Drawing up an announcement for a cash contribution is necessary when enterprises or organizations deposit cash into their bank account. The document is mandatory and has a strict form, so credit institutions are very demanding about its completion and always carefully check the correctness of the information entered into it.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

In what cases is cash transferred to the bank?

According to the law, companies can make payments both through non-cash transfers and cash payments (but only when working with the public). In the second case, the company must have a cash register or use strict reporting forms of the established form.

At the same time, there is a limit on the funds that can be stored in the cash register, but the excess should be regularly deposited at the bank.

It is for such situations that the announcement form for cash contributions has been developed. It should be noted that the document is widely distributed and used by enterprises, regardless of the area in which they operate and the level of business to which they belong.

How does the transfer occur?

The procedure is carried out according to the following scheme:

- An employee of the enterprise fills out the necessary paragraphs of the announcement, signs it and hands it over to an employee of the financial institution.

- The employee checks that the data is entered correctly. No corrections or major blemishes are allowed. If everything is in order, the bank employee signs the document, tears off the coupon and returns it to the company employee. At the same time, the bank employee hands over the acceptance form to the cashier.

- The employee approaches the cash register, the cashier gives him a coupon to verify the signature and issues an advertisement for signature. The cashier then accepts the money and counts it.

- If the amounts match, the cashier signs the documents and stamps them in the “Receipt” section. He then gives the “Warrant” part and the receipt to the applicant.

- The company employee returns to the bank employee and provides him with the receipt and order. After this, the manager credits the specified funds to the company’s account.

Only an authorized person can handle money

As you can see, there is nothing complicated in filling out, as well as in the procedure for submitting an application. Basically, you just need to fill out the basic points and hand it over to the bank employee. He will check the accuracy, fill in the missing items and give you the order to submit to the cashier. After payment, you give the receipt to the manager and the money is transferred to your account. The main thing is not to make a mistake when filling it out, so as not to redo it later, and to put the date correctly (the day of transfer to the bank). So that you don’t have any questions, you can fill out an announcement form for a cash contribution and understand the main points that require filling out.

Action steps

At the end of each working day, the cashier or accountant of the organization is required to count the funds in the cash register. If the money turns out to be more than the established limit, then it must be handed over to the servicing bank for crediting to the current account. Just at the moment of transfer, the announcement form for a cash contribution is filled out.

The document is drawn up in the presence of a bank employee, and in some cases a bank specialist can enter the necessary information into the document himself (at the client’s request).

Money can be donated by both the head of the enterprise and a person acting on behalf of the organization (for example, a cashier or accountant), but in this case the representative must have a valid power of attorney certified by a notary.

Opened form:

Organizations, enterprises and institutions, regardless of their organizational and legal form, store available funds in bank institutions in appropriate accounts on contractual terms. Cash received at the cash desks of enterprises is subject to delivery to banking institutions for subsequent crediting to the accounts of these enterprises. The organization must deposit cash into the cash register only into its bank account opened with this credit institution.

Operations for accepting cash from clients are carried out at a credit institution on the basis of incoming cash documents - announcements for cash deposits 0402001 , which are a set of documents consisting of an announcement, a receipt and an order.

The cash receipt document is drawn up by the client or the accounting employee of the credit institution (bank).

The announcement remains in the cash register, the receipt is handed over to the cash depositor, and the order with the operator’s stamp is attached to the statement for subsequent issuance to the owner of the current account.

Incoming cash documents indicate the sources of cash receipts. Basic codes (symbols) of sources of income:

- 02 Receipts of trade revenue from the sale of consumer goods, regardless of the channels of their sale;

- 05 Revenue receipts from passenger transport;

- 08 Receipts of rent and utility payments;

- 09 Receipts of entertainment enterprises;

- 11 Revenue receipts from enterprises providing other services;

- 12 Revenues from taxes and fees;

- 15 Proceeds from the sale of real estate;

- 16 Receipts to accounts on deposits of citizens (except for the Savings Bank of the Russian Federation);

- 17 Receipts from enterprises of the State Committee of the Russian Federation for Communications and Information;

- 18 Receipts from institutions of the Savings Bank of the Russian Federation;

- 19 Receipts to the accounts of citizens carrying out entrepreneurial activities without forming a legal entity;

- 20 Cash receipts from the sale of government and other securities (except for the Savings Bank of the Russian Federation)

- 28 Refund of wages and other equivalent payments;

- 30 Cash receipts at the cash desks of credit institutions from foreign exchange transactions with individuals;

- 32 Other income;

No erasures or corrections are allowed in the announcement for cash contributions. Otherwise, it is not accepted by the bank and must be redone.

See also:

Place an advertisement for a cash contribution Sample advertisement for a cash contribution - pdf Sample advertisement for a cash contribution - gif

Questions and answers on the form

What happens if you don’t take “extra” cash to the bank?

If, in the event of a sudden inspection, the supervisory authorities discover that the cash limit is exceeded in the cash register, this will result in penalties for the violating company. In this case, the fine can reach up to fifty thousand rubles. The exception is those situations when the money stored in the cash register is intended to pay wages, social benefits, scholarships, insurance, and other needs of enterprise employees.

But here, too, a certain order must be followed: the storage period for such “cash” should not exceed three days. Moreover, if the company operates in the Far North or in hard-to-reach areas, the period increases to 5 days (including the day of payment).

Application procedure

Every day, the chief accountant or cashier of an organization carrying out cash transactions in the organization must monitor the cash balance limit in the organization. If this limit is exceeded, the funds are transferred to the bank. To do this, the responsible person fills out an announcement form for depositing money into the bank, approved on the basis of Bank of Russia Decree No. 3352-U dated July 30, 2014, and put into effect on November 1, 2014.

