Who takes SZV-STAZH and when?

The SZV-STAZH form is an annual report on personalized accounting in the compulsory pension insurance system. It reflects information for each insured person, on the basis of which he will be assigned a pension. All policyholders , that is, employers of insured persons, to submit a report

Organizations and individual entrepreneurs take SZV-STAZH for those who work for them under an employment or civil contract. The exception is self-employed people with whom GPC agreements have been concluded. Insurance premiums are not calculated for them and are not included in the report. If a self-employed person works with an organization or individual entrepreneur under an employment contract, he is an ordinary employee for whom contributions are calculated and SZV-STAZH is submitted.

You need to report even when only the director is listed in the LLC - the only founder without an employment contract. The report also includes employees who were on leave for the entire year without pay or to care for a child and did not receive any payments from the employer. There is no such thing as a zero SZV-STAZH report.

Single entrepreneurs pay insurance premiums only for themselves and cannot enter into an employment contract with themselves, so they do not need to take SZV-STAZH.

The deadline for submitting the SZV-STAZH is annually, no later than March 1 of the following reporting year. But there are situations when the report must be submitted within a year, for example:

- The employee applies for a pension . SZV-STAZH is submitted within three calendar days from the date of application from the employee or request from the Pension Fund. In the report, you need to select the “Pension assignment” information type.

- An LLC or individual entrepreneur is closing down . SZV-STAZH is submitted within a month from the date of approval of the interim liquidation balance sheet of the LLC or the decision to close the individual entrepreneur. The type of information in the report is “Initial”.

- The LLC began bankruptcy proceedings . SZV-STAZH is handed over before the manager’s report on the results of bankruptcy proceedings is submitted to the arbitration court. Information type is “Original”.

Procedure and deadline for passing SZV-STAZH in 2022

The SZV-STAZh report form, submitted in 2022 for 2022, was approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p (as amended on September 6, 2021). In comparison with the information previously included in the quarterly reports submitted to the Pension Fund, there is nothing fundamentally new in it. Even the tables reflecting data on experience are similar. The current form applies from December 12, 2021. The latest edition has made minor adjustments:

- with code "SIMPLE" gr. 11, the codes of territorial conditions (gr. 8), special working conditions (gr. 9), conditions for early assignment of a pension (gr. 12) do not apply;

- with code "QUALIF" gr. 11 you can indicate the codes of special conditions and conditions for the early assignment of a pension during the period of vocational training.

Read more about the latest changes in our article “The Pension Fund of the Russian Federation has changed the procedure for filling out SZV-STAZH.”

However, the Pension Fund considered it necessary to obtain, along with information on length of service, some information that would clarify certain issues regarding the reporting employer:

- on the number of persons for whom information on length of service was generated;

- on the summary amounts of contributions accrued and paid for the year (dividing them by type of payment) and the debt on them at the beginning and end of the year;

- on the existence of working conditions that give the employee the right to early retirement, and on the number of such persons.

To reflect this data, Resolution No. 507p approved another form - EDV-1, which must be submitted along with the SZV-STAZH report.

See also “What are the differences between the SZV-STAZH form and the EDV-1 form?” .

As the deadline for submitting a report on experience, the Law “On Individual (Personalized) Accounting...” dated 04/01/1996 No. 27-FZ (clause 2, Article 11) indicates March 1 of the year following the reporting year. Law No. 27-FZ does not contain rules on shifting it if it coincides with a weekend, so if March 1 is a general day off, the report will have to be submitted earlier.

For 2022, the SZV-STAZH report must be submitted by 03/01/2022.

At the same time, the law also provides for exceptions to the deadline for submitting the SZV-STAZH report.

So, if the insured person submits an application for a pension, then the report must be submitted within 3 calendar days from the date of receipt of such an application (Clause 2, Article 11 of the Law “On Persuance” dated 04/01/1996 No. 27-FZ).

How to fill out the SZV-STAZH when applying for a pension and what additional documents to prepare, find out in the ConsultantPlus Typical Situation, having received trial access to the system for free.

