Let's consider one of the operations constantly carried out by personnel officers and accounting departments. Let's figure out how to properly maintain, fill out and register timesheets manually. We will also determine why this is required, what forms are suitable, what details will be required, what marks to put down, and the like.

What is this document and why is it needed?

It contains information about how many hours each specific person from the entire staff actually worked and how many absences he made during the reporting period. Its presence is mandatory, according to Resolution No. 1 of the State Statistics Committee, adopted on January 5, 2004.

It is useful because it helps:

- objectively reflect the degree of staff employment;

- register tardiness, time off and absenteeism and thus respond to violations and closely monitor the production process;

- obtain accurate statistics and perform analytics based on them.

An accountant must know how to make a payroll time sheet in order to correctly accrue salaries, bonuses, and compensation to the organization’s employees. The HR officer needs this to track attendance and justify imposed fines, penalties or other sanctions.

This document is issued immediately after dismissal (at the request of a former subordinate), and may also be requested by the tax service during the audit process.

Who fills it out

This task is assigned to an authorized person - either a specialist hired separately for this purpose, or an expert from the personnel service or even the head of a structural unit (depending on the company’s general organization). The last two, among other things, must also confirm the correctness of the entered data with their signature and immediately transfer the business paper to the chief accountant.

In modern practice, work time sheets are usually kept by employees specifically assigned by order containing their full name. and the position of a specific performer. If such a document is missing, find out whether such an obligation is provided for in the concluded contract. If not, then any demands from management to solve such problems are unlawful.

In large organizations, an authorized person enters information into the form and shows it to the head of the department, who checks, endorses and transfers the business paper to the personnel officer; he, having personally verified that there are no errors, also signs and sends it to the accountants.

How to correctly fill out the T-13 report card

If the company preferred the first, file-based accounting method, then when programming automated modules for entering data into the T-13 form, it will be useful for the company’s specialists to pay attention to the following nuances:

1. In the “Document number” column, an ordinal indicator is automatically entered.

2. The column “Date of compilation” reflects the last day of the month if the document is drawn up based on the results of the month, or another date of compilation if the time sheet is drawn up for specific purposes.

3. The column “Wage type code” can reflect values determined in accordance with local regulations. A guide to the corresponding values here can be the table contained in the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387 (it contains the codes indicated in the 2-NDFL certificate).

4. Conditional codes of the table (about appearances, absences, vacations and other events), which are filled in by the program in the timesheet, must be used in accordance with the list given in the T-12 form.

The T-13 form can be downloaded for free by clicking on the picture below:

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Shift work mode

We should especially talk about shift work. It raises many questions both during timesheets and when calculating wages. It is advisable to introduce a shift work mode when the duration of the production process exceeds the permissible length of a working day or the equipment at the enterprise operates around the clock.

If an employer hires a new employee, the shift work schedule is already specified in the employment contract. However, if there is a need to transfer all or several previously hired employees to work in shift mode, several procedures must be followed:

- Issue an order to change the operating mode for the enterprise as a whole or for individual employees.

- Reflect this change in the Internal Labor Regulations or the collective agreement (Part 1, Article 100 of the Labor Code of the Russian Federation).

- Create shift schedules. There is no unified form of the schedule, so each organization develops it independently and approves it with accounting policies. The work schedule is a mandatory document for shift work. It can be approved as a separate form or made an annex to a local regulatory act.

- Write down changes in the additional agreement to the employment contract. The working hours are mandatory conditions, which means that the employer must notify the employee 2 months in advance and obtain his consent. If an employee refuses to work under changed conditions, he should be offered a different position with the same schedule. If an employee does not agree to work under new conditions, the employment contract may be terminated due to refusal to work under new conditions (Clause 7, Part 1, Article of the Labor Code of the Russian Federation).

- Familiarize employees with the shift work schedule no later than one month in advance.

When drawing up a shift schedule, it is necessary to take into account restrictions on the length of the working day for certain categories of citizens and on holidays.

How to correctly draw up and maintain a monthly timesheet

Current legislation states that this can be done using one of the following methods:

- continuous – not only attendance or absenteeism are recorded, but also all changes to the usual schedule;

- by deviations - only deviations from the standard work schedule are recorded, for example, business trips.

The first option is much more applicable in practice, because here everything is almost completely automated. Plus, it allows you to more accurately summarize hours spent from different shifts and see potential overtime, which helps you more flexibly adjust the future staff schedule.

Is there any unified form?

