How to apply for sick leave

The certificate of incapacity for work confirms that the person was absent from the workplace for a valid reason.

Temporary disability or maternity benefits are calculated on the basis of sick leave. Sick leave certificates are issued by medical institutions that have the appropriate license.

Until 2022, a ballot could be issued in one of two ways:

- On paper.

- Electronic.

In 2022 and beyond, it is permissible to generate certificates of incapacity for work only in electronic form (Part 6, Article 13 of Federal Law No. 255-FZ of December 29, 2006; see “Starting 2022, electronic sick leave will be generated without the patient’s consent”). At the same time, ballots issued on paper in 2022, and presented in 2022, will be accepted and paid for (see “The FSS reported whether paper sick leave issued last year will be accepted for payment”).

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Doctors create an electronic certificate of incapacity for work (ELN) in the unified integrated information system “Social Insurance” online. FSS employees inform the employer about the closure of the bulletin, and he sends the information necessary to calculate the benefit, and also pays for the first 3 days of illness.

IMPORTANT. To work with electronic electronic signature, an organization must complete the following steps: enter into an appropriate agreement with the regional office of the Social Insurance Fund, purchase an enhanced qualified electronic signature and install the necessary software.

Receive an enhanced qualified electronic signature certificate in an hour

Filling out a sick leave certificate

The sick leave form was approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n. It consists of two sections.

Information for the first section is entered into the system by doctors.

The information for the second section is provided by the employer. This must be done according to the rules approved by Decree of the Government of the Russian Federation dated November 23, 2021 No. 2010. In particular, it is necessary to indicate the insurance period; the amount of payments included in the base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity; data on working hours (with a part-time schedule), etc.

How to transfer this information to the fund? Place it in the Social Insurance system and verify it with an enhanced qualified electronic signature. These actions must be completed no later than 3 business days from the date of receipt of data on the closed electronic insurance policy (Part 8 of Art. Law No. 255-FZ; see “Information about insured persons: what data and when will have to be submitted to the Social Insurance Fund in 2022” ). Next, the information will automatically be sent to the FSS.

Calculation of average earnings for sick leave in 2022

The rules for calculating sick leave are set out in the regulation on the specifics of the procedure for calculating benefits for temporary disability and pregnancy and childbirth (approved by the Decree of the Government of the Russian Federation, Decree of the Government of the Russian Federation dated September 11, 2021 No. 1540; see “New rules for calculating sick leave, maternity and child benefits have been approved”) . To correctly calculate benefits, you first need to calculate the employee's average earnings. To do this you will need to perform a number of actions.

Free calculation of average earnings according to current rules

Determine the billing period

As a general rule, the calculation period includes two calendar years preceding the year in which the illness occurred or maternity leave began. For a ballot opened in 2022, the calculation period is 2022 and 2022.

An exception is provided for women who were on maternity leave or maternity leave during the billing period. They are allowed to carry forward one or two years. The basis is a written statement from the employee.

Example 1.

Let's assume the employee gets sick in February 2022. The calculation period for it is the period of time from January 1, 2022 to December 31, 2022 inclusive. But since the woman was on maternity leave in 2022, and on maternity leave in 2022, she wrote a request for a transfer. As a result, the new calculation period included the years 2022 and 2022.

Calculate average earnings

It consists of the amounts that the employee received in the billing period and from which contributions to compulsory social insurance were transferred.

Calculate your salary and benefits taking into account the annual increase in the minimum wage Calculate for free

Compare with the maximum permissible base value

The average earnings for calculating benefits cannot be as large as desired. It is permissible to take it into account only in the part that does not exceed the maximum value of the base for contributions in case of temporary disability and in connection with maternity. This value is approved by the Government of the Russian Federation every year.

IMPORTANT. It is necessary to compare the average earnings in the billing period with the base limits in force at that time. It is necessary to compare not the total figure, but data for each year separately (example in Table 1).

Table 1

An example of comparing average earnings with the base limits

| Indicators | Billing period | |

| 2020 | 2021 | |

| Limit value of the base for the corresponding year | 912,000 rub. | RUB 966,000 |

| Average earnings | 880,000 rub. (does not exceed) | 990,000 rub. (exceeds) |

| Amount taken into account when calculating sick leave Total: | 880,000 rub. | RUB 966,000 |

| RUB 1,846,000 (880 000 + 966 000) | ||

Compare with minimum wage

Average earnings must be greater than or equal to the minimum wage that was in effect on the date of the onset of illness or maternity leave. Otherwise, the benefit should be calculated based on the minimum wage.