Also, the report is submitted ahead of schedule by the insured in the event of liquidation, reorganization, termination of the status of a lawyer, the powers of a notary engaged in private practice (Clause 3 of Article 11 of the Law “On Persuchet” dated 04/01/1996 No. 27-FZ). Information on when a report must be submitted in such situations is given in the table:

| Policyholder submitting a report early | In what situation is a report submitted early? | When is the report due? |

| Legal entity in liquidation | Upon liquidation | Within one month from the date of approval of the interim liquidation balance sheet |

| In case of bankruptcy | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court | |

| Legal entity created during reorganization | When reorganizing by separating | Within one month from the date of approval of the transfer act (separation balance sheet), but no later than the day of submission of documents for its state registration |

| A legal entity merged with another legal entity during reorganization | Upon reorganization by merger | No later than the day of submission of documents for making an entry in the Unified State Register of Legal Entities on the termination of the activities of the affiliated legal entity |

| Individual entrepreneur | Upon termination of activity | Within one month from the date of the decision to terminate activities as an individual entrepreneur |

| In case of bankruptcy | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court | |

| Lawyer, notary, private practice | Upon termination of the status of a lawyer or the powers of a notary | Simultaneously with the application for deregistration as an insured |

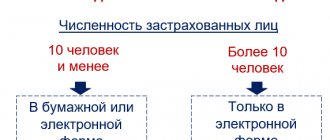

From January 10, 2022, for employers submitting information about the length of service for a number of persons exceeding 10, there is an obligation to send reports to the Pension Fund electronically. When the number of employees whose data is included in the report is 10 or less, the information can be submitted on paper (previously, the maximum number of insured persons for paper submission was 24).

Where and how to take SZV-STAZH

SZV-STAZH is submitted to the territorial office of the Pension Fund, in which the organization or individual entrepreneur is registered as policyholders. The delivery method depends on the number of employees included in the report:

- more than 10 people - only electronically via telecommunication channels;

- 10 or less people - there is a choice: submit on paper (in person or by mail) or electronically through TKS channels.

The electronic report must be signed with an enhanced qualified electronic signature. The paper SZV-STAZH can be submitted in person or through an authorized representative with a power of attorney, including an electronic one.

Rules for filling out SZV-STAZH

When filling out the paper SZV-STAZH form manually, follow the rules:

- use a ballpoint or fountain pen of any color except red and green;

- write in capital block letters, without blots or corrections;

- if there are no indicators, put dashes - a straight line in the middle of the cell.

Information about wages and other payments in favor of the employee, about accrued insurance premiums is taken from salary slips. About the period of work - from orders and other personnel records documents, GPC agreements.

The report is signed by the manager or representative with a power of attorney. Be sure to fill out the job title and signature. A stamp is placed if there is one.

Sample of filling out SZV KORR

Let's look at the step-by-step procedure for filling out the SZV CORR form. It consists of 6 sections. Sections 1-2 are completed for all three types of forms. You can find the form in the Resolution of the Pension Fund of Russia Board dated December 6, 2018 No. 507p (Appendix 3). In addition, it can be downloaded from the Pension Fund website. To do this, go to the “Employers” section, click on the “Free programs, forms, protocols” link.

Form title

At the beginning of the form, provide information to identify the policyholder: number in the Pension Fund of Russia, INN and KPP. In the “Information Type” cell, enter a four-letter code (KORR, OTMN or SPECIAL). There are quite a few reporting period codes; they are indicated in accordance with the Classifier. It is presented in the Appendix to the Procedure for filling out reporting forms of Resolution No. 3p.

For example, in 2022, an accountant discovered incorrect information about an employee in reporting to the Pension Fund for 2022. Then in the cells of the column “Reporting period in which information is provided” the numbers 0 and 2022 are indicated. In the column “Reporting period for which information is adjusted” 0 and 2022 are entered.

Section 1

The section once again provides the details of the policyholder (employer). The number in the Pension Fund, KPP and TIN are indicated for two (current and adjusted) periods, even if they have not changed. Also enter the short name of your company in accordance with the constituent documents.

Section 2

In this section you need to fill out a table with information about insured employees (full name and SNILS number). Indicate those persons for whom an error was made (CORR type), who were “forgotten” (OSOB) or turned out to be superfluous (OTMN).

