Form and filling procedure

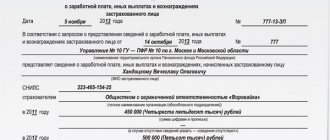

Order of the Ministry of Labor of Russia No. 182n dated 04/30/2013 (as amended on 01/09/2017) indicates the correct name for a certificate for 2 years from a previous job when a woman goes on maternity leave - unified form 182n on the amount of wages, other payments and remunerations for 2 calendar years preceding dismissal or application for a reference document.

How to fill out the certificate

According to the rules, for a new employer, when accruing maternity leave for up to 1.5 years, a certificate 182n from the previous place of work is required. The current form, detailed instructions for filling out and a visual example can be found in the special article “How to draw up a salary certificate using Form 182n.”

The rules for document formation are enshrined in Order No. 182n of the Ministry of Labor, and the form is in Appendix No. 1 to the order. The same standard explains for what period certificate 182n is issued upon dismissal - for the previous 2 years. 182n is filled out on the basis of the accounting data and reporting of the previous employer for the relevant reporting periods. The form is filled out by hand, entering information in blue or black ink. It is acceptable to prepare the paper using a computer.

In most cases, filling out the document takes place as usual, that is, without deviation from generally established rules. Legislators have provided exceptional rules for individual cases. Let's look at how to fill out the paper in problematic situations.

More details: form and example of filling out a salary certificate in form 182n

How to fill out a 2nd personal income tax certificate if the employee had no income?

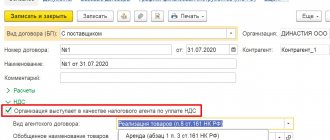

How can I correctly explain to her that this amount should not be indicated either in the certificate or in the register? If someone indicates BIR, early terms, benefits up to 1.5 years in 2NDFL, then with what income code? This question worries both the culprit of the event and accountants involved in payroll issues, since mistakes are fraught with fines or even the FSS’s refusal to reimburse accrued payments.

Important

Neither sick leave nor unemployment benefits are also included in the income tax calculation base.

She is entitled to them only in one case - if she entered into an agreement with the Social Insurance Fund and at least a year before the expected birth she regularly made payments in the required amount.

And in June she has the right to receive a child deduction in the amount of 1400 × 6 = 8400 rubles. When an employee reaches an income of more than 280,000 rubles, child deductions are not provided (paragraph 17, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation). 3. Filling out a 2-NDFL certificate for an employee working in a separate unit. Employee Ugolkov I.P.

works in a separate division, which, according to general rules, has neither a current account nor a balance sheet. Where can he get a 2-NDFL certificate and who will issue it? In separate divisions that do not have a current account and balance sheet, the parent organization calculates and pays personal income tax from employees and provides certificates to employees (letter of the Ministry of Finance of Russia No. 03-04-06-01/224 o dated August 28, 2009).

The employee should contact the parent organization (its office or accounting department), since all personal income tax accounting is kept there.

In this article we will tell you who is issued a 2nd personal income tax certificate during maternity leave and why, and what data it contains.

We suggest you read: Real estate where to apply for registration and what documents are needed

Let's look at the wording first. Maternity leave, maternity leave - for simplicity, this is the name for the time when an employee is:

- on maternity leave

- on maternity leave for up to one and a half years

During such periods, the employee, as a rule, does not work, but receives benefits in accordance with Federal Law No. 255-FZ of December 29, 2006.

When a certificate in form 2-NDFL is issued A certificate in form 2-NDFL is issued only if there have been income payments to the employee.

Certificate 182n for maternity leave

According to the general rules, form 182n is filled out with information for the two previous and current years. If the employee was on maternity leave during this period of time, and then took leave to care for the baby, then there is simply no information to be reflected in the certificate. If an employee is interested in “why do I need certificate 182n if I’m on maternity leave,” she needs to explain that the law allows for the replacement of billing periods for calculating benefits (Part 1 of Article 14 255-FZ of December 29, 2006). In this case, the rights of the woman in labor should be taken into account to use a different, earlier period for calculating benefits.

