State-owned enterprises, including municipal companies, distribute funding received from the treasury authorities. State and municipal companies are required to maintain specialized budget accounting, which is distinguished by its own regulatory documents and has a number of nuances. Budget accounting

are conducted in organizations that are fully or partially financed from the state budget. The system for maintaining accounting documents, reflecting operations on the movement of funds, depreciation, and conducting inventory in government agencies is budget accounting.

Regulatory documents and acts for budget accounting

Accounting in municipal, state, and federal organizations is regulated by laws of national importance. The Federal Law “On Accounting dated December 6, 2011 No. 402-FZ” is considered one of the main regulatory normative acts. The General Regulations are not the only source of legislative regulation; there are also special by-laws intended for budgetary and commercial areas of activity:

- Municipal state companies, in addition to the basic law, are also subject to orders of the Ministry of Finance dated December 1, 2010, which approve a unified chart of accounts for government bodies at various levels, as well as for extra-budgetary funds, state academies of sciences, and municipal institutions;

- order of the Ministry of Finance dated December 29, 2010, number 191, on approval of instructions and procedures for compiling and submitting annual, quarterly and monthly types of reporting, and implementation of budget regulation of the Russian Federation;

- order of the Ministry of Finance dated 03/25/2011 number 33 on the approval of instructions affecting the procedure for drawing up and submitting annual, quarterly and monthly reporting documents.

Responsibilities of accounting in a state institution, municipal enterprise

The multi-structural accounting department of a budgetary institution is a set of departments from the material and technical group, the planning and financial department, the centralized settlement group, and the department of settlements with suppliers and contractors. Accounting responsibilities for maintaining budget records in state and municipal institutions:

- organization of reporting in accordance with current laws;

- control over the correct execution of primary documents, the correct process of transactions;

- accounting for cash expenditures in accordance with the intended purpose;

- calculation and payment of wages to employees;

- accounting for incoming income and expenses in accordance with funds that come from extra-budgetary sources;

- conducting an inventory of fixed assets, raw materials, materials and valuables;

- control over the safety of monetary assets and reserves;

- preparation of reporting documents;

- provision of reporting forms within the prescribed time limits by legislation and regulatory authorities;

- ensuring storage of forms and reporting documents.

The responsibilities of the accounting department include full control over the maintenance of documents, the correct reflection of the movement of funds and equipment on accounts in accordance with regulations.

Structure of the budgetary chart of accounts

The structure of the budget plan is presented in the following sections:

| Chart of accounts section | Contents of accounts | Account code, example |

| Non-financial assets | The “Non-financial assets” section reflects information about all non-current assets of an economic entity. The section includes accounting for the following objects:

New groups:

| 0 101 05 000 “Vehicles” - generation of information on the initial cost of vehicles owned (operably managed) by the enterprise. 0 108 51 000 “Real estate that constitutes the treasury” - reflects the initial cost of real estate located in the treasury. No depreciation is charged on such property. Also, for assets located in the treasury, there is no provision for the allocation of particularly valuable and other property. |

| Financial assets | The “Financial Assets” section accumulates information about all current assets of the institution. Current assets are understood not only as funds in the cash desk and current accounts of an institution, but also as investments in financial assets, advances and receivables. The section includes the following groups:

| 0 201 11 000 “Cash in the institution’s accounts” - discloses information about the availability of finances in current accounts opened with the body providing cash services to the entity (in rubles and foreign currency). 0 205 31 000 “Calculations for income from the provision of paid services (work).” It accrues income from business and other income-generating activities. |

| Liabilities | The “Obligations” section discloses data on accepted obligations:

| 0 302 11 000 “Payroll calculations” - reflects the amount of accrued wages in favor of employees working under an employment contract. 0 302 21 000 “Settlements for communication services” - reflects accounts payable arising under contracts for the provision of communication services. 0 303 01 000 “Calculations for personal income tax” - records data on tax deductions made from the salaries of employees of the organization and from other taxable income. |

| Financial results | A special section “Financial result” is used to reflect income and expenses based on the results of the activities of an economic entity for a certain period. Detailing by time intervals is provided. Information is grouped according to the results of the current period, previous years and future periods. | 0 401 10 000 “Current period income” - used to calculate the institution’s income due in the current financial year. 0 401 28 000 “Expenses of the financial year preceding the reporting year” - discloses information about incurred expenses of the previous period. |

| Authorization of expenses | The registers in the “Authorization of Expenses” section disclose accounting information on:

| 0 501 11 000 “Adjusted LBO” - reflects the amount of completed limits of budget obligations within the current financial year. |

Requirements for maintaining budget accounting for the formation of a unified and accurate system of funds flow

The obligations of the budget accounting sector are based on providing the most transparent information and fully informing the treasury about the movement of funds. To receive funds, you must first submit applications and confirm them with management signatures. A budget organization cannot write off funds on its own without verification by treasury authorities. Some of the main features of budget accounting are:

- all government tasks and requests are carried out only with funds allocated to a certain budget level;

- the property is not the property of the institution, the owner is the state;

- land plots are provided for use indefinitely, but are not owned as property;

- the obligations of the owners are not equal in relation to similar requirements from the budgetary organization;

- A budgetary organization cannot independently dispose of property even if the owner secures such a right.

