earnings are more than the maximum accrual base, to calculate sick leave you need to take the maximum accrual base in the amount of 1,473,000 rubles, no more.

Results

The maximum amount of sick leave in 2022 is limited to:

- a limited indicator of average daily earnings according to the maximum value of the base established for contributions to the Social Insurance Fund: for 2022 - 2,572.60 rubles / day, for 2022 - 2,434.25 rubles / day;

- limited duration of sick leave in days (for a standard case of staying at home due to an ordinary illness - no more than 15).

That is, in a normal situation, the maximum payment for sick leave in 2022 cannot be more: 15 × 2,572.60 = 38,589.00 rubles, and in 2021 - 15 × 2,434.25 = 36,513.75 rubles .

Sources:

- Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of sick leave in 2022 from the minimum wage

When calculating sick pay, the minimum wage must be applied in four cases.

First. If the employee had no earnings during the pay period.

Second. If the average employee’s earnings are below the minimum wage.

Third. If the average earnings are equal to the minimum wage.

Fourth. If the employee's length of service is less than 6 months.

In some regions there are coefficients. If you work in such a region, determine the minimum allowance taking into account the regional coefficient.

Example 3. Calculation of sick leave 2022 from the minimum wage

A new employee has joined the company.

Due to the difficult economic situation in his region, he could not find work for a long time and did not work in 2016 and 2022. After working for about a month, he fell ill. A week later, he brought sick leave for 5 calendar days. Since the employee did not receive wages in the billing period (2016-2017), the accounting department must calculate sick leave benefits based on the minimum wage. First, we determine the average earnings: 9,489 rubles. × 24 months : 730 days = 311.97 rubles. The employee’s work experience is 4 years 3 months, so his benefit will be 60% (up to 5 years) of average earnings. The benefit calculation looks like this: 311.97 × 5 × 60% = 936, 91 rub. A similar situation in which there is no earnings in the billing period will occur for employees returning from maternity leave. If there was no income, you need to calculate sick leave benefits from the minimum wage, taking into account your length of service.

Minimum amount of sick pay in 2022

The amount of average earnings for the period of incapacity calculated according to the basic method must be compared to the minimum indicator. This is usually necessary in cases where the sick employee, for some reason, did not work for 2 years before the sick leave and the amount of the benefit calculated for the month may be less than the established minimum wage.

If the calculation based on average earnings turns out to be less than the calculation based on the minimum wage, it is necessary to calculate the sick leave payment based on the minimum wage. In 2022, the minimum wage was 12,130 rubles. From 01/01/2021 the minimum wage is 12,792 rubles. The minimum wage for 2022 is 13,890 rubles.

Comments and examples from ConsultantPlus will help you calculate benefits based on the minimum wage. Follow the link and get trial access to K+ for free.

Read about the taxation of sick leave with personal income tax in the article “Is sick leave (sick leave) subject to personal income tax?” .

Example 4. Calculation of sick leave 2022 from the minimum wage with less than 6 months of experience

If the employee’s insurance period is less than 6 months, the sick leave benefit cannot exceed the minimum wage for a full calendar month, in accordance with Part 6 of Article 7 of Law No. 255-FZ. In this case, to calculate sick leave, you need to calculate and compare: the daily benefit calculated from the employee’s earnings and the maximum daily benefit for a specific month, calculated from the minimum wage. For example, let’s calculate the maximum daily benefit for March and February 2022. In March there are 31 days, in February - 28 days. The maximum daily benefit in February 2022 will be: 9489 rubles. : 28 days = 338.89 rub. The maximum daily benefit in March 2022 will be: RUB 9,489. : 31 days =306.1 rub.

From January 1, 2022, the minimum wage increased

The minimum salary increased from 7,800 to 9,489 rubles.

The size of the minimum wage affects the amount of benefits. With the growth of the minimum wage, the minimum average earnings grows (Article 14 of Law No. 255-FZ).

In accordance with the bill, from May 1 of this year the minimum wage will reach the subsistence level - 11,163 rubles. (Draft Federal Law No. 374313-7).

Therefore, the minimum average daily earnings to pay for maternity and sick leave benefits will be upon the occurrence of an insured event:

- from 01.07.2017 to 31.12..2017 - 256.44 rubles. (RUB 7,800 x 24 months / 730 days);

- from 01/01/2018 to 04/30/2018 - 311.97 rubles. (RUB 9,489 x 24 months / 730 days);

- from 05/01/2018 (if the bill is adopted) - 367 rubles. (RUB 11,163 x 24 months / 730 days).

Example 7 (calculation of sick leave benefits based on the minimum wage)

The employee was first hired in March 2022 and became ill in the same month. There is no insurance guard. According to the sick leave certificate, the employee was sick from 03/26/2018 to 04/06/2018.

In this case, the benefit cannot be calculated based on average earnings, since there is no income in the billing period (2016-2017). In this case, the average earnings, on the basis of which sick leave benefits are calculated, are taken to be equal to the minimum wage on the day the insured event occurred.

From January 1, 2018, the minimum wage is RUB 9,489.

Therefore, the average daily earnings are calculated based on this “minimum wage”: 311.97 rubles. (RUB 9,489 x 24 months / 730 days).

The average salary taking into account the insurance period (less than 5 years) is 187.18 rubles. (RUB 311.97 x 60%).

We will calculate the maximum possible daily benefit taking into account the established limit (Part 6, Article 7 of Law No. 255-FZ), since the sick person’s length of service on the day of the insured event is less than six months:

- in March: 306.10 rub. (9,489 rubles / 31 days), which is more than 187.18 rubles;

- in April: 316.30 rub. (9,489 rubles / 30 days), which is more than 187.18 rubles.