Therefore, when preparing form 182n for a resigning maternity leave, include information about other periods of her work. Let's look at the rules for filling out a document using an example.

The employee decided to resign on July 15, 2021. She has been working in a government agency since January 10, 2016. Here's how to fill out form 182n if the employee is currently on maternity leave and plans to quit after maternity leave - do not indicate periods of maternity leave if there were no accruals in them. In our example, this is part 2022, 2022, 2022 and 2022: the employee was on maternity leave and then went on maternity leave, there is no data on payroll. In this case, include information in the document for earlier periods of the employee’s work in the institution, that is, reflect information for 2016, 2022 and part of 2022.

This is what a sample of filling out certificate 182n with maternity leave in 2022 looks like:

Answers to common questions

Question No. 1. An employee who is on maternity leave asks for a 2-NDFL certificate to receive a subsidy. The employee did not have any income this year, what should I do?

If your organization is located in regions where the Social Insurance Fund pilot project is not yet operating, you can issue it a free-form certificate indicating the amount of benefits received. In the regions where the pilot project operates, organizations do not pay benefits for maternity and child care up to one and a half years old.

Combining work and maternity leave

Some mothers do not plan to spend a long time on maternity leave and go part-time. Let's assume a female employee in 2022 and 2022. was on maternity leave to care for a child under 3 years old, but worked part-time. Then in certificate 182n, if the employee was on parental leave for a child under 3 years old in 2022, but continued to work, we reflect the information:

- in section No. 3 we reflect the amount of accrued wages that the employee received while working part-time;

- in section No. 4 we indicate care leave, and reflect the entire period, without any interruptions. In this case, the days of work do not change the duration of parental leave.

Additionally, sections No. 3 and No. 4 should be completed for the 2022 and 2019 periods or earlier periods in order to retain the rights to transfer years to earlier dates.

Is it possible to get a 2nd personal income tax certificate if you are on maternity leave?

In everyday life, maternity leave is a leave that is taken out in connection with childbirth, as well as for caring for a baby until he reaches 1.5 years of age. According to the law, benefits are issued during this period.

A woman who is on maternity leave can contact the bank to open a credit line or apply for a visa to the consulate. In such cases, she will need a declaration, but how to issue a certificate in Form 2 of personal income tax for a maternity leave, if the type of income is not subject to income tax.

Let's consider all the features of filling out documents in this case.

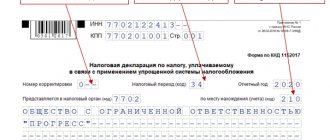

When is the 2nd personal income tax declaration completed?

A business entity can issue an employee a personal income tax certificate 2 only if income that is subject to income tax was transferred in her favor.

These include:

- Salary and equivalent payments, bonuses and allowances;

- financial assistance, the amount of which exceeded the minimum threshold for calculating personal income tax of 4,000 rubles. in year;

- amounts accrued for sick leave, including child care;

- other income, for example from the rental of real estate, is subject to personal income tax.

2 Personal income tax and maternity leave

Social benefits to a woman on maternity leave are not subject to personal income tax. This is enshrined in Article 217, paragraph 1.

Therefore, personal income tax certificate 2, if you are on parental leave, can be issued in the following cases:

- A woman who, by law, is on maternity leave to care for her child until he reaches the age of 1.5 years, expressed a desire to work part-time. In this case, the benefit remains, but she begins to receive earnings subject to personal income tax;

- if the decree is issued to the husband, parents, guardian or one of the close relatives. They also go to work part-time during vacation;

- if a woman was awarded a bonus based on the results of the previous period. In addition, she may be paid swearing assistance. All these charges are subject to personal income tax, they are reflected with the corresponding income code in personal income tax certificate 2;

- if a woman continues to receive benefits during maternity leave, for example from rent;

- in other cases when it accrues profit subject to taxation.