Accounting for materials in autonomous institutions

Material reserves act as a kind of foundation in the work of an autonomous institution. They are varied in their purpose and functions for which they are purchased. The purchase of materials using subsidies is reflected as follows:

- Acceptance of various types of raw materials and materials for accounting (their actual cost):

- DT 4.105. (36). 340

- CT 4.302. (34). 730

- Issue to the person with whom the agreement on financial liability is concluded:

For Debit and Credit 4.105. (36). 340

When funds received from commercial activities were spent on the purchase of raw materials and various types of materials, or the purchase passed through accountable persons, the notes are as follows:

- Taking material assets into accounting accounts:

- DT 2.105 (36) 340;

- KT 2.208 (34) 660

- Transfer to an employee with a liability agreement:

For Debit and Credit 2.105 (36) 340

- Write-off of materials:

- Debit 2.109.(61).272;

- Credit 1.105.(36.440).

Materials are recorded on accounts to the nearest penny.

Budget accounting and reporting within the framework of current tax legislation

Budget accounting is an important accounting policy of government agencies, the main purpose of which is not to make a profit. To allocate funds from the state budget, the organization must provide full reporting on estimates of income and expenses. The expenditure of public funds is constantly monitored. Budget accounting is an important tool for providing all payment schemes and movements of federal and municipal funds.

All budget organizations must submit forms for various accounting periods. From 1 to 5 reporting documents are submitted monthly. Once a quarter it is required to provide from 5 to 10 types of reports. Annual reporting includes an extended list of forms from 10 to 30.

The list of required documents for reporting is included in the list of regulations and includes:

- balance sheets of the chief accountant, head of the planning financial department, administrator responsible for receiving budget funds using strict reporting form 0502130;

- balance sheet of the institution in form 0503730;

- report on the implementation of the financial and economic activity plan in form 0503737;

- reporting form on the results of the organization’s financial activities according to form 0503721;

- information on accounts receivable and payable in form 0503769;

- data in the form of reporting forms about the organization’s cash balances.

The features of reflecting funds on the balance sheet of an enterprise in the commercial and budgetary spheres are formed according to a single principle. The balance sheet of a budgetary institution includes the following types of features:

- the balance sheet consists of assets and liabilities, budget specialists distribute all items with a detailed display of the use of target funds and their own profits;

- reflected only for one previous year; in the commercial sphere, information is provided for the previous two years;

- assets are divided into financial and non-financial, funds are divided into material and monetary;

- the liability side displays all types of obligations, and the commercial obligation is distributed according to terms

Methodological support and support

The delivery of the configuration “1C:Enterprise 7.7. Accounting for budgetary institutions”, edition 6 includes methodological literature and a demonstration base reflecting the technology of accounting in budgetary institutions using configuration.

When legislation and accounting methodology change, configuration updates (releases) are issued. The update mechanism allows you to download new features without losing user input and preserve user configuration settings.

Registered users have the right to:

- updating the set of quarterly reports, new configuration releases;

- use of the Consultation Line services.

An important place is occupied by monthly comprehensive information and technological support on CD within the framework of the ITS project. For example, if they have access to the Internet, ITS subscribers can quickly receive and connect new sets of regulated reporting to the standard configuration, and receive configuration updates.

Methodological printed publications are published to help users.

has been developing solutions for the public sector for more than 10 years. The economic program is the carrier of a certain accounting methodology. Constant changes in the legislative framework and, consequently, accounting and tax rules require keeping the program up to date.

Typical configurations of economic programs represent holistic methodological solutions. promptly updates standard configurations of its economic programs, bringing them into compliance with current legislation. Registered users of economic programs have the opportunity to receive updates (new releases) of programs and their standard configurations, and current sets of accounting and tax reporting forms.

When there is a fundamental change in legislation, new editions of programs are released to ensure record keeping according to the new rules. For example, during the transition in 2000 to accounting according to Instruction No. 107n dated December 30, 1999. registered users of previous editions of the “Accounting for Budgetary Organizations” configuration (according to Instruction No. 122 of 1993) received configuration updates - edition 4 on time and free of charge.

The “Accounting for Budget Institutions” configuration, edition 5 was developed in connection with changes in budget legislation that came into force on January 1, 2005.

The “Accounting for Budget Institutions” configuration, edition 6 was developed in connection with changes in budget legislation that came into force on January 1, 2006.

For official users of the “Accounting for Budget Institutions” configuration, edition 5, the new edition – 6 is provided in the usual release update procedure (free of charge).

Updates can be obtained from the advice line or from regional partners. The configuration is also included in the Information Technology Support (ITS) disks.

Information on using the new configuration “Accounting for budgetary institutions”, edition 6 is included in the configuration in electronic form. Along with this, it is also possible to replace printed documentation on a paid basis; the recommended retail price of the book is 17 USD.

Due to the increase to 5 required sections of analytical accounting for the operation of the configuration that implements accounting in accordance with Instruction No. 25n dated February 10, 2006, the user’s computer requires a professional version of the program “1C: Accounting 7.7” (“1C: Enterprise 7.7. Accounting"). Registered users of the standard version of the 1C: Accounting 7.7 program have price benefits when upgrading to a higher version of the program. The upgrade price for products of the 1C:Enterprise program system is determined as the difference in retail prices according to the current price list between the purchased and surrendered versions plus 5 cu, but not less than fifty percent of the retail price of the purchased version.

In connection with the ongoing reform of budget accounting, the Ministry of Finance of the Russian Federation plans to make changes to new regulatory documents, taking into account the practice of their use. In order to regularly receive the latest information - methodological recommendations, program releases, regulatory documents, we recommend subscribing to monthly Information and Technology Support "1C:Enterprise" (on CD-ROM). You can subscribe through regional partners.

