Basic concepts for expanding your service area

Additional work activities are assigned to an employee only with his written consent. Expansion of his service area (ZA) is carried out as an addition to his main professional responsibilities. Work may be assigned to:

- related activities,

- in cases of changes in load volumes,

- replacing an absent employee on a temporary basis.

The deadlines for the performance of such duties are also established separately, and the employee will be able to refuse to take on additional functions and notify the employer in writing in advance, three days before the order comes into force (Article 60.2 of the Labor Code). In practice, such cases are defined by a spatial term - combination. However, there are some differences. And therefore, the personnel officer or the person who performs these duties in the documentation should be guided by the definitions of Article 151 of the Labor Code.

Performing work in related professions characterizes combination as the simultaneous performance of the main position and the functions of another employee.

In some cases, when there is a change in the volume of daily work, the service boundaries are expanded. If such a change is not specified in his employment contract, then additional payment is required.

DIFFERENCES IN EXPANDING SERVICE AREA AND INCREASING THE VOLUME OF WORK

Expanding service areas and increasing the volume of work means performing, along with one’s main work stipulated by an employment contract, an additional amount of work in the same profession or position, that is, performing homogeneous work (for a similar position, specialty, qualification).

At the same time, the concept of “expansion of service areas” for the purpose of applying Articles 60.2 and 151 of the Labor Code of the Russian Federation includes the assignment of additional work for the same position, the work for which is made dependent on zones or areas, and with an increase in the volume of work - on production standards.

The clarifications of the State Labor Inspectorate in the Chelyabinsk Region dated November 21, 2017 indicate that the main difference between expanding service areas and increasing the volume of work is that expanding the service area is established when a position requires the presence of zones or areas (for example, a social worker, a doctor, a cleaner) . And when the volume of work increases, in addition to the main work, the employee is entrusted with similar additional work, that is, the volume of previously performed work increases (for example, a mechanic for mechanical assembly work).

For clarity, let's summarize these differences in a table:

The table shows that the rest of the registration of additional work is the same both when expanding service areas and when increasing the volume of work: you need to enter into an agreement with the employee, adhere to the rule of equal pay for work of equal value, and there is no need to keep separate records of working time for additional work.

[…] The concept of “expanding service areas” is not considered by the legislator separately, but only in conjunction with “increasing the scope of work”, therefore, in order to avoid possible mistakes, it is worth noting the differences. Expanding service areas involves assigning additional responsibilities to jobs with clear boundaries. The main difference between expanding the service area and increasing the scope of work is that the expansion of the service area is established when the position requires the presence of zones or areas (for example, a social worker, a doctor, a cleaner). Increase in the volume of work - in addition to the main work, the employee is entrusted with similar additional work, that is, the volume of previously performed work increases. Thus, expanding the service area is more often used for workers who are assigned areas - doctors, electricians, while increasing the volume is more likely applicable for workers who have a production standard. In accordance with Part 2 of Art. 60.2 of the Labor Code of the Russian Federation, additional work entrusted to an employee along with the work specified in the employment contract can be performed by him in the order of combining professions (positions), by expanding service areas, increasing the volume of work, or in connection with the assignment of duties to a temporarily absent employee. In this case, the employer can entrust the employee with performing such additional work only with his written consent and for an additional fee (Part 1 of Article 60.2 of the Labor Code of the Russian Federation). When expanding service areas or increasing the volume of work, the employee performs work in the same profession or position, which is stipulated by the employment contract, but to a greater extent compared to what he previously performed in accordance with the employment contract. The law does not provide for a limitation on the period for which an employer can assign an employee to perform additional work along with his main job. In each specific case, the period during which the employee will perform, along with the work specified in the employment contract, additional work by expanding service areas, increasing the volume of work, is determined by the employer with the consent of the employee (Part 3 of Article 60.2 of the Labor Code of the Russian Federation). If the employee does not agree with the period determined by the employer, this period may be determined by agreement of the parties. If the parties cannot agree on the period during which additional work must be performed, the employee has the right to refuse to perform it. According to Part 4 of Art. 60.2 of the Labor Code of the Russian Federation, the employee has the right to refuse to perform additional work ahead of schedule, and the employer has the right to cancel the order to perform it ahead of schedule, warning the other party about this in writing no later than three working days. At the same time, as follows from the content of this norm, neither the employee nor the employer is required to indicate the reason why they prematurely refuse the agreement to perform additional work. When expanding service areas or increasing the volume of work, it is necessary to pay attention to the quantitative component of the labor function. This is important for both the employee and the employer. Firstly, the employer must determine the amount of additional payment for expanding the service area or increasing the volume of work, which is determined by the norms of labor legislation (Article 151 of the Labor Code of the Russian Federation). So, in accordance with Part 2 of Art. 151 of the Labor Code of the Russian Federation, the amount of additional payment established by agreement of the parties to the employment contract depends on the content and (or) volume of additional work. At the same time, it is necessary to take into account that, in accordance with Part 2 of Art. 22 of the Labor Code of the Russian Federation, the employer is obliged to provide employees with equal pay for work of equal value. Secondly, the employee must know what functions he is obliged to perform, since by virtue of Art. 60 of the Labor Code of the Russian Federation, it is prohibited to require an employee to perform work not stipulated by the employment contract. The exception is cases strictly provided for by the Labor Code of the Russian Federation and other federal laws. […] Failure to provide additional payment when expanding service areas and increasing the volume of work performed, or engaging an employee in such work without his written consent are violations of labor legislation and entail administrative liability under Part 1 of Art. 5.27 of the Code of the Russian Federation on Administrative Offences. Prepared on the basis of material by I. A. Vasiliev, 1st class adviser to the state civil service of the Russian Federation. State Labor Inspectorate in the Chelyabinsk Region 11/21/2017