Section 3

This part indicates information that was incorrect (KORR) or “lost” (OSOB). First we enter the category code of the insured employee from the Classifier of the Pension Fund Resolution No. 507p. Examples of filling out this field: HP (hired employee), FL (individuals who do not make payments and remuneration to other individuals), VZHNR (temporary resident employee). From April 1, 2020, additional lines must be filled in if one of the following codes was used for the insured person:

- MS - employee of a small or medium-sized business (SME)

- VPMS - temporary SME worker

- VZhMS - temporary resident SME worker

- KV - employee of an organization included in the register of socially oriented non-profit organizations (SONCO)

- VZHKV - temporary resident employee of SONKO

- VPKV - temporary worker of SONKO

The “Contract type” field can have two values: “labor” or “civil law”. We indicate the one that is concluded with this person. Next, the number and date of concluding the contract with the employee are noted. These two fields must be completed if corrections are made for periods up to and including 2001. The column “Additional fare code” is filled in if we are talking about crew members of civil aviation aircraft (code AVIA). If this column is filled in, then the “Insured Person Category Code” column must be empty.

Section 4

In section 4 we now include correct information about the amounts of payments to employees and insurance premiums. The first column is the month code for which corrections are needed. It represents the first three letters of the name of the corresponding month. Exceptions are March (MRT) and November (Nbr).

The following column “Adjusted payment amounts” is filled out differently depending on the period for which the data is corrected (supplemented):

- 1996-2001: in column 2 “Amount of payments” enter the amount of accruals that are taken into account for calculating the pension; in column 3, indicate the amount minus accruals for sick leave and scholarships;

- 2002-2009: the block with the payment amount is not filled in;

- from 2010: fill in all columns 2-6; reveal the structure of the total amount of payments; the base for insurance premiums is divided into maximum and exceeding the maximum. Also separately disclose the amounts for civil contracts.

The part on additional calculation of insurance premiums is also filled out depending on the period:

- 1996-2000: enter information in columns 7 and 8 (additional contributions paid by the employer and contributions paid from the employee’s earnings);

- 2001: fill in column 7 of the table only;

- 2002-2013: columns 9 and 10 are filled in (additional assessment of contributions to the insurance/funded pension);

- from 2014: the amount of contributions is entered only in column 11; Contributions calculated on a base above the maximum are not taken into account.

The last two columns must be completed if you are not a premium payer for individuals. In this case, the adjustment is performed only for the period from 2010 to 2013.

Section 5

Section 5 is intended to correct data on persons employed in certain types of work listed in paragraphs. 1-18 Federal Law dated December 28, 2013 No. 400-FZ. In this case, contributions are calculated at an additional rate. For example, for employees of enterprises with hazardous production conditions.

In the table, enter the codes of the month and special assessment of working conditions from the Classifier. The remaining columns indicate the amounts of payments to employees for such types of activities. Everywhere we deposit the correct amount, taking into account corrections.

Section 6

In the sixth part of the form we indicate the corrected terms of work of the insured persons (blocks 1 and 2 of the table). Columns 3 and 4 relate to the place and working conditions and are filled out if necessary based on the Classifier. For example, work with difficult working conditions is designated by code ZP12B or 27-2.

Using special Classifier codes, we also fill in the remaining columns. If there are no grounds, they are left blank. At the end of the form, indicate the required details: the position of the manager, his signature with a transcript and the date.

How to fill out SZV-STAZH for 2022

From December 12, 2022, an updated procedure for filling out the SZV-STAZH is in effect. It will be applied starting from the 2022 report. The changes mainly affected employees who have the right to early retirement.

Section 1 “Information about the policyholder”

Fill in the registration number in the Pension Fund. It is taken from the notification sent by organizations or individual entrepreneurs after registering as an insurer.

TIN - fill out starting from the first cell on the left. There are 12 cells for it, so organizations put dashes in the last two cells, for example: “1 2 3 4 5 6 7 8 9 9 — -”.

Checkpoint - only for organizations. Separate divisions are indicated by the checkpoint as in the notification of registration with the Federal Tax Service at their location.

Indicate the abbreviated name of the organization as in the constituent documents (in Latin transcription is possible) or the full name of the entrepreneur.

About the type of information “Initial”, if you are taking SZV-STAZH for the first time in 2022.

Section 2 “Reporting period”

The calendar year is the one for which you are reporting, that is, 2021. If you fill out SZV-STAZH with the type of information “Pension assignment”, indicate the current year - 2022.

