“Colleagues, we need to finish the statistical report for the meeting. Who can stay to do extra work?” - asks the head of the department. “Let Masha stay, she’s young, unmarried, and she doesn’t have children,” Balzac’s aunts answer. Common situation? And now the question is: should Masha continue to work overtime?

And if so, how should I register and pay for these hours? And no less important: how to report to the tax authorities later? We will analyze the main points in the article. But if you have a special case, professional accountants can help you.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

60 lawyers on RTIGER.com can help with this issue

Solve the issue >

What work is considered overtime?

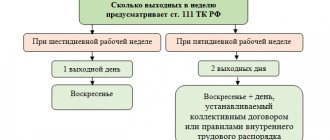

Art. 99 of the Labor Code (LC RF) gives the employer the right to detain an employee at work. That is, overtime work has two characteristics: it is initiated by the employer, and it is performed during the time that is considered non-working according to the contract. Moreover, this applies to the classic 5/2 schedule, and to shift work, rotational work and other work with summarized accounting of working hours.

A normal working week does not exceed 40 hours (Article 152 of the Labor Code of the Russian Federation). Anything processed above the limit is considered recycling. But what about those who already work less? There are categories of citizens for whom the work week is reduced to 24–36 hours. According to the law (Article 92 of the Labor Code of the Russian Federation), the following work less:

- minors;

- disabled people of groups I and II;

- workers in hazardous industries of the 3rd and 4th degree;

- employees engaged in hazardous work;

- women in the Far North;

- medical personnel;

- teachers.

For them, the standard work week exceeds the norm. If a disabled person works 40 hours a week, then 5 of them will be considered overtime.

The concept of overtime work does not correlate with an irregular schedule. Employees may perform duties on weekends and public holidays. But such work is paid according to Art. 113 and Art. 153 Labor Code of the Russian Federation.

Some employees try to abuse their rights - they stay late or come early on their own for the sake of compensation. But according to the law, this is not overtime work; management is not obliged to pay for it.

Article 99. Overtime work

Ruling of the Supreme Court of the Russian Federation dated October 4, 2016 N 301-KG16-13302 in case N A28-10783/2015 Having assessed the evidence presented by the parties in accordance with the requirements of Article 71 of the Arbitration Procedural Code (hereinafter referred to as the Code), guided by Articles 198, 201 of the Code, Articles , Labor Code of the Russian Federation, Federal Law dated December 10, 1995 N 196-FZ “On Road Safety”, Federal Law dated May 4, 2011 N 99-FZ “On Licensing of Certain Types of Activities”, Regulations on Licensing the Transportation of Passengers by Motor Transport Equipped for transportation of more than 8 people, approved by Decree of the Government of the Russian Federation dated 04/02/2012 N 280, the Regulations on the peculiarities of working hours and rest time for car drivers, approved by order of the Ministry of Transport of the Russian Federation dated 08/20/2004 N, the courts came to the conclusion that clause 3 of the contested order regarding the duration of drivers' rest between shifts does not comply with the law, and the application was granted in this part. The courts found that the planned and actual duration of the work shift of some drivers was more than 12 hours, which indicates improper planning by the company of the daily shifts of drivers and non-compliance with their work schedule.

Resolution of the Supreme Court of the Russian Federation dated August 3, 2017 N 73-AD17-2

Part seven of Article of the Labor Code of the Russian Federation imposes on the employer the obligation to ensure accurate recording of the duration of overtime work for each employee. In violation of this requirement, the employer did not provide an accurate record of the duration of overtime work performed by T.N. Belyakova, E.G. Kamalova, O.V. Novik, L.Ts. Ochirova, L.V. Rekhovskaya, M.A. Yakovenko, Tsybikzhapova E.I., Mironova V.A. in April - June 2016.

Determination of the Supreme Court of the Russian Federation dated May 21, 2009 N 21-В09-5

In accordance with the article of the Labor Code of the Russian Federation, overtime work is work performed by an employee at the initiative of the employer outside the working hours established for the employee: daily work (shift), and in the case of cumulative accounting of working hours - in excess of the normal number of working hours for the accounting period. The duration of overtime work should not exceed 4 hours for each employee for two consecutive days and 120 hours per year.

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated December 14, 2015 N 18-КГ15-221

In December 2013, the plaintiffs submitted applications to the general director of Nestle Kuban LLC with a request for payment of overtime work for the period from December 2009 to the day of filing the application, which they were denied, which was reported to the plaintiffs in letters from the HR director and administrative issues of Nestlé Kuban LLC. In responses to the plaintiffs' statements, it was stated that, in accordance with Art. Labor Code of the Russian Federation, the work of the plaintiffs in excess of 36 hours a week is not overtime work, since no orders were issued to involve the plaintiffs in overtime work, the labor contracts signed by the plaintiffs provided for a 40-hour work week, the plaintiffs were paid based on a 40-hour working week.

