Reasons for substitution

A variety of circumstances may serve as a reason for replacing any of the personnel. The most common:

- one of the employees going on sick leave;

- going on maternity or planned regular leave;

- going on a business trip, etc.

It should be noted that in such cases a temporary deputy is not always appointed.

This is usually required when the absence lasts more than three working days or when the employee’s duties are so significant that without them the normal day-to-day activities of the company are impossible.

Combination

If an employee is temporarily assigned someone else's duties, his consent is required. In this case, both the scope of work and the amount of additional payment must be agreed upon and indicated in the document.

Additional work can be performed during the main working hours of the replacement employee.

Important: the temporary combination agreement can be terminated without specifying reasons at the initiative of the director or replacement employee, but with a warning of 3 working days.

Surcharge

According to the norm of Article 151 of the Labor Code, the combination is paid by agreement. No instructions for calculating surcharges or indicating specific amounts are contained in any legal act.

That is, whatever amount of money the parties to the agreement (director and replacement employee) agree on, that much will be accrued, of course, minus personal income tax.

Decor

Article 60.2 of the Labor Code begins with the words “with the written consent of the employee.” This means that an employee who agrees to take on additional functions must confirm his consent in writing.

The combination can be formalized by means of an additional agreement to the employment contract.

All agreements are drawn up according to the same scheme as employment contracts. That is, the inclusions must be present:

- designation of the employer (name of the company, person authorized to sign the contract with reference to the charter or power of attorney);

- information about the employee (name, profession, position, department, address);

- essence of the agreement.

The text of the additional agreement may be as follows: “The employee and the employer agreed that the employee undertakes in the period from 07/01/2016. to 08/29/2016 in addition to his main duties, perform the functions of a secretary (job description attached). For combining professions, an employee is paid an additional payment to his salary in the amount of 22,000 rubles.”

Based on the signed agreement, a combination order is issued, which states:

- what positions or professions the employee will combine;

- for what period is the combination established;

- what additional payment will be made?

Upon expiration of the agreement, it becomes invalid, that is, the employee is not required to perform additional work, and the director does not have to pay for the combination.

Who can be appointed

In order to start the process of replacing a temporarily absent employee, you must first select the right candidate for a replacement.

This must be a person with sufficient qualifications, education and experience.

He can work in any position within the company (in this case, you will also need to obtain his written consent) or hired “from the outside” on a part-time basis.

In some situations, to replace a valuable “personnel” who has been absent for a long time, a new specialist is hired - then a separate fixed-term employment contract must be concluded with him, indicating a specific limited period of validity.

How to assign functions to another employee?

If a person goes on vacation, then his work responsibilities can be assigned to someone else. At the same time, you cannot simply verbally force another employee to perform additional functions of the absent one.

Each employee has a job description according to which he works. If he is assigned additional functions, he is not obliged to perform them unless an order to assign duties is issued.

The transfer of additional work is accompanied by a corresponding additional payment, which must be indicated in the order.

When choosing a replacement person, you should carefully consider his level of knowledge and experience. It is necessary to compare the required level of qualification with the actual one.

Some positions require special education, knowledge and experience.

For example, the chief accountant can be replaced by a manager and, in rare cases, another employee if he meets the necessary requirements.

An important point is that before transferring the responsibilities of an employee who is absent due to vacation to another, you must obtain written consent from the applicant for replacement.

An employee cannot be forced to perform the duties of another due to his absence.

The procedure for assigning functions during vacation should be voluntary.

To obtain consent, the person should be incentivized, for example, by additional pay or by providing time off in the future.

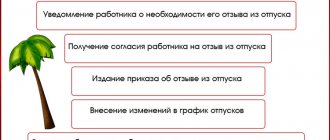

How to register for a period of temporary absence of the main employee?

If an employee not from the management team goes on vacation, then his work can be performed by another specialist of the appropriate level and similar level of training.

This can be an employee of the same or similar position, or from the same department as the absentee.

That is, the employee must fully understand the essence of the vacationer’s responsibilities, and must also agree with the assignment of additional functions to him.

It is better to obtain consent in writing to avoid conflicts in the future.

A substitute person can be required to perform the duties of a vacationer only if an order to this effect has been drawn up. At the same time, a procedure was carried out to become familiar with it against signature.

If there is no order, or there is no introductory signature on it, then forcing an employee to do work for another is not allowed.

The order for temporary replacement for the vacation period should indicate:

- place and date of compilation;

- reason for registration and document basis;

- an order to assign the duties of one employee to another for the period of leave (specific terms are indicated);

- an order to establish an additional payment for performing additional work;

- director's approval signature;

- introductory signature of the substitute.

If the selected person does not want to replace the employee and do his work, does not give consent and does not sign the order, then he cannot be forced to do this.

You need to choose another person.

Registration if the general director is absent

The head of the company performs specific functions that not every employee of the organization can cope with.