To whom and how are additional payments calculated?

The basis for accruals when expanding the zone can be:

- joining additional microdistricts served by social workers to the main zone;

- trips to new areas for goods delivery services;

- expansion of warehouse facilities transferred to one responsible person to control shipments.

It is customary to distribute the job responsibilities of a staff unit of identical professions personally to each employee. In the case of expansion of production or services, the load changes. If management does not plan to introduce a new full-time employee, responsibilities are distributed among existing staff. Also, employees are burdened with additional work during the absence of other employees (on sick leave, annual leave, maternity leave).

Establishment procedure and calculation methods

In order to correctly assign charges, you need to remember that you will need to confirm the contractor’s consent in writing. In addition to the order for additional work, issue:

- additional agreement on expanding service areas to the employment contract;

- approve the order with the employer.

This order is not named in the register of primary forms of accounting for wages, so enterprises develop their own form, where it is necessary to mention: volumes, detailed content, time period for assigning additional work, method of calculation. Read also the article: → “Personal allowance and when is it established?”

Calculation example. A cafe employee serves a room with ten tables. The salary was 30,000 rubles. bonuses in the amount of 5% of monthly revenue. During the warmer months, he serves outdoor tables. The bonus for the expansion of the ZO will be, by agreement, 20% of the salary.

| Pay slip | |

| Salary accrued for main work | 30 000 |

| Bonuses from revenue (conditionally 100,000 rubles) will be 5% | 5 000 |

| Surcharge for additional tables | 6 000 |

| Deductions from assigned payments | |

| Fine for damage to property | 1 500 |

| Personal income tax | 5 330 |

| Total to be issued | 34 170 |

Part-time allowance

Provided that the employee works part-time, it is likely that the responsibilities are partially assigned to other employees of the enterprise. Such working conditions are acceptable to all employees by agreement with management or due to circumstances. An employee on parental leave has the right to work under reduced conditions. At the same time, he occupies a staff position and performs official functions. Payment is calculated as a proportion of salary to time worked.

A distinctive feature of this method of work is that there are no clear boundaries for part-time work. The average norm under this regime is less than 40 hours per week. This is determined based on the practice of applying Art. 91 of the Labor Code and can be assigned upon hiring, and subsequently at any time during cooperation. Working hours may change to a six-day work week.

Additional payment when paying according to the minimum wage

Employees who work part-time, part-time, with additional payments for the amount of work retain their rights to all conditions implemented by labor legislation. Subject to payment of remuneration for work below the federal minimum wage level (7800 from 07/01/2017), it is required to increase the additional payment to the required amount.