The FSS, in letter dated 03/01/11 No. 14-03-18/05-2129, recommends comparing two values of average daily earnings: actual and based on the minimum wage. You need to do the following:

- Divide actual average earnings by 730 days.

- The minimum wage on the date of onset of illness or maternity leave is multiplied by 24 months and divided by 730 days.

- If the first value is greater than or equal to the second, calculate sick leave based on the first value. If the first value is less than the second, calculate the benefit based on the second value (example in Table 2).

table 2

An example of comparing two values of average daily earnings (actual and based on the minimum wage)

| Date of onset of illness | January 25, 2022 |

| Average earnings for the billing period (2020 and 2022) | 83,000 rub. |

| Minimum wage for 2022 | RUB 13,890 |

| Actual average daily earnings | RUB 113.7 (RUB 83,000: 730 days) |

| Average daily earnings based on the minimum wage | RUB 456.66 (RUB 13,890 x 24 months: 730 days) |

| Conclusion: | Since the actual average daily earnings are less than this figure calculated based on the minimum wage, the benefit must be calculated according to the minimum wage |

REFERENCE. In some cases, the benefit cannot exceed the minimum wage for a full calendar month, multiplied by the regional coefficient (if any), even if the actual average earnings exceed the minimum wage. This rule applies in the following situations: the employee’s insurance period is less than 6 months; the patient violated the regime prescribed by the doctor, or did not show up for examination, etc.

Find average daily earnings

For temporary disability benefits, in the general case, it is equal to the average earnings for the billing period (taking into account the maximum value of the base), divided by 730 days.

For maternity benefit (BIR) it is generally a fraction. The numerator is the average earnings for the billing period (taking into account the maximum value of the base). The denominator is the number of calendar days in the billing period minus the number of calendar days falling within the excluded period.

The excluded period includes days of illness, maternity leave, maternity leave for children up to one and a half years old, and days when a woman was released from work according to Russian laws with full or partial retention of wages (if contributions were not paid from the payments in case of temporary disability and in connection with motherhood).

Example 2 . The average salary of an employee in the billing period is 950,000 rubles, the base limit has not been exceeded. The number of calendar days of the billing period is 730. Of these, the employee was on sick leave for 20 calendar days (excluded period). The average daily earnings is 1,338.03 rubles (950,000 rubles: (730 days - 20 days)).

If the benefit is calculated based on the minimum wage, then the average daily earnings are equal to the minimum wage (as of the start date of the bulletin), multiplied by 24 months and divided by 730 days. For part-time work, a coefficient corresponding to the length of working time is added to the formula.

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

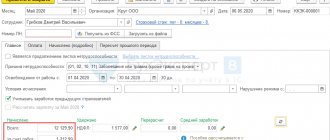

Example 5. Limitation of benefits to the minimum wage due to short work experience

Employee D.V.

Borovoy began working on 04/01/2016 full-time at an enterprise in an area without a regional coefficient (RK). A certificate of earnings from a previous employer in 2015 confirms the amount of 500,000 rubles. Sick leave was provided for 2 days: 06/30/2016–07/01/2017.

On the day of the onset of illness, the length of service is less than six months and the amount of benefit is limited not by the maximum value of the base for calculating insurance premiums, but by the maximum amount of daily benefit calculated from the minimum wage.

The actual average daily earnings were: RUB 500,000. / 730 = 684.93 rub. The experience is less than five years, so the average daily earnings are limited to 60% and equal to 684.93 rubles. x 60% = 410.96 rub. But since the length of service is less than six months, it is limited to the maximum daily benefit in June: 6,204 rubles. / 30 = 206.80 rubles, and in July 7,500 rubles. / 31 = 241.94 rub.

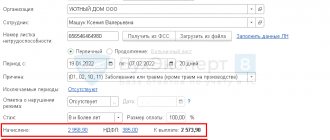

Thus, for 2 days, a benefit of 206.80 rubles was accrued. + 241.94 rub. = 448.74 rub. (Fig. 4).

Rice. 4. Sick leave accruals from the minimum wage

Please note that maternity benefits are accrued in advance even if the employee went on maternity leave before July 1 and before the new minimum wage was approved. Moreover, if the vacation continues after July 1, then the amount of the benefit must be recalculated taking into account the new minimum wage and the difference must be paid.