Yes, Goskomstat approved two types of time sheets: T-12 and T-13. Although it is not necessary to strictly adhere to them - if necessary, the company has the right to invent and use its own, it’s just that the standard ones are more convenient, since they are well known to other organizations.

T-13 is more popular because it is presented not only in paper, but also in electronic version, so it can be integrated into the card system and enter data on absenteeism and tardiness automatically. The main thing is to debug the software so that no errors occur.

T-12 is more interesting for accountants, since it allows you to reflect salaries, bonuses and other deductions, but it is not yet possible to post it through a PC, and this is its comparative disadvantage.

Features of working time recording due to coronavirus

Due to the situation with COVID-19, it is recommended to transfer employees to remote work again. If the employee does not mind, then an additional agreement must be concluded.

If the organization has employees over 65 years of age, then it is recommended to separately isolate such employees in order to preserve their life and health. During the isolation period, employees must retain their earnings. If everything is more or less clear with the problems of isolation, then the question of what to put on the report card for workers over 65 years of age who are in quarantine does not have a single answer. The editors believe that during this period it is necessary to approve additional code specifically for this situation. If developing a new code is not an option, then code OB or 27 is used - additional days off (paid), but such a code is not entirely correct.

For people who have switched to remote work, use the code “I” if they work, and “B” if they take a weekend break. If they went on paid leave or without pay, then use a different code that suits the situation.

ConsultantPlus experts discussed how to reflect the period of an employee’s medical examination in a time sheet. Use these instructions for free.

Step-by-step instructions for drawing up and filling out a time sheet on form T-13

An important clarification right away: we choose continuous as a method - in this case it is more convenient and clearer.

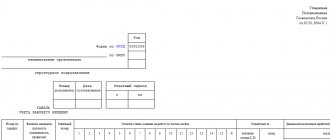

Step one: Name of the organization and its structural unit

At the very top you should indicate the name of the company and the division whose specialist created the document, for example, a production workshop or marketing department.

Step two: enter the OKPO code

This abbreviation hides information from the All-Russian Classifier of Companies of all OPFs, stored in the Rosstat database. Attention, you must enter it strictly in the special header in the upper right corner as follows:

- 8 digits – for officially registered legal entities;

- 10 – for individual entrepreneurs (individual entrepreneurs).

Step three: enter the number and date

When deciding how to draw up a time sheet, be sure to take into account the following point: the number is assigned strictly according to the procedure followed at the enterprise, as of the last day of the current month, which is necessarily reflected in writing in the fields intended for this - as shown below:

Step four: selecting a reporting period

Usually this is the interval between the beginning and end of the reporting period (the document we are considering is regular). In the case of our example, from June 01 to June 30.

Step five: entering employee data

Each person entered into the document is assigned a separate line. He also receives an individual number, which subsequently goes through all internal documentation, is retained during the term of service and is not transferred to anyone else until dismissal (and even for a certain period after it).

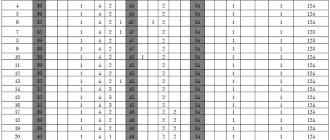

Step six: information about hours and attendance

Having analyzed how time sheets are kept, we come to a logical conclusion: this information is filled out in an abbreviated format so as not to overload the form. In general, the following conventions are accepted:

- I – attendance (if there is no absenteeism, then in the cell below you must indicate the time, in hours, that the person actually worked during the shift);

- K – business trip;

- B – a day off as required by law;

- OT – scheduled (regular) vacation.

Step seven: calculating the final number of days/hours

The most accurate and accurate calculation is carried out in 2 stages:

- first in the fifth column - for every half month;

- after - in the sixth, the result for the reporting period.

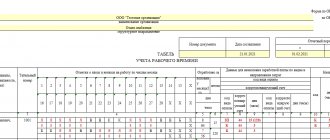

Step eight: entering information to determine payment amounts

Employees' working time sheets should be filled out with codes that are strictly suitable for this purpose - they establish the type and amount of monetary compensation provided for a particular volume of tasks completed. There is a whole list of these identifiers - it is in the public domain, this is reference information. In the form (below in the screenshot) two popular ones are taken:

- 2000 – labor costs;

- 2012 – vacation pay.

These funds are written off to a corresponding (special accounting) account. It can be different - separately for salary, travel allowance, vacation pay - or general, for everything at once.

The main thing is that for each type of payment in the ninth column it is necessary to indicate the number of hours or days spent by a person on work (actually). Here in the “red” cell are attendance and business trip allowances, and in the “green” cell are vacation pay.

If during the period under review one type of salary is applicable to all personnel, then the corresponding code can be given at the top of the form, and the seventh from eighth columns can be left blank.