Additional payment is made on the basis of an order for the enterprise. In addition, it is required to index all additional allowances and salaries for performing basic duties.

The established surcharge regulates wages in educational institutions, medical workers, and employees working in the Far North or nearby areas. If there is an employee on staff who receives a full 0.5 rate, its amount should not be less than half the amount of the established minimum wage.

Calculation of the amount for part-time work

Part-time work has special features. The amount of working time should not exceed four hours a day. If he is not busy/released from his main duties, he is allowed to work in a dual position within the established standards.

The terms of payment for his work are stipulated in the employment agreement, and for the rest (allowances, bonuses), all compensation and other remunerations are applied to part-time workers and the rights to rest and sick leave apply. In particular, he gets the opportunity to pay extra when expanding his service areas.

Additional payment for combining positions according to the Labor Code of the Russian Federation for 2022

Elena, due to the current situation on the labor market, I would like to advise you to calm down and moderate your “revolutionary spirit”. Now to the point. 1. According to Art. 151 of the Labor Code of the Russian Federation When combining professions (positions), expanding service areas, increasing the volume of work, or performing the duties of a temporarily absent employee without release from work specified in the employment contract, the employee is paid additionally. In your case, the increase in the amount of work is obvious. The law clearly requires additional payments. I don’t know where your leader was pointing, apparently he limited himself to verbal polemics and threats. At the same time, there are controversial Letters of Rostrud dated May 24, 2011 No. 1412-6-1 and the Ministry of Health and Social Development of Russia dated March 12, 2012 No. 22-2-897, which indicate that if the performance of job duties of an absent employee is included in job descriptions or an employment contract, then payment for such work should not be performed, since it is carried out within the framework of an employment contract. If your manager nevertheless “poked” you not in the Labor Code of the Russian Federation, but in your job description or TD, then the issue here is ambiguous and can only be finally resolved in court. Personally, this letter seems incorrect to me, since I do not see a direct indication of the conclusions made in it in the Labor Code of the Russian Federation. Moreover, it directly contradicts the position expressed in the Ruling of the Armed Forces of the Russian Federation dated March 11, 2003 No. KAS03-25, as well as judicial practice, for example: Resolution of the Arbitration Court of the North-Western District dated November 16, 2016 No. F07-9908/2016, A44-658 /2016; Determination of the Voronezh Regional Court dated May 10, 2012 No. 33-2442; Determination of the Kamchatka Regional Court dated November 20, 2014 No. 33-1836/2014. In this connection, the employer’s position on this issue seems to me to be unlawful. 2. Regarding the period of self-isolation, I cannot advise you anything, since I have not seen the text of the order and its conditions, and I also do not fully understand what period we are talking about. In any case, the easiest thing for you would be not to write a statement, but since you have already done this, there is no point in proving anything now. 3. According to Art. 129 of the Labor Code of the Russian Federation, the employer himself establishes in his local acts the procedure for calculating additional payments and allowances. In this regard, if the wage regulations provide for their accrual on an individual basis by decision of the manager, the actions of your boss are formally legal. You have virtually no chance to challenge them. 4. As for the certification, not everything is so simple with it, and when making a decision based on its results, in the event of a dispute about dismissal, the employer will have to prove that he created all the conditions for you to get used to the workplace and be able to pass it . In addition, he will be obliged to offer you another job he has with lower qualifications. It seems to me that only point 1 is the most productive from the point of view of a complaint to the inspection authorities. However, I would not recommend that you complicate your relationship with the employer, since he always has more leverage over the employee. In addition, if there are even minor mistakes in your work, they can be used by the employer against you when terminating the contract on formally legal grounds. Think about what is more important for you: saving your job or achieving “justice” and proving something to someone, but being left without a livelihood.

Documentation of compensation

To properly document consent to additional work, you must complete:

- Order on the assignment of additional work (free form);

- Written consent (application) to perform additional workload;

- Additional agreement to the employment contract;

- Staffing table;

- Time sheet;

- Calculation sheets for calculating compensation for additional workload.

The issuance of an order occurs after the written consent of the executor. The order contains:

- type of additional work;

- the period during which the employee will be engaged in additional work;

- content of additional work;

- amount of additional functionality.

The order must indicate the amount of the bonus for additional work, which is approved in the employment agreement.