Ruling of the Supreme Court of the Russian Federation dated July 22, 2021 N 305-ES20-17023(3) in case N A40-129950/2015

Based on the results of studying the judicial acts adopted in the case and the arguments contained in the cassation appeal, it was established that the grounds provided for in Article 291.6 of the Arbitration Procedural Code of the Russian Federation for transferring the complaint for consideration in a court session of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation are absent. The district court was guided by Articles 61.1, 61.2, 61.6 of the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”, Articles , , , 129, 132, 135, 191 of the Labor Code of the Russian Federation and proceeded from the fact that the court first the authority has established a set of conditions necessary to recognize transactions as invalid. The appellate court did not refute these conclusions and at the same time incorrectly applied paragraph 2 of Article 61.2 of the Bankruptcy Law.

Determination of the Constitutional Court of the Russian Federation dated December 8, 2011 N 1622-О-О

3. In accordance with the article of the Labor Code of the Russian Federation, overtime work is work performed by an employee at the initiative of the employer outside the working hours established for the employee: daily work (shift), and in the case of cumulative accounting of working hours - in excess of the normal number of working hours for the accounting period .

Decision of the Supreme Court of the Russian Federation dated June 26, 2018 N AKPI18-376

Y. appealed to the Supreme Court of the Russian Federation with an administrative claim for recognition as invalid from the date of adoption (March 9, 2016) of the second paragraph of paragraph 38 of the Features, as contrary to Articles 100, 104 and 111 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation, Code ), and paragraph three of paragraph 48 of the Peculiarities in the part establishing the period no later than which (May 1 of the next calendar year) unused rest time between shifts must be compensated by providing additional rest time at the end of the period of mass passenger transportation, as contrary to Articles , , 104 and 152 Labor Code of the Russian Federation. According to the administrative plaintiff, when accounting for working hours together with an accounting period of one year, unused rest time between shifts should be compensated for employees of train crews of passenger trains and ticket cashiers on railway transport by providing additional rest time at the end of the period of mass passenger transportation, but no later than the end of the calendar year , and unused rest time between shifts at the end of the accounting period is overtime work and is subject to payment in accordance with Article 152 of the Labor Code of the Russian Federation. The contested norms violate her rights, guaranteed by law for a five-day working week and wages when hired to work on a day off at double the rate, and when recruited to work on rest between shifts - at one and a half times the rate.

Appeal ruling of the Appeal Board of the Supreme Court of the Russian Federation dated October 18, 2018 N APL18-421

Ya., working as a conductor of passenger cars, filed an administrative claim with the Supreme Court of the Russian Federation for recognition as invalid from the date of adoption of the second paragraph of paragraph 38 of the Peculiarities due to its contradiction with Articles 100, 104 and 111 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) , Code), and paragraph three of paragraph 48 of the Peculiarities in the part establishing the period (May 1 of the next calendar year), no later than which the employee must be compensated for unused rest time between shifts by providing additional rest time at the end of the period of mass passenger transportation, as contrary to articles , , 104 and 152 of the Labor Code of the Russian Federation. In the statement, she indicated that for conductors of passenger cars in the Arkhangelsk carriage section of the Northern branch of JSC "Federal Passenger Working Time" (chapters 15 - 16), the concept of working time and its types are defined, including normal, reduced, part-time, overtime working time (Articles - , Labor Code of the Russian Federation), the duration of daily work is regulated (article of the Labor Code of the Russian Federation), work at night (article of the Labor Code of the Russian Federation), work outside the established working hours (article of the Labor Code of the Russian Federation), and also given normative regulation of the working time regime and its accounting (daily, summarized, hourly - Articles 100 - 105 of the Labor Code of the Russian Federation).

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated November 29, 2021 N 56-KG21-17-K9

Section IV of the Labor Code of the Russian Federation “Working time” (chapters 15 - 16) defines the concept of working time and its types, including normal, reduced, part-time, overtime working time (Articles -, Labor Code of the Russian Federation), regulates the duration of daily work (article of the Labor Code of the Russian Federation), work at night (article of the Labor Code of the Russian Federation), work outside the established working hours (article of the Labor Code of the Russian Federation), and also the normative regulation of the working time regime and its accounting (daily, summarized , hourly - Articles 100 - 105 of the Labor Code of the Russian Federation).

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated December 13, 2021 N 56-KG21-19-K9

Section IV of the Labor Code of the Russian Federation “Working time” (chapters 15 - 16) defines the concept of working time and its types, including normal, reduced, part-time, overtime working time (Articles -, Labor Code of the Russian Federation), regulates the duration of daily work (article of the Labor Code of the Russian Federation), work at night (article of the Labor Code of the Russian Federation), work outside the established working hours (article of the Labor Code of the Russian Federation), and also the normative regulation of the working time regime and its accounting (daily, summarized , hourly - Articles 100 - 105 of the Labor Code of the Russian Federation).

