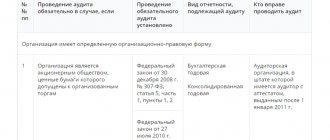

Who is required to prepare a cash flow statement?

Russian companies have prepared cash flow statements before, but now the procedure for its formation has been brought to the regulatory level. The question remains debatable: are small businesses required to submit a cash flow statement? Let's try to solve it.

Paragraph 6 of Order No. 66n talks about how small businesses are formed

t

financial statements. Of course, they prepare it for presentation purposes. But the direct presentation

of financial statements is regulated by the Regulations on maintaining accounting records and financial statements in the Russian Federation* (clause 2).

Paragraph 85 of the Regulations directly allows

small businesses and non-profit organizations not to submit this report. Therefore, a small enterprise should apply the standard in question only if it voluntarily decided to submit or publish a cash flow statement (clause 2 of PBU 23/2011).

Please note: the new standard is addressed to commercial organizations (clause 1 of PBU 23/2011). This is understandable - as noted above, non-profit organizations in general are not required to submit it.

Suppose your company is to prepare a report on the results of the current year. What innovations will accountants encounter?

Cash equivalents and cash flows

The “prototype” of PBU 23/2011 is IFRS (IAS) 7 “Cash Flow Statements”. This international standard operates with the concept of monetary equivalents, which has been absent in Russian standards until now. And this term is included in PBU 23/2011. As a result, the Russian report compiled according to the new rules will expand: it will cover the movement of not only cash, but also cash equivalents. True, the corresponding discrepancy between Russian and international reports has not been completely eliminated. The fact is that the developers of PBU 23/2011 narrowed the concept of cash equivalents. This nuance deserves attention.

PBU 23/2011 (clause 5) establishes that cash equivalents are highly liquid financial investments

that can be easily converted into a known amount of cash and which are subject to an insignificant risk of changes in value. In turn, PBU 19/02 (clause 2) characterizes financial investments as assets that can bring economic benefits to the company in the future. However, companies often replace cash flow with the movement of interest-free bank bills, recorded at par and not related to financial investments. Obviously, such non-monetary forms of payment are equivalent to monetary ones, but formally these bills are not recognized as monetary equivalents. How should an accountant act?

Firstly, it is necessary to use the principle of priority of economic content over the legal form (clause 6 of PBU 1/2008). And secondly, remember that the formation of accounting policies on issues not regulated by regulatory legal acts is allowed to be carried out on the basis of IFRS. And if we turn to the text of IFRS 7 (§ 6 - 9), we will find that cash equivalents are defined more broadly - as investments or investments of the company. The international standard emphasizes that cash equivalents are determined based on the company's cash management policies and even practices.

Thus, for the reporting year, the company sets cash equivalents on an individual basis and reflects the decision made in the accounting policy (clause 23 of PBU 23/2011). Such an object as cash equivalents appears in accounting practice for the first time, therefore the adopted classification is formalized as a change in accounting policy.

Example 1

Saturn LLC is the general contractor of the construction and is awaiting receipt of funds from the customer, which it intends to transfer to subcontractors. However, the company’s operations on its bank accounts were suspended (clause 3 of article 76 of the Tax Code of the Russian Federation). Under such circumstances, management agreed with the counterparties to pay with promissory notes of Sberbank of the Russian Federation at par. For purposes of preparing a statement of cash flows, these securities are legitimately treated as cash equivalents.

In passing, we note that the organization of bill settlements bypassing collection orders for the transfer of taxes (clause 4 of Article 46 of the Tax Code of the Russian Federation) constitutes a criminal offense under Article 199.2 of the Criminal Code of the Russian Federation (definition of the Constitutional Court of the Russian Federation of March 5, 2009 No. 470-O-O) .

In PBU 23/2011 (clause 6) we will discover another new concept - cash flow. These are payments to the company and receipts of cash and cash equivalents to the company. The cash flow statement shows the company's cash flows and balances of cash and cash equivalents at the beginning and end of the reporting period. (Please note: the reporting period in this standard should be understood as a calendar year.) As an example of cash equivalents, PBU 23/2011 indicates demand deposits opened in credit institutions. Obviously, such deposits must be shown in balances: they cannot participate in cash flows (clause 3 of Article 834 of the Civil Code of the Russian Federation).