Section 3 “Information about the period of work of insured persons”

Fill out the table of 14 columns:

- 1 - serial number;

- 2-4 — Full name of the employee in the nominative case. The annual report also includes those for whom SZV-STAZH was submitted during 2022 with the type of information “Pension assignment”;

- 5 — employee’s insurance number in the format “023-456-789-12”;

- 6 and 7 - start and end dates of work within 2022. If a person worked the entire reporting period, enter 01/01/2021 and 12/31/2021 . If there were unworked periods, for example, leave to care for a child or at your own expense, they are indicated on separate lines, and the full name and SNILS are filled out once. The serial number will also be the same. There are also several periods of work when during the year the employee had both an employment contract and a civil law one. If you fill out SZV-STAZH with the “Pension Assignment” type, column 6 will contain 01/01/2022, and column 7 will indicate the employee’s expected retirement date;

- 8 — code of territorial working conditions from the classifier. Fill out when working conditions differ from normal and, therefore, the employee has the right to a preferential pension. For example, for those who work in areas equated to the regions of the Far North, indicate the code “MKS” or “MKSR” - depending on the type of benefit;

- 9 — codes for special working conditions are taken from the classifier and indicated by harmful workers who have the right to a preferential pension. The column is filled in if insurance premiums at the additional tariff were paid for the corresponding periods of work. For example, code 27-2 indicates work in difficult working conditions;

- 10 — special codes for the basis for calculating the insurance period for beneficiaries;

- 11 — fill out when there is additional information on work periods. Designated by codes from the classifier. For example, unworked periods: “VRNETRUD” - sick leave, “NEOPL” - leave without pay, “CHILDREN” - leave to care for a child up to 1.5 years. The code “DLOTPUSK” is filled in only for pest workers when they are on annual leave and there are no additional insurance premiums accrued for this period. For ordinary employees, the period of annual leave is not indicated in any way. The period of work under a GPC agreement is designated by the code “AGREEMENT” if payment was accrued under it during the reporting period. If payment has not yet been made, use the code “NEOPLDOG”. According to the new filling rules, if column 11 contains the code “SIMPLE”, indicating downtime due to the fault of the employer, columns 8 and 9 will be empty. This period is not included in the length of service for a preferential pension. Another innovation: the code “QUALIF” - for periods of vocational training for workers away from production. For pests, it can be indicated simultaneously with the completed column 8 or 9 - codes of territorial or special working conditions. But only on the condition that the pest, while away from work, underwent vocational training or received additional vocational education. This period is included in the grace period. If the employee has undergone an independent qualification assessment, the code “QUALIFY” in column 11 is filled in, but column 8 or 9 is not. If column 11 indicates the code “CHILDREN” - leave for a parent to care for a child up to 1.5 years old, column 8 should be empty or with the code “VILLAGE”, indicating work in agriculture;

- 12 and 13 - special codes of grounds for the conditions for early assignment of an insurance pension and additional information on such beneficiaries.

- 14 - fill out only for employees who quit on December 31, 2022. That is, on the last day of the reporting period for which the SZV-STAZH is submitted. In this case, the date 12/31/2021 is entered in column 14.

Sections 4 and 5

Leave them blank if you are submitting a report for 2022. These sections are filled out only when passing the SZV-STAZH for an employee who retires in 2022.

EDV-1

The EDV-1 inventory is included in one set with the SZV-STAZH form. It comes with the type of information “Initial” - for the initial report, as well as “Correcting” or “Cancelling” - if you need to correct the EFA-1 itself. When passing the SZV-STAZH for 2022 in the EDV-1 form, fill out the following sections:

- “Details of the policyholder submitting the documents” - by analogy with filling out the details in SZV-STAZH.

- “Reporting period (code)” - code “0” and year “2021”.

- “List of incoming documents”—in the column “Number of insured persons” indicate the number of employees for whom SZV-STAGE is submitted for 2022.

Section 4 is not completed if EDV-1 accompanies the SZV-STAGE form. It is only needed if you take SZV-ISH for periods before 01/01/2017 or SZV-KORR with the “Special” type.