Who can and who cannot be involved in overtime work?

If you're concerned about the fate of Masha, who is forced to stay behind to finish the report, you need to find out more about her. For example, if she is pregnant or she is 17 years old, the manager cannot force her to work more. After all, according to Art. 99 of the Labor Code of the Russian Federation, children under 18 years of age and pregnant women should not be involved in overtime work.

But there are some assumptions. May work beyond normal:

- representatives of creative professions (Article 258 of the Labor Code of the Russian Federation), a list of which can be found in Decree of the Government of the Russian Federation No. 252 of April 28, 2007;

- athletes (Article 348.8 of the Labor Code of the Russian Federation);

- working under an apprenticeship contract (Article 203 of the Labor Code of the Russian Federation);

- employees with certain medical conditions for whom working hours are limited.

However, our heroine is an adult and is not yet pregnant. Will she still have to stay against her will? Only if she doesn't know her rights. Because first the employer must obtain the employee's consent.

Only with written consent... or not only?

A manager does not have the right to force subordinates to work overtime. First, he must obtain consent against signature and issue an order. When everything is documented, the employee can begin overtime work. Moreover, there must be a specific reason for this:

- some technical problems arose due to which the work “stopped” - and failure to complete it should threaten either valuable property or the safety of people;

- an emergency occurred that stopped the organization’s work, and its consequences must be urgently eliminated;

- work is carried out in shifts and cannot be stopped, but the shift worker did not come out - then you need to find another worker as soon as possible.

That is, the situation that has developed at work must be quite serious. And preparing a report for a meeting is not included in this list. But in practice, by mutual agreement, the employee can stay and finish the job.

In Art. 259 and 264 of the Labor Code of the Russian Federation indicate special cases. Some workers may refuse to work overtime. If you want to attract them, familiarize your subordinates with their rights upon signature. This list includes:

- women with children under 3 years of age;

- disabled people;

- parents of disabled children;

- guardians of orphans;

- single fathers and mothers with children under 5 years old;

- workers caring for seriously ill relatives.

However, there are cases when consent is not required:

- an industrial accident, man-made or natural disaster has occurred or may occur, and workers are required to prevent or eliminate the consequences of the incident;

- the water, heat, gas or electricity supply system, sewerage system has failed, urgent repairs are required;

- a large number of people are in danger due to a military conflict or natural disaster, mass evacuation is carried out, etc.

In these cases, everyone can work, with the exception of children under 18 years of age and pregnant women. But even if the employee performs his duties in conditions where written consent is not required, overtime work must be documented.

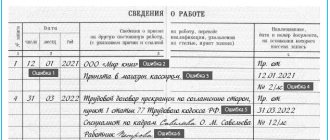

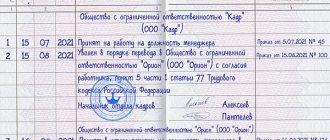

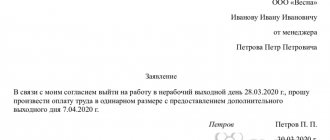

Features of registration of overtime work

The consent that the employee must sign is the last link in the document flow chain. Other documents must be prepared first.

When an enterprise needs to involve employees in overtime work, you first need to write a memo. This should be done by the head of the department. The addressee is usually the director of the company. The note states:

- the reason for the need for overtime work;

- list of involved employees;

- the period for which such a regime is established;

- the time when the work will be carried out;

- destination;

- date and signature of the applicant.

We do not recommend using the vague wording “production necessity” as a reason. Identify the specific event that requires such measures. And remember that the head of the company has the right to call you to clarify the circumstances.

If the director puts the resolution “In the order” on the memo, the document is transferred to the head of the personnel department and the chief accountant so that he can calculate compensation for overtime work.

An order in the HR department is generated for each employee separately. Additionally, a notification (consent) is drawn up. There is no approved form for it, but there is a list of data that needs to be included in it:

- Full name and position of the employee;

- the reason for engaging in overtime work;

- period and time of its implementation;

- processing payment details;

- signature of the head of the HR department, date.

If the employee has the right to refuse (we wrote about this above), room must be left for consent. Usually this item is on the reverse side.

What is considered overtime work?

According to the law, this type of work includes the employee performing duties, in accordance with his job description, after the working day or shift established for him.

Moreover, this work must be carried out with the knowledge of the management of the business entity. If an employee starts work without the consent of management, he may not be paid for overtime work.

She also cannot be considered to perform official duties outside of her working day if her employment contract provides for an irregular day schedule.

Part-time work when an employee performs duties stipulated by several job descriptions does not apply to overtime.

Cost question: how much does overtime cost?