The main differences and similarities between budget accounting and tax control in commercial companies

The general accounting rules for public sector organizations and private companies do not differ significantly. In accounting for private enterprises and budget accounting of municipal enterprises, it is necessary to reflect all transactions. The main distinguishing parameter in budget accounting is the use of a different chart of accounts, in which transactions are reflected slightly differently.

Financing for private companies can be different, for example, personal funds contributed, bank loans issued, or contributions from members of a joint-stock company. The budgetary sphere is financed exclusively by the state, local or federal budget. Also part of the funding are donations from private companies, individuals, and foundations. All funds received into the general account in the treasury are state property, and the form of subsidizing municipal organizations can be different:

- funds provided for the implementation of government tasks;

- money for temporary use for certain purposes;

- funds for payments under health insurance;

- own funds received as part of income from work and services performed.

The volume of reporting in the budgetary sector is much larger, because every action must be recorded and flow patterns of funds displayed in detail. In a private company, receipts or debits from current accounts are made independently; permission from the treasury authorities is not required. In terms of payment for work and services, a private company is more mobile, but at the same time less protected from erroneous write-offs.

Chart of accounts for budgetary and government institutions

Current table of budget accounting accounts in 2022 for state and budgetary institutions according to instruction 157n:

| Balance account name | Synthetic account of an accounting object | Group name | ||

| Synthetic | Analytical | |||

| Group | View | |||

| 1 | 2 | 3 | 4 | 5 |

| NON-FINANCIAL ASSETS | 1 0 0 | 0 | 0 | |

| Fixed assets | 1 0 1 | 0 | 0 | |

| 1 0 1 | 1 | 0 | Fixed assets - real estate of the institution | |

| 1 0 1 | 2 | 0 | Fixed assets - especially valuable movable property of an institution | |

| 1 0 1 | 3 | 0 | Fixed assets - other movable property of the institution | |

| 1 0 1 | 9 | 0 | Fixed assets - other movable property of the institution | |

| 1 0 1 | 0 | 1 | ||

| 1 0 1 | 0 | 2 | ||

| 1 0 1 | 0 | 3 | ||

| 1 0 1 | 0 | 4 | ||

| 1 0 1 | 0 | 5 | ||

| 1 0 1 | 0 | 6 | ||

| 1 0 1 | 0 | 7 | ||

| 1 0 1 | 0 | 8 | ||

| Intangible assets | 1 0 2 | 0 | 0 | |

| 1 0 2 | 2 | 0 | Intangible assets - especially valuable movable property of an institution | |

| 1 0 2 | 3 | 0 | Intangible assets - other movable property of the institution | |

| Non-produced assets | 1 0 3 | 0 | 0 | |

| 1 0 3 | 1 | 0 | Non-produced assets - real estate of the institution | |

| 1 0 3 | 3 | 0 | Non-produced assets - other movable property | |

| 1 0 3 | 9 | 0 | Non-produced assets - as part of the grantor's property | |

| 1 0 3 | 0 | 1 | ||

| 1 0 3 | 0 | 2 | ||

| 1 0 3 | 0 | 3 | ||

| Depreciation | 1 0 4 | 0 | 0 | |

| 1 0 4 | 1 | 0 | Depreciation of the institution's real estate | |

| 1 0 4 | 2 | 0 | Depreciation of particularly valuable movable property of the institution | |

| 1 0 4 | 3 | 0 | Depreciation of other movable property of the institution | |

| 1 0 4 | 4 | 0 | Depreciation of rights of use of assets | |

| 1 0 4 | 5 | 0 | Depreciation of property constituting the treasury | |

| 104 | 6 | 0 | Amortization of rights to use intangible assets | |

| 1 0 4 | 9 | 0 | Depreciation of the property of an institution in a concession | |

| 1 0 4 | 0 | 1 | ||

| 1 0 4 | 0 | 2 | ||

| 1 0 4 | 0 | 3 | ||

| 1 0 4 | 0 | 4 | ||

| 1 0 4 | 0 | 5 | ||

| 1 0 4 | 0 | 6 | ||

| 1 0 4 | 0 | 7 | ||

| 1 0 4 | 0 | 8 | ||

| 1 0 4 | 0 | 9 | ||

| 1 0 4 | 2 | 9 | ||

| 1 0 4 | 3 | 9 | ||

| 1 0 4 | 4 | 9 | ||

| 1 0 4 | 5 | 1 | ||

| 1 0 4 | 5 | 2 | ||

| 1 0 4 | 5 | 4 | ||

| 1 0 4 | 5 | 9 | ||

| Material reserves | 1 0 5 | 0 | 0 | |

| 1 0 5 | 2 | 0 | Material reserves are particularly valuable movable property of an institution. | |

| 1 0 5 | 3 | 0 | Material reserves - other movable property of the institution | |

| 1 0 5 | 0 | 1 | ||

| 1 0 5 | 0 | 2 | ||

| 1 0 5 | 0 | 3 | ||

| 1 0 5 | 0 | 4 | ||

| 1 0 5 | 0 | 5 | ||

| 1 0 5 | 0 | 6 | ||

| 1 0 5 | 0 | 7 | ||

| 1 0 5 | 0 | 8 | ||

| 1 0 5 | 0 | 9 | ||

| Investments in non-financial assets | 1 0 6 | 0 | 0 | |

| 1 0 6 | 1 | 0 | Investments in real estate | |

| 1 0 6 | 2 | 0 | Investments in particularly valuable movable property | |

| 1 0 6 | 3 | 0 | Investments in other movable property | |

| 1 0 6 | 4 | 0 | Investments in financial lease objects | |

| 1 0 6 | 6 | 0 | Investments in the rights to use intangible assets | |

| 1 0 6 | 0 | 1 | ||

| 1 0 6 | 0 | 2 | ||

| 1 0 6 | 0 | 3 | ||

| 1 0 6 | 0 | 4 | ||

| Non-financial assets in transit | 1 0 7 | 0 | 0 | |

| 1 0 7 | 1 | 0 | The institution's real estate is in transit | |

| 1 0 7 | 2 | 0 | Particularly valuable movable property of the institution is in transit | |