PBU 23/2011 (clause 18) classifies foreign currency as cash. Currency exchange transactions, as well as transactions of transferring funds into cash equivalents and back, do not generate cash flows.

Determination of cash and cash equivalents

In the previous form of ODDS it was indicated that it was possible to provide information on the movement of not only cash, but also their equivalents. However, there was no definition of the term cash equivalents in Russian standards. And many companies have used the definition given in IAS 7.

And so, in paragraph 6 of PBU 23, they finally gave a definition of cash equivalents, information on the movement of which, together with cash, is presented in the ODDS. Cash equivalents are short-term, highly liquid financial investments that can be easily converted into a known amount of cash and are subject to an insignificant risk of changes in value.

What does short-term mean?

IAS 7 proposes to consider a three-month repayment period or another similarly short period as the time criterion for cash equivalents. In fact, we find indirect confirmation that Russian companies can focus on this period in subparagraph h) of paragraph 9 of PBU 23, which provides examples of current cash flows. Among other things, this subclause states that these may include cash flows on financial investments acquired for the purpose of resale in the short term (usually within three months).

The company must independently establish and consolidate in its accounting policies exactly which financial investments it will include in cash equivalents, based on determining their short-term nature, liquidity and exposure to an insignificant risk of changes in value.

Investments in shares of other organizations do not qualify as cash equivalents unless they are purchased with the intention of resale in the near future (for example, shares of large companies purchased for the purpose of speculating on their price). Typically, cash equivalents are intended more to pay off short-term obligations (for example, highly liquid bills that will be used to pay a supplier) rather than for investment.

Examples of cash equivalents include highly liquid bills or bonds, demand deposits and short-term bank deposits that are opened to manage an organization's cash flows in order to earn interest income.

ODDS does not show the transfer of cash or cash equivalents from one form to another. After all, this will lead to double the flow. The transfer of money into cash equivalents (their acquisition) and the receipt of money from the redemption of these equivalents are not cash flows.

Example 1

| The company placed the money on a short-term deposit. Then it was closed, the money was returned to the current account with interest. Only accrued interest is reflected in the ODDS. The movement of money from the current account (account 51) to the deposit (account 55) and back is not shown in the ODDS. |

Cash flow classification

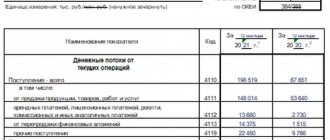

The cash flow in the report must be distributed in three directions - from current, investment and financial operations. A similar division was used in previous years. It was provided for by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n “On the forms of financial statements of organizations” (hereinafter referred to as Order No. 67n). However, in the new standard this classification is presented in more detail and illustrated with examples (see table).

Table. Current, investment and financial operations

| Types of cash flows | Characteristics of operations that generate a flow | Purpose of flow information | Notes |

| Current | Operations involving the ordinary course of business of a company that generate revenue, as well as operations that generate other income and expenses that are not classified as investment or financial | Shows the level of the company's cash flow to repay loans, maintain activities at the level of existing production volumes, pay dividends and new investments without attracting external sources of financing | The stream includes: — payment of interest on debt obligations (except for interest included in the cost of investment assets); — receipt of interest on receivables from buyers (customers) |

| Investment | Operations related to the acquisition, creation or disposal of non-current assets of an organization | Shows the level of company costs for the acquisition or creation of non-current assets that provide cash flow in the future | Non-current assets include long-term financial investments. The flow includes the amounts of loans issued by the company and repaid to it, including interest-free |

| Financial | Operations related to the company's attraction of financing on a debt or equity basis, leading to a change in the amount and structure of capital and borrowed funds | Provides a basis for forecasting the claims of creditors and shareholders (participants) in relation to the company's future cash flows, as well as the company's future needs for raising debt and equity financing | Examples: — cash contributions of participants, proceeds from the issue of shares; — obtaining credits (loans) and repaying the principal debt; — payment of dividends |

Note that in the previous form of the report, approved by Order No. 67n, the repayment of finance lease obligations is classified as financial activity. New regulations of the Russian Ministry of Finance do not explain how to classify these payments in 2011. But if the lessee wants to follow IFRS 7 (§ 17 “e”), then he must show his payments as part of financial flows. Well, the lessor will include income from finance leases in the current flow.