Section 5 is filled out if the EDV-1 inventory comes complete with SZV-STAZH and SZV-ISKH, which contain information about employees with the right to early retirement.

Rules for filling out form SZV-6-1

Information on accrued and paid insurance premiums for compulsory pension insurance and the insurance experience of the insured person was provided by the policyholder (employer) or an individual who independently pays insurance premiums to the territorial body of the Pension Fund of the Russian Federation.

Form SZV-6-1 information on accrued and paid insurance contributions for compulsory pension insurance and the insurance period of the insured person is submitted if in the reporting period it was necessary to indicate leave without pay and (or) receipt of temporary disability benefits and (or) the work of the insured person with the need to fill in the details “territorial working conditions (code)”, “special working conditions (code)”, “calculation of the insurance period”, “conditions for the early assignment of a labor pension”.

How to correct mistakes after passing SZV-STAZH

If, after successfully submitting the SZV-STAZH report, you find errors in it, you need to submit an updated report. In what form you submit it depends on what exactly you made a mistake:

- you forgot to include the employee in the report - in the SZV-STAZH form with the information type “Additional”, fill out information only for this person;

- incorrectly indicated the period of work - fill out a special form SZV-KORR with the “KORR” type only for the people for whom corrections need to be made;

- included an extra person in the report - fill out the SZV-KORR with the type “OTMN” for it.

Together with the clarification, submit the EDV-1 inventory with the “Initial” type.

Errors can also be detected by the Pension Fund itself. Then the report will not be accepted - in whole or in part. Also, SZV-STAZH can first accept and then send an error report and a notification about the correction of inaccuracies. If errors are identified by the Pension Fund, you must submit an update within 5 working days from the date of receipt of the notification, otherwise there will be penalties.

Penalties for lateness, failure to submit and errors in SZV-STAZH

If you are late in submitting your SZV-STAZH, the fine will be 500 rubles for each employee for whom you did not report. If the report contains incomplete or unreliable information, the fine is the same, but it will be multiplied by the number of employees for whom you submitted incorrect information (Article 17 of Law No. 27-FZ of 04/01/1996).

Officials of the organization - the director or chief accountant - may also be fined through the court in the amount of 300 to 500 rubles . (Part 1 of Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation). Individual entrepreneurs are not subject to administrative liability on this basis.

If errors in SZV-STAZH led to the Pension Fund overpaying someone’s pension, the employer may be required to recover damages for overspending of budget funds in court.

If you are required to take the SZV-STAZH electronically, but passed it on paper, for violating the method of submitting information there will be a fine of 1000 rubles.

In any form?

Form SZV-6-4 is submitted on paper or in electronic form in accordance with the legislation of the Russian Federation. At the same time, organizations with an average number of employees of more than 50 people must submit reports according to the form only in electronic form.

[pfr_form=Do you want to prepare SZV-6-4 right now?]

List of details of form SZV-6-4 and rules for filling them out.

| Props | Filling rules | Mandatory filling |

| Policyholder details | ||

| Pension Fund registration number | The number under which the employer is registered as a payer of insurance premiums is indicated, indicating the codes of the region and district according to the classification adopted by the Pension Fund of Russia | Required to fill out. The registration number of the Pension Fund is communicated to the employer by the territorial body of the Pension Fund. |

| Organization name (abbreviated) | The short name of the organization is indicated | Required to fill out |

| INN checkpoint | Indicate the taxpayer identification number - the employer and the reason code for registration | Required to fill out |

| Insured person category code | Filled out in accordance with the parameter classifier of the same name (Appendix No. 1 to these Instructions). Corrective (cancelling) information must contain the category code of the insured person specified in the original information. | Required to fill out |

| Date of submission to the Pension Fund | Fill in as follows: DD name of the month YYYY. The date of receipt of documents by the territorial body of the Pension Fund is indicated. | To be completed by the territorial body of the Pension Fund of Russia |

| Reporting period | The symbol “X” marks the reporting period (quarter, half-year, 9 months, year), information for which the form contains | Required to fill out |

| Information type | The “X” symbol indicates one of the following values: | Required to fill out |

| “initial” - information submitted for the first time by the policyholder for the insured person; | If the original form submitted was returned to the policyholder due to errors contained in it, the original form shall also be submitted in its place. | |

