In what cases and who needs

To apply for benefits, an elderly citizen must bring a package of documents to the Pension Fund. It includes a work book, passport and SNILS. At the same time, the work book is the main document certifying periods of work before 2002. After 2002, labor data is contained in the Pension Fund of Russia - in the personalized accounting system (SPA). To confirm earnings before 2002, two methods are used to calculate the average monthly salary:

- The average monthly income for 2000-2001 is taken. At this time, the Pension Fund of the Russian Federation already had an STC in force, so no additional documents need to be provided in this case;

- if the employee’s income in 2000-2001 was very modest or the person did not work at all at that time, a salary certificate for pension may be required for any 5 consecutive years in the period before 01/01/2002. This will help increase your retirement benefits.

Let us say right away that the need to provide a certificate was due to the requirements of the Ministry of Labor Resolution No. 16, Pension Fund of the Russian Federation No. 19pa dated February 27, 2002, but currently this document has lost its force (see Order of the Ministry of Labor No. 1027n, Pension Fund of the Russian Federation No. 494p dated December 11, 2014) . However, the Pension Fund pretends that it doesn’t seem to know about this and continues to demand that this information be provided. You can complain and go to court... but this is extra time, it’s easier to do what they demand.

What documents are needed to obtain a certificate?

A certificate of the amount of earnings is drawn up according to the established template, but in order to draw it up correctly, you must submit:

- passport of a citizen of Russia or another country;

- original work book;

- documentation issued by the employer confirming the length of service worked at this enterprise;

- a certificate containing information about earnings for the period before 2002;

- if there are dependents or incapacitated family members, they must submit documents confirming this circumstance, and they must be issued by social protection authorities;

- presence of a residence permit indicating territorial relation to this particular branch of the Pension Fund of Russia;

- paper confirming the change of surname or other initials;

- If you have a disability, you must attach the appropriate certificate.

Compilation rules

The document is drawn up in any form. It should contain:

- corner stamp, date of issue and document number;

- FULL NAME. and the applicant's date of birth;

- work periods and organization;

- salary indicated monthly, reflecting the total amounts by year;

- an indication of the currency in which the accruals took place;

- amounts are reflected as accrued, and not actually paid (due to the deduction of taxes).

The following are excluded from earnings:

- compensation for unused vacation;

- child care allowance.

In the note you need to indicate the months of accrual and the amount of certificates of incapacity for work, periods of vacation at your own expense.

Below it is written that for all accruals, deductions were made to the Pension Fund of the Russian Federation at established rates. The basis for issuing the form (personal accounts, pay slips) is also included.

The document is certified by the signature of the chief accountant, the head of the enterprise and a seal.

Carefully study the sample salary certificate for calculating a pension and the rules for filling it out. Judicial practice shows that it is the employer who will be punished for errors made in this form. Thus, the Arbitration Court of the Central District issued a Resolution dated June 11, 2019 in case No. A83-4304/2018, in which it agreed with the decision of the Pension Fund of Russia to recover about 150 thousand rubles from the company for the fact that an error was made in the certificate. From the case materials it follows that the employee asked the employer for a certificate from the Pension Fund for the purpose of assigning an old-age pension. The employer provided the certificate, but incorrectly indicated the amount of the employee’s salary in the period from January 1986 to February 1992. Fund employees calculated the pension taking into account these data, but then they doubted it and carried out a check. It turned out that due to an error, the pensioner was paid more than he should have been paid for 32 months. The total amount of the overpayment was 144,742.82 rubles. This money was not demanded from the pensioner, but was collected from the company, since it was the employer who was considered guilty. The arbitration court agreed with this decision. In addition to the overpayment, the organization had to pay a state fee in the amount of over 5 thousand rubles. As a result, an error in the salary certificate cost the employer almost 150 thousand rubles.

What documents must be submitted to the Pension Fund to apply for a pension?

