The concept of material assistance is enshrined in Article 36 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation” (as amended and supplemented).

It is expressed in the regular processing of cash payments or the provision of essential goods in their in-kind form. However, payments can be one-time or targeted. The standards for this phenomenon are also reflected in the Tax Code.

Financial assistance is paid on the basis of an order; in the article we suggest downloading its samples when providing financial support to an employee in connection with the death of a relative, long-term treatment, surgery, a difficult financial situation in the family, the birth of a child, or coronavirus.

In what situations is an employee entitled to claim financial support?

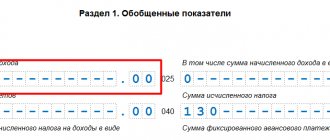

Accrual of financial assistance is the right, but not the obligation of the employer. This payment is a one-time payment. The basis for the issuance of funds is the order signed by the manager for the issuance of funds. Financial support in the amount of up to 4,000 rubles per year is not subject to income tax and insurance contributions. There are three exceptions to this rule: the death of an employee or his relative, the occurrence of force majeure (accident, terrorist attack, emergency), the birth of a child. In the latter case, the non-taxable limit increases to 50,000 rubles; in case of force majeure and death, payments are not included in the tax base at all.

ConsultantPlus experts examined how to assess financial assistance with personal income tax and insurance contributions. Use these instructions for free.

The list of situations in which an employee has the right to receive financial support is indicated in the company’s local regulations and in the employment contract. The General Regulations on Financial Assistance, which contains a list of situations when employees can be supported financially, prescribes the procedure for allocating it, determining the amount of payments, etc.

Most often, money is paid in the following cases:

- diseases;

- death of a close relative;

- birth of a child, etc.

When preparing an order for the issuance of financial assistance, the employer will be able to refer to this local regulation. Thus, it will become clear to everyone how and by what criteria such compensation is made.

ConsultantPlus experts examined what types of financial assistance exist for an employee and how to provide it. Use these instructions for free.

Grounds for drawing up an order for the provision of financial assistance

An employee interested in receiving funds must draw up a written application addressed to the director and attach to it certificates confirming the facts that formed the basis of the request.

The reason for providing documents is related to the requirements of Art. 217, 422 Tax Code of the Russian Federation. These articles contain a list of situations when tax is not charged on such payments. What is in the interests of both the employee and the head of the company.

The amount of financial assistance is set by the employer independently. Much in this matter depends on the capabilities of the organization. It is also worth saying that the employer has the right to provide such support not only to the employee, but also to former employees and even members of their families.

Why do you need an order to provide financial assistance?

Organizations often neglect to issue an order when providing financial assistance. On the one hand, this may be a consequence of the fact that the established financial assistance, due to its social nature, is not mandatory, therefore it depends on the will of the employer and does not require additional registration. In the meaning of this payment, it is social from the very beginning (unless, of course, incentive payments and bonuses are veiled by this concept), which is also confirmed by judicial practice. For example, this conclusion follows from the decision of the Arbitration Court of the West Siberian District dated July 24, 2017 No. F04-2629/2017 in case No. A27-23509/2016.

On the other hand, financial assistance in organizations is often referred to as a fixed salary supplement, paid monthly along with other amounts for the employee’s performance of his job duties. In such cases, payment occurs automatically and does not require the regular issuance of an internal act.

At the same time, if material assistance is truly a social benefit, a mandatory condition for its provision is an appropriate order, since it:

- allows you to justify its type (on which the features of its regulation largely depend);

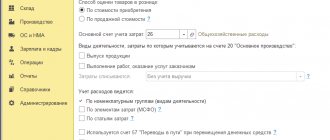

- serves as the basis for accrual of assistance by the accounting department;

- serves as a tax and accounting document, as well as the basis for calculating employee income tax and organization taxes, depending on the applied taxation system;

- necessary for the correct calculation of the amounts of insurance contributions to pension and extra-budgetary funds.

See also “Financial assistance in connection with the employee’s disability”.

How to compose a document

There is no established form for such an order. It is drawn up on the company’s letterhead in any form.

The document contains the following details:

- FULL NAME. employee to whom financial assistance is intended.

- amount of financial payment;

- accrual period;

- base;

- sources from which funds are paid;

- employer's signature.

Only if the above data is available, the order has legal force.

Results

As you can see, an order to provide financial assistance to an employee of an organization does not have an approved form, but its publication must comply with the internal rules established by the enterprise. In addition, the document must not contradict current legislation. That is why, in the absence of practice in issuing such acts, it is advisable to use a clearly competent sample when drawing it up to avoid legal errors.