| “corrective” - information submitted for the purpose of changing previously submitted information about the insured person for the specified reporting period. In case of re-registration of the policyholder, when submitting the adjustment form, it is mandatory to fill in the details “PFR Registration Number during the adjusted period.” | If the original form contained information that did not correspond to reality, then the corrective form must contain the information in full. Thus, the information on the corrective form completely replaces the information on the original form. Corrective forms are submitted along with the original forms for the reporting period in which the error was discovered. Accompanied by form ADV-6-2. In this case, the reporting period for which changes are made is indicated in the “for the reporting period” column, opposite the “corrective” form type. | |

| “cancelling” - information submitted for the purpose of completely canceling previously submitted information about the insured person for the specified reporting period. In case of re-registration of the policyholder, when submitting the cancellation form, it is mandatory to fill in the details “PFR Registration Number during the adjusted period”. | In the cancellation form, fill in the details up to and including “Insurance number”. Canceling forms are submitted along with the original forms for the reporting period in which the error was discovered. Accompanied by form ADV-6-2. In this case, the reporting period for which changes are made is indicated in the “for the reporting period” column, opposite the “cancelling” form type. | |

| Agreement (type of agreement) concluded with the insured person: | The “X” symbol indicates one of the following values: | Required to fill out |

| “labor” - filled in for insured persons to whom insurance premium payers make accruals in the form of payments and other remuneration in their favor under employment contracts | ||

| “civil law” - filled in for insured persons to whom insurance premium payers make accruals in the form of payments and other remuneration in their favor under civil law contracts | If more than one civil law contract is concluded with the insured person during the reporting period, one form SZV-6-4 is submitted for the insured person | |

| Information about the insured person | ||

| Full Name | Details are indicated in the nominative case. Similar to the details of the SZV-1 form of the same name. | Required to fill out |

| Insurance number | The insurance number of the individual personal account of the insured person is indicated. Similar to the details of the SZV-1 form of the same name. | Required to fill out |

| Information on the amount of payments and other remuneration accrued in favor of an individual | The amount of payments and other remunerations accrued by payers of insurance premiums - policyholders in favor of an individual for the last three months of the reporting period with a monthly breakdown in rubles and kopecks is indicated. | Fill in if information is available during the reporting period. Indication of total values is mandatory. |

| Amount of payments and other rewards | The amount of payments and other remunerations accrued by payers of insurance premiums in favor of an individual within the framework of labor relations, including employment contracts, and civil law contracts, the subject of which is the performance of work, the provision of services, as well as under copyright contracts, contracts for alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art, in accordance with parts 1 and 2 of Article 7 of the Federal Law of July 24, 2009 No. 212-FZ “On Insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund,” with the exception of payments named in paragraphs 14 and 15 of Article 1 and in Part 3 of Article 9 of the said Federal Law | Fill in if information is available during the reporting period. Indication of total values is mandatory. |

| Including those for which insurance premiums for compulsory pension insurance are calculated: those included in the base for calculating insurance premiums that do not exceed the maximum; included in the base for calculating insurance premiums, exceeding the maximum | The amount of payments and other remunerations accrued by the payers of insurance premiums in favor of an individual, for which the payers of insurance premiums - policyholders, accrued insurance premiums for compulsory pension insurance, is indicated. For payers of insurance premiums who make payments and other remunerations in favor of crew members of ships registered in the Russian International Register of Ships, in relation to ship crew members, the amount of payments and other remunerations corresponding to the amount of payments and other remunerations for which insurance contributions for compulsory pension are calculated insurance. | Fill in if information is available during the reporting period. Indication of total values is mandatory. |

| Information on the amount of payments and other remunerations of the insured person employed in the relevant types of work for which insurance premiums are calculated at an additional rate | The amount of payments and other remunerations accrued by payers of insurance premiums - policyholders in favor of an individual for the last three months of the reporting period with a monthly breakdown in rubles and kopecks is indicated. | Fill in if information is available during the reporting period. Indication of total values is mandatory. |

| The amount of payments and other remunerations accrued to an insured person employed in the types of work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation” | The amount of payments and other remunerations accrued by the payers of insurance premiums in favor of an individual, for which the payers of insurance premiums - policyholders, accrued insurance premiums at an additional rate, is indicated | Fill in if information is available during the reporting period. Indication of total values is mandatory. |