| 1 0 7 | 3 | 0 | Other movable property of the institution in transit | |

| 1 0 7 | 0 | 1 | ||

| 1 0 7 | 0 | 3 | ||

| Non-financial assets of treasury property | 1 0 8 | 0 | 0 | |

| 1 0 8 | 5 | 0 | Non-financial assets that make up the treasury | |

| 1 0 8 | 5 | 1 | ||

| 1 0 8 | 5 | 2 | ||

| 1 0 8 | 5 | 3 | ||

| 1 0 8 | 5 | 4 | ||

| 1 0 8 | 5 | 5 | ||

| 1 0 8 | 5 | 6 | ||

| 1 0 8 | 5 | 7 | ||

| 1 0 8 | 9 | 0 | ||

| 1 0 8 | 9 | 1 | ||

| 1 0 8 | 9 | 2 | ||

| 1 0 8 | 9 | 5 | ||

| Costs of manufacturing finished products, performing work, services | 1 0 9 | 0 | 0 | |

| 1 0 9 | 6 | 0 | Cost of finished products, works, services | |

| 1 0 9 | 7 | 0 | Overhead costs of production of finished products, works, services | |

| 1 0 9 | 8 | 0 | General running costs | |

| Rights to use assets | 1 1 1 | 0 | 0 | |

| 1 1 1 | 4 | 0 | Rights to use non-financial assets | |

| 1 1 1 | 4 | 1 | ||

| 1 1 1 | 4 | 2 | ||

| 1 1 1 | 4 | 4 | ||

| 1 1 1 | 4 | 5 | ||

| 1 1 1 | 4 | 6 | ||

| 1 1 1 | 4 | 7 | ||

| 1 1 1 | 4 | 8 | ||

| 1 1 1 | 4 | 9 | ||

| 1 1 1 | 6 | 0 | Rights to use intangible assets | |

| Impairment of non-financial assets | 1 1 4 | 0 | 0 | |

| 1 1 4 | 1 | 0 | Depreciation of the institution's real estate | |

| 1 1 4 | 2 | 0 | Depreciation of particularly valuable movable property of an institution | |

| 1 1 4 | 3 | 0 | Depreciation of other movable property of the institution | |

| 1 1 4 | 4 | 0 | Impairment of rights to use assets | |

| 1 1 4 | 6 | 0 | Impairment of rights to use intangible assets | |

| 1 1 4 | 0 | 1 | ||

| 1 1 4 | 0 | 2 | ||

| 1 1 4 | 0 | 3 | ||

| 1 1 4 | 0 | 4 | ||

| 1 1 4 | 0 | 5 | ||

| 1 1 4 | 0 | 6 | ||

| 1 1 4 | 0 | 7 | ||

| 1 1 4 | 0 | 8 | ||

| 1 1 4 | 0 | 9 | ||

| 1 1 4 | 6 | 0 | ||

| 1 1 4 | 6 | 1 | ||

| 1 1 4 | 6 | 2 | ||

| 1 1 4 | 6 | 3 | ||

| FINANCIAL ASSETS | 2 0 0 | 0 | 0 | |

| Institutional funds | 2 0 1 | 0 | 0 | |

| 2 0 1 | 1 | 0 | Cash in the institution’s personal accounts with the Treasury | |

| 2 0 1 | 2 | 0 | Funds of the institution in a credit institution | |

| 2 0 1 | 3 | 0 | Cash in the institution's cash desk | |

| 2 0 1 | 0 | 1 | ||

| 2 0 1 | 0 | 2 | ||

| 2 0 1 | 0 | 3 | ||

| 2 0 1 | 0 | 4 | ||

| 2 0 1 | 0 | 5 | ||

| 2 0 1 | 0 | 6 | ||

| 2 0 1 | 0 | 7 | ||

| Funds in budget accounts | 2 0 2 | 0 | 0 | |

| 2 0 2 | 1 | 0 | Funds in budget accounts with the Federal Treasury | |

| 2 0 2 | 2 | 0 | Funds in budget accounts in a credit institution | |

| 2 0 2 | 3 | 0 | Budget funds in deposit accounts | |

| 2 0 2 | 0 | 1 | ||

| 2 0 2 | 0 | 2 | ||

| 2 0 2 | 0 | 3 | ||

| Funds in the accounts of the body providing cash services | 2 0 3 | 0 | 0 | |

| 2 0 3 | 0 | 1 | ||

| 2 0 3 | 1 | 0 | Funds in the accounts of the body providing cash services | |

| 2 0 3 | 2 | 0 | Funds in the accounts of the body providing cash services are in transit | |