To receive a pension, a citizen must collect a package of documents and submit them to the Pension Fund at the place of residence. In paragraph 6 of Art. 21 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ states that the list of documents required to establish a pension is determined by the Government of the Russian Federation. Turning to the order of the Ministry of Labor dated January 19, 2016 No. 14n, we find in paragraph 17 a list of documents that a citizen must submit to the Pension Fund:

- application for a pension;

- document proving the identity, age and citizenship of the person applying for a pension (passport);

- documents confirming periods of work and other periods included in the insurance period (work book, labor and civil contracts, personal accounts and salary statements);

- other documents to confirm special circumstances.

The salary certificate we mentioned to the Pension Fund is not listed in the list of documents. However, it is mentioned in the no longer valid Resolution of the Ministry of Labor dated February 27, 2002 No. 16. Nevertheless, the Pension Fund continues to require a salary certificate, and it appears in the list of documents required for registration of a pension posted on the Pension Fund website. Therefore, despite doubts about the legality of the requirement to submit a salary certificate, we will analyze what information needs to be included in it and where to get it.

Where can I get a salary certificate?

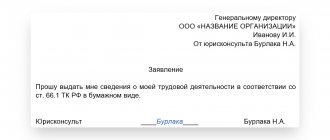

A salary certificate can be issued by the accounting department of the enterprise where the citizen worked in the years selected for calculating the pension. It is better to apply for a certificate of average monthly earnings by submitting a written application drawn up in free form. Art. 62 of the Labor Code of the Russian Federation obliges the employer to issue a certificate within 3 days from the date of the employee’s application. This article of the Labor Code does not specify whether this norm applies only to current employees or to former ones too. However, based on the situation (and Rostrud agrees with this position), we can conclude that former employees have the same rights as current employees to receive information directly related to their work.

The employer has the right to determine the form of the certificate independently, taking into account the necessary information that must be included in such a certificate. A new salary certificate form can be found here.

If the enterprise where the citizen worked in past years does not currently exist, you can find the legal successors of the old organization. If any are not found or are missing, you will have to contact the archive at the former location of the company where the documents are stored.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

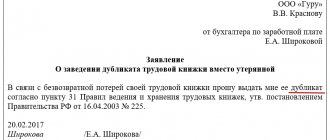

In what order and how is the certificate issued?

At the legislative level, there is no such requirement as the mandatory submission of a written request to obtain a certificate of income. But in addition to laws, there are internal regulations of organizations. For example, bank certificates are issued strictly upon written applications and in person to the applicant.

In large companies, institutions and enterprises, the same scheme for processing requests is practiced. If a certificate of average salary is required from a small organization (2020 sample), then the operation can be carried out without first submitting an application.

The Labor Code regulates the time frame for how long the employer must produce this paper. Article No. 62 of the Labor Code of the Russian Federation states that after a request, the document must be issued in person within 3 days in working hours. It may reflect not only the average salary, but also the payment of tax to the Pension Fund and the receipt of benefits, if any (for example, maternity leave and social benefits).

The algorithm of actions is as follows:

- Contacting the employer;

- Submitting a written application (if required) with a request to issue a certificate;

- Waiting for review and implementation;

- Delivery of paper by hand.

The list that includes documents for obtaining a salary certificate for the Pension Fund:

- a statement reflecting the request for a certificate;

- a copy of the work book.

If you are still working at the enterprise and take out a certificate, then the provision of copied pages of the work book is canceled. It is kept in the personnel department, or the records are kept by an accounting employee. But this type of document may be needed to obtain a certificate from your previous place of work, from where you were fired a long time ago.

If the company was closed, the employee must submit a request to the Central Archive for Liquidated Enterprises of the city. From there, an extract from the papers will be issued that preserved information on the earnings of the citizen who applied.

What does a salary certificate look like?