The amount of the calculated benefit is RUB 2,246.16. (RUB 187.18 x 12 days).

Example 8 (calculation of maternity benefits based on the minimum wage)

The woman got a job at the company on July 4, 2017 (first job). In February 2022, she went on maternity leave. Salary in 2022 – 125,000 rubles.

Average earnings for the billing period (2016-2017) – 171 rubles. (RUB 125,000 / 731 days).

This is less than the minimum average daily earnings, calculated based on the minimum wage (311.97 rubles = 9,489 rubles x 24 months / 730 days).

Therefore, the benefit will be 43,675.80 rubles. (RUB 311.97 x 140 days).

Example 9 (calculation of child care benefits if the average daily earnings are less than the minimum)

The average daily earnings of a worker who went on leave to care for her first child in February 2018 turned out to be less than the minimum average daily earnings of 311.97 rubles.

In this case, the monthly benefit will be 3,795.60 rubles. (RUB 9,489 x 40%). With a further increase in the minimum wage, a revision of the calculated benefit is not provided (clauses 11, 23 of the regulation on the calculation of benefits, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

FEDERAL LAW No. 421-FZ dated December 28, 2017.

Example 5. Calculation of sick leave if the length of service is less than 6 months

Murkin P. has been working for the company since October 2, 2022. This is his first job. On March 20, 2022, he brought sick leave for the period of illness from March 12 to 18 (7 calendar days). Earnings for the billing period 2016 – 2022 we don't count. If an employee has less than 6 months of experience, sick leave benefits cannot be more than the minimum wage for a full calendar month and must be 60% of average earnings. Therefore, to further calculate the benefit, we must take the amount of 311.97 rubles. and multiply it by 60%. We get: 311.97 rubles. × 60% = 187.18 rubles. We calculate sick leave benefits from the daily allowance calculated from the minimum wage. Sickness benefits are equal to: 187.18 rubles. × 7 days = 1310.26 rub. Just in case. For our own peace of mind, let’s compare the accrual amount for March and the minimum wage. The amount received is 187.18 × 31 = 5802.58 rubles. This amount is less than the minimum wage. We pay a benefit in the amount of 1310.26 rubles.

Payment of sick leave for part-time work

Part-time work is not uncommon today. Many enterprises, due to falling revenues, cash shortages, and also to save money, have introduced part-time work. According to a survey conducted on our website in mid-2022, approximately 30% of participants said that they would like to retain staff and introduced part-time work.

If your company has a part-time working regime, sick leave benefits in 2022 should be calculated according to general rules, taking into account several features.

First, it makes no difference how many days and/or hours employees work during the week as long as benefits are calculated based on actual earnings.

Secondly, to determine the average daily earnings, you need to divide the earnings for the billing period by 730. The figure 730 does not change.

At the same time, the average salary of an employee cannot be less than the minimum wage. If, according to your calculations, you get a figure less than the minimum wage, you still need to take the minimum wage to calculate sick leave. Then reduce the average daily earnings, calculated from the minimum wage, in proportion to the length of working hours of such an employee.

This rule can be applied if the part-time work schedule was established no later than the day of illness. Retrospectively, when an employee is on sick leave, part-time work cannot be established.

Example 6. Calculation of sick leave if the company has a part-time working day

Secretary of the director Marinina I.P. works 4 hours a day, 5 days a week. She was sick in January. After returning to work, I brought sick leave for 5 calendar days to the accounting department. Her earnings in the billing period were: - in 2016 - 50,000 rubles, - in 2017 - 65,000 rubles. The insurance experience is just over 5 years. The average daily earnings from actual payments will be: (50,000 rubles +65,000 rubles): 730 days. = 157.53 rub. We compare with the average daily earnings calculated from the minimum wage - 311.97 rubles. The amount we calculated is 157.53 rubles. less than the amount calculated from the minimum wage. Next, to calculate, we take the amount that is larger. This is the amount calculated from the minimum wage: 311.97 rubles. We adjust the average daily earnings by the part-time factor: 311.97: 8 hours × 4 hours = 155.98 rubles. We will calculate the benefit taking into account the length of service: 155.98 rubles. × 80% × 5 days. = 623.92 rub.

“Traumatic” payments are indexed

The amount of the monthly insurance payment is subject to indexation once a year from February 1 of the current year based on the consumer price growth index for the previous year

Its maximum size cannot exceed in 2022 - 72,290.4 rubles. (Law dated July 24, 1998 No. 125-FZ).

From February 1, taking into account the indexation coefficient (1.025), the amount paid for injury increased to 74,097.66 rubles.

The maximum benefit amount for a full calendar month is limited to four times the maximum monthly insurance payment,

Thus, the maximum monthly benefit for an employee who suffered from a work injury from February 2018 will be no more than 296,390.64 rubles. per month (RUB 74,097.66 x 4).

Let’s calculate the amount of compensation “for injury”.

Example 10 (calculating monthly injury benefits)

Salary payments subject to “traumatic” contributions amounted to 900,000 rubles in 2016, and 950,000 rubles in 2022. The employee's insurance experience is five years.

In February 2022 (from 5 to 20 - 16 days) the employee was on sick leave due to a work-related injury.

We determine the average daily earnings of an employee: 2,534.25 rubles. (900,000 rub. + 950,000 rub.) / 730 days.

The amount of benefit calculated for a full month is 70,959 rubles. (RUB 2,534.25 x 28 days), does not exceed the maximum value of RUB 296,390.64.

Therefore, we calculate the benefit based on average earnings of 2,534.25 rubles.

The benefit, which will be fully paid by the Social Insurance Fund, will be 40,548 rubles. (RUB 2,534.25 x 16 days).