| 2 0 3 | 3 | 0 | Funds in accounts for cash payments | |

| 2 0 3 | 0 | 2 | ||

| 2 0 3 | 0 | 3 | ||

| 2 0 3 | 0 | 4 | ||

| 2 0 3 | 0 | 5 | ||

| Financial investments | 2 0 4 | 0 | 0 | |

| 2 0 4 | 2 | 0 | Securities other than shares | |

| 2 0 4 | 3 | 0 | Shares and other forms of capital participation | |

| 2 0 4 | 5 | 0 | Other financial assets | |

| 2 0 4 | 2 | 1 | ||

| 2 0 4 | 2 | 2 | ||

| 2 0 4 | 2 | 3 | ||

| 2 0 4 | 3 | 1 | ||

| 2 0 4 | 3 | 2 | ||

| 2 0 4 | 3 | 3 | ||

| 2 0 4 | 3 | 4 | ||

| 2 0 4 | 5 | 2 | ||

| 2 0 4 | 5 | 3 | ||

| Income calculations | 2 0 5 | 0 | 0 | |

| 2 0 5 | 1 | 0 | Calculations for tax revenues, customs duties and insurance contributions for compulsory social insurance | |

| 2 0 5 | 2 | 0 | Calculations for property income | |

| 2 0 5 | 3 | 0 | Calculations of income from the provision of paid services (works), compensation of costs | |

| 2 0 5 | 4 | 0 | Calculations of fines, penalties, penalties, damages | |

| 2 0 5 | 5 | 0 | Calculations for gratuitous cash receipts of a current nature | |

| 2 0 5 | 6 | 0 | Calculations for gratuitous cash receipts of a capital nature | |

| 2 0 5 | 7 | 0 | Calculations of income from operations with assets | |

| 2 0 5 | 8 | 0 | Calculations for other income | |

| 2 0 5 | 1 | 1 | ||

| 2 0 5 | 2 | 1 | ||

| 2 0 5 | 2 | 2 | ||

| 2 0 5 | 2 | 3 | ||

| 2 0 5 | 2 | 4 | ||

| 2 0 5 | 2 | 6 | ||

| 2 0 5 | 2 | 7 | ||

| 2 0 5 | 2 | 8 | ||

| 2 0 5 | 2 | 9 | ||

| 2 0 5 | 3 | 1 | ||

| 2 0 5 | 3 | 2 | ||

| 2 0 5 | 3 | 3 | ||

| 2 0 5 | 3 | 5 | ||

| 2 0 5 | 4 | 1 | ||

| 2 0 5 | 4 | 4 | ||

| 2 0 5 | 4 | 5 | ||

| 2 0 5 | 5 | 1 | ||

| 2 0 5 | 5 | 2 | ||

| 2 0 5 | 5 | 3 | ||

| 2 0 5 | 6 | 1 | ||

| 2 0 5 | 7 | 1 | ||

| 2 0 5 | 7 | 2 | ||

| 2 0 5 | 7 | 3 | ||

| 2 0 5 | 7 | 4 | ||

| 2 0 5 | 7 | 5 | ||

| 2 0 5 | 8 | 1 | ||

| 2 0 5 | 8 | 3 | ||

| 2 0 5 | 8 | 4 | ||

| 2 0 5 | 8 | 9 | ||

| Calculations for advances issued | 2 0 6 | 0 | 0 | |

| 2 0 6 | 1 | 0 | Calculations for advances on wages, accruals on wage payments | |

| 2 0 6 | 2 | 0 | Calculations for advances for work and services | |

| 2 0 6 | 3 | 0 | Calculations for advances on receipt of non-financial assets | |

| 2 0 6 | 4 | 0 | Calculations for advance gratuitous transfers of a current nature to organizations | |

| 2 0 6 | 5 | 0 | Calculations for gratuitous transfers to budgets | |

| 2 0 6 | 6 | 0 | Social Security Advance Settlements | |

| 2 0 6 | 7 | 0 | Calculations for advances for the purchase of securities and other financial investments | |

| 2 0 6 | 8 | 0 | Calculations for advance gratuitous transfers of capital nature to organizations | |

| 2 0 6 | 9 | 0 | Calculations for advances on other expenses | |

| 2 0 6 | 1 | 1 | ||

| 2 0 6 | 1 | 2 | ||

| 2 0 6 | 1 | 3 | ||

| 2 0 6 | 2 | 1 | ||

| 2 0 6 | 2 | 2 | ||

| 2 0 6 | 2 | 3 | ||

| 2 0 6 | 2 | 4 | ||

| 2 0 6 | 2 | 5 | ||

| 2 0 6 | 2 | 6 | ||

| 2 0 6 | 2 | 7 | ||

| 2 0 6 | 2 | 8 | ||

| 2 0 6 | 2 | 9 | ||

| 2 0 6 | 3 | 1 | ||

| 2 0 6 | 3 | 2 | ||

| 2 0 6 | 3 | 3 | ||

| 2 0 6 | 3 | 4 | ||

| 2 0 6 | 4 | 1 | ||

| 2 0 6 | 4 | 2 | ||

| 2 0 6 | 5 | 1 | ||

| 2 0 6 | 5 | 2 | ||

| 2 0 6 | 5 | 3 | ||

| 2 0 6 | 6 | 1 | ||

| 2 0 6 | 6 | 2 | ||

| 2 0 6 | 6 | 3 | ||

| 2 0 6 | 7 | 2 | ||

| 2 0 6 | 7 | 3 | ||

| 2 0 6 | 7 | 5 | ||

| 2 0 6 | 9 | 6 | ||

| Calculations for credits, borrowings (loans) | 2 0 7 | 0 | 0 | |

| 2 0 7 | 1 | 0 | Calculations for granted credits, borrowings (loans) | |

| 2 0 7 | 2 | 0 | Settlements within the framework of targeted foreign loans (borrowings) | |