The salary certificate does not have an approved form, so it is filled out in free form, but must contain the following mandatory information:

- name and details of the organization where the citizen worked;

- personal data (full name, date of birth) of the citizen;

- work period;

- monthly salary;

- name of the currency in which the accruals were made;

- the total amount of earnings received for the entire period specified in the certificate;

- an indication that contributions to the Pension Fund from the amounts paid have been transferred;

- separately in the note - the periods of being on sick leave and on administrative leave;

- the document on the basis of which this certificate was issued (this could be pay slips or personal accounts of employees);

- signature of the head and seal of the organization.

Monthly earnings are indicated in compliance with the following rules:

- it includes all types of payments as part of the performance of labor duties: vacation pay, sick leave, bonuses, payments for overtime work, work on weekends, part-time work, and so on;

- it does not include compensation for unused vacation, upon dismissal, and child care benefits;

- if desired, you can replace incomplete months of work in connection with its beginning or end, periods of parental leave, caring for a disabled person of the 1st group with months preceding or after the specified period.

A sample of the completed certificate can be downloaded here.

***

The certificate is submitted to the Pension Fund for pension calculation. It must be compiled for 5 consecutive years of work until 2000, where the citizen’s earnings will be listed monthly. You can obtain a certificate at the enterprise where the employee was registered in the specified years, or in the archive if the company was liquidated.

***

You will also be interested in reading the materials that we wrote specifically for our Zen channel.

Where can I get information about income for calculating pension payments?

Old-age pension for men begins at the age of 60 years, for women - 55 years. But some professions (preferential ones) imply retirement at an earlier age.

A certificate of the employee’s average salary for the purpose of an old-age pension is requested from the organization’s accounting department.

As a rule, an employee of pre-retirement age only asks for a certificate orally. This practice is used in small companies; in large enterprises, a corresponding application is also drawn up.

Each enterprise can develop the salary certificate form for the Pension Fund independently; it is also possible to fill it out using an existing document taken from another organization as a basis.

The completed certificate is signed by the head of the human resources department, chief accountant, and head of the enterprise.

If the organization has been liquidated, it is necessary to send a written request to the archive department that accepted the papers of the deregistered company, and issue an extract from the salary documents.

The form of the certificate for the Pension Fund is known to the archive workers; they help collect the necessary documents for assigning a pension.

It is not always possible for an archive employee to draw up a certificate in the approved form, but he has the right to fill out the document himself according to the information he has.

Additionally, on our website you can download samples of earnings certificates:

- for subsidies;

- for unemployment benefits from the employment center;

- for social security benefits.

Nuances: is it possible to get a certificate after dismissal?

After dismissal, a person receives an estimated payment for the amount of work performed for the last month or previously unpaid months. In this case, a certificate of wages and other accruals will be issued to the former employee for the period actually worked. Each laid-off person is entitled to receive benefits as support for the first time until another job is found. These amounts are not considered income, so they will not be reflected in the document.

Obtaining a certificate of earnings is important not only for the Pension Fund of the Russian Federation, but also for the tax authority (in the case where it is necessary to individually confirm the correctness of payments for income taxes). Persons whose age is approaching the retirement period have the right to recalculate their pensions, for example, if they had free savings. For these and other purposes, a certificate of income is required. The sample document is made in free form.

Where should the salary form be submitted?

Order No. 884n of the Ministry of Labor and Social Development (dated November 17, 2014) states that citizens, in order to apply for a pension, send their applications to the territorial bodies of the Pension Fund located at their place of registration.

Persons whose registration and place of actual residence are different can submit a set of documents for calculating a pension at their place of residence.

Convicted citizens submit the form to the Pension Fund through the administration of the correctional colony at their location.

The deadline for applying to the Pension Fund for accrual of an old-age pension is not limited by law.

For what period is it compiled for assigning and calculating a pension?

The pension legislation currently in force allows 2 methods of calculating the average monthly salary to determine the size of the future pension:

- based on personalized accounting information, average monthly earnings in 2000-2001 are taken into account;

- in accordance with the submitted salary certificate for 5 consecutive years of work.

