What is a TORG-12 consignment note?

The TORG-12 consignment note is a document for processing operations for the transfer or receipt of inventory items, which is the primary accounting document.

TORG-12 is drawn up in two copies, of which the first copy remains with the organization handing over the inventory and is the basis for their write-off, and the second copy is transferred to a third party and is the basis for the receipt of goods (inventory).

Why do you need invoice OP-4?

Any movement of inventory items within the enterprise must be provided with accompanying documents. This standard also applies to food products, to record the movement of which a unified form of invoice OP-4 has been developed. This document allows you to write off food products from the enterprise's warehouse.

It should be noted that today organizations are exempt from the need to use previously mandatory forms of primary documents and have the right to develop their own templates.

However, most companies still prefer to use old forms to record goods, since they are convenient and contain all the necessary information.

Federal Law “On Accounting” Art. 9 p. 2

The required details of the primary accounting document are:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the name of the position of the person (persons) who completed the transaction, operation and the person(s) responsible for its execution, or the name of the position of the person(s) responsible for the execution of the event;

- signatures of persons provided for in Art. 2 clause 6 of the Federal Law “On Accounting”, indicating their last names and initials, or other details necessary to identify these persons.

Additional details of the primary accounting document The consignment note, in addition to the mandatory details, may contain any additional information; this is not a violation.

The upper part of the consignment note TORG-12 (header)

- TORG-12 is created in two copies, one for the seller and the other for the buyer.

- The invoice number must correspond to the document numbering approved in the organization’s accounting policies.

- The date of the invoice is indicated as current, at the time of the fact of economic life or after its end, in accordance with Art. 9 clause 3 of the Federal Law “On Accounting”.

- The Shipper column is filled in with the details of the shipper organization. In practice, this column usually coincides with the Supplier , or the details of another organization that is the shipper (for example, a transport company) are indicated.

- The Structural unit column is filled in if inventory items are transferred from a separate unit of the supplier organization.

- Consignee column is filled in with the details of the consignee organization. In practice, this column coincides with the Payer , or the details of another organization that is the consignee are indicated.

- The Supplier column is filled in with the details of the supplier organization, i.e. this column indicates the details of the organization selling the product.

- The Payer column is filled in with the details of the paying organization, i.e. it contains the details of the organization to which the goods are sold.

- The details of the Shipper , Consignee , Supplier and Payer must indicate: name of the organization or entrepreneur, address, telephone, fax, INN, KPP, bank details, name of the bank, BIC, correspondent account, r/account or l/account.

- Opposite all details at the end of the line, a special field is filled in - OKPO code .

- The type of activity according to OKDP is not filled in in practice; the field remains empty.

- In the Basis , “Account” or “Agreement” is usually indicated; at the end of this line, in special fields, the number

and

date

are indicated, respectively, the number and date of the Invoice or Agreement. - In the column number

and

date

of the Waybill, its number and date are indicated, respectively. This field is optional; it can be left blank if the waybill is not created. - Type of operation - in practice it is not filled in, the field remains empty.

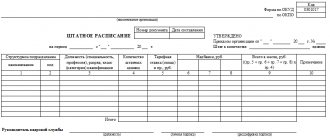

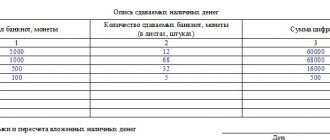

Elements of the invoice for goods release OP-4

Invoice OP-4 consists of a form header that reflects information about the company that compiled the document, and a tabular part that discloses information about the transferred raw materials.

The invoice header must contain the following information about the organization:

- Company name;

- Name of the unit transferring the goods;

- The division that is the recipient of the goods;

- OKPO code;

- Type of activity according to the OKDP classifier;

- The date of the invoice and its number.

Next, you should reflect information about the document that served as the reason for filling out the invoice, the time of transfer of products, goods or materials and the financially responsible person who is responsible for monitoring the use of raw materials.

List of goods in the delivery note TORG-12

The table with the list of goods is filled with data in accordance with the column headings.

- Column 1 - item number , indicates the serial number of the product.

- Column 2 - Name , indicates the name, characteristics, grade, and article number of the product. If you have a trade turnover and each product is assigned an article number, then it is in this field that it is indicated, either before or after the name of the product, separated by a comma, in parentheses, separated by a dash or other sign.

- Column 3 - Code , in practice it is not filled in and is marked with a dash. This field is in addition to the name of the product and is indicated if it is impossible to identify the product by the name of the product (by the second column).

- Column 4 and 5 - Unit of measurement , indicate the name and code of the unit of measurement of the product, in accordance with the OKEI classifier.

- Column 6 - Type of packaging , in practice is not filled in and is marked with a dash.

- Column 7 and 8 - Quantity , in one place and places, pieces , in practice, is usually not filled in and is marked with a dash. Please note that the quantity of the product is indicated in the tenth column.