| 2 0 7 | 3 | 0 | Settlements with debtors under state (municipal) guarantees | |

| 2 0 7 | 0 | 1 | Settlements for other debt claims | |

| 2 0 7 | 0 | 3 | ||

| 2 0 7 | 0 | 4 | ||

| Calculations with accountable persons | 2 0 8 | 0 | 0 | |

| 2 0 8 | 1 | 0 | Settlements with accountable persons for wages, accruals for wage payments | |

| 2 0 8 | 2 | 0 | Settlements with accountable persons for payment for work and services | |

| 2 0 8 | 3 | 0 | Settlements with accountable persons for receipt of non-financial assets | |

| 2 0 8 | 5 | 0 | Settlements with accountable persons for gratuitous transfers to budgets | |

| 2 0 8 | 6 | 0 | Settlements with accountable persons for social security | |

| 2 0 8 | 9 | 0 | Settlements with accountable persons for other expenses | |

| 2 0 8 | 1 | 1 | ||

| 2 0 8 | 1 | 2 | ||

| 2 0 8 | 1 | 3 | ||

| 2 0 8 | 2 | 1 | ||

| 2 0 8 | 2 | 2 | ||

| 2 0 8 | 2 | 3 | ||

| 2 0 8 | 2 | 4 | ||

| 2 0 8 | 2 | 5 | ||

| 2 0 8 | 2 | 6 | ||

| 2 0 8 | 2 | 7 | ||

| 2 0 8 | 2 | 8 | ||

| 2 0 8 | 2 | 9 | ||

| 2 0 8 | 3 | 1 | ||

| 2 0 8 | 3 | 2 | ||

| 2 0 8 | 3 | 4 | ||

| 2 0 8 | 6 | 1 | ||

| 2 0 8 | 6 | 2 | ||

| 2 0 8 | 6 | 3 | ||

| 2 0 8 | 9 | 1 | ||

| 2 0 8 | 9 | 3 | ||

| 2 0 8 | 9 | 4 | ||

| 2 0 8 | 9 | 5 | ||

| 2 0 8 | 9 | 6 | ||

| Calculations for damage and other income | 2 0 9 | 0 | 0 | |

| 2 0 9 | 3 | 0 | Cost compensation calculations | |

| 2 0 9 | 3 | 4 | ||

| 2 0 9 | 3 | 6 | ||

| 2 0 9 | 4 | 0 | Calculations of fines, penalties, penalties, damages | |

| 2 0 9 | 4 | 1 | ||

| 2 0 9 | 4 | 3 | ||

| 2 0 9 | 4 | 4 | ||

| 2 0 9 | 4 | 5 | ||

| 2 0 9 | 7 | 0 | Calculations for damage to non-financial assets | |

| 2 0 9 | 7 | 1 | ||

| 2 0 9 | 7 | 2 | ||

| 2 0 9 | 7 | 3 | ||

| 2 0 9 | 7 | 4 | ||

| 2 0 9 | 8 | 0 | Calculations for other income | |

| 2 0 9 | 8 | 1 | ||

| 2 0 9 | 8 | 2 | ||

| 2 0 9 | 8 | 9 | ||

| Other settlements with debtors | 2 1 0 | 0 | 0 | |

| 2 1 0 | 0 | 2 | ||

| 2 1 0 | 8 | 2 | Settlements with the financial authority to clarify unknown revenues to the budget of the year preceding the reporting year | |

| 2 1 0 | 9 | 2 | Settlements with the financial authority to clarify unclear revenues to the budget of previous years | |

| 2 1 0 | 0 | 3 | ||

| 2 1 0 | 0 | 4 | ||

| 2 1 0 | 0 | 5 | ||

| 2 1 0 | 0 | 6 | ||

| 2 1 0 | 1 | 0 | Calculations for tax deductions for VAT | |

| 2 1 0 | 1 | 1 | ||

| 2 1 0 | 1 | 2 | ||

| 2 1 0 | 1 | 3 | ||

| Internal settlements based on receipts | 2 1 1 | 0 | 0 | |

| Internal settlements for disposals | 2 1 2 | 0 | 0 | |

| Investments in financial assets | 2 1 5 | 0 | 0 | |

| 2 1 5 | 2 | 0 | Investments in securities other than shares | |

| 2 1 5 | 3 | 0 | Investments in shares and other forms of participation in capital | |

| 2 1 5 | 5 | 0 | Investments in other financial assets | |

| 2 1 5 | 2 | 1 | ||

| 2 1 5 | 2 | 2 | ||

| 2 1 5 | 2 | 3 | ||

| 2 1 5 | 3 | 1 | ||

| 2 1 5 | 3 | 2 | ||

| 2 1 5 | 3 | 3 | ||

| 2 1 5 | 3 | 4 | ||

| 2 1 5 | 5 | 2 | ||

| 2 1 5 | 5 | 3 | ||

| OBLIGATIONS | 3 0 0 | 0 | 0 | |

| Settlements with creditors on debt obligations | 3 0 1 | 0 | 0 | |

| 3 0 1 | 1 | 0 | Settlements on debt obligations in rubles | |

| 3 0 1 | 2 | 0 | Settlements on debt obligations for targeted foreign loans (borrowings) | |