Sample of personal income tax certificate 2

Social guarantees of the state

Legal acts provide for maternity leave, which is issued with a sick leave certificate for 70 days before childbirth and 70 days after it. If complications arise during this time, the total period of prenatal and postnatal leave is extended to 140 days.

The source of funding for this benefit, as well as sick leave, are social insurance funds.

Procedure for payment of amounts

The following categories of women have the right to maternity benefits:

- Working;

- registered with the central control center;

- full-time students;

- military.

The amount of payments depends on the amount of accrued income. It should be separately noted that the state also took care of those women who took in children from the orphanage.

If an employee on maternity leave refuses subsidies and continues to work, she is not entitled to transfer benefits, since she receives her basic income, which is subject to personal income tax. At any time she can go on maternity leave, in which case the payment of remuneration will be stopped and the benefit will replace it.

The subsidy is transferred to the woman at her place of employment. If the company was liquidated during maternity leave, payments continue to be made to the social insurance at the place of residence.

The subsidy is calculated based on the amount of earnings, for students - from a scholarship, for military personnel - from salary allowance. For dismissed employees due to the liquidation of the organization, 300 rubles are paid.

The amount of maternity leave is calculated based on average earnings for the last 2 years. If a woman was on maternity leave during a given period of time, it can be replaced by previous months. It is important to exclude periods of sick leave from the calculation.

When you can and cannot replace years to calculate maternity payments

The legislation allows in some cases to replace the billing periods for calculating subsidies:

- To calculate maternity and child care benefits;

- if during the billing period the woman was on maternity leave;

- if the average salary increases with such a replacement, the amount of the benefit will increase accordingly;

- you can replace both the first and second years of accrual, and it does not matter which of them was the time after maternity leave;

- can be replaced by earlier periods;

- it is important to take into account the number of days in the period being replaced, taking into account leap years;

- The average daily earnings of the year being replaced should not exceed the maximum permissible average value for the given period.

Sample application for transferring years to calculate benefits:

Calculation of maternity benefits for a part-time worker

Maternity benefits for the expectant mother are calculated for each place of employment, and it does not matter whether it is the main place or a combination. She must provide the original certificate of incapacity for work to all employers, apply for leave and receive the benefit amount.

In this case, the benefit will be accrued for the last two years. If employment during this period was in several places, each earnings must be calculated separately. It is important to take exactly those incomes where contributions to the Social Insurance Fund were made. If there were rewards and contributions were not accrued, such amounts are not taken into account.

For 2022, the maximum amount of earnings has been determined to be 815 thousand rubles. In case of combination, this limit is considered for each enterprise.

Example calculation calculator:

- The woman’s earnings at one company amounted to 600,000 rubles;

- for the second – 100,000 rubles;

- on the third – 300,000 rubles;

- the total amount of income is 1,000,000 rubles.

The minimum amount of benefits in case of combination cannot be lower than the calculated value of 43,675.40 rubles.

The maximum calculation of maternity leave for 2 years for part-time workers is:

- (755000+718000)/730*140 = 282493.15 rubles.

The size of the maximum payment amounts by year:

Example of calculating limit amounts

The woman wrote a statement asking to replace 2013 with 2011, and 2014 with 2012 due to the fact that she was on maternity leave at that time.

The maximum subsidy amount will be calculated as follows:

- 463000+512000 = 975000 rub.;

- 975000/730 = 1335.62 rubles. – the maximum limit on the average daily wage.

The dismissed employee fell ill

Let’s say a specialist quits in July 2022. All documents required upon dismissal were issued on time. But the former employee fell ill within 30 days from the date of termination of the employment contract. During this time, he did not manage to get a new job.

The former employee submitted the issued sick leave to the accounting department for payment. Form 182n is not required to be filled out, since sick time after dismissal is not included in the period of work.

Let us remind you that such certificates of incapacity for work are paid in the amount of 60% of the average daily earnings. Moreover, the duration of illness does not matter; all days are subject to payment. It should also be taken into account that payment is made only when the specialist himself is ill. If the sick leave is issued for a child or a close relative, no payments are made.