As practice shows, with a permanent place of work, it is more profitable for a citizen to take the salary received in the period 1976-1986 for calculation.

A salary certificate for 5 years is not needed in cases where the employee’s monthly earnings in 2000-2001 are equal to:

- 2100 rub. — for regions where wages are multiplied by a regional coefficient of up to 1.5 (for example, 1.5 for the Udmurt Republic);

- 2600 rub. — for areas with an established coefficient in the range from 1.5 to 1.8 (Murmansk region);

- 2900 rub. — for areas with a coefficient over 1.8 (Yakutia).

Otherwise, an employee planning to retire must prepare in advance for the Pension Fund a certificate for 5 years of work with a higher salary, if there were any for a different period of work.

The earnings certificate submitted to the Pension Fund serves as one of the main documents from the entire necessary package for calculating a pension.

The amount of the accrued pension depends on the amount of income. Every citizen is very interested in providing this form.

Filling out for Pension Fund authorities

An employee’s earnings certificate for applying for a pension must include information on the salary amounts paid for each individual year.

Average values (for 3 or 6 months) are not taken into account when calculating pensions.

To accrue and calculate a pension, the Pension Fund accepts any official payment to an employee:

part-time wages, overtime, days off, with the exception of dismissal benefits or compensation for unused vacation, child care benefits.

The certificate for the Pension Fund is drawn up in any form; it must contain the following information:

- company stamp (corner) with the date of issue of the document and its number;

- FULL NAME. (in full) of the employee who applied;

- date of birth of the worker;

- period of work;

- monthly salary amount and calculation of annual income;

- Payroll currency (ruble).

The form in the Pension Fund must also contain information about the organization that issued it:

- full name of the legal entity (in accordance with the constituent documentation);

- address of registration of the enterprise with the tax authority;

- company telephone numbers, tax identification number.

It is necessary to take into account in the certificate the amount of wages actually paid to the employee, and not accrued.

As a note, you should note the periods of sick leave and unpaid leave, and also record the presence of a certificate of incapacity for work before and after the birth of the child.

At the bottom of the form, the fact of deductions of insurance contributions to the Pension Fund of the Russian Federation for all employee accruals at accepted tariffs, as well as the grounds for issuing a salary certificate (personal accounts, payroll statements) must be recorded.

The certificate is signed by the company's responsible persons and the company's seal is affixed.

to the Pension Fund of Russia

Download a free sample of filling out a certificate to the Pension Fund for the calculation and assignment of a pension –word.

Useful video

What documents are needed to calculate a pension and important points to pay attention to can be found in this video:

Useful topics:

- Methods for calculating depreciation in accounting

- Accrual and cash method

- Postings for accrual of dividends to the founder

- Production method of depreciation

- Accrual accounting

- Certificate of expenses

- 2 Personal income tax certificate

- Help 182n

What are the features of calculating income in a certificate of average salary?

When the Pension Fund calculates earnings, then to calculate the pension, a salary certificate may be needed for a specific period. It is not necessary in all cases to require papers for all periods of the insured person’s working life.

The size of the future pension benefit can be calculated in one of 2 ways:

- relying on information from personalized records generated according to the data provided by employers for the citizen;

- based on data from the salary certificate issued by the Pension Fund according to the standard 2-NDFL sample for the period of the last 5 years.

In the first case, a person’s earnings for the billing period from 2000 to 2001 are taken into account. The amount of wages received by the employee will be taken into account as the average monthly salary, and not the actual salary established in the staffing table. If a person worked for a long time at one enterprise, he can take a document about the salary issued for the period from 1976 to 1986.

The following will be taken into account in the sample salary certificate:

- official income;

- part-time income;

- business trips;

- overtime allowances;

- other payments related to obtaining income-generating means of subsistence.

Severance pay that is given to an employee on the day of dismissal, as well as vacation pay for unused days intended for rest, are not taken into account.