Sample application for consent to expand the service area:

Position of manager (director, head of department)

Name of the employer's organization (LLC "Firm")

Last name, I.O. (initials abbreviated)

From (employee position)

Last name I.O.

Statement.

I, full name employee holding the position ________ I give my consent to perform additional work during the entire working day simultaneously with the main job responsibilities in accordance with Article 60.2, 151 of the Labor Code of the Russian Federation and the employment contract under certain conditions:

- additional work is carried out according to the position held;

- the volume, type and composition of work consists of responsibilities: (job description, detailed functional responsibilities;

July 17, 2016 (Date of compilation)

Signature and transcript of the applicant

Note: if the work will be performed for another professional position, then its name is indicated in paragraph 1.

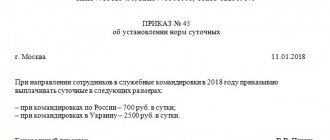

Sample order on combining professions/expanding the scope of work:

Order No.___

About expanding the service area

Podolsk July 17, 2016 (date of compilation)

in connection with the dismissal of the chief engineer for ____ (time, period), until the appointment of a new employee to the position on the basis of Article 151 of the Labor Code of the Russian Federation

I order:

- Transfer the responsibilities of the chief engineer as an extension of the service area to the technical engineer (_________) indicate full name) performed during the main working day.

- Establish responsibilities: monitoring compliance with product quality, drawing up the necessary technical documentation, compliance with labor protection requirements, fire safety standards. In other matters, base your actions on the job description of the chief engineer.

- Determine a fixed payment amount of 20,000 rubles (or % of the salary as agreed with the contractor).

- The accountant should be guided by this order when calculating earnings.

- The HR officer must formalize assignment, recording of working hours and payment in accordance with the Labor Code. Familiarize the employee with the order against signature.

Reason: additional employee agreement dated July 17, 216 to employment contract No.___ dated November 11, 2013.

Director/manager ___________ Explanation

I have read the order:

Date signature signature description

REGISTRATION OF ADDITIONAL WORK

Let's look at the process of completing additional work using specific examples.

Let’s say that an agreement has been drawn up with an employee of Selena LLC, a 4th category electrician, O. A. Serebrov, to perform additional work (expanding service areas) in another area of work (examples 1, 2), and a 3rd category mechanical assembly mechanic, E. Yu Makarova The employer registered the additional work as an increase in the scope of work (examples 3 and 4).

The law does not limit the period for which an employer can assign an employee to perform additional work. In each specific case, the period during which the employee will perform, along with the work specified in the employment contract, additional work by expanding service areas, increasing the volume of work, is determined by the employer with the consent of the employee (Part 3 of Article 60.2 of the Labor Code of the Russian Federation).

Methodology for accounting for additional payments in accounting

All expenses for payment for increasing the volume of work and expanding the service area are recognized as the organization’s expenses for ordinary activities. The collection of information on settlements with personnel is carried out on account 70 in correspondence with cost accounts.

| Debit | Credit | Operation information |

| 20, 26, 44 | 70 | Amount of salary, allowances for expanding the zone |

| 70 | 68-2 | Personal income tax on earnings |

| 20, 26, 44 | 69 | Contributions to compulsory pension insurance, compulsory medical insurance, social security fund |

| 70 | 50, 51 | Salaries paid to employees |

Accruals in the form of compensation or incentive payments are made by the accountant based on information on the actual time worked. Payment for additional work is based on the time sheet and agreement with the employee. By agreement it is possible:

- Payment in a fixed amount;

- % of monthly, daily or hourly tariff;

- % rate of the salary of the position being filled;

- Based on the volume of work performed (piecework).

Carrying out the duties of a temporarily absent employee

The duties of an absent employee are temporarily assigned to one of the employees or distributed among several employees (performance of the duties of an absent employee in accordance with Article 60.2 of the Labor Code of the Russian Federation). When an employee performs duties for a vacant position without being relieved of his work, we can talk about combining positions or that there is an expansion of service areas or an increase in the volume of work. Fulfilling the duties of a temporarily absent employee is the performance by one of the employees of the labor functions provided for in the employment contract for the relevant employee.

However, the absent person retains his place of work. In this case, the employee performs both his functions and the functions of a temporarily absent person.