Please note that for exceeding the limit, the organization may be fined, with the maximum amount being 50 thousand rubles. In excess of the limit, the organization can store cash intended to pay salaries, as well as amounts intended for social payments for scholarships and insurance. The acceptable storage period for these amounts is 3 working days for ordinary areas and 5 for areas of the Far North, and the day of receipt of the money is included in this period.

Rules for drawing up an advertisement for a cash contribution

The document has a standard unified form that is mandatory for use. In addition to the announcement itself, the form includes an order and a receipt - they are filled out in the same way. The document contains:

- information about the company to whose account the cash is transferred,

- Bank's name,

- current account number,

- amount (it must exactly match the one deposited into the account)

- and the source of its receipt,

- date of enrollment (i.e. the day on which the action actually occurs).

It should be noted that the source of financial resources can be written either in words or noted in the form of a code. For example, 15 – sale of real estate; 11 – enterprise revenue from the provision of other services; 02 – trade revenue from the sale of consumer goods through any sales channels.

If you have any difficulties in this part, you should consult a banking specialist for a complete list of codes (15 main values in total).

Recommendations for filling out the form

The application for cash donation must be filled out very carefully.

The tips below will help you fill out form 0402001.

- “Announcement No.” (at the top) – the next number is put down, and every year the numbering starts anew.

- “Date” is the number when cash is deposited at the bank; numbers and letters are used in this column. The entry might look like this: July 21, 2016.

- “From” – here indicate the full name of the person contributing the money, including the structural unit (if any).

- “Debit account No., credit account No.” - these are the columns to be filled in by the operational employee who enters accounts in accordance with the chart of accounts.

- “Recipient” – here indicates the name of the recipient organization; if it is, then the name is written in full.

- TIN - copy the number from the certificate that is issued upon tax registration.

- “Account No.” is the account number to which the money should arrive.

- “Name of the depositing bank” – the name of the organization (branch) where the money is deposited.

- “Name of recipient bank” – the name of the bank where the account to which the money is transferred is located.

- BIC is a code that every bank has; you will need the identification numbers of both banks (where the money is deposited, where it will go).

- “Amount in words” - you need to write down the amount credited in letters, without making any indents. For example, ten thousand. If there is space left until the end of the line, then you need to put a double dash. If the form is filled out on a computer, then “RUB” is placed immediately after the amount. In this case, a dash is not needed. Kopecks are indicated in numbers.

- “Source of receipt” – where the money came from. Codes are used for this column. They are given below:

- 02 – revenue from trade in goods;

- 05 – revenue from the provision of transport services;

- 08 – utility bills, money from paying rent;

- 11 – revenue from services not included in the list above;

- 12 – money received as taxes, contributions, fines;

- 15 – money from real estate transactions;

- 28 – return of wages that were not paid;

- 32 – other revenue. This column can be supplemented with the entry “by proxy”. This is done in cases where money is deposited by proxy. Next to this entry indicate the number of the power of attorney.

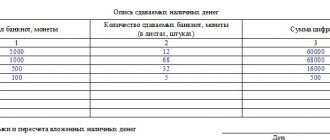

- “Amount in numbers” – the deposited amount is written only in numbers using a hyphen, for example, 10000 – 00.

- “Including by symbol” – source codes are entered, the amount that was received from this source.

The final part of the advertisement contains the signature of the accountant and cashier. The chief accountant or director does not need to sign the document. There is no need to sign in advance; when the bank employee checks, then the document is signed.

Bank employees sign there and then. In addition to signatures, positions are indicated. Below the announcement are other parts of the document. They are filled out in the same way as an advertisement.

Rules for placing an advertisement for a cash contribution

The announcement can be filled out either by hand or on a computer (but using only the approved form - the bank will not accept another), in addition, the company details can be entered using a stamp or seal.

You cannot make mistakes in the document form, so when filling it out you need to be as focused and collected as possible. If a blot or inaccuracy does occur, you should not correct them - such an advertisement will in any case be considered damaged, so it is better to immediately fill out a new form.

The form is drawn up in a single copy and after accepting cash, a specialist from a banking organization (cashier) signs and stamps it.

The completed announcement form remains with the bank employee, the receipt with his signature is handed over to the company representative who deposited the cash, and the receipt order is sent to the accounting department of the credit institution and is subsequently attached to the bank statement.

Sample of filling out an announcement for a cash contribution

The form of the document is not very complicated and is quite understandable even to an inexperienced person.

- At the beginning, the form number is written and the date of completion is indicated, which must correspond to the date of depositing cash into the account.

- After this, enter the name of the company that deposits the cash.

- Next comes the “Debit” line: the account number of the sender of the funds is entered here, and the name of the company to whose account they are received is entered in the “Recipient” line.

The “Credit” column indicates the recipient’s current account number. It should be noted that it is not necessary to fill in the lines “Debit” and “Credit”, since the specialist of the credit institution himself can enter the necessary information into them when receiving “cash”. - Then fill in the information about the Taxpayer Identification Number (TIN), KPP - the numbers corresponding to the constituent papers of the company are entered here. The line called “Account No.” refers to the recipient’s current account number.

- Then information is written about the depositing bank and the receiving bank: their names and BIC (bank identification code).

- After this, the amount of funds deposited is entered (in the required cells in words and numbers), and the source of receipt is also indicated: in words or in the form of an appropriate code. The “Symbol” cell indicates the code of the source of money receipt and the corresponding amount of receipt.

- The document must be signed by the cashier of the credit institution, as well as by the person who deposits the money (this can be the head of the enterprise or a representative acting on his behalf).