Since the employee actually works outside of working hours, he needs to be motivated. The law provides two ways to compensate for overtime: increased pay and additional time off. In both cases there are some nuances that need to be taken into account.

Procedure for payment of overtime work

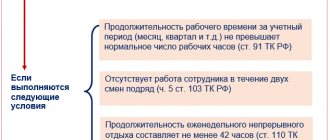

In Art. 152 of the Labor Code of the Russian Federation describes in detail the procedure for paying for overtime. Regardless of the working time recording system (except for those who have irregular working hours). The law states that the first 2 hours are paid at one and a half times, and starting from the 3rd hour - at double.

The same article sets out the minimum amount that the employer must pay. Of course, no one forbids paying more. But this condition must be stipulated in local regulations. However, if the employer pays the “minimum wage”, this should also be noted in the documents.

Compensation is calculated depending on the established form of payment for a particular employee. It can be time-based or piecework. However, the law does not say exactly how the calculation should be carried out. Therefore, there are unspoken rules in accounting practice.

To calculate payment to an employee paid on a time basis (hourly, daily, monthly, salary), you need to determine how much one hour of work costs. And proceed from these indicators. That is, if an employee receives 200 rubles per hour, then for the first two hours of overtime he will receive not 400, but 700 rubles, etc.

With summarized recording of working time, the fact of overtime work can be established only by counting hours for the accounting period. It can be anything, but no more than a year. The calculation is carried out in exactly the same way, the first two hours are paid at one and a half times the rate, then double.

If an employee has overtime, for example, 20 hours a month, then for the first 2 hours he will receive one and a half rates, for the remaining 18 - double.

Additional day off - who benefits?

Upon written request from the employee, the employer may replace overtime pay with additional days off. The duration of rest must correspond to the amount of time worked. If an employee works 3 hours, then he must rest for at least 3 hours.

The important thing is that this day off is not paid. On the report card it is about, that is, time off without pay. And overtime work is not paid at an increased rate. This is very convenient for the employer, but not always for the employee. But there is such a possibility in the legislation.

Overtime is rarely more than 1-2 shifts, and most often it is just “extra” hours. The Labor Code of the Russian Federation does not indicate how to correctly record hours of additional rest. But experts advise simply marking the time actually worked on the timesheet or coming up with your own designation, enshrining it in a local act.

Overtime pay

The Labor Code of the Russian Federation states that overtime payments must be made at least 1.5 times for the first two hours, and 2 times for all subsequent hours. This means that the Payment Regulations and other regulations of the enterprise itself may provide for other amounts, the main thing is that they are greater than the established minimum.

Attention! In addition, the legislation provides the right to the employee, according to which he can choose either increased pay or regular pay with the provision of additional rest time, but not less than the hours worked. Therefore, when notifying and obtaining consent for overtime work, it is advisable to request the type of compensation from the employee in writing.

It is also necessary to take into account that the enterprise may operate a piecework or salary system of payment. In this case, for the calculation, not the hourly tariff rate is taken, but the piece rate for the products produced, or the corresponding part of the salary (that is, the salary divided by the standard working time, expressed in hours).

An absurd question: is it possible to obey the law by breaking the law?

The most controversial issue concerns paying taxes. The point is that when a company files a tax return, it can legally reduce its income tax.

In Art. 255 of the Tax Code of the Russian Federation (TC RF) states that additional payment for overtime work should be deducted from the profit of the enterprise, since these are labor costs. But the trick is that this can only be done when all the conditions for processing processing are met.

Their number is strictly regulated by Art. 99 Labor Code of the Russian Federation. Overtime should not exceed 120 hours per year. And an employee cannot be required to work overtime for more than 4 hours on two days in a row. But, of course, we all understand that these laws are not always observed. And it turns out that employers commit violations.

At the same time, no matter how absurd it may sound, there are documents that allow this. Moreover, they indicate that such processing can be included in the tax return.

We are talking about two letters from the Ministry of Finance: No. 03–03–06/1/278 dated 05.22.2007, No. 03–03–04/1/724, dated 07.11.2006. They note that exceeding the limit specified in Art. 120 is a violation. But an employee should not be deprived of overtime pay, even if the number of hours is higher than normal. Therefore, the employer pays money, and these are expenses that can be included in the declaration.

But in the letter of the Federal Tax Service for Moscow No. 16–15/ 0 2 5 7 8 7.1 dated March 23, 2009, it is written that only such payments that are required by law can be classified as expenses. Working overtime more than 120 hours per year is against the law. And even if the employer pays for it, he cannot include this amount in the declaration.

In practice, enterprise managers are guided by the letter from the Ministry of Finance and successfully reduce taxes. But for employees everything is crystal clear. Payment for overtime is part of the salary, therefore it is subject not only to personal income tax, but also to other taxes.