| 3 0 1 | 3 | 0 | Calculations for state (municipal) guarantees | |

| 3 0 1 | 4 | 0 | Settlements on debt obligations in foreign currency | |

| 3 0 1 | 0 | 1 | ||

| 3 0 1 | 0 | 2 | ||

| 3 0 1 | 0 | 3 | ||

| 3 0 1 | 0 | 4 | ||

| Calculations for accepted obligations | 3 0 2 | 0 | 0 | |

| 3 0 2 | 1 | 0 | Calculations for wages, accruals for wage payments | |

| 3 0 2 | 2 | 0 | Calculations for works and services | |

| 3 0 2 | 3 | 0 | Calculations for receipt of non-financial assets | |

| 3 0 2 | 4 | 0 | Calculations for gratuitous transfers of a current nature to organizations | |

| 3 0 2 | 5 | 0 | Calculations for gratuitous transfers to budgets | |

| 3 0 2 | 6 | 0 | Social security payments | |

| 3 0 2 | 7 | 0 | Calculations for the acquisition of financial assets | |

| 3 0 2 | 8 | 0 | Calculations for gratuitous capital transfers to organizations | |

| 3 0 2 | 9 | 0 | Calculations for other expenses | |

| 3 0 2 | 1 | 1 | ||

| 3 0 2 | 1 | 2 | ||

| 3 0 2 | 1 | 3 | ||

| 3 0 2 | 2 | 1 | ||

| 3 0 2 | 2 | 2 | ||

| 3 0 2 | 2 | 3 | ||

| 3 0 2 | 2 | 4 | ||

| 3 0 2 | 2 | 5 | ||

| 3 0 2 | 2 | 6 | ||

| 3 0 2 | 2 | 7 | ||

| 3 0 2 | 2 | 8 | ||

| 3 0 2 | 2 | 9 | ||

| 3 0 2 | 3 | 1 | ||

| 3 0 2 | 3 | 2 | ||

| 3 0 2 | 3 | 3 | ||

| 3 0 2 | 3 | 4 | ||

| 3 0 2 | 4 | 1 | ||

| 3 0 2 | 4 | 2 | ||

| 3 0 2 | 5 | 1 | ||

| 3 0 2 | 5 | 2 | ||

| 3 0 2 | 5 | 3 | ||

| 3 0 2 | 6 | 1 | ||

| 3 0 2 | 6 | 2 | ||

| 3 0 2 | 6 | 3 | ||

| 3 0 2 | 7 | 2 | ||

| 3 0 2 | 7 | 3 | ||

| 3 0 2 | 7 | 5 | ||

| 3 0 2 | 9 | 3 | ||

| 3 0 2 | 9 | 5 | ||

| 3 0 2 | 9 | 6 | ||

| Calculations for payments to budgets | 3 0 3 | 0 | 0 | |

| 3 0 3 | 0 | 1 | ||

| 3 0 3 | 0 | 2 | ||

| 3 0 3 | 0 | 3 | ||

| 3 0 3 | 0 | 4 | ||

| 3 0 3 | 0 | 5 | ||

| 3 0 3 | 0 | 6 | ||

| 3 0 3 | 0 | 7 | ||

| 3 0 3 | 0 | 8 | ||

| 3 0 3 | 0 | 9 | ||

| 3 0 3 | 1 | 0 | ||

| 3 0 3 | 1 | 1 | ||

| 3 0 3 | 1 | 2 | ||

| 3 0 3 | 1 | 3 | ||

| Other settlements with creditors | 3 0 4 | 0 | 0 | |

| 3 0 4 | 0 | 1 | ||

| 3 0 4 | 0 | 2 | ||

| 3 0 4 | 0 | 3 | ||

| 3 0 4 | 0 | 4 | ||

| 3 0 4 | 8 | 4 | ||

| 3 0 4 | 9 | 4 | ||

| 3 0 4 | 0 | 5 | ||

| 3 0 4 | 0 | 6 | ||

| 3 0 4 | 8 | 6 | ||

| 3 0 4 | 9 | 6 | ||

| Calculations for cash payments | 3 0 6 | 0 | 0 | |

| Settlements on transactions on the accounts of the body providing cash services | 3 0 7 | 0 | 0 | |

| 3 0 7 | 1 | 0 | Settlements on transactions on the accounts of the body providing cash services | |

| 3 0 7 | 0 | 2 | ||

| 3 0 7 | 0 | 3 | ||

| 3 0 7 | 0 | 4 | ||

| 3 0 7 | 0 | 5 | ||

| Internal settlements based on receipts | 3 0 8 | 0 | 0 | |

| Internal settlements for disposals | 3 0 9 | 0 | 0 | |

| FINANCIAL RESULTS | 4 0 0 | 0 | 0 | |

| Financial result of an economic entity | 4 0 1 | 0 | 0 | |

| 4 0 1 | 1 | 0 | Revenues of the current financial year | |

| 4 0 1 | 1 | 6 | Income of the financial year preceding the reporting year, identified through control measures | |

| 4 0 1 | 1 | 7 | Income of previous financial years identified through control measures | |

| 4 0 1 | 1 | 8 | Income of the financial year preceding the reporting year, identified in the reporting year | |

| 4 0 1 | 1 | 9 | Income of previous financial years identified in the reporting year | |

| 4 0 1 | 2 | 0 | Expenses of the current financial year | |

| 4 0 1 | 2 | 6 | Expenses of the financial year preceding the reporting year, identified through control activities | |

| 4 0 1 | 2 | 7 | Expenses of previous financial years identified through control activities | |