Step nine: information about the reasons and duration of absences

In the example we took of compiling and processing a work time sheet, the employee did not come to the enterprise for 13 days, but 3 of them were on a business trip, and 10 were on vacation. Information about this should be entered in the 10-12th columns - and always with a letter abbreviation explaining the reason, and a number indicating the period of absence, in days or hours:

Step ten: signatures of each responsible person

They must be entered at the end of the calendar month. If we take our case, this is the responsibility of the manager (as an authorized subordinate), the head of the department and the HR specialist. If at least some of the details are missing, the document cannot be considered valid.

Instructions for filling out a working time sheet in form T-12

When recording the arrival of personnel to work, coded symbols are entered into the timesheet, recording only those personnel who are officially employed, including internally.

Labor activity for the following composition is not taken into account:

- Working unofficially.

- Arranged on an external part-time basis.

- Executed under a civil agreement.

Maintaining the timesheet is entrusted to either the personnel officer, the head of the department, or another person appointed by order of the employer. Based on the codes recorded in the time sheet, the company’s personnel are paid salaries and other payments.

Depending on the company’s method of monitoring the daily routine, the time sheet can be drawn up either in one general form (for the entire enterprise) or in a separate form for each department.

The report card refers to a regular form submitted monthly on the date set by the company. The rules for formatting the form require correct completion of the title page and tabular section of the form.

Title page

This section of the form displays the following data:

- Company name.

- Codes OKPO and OKUD.

- The form number, which is assigned by the company independently.

- Reporting period – i.e. month during which the data is recorded.

- The date the form was compiled, which is usually the end date of the reporting month.

The address section of the form displays the full name of the institution, and subsequently, in brackets, its short name.

The “Postal Address” line displays the name of the subject of the Russian Federation, legal and actual address, with a display of the postal code.

The company code (OKPO) is displayed based on the All-Russian Classifier registered in the structures of Rosstat.

The company identification number is displayed in the same way.

Tabular part

In this section you need to fill in all the fields:

- The first column assigns a number to each employee.

- The second and third columns display personal information about the employee (full name, vacancy and personnel number).

- In the columns of the 4th and 6th columns containing the dates of the month, symbols are recorded indicating the arrival/absence of personnel at work, in which the code is written in the numerator, and the number of working hours in the denominator.

- In the 5th and 7th columns, the totals are entered, displaying the number of shifts and hours worked for the corresponding part of the month.

- From the 8th to the 13th column, the final indicators of labor activity for the month are filled in, displaying the shifts worked and hours at the company.

- The 14th column records missed shifts, with the reasons for absences displayed in the 15th and 16th columns.

- And finally, the 17th column indicates the number of weekends and holidays.

At this point, work with the report card is completed, and the responsible employee must sign the completed form, filling in the date and signature.

Vacation notes

The key feature of how to correctly fill out a worksheet is the ability to enter the appropriate codes:

- correct type;

- proper duration;

- suitable method (consecutive or by deviation).

They are written with the following abbreviations:

| FROM | Another paid one |

| OD | Additional |

| U | Educational (salary retained) |

| UD | Educational (salary is not saved) |

| UV | Training (with a shortened day, without interruption from work) |

| BEFORE | Administrative |

| R | Pregnancy, childbirth |

| coolant | Caring for a baby up to 3 years old |

| Far East | Add. (not paid) |

| OZ | In other situations prescribed by law (also unpaid) |

Other designations

When deciding how to make a time sheet, remember that it may contain the following notes:

| Presence | |

| RV | Appearing on a holiday, a day off (or a day equivalent to it due to quarantine) |

| VM | Shift workers |

| WITH | Overtime |

| Business trips, professional courses | |

| TO | Business trip |

| PC | On-the-job training |

| PM | Studying in another locality, with the cessation of work |

| Absence on site | |

| ETC | Absenteeism |

| B | Sick leave |

| T | Unpaid sick leave |

| PV | Absenteeism, but forced, due to unlawful removal |

| NS | Partial shift mode |

| Champions League | Abbr. day |

| G | Failure to appear for a valid reason (state or public duties) |

| IN | Weekends or holidays |

| NN | The reason is not clear |

| OB | Add. day off (paid) |

| NV | Add. day off (not paid) |

| RP | Simple, provoked by superiors |

| VP | Downtime provoked by an employee |

| NP | Downtime due to circumstances beyond anyone’s control (there is a high probability that it will have to be worked out in the future) |

| ZB | Strike |

| BUT | Removal with retention of salary |

| NB | Unpaid suspension |

| NZ | Suspension of labor caused by delays in salary |

| Digital wage codes | |

| 2000 | Standard deductions (salary, bonus) |

| 2010 | Money provided for by the GPA |

| 2300 | Sick leave payments special due to sick leave |

Working time calculation

To calculate the work rate for a certain time, you will need:

- Determine the accounting period.