Cash flows that cannot be unambiguously classified are considered as cash flows from current operations (clause 12 of PBU 23/2011).

But a “surprise” awaits accountants regarding income tax. Of course, this tax is declared and paid in a single payment. However, part of the tax amount directly related to cash flows from investment or financial transactions must be included in these same flows (clause 9 “e” of PBU 23/2011). Thus, the accountant will have to distribute the payment for this tax (clause 13 of PBU 23/2011). But at the same time, one should not forget about the criterion of materiality of indicators (clause 17 of PBU 1/2008).

Example 2

In the fourth quarter of 2010, Saturn LLC did not carry out financial transactions, but sold an expensive fixed asset (real estate). Taxable profit from this transaction is RUB 500,000. – reflected in line 050 of Appendix No. 3 to sheet 02 of the income tax return. Tax for the specified period in the amount of 150,000 rubles. the company paid in 2011. As a result, part of this amount is 100,000 rubles. (500,000 rubles x 20%) the accountant will include in the investment flow, and the remaining amount in the amount of 50,000 rubles. (150,000 – 100,000) will be shown as part of the current stream.

PBU 23/2011

ACCOUNTING REGULATIONS

“CASH FLOW STATEMENT”

PBU 23/2011

(Approved by order of the Ministry of Finance of Russia dated February 2, 2011 No. 11n)

I. General provisions

1. These Regulations establish the rules for drawing up cash flow statements by commercial organizations (with the exception of credit organizations) that are legal entities under the laws of the Russian Federation (hereinafter referred to as organizations).

2. These Regulations apply to the preparation of a cash flow statement in cases where the preparation, and (or) presentation, and (or) publication of this report are provided for by the legislation of the Russian Federation or regulations, and also when the organization voluntarily decided to submit and (or) publication of such a report.

This Regulation does not apply when compiling an organization’s reporting for internal purposes, reporting compiled for state statistical observation, reporting information submitted to a credit organization in accordance with its requirements, and reporting information for other special purposes, if the rules for compiling such reporting and information do not provide for application of this Regulation.

3. The cash flow statement is part of the organization’s financial statements.

4. The cash flow statement is drawn up on the basis of the general requirements for the organization’s financial statements established by regulatory legal acts on accounting, and the requirements established by these Regulations.

5. The cash flow statement is a summary of data on cash, as well as highly liquid financial investments that can be easily converted into a known amount of cash and that are subject to an insignificant risk of changes in value (hereinafter referred to as cash equivalents). Cash equivalents may include, for example, demand deposits opened with credit institutions.

6. The cash flow statement reflects the organization’s payments and receipts of cash and cash equivalents to the organization (hereinafter referred to as the organization’s cash flows), as well as the balances of cash and cash equivalents at the beginning and end of the reporting period.

The organization's cash flows are not:

a) payments of funds related to their investment in cash equivalents;

b) cash receipts from the repayment of cash equivalents (excluding accrued interest);

c) foreign exchange transactions (excluding losses or benefits from the transaction);

d) exchange of some cash equivalents for other cash equivalents (excluding losses or benefits from the transaction);

e) other similar payments to the organization and receipts to the organization that change the composition of cash or cash equivalents, but do not change their total amount, including receiving cash from a bank account, transferring funds from one account of the organization to another account of the same organization .

II. Cash flow classification

7. The organization's cash flows are divided into cash flows from current, investment and financial operations.

8. An organization's cash flows are classified depending on the nature of the transactions with which they are associated, as well as on how information about them is used to make decisions by users of the organization's financial statements.