| The amount of payments and other remunerations accrued to the insured person employed in the types of work specified in subparagraphs 2-18 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation” | The amount of payments and other remunerations accrued by the payers of insurance premiums in favor of an individual, for which the payers of insurance premiums - policyholders, accrued insurance premiums at an additional rate, is indicated | Fill in if information is available during the reporting period. Indication of total values is mandatory. |

| Information on accrued and paid insurance contributions for compulsory pension insurance | ||

| The amount of insurance contributions for the insurance part of the labor pension | ||

| Accrued | The amount of insurance contributions for the insurance part of the labor pension, accrued in the last three months of the reporting period, is indicated in rubles and kopecks. For payers of insurance premiums who make payments and other remuneration in favor of crew members of ships registered in the Russian International Register of Ships, the amount of insurance premiums corresponding to the amount of insurance premiums to finance the insurance part of the labor pension at the basic tariff is indicated in relation to crew members of ships | Fill in if information is available during the reporting period |

| Paid | The amount of insurance contributions paid for the insurance part of the labor pension in the last three months of the reporting period is indicated, in rubles and kopecks. The amount of overpaid (collected) insurance premiums is not taken into account in this detail. | Fill in if there is information available during the reporting period or payment for the insured person (including the dismissed person) of debts for previous reporting periods |

| The amount of insurance contributions for the funded part of the labor pension | ||

| Accrued | The amount of insurance contributions for the funded part of the labor pension, accrued in the last three months of the reporting period, is indicated in rubles and kopecks. For payers of insurance premiums who make payments and other remuneration in favor of crew members of ships registered in the Russian International Register of Ships, the amount of insurance premiums corresponding to the amount of insurance premiums to finance the funded part of the labor pension at the basic tariff is indicated in relation to the crew members of ships. | Fill in if information is available during the reporting period |

| Paid | The amount of insurance contributions paid for the insurance part of the labor pension in the last three months of the reporting period is indicated, in rubles and kopecks. The amount of overpaid (collected) insurance premiums is not taken into account in this detail. | Fill in if there is information available during the reporting period or payment for the insured person (including the dismissed person) of debts for previous reporting periods |

| Work period for the last three months of the reporting period | ||

| From (dd.mm.yyyy.) Software (dd.mm.yyyy.) | Dates must be within the reporting period | Fill in if information is available during the reporting period |

| Territorial conditions (code) | Similar to the details of the SZV-1 form of the same name. At the same time, the size of the regional coefficient established centrally for the wages of workers in non-production industries in the regions of the Far North and areas equated to the regions of the Far North is not indicated. If an employee performs work full-time during a part-time work week, the period of work is reflected according to the actual working time worked. If the employee performs work part-time, the volume of work (share of the rate) in this period is reflected. | Fill in if information is available during the reporting period |

| Special working conditions (code) Calculation of length of service basis (code) additional information conditions for early assignment of a labor pension basis (code) additional information | Similar to the details of the SZV-1 form of the same name. The period of “leave without pay” and “for temporary disability” is indicated using parameter classifier codes (Appendix 1). For insured persons employed in the jobs specified in subparagraph 1-18 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation,” codes of special working conditions and (or) grounds for early assignment of a labor pension are indicated only in the case of accrual (payment) insurance premiums at an additional rate. In the absence of accrual (payment) of insurance premiums at the additional tariff, codes of special working conditions and (or) grounds for early assignment of a labor pension are not indicated. | Fill in if information is available during the reporting period |

Using Contour.Extern you can also prepare and check:

- personalized accounting in the Pension Fund: new forms SZV-6-4, ADV-6-5, as well as SZV-6-1, SZV-6-2, ADV-6-2, ADV-6-3;

- insurance premiums - forms RSV-1, RSV-2, RV-3;

- registration of employees for retirement - form SPV-1;

- information on payments and remuneration - forms SZV-6-3, ADV-6-4;

- annual reporting until 2010 - forms SZV-4-1, SZV-4-2, ADV-11, ADV 6-1;

- receipt and exchange of insurance certificates - forms ADV-1, ADV-2, ADV-3, ADV-9;

- state co-financing - forms DSV-1, DSV-3.