The need for recalculation arises if maternity benefits are limited to the maximum amount of daily benefits similar to Example 5 due to the fact that the employee’s length of service was less than six months. To perform recalculation in the program, you need to open the previously created and paid sick leave document. Click the Edit button to create a new document. In it, on the Recalculation of the previous period tab, previously accrued amounts are reversed, and on the Accrued (details) tab, new accruals are displayed. As a result, the new document shows the difference, in this case the amount of additional payment.

Percentage of length of service when calculating sick leave

When calculating temporary disability benefits, the average daily earnings must be multiplied by the percentage of length of service:

- if the experience is less than 5 years - by 60%;

- if the experience is from 5 to 8 years - by 80%;

- if the experience is 8 years or more - 100%.

REFERENCE. The length of service is determined by the work book (paper or electronic). If it is not there, use employment contracts and certificates from previous places of work. This is stated in paragraph 9 of the Rules for calculating and confirming insurance experience (approved by order of the Ministry of Labor dated 09.09.20 No. 585n).

When paying BIR benefits, the average daily earnings are always multiplied by 100%.

Rules and procedure for calculating sick leave in 2022

The amount of the benefit is equal to the average daily earnings (taking into account the percentage of length of service) multiplied by the number of calendar days of illness according to the certificate of incapacity for work. If the bulletin was issued in connection with pregnancy and childbirth, then the number of calendar days of sick leave is generally 140.

There is an additional limitation. It applies to a situation where the temporary disability benefit, calculated on the basis of average daily earnings and length of service, does not reach the minimum wage calculated for a full calendar month (in 2022 it is equal to 13,890 rubles). Then sick leave should be paid in the amount of the minimum wage for a full calendar month. In this case, the amount of the daily benefit is equal to the minimum wage divided by the number of calendar days of the month in which the illness occurs. The total benefit is the daily benefit multiplied by the number of calendar days of sickness in each calendar month. If a regional coefficient is introduced, then the minimum wage is determined taking into account this coefficient (for more details, see: “Sick leave in 2022: the temporary procedure for calculating benefits was made permanent”).

In case of illness or injury, the organization pays for the first three days of the bulletin, the remaining days are paid for by the fund. In case of BIR, quarantine and in a number of other cases, the FSS pays for all days (Article 3 of the Federal Law of December 29, 2006 No. 255-FZ).

Calculate salary and personal income tax with standard deductions in the web service

The employee brought sick leave after dismissal

If sick leave is opened on the day the employee is dismissed or before this date, pay temporary disability benefits as if the employee had not resigned. In such a situation, sick leave must be paid for in any case of incapacity for work (due to illness or injury of the employee, caring for a sick child or other relative, etc.).

At the same time, the amount of the benefit depends on the employee’s insurance experience ( Parts 1, 2, Article 5, Part 1, Article 7, Part 1, Article 13 of Law No. 255-FZ).

If the employee has already quit, sick leave is paid only in case of illness or injury that occurs within 30 calendar days from the date of termination of work under the employment contract.

The benefit amount is 60% of average earnings, which is calculated, as usual, for the 2 previous calendar years.

The basis for payment of benefits after dismissal is sick leave. The dismissed employee must submit it no later than 6 months from the date of restoration of working capacity or establishment of disability (Part 1 of Article 12 of Law No. 255-FZ).

The first 3 days of sick leave due to illness or injury of a dismissed employee are paid at the expense of the organization, the subsequent days - at the expense of the Social Insurance Fund (clause 1, part 2, article 3 of Law No. 255-FZ).

When filling out a certificate of incapacity for work, the code “47” is indicated in the “Calculation conditions” line of the sick leave certificate (clause 66 of the Procedure). The line “Insurance experience” indicates the number of full years and months of work on the date of dismissal from the organization, despite the fact that the amount of benefits in such a situation does not depend on the insurance experience and is 60% of average earnings.

Minimum and maximum disability benefits in 2022

The maximum average daily earnings is 2,572.6 rubles ((912,000 rubles + 966,000 rubles): 730 days).

The maximum benefit for BIR in the general case is 360,164 rubles ((912,000 rubles + 966,000 rubles): 730 days × 140 days).

Temporary disability benefit, calculated based on the minimum wage (provided that the work experience is more than 8 years) - 456.66 rubles. per day (RUB 13,890 × 24 months: 730 days).