9. An organization's cash flows from transactions related to the organization's ordinary activities that generate revenue are classified as cash flows from current operations. Cash flows from current operations are usually associated with the formation of profit (loss) of the organization from sales.

Information on cash flows from current operations shows users of the organization's financial statements the level of provision of the organization with funds sufficient to repay loans, maintain the organization's activities at the level of existing production volumes, pay dividends and new investments without attracting external sources of financing. Information about the composition of cash flows from current operations in previous periods, combined with other information presented in the entity's financial statements, provides the basis for forecasting future cash flows from current operations.

Examples of cash flows from current operations are:

a) receipts from the sale of products and goods to buyers (customers), performance of work, provision of services;

b) receipts of rental payments, royalties, commissions and other similar payments;

c) payments to suppliers (contractors) for raw materials, materials, work, services;

d) remuneration of the organization’s employees, as well as payments in their favor to third parties;

e) payments of corporate income tax (except for cases where corporate income tax is directly related to cash flows from investment or financial transactions);

f) payment of interest on debt obligations, with the exception of interest included in the cost of investment assets in accordance with the Accounting Regulations “Accounting for expenses on loans and credits” (PBU 15/2008), approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 107n (registered with the Ministry of Justice of the Russian Federation on October 27, 2008, registration number 12523) as amended by orders of the Ministry of Finance of the Russian Federation dated October 25, 2010 No. 132n (registered with the Ministry of Justice of the Russian Federation on November 25, 2010, registration number 19048), dated November 8, 2010 No. 144n (registered with the Ministry of Justice of the Russian Federation on December 1, 2010, registration number 19088) (hereinafter referred to as PBU 15/2008);

g) receipt of interest on receivables from buyers (customers);

h) cash flows on financial investments acquired for the purpose of resale in the short term (usually within three months).

10. Cash flows of an organization from transactions related to the acquisition, creation or disposal of non-current assets of the organization are classified as cash flows from investment transactions.

Information on cash flows from investment transactions shows users of the organization's financial statements the level of the organization's expenses incurred to acquire or create non-current assets that provide cash flows in the future.

Examples of cash flows from investment transactions are:

a) payments to suppliers (contractors) and employees of the organization in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets, including costs of research, development and technological work;

b) payment of interest on debt obligations included in the value of investment assets in accordance with PBU 15/2008;

c) proceeds from the sale of non-current assets;

d) payments in connection with the acquisition of shares (participatory interests) in other organizations, with the exception of financial investments acquired for the purpose of resale in the short term;

e) proceeds from the sale of shares (participatory interests) in other organizations, with the exception of financial investments acquired for the purpose of resale in the short term;

f) providing loans to other persons;

g) repayment of loans provided to other persons;

h) payments in connection with the acquisition of debt securities (rights to claim funds against other persons), with the exception of financial investments acquired for the purpose of resale in the short term;

i) proceeds from the sale of debt securities (rights to claim funds against other persons), with the exception of financial investments acquired for the purpose of resale in the short term;

j) dividends and similar income from equity participation in other organizations;

k) receipts of interest on debt financial investments, with the exception of those acquired for the purpose of resale in the short term.

11. An organization’s cash flows from operations related to the organization’s attraction of financing on a debt or equity basis, leading to a change in the size and structure of the organization’s capital and borrowings, are classified as cash flows from financial transactions.

Information about cash flows from financial transactions provides the basis for forecasting the claims of creditors and shareholders (participants) in relation to the organization's future cash flows, as well as the organization's future needs for raising debt and equity financing.

Examples of cash flows from an organization's financial transactions are:

a) cash contributions from owners (participants), proceeds from the issue of shares, increase in participation shares;

b) payments to owners (participants) in connection with the repurchase of shares (participatory interests) of the organization from them or their withdrawal from the membership;

c) payment of dividends and other payments for the distribution of profits in favor of the owners (participants);

d) proceeds from the issue of bonds, bills, and other debt securities;

e) payments in connection with the redemption (redemption) of bills and other debt securities;

f) receiving credits and loans from other persons;

g) return of loans and borrowings received from other persons.