- Approve it by normative act, enshrine it in the internal labor regulations.

- When calculating shifts, each employee must work the required hours and days in accordance with the production calendar.

Shift schedules are calculated online or in special programs (1C, etc.). The main thing is that it exists and employees are familiar with it.

The accounting period is allowed to be one month, quarter, half year or year. The maximum duration of this period is one year, and for personnel working in harmful or dangerous conditions - three months.

The duration of working hours during the accounting period should not differ from the indicators established by the production calendar.

So, if the accounting period is one month, then employees, for example, in March 2022 should not work more:

- 175 hours with a 40-hour week;

- 157.4 hours with a 36-hour week;

- 104.6 hours based on a 24-hour week.

In addition, the number of working days in March 2022 is no more than 22, and the number of weekends is no less than 9.

Therefore, it is recommended to take a period of at least three months (one quarter). This accounting period allows you to flexibly regulate the activities of subordinates.

For example, with an accounting period equal to one quarter (take the first quarter of 2022):

- 57 working days;

- 33 weekends and holidays.

Working hours are at:

- 40-hour week - 454 hours;

- 36-hour week - 408.4 hours;

- 24-hour week - 271.6 hours.

Therefore if:

- in January 2022, workers worked within the production calendar of 16 days and 128 hours;

- and in February the staff worked 21 days and 167 hours, which is more than the norm -

then in March, in order to reach the calculated norm of working days and hours for the accounting period, the employer will have to reduce the working hours of employees by two working days and 16 working hours.

Otherwise, you will have to pay employees additional money, and a lot of it.

For beginners, figuring out how to create a duty schedule for a month in the form of a table is not difficult, since this can even be done online, using Google Docs. By creating a copy of this file, you can create shifts in real time.

Read more: Time log

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What to do after

Let's figure out how to work with a time sheet. It should be printed out, submitted to all certifying persons, and then a salary or bonus should be calculated on its basis. Then, when the document is no longer needed, it must be archived and carefully stored for 5 years so that it can be presented to the tax authorities or a resigning employee.

Results

The Labor Code of the Russian Federation requires all employers to keep records of indicators reflecting employees’ attendance at work and the number of their working hours. For these purposes, a time sheet is used. The employer can conduct it manually or through automated solutions. In the first case, the T-12 form is used, in the second - the T-13 form. The exact form that HR officers need to use is specified in the local regulations.

You can learn more about the use of documents related to personnel records in an organization in the articles:

- “How to calculate working time balance”;

- .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fix errors

Form T-13 is convenient in that it is created automatically from those already existing in the database, therefore, with normally configured software, all information should be entered correctly. Although this is not a reason for the head of a structural unit to relax, it is still better to check before signing.

But even if you know exactly how a time sheet is made and prepared according to the T-12 form, when filling it out manually you are not immune from clerical errors and inaccuracies caused by carelessness. If you discovered them before the sighting, this is not a problem at all - the printout can simply be redone. If later, you will have to create a corrective document, indicate the correct data in it and assign it a number following the incorrect primary one. As an appendix to it, a memo is required detailing the reasons for making the changes and clarifying papers, for example, a copy of the sick leave certificate if absenteeism is being corrected.

Otherwise, any defect discovered during a tax audit threatens to entail a fine of 30-50 thousand rubles (for legal entities), and if the situation repeats, even more severe sanctions will be imposed.

We examined in detail how to draw up and fill out time sheets for individual entrepreneurs and organizations, manually entering the appropriate notes.

And you can easily find the programs necessary for automating business processes, as well as accounting, in the Cleverence catalog - contact us for a profitable order of reliable, functional, easy-to-learn software. Number of impressions: 10110

What is the difference between forms No. T-12 and No. T-13

The two approved forms differ in that one of them (T-13) is used in institutions and companies where a special turnstile is installed - an automatic system that controls the attendance of employees. And the T-12 form is universal and contains, in addition, an additional section 2. It reflects settlements with employees for wages. But if the company conducts settlements with personnel as a separate type of accounting, section 2 simply remains empty.

ConsultantPlus experts discussed how to keep track of working hours. Use these instructions for free.