Sources:

- Tax Code of the Russian Federation

- Labor Code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Samples

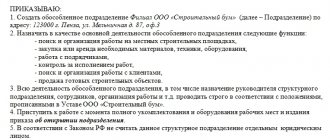

This example is a sample order for financial assistance for the treatment of an employee of an organization from coronavirus

| Limited Liability Company "Clubtk.ru" OGRN/OKPO 1234567891011/12345678 INN/KPP 1213141516/111111111 LLC "Clubtk.ru" |

ORDER

on the accrual and issuance of additional financial support

Based on the regulation “On financial support provided to employees of Clubtk.ru LLC at the expense of the enterprise”, approved by Order No. 15K dated 08/14/2019, and in pursuance of the collective agreement No. 13 dated 08/14/2019, as well as in connection with illness of storekeeper Linev K.K. coronavirus

I order:

- In order to provide financial support and for the purchase of medicines and medical procedures, accrue and pay the storekeeper of Clubtk.ru LLC, K.K. Linev. in connection with the identification of a long-term post-Covid syndrome, at the expense of the enterprise’s profits, a lump sum of 10,000 (Ten thousand) rubles.

- Payment of funds must be made no later than 02/26/2021.

- V.F. Smirnova, chief accountant of Clubtk.ru LLC, shall be appointed responsible for the execution of this order.

Grounds for drawing up an order:

- Personal statement of the storekeeper of Clubtk.ru LLC Linev K.K.

- An extract from the medical record with a medical prescription and prescriptions.

| General Director of Clubtk.ru LLC: | Voronov | Voronov A.V. |

| I have read the order: 02.24.2021 | Linev | Linev K.K. |

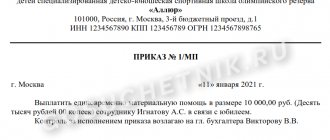

One more example:

How to place an order

The State Statistics Committee has not established a standard form for an order for the issuance of financial assistance. However, standards can be established within the enterprise: by local acts and/or collective agreement.

Unified order structure:

- At the top of the sheet are the details of the organization: full and short names, organizational and legal status, activity codes, legal address.

- Then the title of the document is written (“Order…”).

- The main part should include the legal justification for the payment.

- The administrative part provides the amount and purpose of the payment, its nature (periodic or not), as well as related information (term, responsible and controlling persons).

The creation of an order initiates an application from the employee addressed to the manager with a request to pay financial assistance.

The completed order for payments must be reviewed and signed by the person who requested financial assistance, employees of the accounting department, personnel department and others to whom the employer has instructed to process the payment.

The order is sent according to the standard scheme: you can make copies of it, make extracts, store it in a journal for orders, send it to the archive (for a period of at least 5 years), use it to generate tax reporting, present it for state inspections, public and state examinations.

Due to the death of a relative

When writing an application by an employee and issuing an order, the reason for the request must be clearly formulated and documented.

To process payments, you must provide a death certificate of the person. To organize a funeral, according to labor law, an employee can also take 5 days off.

At the place of work of the deceased (if he was officially employed), his relatives can receive social benefits for burial (clause 2 of Article 10 of Law No. 8-FZ). The payment amount is fixed and determined by the Social Insurance Fund separately for each region of the Russian Federation.

A sample order for the payment of financial support in connection with the death of a relative can be found at the bottom of the article.

How to write an application for financial assistance:

- due to the death of a family member;

- in connection with the birth of a child;

- in connection with treatment.

At the birth of a child

This order will require the child's birth certificate.

Pregnant women can also get help if they provide a certificate from the antenatal clinic.

Payment for the birth of a child is not subject to personal income tax and other social contributions (provided that the amount is less than 50 thousand rubles).

The specifics of paying financial assistance to young parents can be found in paragraph 8 of Article 217 of the Tax Code.

Example:

Due to coronavirus

A new type of financial assistance - payments due to the covid pandemic. This type of payment is sent to people whose financial situation has worsened due to the pandemic.

An employer can pay a set amount to employees in a lump sum.

If you lose your job, the state is obligated to pay increased benefits and extend the payment period.

Among other things, the government organized many one-time payments for children, and also introduced a number of other benefits: an increase in the maximum amount of sick leave, credit and mortgage holidays, subsidies for the payment of housing and communal services and a moratorium on charging penalties for utility debts.

Due to illness, treatment, surgery

To receive financial assistance, a person must provide a medical report with a confirmed diagnosis, a referral, doctor’s prescriptions, receipts for treatment, purchase of medicines, payments for procedures and other “financial statements.”

The trade union also provides assistance in the treatment of serious illnesses (when signing a collective agreement, it may be decided that in emergency cases, an employee does not even have to be a member of the trade union to receive assistance).

Example:

In case of difficult financial situation in the family

The application and order must be accompanied by a certificate of income below the subsistence level for a family member.

Since such a situation should not exist de jure for a working person, the unemployed more often turn to their last place of work for help.

In addition to payments from the organization, the former employee can count on small contributions from the trade union (if this is stipulated in the collective agreement).

Example:

Download samples

order to provide financial assistance in connection with:

- death of a relative;

- the birth of a child;

- difficult financial situation;

- expensive treatment;

- vacation.