12. Cash flows of an organization that cannot be unambiguously classified in accordance with paragraphs 8–11 of these Regulations are classified as cash flows from current operations.

Collapsing Threads

Until now, companies have generated cash flow statements including VAT. PBU 23/2011 changes this usual order. The new standard establishes that in a number of cases cash flows are reflected in a collapsed manner (clauses 16 and 17 of PBU 23/2011). Russian accountants will have to use this approach to filling out a report for the first time. It is known only to those who have encountered the use of IFRS.

PBU 23/2011 requires a collapsed presentation of indirect taxes as part of receipts from buyers and customers, payments to suppliers and contractors and payments to the budget or reimbursement from it. In the Russian tax system, indirect taxes are excise taxes and VAT. And so that the reader is left in no doubt about this, we refer to the explanations of the Constitutional Court of the Russian Federation contained in the rulings of December 9, 2002 No. 346-O and of April 2, 2009 No. 475-O-O. Thus, VAT in the report will be presented only in amounts transferred to the budget or received from the budget. There is no need to distribute it; it will participate in the formation of the current flow.

But if your company uses a simplified taxation system, then VAT is not an indirect tax. Therefore, cash outflows to suppliers and contractors must be shown including tax.

In addition, the net procedure for recording cash flows will have to be applied by intermediaries involved in settlements. For example, the cash flow statement of a commission agent selling the principal's goods will include only the amount of commission fees. The same applies to the technical customer of construction, who, as an agent, transfers funds from the investor-developer to designers, contractors and other persons involved in the creation of the property.

Example 3

Pluton OJSC accepts payments from subscribers of MTS, Beeline and Megafon and credits the received funds to the accounts of cellular operators without commission, and at the end of each month receives agency fees from the operators. In the cash flow statement, the company will show only the amounts of these remunerations, that is, revenue from the provision of cash flows from subscribers to operators is not presented in the report.

Thus, cash flows will illustrate the “cash execution” of the income statement, formed on an accrual basis.

Foreign exchange flows

Companies will also have to change the way they report foreign currency transactions. Let us recall that in accordance with the instructions of Order No. 67n, the company compiled a separate cash flow statement for each of the used types of foreign currency. Such reports included amounts characterizing the purchase and sale of foreign currency. Then the data from these reports was recalculated at the exchange rate of the Central Bank of the Russian Federation on the date of reporting, that is, on December 31 of the reporting year. In addition, the company compiled a report on the movement of Russian rubles, which included the amounts spent on the purchase of foreign currency and received from its sale. The final report was obtained by summing up the corresponding indicators of individual reports. Therefore, foreign currency conversion transactions were presented in detail in the cash flow statement.

In comparison with this procedure, PBU 23/2011 (clauses 18 and 19) introduces simpler rules. Foreign currency is considered as cash on a par with cash and non-cash Russian currency. To convert foreign currency transactions into rubles, the rate established by the Central Bank of the Russian Federation on the date of payment is applied. The corresponding amounts immediately participate in the formation of cash flow.

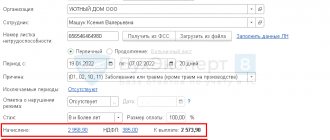

Example 4

Let’s assume that on December 26, 2011, a loan in the amount of 100,000 euros is received in the foreign currency account of Saturn LLC. As of the reporting date, December 31, 2011, the company did not use this amount and did not pay interest. Let us accept the rates of the Central Bank of the Russian Federation in the following values: as of December 26, 2011 – 40 rubles/€, as of December 31, 2011 – 41 rubles/? (numbers are conditional). This transaction makes the following contributions to the cash flow statement figures:

- credits and loans received (line code 4311) - 4,000,000 rubles. (100,000? x 40 rub./?);

- cash balance at the end of the reporting period (line code 4500) – RUB 4,100,000. (100,000? x 41 rub./?);

- the magnitude of the impact of changes in the foreign currency exchange rate against the ruble (line code 4490) – 100,000 rubles. (4,100,000 - 4,000,000).