The BIR benefit, calculated based on the minimum wage in the general case, is 63,932.4 rubles (13,890 rubles × 24 months: 730 days × 140 days).

Temporary disability benefit based on the minimum wage for a full month:

in April, June, September, November - 463 rubles. per day (RUB 13,890: 30 cal days);

in January, March, May, July, August, October, December - 448.06 rubles. per day (RUB 13,890: 31 cal days);

in February - 496.07 rubles. per day (RUB 13,890: 28 cal days).

Example 3. Calculation of disability benefits in the presence of non-insurance periods

| Disability benefits were provided from 06/01/2016 to 06/18/2016. The employee has a length of service for paying sick leave, taking into account non-insurance periods, of 10 years 5 months, including a non-insurance period of 8 years. When filling out the Sick Leave document, on the Payment tab, select the Apply benefits flag and select Payments in connection with the inclusion of non-insurance periods in the insurance period. The Payment percentage field was automatically set to 100%, because the total experience is more than 8 years. But in the field Percentage of payment without benefits is 60%, because without benefits the length of service is only 2 years and 5 months, which is less than 5 years. The difference between total length of service and length of service without benefits is paid from the federal budget minus the first three days paid by the employer. On the Accrued tab (Fig. 3), the sick leave accrual is calculated for a total amount of 13,767.15 rubles, including at the expense of the federal budget - 5,506.80 rubles. In the 4-FSS report, expenses from the federal budget are allocated automatically. |

Rice. 3. Accruals for sick leave, taking into account non-insurance periods

Examples of calculations

Example 3

The employee was sick from March 1 to March 11, 2022, and was in the hospital. On March 6, he violated the regime, and the doctor made a note about this on the sick leave. The period from March 6 to March 11 was paid based on the minimum wage.

The employee's length of service is 13 years, the actual average daily earnings are 1,900 rubles.

The amount of the benefit was:

- for the period from March 1 to March 5 - 9,500 rubles (1,900 rubles × 5 days), incl. at the expense of the employer - 5,700 rubles (1,900 rubles x 3 days);

- for the period from March 6 to March 11 - 2,558.4 rubles (426.4 rubles × 6 days).

The total benefit amounted to 12,058.4 rubles (9,500 + 2,558.4).

Example 4

The woman was issued a certificate of incapacity for work according to the BIR. The start of maternity leave is February 18, 2022. As of this date, the insurance period is 5 months.

The benefit is calculated based on the minimum wage in the amount of 63,932.4 rubles

Work with electronic sick leave with a “complicated” salary with bonuses and coefficients

Limitation of the paid period

There are exceptions when not all sick days are paid. One of them is provided for people working under a fixed-term employment contract concluded for less than six months. In general, benefits can be accrued to such employees for no more than 75 calendar days under this agreement.

There are exceptions for people who have taken out a ballot to care for relatives. For example, when caring for a child from 7 to 15 years old, one sick leave is paid for no more than 15 calendar days, and in a total year it is permissible to pay no more than 45 calendar days (Article 6 of Law No. 255-FZ).

Deadlines for sick pay in 2022

Starting from 2022, the following system will apply in all regions. The employee receives temporary disability benefits for the first 3 days from the employer, for all other days - directly from the Social Insurance Fund. The BIR benefit in full is directly from the FSS (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the FSS”).

The Fund is obliged to assign and pay its part of the benefit within 10 working days from the moment the policyholder entered the necessary information into the Social Insurance system (Part 1, Article 15 of Law No. 255-FZ). Employers typically provide their portion of the benefit along with the salary or advance payment.

What is important for state employees to remember in 2022

Budgetary organizations are obliged to pay their employees on time and make correct accruals. This also applies to the payment of temporary disability benefits. The main changes to the payment of sick leave in 2022 affected the calculation procedure. Here's what's changed since the new year:

- Minimum wage. From January 1, 2020, the minimum wage amounted to RUB 12,130. The minimum average daily earnings in 2022 is 398.79 rubles, the maximum is 2301.37 rubles.

- Billing period. When calculating social benefits, the two previous calendar years are taken. The limit of taxable insurance premiums for 2018 is RUB 815,000.00, for 2022 - RUB 865,000.00. For 2020, the limit on OSS is RUB 912,000.00.

- New KOSGU. Compensation for the first 3 days for temporary disability and maternity is reflected in subarticle 266 “Social benefits and compensation to personnel in cash.”

All social payments of budgetary institutions must be carried out within the established limits of budgetary obligations.