| 4 0 1 | 2 | 8 | Expenses of the financial year preceding the reporting year identified in the reporting year | |

| 4 0 1 | 2 | 9 | Expenses of previous financial years identified in the reporting year | |

| 4 0 1 | 3 | 0 | Financial results of previous reporting periods | |

| 4 0 1 | 4 | 0 | revenue of the future periods | |

| 4 0 1 | 4 | 1 | Deferred income to be recognized in the current year | |

| 4 0 1 | 4 | 9 | Deferred income to be recognized in subsequent years | |

| 4 0 1 | 5 | 0 | Future expenses | |

| 4 0 1 | 6 | 0 | Reserves for future expenses | |

| Result for budget cash transactions | 4 0 2 | 0 | 0 | |

| 4 0 2 | 1 | 0 | Receipts | |

| 4 0 2 | 2 | 0 | Disposals | |

| 4 0 2 | 3 | 0 | The result of past reporting periods for cash budget execution | |

| AUTHORIZATION OF EXPENSES | 5 0 0 | 0 | 0 | |

| 5 0 0 | 1 | 0 | Validation for current financial year | |

| 5 0 0 | 2 | 0 | Authorization for the first year following the current (next financial year) | |

| 5 0 0 | 3 | 0 | Authorization for the second year following the current one (first year following the next one) | |

| 5 0 0 | 4 | 0 | Authorization for the second year following the next one | |

| 5 0 0 | 9 | 0 | Authorization for other subsequent years (outside the planning period) | |

| Limits on budget obligations | 5 0 1 | 0 | 0 | |

| 5 0 1 | 0 | 1 | ||

| 5 0 1 | 0 | 2 | ||

| 5 0 1 | 0 | 3 | ||

| 5 0 1 | 0 | 4 | ||

| 5 0 1 | 0 | 5 | ||

| 5 0 1 | 0 | 6 | ||

| 5 0 1 | 0 | 9 | ||

| Liabilities | 5 0 2 | 0 | 0 | |

| 5 0 2 | 0 | 1 | ||

| 5 0 2 | 0 | 2 | ||

| 5 0 2 | 0 | 5 | ||

| 5 0 2 | 0 | 7 | Obligations accepted | |

| 5 0 2 | 0 | 9 | Deferred liabilities | |

| Budget allocations | 5 0 3 | 0 | 0 | |

| 5 0 3 | 0 | 1 | ||

| 5 0 3 | 0 | 2 | ||

| 5 0 3 | 0 | 3 | ||

| 5 0 3 | 0 | 4 | ||

| 5 0 3 | 0 | 5 | ||

| 5 0 3 | 0 | 6 | ||

| 5 0 3 | 0 | 9 | ||

| Estimated (planned, forecast) assignments | 5 0 4 | 0 | 0 | |

| Right to assume obligations | 5 0 6 | 0 | 0 | |

| Approved amount of financial support | 5 0 7 | 0 | 0 | |

| Financial support received | 5 0 8 | 0 | 0 | |

Modern requirements for specialists and accountants working in the public sector

Accounting for a budgetary organization has important differences that permeate all levels of the system’s functioning. Accounting provisions, reflection of assets and liabilities, as well as the composition and procedure for reporting. The budget accounting system is constantly being improved, changes are made and new regulatory documents are created. An accountant for maintaining budget accounting in municipal, federal, and state institutions must constantly improve his knowledge and take advanced training courses and training seminars.

Primary accounting documents

As follows from paragraph 3 of Art. 9 of Law No. 402-FZ, the primary accounting document must be drawn up when a fact of economic life is committed, and if this is not possible, immediately after its completion. The person responsible for registration of the fact of economic life ensures the timely transfer of primary accounting documents for registration of the data contained in them in the accounting registers, as well as the reliability of this data. Law No. 247-FZ introduced clarifications to this paragraph. It follows from them that the written requirements of the chief accountant regarding compliance with the established procedure for documenting the facts of economic life, submitting documents (information) necessary for maintaining accounting records are mandatory for all employees of an economic entity.

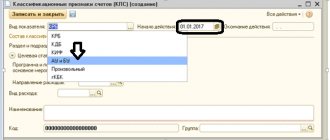

1C: Accounting of a state institution 8 (1C: BSU)

A specialized solution for automating accounting and tax accounting in state (municipal) institutions.

- Unified chart of accounts in accordance with the order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n;

- Budget classification of the Russian Federation;

- Separate accounting by sources of financial support;

- Accounting for authorization of expenses;

- Maintaining centralized records of a group of institutions in one information base;

- Accounting for calculations of wages, scholarships and allowances;

- Formation of regulated accounting, tax and statistical reporting;

- Integration with the state information system about State and municipal payments (GIS GMP).

More details Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Accounts for business entities

The plan for business entities that keep records using the double entry method, including non-profit organizations, is fixed and regulated by Order of the Ministry of Finance No. 94n dated October 31, 2000. This plan is the same for all institutions, except budgetary and credit (banks).

PAS consists of synthetic and analytical accounts, each of which has a specific numbering. Thus, the register structure represents first and second order accounts. The working document of each organization is developed in accordance with a single PS and includes synthetic and subaccounts.

Accounting registers differ in their content and are active, passive and active-passive. In total, the PAS, which is used by non-profit organizations and other business entities, contains 71 synthetic accounts, including 11 off-balance sheet accounts. The following sections of the PS for business entities are distinguished:

- fixed assets;

- productive reserves;

- production costs;

- finished products, goods;

- cash;

- calculations;

- capital;

- financial results.