When performing the duties of a temporarily absent employee, his “deputy” may be assigned additional work in the same profession or in a different one. Delegating the duties of an absent employee to another employee is possible only if he has given his consent. The period during which additional work will be performed, and what concerns its content and scope, is provided by the employer with the written consent of the employee. The employee has the right to early refusal to perform an additional amount of work in case of written warning to the other party no later than 3 working days. The amount of additional payment is by agreement of the parties, taking into account the content and (or) volume of this work.

Tax base when calculating profit

In relation to the surcharge for expanding the service area, the instructions of PBU 10/99 (Expenses of the organization) are applied and, regardless of the terms of registration and method of payment, are recognized as part of the main expenses of the enterprise. In accordance with the requirements of the Tax Code, rules apply for the recognition of expenses for the performance of labor duties and legally reduce the tax base of the enterprise.

This allowance is recognized as income and is subject to deduction from the total amount of personal income tax, and the accrual is reflected in reports 2 - personal income tax, 6 - personal income tax. The law establishes a closed list of amounts in respect of which contributions to compulsory health insurance, compulsory medical insurance, social security fund and injuries are not charged. This allowance is not named in it and is subject to the calculation of contributions in the usual manner.

Additional payment for expanding the service area: Labor Code of the Russian Federation on the essence and procedure for establishing

When the service area increases, the employee performs work in a position similar to his profession, if the enterprise does not have an additional staffing position or there is no point in introducing one. Examples include situations where:

- additional service stores are added to the merchandiser;

- the taxi driver's service area is expanded;

- the cleaning lady is charged with cleaning a new small room, etc.

When several employees of one position work at an enterprise and perform their job duties within a specific territory, each of them is assigned a certain area. During the period of temporary absence of one of these employees (for example, due to illness) or in the event of expansion of the territory served by the company, the new area must be assigned to some responsible person. For these purposes, the manager distributes additional responsibilities among the existing personnel and sets a bonus for expanding the service area for each of the employees involved.

Thus, the extended service area is the area within which the employee performs his job duties in addition to work in the main territory assigned to him under the employment contract.

The norm of Article 60.2 of the Labor Code of the Russian Federation requires the written consent of the employee to determine the content and duration of additional work. A new employment contract is not required; it is enough to draw up two documents:

- agreement between the employee and the employer to expand the service area;

- order from the manager in any form on company letterhead.

The order must contain an indication of the type of additional work, its content, volume and deadline. The administrative document must also make reference to setting the amount of the surcharge in the agreement of the parties.

Answers to common questions

Question No. 1. The employee received a bonus for expanding the service area. Is it included in the minimum wage or not?

Monthly earnings consist of salary, allowances, and payments based on an employment contract. Remuneration for expanding the service area is accrued according to an additional agreement. Consequently, the additional payment up to the minimum wage is calculated without interconnection with the additional payment for the expansion of the ZO.

Question No. 2. The company is increasing salaries. What payments can be indexed if the employee is accrued: salary, 30% additional payment for expanding the salary, an end-of-year bonus for success.

Salaries and bonuses for the volume of work, payments for combining and expanding the scope of work are subject to indexation. The bonus is awarded once, regardless of salary.

How does a budget organization calculate additional payments for combining professions (positions)

Currently, the salary of employees of budgetary organizations consists of salary, incentive payments (allowances and bonuses) and compensating additional payments. The latter include, among other things, additional payments for combining the positions of employees (professions of workers), expanding service areas (increasing the volume of work), performing the duties of a temporarily absent employee without exemption from work determined by the employment contract, job (work) instructions (paragraph 3 p. 1 of Decree No. 27, part 3 of article 67 of the Labor Code, paragraph 3, sub-clause 3.2, clause 3 of the Instructions on the amount and procedure for payments, approved by resolution of the Ministry of Labor and Social Protection No. 13).

In this case (clause 1 - 3, part 2, article 67 of the Labor Code):

— additional payment for combining professions (positions) is a payment established for employees who, along with their main work, during their working day (shift) perform additional work in another profession (position);

— additional payment for expanding service areas (increasing the volume of work) is paid to employees who, within working hours, in parallel with their main job, perform duties for the same position (profession).