- Column 9 - Gross weight , in practice it is usually not filled in and is marked with a dash.

- Column 10 - Quantity (net weight) , indicates the quantity of the product.

- Column 11 - Price, rub. cop. , the price per unit of goods is indicated without VAT.

- Column 12 - Amount excluding VAT, rub. cop. , indicates the amount of the product excluding VAT.

- Column 13 and 14 - VAT rate, % and amount, rub. cop. , the VAT percentage rate and the VAT amount are indicated.

- Column 15 - Amount including VAT , indicates the amount of the product including VAT.

Total by invoice - the sums of numbers in columns Nos. 8, 9, 10, 12, 14 and 15 are summed up.

The lower part of the consignment note TORG-12 (basement)

The lower part contains the summary data of the delivery note:

- The consignment note has an attachment on _ sheets - in practice it is not filled out, it is marked with a dash.

- contains _ serial numbers of records - indicates the number of serial numbers of the record in the list of goods. You must write the number in words.

- Total seats _ - in practice it is not filled in, it is marked with a dash.

- Cargo weight (net) _ and Cargo weight (gross) _ - in practice they are not filled in, they remain empty.

- Application (passports, certificates, etc.) on _ sheets - in practice it is not filled out, a dash is added.

- Total issued for the amount of _ - indicates the total amount of all goods in the invoice. You must write the amount in words.

Signatures of responsible persons (left side, seller):

- The release of cargo is authorized - the position, full name and signature of the responsible person are indicated.

- Chief (senior) accountant - the full name and signature of the chief accountant are indicated.

- The cargo has been released - the position, full name and signature of the responsible person are indicated.

Shipment of goods . An individual entrepreneur signs only once in the column Release of cargo allowed. In large companies, different people can sign in all three places, in accordance with their job responsibilities. In small companies, the same person may sign in all three places, for example, the General Director . The manager can also sign in all three fields, but only with a valid intra-organizational order with the right to ship goods, sign shipping and accounting documents.

Why do you need a bill of lading?

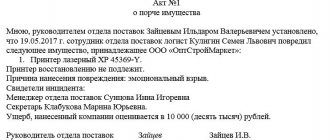

All events in the work of a business entity should be confirmed by documents that are drawn up during the transaction or immediately after its completion. Such documents are called primary. In accounting, primary documentation has an important status, since it can be used to prove that the operation was actually carried out. These include:

- invoices (commodity and goods-transport);

- invoices, invoices;

- cash documents (receipt and expense orders, checks, receipts).

The data from the primary documentation is subsequently summarized and systematized in order to be reflected in the final accounting reports, showing the positive or negative results of the enterprise.

Attention! An individual entrepreneur, as a representative of a small business, does not have to complicate his work with all the accounting rules. But for reasons of order, or if a serious audit is ahead, it is necessary to maintain a primary account, if only because the entries in the Book of Accounting for Income and Expenses need to be backed up with something.

The main events in the trading sphere are the transfer of goods from the seller to the buyer. All trading consists of such events. The consignment note is precisely intended to certify such a transfer, that is, to record the completion of the transaction. The main purpose of the document is to act as a deed of transfer.

Moreover, not only the seller needs a technical tax to reflect his income, but also the buyer who incurred the expense, especially if he himself is an individual entrepreneur. It gives rise to other accounting operations: writing off or capitalizing received funds. Therefore, the invoice is issued in at least two sets for the supplier and the buyer. When intermediaries are involved in a transaction, for example, when applying for a loan, the document must also be printed for the bank.

Receipt of goods by proxy and rules for filling out TORG-12

The goods can be received by an authorized person by providing a power of attorney form M-2, M-2a, executed in the prescribed manner, with the obligatory presentation of an identification document (passport). The power of attorney remains with the Seller.

Filling out TORG-12 by proxy . If the goods are received by proxy, the following three fields must be filled in:

- By power of attorney No. _ - indicates the number and date of issue of the power of attorney. If the power of attorney is without a number, then the identification number and the date of its issue are indicated.

- issued _ - the name of the organization that issued the power of attorney is indicated (for example, Buyer LLC, forwarder A.V. Ivanov).

- Next, in the Cargo Accepted , the position, signature and full name of the person to whom the power of attorney was issued is entered. If the power of attorney is issued to a person who is not an employee of the organization, then the position is not indicated.

The power of attorney of form M-2, M-2a gives a specific right, namely, the receipt of inventory items; accordingly, the right to sign only in the Cargo accepted . the right to sign in the Cargo .

Opened form:

A consignment note is a primary accounting document used to formalize the transfer of ownership (by sale, release) of goods or other material assets from the seller to the buyer. The invoice indicates the name (type) of the product, its price, quantity and total cost, as well as the amount of VAT. In addition, the delivery note must contain the details of the transferring and receiving parties, handwritten signatures of authorized persons, and the seal of the organization.