There are no legal requirements when selecting a replacement person. You do not need to have a certain level of education or extensive experience in management; you do not need special knowledge and skills.

However, it is in the interests of the general director himself to choose a temporary replacement in the most correct and competent manner, which will ensure the normal operation of the enterprise and minimize risks.

Typically, the authority of a manager is vested in his deputy or chief accountant. In this case, this person is assigned an additional payment for performing an increased amount of work.

The order conferring the powers of the director should indicate:

- who chooses the surrogate;

- what responsibilities are assigned to him;

- over what period of time they will have to be fulfilled;

- what additional pay and other privileges does the deputy receive?

The order is approved by the director, after which it is handed over to the replacement person for review. If he agrees, he signs.

It is also recommended to obtain a separate written consent from the deputy that he undertakes to perform the duties of the director who is absent during the vacation period.

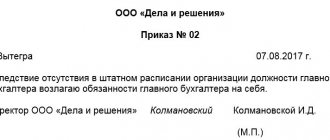

When replacing the chief accountant

Great difficulty in assigning responsibilities arises when the chief accountant goes on vacation.

Such an employee has specific responsibilities that not everyone can handle. The person performing the functions of the chief accountant must have the necessary education and knowledge in the field of tax and accounting law.

Usually the chief accountant is replaced by the head of the company himself.

In rare cases, these functions are assigned to other employees, for example, an accountant.

In any case, the employee to whom the responsibilities of the chief accountant are transferred must agree with this. And for additional work you need to pay extra.

Download samples

Download a replacement order for the employee's vacation period - sample.

This is what the sample looks like:

Download the order assigning the duties of a director - sample.

This is what the sample looks like:

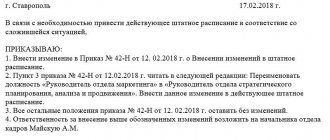

What to take as a basis for an order

All developed orders must be based on something. In particular, each such order must have a documentary basis and justification.

The basis may be either an article of law directly related to the essence of the order, or an internal document of the company (for example, some act, Accounting Policy Regulations, an official or memorandum). With justification, everything is simpler - this is the real reason for which the order is issued.

Need replacement

Any employee of a company (individual entrepreneur) working under an employment contract has the right to annual paid leave of at least 28 calendar days (Article 247 of the Labor Code of the Russian Federation). An employee may also go on sick leave or go on a business trip. In this case, an order is needed to assign duties without additional payment or, conversely, with additional payment, depending on the circumstances.

The sequence of staff vacations is established by the vacation schedule. This document is approved by the head of the organization, taking into account the opinion of the trade union organization, and is mandatory for both the employer and the employees (Parts 1, 2 of Article 123 of the Labor Code of the Russian Federation).

For more information, see “Vacation Schedule 2022: Smart Form in Excel.”

Who must sign an order to replace a temporarily absent employee

The order refers to those documents that always come from the top management of the enterprise.

Therefore, this document must be signed either by the director of the organization personally or by an employee who temporarily performs his duties. Also, all persons in respect of whom it was issued and those responsible for its execution must sign the order.

Thus, all the above-mentioned employees will testify that they are familiar with the order and are ready to carry it out.

Temporary transfer

Substitution by translation is made again by agreement. But, unlike a combination, during a transfer the employee will perform only the work duties of the replaced employee, but not his own.

In this case, the employee’s consent to the transfer does not matter, that is, he will be required to perform someone else’s duties in the following circumstances:

- if a catastrophe, accident or natural disaster occurs;

- the population or part of it is threatened by epidemics, famine or the consequences of accidents;

- failure to complete the work threatens downtime or destruction of the property of the company or its contractors.

Payment

According to the norm of Article 72.2 of the Labor Code, payment for temporary work as a result of a transfer is made in proportion to the function performed. At the same time, the salary of the replacement employee should not be less than what he receives in his main position.

If there is an agreement between the parties, then the replacement employee is paid the amount of money specified in the agreement, minus personal income tax.

Decor

Since Article 72.2 of the Labor Code is still

obliges to sign an agreement for a temporary transfer; if the transfer does not take place without consent, then again an additional agreement is drawn up to the employment contract.

The text of the additional agreement will be something like this:

“The employee and the employer agreed that the employee in the period from 07/01/2016. to 08/29/2016 during the vacation of secretary Ivanova T.T. transferred to the position of secretary (job description attached). For performing secretarial duties, the employee is paid a salary of 15 thousand rubles.”

Based on an additional agreement or in a situation where the employee’s consent to the transfer is not required, a transfer order is drawn up. You can issue an order on form T-5. This form is not required for use, but can be used.

The order must indicate the following information:

- about the company (name and mandatory codes);

- about the employee (full name, position and department);

- previous place of work;

- new workplace;

- transfer period (temporarily);

- salary amount at the time of transfer.

The order must be endorsed by the director of the company and signed by the replacement.

Form T-5 for issuing orders can be downloaded here.