Important! A prerequisite for establishing an additional payment for combining professions (positions) and expanding service areas (increasing the volume of work) is the presence in the staffing table of a vacancy in the combined profession (position) (clause 1 - 2, part 2, article 67 of the Labor Code);

— additional payment for performing the duties of a temporarily absent employee is established for the employee’s performance, along with his main job, of duties both in another and in the same position (profession) within his working time.

Note Additional payments for combining positions (professions), expanding service areas (increasing the volume of work), performing the duties of a temporarily absent employee (hereinafter referred to as additional payments for combining positions) are not established in cases where work in another position (profession) is provided for by an employment agreement (contract) , job description (part 2, clause 14 of the Instruction on the amount and procedure for payments, approved by Resolution of the Ministry of Labor and Social Protection No. 13).

The amount of additional payments for combining depends on the amount of additional work. In this case, additional payments can be established for one or more employees within the salary range for the combined profession (position). The terms of combination and the amount of additional payment are established for each specific employee by order (instruction) of the employer with the written consent of the employee (parts 4 and 5 of article 67 of the Labor Code, part 1 of paragraph 14 of the Instruction on the amount and procedure for payments, approved by Resolution of the Ministry of Labor and Social Protection No. 13 ).

For employees of budgetary organizations, whose salaries are calculated on the basis of monthly salaries, we recommend calculating the additional payment for combination in proportion to the time of combination according to the formula (part 3 of article 67 of the Labor Code, subsection 7.1.1 clause 7 of the Regulations on the Ministry of Labor and Social Protection, approved by resolution of the Council of Ministers N 1589, part 1, clause 14 of the Instructions on the procedure and conditions of remuneration, approved by Resolution of the Ministry of Labor and Social Protection N 13):

Formula 1

In turn, the salary for a combined profession (position) is calculated according to the formula (paragraph 7, clause 11 of Decree No. 27, part 1, clause 3 of the Instructions on the procedure and conditions of remuneration, approved by Resolution of the Ministry of Labor and Social Protection No. 13):

Formula 2

Example. Calculation of additional payment for combining the profession of office cleaner

An employee of a budgetary organization combines the profession of an office cleaner for 15 working days with an additional payment for combining 70% of the cleaner's salary. The organization has a five-day work week. According to the work schedule, there are 22 working days per month.

In an organization, the profession of a replaced cleaner of office premises (including cleaning of bathrooms) is charged with the 2nd category of work (paragraph 387 of issue 1 of the ETKS). The multiple of the base rate for this profession is 1.07 (clause 2 of Table 3 of the Appendix to Resolution of the Ministry of Labor and Social Protection No. 13).

The salary for a combined profession will be 208.65 rubles. (RUB 195 x 1.07).

Consequently, the amount of additional payment to an employee for combining the profession of an office cleaner will be 99.58 rubles. (RUB 208.65 / 22 days x 70% x 15 days).

If an organization has introduced hourly wages for employees, we recommend determining the amount of additional payment for each specific employee as follows (parts 3 and 4, clause 3 of the Instructions on the procedure and conditions of remuneration, part 1, clause 14 of the Instructions on the amount and procedure of payments, approved. Resolution of the Ministry of Labor and Social Protection No. 13):

Formula 3

In this case, the hourly salary for a combined profession (position) in this case will be determined by the formula (parts 3 and 4 of clause 3 of the Instruction on the procedure and conditions of remuneration, approved by Resolution of the Ministry of Labor and Social Protection N 13, part 3 of Article 124 of the Labor Code , sub-clause 7.1.1 clause 7 of the Regulations on the Ministry of Labor and Social Protection, approved by Resolution of the Council of Ministers No. 1589):

Formula 4

Example. Calculation of additional payments for combinations when introducing hourly wages into organizations

Based on the data from the previous example, we will calculate the additional payment for combining work for an employee who combines his main job with an additional one for 120 hours.

To calculate the surcharge, we will take the average monthly estimated working time for a five-day working week, which for the current year is 170.8 hours (2050 hours / 12 months).

In this case, the hourly salary for the combined profession will be 1.22 rubles. (208.65 rubles / 170.8 hours). For additional work you should pay 102.48 rubles. (RUB 1.22 x 70% x 120 hours).

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service