The bill of lading form is contained in the album of unified forms of primary accounting documentation called form TORG-12 . It is drawn up in two copies, one of which remains with the supplier organization and is the basis for writing off inventory items. The second copy of the consignment note is transferred to the buyer (consignee) and can serve as the basis for recording these valuables and deducting VAT.

A consignment note, the form of which does not correspond to the unified form, may be accepted for accounting by the purchasing organization. Article 252 of the Tax Code of the Russian Federation does not require accepting only unified invoices as confirmation - it is important that the primary documents prove that the organization actually incurred expenses and contain the required details. However, tax inspectors can reject such a document by referring to paragraph 2 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”. Therefore, if possible, it is necessary to insist that suppliers of goods issue a unified form of invoice.

Registration of an invoice also often causes disputes with fiscal authorities. Tax authorities require that all fields of the Torg-12 form be filled out, and the form itself be sealed with the seal of the selling party. Otherwise, the buyer’s right to reflect the costs of purchasing goods and to accept a VAT deduction is called into question. Judicial practice shows that in cases where other documents reflect the missing information, and powers of attorney in form M-2 or M-2a contain the seal of the trading organization, as a rule, invoice-12 is recognized as valid. But it’s better, of course, to play it safe and fill out the document as indicated by the sample invoice.

When participating in a carrier's purchase and sale operation, experts recommend abandoning the Torg-12 form and using another unified document - a consignment note - to write off goods from shippers and capitalize them from consignees. In this case, it is necessary to enter the “VAT” column, and in the “Price” and “Amount” columns indicate “including VAT”.

It is better to start filling out the invoice from the date. According to paragraph 4 of Art. 9 of the Accounting Law, the primary document must be drawn up at the time of the transaction, or immediately after its completion. Tax authorities require that the date on the invoice form coincide with the date of shipment.

The legislation allows the introduction of minor changes to the forms of unified forms of primary accounting documentation. Thus, when drawing up a consignment note, it is allowed to expand and narrow columns and lines, include additional lines (including free ones) and folding sheets for ease of placement and processing of information.

See also:

Create a delivery note Sample delivery note - pdf Sample delivery note - gif

Questions and answers on the form

Receiving goods without a power of attorney (carrying a stamp)

- Only its sole executive body, for example, the general director, can receive goods on behalf of an organization without a power of attorney. However, in this case, the seller, before drawing up the delivery note, is obliged to make sure that the person receiving the goods is the real sole executive body. It is necessary to request a document on the appointment of the general director, which contains passport data, and also require the presentation of the passport itself to verify this data.

- The goods can also be received by a materially responsible person appointed by order of the General Director, or on the basis of a general power of attorney. The order and the general power of attorney must clearly indicate the authority to receive the goods and the right to sign the TORG-12 consignment note, as well as the passport details of the materially responsible person. The seller is also obliged to verify passport data when shipping the goods.

In both cases, the signature is placed in only one column. The cargo was received by the consignee :

- The cargo was received by the consignee - filled in when the consignee receives the goods. The position, full name and signature are indicated (for example, General Director Petrov V.A.).

Date in the consignment note TORG-12

- Date of compilation - indicates the actual date of compilation of the invoice.

- Product shipment date —indicates the actual date of shipment of the product from the warehouse.

- Date of receipt of goods - indicates the actual date of receipt of the goods.

Most accountants tend to have three identical dates on the invoice: the date of the invoice, the date of shipment and the date of receipt of the goods. Thus, in the future, the accountant will be able to easily post such a document in accounting (in an accounting program).

It is strongly recommended that you seek clarification from your accountant on completing the date. In practice, a situation can quite easily arise when all three dates are different. And this situation will complicate the work of the accountant, who has a headache about how to properly capitalize the goods, to which temporary or virtual warehouse to move the goods, when to write them off, etc.

Instructions for filling out the TORG-12 form

Filling out the generally accepted TN form has a number of features:

- The moment of transfer of goods must correspond to the date stamped.

- The invoice and delivery note data must be identical.

- Information about the product must be described in detail, indicating codes, units of measurement, type of packaging, etc.

- The form is signed:

the sending party - the chief accountant responsible for release from the warehouse and the direct executor;

receiving party - responsible for accepting the goods.

Most businessmen are in special regimes and do not pay VAT. There are no separate instructions for filling out the tax form without VAT, nor is there a special form provided. Therefore, in this case, you can enter “excluding VAT” in column 13, and 0 in column 14.

An example of filling out the TORG-12 invoice for an individual entrepreneur (without paying VAT):

Dashes in the table with a description of the product are allowed in the form “X” where the total cannot be calculated.