If during a calendar year (or a shorter period) the official exchange rate of a foreign currency to the ruble changes insignificantly, then when performing a large number of similar transactions in such a currency, the company has the right to use the average rate to convert foreign currency payments into rubles. The procedure for determining this rate must be established independently, but you can use the algorithm described in paragraph 18 of PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.” In accordance with it, the average exchange rate for the period is calculated as the result of dividing the sum of the products of the official exchange rates of a given foreign currency to the ruble, established by the Central Bank of the Russian Federation, and the days of their validity in the period under review by the number of days in this period.

Please note: the sale or purchase of foreign currency no longer generates an independent monetary transaction in the report. Paragraph 5 “e” of PBU 23/2011 emphasizes that foreign exchange transactions are not cash flows.

III. Reflection of cash flows

14. The organization's cash flows are reflected in the cash flow statement, subdivided into cash flows from current, investing and financial operations.

15. Each significant type of income to the organization of cash and (or) cash equivalents is reflected in the cash flow statement separately from the organization's payments, unless otherwise provided by these Regulations.

16. Cash flows are reflected in the cash flow statement on a net basis in cases where they characterize not so much the activities of the organization as the activities of its counterparties, and (or) when receipts from some persons determine corresponding payments to other persons. Examples of such cash flows are:

a) cash flows of a commission agent or agent in connection with the provision of commission or agency services (except for fees for the services themselves);

b) indirect taxes as part of receipts from buyers and customers, payments to suppliers and contractors and payments to the budget system of the Russian Federation or reimbursement from it;

c) receipts from the counterparty for reimbursement of utility bills and making these payments in rental and other similar relationships;

d) payment for transportation of goods with receipt of equivalent compensation from the counterparty.

17. Cash flows are shown on a net basis in the cash flow statement in cases where they are characterized by rapid turnover, large amounts and short repayment periods. Examples of such cash flows are:

a) mutually determined payments and receipts for settlements using bank cards;

b) purchase and resale of financial investments;

c) making short-term (usually up to three months) financial investments using borrowed funds.

18. The indicators of the organization's cash flow statement are reflected in the currency of the Russian Federation - rubles.

The amount of cash flows in foreign currency is converted into rubles at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation on the date of payment or receipt. If there is an insignificant change in the official exchange rate of a foreign currency to the ruble, established by the Central Bank of the Russian Federation, conversion into rubles associated with the performance of a large number of similar transactions in such foreign currency can be carried out at the average rate calculated for a month or a shorter period.

If, immediately after receiving foreign currency, an organization, as part of its normal activities, changes the received amount of foreign currency into rubles, then the cash flow is reflected in the cash flow statement in the amount of rubles actually received without intermediate conversion of foreign currency into rubles. If, shortly before a payment in foreign currency, an organization, as part of its normal activities, exchanges rubles for the required amount of foreign currency, then the cash flow is reflected in the cash flow statement in the amount of rubles actually paid without intermediate conversion of foreign currency into rubles.

19. Balances of cash and cash equivalents in foreign currency at the beginning and end of the reporting period are reflected in the statement of cash flows in rubles in the amount determined in accordance with the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” ( PBU 3/2006), approved by Order of the Ministry of Finance of the Russian Federation dated November 27, 2006 N 154n (registered with the Ministry of Justice of the Russian Federation on January 17, 2007, registration number 8788), as amended by Orders of the Ministry of Finance of the Russian Federation dated December 25 2007 N 147n (registered with the Ministry of Justice of the Russian Federation on January 28, 2008, registration number 11007), dated October 25, 2010 N 132n (registered with the Ministry of Justice of the Russian Federation on November 25, 2010, registration number 19048).

The difference arising in connection with the recalculation of the organization's cash flows and cash balances and cash equivalents in foreign currencies at rates on different dates is reflected in the cash flow statement separately from the organization's current, investing and financial cash flows as the impact of changes in the foreign currency exchange rate against the ruble.

20. Significant cash flows of the organization between it and business companies or partnerships that are subsidiaries, dependent or main in relation to the organization are reflected separately from similar cash flows between the organization and other persons.